| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Eureka Mining - time to spell it out (EKA)

tallsiii

- 11 Apr 2005 14:30

- 11 Apr 2005 14:30

EKA are expecting to mine 3.8 million lbs of Molybdenum this year. For the more sceptical amongst you, read this to confirm:

http://moneyam.uk-wire.com/cgi-bin/articles/200412150700023844G.html

They own the mine and the molydbenum in it has been independently varified as stated in the announcement linked above.

Molydbenum currently trades at around $38.50 per lb, you can check this at:

http://www.monterrico.co.uk/s/MetalPrices.asp

so do the sums 3.8m x $39.25 = $149m = 82m

Eureka Mining's market cap is 26m

In 2006 they expect to pull over 10,000 tonnes (20m lbs) of Moly out of that mine.

On top of all that they have recently aquired a mine in Russia with estimated contained metal of 3.32 million tonnes of copper, 3.26 million

ounces of gold and 98.9 million pounds of molybdenum. They hope to complete the feasibility study for this one in 2006:

http://moneyam.uk-wire.com/cgi-bin/articles/200501130700033169H.html

http://moneyam.uk-wire.com/cgi-bin/articles/200412150700023844G.html

They own the mine and the molydbenum in it has been independently varified as stated in the announcement linked above.

Molydbenum currently trades at around $38.50 per lb, you can check this at:

http://www.monterrico.co.uk/s/MetalPrices.asp

so do the sums 3.8m x $39.25 = $149m = 82m

Eureka Mining's market cap is 26m

In 2006 they expect to pull over 10,000 tonnes (20m lbs) of Moly out of that mine.

On top of all that they have recently aquired a mine in Russia with estimated contained metal of 3.32 million tonnes of copper, 3.26 million

ounces of gold and 98.9 million pounds of molybdenum. They hope to complete the feasibility study for this one in 2006:

http://moneyam.uk-wire.com/cgi-bin/articles/200501130700033169H.html

tallsiii

- 21 Nov 2005 14:36

- 116 of 215

- 21 Nov 2005 14:36

- 116 of 215

The big find at VOG appears to have given a lift to EKA.

Aside from that it may be time to review EKA now that we approach 2006 'the year of production'. The Moly price has stayed up there (currently $30 per lb), contrary to many expert preidcitons for a crash. EKA has now forecast costs at $5-$7 per lb and they talk about average production of 2.7 million lbs per year.

So a conservative 2 million lbs in the first year with a margin of $10 per lb would generate $20 million. That is half their current market cap, and so if they can acheive that then they are currently pretty cheap.

It is also worth noting that the value of the resources in Chebinsk is a serveral times multiple of the recent natural gas discovery made by VOG.

I am not saying it is time to buy now, but unless they dissapoint us again with expectations for 2006, they may have no reason to trace back below where they are now.

Aside from that it may be time to review EKA now that we approach 2006 'the year of production'. The Moly price has stayed up there (currently $30 per lb), contrary to many expert preidcitons for a crash. EKA has now forecast costs at $5-$7 per lb and they talk about average production of 2.7 million lbs per year.

So a conservative 2 million lbs in the first year with a margin of $10 per lb would generate $20 million. That is half their current market cap, and so if they can acheive that then they are currently pretty cheap.

It is also worth noting that the value of the resources in Chebinsk is a serveral times multiple of the recent natural gas discovery made by VOG.

I am not saying it is time to buy now, but unless they dissapoint us again with expectations for 2006, they may have no reason to trace back below where they are now.

tallsiii

- 22 Nov 2005 07:35

- 117 of 215

- 22 Nov 2005 07:35

- 117 of 215

Looks like EKA is trying to stay with the VOG coat tails. They were both spun off from CER and still both have the same chairman.

The value of the VOG discovery is around $4bn, while the value of the resources at Chebinsk is around $18bn. That compares favourably with the EKA market cap of 30m.

Though the real issue is whether they can get it out of the ground and get it out of Russia without losing too much of it in 'taxes'.

Regulatory Announcement

Go to market news section

Company Eureka Mining PLC

TIDM EKA

Headline JORC Resource

Released 07:00 22-Nov-05

Number 4480U

RNS Number:4480U

Eureka Mining PLC

22 November 2005

Eureka Mining PLC

Chelyabinsk Copper Project Miheevskjoye Deposit - JORC Resource

1.66 Million Tonne Copper and 2.8 Million Ounces Gold

Eureka Mining Plc ("Eureka" or "the Company") (Tic: EKA) today announces that

the Joint Ore Reserves Committee Resource ("JORC") estimate for the Miheevskoye

Copper Deposit at the Chelyabinsk Copper Project has been confirmed by Snowden

Mineral Industry Consultants ("Snowden").

