| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Kyoto

- 24 Jan 2008 02:57

- 2 of 50

- 24 Jan 2008 02:57

- 2 of 50

Morning all. Market reports:

Telegraph

The Times

The Times (Need to know)

FT

The Guardian

This is Money

US stock markets rebounded strongly last night on hopes of a $15bn (7.66bn) bail-out of the world's major bond insurers, reversing five days of heavy losses on Wall Street.

US stock markets re-bound on bail-out plan

Hopes of a bailout for Americas bond insurers triggered a blistering rally on Wall Street yesterday after regulators said that they were in discussions with investment banks about how to stop the fixed-income underwriting business from imploding.

Bailout for US bond insurers triggers rally on Wall Street

Triumphant bears have swept all before them at the World Economic Forum in Switzerland this year, growling down plaintive squeaks of optimism from the odd dazed bull.

Europe and Asia face hard landings as bubbles burst

A full-blown, prolonged recession in the United States is now inescapable, with the rest of the world set to be dragged into a severe slowdown despite this week's emergency cut in US interest rates, leading economists said in Davos yesterday.

Davos 2008: 'Inescapable' recession in United States will trigger global slump, say economists

The billionaire investor famous for "breaking" the Bank of England in the 1990s has warned that Britain is heading for a recession. George Soros said that a recession in both the United States and Britain "will be very difficult to avoid". He was speaking on the fringes of the World Economic Forum summit in Davos, Switzerland, where many of the world's top politicians and businessmen are meeting.

Dollar's golden era is ending, warns Soros

Some of the world's leading economists and financiers have warned that dawdling and mismanagement by central banks around the world pose by far the greatest risk to the global economy - on another roller-coaster day for markets on both sides of the Atlantic.

Central banks' bungling 'main economic risk'

Hopes for aggressive, American-style interest rate cuts in Britain faded yesterday while the turmoil in the global markets showed little sign of abating.

Hopes of large cuts in interest rates dashed by bankers

The Bank of England's interest-rate-setters voted 8-1 in favour of leaving the cost of borrowing unchanged at 5.5 per cent this month because of fears over British inflation, it emerged yesterday.

Inflation fear swung rates call, MPC minutes show

Telegraph

The Times

The Times (Need to know)

FT

The Guardian

This is Money

US stock markets rebounded strongly last night on hopes of a $15bn (7.66bn) bail-out of the world's major bond insurers, reversing five days of heavy losses on Wall Street.

US stock markets re-bound on bail-out plan

Hopes of a bailout for Americas bond insurers triggered a blistering rally on Wall Street yesterday after regulators said that they were in discussions with investment banks about how to stop the fixed-income underwriting business from imploding.

Bailout for US bond insurers triggers rally on Wall Street

Triumphant bears have swept all before them at the World Economic Forum in Switzerland this year, growling down plaintive squeaks of optimism from the odd dazed bull.

Europe and Asia face hard landings as bubbles burst

A full-blown, prolonged recession in the United States is now inescapable, with the rest of the world set to be dragged into a severe slowdown despite this week's emergency cut in US interest rates, leading economists said in Davos yesterday.

Davos 2008: 'Inescapable' recession in United States will trigger global slump, say economists

The billionaire investor famous for "breaking" the Bank of England in the 1990s has warned that Britain is heading for a recession. George Soros said that a recession in both the United States and Britain "will be very difficult to avoid". He was speaking on the fringes of the World Economic Forum summit in Davos, Switzerland, where many of the world's top politicians and businessmen are meeting.

Dollar's golden era is ending, warns Soros

Some of the world's leading economists and financiers have warned that dawdling and mismanagement by central banks around the world pose by far the greatest risk to the global economy - on another roller-coaster day for markets on both sides of the Atlantic.

Central banks' bungling 'main economic risk'

Hopes for aggressive, American-style interest rate cuts in Britain faded yesterday while the turmoil in the global markets showed little sign of abating.

Hopes of large cuts in interest rates dashed by bankers

The Bank of England's interest-rate-setters voted 8-1 in favour of leaving the cost of borrowing unchanged at 5.5 per cent this month because of fears over British inflation, it emerged yesterday.

Inflation fear swung rates call, MPC minutes show

Kyoto

- 24 Jan 2008 02:57

- 3 of 50

- 24 Jan 2008 02:57

- 3 of 50

Kyoto

- 24 Jan 2008 06:44

- 4 of 50

- 24 Jan 2008 06:44

- 4 of 50

OUTLOOK Misys to reassure over sub-prime crisis fearsOUTLOOK Sabadell Q4 results overshadowed by Spanish retail banking concernsOUTLOOK Siemens Q1 opg seen up as higher results expected across most divisionsAustralian shares close higher for second day in a row on US gains - UPDATETFN economic and business calendarAustralian shares close higher for second day in a row on US gainsThomson Financial Europe AM at a glance share guide: Stocks, oil mixed

