| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

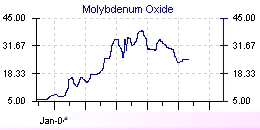

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 05 Feb 2006 04:46

- 2 of 213

- 05 Feb 2006 04:46

- 2 of 213

Feature Story Date: January 26, 2006

Eureka Mining Moving Fast At Both Chelyabinsk And Shorskoye.

By Jack Hammer

What with recurring illness and deal-making across central Asia, Eureka Mining chief executive David Bartley didnt have much time to stay in touch with the City last year, except when he was announcing big deals. But although the newsflow was sometimes a bit thin, those long hard hours on the road are beginning to pay off. Eureka is shaping up nicely full scale mining on the fifty per cent owned Shorksoye molybdenum project in Kazakhstan is imminent, and a pre-feasibility on the Chelyabinsk copper project in Russia is underway.

So, late in December Mr Bartley promised to pay more attention to the deskbound folk in London, to be around more, and to provide regular updates. He was off alcohol back then, on account of his recurring bouts of malaria, putting him for the time being - and somewhat unusually - on a level with Joe Nally, the mining money-man at Cenkos who is a close ally, and who has given up the booze for January. But some resolutions are harder to keep than others - David Bartley is not currently in town, and nor is he in touch. One mining analyst is under the impression that hes lying in hospital in Australia with another attack of malaria, but a PR for Eureka eventually establishes that hes in Moscow so, sorry, can I get back to you in two weeks?

Fair enough its not so long since Mr Bartley visited London to update press and investors. But he also spent a fair bit of time on that visit moaning about weakness in Eurekas share price. There are moves afoot to rectify that weakness from the broking angle, but if Mr Bartley wants the shares to firm up someone needs to be here pushing the story full time.

Its not clear either what exactly Mr Bartley is doing in Russia. With any luck though, its something to do with the pre-feasibility study on Chelyabinsk, which is due to be delivered in the first quarter of this year.

Chelyabinsk is a copper-gold project with a total resource 687 million tonnes at 0.7 % copper equivalent in the Russian C1 and C2 categories. Those numbers are derived from three deposits within Chelyabinsk, and a JORC calculation has been made and verified by Snowden - for Miheevskjoye, the largest. It shows 405 million tonnes at average grades of 0.4 % copper and 0.22 g/t gold in the inferred category. Its not world class, says Richard Chase, who continues to provide analysis for broker Ambrian, in spite of a recent move up the foodchain there, but its not bad either. It should be cheaper to develop than Montericcos bigger Rio Blanco project in Peru for example.

Last year Eureka signed up Barclays Capital to act as advisor on financing. Barclays chief Gerard Holden went out to take a look for himself, was favourably impressed, and on current plans could be looking to put the finance in place before the year is out. Post tax, assuming 60 per cent debt finance, and on a 15 per cent discount, Ambrians Mr Chase values Chelyabinsk at US$105 million. This isnt going to be a 200 million company, he says, before adding, with one eye on future developments, at least not on these assets.

Eureka is not a one trick pony, however. In the summer David Bartley pulled off a deal in which the company gave up 50 per cent of Shorskoye in exchange for access to the plant and processing facilities of local operator Kazatomprom. Thats a lot of a project to give away, but the point was to get producing fast. Molybdenum wont stay above US$30/lb forever the long-term average is below US$10/lb. Ambrians Richard Chase says: I wouldnt be surprised if Shorskoye is all done and dusted in three years. But over those three years he forecasts nearly US$45 million in net cash flow, assuming a (currently) conservative US$20/lb molybdenum price. Those are reasonable numbers, and should sustain Mr Bartley nicely on his travels, as he works up other early stage exploration assets and hunts down more deals.

Companies featured in this Story Eureka Mining Plc (AIM-EKA)

PapalPower

- 05 Feb 2006 04:47

- 3 of 213

- 05 Feb 2006 04:47

- 3 of 213

I want news on the BFS for Chelyabinsk asap, as it looks like a very good time is approaching for copper, if Chelyabinsk is producing in 2008, it will be perfect timing to catch the wave maybe.

Extract from Jan 06 report on copper (from http://www.miningnews.net) :

"Meantime a report early this month by UBS Warburg will have seen miners lighting up cigars and breaking open crates of the finest malt whiskey.

UBS said there were "strong similarities" between the positive fundamentals for oil and copper, including:

- Decline in reserve quality, and cost inflation

- Chinese demand

- Energy link (Electrical power requirements are growing, and the potential for increased copper use in hybrid autos is being driven by high energy values)

- Fund money

- Bottlenecks (Refining in oil, smelters in copper)

- Corporate perception M&A activity (It appears that both oil and copper companies remain unconvinced that high prices are here to stay; a consequence is conservatism on capital spending delaying the supply response. Even so, competition for operating assets remains heated)

- Elastic demand response to high prices (Consumers of both products looking at substitution)

- Focus on inventories

"While the similarities between the two commodities are quite striking, we believe that an argument could be made that copper fundamentals are superior," UBS said.

"A key difference between the two is supply reaction; a new copper mine takes a least two years to build and much longer to find; an oil well takes less than a year to bring to production.

"Furthermore, the copper market has no OPEC to satisfy unexpected demand when it arises."

All of which begs the question, is this copper nirvana?"

PapalPower

- 05 Feb 2006 04:47

- 4 of 213

- 05 Feb 2006 04:47

- 4 of 213

Extract from an 18th Jan The Australian report :

"A year ago copper was forecast to average $US1.23 a pound but came in at $US1.66 a pound. The red metal is now at a record high around $US2.15.

In a report from London last week, Credit Suisse First Boston warned that the market could be seriously underestimating the strength of the metal price outlook.

According to CSFB's scenario, mining executives remain scarred by past busts and are too focused on value, so they are reluctant to commit themselves to new mines, the costs of which have jumped 20-50 per cent in the past five years. That means supply simply won't ramp up quickly enough and the market is in for further metal price spikes in the next two years.

CSFB estimates that in metals such as copper, zinc, nickel and aluminium new supply won't be enough to cover demand growth of 3 per cent.

"Mining executives today are too focused on returns and aren't incentivised to take risk to build new mines or smelters. Share buybacks and mergers and acquisitions are a lower-risk strategy than developing a mine with four-year lead times and the uncertainty of where prices will be once the project is finished," it says.

CSFB says that while Rio Tinto and BHP Billiton are pulling out all stops to expand iron ore production following a 71 per cent price leap last year, growth plans are generally characterised by smaller brownfield expansions rather than large new projects.

CSFB estimates that for a new copper mine to earn a 20 per cent return, it needs a long-term price of about $US1.50 a pound, up from current thinking of US90c a pound.

CSFB sees copper prices averaging a whopping $US2.30 a pound this year.

The wide range in forecasts makes it tough for investors. Diversified majors such as BHP and Rio Tinto are trading at 10-11 times earnings, which is approaching the high side, if commodity prices are peaking. But if you plug in spot prices, they are trading closer to an attractive 8 times earnings.

According to UBS, the sector's quarterly reporting season, which kicks off with Rio's production report, could trigger a fall in prices if the reports highlight continued cost pressures.

But it says any fall should be seen as a buying opportunity. "Whereas we believe the market is lagging on updating for rising costs, we believe it is also lagging on upgrading for higher commodity prices," UBS says. "

PapalPower

- 05 Feb 2006 04:49

- 5 of 213

- 05 Feb 2006 04:49

- 5 of 213

unionhall - 1 Feb'06

Meanwhile, Phelps Dodge Senior Vice President for Marketing Arthur Miele Tuesday forecast a $2 per pound copper price during the first quarter, along with a 3.5%-4% growth in copper consumption this year. He also predicted an $18 to $25 per pound average molybdenum price during 2006 with a first-quarter average price of $22/lb.

I understand Shorskoye production mid-April.

Stockpiled ore from mining confirms required grades.