The deposit forms part of the Chelyabinsk Copper Project ("the Project") in the

Southern Urals region of the Russian Federation, approximately 400km south of

the city of Chelyabinsk, one of Russia's largest cities.

These results, initially determined by Perth based consulting firm Resource

Evaluations Pty Ltd ("ResEval") have also now been reviewed and confirmed by

Snowden, one of the world's leading and largest independent resource evaluation

groups.

Highlights

Large JORC resource of 405 Mt at an average grade of 0.41% copper ("Cu")

and 0.22g/t gold ("Au") calculated by ResEval and endorsed by Snowden

Contained metal of 1.66 million tonnes Cu and 2.8 million ounces Au

Mining studies indicate that a high grade starter pit of 0.9% Cu

equivalent with very low mining strip ratio can be mined in the initial

years

High grade significant intersections include:

149m @ 1.19% Cu eq*

277m @ 1.24% Cu eq*

303m @ 1.07% Cu eq*

252m @ 0.90% Cu eq*

216m @ 0.93% Cu eq*

Snowden's independent review suggests the deposit has the potential to

increase in grade with further definition drilling.

* Based on a copper price of US$0.90c per pound and a gold price of US$425 per

ounce

David Bartley, CEO of Eureka Mining said, "This is a substantial resource which

has been confirmed by Snowden, situated in a major industrial area of the world.

We look forward to announcing results of the Chelyabinsk Scoping Study soon."

The Company also wishes to announce that the Shorskoye Molybdenum Project is

still on track for producing cash flow in Q1 06 with the molybdenum ("Mo") price

still at a comfortable level of US$35/lb.

For further information:

David Bartley/Kevin Foo Laurence Read

Chief Executive Officer/Chairman Conduit PR

Eureka Mining Plc Tel: +44 (0)20 7618 8760 /

Tel: +44 (0)20 7921 8810 +44 (0)7979 955923

www.eurekamining.co.uk

The Chelyabinsk Copper/Gold Project

On 13th January 2005, Eureka announced the acquisition of 51% of the Chelyabinsk

Copper/Gold Project in the southern Urals region of Russia and, subject to the

satisfactory conclusion of a feasibility study, the Company has the exclusive

option to acquire 100% of the project.

The Chelyabinsk Copper/Gold Project comprises three separate deposits,

Miheevskoye, Tominskoye and Taruntinskoye. Over 80 km of drilling has been

completed to date, delineating total C1 and C2 resources of 687 million tonnes

at 0.70 per cent Cu equivalent. Contained metal is currently estimated to be

3.57 million tonnes of Cu, 4.2 million ounces of Au and 99 million pounds of Mo.

JORC Resource on Miheevskoye

The Inferred Mineral Resource estimate complies with recommendations in the

Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared

in 2004 by the Joint Ore Reserves Committee ("JORC"). Therefore it is suitable

for public reporting. The ResEval Mineral Resource estimate, confirmed by

Snowden, is summarised in Table 1.

Table 1: Miheevskoye Deposit May 2005 Inferred Mineral Resource Estimate

280mRL to -40mRL, 0.2% Cu Cut-off Grade

Category Tonnes Cu Au Mo S Cu Au

MT % g/t % % T Ounces

----------- -------- ------ ------ ------ ------ --------- ---------

Oxide 16.3 0.55 0.23 0.0036 0.65 89,000 120,000

Transitional 12.8 0.46 0.23 0.0036 0.65 59,000 94,000

Fresh 375.7 0.41 0.22 0.0071 0.93 1,530,000 2,660,000

----------- -------- ------ ------ ------ ------ --------- ---------

TOTAL 404.8 0.41 0.22 0.0068 0.91 1,678,000 2,874,000

----------- -------- ------ ------ ------ ------ --------- ---------

Miheevskoye Deposit

The Miheevskoye deposit is hosted by volcanoclastics and basalts of Upper

Devonian to Carboniferous age. The deposit has a simple geometry of an overall

length over 2.5 km and the width varies from 200m to 400m. The reported Mineral

Resource for the Miheevskoye deposit encompasses the 320m vertical interval from

280mRL to -40mRL which is the limit of drilling at the deposit. A total of 44km

of drilling has been completed on the deposit to date.

