| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Davai - 18 Apr 2012 11:13

Thread designed to record set-ups and targets on index and FX pairs.

'A market is only your enemy until you understand it, then it becomes your best friend.'

Any questions, please feel free to ask.

From time to time i may openly state an opinion regarding direction of a set-up and wish to add that in no way am i recommending a trade. I am sometimes only in trades for a matter of minutes and can't always update as to entry/exits taken.

As always, markets are dangerous places to be and must be respected as such. Always use stop losses and never over-leverage; 3% of your pot as a maximum per trade. As always, YOU are responsible for your own trades! Happy pip hunting!

Click HERE to visit me at FXtechnicals.net

Davai - 18 Apr 2012 11:16 - 2 of 423

I will start by posting a few set-ups that i have predicted in the last week or so. Feel free to ask any questions. Other than that, i will use this thread to record my thought process and success/failures etc...

Here i was looking for a 123 reversal pattern (as circled) to confirm my thoughts of a next leg up...

update and result;

Here i was looking for a 123 reversal pattern (as circled) to confirm my thoughts of a next leg up...

update and result;

Davai - 18 Apr 2012 11:17 - 3 of 423

Davai - 18 Apr 2012 11:18 - 4 of 423

Davai - 18 Apr 2012 11:20 - 5 of 423

Davai - 18 Apr 2012 11:22 - 6 of 423

Davai - 18 Apr 2012 11:30 - 7 of 423

Davai - 18 Apr 2012 11:53 - 8 of 423

Davai - 18 Apr 2012 12:35 - 9 of 423

UsdJpy; looks like it could be breaking out of recent corrective moves (as do a couple other Yen pairs). Yen weakness could be the theme for the short term then, but with some possible 1st waves nearing completion, poss tomorrow/Friday. Just recording this for a mo, cos if it does play out, i will expect a three wave corrective retracing a good chunk of this weeks gains, get that out of the way and we are good to go (long). Still looking for evidence right now;

Davai - 18 Apr 2012 13:19 - 10 of 423

Very speculative for now, but having been in a complex corrective move for so long (and i consider it a 4th wave on the daily), it must be ending soon! If this is a 1st wave (in 5waves) we might see something like this; I have shown it as an extended 5th subwave as opposed to the 3rd being the longest;

might be far simpler;

or could still be corrective!

might be far simpler;

or could still be corrective!

Davai - 18 Apr 2012 13:34 - 11 of 423

Davai - 18 Apr 2012 18:56 - 12 of 423

Davai - 18 Apr 2012 20:48 - 13 of 423

Davai - 19 Apr 2012 10:32 - 14 of 423

Yen pairs still trending well even when corrective, in particular the GbpJpy is being very kind to the system, with every target getting met;

Two short set-ups in the down channel. The green arrows are merely to highlight that a retrace normally occurs just after target is met, purely to create a fresh set-up;

After the last significant high (before the recent low) is breached, we swing long;

Two short set-ups in the down channel. The green arrows are merely to highlight that a retrace normally occurs just after target is met, purely to create a fresh set-up;

After the last significant high (before the recent low) is breached, we swing long;

Davai - 19 Apr 2012 14:48 - 15 of 423

Davai - 19 Apr 2012 15:37 - 16 of 423

£ is looking likely nearing a couple of tops (cable and vs Yen) so could start a decline soon.

Davai - 19 Apr 2012 17:19 - 17 of 423

Here i have a long set-up on the FTSE, which went according to plan perfectly.

We are looking for an ABC retrace within the whole corrective move. Once the last significant LH (lower high) is breached we swing long and can look for a flag to form. If this breaks in a certain way and i get a trigger from my 'trend indicator' it is a confirmed set-up. Stop is a pip below the lowest point of the pullback and target is identical distance to the risk (ie; 1:1). Again, look how price gets there by a mere handful of points before retracing. I'm now short too.

We are looking for an ABC retrace within the whole corrective move. Once the last significant LH (lower high) is breached we swing long and can look for a flag to form. If this breaks in a certain way and i get a trigger from my 'trend indicator' it is a confirmed set-up. Stop is a pip below the lowest point of the pullback and target is identical distance to the risk (ie; 1:1). Again, look how price gets there by a mere handful of points before retracing. I'm now short too.

Davai - 19 Apr 2012 18:44 - 18 of 423

Davai - 19 Apr 2012 19:20 - 19 of 423

Chris Carson

- 19 Apr 2012 19:22

- 20 of 423

- 19 Apr 2012 19:22

- 20 of 423

Aye good call.

Davai - 19 Apr 2012 19:53 - 21 of 423

Yeh thx Chris. I closed the FTSE short ten minutes ago for +40. Its right on a flagline, which i'm watching closely. I might get a validation trigger candle tonight which, if so, means more short side will be nailed on...

Chris Carson

- 19 Apr 2012 20:04

- 22 of 423

- 19 Apr 2012 20:04

- 22 of 423

I closed @ 5710.5 + 24 cheers again.

Chris Carson

- 19 Apr 2012 21:05

- 23 of 423

- 19 Apr 2012 21:05

- 23 of 423

That was some comeback on the Dow, didn't trade it scares the shxt out of me :O)

Davai - 19 Apr 2012 21:20 - 24 of 423

Lol! Yep, that's why i closed short, still expecting much more downside but will wait to see if i get the set-up in the morning. Dow has been a bit jumpy today though!

Davai - 20 Apr 2012 07:30 - 25 of 423

Further to post 10;