All equipment in country following delay at customs. Clear for takeoff.

Trying to force final positive confirmation re Chelyabinsk while work continues on site.

3rd Feb

David Bartley was in Russia beginning of week trying to finalise Chelyabinsk.

In all day meeting in London today.

Back in Russia next Monday and Tuesday.

PapalPower

- 05 Feb 2006 05:00

- 6 of 213

- 05 Feb 2006 05:00

- 6 of 213

Link Click Here

PapalPower

- 05 Feb 2006 12:51

- 7 of 213

- 05 Feb 2006 12:51

- 7 of 213

We also must not forget the bullish outlook on copper, which if Chelyabinsk news is good, then demands that EKA takes a serious re-rating upwards.

PapalPower

- 05 Feb 2006 23:07

- 8 of 213

- 05 Feb 2006 23:07

- 8 of 213

Link for latest prices

From the link you provided :

Indium

99.99%min European market

950-990 usd/kg

Manganese Flake

99.7%min European market

1280-1330 usd/mt

Molybdenum Oxide

57%min European market

25.5-26.5 usd/lb Mo

Selenium

99.9%min European market

31-33 usd/lb

Silicon

4-4-1 European market

1250-1280 eur/mt

Tungsten APT

88.5%min European market

265-275 usd/mtu

Vanadium Pentoxide

98%min European market

8.0-9.0 usd/lb VO5

PapalPower

- 06 Feb 2006 09:40

- 9 of 213

- 06 Feb 2006 09:40

- 9 of 213

PapalPower

- 06 Feb 2006 15:47

- 10 of 213

- 06 Feb 2006 15:47

- 10 of 213

silvermede

- 06 Feb 2006 16:29

- 11 of 213

- 06 Feb 2006 16:29

- 11 of 213

Thanks for the work on this new thread, succint repository of info.

PapalPower

- 06 Feb 2006 16:39

- 12 of 213

- 06 Feb 2006 16:39

- 12 of 213

http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

Here we go, up through 200p and more to come...............the full RNS is much longer than the highlights below and full of information !

RNS Number:9954X

Eureka Mining PLC

06 February 2006

Eureka Mining PLC

("Eureka" or "the Company")

06 February 2006

Eureka acquires 100% ownership of the

Chelyabinsk Copper/Gold Project, Russia and announces results of Scoping Study

* Ownership increased to 100% by payment of US$6 million

* Confirmation of good and unencumbered title received

* Miheevskoye Scoping study demonstrates robust economics

* NPV(10%) of US$257m and IRR of 23.6%, at US$1.00/lb copper and US$400/oz gold

* Capital cost estimate US$342m and cash costs of US$0.39/lb before credits

* Start-up scheduled for 2008

Acquisition of 100% of Chelyabinsk Copper Company

tallsiii

- 06 Feb 2006 16:47

- 13 of 213

- 06 Feb 2006 16:47

- 13 of 213

tallsiii

- 06 Feb 2006 16:51

- 14 of 213

- 06 Feb 2006 16:51

- 14 of 213

tallsiii

- 06 Feb 2006 17:01

- 15 of 213

- 06 Feb 2006 17:01

- 15 of 213

So with a copper price of $1.70 and a gold price of $575, you could add 7 times $109 to the NPV of $257m. That would give a total NPV of over $1000m (580m), 17 times the current Market Cap (34m) of EKA. The copper price is in fact way above $1.70 at the moment, but using that price allows for a simple calculation.

PapalPower

- 06 Feb 2006 17:13

- 16 of 213

- 06 Feb 2006 17:13

- 16 of 213

The figures are mind boggling, VOG had its day in the sun, now its sister company EKA to have the fun.

silvermede

- 06 Feb 2006 17:14

- 17 of 213

- 06 Feb 2006 17:14

- 17 of 213

tallsiii

- 06 Feb 2006 17:21

- 18 of 213

- 06 Feb 2006 17:21

- 18 of 213

PapalPower

- 06 Feb 2006 17:27

- 19 of 213

- 06 Feb 2006 17:27

- 19 of 213

The Fox Davies reports gives target prices, and its all in the link above.

tallsiii

- 06 Feb 2006 17:37

- 20 of 213

- 06 Feb 2006 17:37

- 20 of 213

PapalPower

- 06 Feb 2006 17:50

- 21 of 213

- 06 Feb 2006 17:50

- 21 of 213

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

Shorskoye - 10m profit p/a @ $20 Moly

PapalPower

- 07 Feb 2006 00:09

- 22 of 213

- 07 Feb 2006 00:09

- 22 of 213

PapalPower

- 07 Feb 2006 11:18

- 23 of 213

- 07 Feb 2006 11:18

- 23 of 213

PapalPower

- 09 Feb 2006 16:42

- 24 of 213

- 09 Feb 2006 16:42

- 24 of 213

PapalPower

- 11 Feb 2006 01:38

- 25 of 213

- 11 Feb 2006 01:38

- 25 of 213

MOLYMANIA HAS JUST BEGUN

Friday, February 10, 2006

tallsiii

- 21 Feb 2006 14:27

- 26 of 213

- 21 Feb 2006 14:27

- 26 of 213

PapalPower

- 21 Feb 2006 23:32

- 27 of 213

- 21 Feb 2006 23:32

- 27 of 213

PapalPower

- 24 Feb 2006 07:45

- 28 of 213

- 24 Feb 2006 07:45

- 28 of 213

Good news from it, the Foo man say "iminent first production" !!

RNS Number:8784Y

Eureka Mining PLC

24 February 2006

Eureka Mining PLC

("Eureka" or "the Company") (TIC: EKA)

David Bartley temporarily steps down as Eureka CEO

Eureka Mining Plc announces that David Bartley is temporarily stepping down from the position of Chief Executive Officer due to health reasons; he remains a non executive director of the Company. David anticipates resuming the role of CEO towards the middle of the year.

During this period, the Board has appointed Jonathan Scott-Barrett, a

non-executive Director of Eureka since listing, as Chief Executive Officer. Mr

Scott-Barrett will be assisted in this role by Andrzej Sliwa, Executive

Technical Director, Vernon Martins, General Manager Operations, Karl Herrington, Director Russia and Mukhtar Tuyakbayev, Director Kazakhstan.

Mr. Scott-Barrett, 61, is a Chartered Surveyor and has had an extensive career

in senior management and executive positions, including nine years as a

non-executive director of Hanson Plc whose operating companies at that time

included Peabody Coal, the largest coal producer in the US. He was also a

publishing director of Centaur Communications Ltd for over 15 years, one of the

largest business to business publishers in the UK and was publisher of Money

Marketing, The Lawyer and Chairman of Perfect Information, a City based

financial information provider.

Eureka Chairman Kevin Foo said, "David has, through his untiring efforts,

positioned the Company well to take advantage of the high molybdenum prices with imminent first production from the Shorskoye project in Kazakhstan and the advancement of the pre-feasibility study on the Chelyabinsk Copper-Gold project in Russia. We wish David a rapid recovery and with Jonathan assuming the position of Chief Executive Officer the Company will continue to make rapid

progress."

For further information:

Jonathan Scott-Barrett/Kevin Foo Laurence Read

Chief Executive Officer/Chairman Conduit PR

Eureka Mining Plc Tel: +44 (0)20 7429 6666 /

Tel: +44 (0)20 7921 8810 +44 (0)7979 955923

www.eurekamining.co.uk

PapalPower

- 24 Feb 2006 11:43

- 29 of 213

- 24 Feb 2006 11:43

- 29 of 213

Directorate Change - Amended

RNS Number:8950Y

Eureka Mining PLC

24 February 2006

Eureka Mining PLC

("Eureka" or "the Company") (TIC: EKA)

Eureka CEO

The following replaces the Directorate Change Announcement released on 24

February 2006 at 07.01 under RNS No. 8784Y. The notice did not include details

of the timing for studies of the Shorskoye and Chelyabinsk projects

respectively. These are now included. The full amended text appears below, all other information remains unchanged.

