| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Eureka Mining - time to spell it out (EKA)

tallsiii

- 11 Apr 2005 14:30

- 11 Apr 2005 14:30

EKA are expecting to mine 3.8 million lbs of Molybdenum this year. For the more sceptical amongst you, read this to confirm:

http://moneyam.uk-wire.com/cgi-bin/articles/200412150700023844G.html

They own the mine and the molydbenum in it has been independently varified as stated in the announcement linked above.

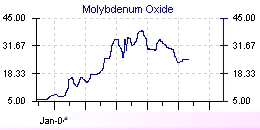

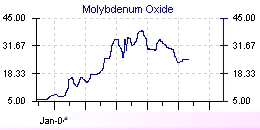

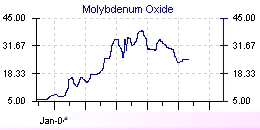

Molydbenum currently trades at around $38.50 per lb, you can check this at:

http://www.monterrico.co.uk/s/MetalPrices.asp

so do the sums 3.8m x $39.25 = $149m = 82m

Eureka Mining's market cap is 26m

In 2006 they expect to pull over 10,000 tonnes (20m lbs) of Moly out of that mine.

On top of all that they have recently aquired a mine in Russia with estimated contained metal of 3.32 million tonnes of copper, 3.26 million

ounces of gold and 98.9 million pounds of molybdenum. They hope to complete the feasibility study for this one in 2006:

http://moneyam.uk-wire.com/cgi-bin/articles/200501130700033169H.html

http://moneyam.uk-wire.com/cgi-bin/articles/200412150700023844G.html

They own the mine and the molydbenum in it has been independently varified as stated in the announcement linked above.

Molydbenum currently trades at around $38.50 per lb, you can check this at:

http://www.monterrico.co.uk/s/MetalPrices.asp

so do the sums 3.8m x $39.25 = $149m = 82m

Eureka Mining's market cap is 26m

In 2006 they expect to pull over 10,000 tonnes (20m lbs) of Moly out of that mine.

On top of all that they have recently aquired a mine in Russia with estimated contained metal of 3.32 million tonnes of copper, 3.26 million

ounces of gold and 98.9 million pounds of molybdenum. They hope to complete the feasibility study for this one in 2006:

http://moneyam.uk-wire.com/cgi-bin/articles/200501130700033169H.html

mickeyskint

- 11 Apr 2005 14:45

- 2 of 215

- 11 Apr 2005 14:45

- 2 of 215

What is molybdenum and what do you do with it. Is Kasakstan politically stable as anything ending in stan makes me very nervous.

MS

MS

stockdog

- 11 Apr 2005 14:49

- 3 of 215

- 11 Apr 2005 14:49

- 3 of 215

Molybdenum is a heavy metal, man - all sorts of industrial uses.

Kazahkstan is the world's tenth (!) largest country. Its political stability can be measured to some extent by the good credit rating it recives from the banking community worldwide.

I am heavily into European Minerals in that country.

DYOR

SD

Kazahkstan is the world's tenth (!) largest country. Its political stability can be measured to some extent by the good credit rating it recives from the banking community worldwide.

I am heavily into European Minerals in that country.

DYOR

SD

tallsiii

- 11 Apr 2005 14:54

- 4 of 215

- 11 Apr 2005 14:54

- 4 of 215

The fact Molybdenum, Eureka Mining and Kazakstan are so completely unheard of is partly what makes this share so favourably valued at the moment.

mickeyskint

- 11 Apr 2005 14:58

- 5 of 215

- 11 Apr 2005 14:58

- 5 of 215

It's on my radar screen.

MS

MS

mickeyskint

- 11 Apr 2005 14:58

- 6 of 215

- 11 Apr 2005 14:58

- 6 of 215

It's on my radar screen.

MS

MS

Jimbob GR - 11 Apr 2005 15:35 - 7 of 215

It is used in stainless steel production and we all know what has happenend to the price of steel, it is very difficult to substitute as it has unique properties as its compounds have very low toxicity for a heavy metal.

Even if you not believe us believe IC they recommended a buy at 156p and it is now at 121p. final drilling results due this month.

Even if you not believe us believe IC they recommended a buy at 156p and it is now at 121p. final drilling results due this month.

proptrade

- 11 Apr 2005 15:35

- 8 of 215

- 11 Apr 2005 15:35

- 8 of 215

its on my radar and i might shoot it down. sorry, silly afternoon...

tallsiii

- 11 Apr 2005 15:40

- 9 of 215

- 11 Apr 2005 15:40

- 9 of 215

Nickel can be used in the place of Moly for steel production, but if you look at the price graph for it, you'll see that it is not currently a viable substitute.

loadsadosh

- 11 Apr 2005 15:58

- 10 of 215

- 11 Apr 2005 15:58

- 10 of 215

Ok Ok Im impressed, will do some homework with a view to joining you, by the way molybdenum as a trace additive is also used as a high pressure lubricant.

regards

Loadsa

regards

Loadsa

tallsiii

- 11 Apr 2005 16:01

- 11 of 215

- 11 Apr 2005 16:01

- 11 of 215

Yes apparently it's used a lot in oil piplines also.

mickeyskint

- 11 Apr 2005 16:56

- 12 of 215

- 11 Apr 2005 16:56

- 12 of 215

What about KY Jelly.

MS

MS

belisce6

- 11 Apr 2005 22:43

- 13 of 215

- 11 Apr 2005 22:43

- 13 of 215

don't mean to give you any negative feedback, but i did read within the past month, in an aussie newspaper (or perhaps it was the Shares mag - aussie version); which had an article about commodities........it reasoned that with the copper prices also being at record highs - and therefore the amount of copper mines coming into production obviously in search of the resultant riches - that the molybdenum price should stabilise quit quickly, and perhaps drop sooner rather than later (by end of 2005 ??) - because apparently molybdenum is a by-product of copper (?) and it will therefore be produced and sold by most copper mines......and although it may only account for up to 5% of the total mine's production, there will be a fair bit of molybdenum coming onto the market.......now that's way too much KY jelly !!

stockdog

- 12 Apr 2005 00:05

- 14 of 215

- 12 Apr 2005 00:05

- 14 of 215

MS - I know about Kay, but I have always wondered why jelly. Nothing to do with that Irish lass of high moral standard, stainless Molly, is it?

:D

SD

:D

SD

tallsiii

- 12 Apr 2005 08:06

- 15 of 215

- 12 Apr 2005 08:06

- 15 of 215

You are right belisce6, history has shown that molybdenum prices do tend to shoot up for a period and then come down. You'll be glad to hear that I have thouroughly researched this one also.

The closest historical example for the commodities boom going on currently, is the one that happened at the end of the 1970's. During this boom most major commodities peaked in 1980 and then gradually returned to a normal level. From what I can see, oil was the leader of the pack. Have a look at the link below:

http://minerals.usgs.gov/minerals/pubs/metal_prices/metal_prices1998.pdf

(the table of data lower down on the page gives more useful information)

Copper prices peaked in 1980, having had two very good years in 1978 and 1979 (during which time many more copper mines will have been brought on stream). You will see from the link that molybdenum prices also peaked in 1980 and gradually dropped off over the next three years.

So the first question is:

Do you think the current commodities boom is over?

Personally I would say no. Goldman Sachs seem to agree with me, as do many others. I have no doubt that we have a bubble in the making here, but in terms of the current commodities party we are only at about 10pm. The fact is that although we are bound to get a hang over at some point, but it is still a long way off.

The second question is:

If the commodities boom were to be over tomorrow, how long would it take the Moly price to drop back to historical norms?

Based historical experience I would have to say 3 years.

Given that EKA think this mine would still be very profitable with moly at $10 per pound, that means they still have a lot of time to make a grand exit.

Tallsiii

The closest historical example for the commodities boom going on currently, is the one that happened at the end of the 1970's. During this boom most major commodities peaked in 1980 and then gradually returned to a normal level. From what I can see, oil was the leader of the pack. Have a look at the link below:

http://minerals.usgs.gov/minerals/pubs/metal_prices/metal_prices1998.pdf

(the table of data lower down on the page gives more useful information)

Copper prices peaked in 1980, having had two very good years in 1978 and 1979 (during which time many more copper mines will have been brought on stream). You will see from the link that molybdenum prices also peaked in 1980 and gradually dropped off over the next three years.