Kyoto

- 24 Jan 2008 06:49

- 5 of 50

- 24 Jan 2008 06:49

- 5 of 50

Kyoto

- 24 Jan 2008 07:00

- 6 of 50

- 24 Jan 2008 07:00

- 6 of 50

Kyoto

- 24 Jan 2008 07:05

- 7 of 50

- 24 Jan 2008 07:05

- 7 of 50

Kyoto

- 24 Jan 2008 07:35

- 8 of 50

- 24 Jan 2008 07:35

- 8 of 50

Kyoto

- 24 Jan 2008 08:05

- 9 of 50

- 24 Jan 2008 08:05

- 9 of 50

Kyoto

- 24 Jan 2008 08:10

- 10 of 50

- 24 Jan 2008 08:10

- 10 of 50

Kyoto

- 24 Jan 2008 08:15

- 11 of 50

- 24 Jan 2008 08:15

- 11 of 50

Kyoto

- 24 Jan 2008 08:30

- 12 of 50

- 24 Jan 2008 08:30

- 12 of 50

Kyoto

- 24 Jan 2008 08:36

- 13 of 50

- 24 Jan 2008 08:36

- 13 of 50

Master RSI

- 24 Jan 2008 08:42

- 14 of 50

- 24 Jan 2008 08:42

- 14 of 50

Good morning

JSP

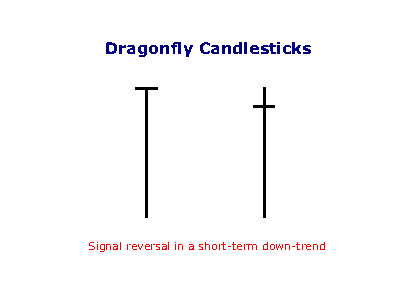

The "candlestick" finish yesterday>>>>> DRAGONFLY DOJI is a reversal signal on a short term downtrend.

BULLISH DRAGONFLY DOJI

Type: Reversal

Relevance: Bullish

Prior Trend: Bearish

Reliability: Medium

Confirmation: Suggested

Definition:

The Bullish Dragonfly Doji Pattern is a single candlestick pattern that occurs at the bottom of a trend or during a downtrend. The Bullish Dragonfly Doji Pattern is very similar to the Bullish Hammer Pattern mentioned above. The distinction between the two is if there is a body or not. In case of Bullish Dragonfly Doji Pattern, the opening and closing prices are identical and there is no body. On the other hand the Bullish Hammer Pattern has a small real body at the upper end of the trading range.

Recognition Criteria:

1. There is an overall downtrend in the market.

2. Then we see a Doji at the upper end of the trading range.

3. The doji has an extremely long lower shadow.

4. However the doji does not have any upper shadow.

Explanation:

The market is in an overall bearish mood characterized by a downtrend. Then market opens and sells off sharply. However, the sell-off is suddenly abated and the prices reverse direction and start going up for the rest of the day closing at or near the days high thus leading to the long lower shadow. The failure of the market to continue in the selling side reduces the bearish sentiment. Now the shorts are increasingly uneasy with their bearish positions. If the market opens higher next day, many shorts will have a strong incentive to cover their short positions.

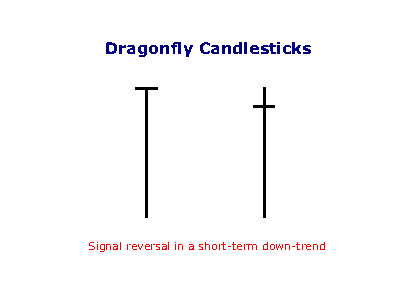

JSP

The "candlestick" finish yesterday>>>>> DRAGONFLY DOJI is a reversal signal on a short term downtrend.

BULLISH DRAGONFLY DOJI

Type: Reversal

Relevance: Bullish

Prior Trend: Bearish

Reliability: Medium

Confirmation: Suggested

Definition:

The Bullish Dragonfly Doji Pattern is a single candlestick pattern that occurs at the bottom of a trend or during a downtrend. The Bullish Dragonfly Doji Pattern is very similar to the Bullish Hammer Pattern mentioned above. The distinction between the two is if there is a body or not. In case of Bullish Dragonfly Doji Pattern, the opening and closing prices are identical and there is no body. On the other hand the Bullish Hammer Pattern has a small real body at the upper end of the trading range.

Recognition Criteria:

1. There is an overall downtrend in the market.

2. Then we see a Doji at the upper end of the trading range.

3. The doji has an extremely long lower shadow.

4. However the doji does not have any upper shadow.

Explanation:

The market is in an overall bearish mood characterized by a downtrend. Then market opens and sells off sharply. However, the sell-off is suddenly abated and the prices reverse direction and start going up for the rest of the day closing at or near the days high thus leading to the long lower shadow. The failure of the market to continue in the selling side reduces the bearish sentiment. Now the shorts are increasingly uneasy with their bearish positions. If the market opens higher next day, many shorts will have a strong incentive to cover their short positions.