Eureka Mining Plc announces that David Bartley is temporarily stepping down from the position of Chief Executive Officer due to health reasons; he remains a non-executive director of the Company. David anticipates resuming the role of

CEO towards the middle of the year.

During this period, the Board has appointed Jonathan Scott-Barrett, a

non-executive Director of Eureka since listing, as Chief Executive Officer. Mr

Scott-Barrett will be assisted in this role by Andrzej Sliwa, Executive

Technical Director, Vernon Martins, General Manager Operations, Karl Herrington, Director Russia and Mukhtar Tuyakbayev, Director Kazakhstan. This team is responsible for the Shorskoye Molybdenum project in Kazakhstan and the

Chelyabinsk Copper-Gold project in Russia. Shorskoye is scheduled for first

production in April and the Chelyabinsk pre-feasibility study is due for

completion in May. The main feasibility study for Chelyabinsk is planned for

completion by end 2006.

PapalPower

- 10 Mar 2006 09:59

- 30 of 213

- 10 Mar 2006 09:59

- 30 of 213

57%min Europe

23.0-24.0 USD/lb Mo

PapalPower

- 10 Mar 2006 10:00

- 31 of 213

- 10 Mar 2006 10:00

- 31 of 213

The Fox Davies report puts the value at this stage at over 300p with a long term price target of over 500p when Chelyabinsk is on line from 2008, therefore we should be looking for a price of well over 200p once Moly production is on line and news comes from the pre BFS :

http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

Base Case: Around 330380p/share: this assumes US$1.10/lb copper long-term, US$20/lb molybdenum in 2006, and a discount rate of 20%.

Upper Case: Around 550p/share: this uses the Base Case metal prices, but uses a lower discount rate of 15%. The market will apply this lower rate over time, as management demonstrates success at Shorskoye and Chelyabinsk

PapalPower

- 10 Mar 2006 10:00

- 32 of 213

- 10 Mar 2006 10:00

- 32 of 213

There has been some nervousness over mining stocks on uncertainty over metal pricing negotiations and some oversupply. Copper prices fell back over the past few days to a low of around $4750/t although there are signs of recovery. 2006 commodity prices overall are set to be pretty buoyant against historical levels but not as high as in 2005, an exceptionally strong year. None of this, though, changes our fairly bullish long term view on commodities overall - there will inevitably be short term relaxation of sector performance and accompanying investor nervousness but, in our view, the long term path is up.

PapalPower

- 10 Mar 2006 11:34

- 33 of 213

- 10 Mar 2006 11:34

- 33 of 213

PapalPower

- 11 Mar 2006 02:22

- 34 of 213

- 11 Mar 2006 02:22

- 34 of 213

Presently its 2.21$ per pound as per below :

"DJ Comex Copper Review: Reverses From Lows To End Higher 10th March

NEW YORK (Dow Jones)--Comex copper overcame a lower open and pressure

throughout the session to settled higher on Friday at the New York Mercantile

Exchange.

The most-active May contract settled 1.45 cents higher at $2.2100 per pound.

During the session the contract dipped to a $2.1550 low but buying interest

moved in to take it higher by the close.

Analysts at Barclays Capital in London said current trading conditions remain

highly nervous, creating large price volatility, with market participants

particularly uncertain over the effects of a rising interest-rate environment

across major economies.

"While higher borrowing costs might limit fund involvement, we think the

recent negative reaction in the base metal markets is exaggerated, based on the

outlook for supply and demand fundamentals," said Barclays.

Bill O'Neill, a managing partner at LOGIC Advisors, said copper has been

easing along with other metals, but he added that strong U.S. economic data on

Friday was helpful for copper.

The U.S. data, which also took the dollar higher, included a rise in nonfarm

payrolls by 243,000 after rising by a revised 170,000 in January and 145,000 in

December. The unemployment rate rose slightly to 4.8% last month from 4.7% in

January. The jobs figure rose above market expectations of 212,000 but

economists had been looking for a steady 4.7% unemployment reading.

Settlements (ranges include overnight and day sessions):

March(HGH06) $2.2170; up 1.25c; Range $2.1660-$2.2220

May (HGK06) $2.2100; up 1.45c; Range $2.1550-$2.2130 "

PapalPower

- 11 Mar 2006 16:51

- 35 of 213

- 11 Mar 2006 16:51

- 35 of 213

US$24.50/lb

(Metal Bulletin,

U.S. molybdenum oxide,

Feb. 28, 2006)

Another link to get up to date Moly prices on :

http://www.bluepearl.ca/s/Home.asp

PapalPower

- 11 Mar 2006 17:05

- 36 of 213

- 11 Mar 2006 17:05

- 36 of 213

http://tinyurl.com/hhvrc

"In other news, South Korea plans to begin stockpiling strategic reserves of industrial metals needed for making electronic goods, according to an official at a state-run resources agency, cited in a Reuters report.

"If the metal imports from the countries are suspended because of war or natural disaster, this would badly hit South Korea's IT industry," an official at the Korea Resources Corporation was cited as saying.

Seoul will reportedly start from 2007 to stock pile 14 types of minor metals including indium, ferro-molybdenum, cobalt, manganese, antimony, ferro-titanium and ferro-tungsten. "

PapalPower

- 13 Mar 2006 06:46

- 37 of 213

- 13 Mar 2006 06:46

- 37 of 213

It might also point to them getting ready for war before the end of this decade, as a final solution to the problems with North Korea.....that is not such a nice thought.

PapalPower

- 13 Mar 2006 09:22

- 38 of 213

- 13 Mar 2006 09:22

- 38 of 213

tallsiii

- 13 Mar 2006 13:24

- 39 of 213

- 13 Mar 2006 13:24

- 39 of 213

PapalPower

- 13 Mar 2006 13:43

- 40 of 213

- 13 Mar 2006 13:43

- 40 of 213

Roughly 4 to 5 weeks from April Moly production on line.

Then from that 4 to 6 weeks for pre BFS complete.

The from there 5 to 6 months for the very big one, BFS complete.

With BFS done this should be over 300p I think, so lets start the ball rolling slowely and build up first with Moly production on line, then some more before pre-BFS and then more for the final BFS done :)

PapalPower

- 14 Mar 2006 00:57

- 41 of 213

- 14 Mar 2006 00:57

- 41 of 213

PapalPower

- 14 Mar 2006 11:22

- 42 of 213

- 14 Mar 2006 11:22

- 42 of 213

A colleague of mine has been in contact with Jonathan Scott-Barrett yesterday at EKA, and the timescales of the recent RNS still hold, these being Moly production on line and producing in April, then pre-BFS complete in May and final BFS complete in December.

Excellent news :) no concerns or worries and all proceeding well.

silvermede

- 14 Mar 2006 12:59

- 43 of 213

- 14 Mar 2006 12:59

- 43 of 213

Just to let you know that your posts are read and appreciated, these do look good long term roll on 300p :)

PapalPower

- 14 Mar 2006 13:54

- 44 of 213

- 14 Mar 2006 13:54

- 44 of 213

Things do look good, should be over 300p by year end on a complete and done BFS in December.

PapalPower

- 15 Mar 2006 14:01

- 45 of 213

- 15 Mar 2006 14:01

- 45 of 213

PapalPower

- 16 Mar 2006 01:19

- 46 of 213

- 16 Mar 2006 01:19

- 46 of 213

"The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project."

unionhall - 15 Mar'06 - 20:52 - 105 of 105

Chilean copper producer Antofagasta PLC said Tuesday it expected molybdenum prices to average about $23/lb in 2006 due to current tight supplies and the unlikelihood of significant supply increases. However, prices are expected to be lower than the Platts 2005 average moly oxide price of about $32/lb as the second-half of 2006 might see some slowing.