To determine the potential of the deposit below the base of drilling, where the

mineralisation remained open, the wireframes were extended an additional 100m

below the drill holes and then interpolated. This portion of the deposit (termed

Mineral Potential) comprises approximately 100 million tonnes and is additional

to the JORC compliant resource quoted in Table 1.

To check the integrity of the previous drilling, a verification drilling

programme was carried out by Eureka in 2005. A total of 5 holes were completed

which returned intersections of similar width and grade compared to the Russian

drilling. This was considered to have confirmed the previous work. In addition,

a large number of samples from the Russian drilling programme were re-analysed

by Eureka. These confirmed the previous results.

The deposit was estimated for Copper by ResEval using Inverse Distance to Power

2 (ID2) grade interpolation, constrained by resource outlines based on

mineralisation envelopes prepared using a nominal 0.20% cut-off grade.

A feature of the deposit which enhances its economic potential is the distinctly

higher grade zone in the northern portion of the deposit. Large zones of

mineralisation in excess of 0.6% copper with gold grades are present suggesting

that a higher than average head grade will be achieved in the early years of

mining at the project.

The internationally recognised consulting group Snowden Mineral Industry

Consultants was commissioned by Eureka to review the ResEval resource estimate.

Snowden endorsed the results and classification of the current estimate. Snowden

have also agreed to prepare the resource estimates to be used in the

pre-feasibility and definitive feasibility studies.

2005/2006 Drilling Programme

Since the resource estimate and mining study was completed, Eureka has commenced

a large drilling campaign with the objective of upgrading the defined resource

to Measured and Indicated Mineral Resource categories as part of the Feasibility

Study. Two Russian diamond drill rigs have been operating at the site since

March, and an additional four rigs commenced operations in early November.

To date, eleven resource definition holes have been completed and results have

been returned from four of the holes. Deeper holes in the high grade areas are

now underway to evaluate the potential for delineating further resources.

In addition to the resource drilling, programmes of confirmation drilling and

specific large diameter metallurgical drilling has been carried out. A summary

of work to date is shown in Table 3.

Table 3: Miheevskoye 2005 Drilling Completed

Type Count Metres

Confirmation 5 966

Metallurgical 7 920

Resource 11 3,202

Total 23 5,088

Appendix 1: Mineral Resource Summary - Miheevskoye Deposit November

2005 Estimate

Undiluted Inferred Mineral Resource, 0.2% Cu Cutoff Grade

------------ ------------ ------- -------- --------- ----------

Class Tonnes Cu % Au g/t Cu T Au oz

Measured - - - - -

Indicated - - - - -

Inferred 404,800,000 0.41 0.22 1,678,000 2,874,000

Total 404,800,000 0.41 0.22 1,678,000 2,874,000

------------ ------------ ------- -------- --------- ---------

The Mineral Resource estimate was completed using the following parameters:

The Miheevskoye resource area extends over a strike length of 2,500m and

includes the 320m interval from 280mRL to -40mRL.

Drill holes used in the estimate included 82 diamond core holes for a

total of 18,373m of drilling. The majority of holes were NQ equivalent

diameter.

Holes in the Miheevskoye area were drilled at approximate section

spacings of 200m except the higher grade northern zone which was drilled at

100m section spacings.

Holes were sampled using half core for all mineralised zones. Visually

unmineralised zones were either unsampled, or sampled using composite chip

samples from intervals from 4m to 10m.

For drilling completed since 1994, copper analyses were carried out

using the XRF technique. Prior to that acid digest with AAS analysis was

generally used.

Quality control data for the portion of the drilling completed between

since 1994 has been reviewed and was found to be satisfactory.

A programme of confirmation holes completed in 2005 was designed to twin

five existing holes at the project. The results of these have returned

similar intersection intervals and grade and are considered to have

verified the previous drilling.

Collar surveys of holes were carried out using conventional surveying

methods (theodolite, EDM) not by GPS.

The majority of historical drill holes have been downhole surveyed by

wireline survey. Readings were taken at 10m intervals down hole.

Wireframes were constructed using cross sectional interpretations based

on mineralised envelopes constructed at a nominal 0.2% Cu cut-off grade.

Zones of 'weathered' and 'fresh' were produced as separate wireframes.

Samples within the wireframes were composited to even 2.0m intervals. No

high grade cuts were used.

A Surpac block model was used for the estimate with a block size of 50m

NS x 25m EW x 10m vertical with sub-cells of 12.5m x 6.25m x 2.5m.