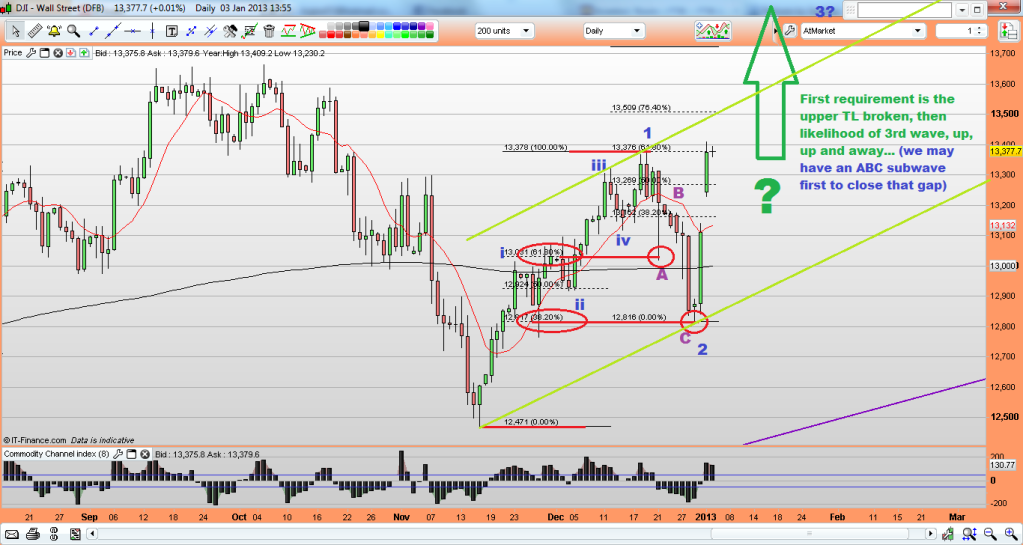

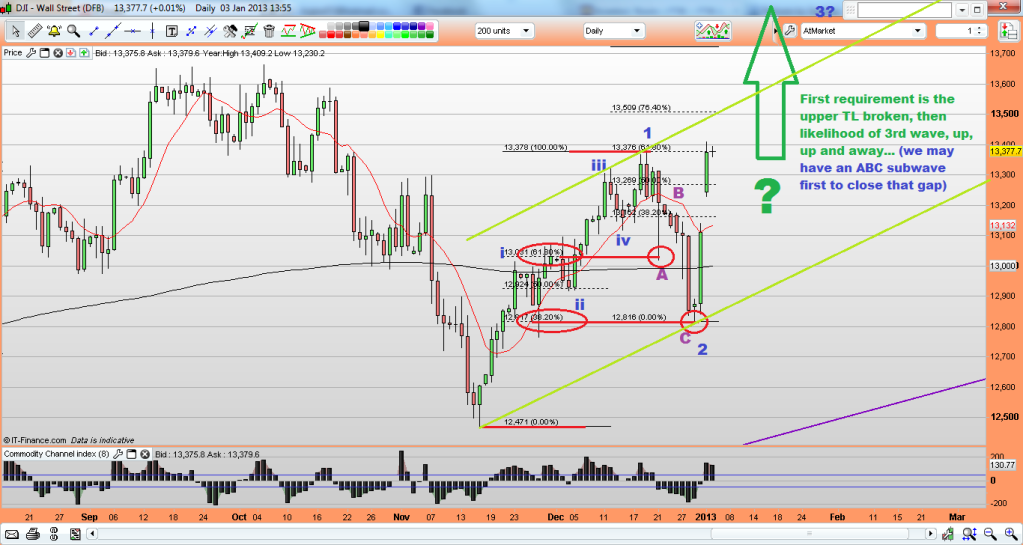

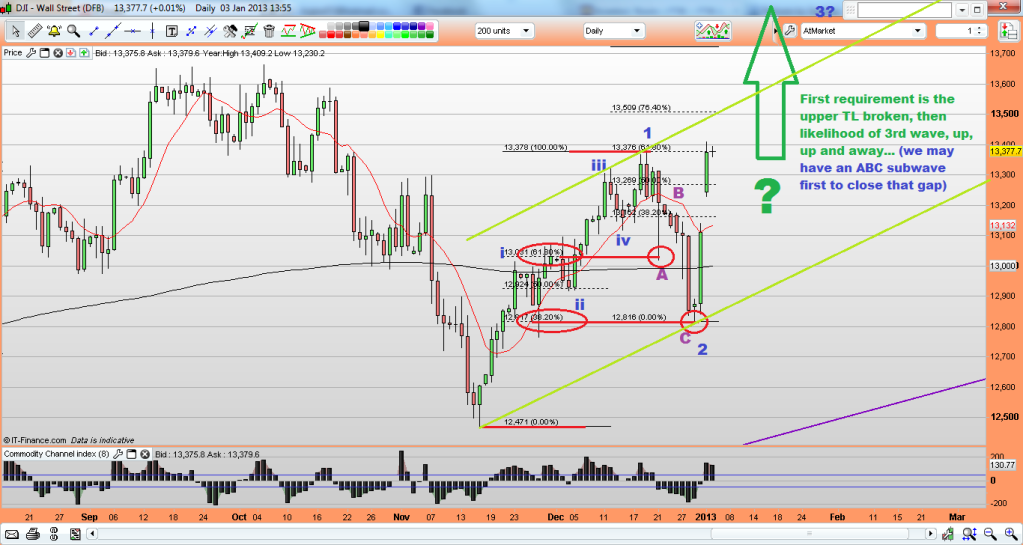

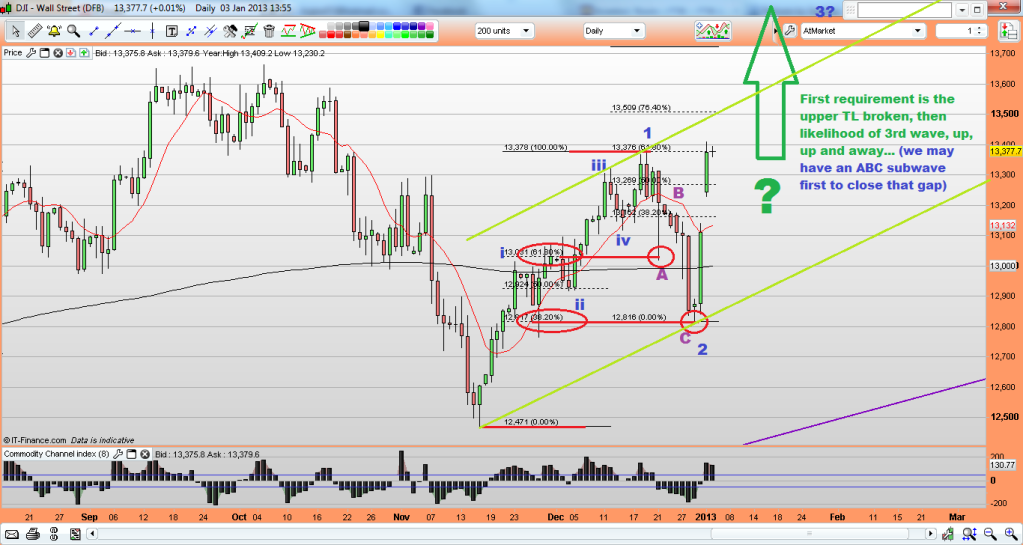

Looks like a possible 1&2 with wave 3 soon;

Complete conflict to last nights thoughts, however, i don't particularly like the structure of wave 1, with the retrace roughly halfway, however, even if an 'AB' of a corrective move, we should still head higher for a 'C' wave.

Biased long, but a break of either black line will make it more obvious.

Looks like a possible 1&2 with wave 3 soon;

Complete conflict to last nights thoughts, however, i don't particularly like the structure of wave 1, with the retrace roughly halfway, however, even if an 'AB' of a corrective move, we should still head higher for a 'C' wave.

Biased long, but a break of either black line will make it more obvious.

Davai - 20 Apr 2012 07:57 - 26 of 423

Davai - 20 Apr 2012 09:34 - 27 of 423

Davai - 20 Apr 2012 10:42 - 28 of 423

Davai - 20 Apr 2012 14:48 - 29 of 423

Given up on the Euro some time ago. Not trending nicely at all and has an algo in play that gives me an entry right into a corrective move, so straight into a loss almost to stop out before turning. here is a perfect example of this, (despite it looking like a valid set-up, i can do without the stress!) The algo comes and goes, but it hasn't been flavour of the month for a while now;

Davai - 20 Apr 2012 14:49 - 30 of 423

Davai - 20 Apr 2012 21:34 - 31 of 423

Davai - 20 Apr 2012 21:45 - 32 of 423

Davai - 21 Apr 2012 13:20 - 33 of 423

Davai - 21 Apr 2012 13:22 - 34 of 423

Obviously complete contrast between the last two charts, so i need the market to show its hand. Will post an exact set-up as it happens. No trigger, no trade. Discipline and patience are equally as important as reading charts in a traders world.

Davai - 23 Apr 2012 10:21 - 35 of 423

Fridays action on the Dax (in particular) was puzzling if it was indeed to be as i had labeled it (a 'i'&'ii' leading to (sub)wave 'iii'), (bigger red circle);

Although powering up in the morning, there was simply no continuance. I was expecting something like i have shown, but instead we got the action within the blue circle, which was at least a red flag so to speak.

I closed the long and although i was tempted to re-enter as it drifted down in the evening, i thought it better to wait for more evidence.

Well, from the off this morning it looked like the alternative count was indeed the way forward, (this on the Dow, but they all make the main moves roughly in conjunction with one another);

Sure enough i got a short trigger on the FTSE at 08:01 and would consider we have quite a way to drop over the coming week. Perhaps a little too early to make that assumption, so the first requirement is a LL on the Dax (6529 req'd)

Although powering up in the morning, there was simply no continuance. I was expecting something like i have shown, but instead we got the action within the blue circle, which was at least a red flag so to speak.

I closed the long and although i was tempted to re-enter as it drifted down in the evening, i thought it better to wait for more evidence.

Well, from the off this morning it looked like the alternative count was indeed the way forward, (this on the Dow, but they all make the main moves roughly in conjunction with one another);

Sure enough i got a short trigger on the FTSE at 08:01 and would consider we have quite a way to drop over the coming week. Perhaps a little too early to make that assumption, so the first requirement is a LL on the Dax (6529 req'd)

Davai - 23 Apr 2012 12:48 - 36 of 423

Updated FTSE probability;

The only thing i don't like is that, again, its not very easy to make an obvious 5wave counter with 'A' and subsequent abc 3wave for 'B', (should be a 5-3-5). Certainly tricky right now and thus it best to keep taking small profits as and when the market gives the next clue. Trying to second guess the longer move right now, is simply not possible, with far too many connotations.

The only thing i don't like is that, again, its not very easy to make an obvious 5wave counter with 'A' and subsequent abc 3wave for 'B', (should be a 5-3-5). Certainly tricky right now and thus it best to keep taking small profits as and when the market gives the next clue. Trying to second guess the longer move right now, is simply not possible, with far too many connotations.

Davai - 23 Apr 2012 13:08 - 37 of 423

Davai - 23 Apr 2012 16:15 - 38 of 423

Davai - 23 Apr 2012 18:16 - 39 of 423

Ok, so using this as a diary to log my thought process. I have a system that works perfectly during trends, being able to dictate a TP (target price) with a very high success rate and thus, have never bothered trading the corrective moves as the chop makes it somewhat unreliable, however, i have deemed it necessary to continue to trade such times as they can indeed last for months. This has seen me have to concentrate more on studying Elliott Wave. It is obvious that you can't try to predict too far ahead during complex correctives, due to the endless connotations available to the market, however, it is very useful indeed to have a plan beforehand and then to reduce the timescales and look for shorter term set-ups. Here's a chart of the £/Yen that i have labelled... My thoughts with regard to the recent gain is that it is still corrective and we will see lower to come after completing a 'B' wave, however, i'm struggling to label last weeks rise as a full 5 waves. I thought the pullback today might be a 'iv', however it just doesn't fit and rather think this is as per the chart. Lets see how it plays out and at least i can compare afterwards to see where i went wrong...

(or curse that i never traded it, if it plays out correctly!)

(or curse that i never traded it, if it plays out correctly!)

Davai - 24 Apr 2012 10:29 - 40 of 423

Davai - 24 Apr 2012 12:34 - 41 of 423

Going back to my chart of the £/Yen in post 39;

To zoom in now on my 'suspected' 3 legged (abc) 'B'wave (of the 5-3-5), in particular what i expect to be the 'c', we can label it in 5;

Not so sure about allowing my subwaves 'i'&'iv' to overlap, but its not important. the interesting thing i have noticed on many occasion is that the subwave 'iv' of 3, is very often a smaller version of the pattern to expect in the 4th, (as shown in the red circles), in this case a flat abc correction...

To zoom in now on my 'suspected' 3 legged (abc) 'B'wave (of the 5-3-5), in particular what i expect to be the 'c', we can label it in 5;

Not so sure about allowing my subwaves 'i'&'iv' to overlap, but its not important. the interesting thing i have noticed on many occasion is that the subwave 'iv' of 3, is very often a smaller version of the pattern to expect in the 4th, (as shown in the red circles), in this case a flat abc correction...

Davai - 24 Apr 2012 22:26 - 42 of 423

With ref to above, slightly confusing, but i think it can be labelled differently, but with the same HH outcome (as was the case). Knackered right now, so will do it in the morning.