PapalPower

- 17 Mar 2006 14:31

- 47 of 213

- 17 Mar 2006 14:31

- 47 of 213

PapalPower

- 17 Mar 2006 16:26

- 48 of 213

- 17 Mar 2006 16:26

- 48 of 213

Looks good for next week.

PapalPower

- 19 Mar 2006 04:27

- 49 of 213

- 19 Mar 2006 04:27

- 49 of 213

dale4j - 19 Mar 2006 05:31 - 50 of 213

Why do you think these dipped to below 100p around Christmas time? Steady climb since then.

PapalPower

- 19 Mar 2006 08:08

- 51 of 213

- 19 Mar 2006 08:08

- 51 of 213

If you want to see that article the details are below :

Celtic Twilight - Not only the gold is lost

By: John Helmer

Posted: '29-NOV-05 08:00' GMT Mineweb

PapalPower

- 19 Mar 2006 13:37

- 52 of 213

- 19 Mar 2006 13:37

- 52 of 213

PapalPower

- 21 Mar 2006 16:36

- 53 of 213

- 21 Mar 2006 16:36

- 53 of 213

PapalPower

- 21 Mar 2006 16:50

- 54 of 213

- 21 Mar 2006 16:50

- 54 of 213

"unionhall - 21 Mar'06 - 16:38 - 134 of 134

I understand that the company has approx 90k tonnes of ore stock-piled in preparation for plant commissioning.

Commissioning is on track for mid-April with production increasing to full-tilt by May.

Pre-feasibility still planned to complete in May on Chelyabinsk.

Confirmed that the logic used in extrapolating the Chelyabinsk NPV to reflect more realistic copper/gold prices is correct.

(Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

Shorskoye - 10m profit p/a @ $20 Moly).

They are constrained by Barclays and the current norms used worldwide for these calculations but are hoping to be allowed increase them in the next release.

Presumably as the strength in Copper and gold prices becomes more established the norms for feasibility studies will increase..."

PapalPower

- 24 Mar 2006 12:03

- 55 of 213

- 24 Mar 2006 12:03

- 55 of 213

April and May news draws ever closer :)

dale4j - 24 Mar 2006 19:09 - 56 of 213

There has been very little activity on this share this week. Is this something to worry about? Apart from EKA, LEAD and TAG, is there anything else you would strongly recommend at the moment?

PapalPower

- 25 Mar 2006 00:28

- 57 of 213

- 25 Mar 2006 00:28

- 57 of 213

PapalPower

- 25 Mar 2006 00:30

- 58 of 213

- 25 Mar 2006 00:30

- 58 of 213

http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

Continued strong growth in Chinese demand for molybdenum is

expected as stainless steel production capacity is scheduled to double

by the end of 2006.

There may be a decline in Chinese supplies to the West (maybe to zero)

as Chinese demand increases and its production either plateaus or even

declines because of restructuring of the domestic mining industry.

Molybdenum production in the USA, Chile and Peru was able to increase

rapidly in 2004 and 2005, mainly by employing unused capacity to meet

increased demand. This is unlikely to continue, and new projects may

take some time to come into production. There could be a period in

2006/07 of very tight supply, if demand continues to rise.

Highly corrosion resistant molybdenum-bearing stainless steel appears

to be gaining ground on other types of stainless steel. Consequently,

growth rates for molybdenum demand could be higher than those for the

stainless steel market as a whole.

Although the price of molybdenum eased slightly through late 2005 and

early 2006, it could be expected to rise again through 2006.

Kivver

- 25 Mar 2006 09:24

- 59 of 213

- 25 Mar 2006 09:24

- 59 of 213

PapalPower

- 25 Mar 2006 12:10

- 60 of 213

- 25 Mar 2006 12:10

- 60 of 213

PapalPower

- 28 Mar 2006 01:51

- 61 of 213

- 28 Mar 2006 01:51

- 61 of 213

PapalPower

- 28 Mar 2006 09:26

- 62 of 213

- 28 Mar 2006 09:26

- 62 of 213

More background info - from this week :

Citigroup turns bullish

Earlier, Citigroup said it's abandoning a long-held bearish outlook on copper and nickel on expectations of economic growth, tight supplies, sluggish capacity additions and persistent operating outages or shortfalls.

"We continue to adhere to the Commodity Supercycle theory, believing that the combination of 15 years of underinvestment, thorough-going corporate consolidation, mounting regulatory/NGO pressure, and input cost escalation are conspiring to prevent the industry from mounting a meaningful supply response to "peak-peak" prices," said analyst John Hill.

Citigroup raised its 2006 forecast for gold to $553 an ounce from $540, and upped its copper outlook to $1.85 per pound from $1.59.

On the supply side, copper inventories were down 44 short tons at 28,104 short tons as of late Friday, according to data from Nymex.

Gold supplies were down 487 troy ounces at 7.53 million troy ounces, while silver supplies were down 119,875 troy ounces at 124.9 million troy ounces.

PapalPower

- 30 Mar 2006 04:04

- 63 of 213

- 30 Mar 2006 04:04

- 63 of 213

Lehman Bros. raised its 2006 copper price forecast to $2.05 a pound from $1.90 on the belief that increasing global supplies of copper will be much more difficult than expected.

'With mature mines throughout the world facing shortages of labor, machinery, and tires and encountering tougher mining conditions, 'unexpected' production disappointments should be expected,' said Analyst Peter Ward.

He also raised his 2007 forecast to $1.75 a pound from $1.60 and his 2008 projection to $1.50 a pound from $1.40.

PapalPower

- 30 Mar 2006 04:20

- 64 of 213

- 30 Mar 2006 04:20

- 64 of 213

China may become net moly importer in five years

Written by Platts

Sunday, 26 March 2006

China may become a net importer of molybdenum in five years from now,

George Song, president of Shangxiang Minmetals said Friday. Speaking at the

Metal Bulletin's 7th Asian ferroalloys conference in Hong Kong, Song said

China's domestic consumption on moly had been on the uptrend and the country

would continue to see steady demand growth in 2006. "China now consumes

about 50% of the country's total moly production and this will continue to

increase," he said.

Song said China's molybdenum output in 2005 stood at around 69 million lb

and the country was expected to produce 75 million lb in 2006.

......

According to Song, China imported 44.34 million lb of moly concentrate

in 2005, doubling the 2004 level. "China will import more moly concentrate in

the future due to the tolling conversion being introduced again after the ban

in 2004-2005," he said.

......

According to Song, China exported not more than 80 million lb of

molybdenum in 2005, 25% less than the 2004 level mainly due to growing

domestic demand and limited output in the country.

http://www.molyseek.com/index.php?option=com_content&task=view&id=29&Itemid=28

silvermede

- 30 Mar 2006 08:59

- 65 of 213

- 30 Mar 2006 08:59

- 65 of 213

PapalPower

- 03 Apr 2006 10:41

- 66 of 213

- 03 Apr 2006 10:41

- 66 of 213

PapalPower

- 03 Apr 2006 11:05

- 67 of 213

- 03 Apr 2006 11:05

- 67 of 213

Copper and other base metals - outlook

Sirius's core strategy is to focus upon the exploration and identification of sources of base metals. Although other junior exploration companies on AIM concentrate upon the search for high-value precious metals such as gold and silver, Sirius's regards the demand dynamics for base metals (of which copper is the most valuable) as particularly positive and a stable foundation upon which to build.

The technical and industrial advances of recent years have driven a massive expansion in the world's physical infrastructure and explain the soaring demand for commodities such as base metals (as well as precious metals, crude oil and natural gas).

Demand for base metals is being driven particularly by the growth in the so-called BRIC ( Brazil , Russia , India and China ) economies. However copper has always been fundamental to the growth of human civilization, because of specific properties that make it applicable for a wide range of domestic, industrial, and high technology applications. Copper is ductile, resists corrosion, malleable and an excellent conductor of heat and electricity. As an alloy, with other metals, such as zinc (to form brass), aluminium or tin (to form bronzes), or nickel, it acquires new characteristics for use in highly specialised applications.