So the first question is:

Do you think the current commodities boom is over?

Personally I would say no. Goldman Sachs seem to agree with me, as do many others. I have no doubt that we have a bubble in the making here, but in terms of the current commodities party we are only at about 10pm. The fact is that although we are bound to get a hang over at some point, but it is still a long way off.

The second question is:

If the commodities boom were to be over tomorrow, how long would it take the Moly price to drop back to historical norms?

Based historical experience I would have to say 3 years.

Given that EKA think this mine would still be very profitable with moly at $10 per pound, that means they still have a lot of time to make a grand exit.

Tallsiii

Andy

- 12 Apr 2005 08:50

- 16 of 215

- 12 Apr 2005 08:50

- 16 of 215

tallsii,

When is the mining going to commence?

When is the mining going to commence?

tallsiii

- 12 Apr 2005 08:53

- 17 of 215

- 12 Apr 2005 08:53

- 17 of 215

Second half of this year. As I say they are planning to extract 3.8 million pound of moly by the end of the year.

Andy

- 12 Apr 2005 09:15

- 18 of 215

- 12 Apr 2005 09:15

- 18 of 215

tallsii,

Ok thanks.

is the full 63 million attributable to Eureka? or are there any JV partners?

Do you have any idea of the mining / extraction costs per lb?

Ok thanks.

is the full 63 million attributable to Eureka? or are there any JV partners?

Do you have any idea of the mining / extraction costs per lb?

tallsiii

- 12 Apr 2005 09:25

- 19 of 215

- 12 Apr 2005 09:25

- 19 of 215

There are no JV partners.

EKA will not have an accurate cost per lb until the feasability study is completed. But have a look at the write up of the Shorskoye Molybdenum Project

under the Projects section of their website at the link below:

http://www.eurekamining.co.uk

That was written in November 2003, when the moly price was $5.70 per lb. Presumably they were planing the mine some time before that when the moly price was even lower.

There will be some additional costs incurred due to the fact that they are fasttracking the mine to start production a year early, but I think we can assume that the extraction cost per lb will be significantly below $6 per lb.

EKA will not have an accurate cost per lb until the feasability study is completed. But have a look at the write up of the Shorskoye Molybdenum Project

under the Projects section of their website at the link below:

http://www.eurekamining.co.uk

That was written in November 2003, when the moly price was $5.70 per lb. Presumably they were planing the mine some time before that when the moly price was even lower.

There will be some additional costs incurred due to the fact that they are fasttracking the mine to start production a year early, but I think we can assume that the extraction cost per lb will be significantly below $6 per lb.

Jimbob GR - 13 Apr 2005 12:55 - 20 of 215

ON the move Up 1.5p

tallsiii

- 13 Apr 2005 13:09

- 21 of 215

- 13 Apr 2005 13:09

- 21 of 215

Yes people seem to buying now.

Jimbob GR - 13 Apr 2005 15:06 - 22 of 215

Lots Of 10K+ buys now looks like the watchers are starting to buy now. Perhaps news is on its way!

tallsiii

- 15 Apr 2005 12:53

- 23 of 215

- 15 Apr 2005 12:53

- 23 of 215

What can I say? Loads of buying going on, but the price is down on sector sentiment.

Jimbob GR - 15 Apr 2005 18:09 - 24 of 215

I cant see any large trades that justified the drop but loads of decent sized buys?

jimbobGR - 17 Apr 2005 16:09 - 25 of 215

What we expewcting this week tallsii?

That news on molly mine must be due within the next 2 weeks, then we are expectin a fair bit of promotion by the company right?

That news on molly mine must be due within the next 2 weeks, then we are expectin a fair bit of promotion by the company right?

tallsiii

- 18 Apr 2005 10:00

- 26 of 215

- 18 Apr 2005 10:00

- 26 of 215

Fingers crossed that should be it. Though with the current fallout that is going on between the mining sector and the markets I would expect the promotion to have less of an impact. We may have to wait for the cold hard cash before this investment is anywhere near fully valued.

wilbs

- 19 Apr 2005 08:51

- 27 of 215

- 19 Apr 2005 08:51

- 27 of 215

Here's a little info on Molybdenite that I dug up off the web.

Before Scheele recognized molybdenite as a distinct ore of a new

element in 1778, it was confused with graphite and lead ore. The metal was prepared

in impure form in 1782 by Hjelm. Molybdenum does not occur natively, but is obtained

principally from molybdenite. Wulfenite, and Powellite are also minor commercial ores.

Molybdenum is also recovered as a by-product of copper and tungsten mining operations.

The metal is prepared from the powder made by the hydrogen reduction of purified molybdic

trioxide or ammonium molybdate.

Properties

The metal is silvery white, very hard, but is softer and more ductile than tungsten. It

has a high elastic modulus, and only tungsten and tantalum of the more readily available

metals, have higher melting points. It is a valuable alloying agent, as it contributes to

the hardenability and toughness of quenched and tempered steels. It also improves the

strength of steel at high temperatures.

Uses

It is used in certain nickel based alloys, such as the Hastelloys which

are heat-resistant and corrosion-resistant to chemical solutions. Molybdenum oxidizes at

elevated temperatures. The metal has found recent application as electrodes for

electrically heated glass furnaces and forehearths. The metal is also used in nuclear

energy applications and for missile and aircraft parts. Molybdenum is valuable as a

catalyst in the refining of petroleum. It has found applications as a filament material in

electronic and electrical applications. Molybdenum is an essential trace element in plant

nutrition; some lands are barren for lack of this element in the soil. Molybdenum sulfide

is useful as a lubricant, especially at high temperatures where oils would decompose.

Almost all ultra-high strength steels with minimum yield points up to 300,000

psi contain molybdenum in

amounts from 0.25 to 8%. Biologically, molybdenum as a trace element is

necessary for nitrogen fixation and other metabolic processes.

wilbs

Before Scheele recognized molybdenite as a distinct ore of a new

element in 1778, it was confused with graphite and lead ore. The metal was prepared

in impure form in 1782 by Hjelm. Molybdenum does not occur natively, but is obtained

principally from molybdenite. Wulfenite, and Powellite are also minor commercial ores.

Molybdenum is also recovered as a by-product of copper and tungsten mining operations.

The metal is prepared from the powder made by the hydrogen reduction of purified molybdic

trioxide or ammonium molybdate.

Properties

The metal is silvery white, very hard, but is softer and more ductile than tungsten. It

has a high elastic modulus, and only tungsten and tantalum of the more readily available

metals, have higher melting points. It is a valuable alloying agent, as it contributes to

the hardenability and toughness of quenched and tempered steels. It also improves the

strength of steel at high temperatures.

Uses

It is used in certain nickel based alloys, such as the Hastelloys which

are heat-resistant and corrosion-resistant to chemical solutions. Molybdenum oxidizes at

elevated temperatures. The metal has found recent application as electrodes for

electrically heated glass furnaces and forehearths. The metal is also used in nuclear

energy applications and for missile and aircraft parts. Molybdenum is valuable as a

catalyst in the refining of petroleum. It has found applications as a filament material in

electronic and electrical applications. Molybdenum is an essential trace element in plant

nutrition; some lands are barren for lack of this element in the soil. Molybdenum sulfide

is useful as a lubricant, especially at high temperatures where oils would decompose.

Almost all ultra-high strength steels with minimum yield points up to 300,000

psi contain molybdenum in

amounts from 0.25 to 8%. Biologically, molybdenum as a trace element is

necessary for nitrogen fixation and other metabolic processes.

wilbs

wilbs

- 20 Apr 2005 07:31

- 28 of 215

- 20 Apr 2005 07:31

- 28 of 215

Eureka Mining PLC

20 April 2005

Eureka Mining Plc

Preliminary results

Financial Highlights

Net assets of approximately US$30 million

Mining assets of US$21.7m in Kazakhstan and FSU with net cash balance of

US$8m awaiting investment

Net loss in first year of operation US$82,000

US$12.5m of funds raised through AIM admission and seed placing

Kazakhstan

Almost 10,000m of diamond drill core completed at the Shorskoye

Molybdenum Project

Using our own mining contractors and third party treatment facilities,

first concentrates anticipated from Shorskoye by the end of 2005

Extensive data reviews completed on the Dostyk and Kentau Projects during

the year and targets for development/action in 2005 identified

Russia

Acquisition of 51% of the very large copper/gold project at Chelyabinsk,

with the exclusive rights to purchase 100% of the Project

Internationally recognised independent consultants report that the most

advanced of the three deposits at Chelyabinsk, Miheevskoye, compares more

than favourably with its peers on a technical and commercial basis

Mine planning and permitting work is currently underway with various

recognised consultants with local Russian experience taking roles in the

initial phases

Please find Chairman's letter, Chief Executive Officer's report and financial

results accompanying this highlights page. The Company's annual report and

accounts will be distributed to shareholders this week and available shortly

thereafter on our website.