Davai - 25 Apr 2012 10:07 - 43 of 423

Ok, so without trying to label every last minuette subwave, this is how it looks. It's obvious to me that extended 5th waves occur frequently during corrective cycles, so point learnt. I have shown this in the following chart. I was right to expect a HH as per post 41, but didn't realise we were printing a larger (and somewhat out of proportion, it has to be said) 4th, (red circle)... Whilst looking for an end to the 5th, i look out for what is essentially a 123 reversal. As explained before, it is basically waves 1&2 of the next move, (blue circle)... the 123 is numbered 5,1&2 in that order, within the blue circle. Entry is upon break of point 2 and stop a pip above point 3... I went short earlier @ 13,120 using this popular reversal pattern, the poor GDP data sped things up a tad!

Davai - 25 Apr 2012 10:22 - 44 of 423

Davai - 25 Apr 2012 14:47 - 45 of 423

Update to trade and i think the markets done me a beauty. Originally banked a whack from the sharp drop this morning, but a bit of ill-discipline later and i find myself shorting free-style within what i presumed was a 4th wave, feeling safe in the knowledge a 5th wave and LL (lower low) was to come. Except, it took me far too long to accept or realise that the move wasn't flat enough. Pullback of '2' was quite sharp as per last chart, so '4' should be flat. Looking at the following chart, we have what i believe was a short 4th, (now shown as 'iv') with the 5th ('v') ending exactly to the tenth of a pip level with '3' ('iii'). This means back in 3 waves corrective for an ABC to form a much larger 1&2... I decided to close out giving back a large chunk of what i had gained earlier!... follow me so far?!

The chart;

I could have raised my stops, but would rather let it play out and look for more confirmation instead. I'm watching two fib retracement levels (orange and red) for a bounce, (the orange 61.8% being favourable as it should be a resistance turned support level). We then go back to looking for another 123 reversal pattern to form subwaves 1&2 of the 3rd. If correct a much larger drop should ensue. lets see...

The chart;

I could have raised my stops, but would rather let it play out and look for more confirmation instead. I'm watching two fib retracement levels (orange and red) for a bounce, (the orange 61.8% being favourable as it should be a resistance turned support level). We then go back to looking for another 123 reversal pattern to form subwaves 1&2 of the 3rd. If correct a much larger drop should ensue. lets see...

Davai - 25 Apr 2012 15:13 - 46 of 423

Davai - 25 Apr 2012 16:06 - 47 of 423

Davai - 25 Apr 2012 18:05 - 48 of 423

Davai - 25 Apr 2012 20:11 - 49 of 423

Davai - 25 Apr 2012 20:44 - 50 of 423

Just getting the impression that there is a big rush on to complete some wave counts. Cable has (so far) only made a HH for its final 'C' wave of the corrective move, over point 'A' by a mere 16 pips. You may be scratching your head as to why its higher now than when the dire GDP data came out earlier showing we are back in a recession! That is your answer! It has to complete its obligations. Looking for 123 reversals and need a small one which will be subwaves 'i'&'ii' of a larger 1&2. I may even try to get a decent swing trade on the go to run alongside my system trades.

Davai - 25 Apr 2012 21:44 - 51 of 423

Davai - 25 Apr 2012 23:18 - 52 of 423

Davai - 25 Apr 2012 23:32 - 53 of 423

Davai - 26 Apr 2012 09:16 - 54 of 423

Davai - 26 Apr 2012 09:31 - 55 of 423

Davai - 26 Apr 2012 17:29 - 56 of 423

I should have shown 'C' as 5 waves, thus a triple 3, (11 moves). I'm currently trying to determine if according to the rules, 'x' is allowed to breach a 'b' within the cycle. If not and you get your counts right, it would make for an absolutely fantastic high probability/low risk trade right now. If the minor 'c' of the final 'x' wave has to make a HH over minor 'a', but can't breach the previous 'x', (between the blue lines), we can short there knowing there is one more abc to come and put our stop merely a dozen or so points above, (a pip above 'b'). Target is around the previous low of 'A' as this is a flat corrective. Watching;

Davai - 26 Apr 2012 20:36 - 57 of 423

Chris Carson

- 26 Apr 2012 21:50

- 58 of 423

- 26 Apr 2012 21:50

- 58 of 423

Davai - I like this chart better, I am no technical analyst (no shit I hear you say :O) but if, a very big if, volume was to increase dramatically isn't it just possible Dow could go higher to close to 5yr highs? I'm not trading it to find out scares the shxt out of me.

Chris Carson

- 26 Apr 2012 21:56

- 59 of 423

- 26 Apr 2012 21:56

- 59 of 423

Chris Carson

- 26 Apr 2012 21:56

- 60 of 423

- 26 Apr 2012 21:56

- 60 of 423

Davai - 26 Apr 2012 22:24 - 61 of 423

Chris, in short, i am expecting higher to come this summer, but probably not a fresh high over 2007 level. This whole move since October 2007 is corrective and we still have a final leg up before it completes the 'B' wave, (well, my reckoning anyway), there are a couple of different ways to label it, but it might see us well into late summer/autumn, hell, even into 2013 before the death spiral of wave 'C' back down to new lows...

Right now, my thinking is that we are in a complex corrective wave, of which A is finished and to repost my chart from earlier (below) i actually think tonight sees us end wave B too. That leaves us free to weave our way back down to a new low (12,700 area) before starting a more orderly climb back up.

Of course these are just my own workings and thus an opinion.

Right now, my thinking is that we are in a complex corrective wave, of which A is finished and to repost my chart from earlier (below) i actually think tonight sees us end wave B too. That leaves us free to weave our way back down to a new low (12,700 area) before starting a more orderly climb back up.

Of course these are just my own workings and thus an opinion.

Chris Carson

- 26 Apr 2012 22:28

- 62 of 423

- 26 Apr 2012 22:28

- 62 of 423

Thanks for that Davai, interesting.

Davai - 27 Apr 2012 09:12 - 63 of 423

Back to post 56 now;

Davai - 26 Apr 2012 17:29 - 56 of 62 edit this post

'I should have shown 'C' as 5 waves, thus a triple 3, (11 moves). I'm currently trying to determine if according to the rules, 'x' is allowed to breach a 'b' within the cycle.'

'Target is around the previous low of 'A' as this is a flat corrective. Watching;'

-----------------------------

Ok learnt a couple of things. The market mixes it up enough to make it difficult to label the moves for certain before they are completed, therefore better to keep your stop above either the last known 'X' or better still a pip above point 'B'

I'm happy with the way i've labeled the following chart and it says to me that 'X' can breach the previous 'b', but obviously not the previous 'X'

If you strip all the workings down, then the important part was this,

'Target is around the previous low of 'A' as this is a flat corrective.' ('A' being the low to the left of the chart)

So, with your stop above point 'B' (after the abcde wave) we had a target of approx point 'A' because we had determined this was a flat corrective move.

Some overnight news caused some very rapid movements, but the second chart shows in detail the last abc move to print the target req'd;

Davai - 26 Apr 2012 17:29 - 56 of 62 edit this post

'I should have shown 'C' as 5 waves, thus a triple 3, (11 moves). I'm currently trying to determine if according to the rules, 'x' is allowed to breach a 'b' within the cycle.'

'Target is around the previous low of 'A' as this is a flat corrective. Watching;'

-----------------------------

Ok learnt a couple of things. The market mixes it up enough to make it difficult to label the moves for certain before they are completed, therefore better to keep your stop above either the last known 'X' or better still a pip above point 'B'

I'm happy with the way i've labeled the following chart and it says to me that 'X' can breach the previous 'b', but obviously not the previous 'X'

If you strip all the workings down, then the important part was this,

'Target is around the previous low of 'A' as this is a flat corrective.' ('A' being the low to the left of the chart)

So, with your stop above point 'B' (after the abcde wave) we had a target of approx point 'A' because we had determined this was a flat corrective move.

Some overnight news caused some very rapid movements, but the second chart shows in detail the last abc move to print the target req'd;

Davai - 27 Apr 2012 15:24 - 64 of 423

The Dow made a HH this morning and thus invalidated the possible set-up that i mentioned last night. The pullback was actually abc corrective (label ('iii'),('iv') & ('v') as a,b & c respectively. Here is a chart as to what would have been a great set-up. Its this kind of thing that i look for constantly. The primary 123 can be traded in its own right, but they occur quite frequently and don't always give the points, so i prefer to use them as a 'heads up' of a larger 1&2 (secondary 123). Entry is the break of point 2 (by a full pip), stop above point 1, (or 3 aggressively and only if the pullback was deep)

Anyway, moving on, we may still be a whisker away from an intermediate top; possibility for the Dax. Last nights short off of the line gave a good hundred pips plus, but was a likely abc 4th wave instead, therefore we might have the scenario in the bottom two charts;

last night;

this morning;

and how i view it right now;

wave 'B' in close up;

Anyway, moving on, we may still be a whisker away from an intermediate top; possibility for the Dax. Last nights short off of the line gave a good hundred pips plus, but was a likely abc 4th wave instead, therefore we might have the scenario in the bottom two charts;

last night;

this morning;

and how i view it right now;

wave 'B' in close up;

Davai - 27 Apr 2012 19:48 - 65 of 423

Something was bugging me earlier. The GbpJpy usually correlates to the markets and as my charts suggest, i reckon there is a good blast north around the corner. However, i have also posted i expect the markets to tank shortly. Well, its possible we will have a couple more days or so yet and end up with an irregular correction on the Dow, ('B' wave making a fresh high), with 'C' a slightly LL and probably a flat for the £/yen. All three that i watch correlate closely together with this particular count which involves the Dax and the Dow reaching a 1.62 fib extension of their 'a' of the 'B' wave.