The China Effect

Vast amounts have been written about China 's status as an emerging economic powerhouse. It represents a credible basis upon which to project long-term growth in demand for base metals as China has a huge and diverse manufacturing base with a large appetite for raw materials.. Previous cyclical demand peaks tracked the industrialisation of other economies such as the US , Japan and Korea , each of which experienced long periods of sustained economic growth.

China 's ongoing urbanisation is a key component of this, as it has been undergoing a huge internal migration over the last two decades, which has seen an estimated 200m people move from rural to urban settings. However the scale dwarfs the equivalent phase in the evolution of any of the other economies mentioned, has created considerable wealth and had very significant implications for base metal consumption.

Yet this process may have much further to run. In previous cycles, commodity demand has peaked when between 65% and 90% of a country's population had migrated to an urban environment. Currently, the figure for China is still estimated to be below 40%, which would suggest that at least another 300m people may migrate to urban environments. China already has over 600 cities but the infrastructure needed to fulfil that rate of growth could keep demand for raw materials under pressure for some years to come.

The rise in the urban population is also a key component of the rapid growth in China's manufacturing capability, because access to a huge supply of cheap labour enables it to transform relatively high-priced commodities into large volumes of cheap, quality manufactured goods that satisfy the world's 6.5bn global consumers. During the last commodities bull market of the 1970s the world's population was around 4bn, many located in the former communist states that did not compete as aggressively for natural resources.

Consequently supply is struggling to keep up with demand and if these dynamics are maintained, new sources of minerals, including base metals, will be needed urgently. The finite nature of that latter group of commodities has put producers under considerable pressure and although rising prices may make it more profitable to find and mine mineral resources, the time taken to identify new sources and the huge financial commitment each new project represents is a strong argument for the investment in exploration by companies such as Sirius.

Outlook

During March 2006 copper and zinc prices surged to new peaks, with some analysts expecting further rises. The projections are that demand will continue to exceed supply, and therefore drive demand for raw materials that have essential industrial and economic uses. In a recent presentation to analysts by Sirius's partner, Phelps Dodge stated that it expect copper prices to remain strong on the back of Chinese consumption, a jump in investment demand and "unprecedented" supply disruptions during 2005. Although price cycles will remain tied to the ups and downs of the economy, it commented that it expects that "demand will be quite strong over the next couple of cycles and it will be quite challenging for our industry to make sure that we find the supplies to provide for that demand growth".

Although there may be sufficient resources below ground, new sources take time to find and extract. Currently Chile produces over a third of all copper mined annually, with its two best known mines, at Escondida and Chuquicamata together producing nearly 10% of all copper mined globally. The region is however forecast to reach its peak production in 2008 and although it has plans to expand, new copper discoveries are still urgently required.

World's Top Four Copper Producers 2005e

Chile 36%

USA 8%

Indonesia 7%

Peru 7%

During 2005, the International Copper Study Group estimated suggest that global copper production was broadly in line with demand, post an estimated 4% growth in production. Its forecast for 2006 is that demand will exceed 17m metric tons and t he outlook is for market conditions to remain tight during 2006 with limited production growth and demand picking up outside of China . That environment suggests that copper prices should be supported at relatively high levels during 2006.

PapalPower

- 03 Apr 2006 13:15

- 68 of 213

- 03 Apr 2006 13:15

- 68 of 213

PapalPower

- 03 Apr 2006 15:43

- 69 of 213

- 03 Apr 2006 15:43

- 69 of 213

Something in the air ?? ;

tallsiii

- 03 Apr 2006 17:23

- 70 of 213

- 03 Apr 2006 17:23

- 70 of 213

PapalPower

- 04 Apr 2006 03:28

- 71 of 213

- 04 Apr 2006 03:28

- 71 of 213

tallsiii

- 04 Apr 2006 08:03

- 72 of 213

- 04 Apr 2006 08:03

- 72 of 213

PapalPower

- 04 Apr 2006 08:24

- 73 of 213

- 04 Apr 2006 08:24

- 73 of 213

PapalPower

- 04 Apr 2006 12:17

- 74 of 213

- 04 Apr 2006 12:17

- 74 of 213

I think that news from the production line might be leaking back, has to be something like that, that all is good and we will have first production in a couple of weeks time :)

PapalPower

- 04 Apr 2006 12:44

- 75 of 213

- 04 Apr 2006 12:44

- 75 of 213

Although the old Fox Davies report would support this view, I really want to see this new report that is due out soon, to see their summaries and milestone targets.

PapalPower

- 04 Apr 2006 15:02

- 76 of 213

- 04 Apr 2006 15:02

- 76 of 213

Looking good.

PapalPower

- 05 Apr 2006 09:18

- 77 of 213

- 05 Apr 2006 09:18

- 77 of 213

PapalPower

- 06 Apr 2006 10:07

- 78 of 213

- 06 Apr 2006 10:07

- 78 of 213

CNKS well out of the way holding at lowest and highest they are 125/135.

PapalPower

- 06 Apr 2006 10:19

- 79 of 213

- 06 Apr 2006 10:19

- 79 of 213

tallsiii

- 06 Apr 2006 16:22

- 80 of 213

- 06 Apr 2006 16:22

- 80 of 213

tallsiii

- 07 Apr 2006 09:43

- 81 of 213

- 07 Apr 2006 09:43

- 81 of 213

PapalPower

- 07 Apr 2006 09:47

- 82 of 213

- 07 Apr 2006 09:47

- 82 of 213

PapalPower

- 07 Apr 2006 10:19

- 83 of 213

- 07 Apr 2006 10:19

- 83 of 213

Should be moving up next week too then :)

PapalPower

- 07 Apr 2006 12:32

- 84 of 213

- 07 Apr 2006 12:32

- 84 of 213

The expectation has to be plant commissioned and first production of Moly this month (April), then ramping up to full output in May, and along with this comes the pre-BFS for Chelyabinsk in May.

Therefore we should be hoping for news once the Moly plant is commissioned :) sometime this month :)

PapalPower

- 12 Apr 2006 00:20

- 85 of 213

- 12 Apr 2006 00:20

- 85 of 213

PapalPower

- 14 Apr 2006 01:22

- 86 of 213

- 14 Apr 2006 01:22

- 86 of 213

PapalPower

- 15 Apr 2006 10:03

- 87 of 213

- 15 Apr 2006 10:03

- 87 of 213

"Key Financials - Molybednum Poject 21st July 2005:

Payback six months

Only eight per cent. of Shorskoye reserves mined Further cash flow can be generated by increasing tonnage through plant

Molybdenum price assumed is conservative against todays price, at US$20/lb for one year and US$10/lb thereafter (current price is US$35/lb)

Further review of Copper (Cu) and Rhenium (Re) will be undertaken during production to evaluate the economic viability of their recovery "

PapalPower

- 18 Apr 2006 02:05

- 88 of 213

- 18 Apr 2006 02:05

- 88 of 213

ROBTV Mon 17th April 11:13AM:

Title: Look To Industrial Metals For Superior Returns with Otto Spork, president and CEO, Sextant Capital Management

http://www.robtv.com/shows/past_archive.tv

cynic

- 18 Apr 2006 07:55

- 89 of 213

- 18 Apr 2006 07:55

- 89 of 213

PapalPower

- 19 Apr 2006 09:55

- 90 of 213

- 19 Apr 2006 09:55

- 90 of 213

L2 now 5 v 1 so we should be moving up some more I think :)

PapalPower

- 20 Apr 2006 03:01

- 91 of 213

- 20 Apr 2006 03:01

- 91 of 213

We should be getting prelims anytime soon, and that should give us the latest updates :)

PapalPower

- 20 Apr 2006 07:10

- 92 of 213

- 20 Apr 2006 07:10

- 92 of 213

"Whilst molybdenum prices have fallen from their recent highs, they seem to have stabilised at around US$24/lb currently, reflecting strong demand from stainless steel producers and chemical users in Asia and the western world. The outlook for demand and prices in the medium term appears to be good."