For more information please contact:

Kevin Foo / David Bartley Leesa Peters / Laurence Read

Eureka Mining Plc Conduit PR

Tel: +44 (0)20 7921 8810 Tel: +44 (0)20 7618 8760

info@eurekamining.co.uk

Tel: +44 (0)20 7618 8708

leesa@conduitpr.com

/

laurence@conduitpr.com

Joe Nally / Nick Morgan

Williams de Broe

Tel: +44 (0)20 7588 7511

www.eurekamining.co.uk

CHAIRMAN'S LETTER

FOR THE YEAR ENDED 31 DECEMBER 2004

Dear Fellow Shareholder

I am very pleased to present your Company's inaugural Annual Report.

In our first year of operations we have made appreciable progress and have not

wavered from the key objectives we set out in the prospectus, which were to:

Develop a significant mining company focused on assets based in

Kazakhstan and the surrounding regions of the Former Soviet Union (FSU).

Acquire additional resource assets which represent realistic commercial

ventures for Eureka.

Allocate resources prudently and efficiently to achieve maximum value

for the Group and its shareholders.

Our special expertise is operating in the FSU and with the abundant resources

base in this huge area, which covers 14% of the earth's land mass and with metal

markets enjoying significant growth, we feel we are in the right place, at the

right time, with the right team.

Since admission to the AIM market, the Company, under the leadership of David

Bartley, has not only achieved significant milestones on the original projects

but has also examined many projects in Kazakhstan, Russia and the surrounding

regions for acquisition opportunities. The focus has very much been on projects

with defined reserves which will offer us early production and near term cash

flow.

When acquisitions have been undertaken, they have been achieved with minimal

upfront financial consideration and within a timeframe in which they can be

adequately reviewed. On this basis, we are able to assess projects efficiently

and cost effectively and, when appropriate, continue with the acquisition or

terminate involvement.

This year, 2005, will be an exciting year. We plan to commence mining and

concentrate production from the Shorskoye Molybdenum Project, following our

decision to 'fast track' this project to take advantage of the high molybdenum

prices. We also plan to complete the acquisition of the exciting Chelyabinsk

Copper/Gold Project in Russia and continue assessment of this very large

deposit. In Kazakhstan, we will be drilling the most prospective targets

identified at our extensive exploration properties.

Annual General Meeting

The second Annual General Meeting of the Company will take place in London on 15

June 2005. The notice of meeting will be set out at the end of the annual report

and accounts, which will be sent to shareholders shortly with a form of proxy.

The Directors look forward to the opportunity to meet as many as possible of our

shareholders following the announcement of the first full results from the

Company.

Future Plans

Eureka remains fully committed to the objectives that we have set. We are

targeting further acquisitions that will provide cash to help preserve our

current capital position and allow us to maintain an aggressive approach to

developing the Company's existing base metal and gold projects. When we find

opportunities that need additional shareholders' funds we will make the case for

such support.

I should like to thank my fellow directors for their support of the Company

during this period. We are indebted to all of our staff for their commitment and

enthusiasm in meeting our objectives and I congratulate the management of Eureka

on an outstanding start to building the Company.

It has been a successful twelve months and the outlook is very exciting. We look

forward to your continued support.

Yours sincerely,

Kevin Foo

Chairman

CEO REPORT

FOR THE YEAR ENDED 31 DECEMBER 2004

I am delighted to report on an outstanding first year of operations for Eureka

Mining Plc, the highlights of which include:

Successful drilling, resource confirmation, testwork and prefeasibility

studies to enable a production decision to be taken on the Shorskoye

Molybdenum Project

Acquisition of the very large copper/gold project in Chelyabinsk, Russia

Exploration and drilling activities over three prospective targets -

Mykubinsk, Central Kazakhstan and Kentau

Establishment of first class technical and commercial teams in Kazakhstan

and Russia

Establishment of offices in Almaty, Semipalatinsk and Chelyabinsk

Shorskoye Molybdenum Project

The Shorskoye Molybdenum Deposit was discovered in 1993 and is located about 90

km south-west of Semipalatinsk in north-eastern Kazakhstan. The region has

existing road, rail and power infrastructure providing direct rail access into

the Chinese and Russian markets.

The zone of mineralisation delineated to date is approximately 600m long x 250m

wide x 200m deep. The zone is open at depth and is comprised of several lenses

of disseminated mineralisation of between 20m and 40 m thick. The mineralisation

is amenable to low waste to ore strip ratios and bulk open pit mining methods.

Metallurgical testwork on ore from the Shorskoye deposit has commenced at the

Kazmekhanobr Institute in Almaty, Kazakhstan. This testwork has defined a

conventional flowsheet for the concentration of molybdenum in the ore. The flow

sheet involves a coarse grind, bulk flotation of the molybdenum, differential

flotation for copper and molybdenum minerals and cleaner flotation to produce a

final concentrate. Shorskoye is expected to be able to produce a minimum

concentrate specification with MoS2 grade of 87-90% (i.e. 48-53% Mo).

The molybdenum concentrate can either be sold directly as a concentrate or

roasted to produce a higher value oxide product, TGMO (Technical Grade Molybdic

Oxide) which would also provide rhenium credits.

At the beginning of 2004, within one month of admission to AIM, we had

established offices in Kazakhstan and had commenced drilling at Shorskoye. By

the end of the first month of operations, we had three diamond drill rigs

operating around the clock at temperatures as low as -20degreesC. By the year

end, almost 10,000m of diamond drill core had been completed at Shorskoye.

Within the last 12 months, we have drilled and delineated a mineable, high grade

JORC compliant resource (Table 1). Bulk samples have been produced for

confirmation testwork, with preparation of concentrate samples for obtaining

expressions of interest from concentrate buyers.

We have initiated an overall project feasibility study to 'fast track' the

development of Shorskoye and we have concluded that this development, on a

limited scale in the short term, was appropriate to take advantage of the

current high molybdenum prices.

Consequently, using our own mining contractors and third party treatment

facilities, we intend to produce the first concentrates from Shorskoye by the

end of 2005.

In parallel with this, we shall complete a major feasibility study on the

overall deposit which includes detailed resource drilling, mining assessments,

metallurgical studies, environmental and permitting work and marketing studies.

Table 1 - Shorskoye East JORC Compliant Resource Estimate

TONNES GRADE CONTAINED METAL JORC

Ore Molybdenum Copper Cut Off Molybdenum Copper Category

Million % % Mo % Million Million

Tonnes Pounds Pounds

25.48 0.087 0.054 Uncut 49.1 30.5 Inferred

13.97 0.113 0.062 0.07 34.8 19.1 Inferred

5.36 0.163 0.070 0.10 19.3 8.3 Inferred

3.11 0.202 0.067 0.12 13.8 4.6 Inferred

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all

historical data and identified at least six drill targets, with particular focus

on base metal projects. During 2004, we drilled five projects and completed

significant field activity on two projects, including the high priority targets

Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold),

Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising

of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data

review, with a comprehensive Geographic Information Systems database being

created. This has enabled us to plan a focused exploration programme on

previously identified targets. Drilling is expected to commence in May 2005 at

two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold

Mine in northern Kazakhstan. However, after a thorough assessment and

reinterpretation of the project, including the completion of a drilling

programme, we decided not to exercise the option and purchase agreement over the

Nova project.

Our exploration and assessment teams are continuously reviewing potential

projects for Eureka across the FSU and only the very best are selected for

further work.

Chelyabinsk Copper-Gold Projects in Russia

In January 2005, Eureka completed the acquisition of 51% of the Chelyabinsk

Copper/Gold Project in the southern Urals region of Central Russia. This is held

through a UK company which holds 100% of three Russian subsidiary companies,

each of which owns one of the three deposits.