Here's all three charts;

(as prev posted), £/yen;

the Dow plan;

and the Dax;

all three give us probably into the middle of the week for more gains before a major turn, with the £/yen in particular looking good for some great gains. Well, its only analysis at this stage, but at least with a plan i can now look on smaller timescales to see if it works out and of course trade it accordingly.

Here's all three charts;

(as prev posted), £/yen;

the Dow plan;

and the Dax;

all three give us probably into the middle of the week for more gains before a major turn, with the £/yen in particular looking good for some great gains. Well, its only analysis at this stage, but at least with a plan i can now look on smaller timescales to see if it works out and of course trade it accordingly.

Davai - 27 Apr 2012 20:49 - 66 of 423

Chris, i reckon you stand a very good chance of winning the M&S vouchers this month mate!

Chris Carson

- 27 Apr 2012 21:04

- 67 of 423

- 27 Apr 2012 21:04

- 67 of 423

Well it would be a first Davai, I'll believe it when I see it mate :O)

As regards Monday never mind next month I haven't got a clue where the indeces are going. To be honest just wish it would stop bloody raining so I could play some golf. Good luck with your trading.

As regards Monday never mind next month I haven't got a clue where the indeces are going. To be honest just wish it would stop bloody raining so I could play some golf. Good luck with your trading.

Davai - 27 Apr 2012 21:28 - 68 of 423

Just got a feeling it might add 30 odd points on Monday, but lets see! Have a good weekend!

Davai - 30 Apr 2012 18:43 - 69 of 423

So, bit surprised by todays moves, still biased for upside soon and am wondering if its looking for the 1.62% level of 'a' for the target. Decisive break of this and its a completely different count entirely, with another fib level at 12890 being the 61.8% retrace of the recent move up. As it is, its just back to how i envisaged it last week;

last week;

last week;

Davai - 30 Apr 2012 19:22 - 70 of 423

So, the alternative count. Although i would even consider this a more natural looking corrective move, (retracing 50/61.8% of wave 1) for wave 2, i struggle to accept the final part ('c') of the 'B' wave being the recent 'abcde' expanding triangle move, (although it is in 5 waves). It also appears massively out of symmetry. So i will try to see if its possible/likely,

Davai - 01 May 2012 16:03 - 71 of 423

Davai - 01 May 2012 16:19 - 72 of 423

So, now in closer detail;

The reversal was easy to spot. Three 15min candles with a bit of impetus and on closer inspection gave me a fast 5wave impulse move, the pullbacks of each being so minor, it was clearly showing the way, (these i have listed as (i) through to (v) of '1'). Then follows another clear abc corrective move, before climbing up to trigger the set-up long on a break of point (v). Reading it as a 123 reversal; this is point 2. Stop is a pip below point 3. the ISM data did the rest;

The reversal was easy to spot. Three 15min candles with a bit of impetus and on closer inspection gave me a fast 5wave impulse move, the pullbacks of each being so minor, it was clearly showing the way, (these i have listed as (i) through to (v) of '1'). Then follows another clear abc corrective move, before climbing up to trigger the set-up long on a break of point (v). Reading it as a 123 reversal; this is point 2. Stop is a pip below point 3. the ISM data did the rest;

Davai - 01 May 2012 16:29 - 73 of 423

Davai - 02 May 2012 09:28 - 74 of 423

So you've realised that the £/Yen is my favourite pair for trading right now.

This may be repetitive from yesterday, but the count became clear from the overnight action, so i want to post the relevant charts and updates;

Expected reversal point from Mondays action;

update;

Updated update (with overnight action);

and in closer detail with the wave counts etc;

That is surely proof to any doubters that charts and Elliott wave do work!

This may be repetitive from yesterday, but the count became clear from the overnight action, so i want to post the relevant charts and updates;

Expected reversal point from Mondays action;

update;

Updated update (with overnight action);

and in closer detail with the wave counts etc;

That is surely proof to any doubters that charts and Elliott wave do work!

Davai - 02 May 2012 13:11 - 75 of 423

Davai - 02 May 2012 13:11 - 76 of 423

Davai - 03 May 2012 14:37 - 77 of 423

Davai - 03 May 2012 17:04 - 78 of 423

Davai - 03 May 2012 19:07 - 79 of 423

Davai - 03 May 2012 19:12 - 80 of 423

Davai - 04 May 2012 16:58 - 81 of 423

Davai - 04 May 2012 17:30 - 82 of 423

Interesting to note this;

(from last night's analysis);

'Better post this one on here as well i guess. Possibile alternative play on the Dax with a triangle in play. This shows far less upside before the drop;'

Indeed, the 'E' wave was very short underlining the weakness of the markets today. Similar happened on the Euro, with a very short 'C' wave before the drop...

(from last night's analysis);

'Better post this one on here as well i guess. Possibile alternative play on the Dax with a triangle in play. This shows far less upside before the drop;'

Indeed, the 'E' wave was very short underlining the weakness of the markets today. Similar happened on the Euro, with a very short 'C' wave before the drop...

Davai - 10 May 2012 08:25 - 83 of 423

Davai - 11 May 2012 16:06 - 84 of 423

Unfortunately, looks like more downside next week for index's (and thus strength for dollar). Getting close to some great long entries on a few pairs. The Loonie looks like it wants up from here...

Davai - 11 May 2012 16:14 - 85 of 423

Davai - 14 May 2012 20:33 - 86 of 423

Davai - 14 May 2012 21:30 - 87 of 423

Back to; Davai - 18 Apr 2012 20:48 - 13 of 86

Very clear 5 wave advance on the EurJpy, if this corrective move plays out it will be good to go long and strong;

Update;

and now im watching the small 5 wave advance since hitting my blue line earlier. Hopefully we will get a clear abc and a bounce off of a fib level. I must add, i'm expecting dollar strength tomorrow though therefore the Eur needs to be somewhat resilient, (or it may do a 100% retrace, so long as it doesn't make a fresh low), this just may be the start of a lengthy run for the Euro, (yes, just when all the current Greek problems seem to mean the opposite)...

Very clear 5 wave advance on the EurJpy, if this corrective move plays out it will be good to go long and strong;

Update;

and now im watching the small 5 wave advance since hitting my blue line earlier. Hopefully we will get a clear abc and a bounce off of a fib level. I must add, i'm expecting dollar strength tomorrow though therefore the Eur needs to be somewhat resilient, (or it may do a 100% retrace, so long as it doesn't make a fresh low), this just may be the start of a lengthy run for the Euro, (yes, just when all the current Greek problems seem to mean the opposite)...

Davai - 15 May 2012 11:41 - 88 of 423

Davai - 15 May 2012 12:24 - 89 of 423

Davai - 15 May 2012 20:19 - 90 of 423

Davai - 15 May 2012 21:01 - 91 of 423

Davai - 16 May 2012 13:36 - 92 of 423

If the first small 'i'/'ii' is too risky to determine, we look for a follow on 5w up, half position entered long on pullback to a fib level. In this instance such a deep pullback, gives a fantastic low risk entry at points 'a' & 'c', wave structure here is very important, with 'a' being down in 3, it was going to be either a flat or irregular correction, sure enough, 'b' heads right back up nearly retracing all of 'a' and 'c' making a slightly LL. More confirmation comes with a break of the top of '1' by a full pip, enter second half of position long and look to fibs for target once the 3rd can be determined...

Davai - 16 May 2012 19:50 - 93 of 423

Davai - 18 May 2012 08:37 - 94 of 423

Davai - 18 May 2012 08:38 - 95 of 423

Davai - 18 May 2012 10:58 - 96 of 423

Davai - 18 May 2012 11:57 - 97 of 423

Davai - 18 May 2012 13:22 - 98 of 423

Davai - 22 May 2012 14:47 - 99 of 423

A perfect trade;

After a recent short target was reached on the above chart, coinciding with my Cad target (above) and the Dow twin Fib targets, i was suspecting a bounce;

(Davai - 18 May 2012 08:37 - 94 of 98

'Respite for the markets. This is a perfect 5w count;'),

So we watch for an ABC. The important part is that 'A' breaches the last significant high, (as shown by the blue line in the above chart), now we wait for 'B' to retrace and then turn back upwards, to start wave 'C'. This will be in 5 waves. With that knowledge, we wait for wave 1 to end and draw our fib levels, wave 2 should retrace in 3 minor waves and bounce off of one of those fib levels. we can now draw a flagline starting from the top of 'A' and touching the top of wave 1. Using my system, i get a trigger upon breakout where i can determine a target price for the set-up. Stop is a pip below the lowest point of the pullback ('B'), target is equal distance away from entry, thus a risk:reward of 1:1, but very high probability. This rises still further when you look at the fib level of 261.8%. This is often a target off of wave 1 for either the end of the 3rd wave or even the whole 5 waves, look how it is identical to my system generated target...

It looks like this is ABC of A, followed by tonights drop being ABC of 'B', so a larger 5 wave C to come over next couple of days, this should also mean higher yet for index's before one more drop...