PapalPower

- 20 Apr 2006 09:24

- 93 of 213

- 20 Apr 2006 09:24

- 93 of 213

Whatever happened to MolyMania?

Bob Moriarty

April 20, 2006

.....................I like moly, it's an interesting metal. Some 80% of moly mined, goes into stainless steel. The rest is used in industrial chemicals and in aerospace applications. China is the swing producer and their production determines the world price. Most moly is produced as a byproduct of copper production so the price doesn't have a major effect on supply. China has shut down hundreds of small moly mines in the last two years and since all their production goes straight to steel mills, the price of moly rocketed from $2 a pound to as high as $38 before stabilizing in the $24 range.

It's important for anyone considering the purchase of any primary moly stock to understand there is no shortage of moly properties. In fact, we know of enough moly in the ground to supply 200 years worth of moly. But there is a short term (at least short term) supply shortage. The first companies to actually get into production are the ones who are going to reap the benefit......................................

PapalPower

- 21 Apr 2006 03:49

- 94 of 213

- 21 Apr 2006 03:49

- 94 of 213

http://www.dailyreckoning.co.uk/article/130420062.html

Keith Cotterill - Other articles

Thu 13 Apr, 2006

Investing in copper

Five-year...ten-year...20...then 25-year...now

ALL TIME highs - copper prices are literally going

nuts.

The copper bull story is quickly told and quickly grasped when you see the performance of Phelps Dodge, (one of the world's largest producers of the metal) in the past 16 months:

- Supply is down - Chiles production has slipped and new mines arent being discovered. Prospectors havent found any easy (cheap) new fields in 100

years. In short, were running low on supplies... dangerously low.

- Demand is through the roof - Copper is needed for wiring and plumbing and there is seemingly no viable substitute.

Chinas roaring economic growth is being powered by a massive build-out of the electrical grid, and this demand alone has shaken the delicate balance that

held copper below $1 a pound for decades. And I mean shaken it to the ground: at $2.30 a pound, which it has now hit, we are in uncharted territory.

Investing in copper: Indispensable uses

Though copper is neither a precious metal nor a source of energy, it boasts indispensable industrial, technological and economic uses...it's one of the

most important nonferrous commodities today.

Prices have soared in the last four years with all-time highs being achieved this week. Those companies that produce and sell copper have watched their

revenues and profits skyrocket in this time, and have consequentially provided their shareholders with very handsome gains.

In the 1980s and 1990s commodities were beaten and battered. Inventories were full, mines and drills were shut down left, right and centre, and for all

consumption purposes, commodities were cheap and easy to get. Aside from the occasional bear-market rally, from an investors standpoint commodities were the dogs of the markets.

Well, how times have changed...The global economy is growing at a fast and furious pace led by the super-economies of China and India.

Investing in copper: Supply and demand

Commodities that were once undervalued are now starting to rise in price due to the simple economic imbalance of supply and demand. Industrial

development and growth in manufacturing and high technology have kicked up demand for the various natural resources used in their production causing

global inventories to sharply decline as they struggle to keep up with this new-found demand.

Copper falls comfortably into this cycle and Chinas voracious appetite for this metal has almost single-handedly emptied warehouses, drastically decreasing worldwide stock levels.

Look what happened in July of last year...copper stocks at the London Metals Exchange (LME) hit 31-year lows of 25,550 tonnes...the equivalent of less

than two days of global consumption. The hundreds of warehouses around the world, most commissioned and approved by the major metal exchanges (LME, COMEX, SHFE) have seen their inventories hit dangerously low levels.

According to Zeal.com, Chinas demand for copper has hit such extremes that in 2002 it created a large state-owned enterprise to exploit the international

development of nonferrous metals, mainly copper. The firm is called China Nonferrous Metal Mining & Construction Co., Ltd. (CNMC). Nearly four years

later CNMC has operations in over 30 different countries and is aggressively feeding its smelters back home.

Investing in copper: "...exploit overseas mineral resources"

Upon CNMCs creation, Zhang Jian, general manager of China Nonferrous Metal Industrys Foreign Engineering and Construction Group Company (CNFC) said, "It is of strategic significance to Chinas economic development to set up a long-term and stable overseas mineral resources supply base. However many domestic

small-scale nonferrous companies are incapable of solely tapping mines abroad. The only way is to jointly exploit overseas mineral resources."

With China as well as many other growing economies drawing down global inventories, it becomes clear why copper prices are on the rise and why we are

currently facing a global copper deficit.

Investing in copper: How to play the bull run

So how do you play this bull-run in copper?

First and most important, just like any other metal pulled from the ground, copper is dependent on miners to ultimately provide the supply.

To keep up with today and tomorrow's copper demand, mined output will need to increase.

Sounds simple...but as with all metals, ramping up production and opening up new mines requires significant time and capital. And I reckon it's

during that time, or cycle, that investors have the opportunity to take advantage of rising prices.

The USA's Copper Development Association (CDA)estimates that global copper resources are nearly 6 trillion pounds. The CDA also estimates that

throughout history only 700 billion pounds of copper have been mined.

These massive reserves coupled with coppers high recycle rate show we have no imminent risk of ever running out of the stuff. So for copper it is not an

issue of rarity or store of value, rather a matter of ramping up supply to meet demand. And just like all commodities, until this happens, market forces will adjust the prices accordingly in the upwards direction and give investors the opportunity to go long and profit...

And that's exactly what traders are doing today explains Keith Cotterill.......................More on the original link to the article......

....................................Investing in copper: "...the opportunity for legendary gains"

The bottom line is that the reddish metal we call copper continues to show future promise in this exciting secular bull market. Global inventories are

down and demand is up as the world economy grows.

Whereas in the 1980s and 1990s commodities producers, including copper, were the black plague of stock investing...todays commodities bull presents the

opportunity for legendary gains to investors and speculators.

PapalPower

- 21 Apr 2006 15:19

- 95 of 213

- 21 Apr 2006 15:19

- 95 of 213

PapalPower

- 22 Apr 2006 01:34

- 96 of 213

- 22 Apr 2006 01:34

- 96 of 213

So a few extra days to wait before news :)

cynic

- 23 Apr 2006 08:16

- 97 of 213

- 23 Apr 2006 08:16

- 97 of 213

My only real misgivings about CER is that they have already moved quite substantially over the last 2/3 weeks.

PapalPower

- 24 Apr 2006 09:40

- 98 of 213

- 24 Apr 2006 09:40

- 98 of 213

Results due next Tuesday after the bank holiday, where we should get the news that the Moly plant is on line and producing, along with updates on all the other stuff.

Then not long to wait (early June) for the pre BFS news, as pre BFS due to be complete by end of May.

PapalPower

- 24 Apr 2006 12:50

- 99 of 213

- 24 Apr 2006 12:50

- 99 of 213

Monday, 24 April 2006, 06:44 GMT 07:44 UK

Copper price nears $7,000 a tonne

Demand in China has boosted copper prices

The price of copper has risen to nearly $7,000 a tonne on the back of strong demand and worries over supply. Copper was up $110 on Friday's close to $6,940 a tonne in early Monday trade.

The rise in metal prices, including copper which is used in construction and electronics, has been prompted by growing demand from developing nations.

Copper prices also rose following concerns that supplies could be disrupted by strike action in mines in Mexico and Chile.

Strong demand from China, combined with a lack of investment in new mining projects, has caused surge in commodity prices.

The rise in copper follows peaks in recent weeks in silver, gold and other metals.

"The evidence is the underlying trend is very strong" said Peter Richardson, chief metals economist at Deutsche Bank. "All metals are becoming precious," he added.

The price of copper has risen by 57% this year and has increased nearly five-fold from when it was under $1,400 a tonne in November 2001.

The rise in commodities has prompted investment banks to launch many new funds that specialise exclusively in metals and oil.