Eureka has completed negotiations with the vendors and now owns the rights to

purchase 100% of the Chelyabinsk copper-gold porphyry deposits. The project

comprises three separate deposits, Miheevskoye, Tominskoye and Taruntinskoye and

drilling to date has delineated total C1 and C2 resources of 609 million tonnes

at 0.74% Cu equivalent. Contained metal is currently estimated to be 3.37

million tonnes of copper, 3.61 million ounces of gold and 99 million pounds of

molybdenum. Preliminary mining studies on two of the deposits have identified

high grade ore in excess of 1% copper equivalent in the initial years, with low

mining strip ratios.

The two largest deposits, Miheevskoye and Tominskoye are copper/porphyry

deposits and are located 200km and 40km respectively from Chelyabinsk.

Taruntinskoye is a skarn deposit located on the Russian-Kazakhstan border,

approximately 100km south of the city. All three deposits are connected by the

same rail network.

A feasibility study is underway, addressing the development of up to a 20

million tonne per annum mine and concentrator and, secondly, up to a 3 million

tonne per annum mine and SX/EW project.

Eureka has completed independent due diligence on the project, through

internationally recognised independent consultants. The results from this work

showed that the most advanced of the deposits, Miheevskoye, compares more than

favourably with its peers on a technical and commercial basis. The other

deposits also have significant merit and are expected to add substantial value

and hence warrant further evaluation.

Many of the key elements required for commercial success of a mine are present

in the Chelyabinsk projects. These include:

Good Infrastructure

Low cost grid power near all project sites

Rail access near all project sites

Gas pipeline access

Flat terrain

Land tenure/ownership (new Russian laws will allow ownership)

Low cost mining - low strip ratios

Competitive metal grades and high grade starter pits

Good concentrate grades and recoveries with no penalty elements; and

Close proximity to local smelters

Eureka is now completing mine planning and permitting with the collection of

technical, social and environmental data for mine development. This work is

currently underway with various recognised consultants with local Russian

experience taking roles in the initial phases.

Current Resources

The resources of the three deposits are as follows:

Table 2 - Project Resources Summary (Russian C1, C2)

Project Name Cu cut-off Resource Estimate Cu equivalent Metal

% Cu (Mt, Cu%, Au g/t) grade % Cu* Mt Cu Moz Au

Miheevskoye 0.3% 327Mt @ 0.45% & 0.22g/t 0.66 1.47 2.31

Tominskoye 0.3% 241Mt @ 0.58% & 0.12g/t 0.73 1.40 0.93

Taruntinskoye 0.5% 41Mt @ 1.22% & 0.28g/t 1.48 0.50 0.37

Total 609Mt @ 0.55% & 0.18g/t 0.74 3.37 3.61

* Inclusive of Mo and Au credits

Our targets for 2005 are to:

Bring Shorskoye Molybdenum Project into production and generate positive

cash flow for the Company

Complete a pre-feasibility study on the Chelyabinsk project and define a

JORC compliant reserve

Continue exploration at all of our Kazakhstan properties with the aim of

identifying a possible new mine

Actively continue to review, assess and acquire properties that meet our

investment criteria; and

Raise appropriate funding for the projects as and when required

Our first full year of operations has been exciting and at times challenging and

as CEO, we could not have achieved the progress we have without the full support

of the Board and the excellent teams in Kazakhstan and Russia. We firmly believe

that we have laid the foundation for the next twelve months and beyond, which

will prove to be memorable for Eureka and its shareholders.

David Bartley

Chief Executive Officer

EUREKA MINING PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31 DECEMBER 2004

From incorporation

3 October 2003 to 31 December 2004

$ 000's

Operating costs (344)

-----------

Gross loss (344)

Administrative expenses (1,015)

Exchange gains 901

-----------

Operating loss (458)

Other operating income:

Interest receivable and similar income 437

Interest payable and similar charges (1)

-----------

Loss on ordinary activities before

taxation (22)

Tax on loss on ordinary activities (60)

-----------

Loss for the financial period (82)

===========

Full and diluted earnings per share (in

cents) (0.05)

===========

The profit and loss account has been prepared on the basis that all operations

are continuing operations.

EUREKA MINING PLC

CONSOLIDATED STATEMENT OF RECOGNISED GAINS AND LOSSES

FOR THE PERIOD ENDED 31 DECEMBER 2004

2004

$ 000's

Currency translation gain 441

----------

Loss for the period (82)

----------

----------

Total recognized gains and losses in the period 359

==========

EUREKA MINING PLC

BALANCE SHEETS

AS AT 31 DECEMBER 2004

Group Company

2004 2004

$000's $000's

Fixed assets

Intangible assets 21,691 -

Tangible assets 204 17

Investments - 15,823

----------- -----------

21,895 15,840

----------- -----------

Current assets

Stocks 14 -

Debtors 304 5,932

Cash at bank and in hand 8,102 7,936

----------- -----------

8,420 13,868

Creditors: amounts falling due within one year (329) (163)

----------- -----------

Net current assets 8,091 13,705

----------- -----------

----------- -----------

Net Assets 29,986 29,545

=========== ===========

Capital and reserves

Called up share capital 301 301

Share premium account 29,326 29,326

Translation reserve 441 -

Profit and loss deficit (82) (82)

----------- -----------

Shareholders funds - Equity 29,986 29,545

=========== ===========

The financial statements were approved by the Board on 19th April 2005.

EUREKA MINING PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD ENDED 31 DECEMBER 2004

2004

Notes $000's

Net cash outflow from operating activities A (203)

-----------

Returns on investments and servicing of finance

Interest received 437

Interest paid (1)

-----------

Net cash inflow from returns on investments and servicing of

finance 436

-----------

Tax paid -

Capital expenditure and financial investment

Payments to acquire tangible assets (211)

Payments to acquire intangible assets ( 5,741)

Payments to acquire subsidiaries (523)

-----------

Net cash outflow from capital expenditure ( 6,475)

-----------

Net cash outflow before management of liquid resources and

financing ( 6,242)

Financing

Issue of shares 14,326

-----------

Net cash inflow from financing 14,326

-----------

Increase in cash in the period B 8,084

===========

EUREKA MINING PLC

NOTES TO THE CONOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD ENDED 31 DECEMBER 2004

A. Reconciliation of operating loss to net cash outflow from operating

activities

2004

$000's

Operating loss (458)

Depreciation of tangible assets 16

Translation gain 441

Increase in stocks (14)

Increase in debtors (304)

Increase in creditors 116

-----------

Net cash outflow from operating activities (203)

===========

B. Analysis of net cash

Acquisitions Cash flow 31 December 2004

$000's $000's $000's

Net cash at bank and in hand 18 8,084 8,102

========= ========= ===========

C. Reconciliation of net cash flows to movement in net debt

2004

$000's

Increase in cash in the year 8,084

Companies acquired 18

-----------

8,102

Net debt at start of year -

-----------

Net debt at end of year 8,102

===========

wilbs

20 April 2005

Eureka Mining Plc

Preliminary results

Financial Highlights

Net assets of approximately US$30 million

Mining assets of US$21.7m in Kazakhstan and FSU with net cash balance of

US$8m awaiting investment

Net loss in first year of operation US$82,000

US$12.5m of funds raised through AIM admission and seed placing

Kazakhstan

Almost 10,000m of diamond drill core completed at the Shorskoye

Molybdenum Project

Using our own mining contractors and third party treatment facilities,

first concentrates anticipated from Shorskoye by the end of 2005

Extensive data reviews completed on the Dostyk and Kentau Projects during

the year and targets for development/action in 2005 identified

Russia

Acquisition of 51% of the very large copper/gold project at Chelyabinsk,

with the exclusive rights to purchase 100% of the Project

Internationally recognised independent consultants report that the most

advanced of the three deposits at Chelyabinsk, Miheevskoye, compares more

than favourably with its peers on a technical and commercial basis

Mine planning and permitting work is currently underway with various

recognised consultants with local Russian experience taking roles in the

initial phases

Please find Chairman's letter, Chief Executive Officer's report and financial

results accompanying this highlights page. The Company's annual report and

accounts will be distributed to shareholders this week and available shortly

thereafter on our website.