After a recent short target was reached on the above chart, coinciding with my Cad target (above) and the Dow twin Fib targets, i was suspecting a bounce;

(Davai - 18 May 2012 08:37 - 94 of 98

'Respite for the markets. This is a perfect 5w count;'),

So we watch for an ABC. The important part is that 'A' breaches the last significant high, (as shown by the blue line in the above chart), now we wait for 'B' to retrace and then turn back upwards, to start wave 'C'. This will be in 5 waves. With that knowledge, we wait for wave 1 to end and draw our fib levels, wave 2 should retrace in 3 minor waves and bounce off of one of those fib levels. we can now draw a flagline starting from the top of 'A' and touching the top of wave 1. Using my system, i get a trigger upon breakout where i can determine a target price for the set-up. Stop is a pip below the lowest point of the pullback ('B'), target is equal distance away from entry, thus a risk:reward of 1:1, but very high probability. This rises still further when you look at the fib level of 261.8%. This is often a target off of wave 1 for either the end of the 3rd wave or even the whole 5 waves, look how it is identical to my system generated target...

It looks like this is ABC of A, followed by tonights drop being ABC of 'B', so a larger 5 wave C to come over next couple of days, this should also mean higher yet for index's before one more drop...

Davai - 23 May 2012 08:06 - 100 of 423

Davai - 24 May 2012 20:00 - 101 of 423

Davai - 24 May 2012 10:11 - 8240 of 8247

My current thoughts are with my original chart of last night. We have just played out an abc 4th, which was far longer in timescale due to overnight futures. We head up for a 5th and then back down in an abc corrective (probably tonight), this would mean much higher early next week;

(with regards to above comments; i forgot that it is Thursday today! Tomorrow should be a big up day, prob Mon/Tues for reversal back down, but too early to tell just yet...

My current thoughts are with my original chart of last night. We have just played out an abc 4th, which was far longer in timescale due to overnight futures. We head up for a 5th and then back down in an abc corrective (probably tonight), this would mean much higher early next week;

(with regards to above comments; i forgot that it is Thursday today! Tomorrow should be a big up day, prob Mon/Tues for reversal back down, but too early to tell just yet...

Davai - 25 May 2012 08:14 - 102 of 423

Davai - 25 May 2012 14:18 - 103 of 423

Davai - 26 May 2012 10:21 - 104 of 423

(copied across from the other thread)

Davai - 26 May 2012 10:15 - 8257 of 8257

Look how easily the pattern changes hinged on the length of the (iv)th, its now likely to be an expanding diagonal;

I do have a system target of 1348, but watching with interest as we are in an ABC counter-trend move and thus i don't have enough evidence yet to call that with conviction... If it does reach that level, it will surely reverse thereabouts...

Davai - 26 May 2012 10:15 - 8257 of 8257

Look how easily the pattern changes hinged on the length of the (iv)th, its now likely to be an expanding diagonal;

I do have a system target of 1348, but watching with interest as we are in an ABC counter-trend move and thus i don't have enough evidence yet to call that with conviction... If it does reach that level, it will surely reverse thereabouts...

Davai - 26 May 2012 14:58 - 105 of 423

Davai - 27 May 2012 21:48 - 106 of 423

Davai - 28 May 2012 11:47 - 107 of 423

Davai - 10 Jun 2012 22:45 - 108 of 423

Remember this?;

Davai - 27 Apr 2012 19:48 - 65 of 107

the Dow plan;

Well i think we may have reached the bottom, (speculative for sure right now and need evidence)

Davai - 10 Jun 2012 22:18 - 8343 of 8343

Here are my current thoughts as to the Dow. The FIB levels are reproduced from the length of 'A' (not seen to the left of the chart), it looks as though we have completed a full ABC retrace within the uptrend, with the first part ('A') of the correction starting 27th March. This is of course, speculative, but the FIB levels have been deadly accurate for the whole of wave C.

I'm looking for the last Lower High (prev wave 4 as per chart), to be breached tonight/tomorrow for further confirmation, then we can look for a large ABC retrace to begin. This can be sharp/shallow, zigzag/flat or irregular, but if it forms a clear 3-3-5/5-3-5 and doesn't make a fresh low, we are in business for a Higher High to come in a month or so's time and higher for the rest of the summer at least...

Sound crazy with everyone expecting new lows with all the Spain/Euro probs??? Yep that's how it will catch everyone out. I would expect the ABC to be a deep zigzag, just to scare everyone, but if no LL, we are good to go.

here's the chart;

Davai - 27 Apr 2012 19:48 - 65 of 107

the Dow plan;

Well i think we may have reached the bottom, (speculative for sure right now and need evidence)

Davai - 10 Jun 2012 22:18 - 8343 of 8343

Here are my current thoughts as to the Dow. The FIB levels are reproduced from the length of 'A' (not seen to the left of the chart), it looks as though we have completed a full ABC retrace within the uptrend, with the first part ('A') of the correction starting 27th March. This is of course, speculative, but the FIB levels have been deadly accurate for the whole of wave C.

I'm looking for the last Lower High (prev wave 4 as per chart), to be breached tonight/tomorrow for further confirmation, then we can look for a large ABC retrace to begin. This can be sharp/shallow, zigzag/flat or irregular, but if it forms a clear 3-3-5/5-3-5 and doesn't make a fresh low, we are in business for a Higher High to come in a month or so's time and higher for the rest of the summer at least...

Sound crazy with everyone expecting new lows with all the Spain/Euro probs??? Yep that's how it will catch everyone out. I would expect the ABC to be a deep zigzag, just to scare everyone, but if no LL, we are good to go.

here's the chart;

Davai - 21 Jun 2012 17:02 - 109 of 423

Well, after identifying the recent 5w advance, it is clear that it wasn't followed up by a typical ABC retrace (as per above). Instead, we got a faster 'B' wave pullback and another 5w advance ('C') to follow. This may have already completed, or perhaps have one last move up to go.

If this is correct and it certainly looks it right now, we could be about to start a very nasty sell off. Possibly a couple thousand points to come off of the Dow in the coming weeks...

If this is correct and it certainly looks it right now, we could be about to start a very nasty sell off. Possibly a couple thousand points to come off of the Dow in the coming weeks...

Davai - 21 Jun 2012 17:12 - 110 of 423

Davai - 21 Jun 2012 17:25 - 111 of 423

Davai - 21 Jun 2012 18:41 - 112 of 423

Davai - 21 Jun 2012 19:03 - 113 of 423

Davai - 21 Jun 2012 19:18 - 114 of 423

Davai - 27 Jun 2012 04:29 - 115 of 423

Things looking ripe for some red today!

*edit* A day out with timing and some corrective moves completed by the looks. Markets want up and looks to be the real deal, so now over-rules previous posts. This will probably mean original plan, with a HH to come for the Dow...

*edit* A day out with timing and some corrective moves completed by the looks. Markets want up and looks to be the real deal, so now over-rules previous posts. This will probably mean original plan, with a HH to come for the Dow...

Davai - 06 Oct 2012 11:36 - 116 of 423

Ok, lets try to show workings behind a great trade yesterday...

Firstly, here is a chart of the hourly Audi;

I could have shown a 4hr which would identify this as a complex corrective phase and the likelihood of us being in a 5 wave move ('C' wave).

We are nearing the end of this move (as per the chart). Here we can clearly label the move as the market is being very kind right now and literally signposting each move.

Once we have finished the powerful 3rd wave, we can look for an ABC 4th. In this instance wave 2 was short and simple, thus we can expect alternation and a longer more complex wave 4. I have attempted to label that in the chart below, but first lets observe a couple of things. Draw a line connecting the end of waves 2&4, then drag a parellel line across to the end of wave 1, (blue lines), this will give a likely target for the end of the whole 5 waves... In this instance i believe we may get a second touch as its unlikely that we have finished the move and have just encountered our 4th (subwave) of the 5th just before the close...

Now to look in more detail at the 4th wave and the break out into the powerful 3rd (subwave) of the 5th wave;

Here we can follow the structure of the 4th wave in a 5-3-5 ABC formation. Its even possible to clearly label the subwaves within the 5th wave of 'C'. This set us up for downside early on yesterday, (subwave 1 of the 5th), but after a&b (of subwave 2) and with the need for a corrective 'c' to come around the time of 'Non Farms', (I also had the Euro pegged to go up at the same time), so i wasn't expecting bad news. Surprise surprise, up we go. The Audi made a steep retrace, but couldn't breach the start of point 1 of course (stop placement). Once completed it was time to start subwave 'iii' (of the 5th). At this stage we don't know what shape it will take as 5th's can develop in many fashions, but once it started dropping sharply it was obvious it was impulsive, we would get a clean break of the flagline and likely drop in a strong move. Shorting the rise of the 'C' wave (of subwave 2) with stop above start of point 1 is a great trade. Equally shorting the break of the flagline, (bigger points risk, but more evidence)

Firstly, here is a chart of the hourly Audi;

I could have shown a 4hr which would identify this as a complex corrective phase and the likelihood of us being in a 5 wave move ('C' wave).

We are nearing the end of this move (as per the chart). Here we can clearly label the move as the market is being very kind right now and literally signposting each move.

Once we have finished the powerful 3rd wave, we can look for an ABC 4th. In this instance wave 2 was short and simple, thus we can expect alternation and a longer more complex wave 4. I have attempted to label that in the chart below, but first lets observe a couple of things. Draw a line connecting the end of waves 2&4, then drag a parellel line across to the end of wave 1, (blue lines), this will give a likely target for the end of the whole 5 waves... In this instance i believe we may get a second touch as its unlikely that we have finished the move and have just encountered our 4th (subwave) of the 5th just before the close...