Inverse distance to power 2 (ID2) grade interpolation used an ellipsoid

search ellipse with a first pass radius of 150m and a second pass radius of

300m with the ellipse oriented to match the overall strike and dip of the

mineralised zones.

Bulk density values used for the estimate were 2.03t/m3 for oxide, 2.10t

/m3 for transition and 2.79t/m3 for fresh rock and were based on the values

determined from the Russian test work.

Resource classification was carried out on the basis of continuity of

mineralisation and drill hole spacing. The Mineral Resource was classified

as Inferred.

This information is provided by RNS

The company news service from the London Stock Exchange

END

London Stock Exchange plc is not responsible for and does not check content on this Website. Website users are responsible for checking content. Any news item (including any prospectus) which is addressed solely to the persons and countries specified therein should not be relied upon other than by such persons and/or outside the specified countries. Terms and conditions, including restrictions on use and distribution apply.

2005 London Stock Exchange plc. All rights reserved

The value of the VOG discovery is around $4bn, while the value of the resources at Chebinsk is around $18bn. That compares favourably with the EKA market cap of 30m.

Though the real issue is whether they can get it out of the ground and get it out of Russia without losing too much of it in 'taxes'.

Regulatory Announcement

Go to market news section

Company Eureka Mining PLC

TIDM EKA

Headline JORC Resource

Released 07:00 22-Nov-05

Number 4480U

RNS Number:4480U

Eureka Mining PLC

22 November 2005

Eureka Mining PLC

Chelyabinsk Copper Project Miheevskjoye Deposit - JORC Resource

1.66 Million Tonne Copper and 2.8 Million Ounces Gold

Eureka Mining Plc ("Eureka" or "the Company") (Tic: EKA) today announces that

the Joint Ore Reserves Committee Resource ("JORC") estimate for the Miheevskoye

Copper Deposit at the Chelyabinsk Copper Project has been confirmed by Snowden

Mineral Industry Consultants ("Snowden").

The deposit forms part of the Chelyabinsk Copper Project ("the Project") in the

Southern Urals region of the Russian Federation, approximately 400km south of

the city of Chelyabinsk, one of Russia's largest cities.

These results, initially determined by Perth based consulting firm Resource

Evaluations Pty Ltd ("ResEval") have also now been reviewed and confirmed by

Snowden, one of the world's leading and largest independent resource evaluation

groups.

Highlights

Large JORC resource of 405 Mt at an average grade of 0.41% copper ("Cu")

and 0.22g/t gold ("Au") calculated by ResEval and endorsed by Snowden

Contained metal of 1.66 million tonnes Cu and 2.8 million ounces Au

Mining studies indicate that a high grade starter pit of 0.9% Cu

equivalent with very low mining strip ratio can be mined in the initial

years

High grade significant intersections include:

149m @ 1.19% Cu eq*

277m @ 1.24% Cu eq*

303m @ 1.07% Cu eq*

252m @ 0.90% Cu eq*

216m @ 0.93% Cu eq*

Snowden's independent review suggests the deposit has the potential to

increase in grade with further definition drilling.

* Based on a copper price of US$0.90c per pound and a gold price of US$425 per

ounce

David Bartley, CEO of Eureka Mining said, "This is a substantial resource which

has been confirmed by Snowden, situated in a major industrial area of the world.

We look forward to announcing results of the Chelyabinsk Scoping Study soon."

The Company also wishes to announce that the Shorskoye Molybdenum Project is

still on track for producing cash flow in Q1 06 with the molybdenum ("Mo") price

still at a comfortable level of US$35/lb.

For further information:

David Bartley/Kevin Foo Laurence Read

Chief Executive Officer/Chairman Conduit PR

Eureka Mining Plc Tel: +44 (0)20 7618 8760 /

Tel: +44 (0)20 7921 8810 +44 (0)7979 955923

www.eurekamining.co.uk

The Chelyabinsk Copper/Gold Project

On 13th January 2005, Eureka announced the acquisition of 51% of the Chelyabinsk

Copper/Gold Project in the southern Urals region of Russia and, subject to the

satisfactory conclusion of a feasibility study, the Company has the exclusive

option to acquire 100% of the project.

The Chelyabinsk Copper/Gold Project comprises three separate deposits,

Miheevskoye, Tominskoye and Taruntinskoye. Over 80 km of drilling has been

completed to date, delineating total C1 and C2 resources of 687 million tonnes

at 0.70 per cent Cu equivalent. Contained metal is currently estimated to be

3.57 million tonnes of Cu, 4.2 million ounces of Au and 99 million pounds of Mo.