For more information please contact:

Kevin Foo / David Bartley Leesa Peters / Laurence Read

Eureka Mining Plc Conduit PR

Tel: +44 (0)20 7921 8810 Tel: +44 (0)20 7618 8760

info@eurekamining.co.uk

Tel: +44 (0)20 7618 8708

leesa@conduitpr.com

/

laurence@conduitpr.com

Joe Nally / Nick Morgan

Williams de Broe

Tel: +44 (0)20 7588 7511

www.eurekamining.co.uk

CHAIRMAN'S LETTER

FOR THE YEAR ENDED 31 DECEMBER 2004

Dear Fellow Shareholder

I am very pleased to present your Company's inaugural Annual Report.

In our first year of operations we have made appreciable progress and have not

wavered from the key objectives we set out in the prospectus, which were to:

Develop a significant mining company focused on assets based in

Kazakhstan and the surrounding regions of the Former Soviet Union (FSU).

Acquire additional resource assets which represent realistic commercial

ventures for Eureka.

Allocate resources prudently and efficiently to achieve maximum value

for the Group and its shareholders.

Our special expertise is operating in the FSU and with the abundant resources

base in this huge area, which covers 14% of the earth's land mass and with metal

markets enjoying significant growth, we feel we are in the right place, at the

right time, with the right team.

Since admission to the AIM market, the Company, under the leadership of David

Bartley, has not only achieved significant milestones on the original projects

but has also examined many projects in Kazakhstan, Russia and the surrounding

regions for acquisition opportunities. The focus has very much been on projects

with defined reserves which will offer us early production and near term cash

flow.

When acquisitions have been undertaken, they have been achieved with minimal

upfront financial consideration and within a timeframe in which they can be

adequately reviewed. On this basis, we are able to assess projects efficiently

and cost effectively and, when appropriate, continue with the acquisition or

terminate involvement.

This year, 2005, will be an exciting year. We plan to commence mining and

concentrate production from the Shorskoye Molybdenum Project, following our

decision to 'fast track' this project to take advantage of the high molybdenum

prices. We also plan to complete the acquisition of the exciting Chelyabinsk

Copper/Gold Project in Russia and continue assessment of this very large

deposit. In Kazakhstan, we will be drilling the most prospective targets

identified at our extensive exploration properties.

Annual General Meeting

The second Annual General Meeting of the Company will take place in London on 15

June 2005. The notice of meeting will be set out at the end of the annual report

and accounts, which will be sent to shareholders shortly with a form of proxy.

The Directors look forward to the opportunity to meet as many as possible of our

shareholders following the announcement of the first full results from the

Company.

Future Plans

Eureka remains fully committed to the objectives that we have set. We are

targeting further acquisitions that will provide cash to help preserve our

current capital position and allow us to maintain an aggressive approach to

developing the Company's existing base metal and gold projects. When we find

opportunities that need additional shareholders' funds we will make the case for

such support.

I should like to thank my fellow directors for their support of the Company

during this period. We are indebted to all of our staff for their commitment and

enthusiasm in meeting our objectives and I congratulate the management of Eureka

on an outstanding start to building the Company.

It has been a successful twelve months and the outlook is very exciting. We look

forward to your continued support.

Yours sincerely,

Kevin Foo

Chairman

CEO REPORT

FOR THE YEAR ENDED 31 DECEMBER 2004

I am delighted to report on an outstanding first year of operations for Eureka

Mining Plc, the highlights of which include:

Successful drilling, resource confirmation, testwork and prefeasibility

studies to enable a production decision to be taken on the Shorskoye

Molybdenum Project

Acquisition of the very large copper/gold project in Chelyabinsk, Russia

Exploration and drilling activities over three prospective targets -

Mykubinsk, Central Kazakhstan and Kentau

Establishment of first class technical and commercial teams in Kazakhstan

and Russia

Establishment of offices in Almaty, Semipalatinsk and Chelyabinsk

Shorskoye Molybdenum Project

The Shorskoye Molybdenum Deposit was discovered in 1993 and is located about 90

km south-west of Semipalatinsk in north-eastern Kazakhstan. The region has

existing road, rail and power infrastructure providing direct rail access into

the Chinese and Russian markets.

The zone of mineralisation delineated to date is approximately 600m long x 250m

wide x 200m deep. The zone is open at depth and is comprised of several lenses

of disseminated mineralisation of between 20m and 40 m thick. The mineralisation

is amenable to low waste to ore strip ratios and bulk open pit mining methods.

Metallurgical testwork on ore from the Shorskoye deposit has commenced at the

Kazmekhanobr Institute in Almaty, Kazakhstan. This testwork has defined a

conventional flowsheet for the concentration of molybdenum in the ore. The flow

sheet involves a coarse grind, bulk flotation of the molybdenum, differential

flotation for copper and molybdenum minerals and cleaner flotation to produce a

final concentrate. Shorskoye is expected to be able to produce a minimum

concentrate specification with MoS2 grade of 87-90% (i.e. 48-53% Mo).

The molybdenum concentrate can either be sold directly as a concentrate or

roasted to produce a higher value oxide product, TGMO (Technical Grade Molybdic

Oxide) which would also provide rhenium credits.

At the beginning of 2004, within one month of admission to AIM, we had

established offices in Kazakhstan and had commenced drilling at Shorskoye. By

the end of the first month of operations, we had three diamond drill rigs

operating around the clock at temperatures as low as -20degreesC. By the year

end, almost 10,000m of diamond drill core had been completed at Shorskoye.

Within the last 12 months, we have drilled and delineated a mineable, high grade

JORC compliant resource (Table 1). Bulk samples have been produced for

confirmation testwork, with preparation of concentrate samples for obtaining

expressions of interest from concentrate buyers.

We have initiated an overall project feasibility study to 'fast track' the

development of Shorskoye and we have concluded that this development, on a

limited scale in the short term, was appropriate to take advantage of the

current high molybdenum prices.

Consequently, using our own mining contractors and third party treatment

facilities, we intend to produce the first concentrates from Shorskoye by the

end of 2005.

In parallel with this, we shall complete a major feasibility study on the

overall deposit which includes detailed resource drilling, mining assessments,

metallurgical studies, environmental and permitting work and marketing studies.

Table 1 - Shorskoye East JORC Compliant Resource Estimate

TONNES GRADE CONTAINED METAL JORC

Ore Molybdenum Copper Cut Off Molybdenum Copper Category

Million % % Mo % Million Million

Tonnes Pounds Pounds

25.48 0.087 0.054 Uncut 49.1 30.5 Inferred

13.97 0.113 0.062 0.07 34.8 19.1 Inferred

5.36 0.163 0.070 0.10 19.3 8.3 Inferred

3.11 0.202 0.067 0.12 13.8 4.6 Inferred

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all

historical data and identified at least six drill targets, with particular focus

on base metal projects. During 2004, we drilled five projects and completed

significant field activity on two projects, including the high priority targets

Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold),

Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising

of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data

review, with a comprehensive Geographic Information Systems database being

created. This has enabled us to plan a focused exploration programme on

previously identified targets. Drilling is expected to commence in May 2005 at

two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold

Mine in northern Kazakhstan. However, after a thorough assessment and

reinterpretation of the project, including the completion of a drilling

programme, we decided not to exercise the option and purchase agreement over the

Nova project.

Our exploration and assessment teams are continuously reviewing potential

projects for Eureka across the FSU and only the very best are selected for

further work.

Chelyabinsk Copper-Gold Projects in Russia

In January 2005, Eureka completed the acquisition of 51% of the Chelyabinsk

Copper/Gold Project in the southern Urals region of Central Russia. This is held

through a UK company which holds 100% of three Russian subsidiary companies,

each of which owns one of the three deposits.

Eureka has completed negotiations with the vendors and now owns the rights to

purchase 100% of the Chelyabinsk copper-gold porphyry deposits. The project

comprises three separate deposits, Miheevskoye, Tominskoye and Taruntinskoye and

drilling to date has delineated total C1 and C2 resources of 609 million tonnes

at 0.74% Cu equivalent. Contained metal is currently estimated to be 3.37

million tonnes of copper, 3.61 million ounces of gold and 99 million pounds of

molybdenum. Preliminary mining studies on two of the deposits have identified

high grade ore in excess of 1% copper equivalent in the initial years, with low

mining strip ratios.

The two largest deposits, Miheevskoye and Tominskoye are copper/porphyry

deposits and are located 200km and 40km respectively from Chelyabinsk.