Shanghai copper futures hit a record high, with May contracts hitting $7,794 a tonne.

PapalPower

- 25 Apr 2006 11:18

- 100 of 213

- 25 Apr 2006 11:18

- 100 of 213

PapalPower

- 26 Apr 2006 01:31

- 101 of 213

- 26 Apr 2006 01:31

- 101 of 213

unionhall - 25 Apr'06 - 16:49 - 396 of 399

By Nick Trevethan

LONDON (Reuters) - Copper extended its record-breaking rally on Tuesday, supported by threats to supply and strong demand, and the trend may extend into the long term, analysts said.

"I think we are still in the early stages of the bull trend in copper. We have years of strong prices ahead of us," Barclays Capital analyst Ingrid Sternby said.

"In this uncharted territory, I would look for round numbers. With inventories where they are, prices can spiral higher very quickly. The fundamentals are very compelling."

Three-month copper futures on the London Metal Exchange (LME) hit a record $7,045 a tonne on Tuesday, climbing more than three percent from Monday.

Stocks of the key industrial metal in LME-bonded warehouses were 117,450 tonnes on Tuesday, equivalent to about 2-1/2 days of global consumption. Inventories have fallen from almost 1 million tonnes in April 2002.

"Copper is going to continue up. Supporting that is the latest Ifo business survey and comments from Caterpillar who see many years of strong growth ahead," Sternby said.

Germany's Ifo April business sentiment index unexpectedly rose to a fresh 15-year high of 105.9 from 105.4 in March.

Caterpillar Inc.'s chief financial officer said on Monday he believed the machinery maker had several more years of strong growth ahead.

"This cycle has legs," he said. "We don't think people understand how strong things are...Virtually everywhere on the planet, things look good."

DEMAND STRONG

Net imports of the copper by China, which consumes a fifth of the world's production, rose to 39,760 tonnes in March from a net 32,825 tonnes in February despite increased exports attributed to the State Reserve Bureau.

As a result copper prices would remain high.

The Chilean Copper Commission on Monday raised its forecast for the average 2006 copper price to a range of $2.60-$2.64/lb from its previous forecast of $1.72-$1.76/lb.

Sentiment was also supported by industrial unrest in Mexico, Chile and Canada.

"Copper will continue to go higher. We could see $200-300 on the downside, but the trend is up and I can't see where any real weakness will come from," an LME trader said

PapalPower

- 26 Apr 2006 08:10

- 102 of 213

- 26 Apr 2006 08:10

- 102 of 213

By Jack Lifton

25 Apr 2006 at 05:08 PM EDT

.................................Molybdenum

Since I last wrote about molybdenum there has been some significant movement in the American domestic market to re-open past producers and to develop new mines, because the global market is in a basic undersupply condition.

I said in my earlier article that considering all of the factors involved, the price of molybdenum would not go higher and would probably drop, as additional concentrates get refined in reopened capacity in the near term. I did not take into account the substantial increase in the demand for oil, Chinese resource shortages and the real possibility of U.S. dollar devaluation.

Phelps Dodge [NYSE:PD] has taken these factors into account and has just (April 6, 2006) announced the reopening of the old Climax Molybdenum Mine in the Leadville, Colorado, area. This is a dramatic vote by Phelps Dodge in the future value of molybdenum, because Colorado is one of the three most difficult places in the world to get an environmental permit to remove anything from the ground or process it above ground.

Phelps Dodge has committed up to $250 million to bring the Climax mine back into production beginning in late 2009 or early 2010. The mine when back to full operation is projected to produce 30 million pounds of Mo per year at an estimated cost of $4.00 (2006 U.S. dollars per pound). PD estimates that the value of this output will be, in constant 2006 dollars, $750 million per year. They are clearly putting their money where their mouths are.

The gold price rush now occurring is another factor increasing the supply of molybdenum in the U.S. Past producing gold mines are being brought into operation, as fast as environmental permitting will allow throughout the U.S. west.

Many of them produced molybdenum as a by-product that was ignored when, as recently as six years ago it was worth only $3.50 per pound. Last June, 2005, molybdenum touched $50 per pound; it has since settled at about half of that, but I think that we will not see any further decreases as long as the economies of Asia and India are growing.

Note also that Phelps Dodge has historically been a receptive toll producer for other companies, so some other gold miners with molybdenum by-products will not have to construct their own smelters. This will make permitting much easier for them.

Conclusion

Finally, since major mining companies today use juniors as their prospecting arms, keep your eyes open for reports of tungsten, molybdenum, vanadium and chromium, along with gold and platinum group metals reported and hyped by the juniors.

And if you must follow a trend let it be the trend to invest in natural resources outside of the United States other than gold and platinum. Maybe, just maybe, commodity and minor metals will be the new global currency.

PapalPower

- 26 Apr 2006 10:39

- 103 of 213

- 26 Apr 2006 10:39

- 103 of 213

Therefore, with added potential for mid May IC coverage, then June pre BFS news, plus June IC update, then December final BFS complete for Chelyabinsk, you see a lovely stream of events coming this year !! :)

PapalPower

- 26 Apr 2006 11:08

- 104 of 213

- 26 Apr 2006 11:08

- 104 of 213

PapalPower

- 26 Apr 2006 15:18

- 105 of 213

- 26 Apr 2006 15:18

- 105 of 213

PapalPower

- 27 Apr 2006 08:13

- 106 of 213

- 27 Apr 2006 08:13

- 106 of 213

PapalPower

- 27 Apr 2006 09:06

- 107 of 213

- 27 Apr 2006 09:06

- 107 of 213

PapalPower

- 28 Apr 2006 00:55

- 108 of 213

- 28 Apr 2006 00:55

- 108 of 213

PapalPower

- 01 May 2006 05:15

- 109 of 213

- 01 May 2006 05:15

- 109 of 213

Tuesday 2 May

UK RESULTS: : (final) Epic Reconstruction, Eureka Mining; (interim) Aberdeen Asset Management, CSR, Formation

Wednesday 3 May

UK RESULTS: (F) Babcock International, Matalan; (I) easyJet, Tomkins, BG Group, British Sky Broadcasting, British American Tobacco, Numis, Surfcontrol

Thursday 4 May

UK RESULTS: (F) Blacks Leisure, iTrain; (I) Imperial Chemical Industries, Lonmin, Royal Dutch Shell, Sanderson

Friday 5 May

UK RESULTS: (F) Body Shop International, NWD

PapalPower

- 02 May 2006 04:01

- 110 of 213

- 02 May 2006 04:01

- 110 of 213

Moly production on line, and Chelyabinsk 100% owned, where does that put us with the target prices...

http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

PapalPower

- 02 May 2006 11:44

- 111 of 213

- 02 May 2006 11:44

- 111 of 213

350K X trade today, looks like its time for VDM to wake up ahead of the summer start of mining :) Maybe................

PapalPower

- 02 May 2006 15:42

- 112 of 213

- 02 May 2006 15:42

- 112 of 213

Early start to the day then ;)

PapalPower

- 03 May 2006 01:30

- 113 of 213

- 03 May 2006 01:30

- 113 of 213

PapalPower

- 03 May 2006 07:07

- 114 of 213

- 03 May 2006 07:07

- 114 of 213

Good news, we are producing Moly concentrates now :)

3 May 2006 Eureka Mining Plc

Preliminary results

Financial Highlights

Net assets of approximately US$46 million

Successful 9 million placing with institutional investors of 7.2 million

shares issued at 125p per share in September 2005.

Appointment of Barclays Capital in July 2005 to act as financial advisors

to assist with the Chelyabinsk Copper Project.

As the Company is still in the exploration and development phase, 2005 had

an operating loss of US$2.7 million of which US$1.6 million was exchange

losses

Kazakhstan

50/50 Joint Venture signed with the Kazakhstan State uranium company,

KazAtomProm. KazAtomProm has contributed existing processing plant capacity

and infrastructure, substantially reducing capital costs and enabling fast

track development of project.