Kyoto

- 24 Jan 2008 08:51

- 15 of 50

- 24 Jan 2008 08:51

- 15 of 50

Kyoto

- 24 Jan 2008 08:56

- 16 of 50

- 24 Jan 2008 08:56

- 16 of 50

Kyoto

- 24 Jan 2008 09:07

- 17 of 50

- 24 Jan 2008 09:07

- 17 of 50

Kyoto

- 24 Jan 2008 09:12

- 18 of 50

- 24 Jan 2008 09:12

- 18 of 50

Kyoto

- 24 Jan 2008 09:22

- 19 of 50

- 24 Jan 2008 09:22

- 19 of 50

Kyoto

- 24 Jan 2008 09:28

- 20 of 50

- 24 Jan 2008 09:28

- 20 of 50

Kyoto

- 24 Jan 2008 09:33

- 21 of 50

- 24 Jan 2008 09:33

- 21 of 50

Kyoto

- 24 Jan 2008 09:38

- 22 of 50

- 24 Jan 2008 09:38

- 22 of 50

Kyoto

- 24 Jan 2008 09:44

- 23 of 50

- 24 Jan 2008 09:44

- 23 of 50

Kyoto

- 24 Jan 2008 09:54

- 24 of 50

- 24 Jan 2008 09:54

- 24 of 50

Kyoto

- 24 Jan 2008 09:59

- 25 of 50

- 24 Jan 2008 09:59

- 25 of 50

Kyoto

- 24 Jan 2008 10:14

- 26 of 50

- 24 Jan 2008 10:14

- 26 of 50

Kyoto

- 24 Jan 2008 10:20

- 27 of 50

- 24 Jan 2008 10:20

- 27 of 50

Kyoto

- 24 Jan 2008 10:35

- 28 of 50

- 24 Jan 2008 10:35

- 28 of 50

maddoctor - 24 Jan 2008 10:37 - 29 of 50

Kyoto , thanks for the xta , wondered what the hell was going on there!

Kyoto

- 24 Jan 2008 10:50

- 30 of 50

- 24 Jan 2008 10:50

- 30 of 50

Kyoto

- 24 Jan 2008 11:00

- 31 of 50

- 24 Jan 2008 11:00

- 31 of 50

maddoctor - well if Brazil's newspapers are anything like as accurate as their UK counterparts sometimes, a large pinch of salt may need to be applied there. Still, it's in my mind that the Government there have a shareholding in Vale so I'm guessing they can certainly directly influence the decision if they are opposed to it.

Master RSI

- 24 Jan 2008 11:07

- 32 of 50

- 24 Jan 2008 11:07

- 32 of 50

JRVS 11.25 - 11.50p +0.675p

Has been moving higher lately after a large marked down during the last 50 days

Has been moving higher lately after a large marked down during the last 50 days

Kyoto

- 24 Jan 2008 11:50

- 33 of 50

- 24 Jan 2008 11:50

- 33 of 50

Kyoto

- 24 Jan 2008 12:00

- 34 of 50

- 24 Jan 2008 12:00

- 34 of 50

Kyoto

- 24 Jan 2008 12:11

- 35 of 50

- 24 Jan 2008 12:11

- 35 of 50

Kyoto

- 24 Jan 2008 12:16

- 36 of 50

- 24 Jan 2008 12:16

- 36 of 50

Kyoto

- 24 Jan 2008 12:21

- 37 of 50

- 24 Jan 2008 12:21

- 37 of 50

Kyoto

- 24 Jan 2008 12:26

- 38 of 50

- 24 Jan 2008 12:26

- 38 of 50

Kyoto

- 24 Jan 2008 12:52

- 39 of 50

- 24 Jan 2008 12:52

- 39 of 50

Kyoto

- 24 Jan 2008 12:57

- 40 of 50

- 24 Jan 2008 12:57

- 40 of 50

Kyoto

- 24 Jan 2008 13:02

- 41 of 50

- 24 Jan 2008 13:02

- 41 of 50

Kyoto

- 24 Jan 2008 13:12

- 42 of 50

- 24 Jan 2008 13:12

- 42 of 50

Kyoto

- 24 Jan 2008 13:34

- 43 of 50

- 24 Jan 2008 13:34

- 43 of 50

Master RSI

- 24 Jan 2008 14:26

- 44 of 50

- 24 Jan 2008 14:26

- 44 of 50

IOS

I selected the shares a bit earlier on the "UPS" thread, it may has help a bit since cash balances were at 26.8p.

Master RSI - 24 Jan'08 - 12:46 - 197 of 201 edit

UPS

IOS 15 - 16p

On the move up as a double bottom is on the chart, the much expected reverse take over must be getting closer

I selected the shares a bit earlier on the "UPS" thread, it may has help a bit since cash balances were at 26.8p.

Master RSI - 24 Jan'08 - 12:46 - 197 of 201 edit

UPS

IOS 15 - 16p

On the move up as a double bottom is on the chart, the much expected reverse take over must be getting closer