Taruntinskoye is a skarn deposit located on the Russian-Kazakhstan border,

approximately 100km south of the city. All three deposits are connected by the

same rail network.

A feasibility study is underway, addressing the development of up to a 20

million tonne per annum mine and concentrator and, secondly, up to a 3 million

tonne per annum mine and SX/EW project.

Eureka has completed independent due diligence on the project, through

internationally recognised independent consultants. The results from this work

showed that the most advanced of the deposits, Miheevskoye, compares more than

favourably with its peers on a technical and commercial basis. The other

deposits also have significant merit and are expected to add substantial value

and hence warrant further evaluation.

Many of the key elements required for commercial success of a mine are present

in the Chelyabinsk projects. These include:

Good Infrastructure

Low cost grid power near all project sites

Rail access near all project sites

Gas pipeline access

Flat terrain

Land tenure/ownership (new Russian laws will allow ownership)

Low cost mining - low strip ratios

Competitive metal grades and high grade starter pits

Good concentrate grades and recoveries with no penalty elements; and

Close proximity to local smelters

Eureka is now completing mine planning and permitting with the collection of

technical, social and environmental data for mine development. This work is

currently underway with various recognised consultants with local Russian

experience taking roles in the initial phases.

Current Resources

The resources of the three deposits are as follows:

Table 2 - Project Resources Summary (Russian C1, C2)

Project Name Cu cut-off Resource Estimate Cu equivalent Metal

% Cu (Mt, Cu%, Au g/t) grade % Cu* Mt Cu Moz Au

Miheevskoye 0.3% 327Mt @ 0.45% & 0.22g/t 0.66 1.47 2.31

Tominskoye 0.3% 241Mt @ 0.58% & 0.12g/t 0.73 1.40 0.93

Taruntinskoye 0.5% 41Mt @ 1.22% & 0.28g/t 1.48 0.50 0.37

Total 609Mt @ 0.55% & 0.18g/t 0.74 3.37 3.61

* Inclusive of Mo and Au credits

Our targets for 2005 are to:

Bring Shorskoye Molybdenum Project into production and generate positive

cash flow for the Company

Complete a pre-feasibility study on the Chelyabinsk project and define a

JORC compliant reserve

Continue exploration at all of our Kazakhstan properties with the aim of

identifying a possible new mine

Actively continue to review, assess and acquire properties that meet our

investment criteria; and

Raise appropriate funding for the projects as and when required

Our first full year of operations has been exciting and at times challenging and

as CEO, we could not have achieved the progress we have without the full support

of the Board and the excellent teams in Kazakhstan and Russia. We firmly believe

that we have laid the foundation for the next twelve months and beyond, which

will prove to be memorable for Eureka and its shareholders.

David Bartley

Chief Executive Officer

EUREKA MINING PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31 DECEMBER 2004

From incorporation

3 October 2003 to 31 December 2004

$ 000's

Operating costs (344)

-----------

Gross loss (344)

Administrative expenses (1,015)

Exchange gains 901

-----------

Operating loss (458)

Other operating income:

Interest receivable and similar income 437

Interest payable and similar charges (1)

-----------

Loss on ordinary activities before

taxation (22)

Tax on loss on ordinary activities (60)

-----------

Loss for the financial period (82)

===========

Full and diluted earnings per share (in

cents) (0.05)

===========

The profit and loss account has been prepared on the basis that all operations

are continuing operations.

EUREKA MINING PLC

CONSOLIDATED STATEMENT OF RECOGNISED GAINS AND LOSSES

FOR THE PERIOD ENDED 31 DECEMBER 2004

2004

$ 000's

Currency translation gain 441

----------

Loss for the period (82)

----------

----------

Total recognized gains and losses in the period 359

==========

EUREKA MINING PLC

BALANCE SHEETS

AS AT 31 DECEMBER 2004

Group Company

2004 2004

$000's $000's

Fixed assets

Intangible assets 21,691 -

Tangible assets 204 17

Investments - 15,823

----------- -----------

21,895 15,840

----------- -----------

Current assets

Stocks 14 -

Debtors 304 5,932

Cash at bank and in hand 8,102 7,936

----------- -----------

8,420 13,868

Creditors: amounts falling due within one year (329) (163)

----------- -----------

Net current assets 8,091 13,705

----------- -----------

----------- -----------

Net Assets 29,986 29,545

=========== ===========

Capital and reserves

Called up share capital 301 301

Share premium account 29,326 29,326

Translation reserve 441 -

Profit and loss deficit (82) (82)

----------- -----------

Shareholders funds - Equity 29,986 29,545

=========== ===========

The financial statements were approved by the Board on 19th April 2005.

EUREKA MINING PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD ENDED 31 DECEMBER 2004

2004

Notes $000's

Net cash outflow from operating activities A (203)

-----------

Returns on investments and servicing of finance

Interest received 437

Interest paid (1)

-----------

Net cash inflow from returns on investments and servicing of

finance 436

-----------

Tax paid -

Capital expenditure and financial investment

Payments to acquire tangible assets (211)

Payments to acquire intangible assets ( 5,741)

Payments to acquire subsidiaries (523)

-----------

Net cash outflow from capital expenditure ( 6,475)

-----------

Net cash outflow before management of liquid resources and

financing ( 6,242)

Financing

Issue of shares 14,326

-----------

Net cash inflow from financing 14,326

-----------

Increase in cash in the period B 8,084

===========

EUREKA MINING PLC

NOTES TO THE CONOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD ENDED 31 DECEMBER 2004

A. Reconciliation of operating loss to net cash outflow from operating

activities

2004

$000's

Operating loss (458)

Depreciation of tangible assets 16

Translation gain 441

Increase in stocks (14)

Increase in debtors (304)

Increase in creditors 116

-----------

Net cash outflow from operating activities (203)

===========

B. Analysis of net cash

Acquisitions Cash flow 31 December 2004

$000's $000's $000's

Net cash at bank and in hand 18 8,084 8,102

========= ========= ===========

C. Reconciliation of net cash flows to movement in net debt

2004

$000's

Increase in cash in the year 8,084

Companies acquired 18

-----------

8,102

Net debt at start of year -

-----------

Net debt at end of year 8,102

===========

wilbs

jimbobGR - 20 Apr 2005 17:52 - 29 of 215

On the way up

24,000 buy reckon that was funds?

Lets hope more news follows market seems less hostile for the moment this week

24,000 buy reckon that was funds?

Lets hope more news follows market seems less hostile for the moment this week

tallsiii

- 20 Apr 2005 20:48

- 30 of 215

- 20 Apr 2005 20:48

- 30 of 215

No, that was me!

tallsiii

- 20 Apr 2005 20:54

- 31 of 215

- 20 Apr 2005 20:54

- 31 of 215

The key section is:

'We have initiated an overall project feasibility study to 'fast track' the

development of Shorskoye and we have concluded that this development, on a

limited scale in the short term, was appropriate to take advantage of the

current high molybdenum prices.'

To me that reads that they are going to mine it, and that means positive cash flow this year. If the moly prices stay high and they are able to acheive their goal of 3.8million lbs of moly, then profits for the year should come in at approx 60m. Market cap is still only 20m.

Arrive early in order to avoid dissappointment.

Tallsiii

'We have initiated an overall project feasibility study to 'fast track' the

development of Shorskoye and we have concluded that this development, on a

limited scale in the short term, was appropriate to take advantage of the

current high molybdenum prices.'

To me that reads that they are going to mine it, and that means positive cash flow this year. If the moly prices stay high and they are able to acheive their goal of 3.8million lbs of moly, then profits for the year should come in at approx 60m. Market cap is still only 20m.

Arrive early in order to avoid dissappointment.

Tallsiii

Madison

- 20 Apr 2005 21:32

- 32 of 215

- 20 Apr 2005 21:32

- 32 of 215

Thanks Tallsiii. Interesting.

Cheers, Madison

Cheers, Madison

jimbobGR - 21 Apr 2005 06:53 - 33 of 215

Blimey tallsii you dont mess around!!!!!

tallsiii

- 21 Apr 2005 19:55

- 34 of 215

- 21 Apr 2005 19:55

- 34 of 215

I don't find gems like this one very often.

jimbobGR - 22 Apr 2005 07:07 - 35 of 215

U could retire on this one then IF pe will be 0.1

tallsiii

- 22 Apr 2005 08:23

- 36 of 215

- 22 Apr 2005 08:23

- 36 of 215

Yes, or start a hedge fund!!