Mining at Shorskoye has commenced, with the average grade for the first

three years expected to be 0.2% molybdenum; equivalent to 2-3% copper at

current prices.

First concentrates at Stepnogorsk plant produced during current

commissioning, with Eureka's share of production in 2006 estimated at

600,000lbs of molybdenum.

Russia

In January 2005, we announced the 51% acquisition of the Urals based Chelyabinsk Copper/Gold project in Southern Russia. All the conditions to acquire the remaining 49% were substantially met prior to year end, and the acquisition has now been completed.

Scoping studies on the larger Miheevskoye deposit carried out by St. Barbara

Consultancy Services indicate a robust project, with the following highlights:

NPV(10%) of US$257m and IRR of 23.6% @ US$1.00/lb copper and $400/oz gold.

Mine cash operating cost of US$0.39c/lb copper before credits.

Capital cost estimated at US$342m for 26 Mt per annum concentrator.

High grade starter pit of 45 Mt of ore, with greater than 0.7% copper

equivalent which can be mined in the initial years based on a copper price

of US$0.90c/lb and a gold price of US$425/oz.

Mining strip ratio low at 0.35:1 waste: ore.

Metallurgical test work positive, concentrate grades of 24-25% copper and

9g/t gold.

First production anticipated in late 2008.

The Company would also like to thank David Bartley for all his work at Eureka

and we wish him a speedy recovery. Jonathan Scott-Barrett, who took over as CEO earlier this year, is now building on David's work and actively developing the Company's assets.

Accompanying this highlights page, please find the Chairman's statement, Chief

Executive Officer's report and financial results as extracted from the Company's annual report and accounts, which will be distributed to shareholders on 12 May and available shortly thereafter on our website.

PapalPower

- 03 May 2006 07:09

- 115 of 213

- 03 May 2006 07:09

- 115 of 213

Eureka has set the key operational targets outlined for 2006. We are working

hard on these tasks and look forward to keeping our shareholders informed of our

progress towards these objectives.

Operational targets for 2006:

Full production of the molybdenum concentrate by the plant at Stepnogorsk,

which takes Eureka from exploration into revenue generation.

Complete the Definitive Feasibility Study at Chelyabinsk by Q1 2007 and

then, working with our financial partners, raise the project finance to

enable production to commence in late 2008

Continue exploration in Russia and the FSU to identify new mining

opportunities.

Raise additional funds as appropriate.

In summary, I feel that Eureka Mining is poised to become a profitable

molybdenum producer, is actively developing the large Miheevskoye copper/gold

deposit and is ready to take advantage of the buoyant metal prices we are

enjoying by further acquisitions. Moreover, our field of expertise, the FSU, is

the most exciting of all new regions in mining developments, because of the vast potential and the undeveloped riches that are present. We are relishing the challenge and are determined for success.

Jonathan Scott-Barrett

Chief Executive Officer

PapalPower

- 03 May 2006 07:57

- 116 of 213

- 03 May 2006 07:57

- 116 of 213

The EKA price is very cheap in my opinion for a Moly producer now !! :)

PapalPower

- 03 May 2006 14:57

- 117 of 213

- 03 May 2006 14:57

- 117 of 213

Edited Press Release

Eureka Mining said Wednesday it has made "outstanding progress" on its key objectives since its flotation.

The group said: "Our special expertise is operating in the former Soviet Union, or FSU, and with the abundant resources base in this huge area and with metal markets enjoying buoyant times, we feel we are in the right place, at the right time, with the right team."

The group said its objectives met included developing a mining company focused on assets based in Kazakhstan and the surrounding regions of the FSU, acquiring additional assets which represent realistic commercial ventures for Eureka and allocating resources to achieve maximum value for the company.

Eureka said it is poised to become a profitable molybdenum producer and is actively developing the large Miheevskoye copper/gold deposit. The company added it is ready to take advantage of the buoyant metal prices with further acquisitions.

The group said its 50/50 joint venture signed with the Kazakhstan State uranium company, KazAtomProm, has contributed existing processing plant capacity and infrastructure, substantially reducing capital costs and enabling fast track development of project.

The company said mining at Shorskoye has commenced, with the average grade for the first three years expected to be 0.2% molybdenum; equivalent to 2-3% copper at current prices.

Eureka said that first concentrates at Stepnogorsk plant produced during current commissioning, with the groups share of production in 2006 estimated at 600,000lbs of molybdenum. The company added that scoping studies on the larger Miheevskoye deposit carried out by St. Barbara Consultancy Services indicate a robust project, with first production anticipated in late 2008.

Eureka said that during 2005 it raised GBP9.0 million and expect to seek further funds this summer to continue its development and exploitation of the Chelyabinsk project.

Mining operations at the Shorskoye project are well underway to ensure adequate stockpiles are ready for processing, the company added.

Eureka said the Dostyk Copper/Gold project in central Kazakhstan is still being reviewed and the six best drill targets, focused mainly on base metal projects, have been identified. The results are being evaluated and decisions will be taken regarding further activities once the results are known.

At the Chelyabinsk Copper/Gold Projec, the company said Wardrop Engineers, an independent Canadian mining and engineering consultancy, is conducting a pre-feasibility study due for completion in the second quarter of 2006. Subject to satisfactory results of this study, the Company will proceed to a Definitive Feasibility Study which will be due in early 2007.

(END) Dow Jones Newswires

PapalPower

- 04 May 2006 06:35

- 118 of 213

- 04 May 2006 06:35

- 118 of 213

"COINCIDENCE'? Maybe. Only 24 hours after broker and investment bank Evolution revealed it has entered into exclusive talks with Dutch bank ING; to buy stockbroker Williams de Broe, its top small-cap sales team led by Jeremy Warner-Allen resigns to join Cenkos Securities, the specialist broking firm set up by Andy Stewart, the racehorse enthusiast who founded Collins Stewart."

PapalPower

- 05 May 2006 12:28

- 119 of 213

- 05 May 2006 12:28

- 119 of 213

05/05/2006 12:00:00

Copper pulls the other metals higher, there seems no stopping it at the moment

BaseMetals.com Report

Copper prices advanced further on Thursday as concerns rose about the fundamental situation copper is in, with more talk that the supply deficit may extend into 2007 or possibly even 2008 as strikes and production difficulties continue to ravish the market. In addition there seems to be a fairly broad based rise in nationalistic protests against the mining industry, which has affected copper, nickel, Indonesia, New Caledonia, Peru and is now a potential worrying in Bolivia. Which ever way you look at the market it seems that all the news is stacked up on the side of the bulls. Indeed it is difficult to see just what is capable of derailing this runaway train. Obviously it could be something as simple as funds deciding to take profits, but who knows when they will decide to do this?

The other metals started to follow copper higher yesterday, but initially they seemed to follow reluctantly, but as copper failed to retreat the buying in the other metals gained upward momentum with aluminium and zinc hitting fresh highs and nickel moving back towards the $20,000 level. Even lead is hammering on the top line of its sideways channel and may now have enough incentive to break higher.

This new found strength in the metals once again should act as a strong reminder that there is little point trying to pick the top of the market, but you should have your contingency plan ready and in place. At some stage before too long the acceleration is likely to grind to a sudden halt, stall and then collapse, but it could go higher still in the short term.

- ends -

For further information please contact:

William Adams

Metals analyst, BaseMetals.com

press@basemetals.com

http://www.basemetals.com

BaseMetals.com

12 Camomile Street

London EC3A 7PT

UK

T: +44 (0) 20 7929 6339

F: +44 (0) 20 7929 2369

PapalPower

- 07 May 2006 02:07

- 120 of 213

- 07 May 2006 02:07

- 120 of 213

At present Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

At present Copper/Gold prices : (Chelyabinsk Project)

2008 Copper production = Starting late 2008......

Chelyabinsk NPV of over 1 billion pounds.

cynic

- 07 May 2006 07:10

- 121 of 213