Now to look in more detail at the 4th wave and the break out into the powerful 3rd (subwave) of the 5th wave;

Here we can follow the structure of the 4th wave in a 5-3-5 ABC formation. Its even possible to clearly label the subwaves within the 5th wave of 'C'. This set us up for downside early on yesterday, (subwave 1 of the 5th), but after a&b (of subwave 2) and with the need for a corrective 'c' to come around the time of 'Non Farms', (I also had the Euro pegged to go up at the same time), so i wasn't expecting bad news. Surprise surprise, up we go. The Audi made a steep retrace, but couldn't breach the start of point 1 of course (stop placement). Once completed it was time to start subwave 'iii' (of the 5th). At this stage we don't know what shape it will take as 5th's can develop in many fashions, but once it started dropping sharply it was obvious it was impulsive, we would get a clean break of the flagline and likely drop in a strong move. Shorting the rise of the 'C' wave (of subwave 2) with stop above start of point 1 is a great trade. Equally shorting the break of the flagline, (bigger points risk, but more evidence)

chuckles - 06 Oct 2012 23:59 - 117 of 423

Going back to June Davai it seems like all of your predictions were, err, wrong? No nasty sell off, entirely the opposite in fact.

Davai - 08 Oct 2012 13:04 - 118 of 423

True.... that's the purpose of the thread though to be fair... put it out there to be able to look back and learn from. To be fair, i generally only ever trade on small timescales and thus am only really interested in short term movements...

Apologies, I will try to get it right next time! )

Apologies, I will try to get it right next time! )

chuckles - 08 Oct 2012 20:17 - 119 of 423

All fair comments Davai, my post was more aimed at the inaccuracies of Elliot Wave Theory, give 10 practitioners the same chart and all 10 would have different outcomes :-)

Davai - 11 Oct 2012 11:48 - 120 of 423

Not going to disagree with any of that. Now... just recording some thoughts here;

They are that we have just completed a 5wave down and are now in an ABC retrace. Of that we are printing abc (of 'A'). System target is 12904, but obvious target would be 12920 (the 38.2% fib retracement level), before we start an abc 'B' back down...

I am labeling this as an expanding wedge. I brought my stop up to BE too soon (after system entry) and got stopped out to the exact pip on the downleg of 'D', this was exactly entry point, the market knows this and thus why it did a second retest of this point. Observation is to bring stop up to a pip below point 'B', thus reducing risk by two thirds, but staying clear of the probability of a stop out. If stopped then the entire set-up and thinking is invalid anyway, with risk at just one third of original entry, i should have been able to live with that.... I recognised the pattern merely 30 seconds after stop out, but PA had already risen and gone away from that level.... the trade had gone... I swear i will recognise it earlier next time!

Result; market went to target quite quickly without me onboard... pissed off? yes, but another feather in the cap as it were... carry on...

*Edit* In trying to determine the correct labeling, i am preferring some kind of double or possibly even a triple zigzag. Info says expanding triangles shouldn't occur in a 'C' wave and a diagonal would be contracting. PA also didn't conform within the lines, so a triple zigzag in an 'X' wave it shall be... same conclusion as to stop placement and same result with system target having now been met.

They are that we have just completed a 5wave down and are now in an ABC retrace. Of that we are printing abc (of 'A'). System target is 12904, but obvious target would be 12920 (the 38.2% fib retracement level), before we start an abc 'B' back down...

I am labeling this as an expanding wedge. I brought my stop up to BE too soon (after system entry) and got stopped out to the exact pip on the downleg of 'D', this was exactly entry point, the market knows this and thus why it did a second retest of this point. Observation is to bring stop up to a pip below point 'B', thus reducing risk by two thirds, but staying clear of the probability of a stop out. If stopped then the entire set-up and thinking is invalid anyway, with risk at just one third of original entry, i should have been able to live with that.... I recognised the pattern merely 30 seconds after stop out, but PA had already risen and gone away from that level.... the trade had gone... I swear i will recognise it earlier next time!

Result; market went to target quite quickly without me onboard... pissed off? yes, but another feather in the cap as it were... carry on...

*Edit* In trying to determine the correct labeling, i am preferring some kind of double or possibly even a triple zigzag. Info says expanding triangles shouldn't occur in a 'C' wave and a diagonal would be contracting. PA also didn't conform within the lines, so a triple zigzag in an 'X' wave it shall be... same conclusion as to stop placement and same result with system target having now been met.

Davai - 12 Oct 2012 09:19 - 121 of 423

Hmmmmm, EW working well recently. Again, draw your lines from point 2&4 and run a parallel off of 1 to find likely target for 5. In this instance no valid trigger occured out of the flagline of 4. It is highly unlikely that this current hourly candle will print higher than the previous candle as it would trigger a far higher target.

We can expect an abc 'B' wave back down later, but probably a HH to come yet;

*Edit* there has been absolutely no further evidence of a turn so far and it looks like the last HH could be breached thus a 3rd wave to the longside...

We can expect an abc 'B' wave back down later, but probably a HH to come yet;

*Edit* there has been absolutely no further evidence of a turn so far and it looks like the last HH could be breached thus a 3rd wave to the longside...

Davai - 16 Oct 2012 09:29 - 122 of 423

Continuing from last post and also recording a couple of thoughts;

As above; we came back down in an ABC corrective (B) wave and have since printed what i suspect is another 5w up, (of which we may have just seen the top (speculative for now);

So, my overall thoughts are that we have possibly completed waves 1&2 of a large 'C' wave with the rest to follow shortly. If correct, this can take many forms, so again the next couple of charts are highly speculative. I'm posting them just to be able to compare to the actual event in a couple of weeks time...

It does however mean that i have something to work to and will now look for more evidence, starting with a LL/LH combo's.

or perhaps something like this;

I'm using this thread purely as a diary. This is not to try to claim guru points! Been there and made myself look silly on far too many occasions. EW has a way of presenting a case for both directions, however as i see it, what we have now looks very much like a 5-3-5 complete or nearing completion, so i am certainly looking for a trend change and some pippage to the short side soon with the possibility of the above scenario playing out... If it doesn't then at least i can look back and study to see what was different and how i can apply it to future analysis. There is STILL a case for 'B' being a fresh wave 1 and thus reality could be the exact opposite! with it being time to get long and strong, but i don't think so; it looks too much like its in a 3 wave move (corrective)...

As i have previously pointed out, i actually only play the smaller timescales and thus look for the HH/HL or LL/LH combo's and try to suss 5w/abc moves intraday, so its a case of building a picture and trading accordingly. Regardless, its nice to have a general plan to work too...

Just to include a further chart, here i can see we have reached a Fib retracement level of the larger 5w move down, coinciding with a trend line of an expanding diagonal, ending at the point 'E'.

*Edit* A fresh HH invalidates the above.

Clearly, the labeling in the last chart was wrong; '3' would be '5' (top of wave 1) and '4' was wave '2'. This makes me think the recent down move was a 4th and we are now playing out the 5th...

One possibility;

But i now prefer this : Daily;

As above; we came back down in an ABC corrective (B) wave and have since printed what i suspect is another 5w up, (of which we may have just seen the top (speculative for now);

So, my overall thoughts are that we have possibly completed waves 1&2 of a large 'C' wave with the rest to follow shortly. If correct, this can take many forms, so again the next couple of charts are highly speculative. I'm posting them just to be able to compare to the actual event in a couple of weeks time...

It does however mean that i have something to work to and will now look for more evidence, starting with a LL/LH combo's.

or perhaps something like this;

I'm using this thread purely as a diary. This is not to try to claim guru points! Been there and made myself look silly on far too many occasions. EW has a way of presenting a case for both directions, however as i see it, what we have now looks very much like a 5-3-5 complete or nearing completion, so i am certainly looking for a trend change and some pippage to the short side soon with the possibility of the above scenario playing out... If it doesn't then at least i can look back and study to see what was different and how i can apply it to future analysis. There is STILL a case for 'B' being a fresh wave 1 and thus reality could be the exact opposite! with it being time to get long and strong, but i don't think so; it looks too much like its in a 3 wave move (corrective)...

As i have previously pointed out, i actually only play the smaller timescales and thus look for the HH/HL or LL/LH combo's and try to suss 5w/abc moves intraday, so its a case of building a picture and trading accordingly. Regardless, its nice to have a general plan to work too...

Just to include a further chart, here i can see we have reached a Fib retracement level of the larger 5w move down, coinciding with a trend line of an expanding diagonal, ending at the point 'E'.

*Edit* A fresh HH invalidates the above.

Clearly, the labeling in the last chart was wrong; '3' would be '5' (top of wave 1) and '4' was wave '2'. This makes me think the recent down move was a 4th and we are now playing out the 5th...

One possibility;

But i now prefer this : Daily;

Davai - 18 Oct 2012 10:11 - 123 of 423

Davai - 18 Oct 2012 10:20 - 124 of 423

25/10/12

Possibility of an expanding diagonal 'C' wave;

bigger picture;

If so, be wary that 'E' might be somewhat truncated, it might only just make a fresh low. The 61.8% fib of wave 'A' is common for length of the 'C' wave (red circle) or 76.4 could meet the trendline etc... of course 100% and more is poss too... but if it reverses off the top TL, expect a big down day tomorrow.

Possibility of an expanding diagonal 'C' wave;

bigger picture;

If so, be wary that 'E' might be somewhat truncated, it might only just make a fresh low. The 61.8% fib of wave 'A' is common for length of the 'C' wave (red circle) or 76.4 could meet the trendline etc... of course 100% and more is poss too... but if it reverses off the top TL, expect a big down day tomorrow.