The outlook of 2006 is production of 20 million pounds of moly. At a conservative price forecast of $15 per pound and a cost of $5 per pound, that leads to profits 200 million dollars. And that is before you look at the billions of dollars worth of copper in the Chelyabinsk mine in Russia.

This one is going to be big, whatever way you look at it!!!

The outlook of 2006 is production of 20 million pounds of moly. At a conservative price forecast of $15 per pound and a cost of $5 per pound, that leads to profits 200 million dollars. And that is before you look at the billions of dollars worth of copper in the Chelyabinsk mine in Russia.

This one is going to be big, whatever way you look at it!!!

wilbs

- 22 Apr 2005 08:42

- 37 of 215

- 22 Apr 2005 08:42

- 37 of 215

who has got hard up and sold their 39 shares??

come on, own up!!

wilbs

come on, own up!!

wilbs

danielmace101 - 22 Apr 2005 09:51 - 38 of 215

OK Siii

I am finally convinced re EKA but feel this to be a bit of a long term investment. Are you expecting much movement in the short term?

Are you still keen on VML also?

Dan

I am finally convinced re EKA but feel this to be a bit of a long term investment. Are you expecting much movement in the short term?

Are you still keen on VML also?

Dan

tallsiii

- 22 Apr 2005 10:03

- 39 of 215

- 22 Apr 2005 10:03

- 39 of 215

Daniel, I would expect this share to rise several times over before the end of this year. But you are right that it is long term as it should keep on rising into 2006.

The company has not yet spent any time or money on marketing itself to the city. As it does so the share price should rise and as it if achieves what it says, then it should go up further still.

The company has not yet spent any time or money on marketing itself to the city. As it does so the share price should rise and as it if achieves what it says, then it should go up further still.

tallsiii

- 22 Apr 2005 10:04

- 40 of 215

- 22 Apr 2005 10:04

- 40 of 215

Am still very much into Vane, check out the board.

jimbobGR - 27 Apr 2005 07:19 - 41 of 215

Refresh

jimbobGR - 28 Apr 2005 07:30 - 42 of 215

Dear Mr Ransley,

We plan to promote after the Shorskoye feasibility study has been completed, in

approximately 8 weeks. We cannot give profits at this stage until the

feasibility study is finalised.

Thank you for your comments.

Michelle Surtees-Myers

Eureka Mining Plc

Hatfield House

1st Floor

52/54 Stamford Street

London SE1 9LX

Tel: +44 (0)20 7921 8810

Fax: +44 (0)20 7921 8811

e-mail: michelle.myers@eurekamining.co.uk

-----Original Message-----

From: James Ransley [mailto:jransley@hotmail.co.uk]

Posted At: 24 April 2005 09:04

Posted To: Eureka_Info

Conversation: Shareholder

Subject: Shareholder

I understand that you have stated that you do not intend to promote the

company until the final results arrive from the molybdenum project. When are

these results expected and will the company release a statement saying

should the market conditions remain unchanged the company expects a profit

of xxxxxxxx as Biofuels recently had. I believe the shareholders would

greatly appreciate it as the market is becoming increasingly hostile to

small miners who are not yet producing. I have great faith in your company

and hope to hear the final results from the molybdenum mine soon.

Thankyou for your time James Ransley

jransley@hotmail.co.uk

We plan to promote after the Shorskoye feasibility study has been completed, in

approximately 8 weeks. We cannot give profits at this stage until the

feasibility study is finalised.

Thank you for your comments.

Michelle Surtees-Myers

Eureka Mining Plc

Hatfield House

1st Floor

52/54 Stamford Street

London SE1 9LX

Tel: +44 (0)20 7921 8810

Fax: +44 (0)20 7921 8811

e-mail: michelle.myers@eurekamining.co.uk

-----Original Message-----

From: James Ransley [mailto:jransley@hotmail.co.uk]

Posted At: 24 April 2005 09:04

Posted To: Eureka_Info

Conversation: Shareholder

Subject: Shareholder

I understand that you have stated that you do not intend to promote the

company until the final results arrive from the molybdenum project. When are

these results expected and will the company release a statement saying

should the market conditions remain unchanged the company expects a profit

of xxxxxxxx as Biofuels recently had. I believe the shareholders would

greatly appreciate it as the market is becoming increasingly hostile to

small miners who are not yet producing. I have great faith in your company

and hope to hear the final results from the molybdenum mine soon.

Thankyou for your time James Ransley

jransley@hotmail.co.uk

tallsiii

- 29 Apr 2005 08:12

- 43 of 215

- 29 Apr 2005 08:12

- 43 of 215

Nice one Jimbob. The 8 week timescale is consistent with their AGM on 14th June. I plan to attend.

proptrade

- 29 Apr 2005 10:45

- 44 of 215

- 29 Apr 2005 10:45

- 44 of 215

great comments.

cheers for the updates tallsiii. you are slowly but surely selling me on this one....maybe next week.

cheers for the updates tallsiii. you are slowly but surely selling me on this one....maybe next week.

jimbobGR - 29 Apr 2005 17:42 - 45 of 215

So we reckon the news be out just before AGM to please shareholders

or just after?

B4

Friday 10th

Monday 13th

Later

What do U think

Has it reached bottom now?

or just after?

B4

Friday 10th

Monday 13th

Later

What do U think

Has it reached bottom now?

jimbobGR - 05 May 2005 18:32 - 46 of 215

3 days of small rises now U think we've hit bottom ?

tallsiii

- 06 May 2005 07:50

- 47 of 215

- 06 May 2005 07:50

- 47 of 215

Difficult to say in this market. It could be dragged down in any further sell off of small miners.

jimbobGR - 06 May 2005 17:42 - 48 of 215

Another good day tallsii

tallsiii

- 09 May 2005 07:37

- 49 of 215

- 09 May 2005 07:37

- 49 of 215

News of this share is starting to get around in a small way. I saw a post on www.iii.co.uk where some people were rating it. It will be interesting to see what happens between now and the AGM.

proptrade

- 09 May 2005 09:27

- 50 of 215

- 09 May 2005 09:27

- 50 of 215

morning Siiiiii

i think you are to something here...am putting my portfolio together and looking very closely at this one. what is the big news we are waiting for to potentially rerate this stock?

i think you are to something here...am putting my portfolio together and looking very closely at this one. what is the big news we are waiting for to potentially rerate this stock?

tallsiii

- 09 May 2005 09:31

- 51 of 215

- 09 May 2005 09:31

- 51 of 215

It is difficult to say until a sucessful feasibility study is confirmed in June.

proptrade

- 09 May 2005 09:51

- 52 of 215

- 09 May 2005 09:51

- 52 of 215

cheers. but i assume we are hopeful about this study...

tallsiii

- 09 May 2005 10:30

- 53 of 215

- 09 May 2005 10:30

- 53 of 215

The delay is an issue, but fingers crossed.

jimbobGR - 09 May 2005 17:40 - 54 of 215

Great day +7.5p thats 5 days of rises

tallsiii

- 10 May 2005 15:52

- 55 of 215

- 10 May 2005 15:52

- 55 of 215

Yes something appears to be happening.

Their website has been updated.

Their website has been updated.

proptrade

- 11 May 2005 10:06

- 56 of 215

- 11 May 2005 10:06

- 56 of 215

the word is getting out?

Eureka Mining PLC

11 May 2005

EUREKA MINING PLC ('the Company')

Significant shareholding

The Company was notified on 10 May 2005 that Man Financial Limited had acquired

an interest in the shares of the Company resulting in a total holding of 598,917

Ordinary Shares of 1p each in the Company. This represents 3.38 per cent. of the

issued share capital of the Company.

Eureka Mining PLC

11 May 2005

EUREKA MINING PLC ('the Company')

Significant shareholding

The Company was notified on 10 May 2005 that Man Financial Limited had acquired

an interest in the shares of the Company resulting in a total holding of 598,917

Ordinary Shares of 1p each in the Company. This represents 3.38 per cent. of the

issued share capital of the Company.

tallsiii

- 11 May 2005 15:28

- 57 of 215

- 11 May 2005 15:28

- 57 of 215

From what we can guess this holding of around 750k is either Man the hedge fund, Man spread trading the spreadbetter or GNI the CFD provider. Either way it is an entity that is prepared to put a fair amount of cash into this little prospect.