JORC Resource on Miheevskoye

The Inferred Mineral Resource estimate complies with recommendations in the

Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared

in 2004 by the Joint Ore Reserves Committee ("JORC"). Therefore it is suitable

for public reporting. The ResEval Mineral Resource estimate, confirmed by

Snowden, is summarised in Table 1.

Table 1: Miheevskoye Deposit May 2005 Inferred Mineral Resource Estimate

280mRL to -40mRL, 0.2% Cu Cut-off Grade

Category Tonnes Cu Au Mo S Cu Au

MT % g/t % % T Ounces

----------- -------- ------ ------ ------ ------ --------- ---------

Oxide 16.3 0.55 0.23 0.0036 0.65 89,000 120,000

Transitional 12.8 0.46 0.23 0.0036 0.65 59,000 94,000

Fresh 375.7 0.41 0.22 0.0071 0.93 1,530,000 2,660,000

----------- -------- ------ ------ ------ ------ --------- ---------

TOTAL 404.8 0.41 0.22 0.0068 0.91 1,678,000 2,874,000

----------- -------- ------ ------ ------ ------ --------- ---------

Miheevskoye Deposit

The Miheevskoye deposit is hosted by volcanoclastics and basalts of Upper

Devonian to Carboniferous age. The deposit has a simple geometry of an overall

length over 2.5 km and the width varies from 200m to 400m. The reported Mineral

Resource for the Miheevskoye deposit encompasses the 320m vertical interval from

280mRL to -40mRL which is the limit of drilling at the deposit. A total of 44km

of drilling has been completed on the deposit to date.

To determine the potential of the deposit below the base of drilling, where the

mineralisation remained open, the wireframes were extended an additional 100m

below the drill holes and then interpolated. This portion of the deposit (termed

Mineral Potential) comprises approximately 100 million tonnes and is additional

to the JORC compliant resource quoted in Table 1.

To check the integrity of the previous drilling, a verification drilling

programme was carried out by Eureka in 2005. A total of 5 holes were completed

which returned intersections of similar width and grade compared to the Russian

drilling. This was considered to have confirmed the previous work. In addition,

a large number of samples from the Russian drilling programme were re-analysed

by Eureka. These confirmed the previous results.

The deposit was estimated for Copper by ResEval using Inverse Distance to Power

2 (ID2) grade interpolation, constrained by resource outlines based on

mineralisation envelopes prepared using a nominal 0.20% cut-off grade.

A feature of the deposit which enhances its economic potential is the distinctly

higher grade zone in the northern portion of the deposit. Large zones of

mineralisation in excess of 0.6% copper with gold grades are present suggesting

that a higher than average head grade will be achieved in the early years of

mining at the project.

The internationally recognised consulting group Snowden Mineral Industry

Consultants was commissioned by Eureka to review the ResEval resource estimate.

Snowden endorsed the results and classification of the current estimate. Snowden

have also agreed to prepare the resource estimates to be used in the

pre-feasibility and definitive feasibility studies.

2005/2006 Drilling Programme

Since the resource estimate and mining study was completed, Eureka has commenced

a large drilling campaign with the objective of upgrading the defined resource

to Measured and Indicated Mineral Resource categories as part of the Feasibility

Study. Two Russian diamond drill rigs have been operating at the site since

March, and an additional four rigs commenced operations in early November.

To date, eleven resource definition holes have been completed and results have

been returned from four of the holes. Deeper holes in the high grade areas are

now underway to evaluate the potential for delineating further resources.

In addition to the resource drilling, programmes of confirmation drilling and

specific large diameter metallurgical drilling has been carried out. A summary

of work to date is shown in Table 3.

Table 3: Miheevskoye 2005 Drilling Completed

Type Count Metres

Confirmation 5 966

Metallurgical 7 920

Resource 11 3,202

Total 23 5,088

Appendix 1: Mineral Resource Summary - Miheevskoye Deposit November

2005 Estimate

Undiluted Inferred Mineral Resource, 0.2% Cu Cutoff Grade

------------ ------------ ------- -------- --------- ----------

Class Tonnes Cu % Au g/t Cu T Au oz

Measured - - - - -

Indicated - - - - -

Inferred 404,800,000 0.41 0.22 1,678,000 2,874,000

Total 404,800,000 0.41 0.22 1,678,000 2,874,000

------------ ------------ ------- -------- --------- ---------

The Mineral Resource estimate was completed using the following parameters:

The Miheevskoye resource area extends over a strike length of 2,500m and

includes the 320m interval from 280mRL to -40mRL.