Davai - 31 Oct 2012 15:37 - 125 of 423

Davai - 24 Nov 2012 17:46 - 126 of 423

Post 122, i was looking for a 5 move 'C' wave;

In actual fact the 'B' wave was slightly longer, made a clear 5-3-5 and thus made a HH (looks far more obvious now!), before starting the drop for the 'C' wave. I was a little optimistic with the length perhaps, although the chart was meant purely to show the idea of the 5w 'C' (and not necessarily to scale);

and as this was from a few days ago, i can now see that we had a 'truncated' 5th wave to end with...

In actual fact the 'B' wave was slightly longer, made a clear 5-3-5 and thus made a HH (looks far more obvious now!), before starting the drop for the 'C' wave. I was a little optimistic with the length perhaps, although the chart was meant purely to show the idea of the 5w 'C' (and not necessarily to scale);

and as this was from a few days ago, i can now see that we had a 'truncated' 5th wave to end with...

Davai - 01 Dec 2012 14:42 - 127 of 423

Update, ending diagonal 'C' wave, finished a little short of expectation, but the 5w followed as suspected;

The bigger picture suggests there is a mountain of downside coming;

*Edit 03/12/12* The above chart shows what was the 5th subwave of the third, thus the pullback seen was the fourth, another high followed also adhering to the rules;

Davai - 01 Dec 2012 15:08 - 128 of 423

Davai - 01 Dec 2012 15:23 - 129 of 423

Davai - 01 Dec 2012 21:12 - 130 of 423

I dont normally trade index's, but catching up on Cinners thread earlier i thought i would run my eye over the FTSE. My belief is that the down move has been corrective and we have now completed a 5w advance, which means we will now correct in another ABC. The caveat right now is that we don't know what form this will take;

The fifth looks to have reached its target and zooming in on the final 5th wave, the evidence is stronger again;

The fifth looks to have reached its target and zooming in on the final 5th wave, the evidence is stronger again;

Davai - 04 Dec 2012 09:58 - 131 of 423

Davai - 05 Dec 2012 10:06 - 132 of 423

Davai - 06 Dec 2012 13:25 - 133 of 423

Post 127, Ref EurNzd;

'The bigger picture suggests there is a mountain of downside coming;'

followed by, post 131;

'EurNzd; Difficult to determine right now, looks like a 5-3-5, which would mean an 'X' wave and thus a triple zigzag, with the 'Z' to come... more upside yet?'

We have since had some decent downside and a new low a moment ago, (breach of the low to the left of the chart), i would think negates the possibility of it being an 'X' wave.

As always a picture (chart) says a thousand words;

The drop;

Glad i got this one right, cos i completely f*cked up the FTSE predictions. The drop is coming, but no LL/LH combo's yet, in any case, i have since realised what i did wrong and learnt a little more from it, so its not all bad...

'The bigger picture suggests there is a mountain of downside coming;'

followed by, post 131;

'EurNzd; Difficult to determine right now, looks like a 5-3-5, which would mean an 'X' wave and thus a triple zigzag, with the 'Z' to come... more upside yet?'

We have since had some decent downside and a new low a moment ago, (breach of the low to the left of the chart), i would think negates the possibility of it being an 'X' wave.

As always a picture (chart) says a thousand words;

The drop;

Glad i got this one right, cos i completely f*cked up the FTSE predictions. The drop is coming, but no LL/LH combo's yet, in any case, i have since realised what i did wrong and learnt a little more from it, so its not all bad...

Seymour Clearly

- 06 Dec 2012 19:34

- 134 of 423

- 06 Dec 2012 19:34

- 134 of 423

Thanks for these Davai. I tend to trade cable, fiber and chunnel only. Any particular reason for trading the currencies that you do?

Toya

- 06 Dec 2012 19:46

- 135 of 423

- 06 Dec 2012 19:46

- 135 of 423

Very impressive Davai! So: short FTSE then...?

I daren't trade forex, though if I did I would probably expect the Euro to go down vs the US$ - in the light of today's comments by Draghi

I daren't trade forex, though if I did I would probably expect the Euro to go down vs the US$ - in the light of today's comments by Draghi

Davai - 07 Dec 2012 14:22 - 136 of 423

Hi guys (&girl/gals!), well... i've been learning all this intensely for a while now, but having swung away from my flag trading system to focus more on Elliott. The mistakes are coming thick and fast still, however, the info i've acquired recently has unlocked a huge part of it, i'm on information overload right now and my head is going to explode soon, of that, i'm sure!

SC, thanks! I basically look for pairs which respond well to Fib ratios, so i'm not tied to any in particular. They all fade in and out with regard to accuracy... i guess the market wouldn't want to make it easy?! On top of that, i need the wave structures to be clear... again this comes and goes, but the EurNzd in particular is proving to be a dream right now... Unfortunately its still managed to lose me in the last day or so, with regard as to where we are within the phase... I should have simply stayed short...

Toya, thankyou! With regard to the FTSE, i closed the chart the other day and haven't looked back! I think there was another set of waves in the making, (more upside yet?), so i'm not too sure. If i get the chance later i will take another gander!

Longer term, i think the Euro will achieve parity with the $, but loads of time yet and lots of decent (large) corrective pullbacks along the way...

SC, thanks! I basically look for pairs which respond well to Fib ratios, so i'm not tied to any in particular. They all fade in and out with regard to accuracy... i guess the market wouldn't want to make it easy?! On top of that, i need the wave structures to be clear... again this comes and goes, but the EurNzd in particular is proving to be a dream right now... Unfortunately its still managed to lose me in the last day or so, with regard as to where we are within the phase... I should have simply stayed short...

Toya, thankyou! With regard to the FTSE, i closed the chart the other day and haven't looked back! I think there was another set of waves in the making, (more upside yet?), so i'm not too sure. If i get the chance later i will take another gander!

Longer term, i think the Euro will achieve parity with the $, but loads of time yet and lots of decent (large) corrective pullbacks along the way...

Davai - 07 Dec 2012 14:30 - 137 of 423

Loads of info here... I was actually concentrating elsewhere, so although this was on one of my monitors, i didn't make any use of it. This is hindsight info, but it will certainly stick in my mind as of now... I was certain the rise earlier this morning (to the RHS of chart and off of the 261.8% fib of wave A), was a 5w signalling the end of the corrective move, so entering the trade on (what i deciphered as) the abc decline and with my stop a pip below the previous red bar (ending by the 261.8% fib and red line), i watched as it drifted down and took me out of the trade... I point blank refused to move my stop down to a pip below the start of the advance (point 0).

I set about investigating the 4 hrly & daily and realised this whole upswing is corrective. I was just working out what to do when the jobs data came out and unfortunately missed the massive rise.

Its always nice to get it wrong and lose some dough every once in a while isn't it?! )

The great thing about this kind of trade is, get it wrong and you will always find you are only stopped out by a mere handful of points, then watch it head very rapidly in the original direction without you on board, maximum pain and a great left hook applied by the market me thinks... the safe stop placement was as i said above, a pip below point 0... I should have known better!

Anyway, with the previous wave 4 (of 'C') now breached to the upside, it should be proof enough that this is the start of a larger 3rd wave and hence a lot more upside yet for this pair.... Now to find a low risk entry (as i keep saying... nothing is set in stone!)

Here's what i'm talking about;

I set about investigating the 4 hrly & daily and realised this whole upswing is corrective. I was just working out what to do when the jobs data came out and unfortunately missed the massive rise.

Its always nice to get it wrong and lose some dough every once in a while isn't it?! )

The great thing about this kind of trade is, get it wrong and you will always find you are only stopped out by a mere handful of points, then watch it head very rapidly in the original direction without you on board, maximum pain and a great left hook applied by the market me thinks... the safe stop placement was as i said above, a pip below point 0... I should have known better!

Anyway, with the previous wave 4 (of 'C') now breached to the upside, it should be proof enough that this is the start of a larger 3rd wave and hence a lot more upside yet for this pair.... Now to find a low risk entry (as i keep saying... nothing is set in stone!)

Here's what i'm talking about;

Davai - 07 Dec 2012 15:58 - 138 of 423

Trouble with posting a chart or thought, is that when it changes, i am compelled to update it/them!

I'm now actually suspecting i may have been right with my expectation of the 5w short count, finishing where i suspected but possibly not as a 'C' wave... an 'A' of a larger correction. It fits with the rise, drop and subsequent rise being an 'abc' 'B' wave and also permits the previous 4th to be broken... Gonna stay out and watch instead...

*chart to follow*

I'm now actually suspecting i may have been right with my expectation of the 5w short count, finishing where i suspected but possibly not as a 'C' wave... an 'A' of a larger correction. It fits with the rise, drop and subsequent rise being an 'abc' 'B' wave and also permits the previous 4th to be broken... Gonna stay out and watch instead...

*chart to follow*

Seymour Clearly

- 07 Dec 2012 17:00

- 139 of 423

- 07 Dec 2012 17:00

- 139 of 423

I could never get the hang of Elliott! I'm much more of a 'look at the chart and follow the pattern', support, resistance trendlines, occasionally fib levels, MACD, rsi etc. Don't make many trades, just like them to be glaringly obvious when I do.

Davai - 07 Dec 2012 17:40 - 140 of 423

Agreed.... Elliott on its own doesn't amount to much imo. The problem being that Corrective moves look exactly like the inverse of Impulse moves with ABC's also respecting similar fib levels.. but knowing which fibs to apply and where is a huge part of the jigsaw.

You make a very valid point, however... most people feel compelled to trade whenever they are in front of the screen... having the discipline to sit and wait and stick to what you know is an art itself!

You make a very valid point, however... most people feel compelled to trade whenever they are in front of the screen... having the discipline to sit and wait and stick to what you know is an art itself!