Tallsiii

Tallsiii

tallsiii

- 17 May 2005 11:39

- 58 of 215

- 17 May 2005 11:39

- 58 of 215

Moly is now up to $37.50 per pound!!

jimbobGR - 17 May 2005 17:38 - 59 of 215

Copper fell for a bit but read that its expected to go up again. Very big buys today but no rise.

Madison

- 19 May 2005 17:09

- 60 of 215

- 19 May 2005 17:09

- 60 of 215

Just released:

LONDON (AFX) - Eureka Mining PLC said its chairman Kevin Foo and chief executive David Bartley have increased their stakes in the company.

In a statement, the company said Foo bought 23,500 shares at 1.27 stg each, raising his total holding to 2.70 pct while Bartley bought 123,840 shares at the same price.

He now holds a 1.69 pct stake in the company.

newsdesk@afxnews.com

Cheers, Madison

LONDON (AFX) - Eureka Mining PLC said its chairman Kevin Foo and chief executive David Bartley have increased their stakes in the company.

In a statement, the company said Foo bought 23,500 shares at 1.27 stg each, raising his total holding to 2.70 pct while Bartley bought 123,840 shares at the same price.

He now holds a 1.69 pct stake in the company.

newsdesk@afxnews.com

Cheers, Madison

tallsiii

- 20 May 2005 08:54

- 61 of 215

- 20 May 2005 08:54

- 61 of 215

Does that preclude any news for the next 3 months though?

tallsiii

- 23 May 2005 08:50

- 62 of 215

- 23 May 2005 08:50

- 62 of 215

The price seems to be moving off the back of the director buying.

proptrade

- 23 May 2005 09:16

- 63 of 215

- 23 May 2005 09:16

- 63 of 215

a nice mondat morning for you!

jimbobGR - 25 May 2005 18:29 - 64 of 215

very strong gains off relatively low volume. I think those that are in are in for the medium term now and small buy volumes are likely to see the prices rising significantly from now on.

Whats your view tallsii

Whats your view tallsii

tallsiii

- 25 May 2005 18:39

- 65 of 215

- 25 May 2005 18:39

- 65 of 215

It probably won't be long before the SP gets back up to its previous peak.

I think the rises on small volume are due to the fact that miners in general are coming back into favour.

The real gains should happen later in the year when actual production is occuring and there is a definate sale price for the moly. Production of anything more than 2m lbs with a moly price of anything above $20 per lb should easily double the SP.

I think the rises on small volume are due to the fact that miners in general are coming back into favour.

The real gains should happen later in the year when actual production is occuring and there is a definate sale price for the moly. Production of anything more than 2m lbs with a moly price of anything above $20 per lb should easily double the SP.

jimbobGR - 26 May 2005 07:51 - 66 of 215

17-May Buy Kevin A Foo 127.00p 23,500 29,845.00

17-May Buy Jonathan S Barrett 127.00p 7,830 9,944.10

17-May Buy Malcolm James 122.00p 61,000 74,420.00

17-May Buy Malcolm James 127.00p 47,000 59,690.00

17-May Buy David Bartley 127.00p 123,840 157,276.80

17-May Buy Jonathan S Barrett 127.00p 7,830 9,944.10

17-May Buy Malcolm James 122.00p 61,000 74,420.00

17-May Buy Malcolm James 127.00p 47,000 59,690.00

17-May Buy David Bartley 127.00p 123,840 157,276.80

jimbobGR - 26 May 2005 07:56 - 67 of 215

Tallsii just checked your website http://www.monterrico.co.uk/s/MetalPrices.asp for price I take it you divided the prices by 2.2 to get it in pounds.

Price now $44 lb

Price now $44 lb

jimbobGR - 26 May 2005 08:01 - 68 of 215

Could the company sell future production at a discounted price to take advantage of the currently high prices?

jimbobGR - 30 May 2005 11:29 - 69 of 215

New Sums

3,800,000lbs of molybdenum last quarter at $46.6 per pound minus $5 in extraction costs

3.8mill x (46.6 - 5) = $158 million approx = 86.6 million

Current Market Cap 24 million

If assume valuation on 8 times PE in 4 quarters not one

86.6 million x 4 x 8 = 2,771 million

2,771million / 24 million = 115.5 times potential multiple of current share price

Next Year

Production target 20,000,000lbs molybdenum according to tallsii's statement above

20,000,000 x 41.6 = $832 million approx = 456.3 million

assume valuation at 8 times PE

456.3 million x 8 = 3,650 million

3,650 million / 24million = 152 times current valuation

or current sp x 152 therefore 137p x 152 = 20824p = 208.24 each

Can U look over these tallsii

3,800,000lbs of molybdenum last quarter at $46.6 per pound minus $5 in extraction costs

3.8mill x (46.6 - 5) = $158 million approx = 86.6 million

Current Market Cap 24 million

If assume valuation on 8 times PE in 4 quarters not one

86.6 million x 4 x 8 = 2,771 million

2,771million / 24 million = 115.5 times potential multiple of current share price

Next Year

Production target 20,000,000lbs molybdenum according to tallsii's statement above

20,000,000 x 41.6 = $832 million approx = 456.3 million

assume valuation at 8 times PE

456.3 million x 8 = 3,650 million

3,650 million / 24million = 152 times current valuation

or current sp x 152 therefore 137p x 152 = 20824p = 208.24 each

Can U look over these tallsii

tallsiii

- 31 May 2005 08:02

- 70 of 215

- 31 May 2005 08:02

- 70 of 215

Jimbob

The price tend to go on is that of Molybdenum Oxide. This one is quoted on the Monterrico website and is currently sitting at $38.50. The two ferro molybdenum prices did shot up last week, suggesting the underlying market is still rising.

As for the sums, if we are right, then we could be looking at a share that will make the returns on Asia Energy look like a deposit account. But as we know if something looks too good to be true, then it probably is. So don't put your house on it just yet!!

Tallsiii

The price tend to go on is that of Molybdenum Oxide. This one is quoted on the Monterrico website and is currently sitting at $38.50. The two ferro molybdenum prices did shot up last week, suggesting the underlying market is still rising.

As for the sums, if we are right, then we could be looking at a share that will make the returns on Asia Energy look like a deposit account. But as we know if something looks too good to be true, then it probably is. So don't put your house on it just yet!!

Tallsiii

proptrade

- 31 May 2005 08:30

- 71 of 215

- 31 May 2005 08:30

- 71 of 215

wise words tallsiii! am i right in saying there is news out in the next couple of weeks?

tallsiii

- 31 May 2005 08:51

- 72 of 215

- 31 May 2005 08:51

- 72 of 215

There have been a number of timescales given for the final announcement on the Shorkye fesability study, but I hope there will be something out within a month.

tallsiii

- 31 May 2005 09:15

- 73 of 215

- 31 May 2005 09:15

- 73 of 215

Shorskye is a very hot prospect, but the future beyond that looks very bright also. Chelyabinsk in Russia is due to commence production in 2006 if all goes well with the fesability study. The resource estimates for this mine are 3.37 million tonnes of copper and 3.61 million lbs of gold.

If you assume a conservate $1 per lb for copper and $300 per lb of gold, then valuation looks very good.

3.37 million tonnes of copper = 6740 million lbs copper = $6.74bn

3.61 million lbs of gold = $1.083bn

After extraction cost and discounted cash flow this may boil down to a valuation of just $1bn.

Again this looks too good to be true, but if it is, then it will certainly give them something to be playing with when the molybdenum price has come back down to earth.

If you assume a conservate $1 per lb for copper and $300 per lb of gold, then valuation looks very good.

3.37 million tonnes of copper = 6740 million lbs copper = $6.74bn

3.61 million lbs of gold = $1.083bn

After extraction cost and discounted cash flow this may boil down to a valuation of just $1bn.

Again this looks too good to be true, but if it is, then it will certainly give them something to be playing with when the molybdenum price has come back down to earth.

jimbobGR - 31 May 2005 15:40 - 74 of 215

Good day so far half of me wants it to stagnate for a bit so that I can try and get some more funds together.

tallsiii

- 31 May 2005 16:10

- 75 of 215