Drill holes used in the estimate included 82 diamond core holes for a

total of 18,373m of drilling. The majority of holes were NQ equivalent

diameter.

Holes in the Miheevskoye area were drilled at approximate section

spacings of 200m except the higher grade northern zone which was drilled at

100m section spacings.

Holes were sampled using half core for all mineralised zones. Visually

unmineralised zones were either unsampled, or sampled using composite chip

samples from intervals from 4m to 10m.

For drilling completed since 1994, copper analyses were carried out

using the XRF technique. Prior to that acid digest with AAS analysis was

generally used.

Quality control data for the portion of the drilling completed between

since 1994 has been reviewed and was found to be satisfactory.

A programme of confirmation holes completed in 2005 was designed to twin

five existing holes at the project. The results of these have returned

similar intersection intervals and grade and are considered to have

verified the previous drilling.

Collar surveys of holes were carried out using conventional surveying

methods (theodolite, EDM) not by GPS.

The majority of historical drill holes have been downhole surveyed by

wireline survey. Readings were taken at 10m intervals down hole.

Wireframes were constructed using cross sectional interpretations based

on mineralised envelopes constructed at a nominal 0.2% Cu cut-off grade.

Zones of 'weathered' and 'fresh' were produced as separate wireframes.

Samples within the wireframes were composited to even 2.0m intervals. No

high grade cuts were used.

A Surpac block model was used for the estimate with a block size of 50m

NS x 25m EW x 10m vertical with sub-cells of 12.5m x 6.25m x 2.5m.

Inverse distance to power 2 (ID2) grade interpolation used an ellipsoid

search ellipse with a first pass radius of 150m and a second pass radius of

300m with the ellipse oriented to match the overall strike and dip of the

mineralised zones.

Bulk density values used for the estimate were 2.03t/m3 for oxide, 2.10t

/m3 for transition and 2.79t/m3 for fresh rock and were based on the values

determined from the Russian test work.

Resource classification was carried out on the basis of continuity of

mineralisation and drill hole spacing. The Mineral Resource was classified

as Inferred.

This information is provided by RNS

The company news service from the London Stock Exchange

END

London Stock Exchange plc is not responsible for and does not check content on this Website. Website users are responsible for checking content. Any news item (including any prospectus) which is addressed solely to the persons and countries specified therein should not be relied upon other than by such persons and/or outside the specified countries. Terms and conditions, including restrictions on use and distribution apply.

2005 London Stock Exchange plc. All rights reserved

PapalPower

- 22 Nov 2005 08:02

- 118 of 215

- 22 Nov 2005 08:02

- 118 of 215

Looks good.

EKA should start to take off now !

EKA should start to take off now !

PapalPower

- 22 Nov 2005 09:27

- 119 of 215

- 22 Nov 2005 09:27

- 119 of 215

Some very good news coming according to the Times rumour today :

From todays RNS :

David Bartley, CEO of Eureka Mining said, "This is a substantial resource which

has been confirmed by Snowden, situated in a major industrial area of the world. We look forward to announcing results of the Chelyabinsk Scoping Study soon"

From the Times today :

http://www.timesonline.co.uk/newspaper/0,,2740-1882907,00.html

Eureka Mining, a sister company to Victoria Oil & Gas, last weeks AIM star rose 12p to 123p on word of a positive drilling update from its Chelyabinsk copper project in Russia.

From todays RNS :

David Bartley, CEO of Eureka Mining said, "This is a substantial resource which

has been confirmed by Snowden, situated in a major industrial area of the world. We look forward to announcing results of the Chelyabinsk Scoping Study soon"

From the Times today :

http://www.timesonline.co.uk/newspaper/0,,2740-1882907,00.html

Eureka Mining, a sister company to Victoria Oil & Gas, last weeks AIM star rose 12p to 123p on word of a positive drilling update from its Chelyabinsk copper project in Russia.

PapalPower

- 22 Nov 2005 16:06

- 120 of 215

- 22 Nov 2005 16:06

- 120 of 215

Looks like a good days play from the MM's, paying more than bid for sells, and most buys at full offer, they wanted to get sells today, and did.

The expectation is the rumour from the Times of good news drilling update very soon, and they will want to sell into a large rise on that day, if and when it happens soon !