Toya

- 07 Dec 2012 18:59

- 141 of 423

- 07 Dec 2012 18:59

- 141 of 423

That's very good advice you two :) and one that I need to adhere to more often!

Davai - 07 Dec 2012 20:02 - 142 of 423

Toya, i looked at the FTSE and its got me a bit stumped, seems to be resistance just above us, which appears significant, it keeps trying to break above so if it does, a retest and we should be good for higher, otherwise i suspect we roll over and may actually have already begun... so to sum up i think it may go up... or down )

To try to explain my previous post, or at least to record my own thoughts. I have switched to the EurJpy. I think i was right to consider long (short term) on both this pair and the GbpJpy as per my original idea (the 4th of the 'C' wave down, on the Gbp, being breached on the way back up, on the jobs data spike earlier), however i think its trend change time and its actually only going to be an ABC correcting yesterdays/todays 5w down. I cant explain what i perceive to be the A&B waves beforehand though, so i will be a watcher for a mo... anyway, my reason for thinking this is from labeling the Eur tonight... first the daily;

So the bigger picture... the double ABC's around the middle fits with being first the 4th (subwave) of the 3rd and then the full 4th shortly afterwards once the 3rd was complete... all the measurements fit. With that in mind and switching to a smaller timescale to concentrate on the 5th wave;

so we have wave 3= 100% of wave 1, 2 is irregular, wave 4 retraces 50% of wave 3 and wave 5 has reached its popular 38.2% extension. The pullback appears to say that was the top... of course this is just my opinion based on what i've highlighted and its too early to trust it. I have had a nightmare day and probably should be having a beer right now instead.... anyway, i guess the next move is to concentrate on the move back up, of which we look to have completed the A&B already. If 'C' is in a small 5w and doesn't make a new high, we can look out to have started a larger ABC which will correct the whole 5w move since July (which was around 1400pips), even if its shallow, or Irregular its gotta mean 600+ pips south of here over the coming weeks, before we gear up for a fresh complete 5w back up higher... thats the theory... right where's that beer!

*edit 08/12/12; hmmmm there may be a possibility that i'm one count out... the 3&4 above might be 'iii'&'iv' of this particular third, with the 5th being the end of the 3rd. I've made this mistake a few times recently... will do some more work on it later*

To try to explain my previous post, or at least to record my own thoughts. I have switched to the EurJpy. I think i was right to consider long (short term) on both this pair and the GbpJpy as per my original idea (the 4th of the 'C' wave down, on the Gbp, being breached on the way back up, on the jobs data spike earlier), however i think its trend change time and its actually only going to be an ABC correcting yesterdays/todays 5w down. I cant explain what i perceive to be the A&B waves beforehand though, so i will be a watcher for a mo... anyway, my reason for thinking this is from labeling the Eur tonight... first the daily;

So the bigger picture... the double ABC's around the middle fits with being first the 4th (subwave) of the 3rd and then the full 4th shortly afterwards once the 3rd was complete... all the measurements fit. With that in mind and switching to a smaller timescale to concentrate on the 5th wave;

so we have wave 3= 100% of wave 1, 2 is irregular, wave 4 retraces 50% of wave 3 and wave 5 has reached its popular 38.2% extension. The pullback appears to say that was the top... of course this is just my opinion based on what i've highlighted and its too early to trust it. I have had a nightmare day and probably should be having a beer right now instead.... anyway, i guess the next move is to concentrate on the move back up, of which we look to have completed the A&B already. If 'C' is in a small 5w and doesn't make a new high, we can look out to have started a larger ABC which will correct the whole 5w move since July (which was around 1400pips), even if its shallow, or Irregular its gotta mean 600+ pips south of here over the coming weeks, before we gear up for a fresh complete 5w back up higher... thats the theory... right where's that beer!

*edit 08/12/12; hmmmm there may be a possibility that i'm one count out... the 3&4 above might be 'iii'&'iv' of this particular third, with the 5th being the end of the 3rd. I've made this mistake a few times recently... will do some more work on it later*

Davai - 07 Dec 2012 20:26 - 143 of 423

Toya

- 07 Dec 2012 20:45

- 144 of 423

- 07 Dec 2012 20:45

- 144 of 423

I'll leave the forex to you, Davai! Couldn't begin to do all that analysis... But I agree we've been testing around 5920 on the FTSE - I feel we may have reached the top there for a while; we'll soon see if that's correct!

Davai - 08 Dec 2012 10:20 - 145 of 423

Copied edited remark from above post 142;

*edit 08/12/12; hmmmm there may be a possibility that i'm one count out... the 3&4 above might be 'iii'&'iv' of this particular third, with the 5th being the end of the 3rd. I've made this mistake a few times recently... will do some more work on it later*

The more i look at it, the more it looks more likely... the double ABC again same as with the daily. I was obviously too tired last night! Honestly... mental state is also a big part of trading! It will mean that we are in the 4th (or just finished) right now and still have a blast north yet for the 5th of this degree. This can of course be extended, so its obvious to me the only safety will be to rely on the small time scales.

The reason for all of this? I'm looking to trial a bit of swing trading and see if i can ride a much longer phase. It goes against my usual style as i absolutely hate to stay in corrective moves and watch precious profit disappear time and time again, preferring to be in and out in succession. The problem is often missing the larger move while 'out' of a trade. That means an awful lot of work making small amounts and missing the larger portion...

All of the above charts are workings as to try to find the next big trend. As you can tell, however, it can be tricky and requires more (at this time) experience than i currently possess. This is a work in progress!

Trying to trade a wave 2 pullback to be positioned for wave 3 is proving to be lethal. The best trade and easiest to recognise is after the powerful wave 3 itself. If wave 3 doesn't extend (is not more than 1.618% of wave 1), and wave 4 retraces 38.2% of wave 3, you have a fantastic low risk trade, going with trend off of this fib level to trade the 5th wave. Your stop is a couple of pips inside wave 1 as wave 4 mustn't cross into this territory, therefore should be around a 1:3 R:R...

*edit 08/12/12; hmmmm there may be a possibility that i'm one count out... the 3&4 above might be 'iii'&'iv' of this particular third, with the 5th being the end of the 3rd. I've made this mistake a few times recently... will do some more work on it later*

The more i look at it, the more it looks more likely... the double ABC again same as with the daily. I was obviously too tired last night! Honestly... mental state is also a big part of trading! It will mean that we are in the 4th (or just finished) right now and still have a blast north yet for the 5th of this degree. This can of course be extended, so its obvious to me the only safety will be to rely on the small time scales.

The reason for all of this? I'm looking to trial a bit of swing trading and see if i can ride a much longer phase. It goes against my usual style as i absolutely hate to stay in corrective moves and watch precious profit disappear time and time again, preferring to be in and out in succession. The problem is often missing the larger move while 'out' of a trade. That means an awful lot of work making small amounts and missing the larger portion...

All of the above charts are workings as to try to find the next big trend. As you can tell, however, it can be tricky and requires more (at this time) experience than i currently possess. This is a work in progress!

Trying to trade a wave 2 pullback to be positioned for wave 3 is proving to be lethal. The best trade and easiest to recognise is after the powerful wave 3 itself. If wave 3 doesn't extend (is not more than 1.618% of wave 1), and wave 4 retraces 38.2% of wave 3, you have a fantastic low risk trade, going with trend off of this fib level to trade the 5th wave. Your stop is a couple of pips inside wave 1 as wave 4 mustn't cross into this territory, therefore should be around a 1:3 R:R...

hilary

- 10 Dec 2012 07:58

- 146 of 423

- 10 Dec 2012 07:58

- 146 of 423

The reason that you probably find the kiwi generates easy to follow chart patterns against the greenback is that it's what I would describe as a 'single sided' pair.

By that, I mean most pairs and crosses are influenced by two distinct sets of newsflow. For instance, if you're trading fiber, then Europe's events will influence the pair, as will the newsflow out of the US. If both sets of newsflow are either positive or negative, then the pair can be a bit choppy until the market decides which side's newsflow carries most weight. If one side's newsflow is positive and the other side's newsflow is negative, then the moves will be more exaggerated as a result.

However, New Zealand as a country carries no real economic influence. It has no mineral resources, there are more sheep than there are humans, and they make some nice butter. But that's about the extent of it. The kiwi has historically been used sometimes for carry trades, but not at the moment. Therefore, there's unlikely to be any news coming out of NZ which is going to have any impact on the NZD/USD, and the pair is going to be almost totally influenced by the newsflow out of the US. This single-side aspect is what makes the chart easier to read and interpret.

The downside of this is that the minimal liquidity in the pair means retail punters will generally have to pay high spreads. Everything I've said about NZD/USD also applies to the EUR/NZD cross.

By that, I mean most pairs and crosses are influenced by two distinct sets of newsflow. For instance, if you're trading fiber, then Europe's events will influence the pair, as will the newsflow out of the US. If both sets of newsflow are either positive or negative, then the pair can be a bit choppy until the market decides which side's newsflow carries most weight. If one side's newsflow is positive and the other side's newsflow is negative, then the moves will be more exaggerated as a result.

However, New Zealand as a country carries no real economic influence. It has no mineral resources, there are more sheep than there are humans, and they make some nice butter. But that's about the extent of it. The kiwi has historically been used sometimes for carry trades, but not at the moment. Therefore, there's unlikely to be any news coming out of NZ which is going to have any impact on the NZD/USD, and the pair is going to be almost totally influenced by the newsflow out of the US. This single-side aspect is what makes the chart easier to read and interpret.