EKA is the sister company of VOG, is a certain person going to deliver a massive copper find after a massive gas find !?

The expectation is the rumour from the Times of good news drilling update very soon, and they will want to sell into a large rise on that day, if and when it happens soon !

EKA is the sister company of VOG, is a certain person going to deliver a massive copper find after a massive gas find !?

PapalPower

- 22 Nov 2005 16:19

- 121 of 215

- 22 Nov 2005 16:19

- 121 of 215

And now the MM's lift it up after sucking some sellers out today ;)

PapalPower

- 22 Nov 2005 16:24

- 122 of 215

- 22 Nov 2005 16:24

- 122 of 215

An extract from July 05 IC write up (www.investorschronicle.co.uk), this is their latest one and was with a buy rating. Take this extract with the Times rumour and todays RNS ;

But Shorskoye may prove to be a modest operation compared with the Chelyabinsk copper/gold project to the north-west, across the border in Russia. Eureka acquired a 51 per cent stake in the project in January for 250,000, with an option to buy the rest from local partners for as much as $6m. There are three separate deposits and, earlier this month, Barclays Capital (the investment banking arm of Barclays Bank) was appointed as adviser and lead financier on the project. Phase I covers work up to the production of a bankable feasibility study and debt structuring to maximise the borrowing facility; phase II involves sourcing development finance of possibly up to $300m. Barclays' remuneration is in the form of warrants and fees if, and when, finance is secured.

Eureka is also working on two gold exploration projects at Dostyk in central Kazakhstan and at Kentau in the far south of the country close to the Kyrgyz Republic. An in-specie dividend in April 2004 reduced Celtic's shareholding from 44 per cent to 21 per cent.

But Shorskoye may prove to be a modest operation compared with the Chelyabinsk copper/gold project to the north-west, across the border in Russia. Eureka acquired a 51 per cent stake in the project in January for 250,000, with an option to buy the rest from local partners for as much as $6m. There are three separate deposits and, earlier this month, Barclays Capital (the investment banking arm of Barclays Bank) was appointed as adviser and lead financier on the project. Phase I covers work up to the production of a bankable feasibility study and debt structuring to maximise the borrowing facility; phase II involves sourcing development finance of possibly up to $300m. Barclays' remuneration is in the form of warrants and fees if, and when, finance is secured.

Eureka is also working on two gold exploration projects at Dostyk in central Kazakhstan and at Kentau in the far south of the country close to the Kyrgyz Republic. An in-specie dividend in April 2004 reduced Celtic's shareholding from 44 per cent to 21 per cent.

PapalPower

- 22 Nov 2005 23:25

- 123 of 215

- 22 Nov 2005 23:25

- 123 of 215

Mr Foo gave some deliverance on VOG, now will he give us deliverence with a positive Chelybinsk update in the coming days/weeks. A positive drilling update would give EKA some serious upside, so lets hope the Times is right and news comes this week or next on Chelybinsk drilling.

PapalPower

- 23 Nov 2005 09:07

- 124 of 215

- 23 Nov 2005 09:07

- 124 of 215

Opened up at the start today, a good sign we hope.

tallsiii

- 23 Nov 2005 09:43

- 125 of 215

- 23 Nov 2005 09:43

- 125 of 215

They have already found the copper, billions of pounds worth in the Chelyabinsk mine.

PapalPower

- 23 Nov 2005 12:21

- 126 of 215

- 23 Nov 2005 12:21

- 126 of 215

tallsiii, if the Times rumour is to be believed then they have found something of great value in the Chelybinsk mine, just how big we will have to wait for the official news to say when it comes.

PapalPower

- 24 Nov 2005 16:43

- 127 of 215

- 24 Nov 2005 16:43

- 127 of 215

A copy of a post I put on AFN today;

azalea, firstly there is an IC article today that fund managers are becoming more focussed on miners with near term production planned, and moving away from just exploration types, which given the Q1 06 for Eureka, is good news.

_____________

Second there is a tip from Hemscott today for another copper company (www.hemscott.com) and I will copy an extract on copper but removing the company name as its good info for copper.

" Certainly the long-term outlook for copper demand seems very much in ******** favour. With the metal fundamentally tied to economic growth in general, the rise of China and India in particular should ensure the current tightness in supply-demand will be with us for some time yet.

As the company points out, over the past few years demand for copper has grown on average more than the growth of copper production. That led to a supply shortfall in 2003 which widened further during the course of 2004, with the total deficit estimated by some industry experts to be between 600,000 and 1m tonnes.

This, together with the fact that US, China and Japan have all seen healthy industrial growth over the last two years, has led to a recent decline in stockpiles of copper held by the international exchange warehouses, such as the London Metal Exchange.

The world copper price in September 2005 traded above US$1.70/lb. Four years ago the price was US$0.61/lb and it fluctuated between US$0.61/lb and approximately US$0.80/lb over the ensuing two-year period. Towards the end of 2003 the copper price rose sharply and since then it has fluctuated between just under U.S.$1.20/lb and U.S$1.70/lb. Recent strikes in the industry have further curtailed supply and provided support for the price through the third quarter of 2005.

The copper supply-demand dynamic remains tight and, tellingly, ********* points out that he could (as of earlier this week) secure a 27 month forward copper contract at $1.37/lb if he so desired, effectively accounting for the first years supply from ******* at that level. "

__________________

The earlier IC article on EKA is a Buy recommendation at 146p on 15th July 05.

Here is an extract from it (www.investorschronicle.co.uk)

" Within one month of flotation, it had established offices in Kazakhstan and commenced drilling at its Shorskoye high-grade molybdenum project. By the end of that month, it had three diamond drill rigs operating 24 hours a day in temperatures down to -20c. By end-December 2004, almost 10,000 metres of drill core had been logged. And, egged on by sky-high molybdenum prices (used to strengthen and harden steel), the company has fast-tracked the development of part of this mine and hopes to produce the first concentrates by the end of this year - some 12 months earlier than expected. The development costs are likely to be under $10m, using nearby processing facilities.

But Shorskoye may prove to be a modest operation compared with the Chelyabinsk copper/gold project to the north-west, across the border in Russia. Eureka acquired a 51 per cent stake in the project in January for 250,000, with an option to buy the rest from local partners for as much as $6m. There are three separate deposits and, earlier this month, Barclays Capital (the investment banking arm of Barclays Bank) was appointed as adviser and lead financier on the project. Phase I covers work up to the production of a bankable feasibility study and debt structuring to maximise the borrowing facility; phase II involves sourcing development finance of possibly up to $300m. Barclays' remuneration is in the form of warrants and fees if, and when, finance is secured.

Eureka is also working on two gold exploration projects at Dostyk in central Kazakhstan and at Kentau in the far south of the country close to the Kyrgyz Republic. An in-specie dividend in April 2004 reduced Celtic's shareholding from 44 per cent to 21 per cent. "

________________________________

A second article by the IC said buy at 142p on 29th July, saying the price would be higher by year end.

Extract here;

"Eureka Mining has signed a joint venture with Kazakhstan's state uranium company to accelerate the molybdenum production from Shorskoye. First production is planned for early 2006, which should make Eureka the first Aim company with a productive molybdenum mine"

_______________________________

Here is an extract from 23rd Sept IC article on Moly and Copper

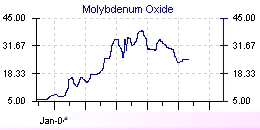

" The most eye-catching of these lately has been number 42 in the periodic table - molybdenum. This alloying element only came into widespread industrial use in the 20th century, and it isn't even as if we use huge quantities of it today. World consumption of 'moly' amounts to around 155,000 tonnes a year, according to the International Molybdenum Association. But its price has rocketed over the past year to a peak of $40 a pound - or around $90,160 a tonne (see chart).

The main reason for this surge has been increasing demand. Molybdenum's main end use is as a hardening agent in the production of stainless and alloy steels, global output of which picked up sharply in 2004. As is so often the case these days, China was responsible for much of the hike in demand. The booming aerospace and defence industry has also contributed, owing to its heavy consumption of specialist heat-resistant alloys.

Until recently, supply of molybdenum has been relatively unresponsive to this rising demand. According to the US Geological Survey, this inelasticity is because around half the world's moly - and around three-quarters of western world supply - is mined as a by-product of copper. Only in China is moly mined extensively as a primary mineral, and accidents at mines there are another reason for the spike in prices.

Its main benefit to copper miners was that separating and selling moly reduced the net cash cost of mining the copper - spectacularly so in recent times. During the first half, soaring moly prices meant cash copper-mining costs at Antofagasta's giant Los Pelambres mine were actually negative. Indeed, the company could have let the copper pile up unsold and still made cash profits of 48 cents on each 1lb! "

________________________________

All in all things are very positive in this area, and with EKA on for Q1 06 with Moly, be prepared for a large rise, either before year end or just after, it should not be staying this cheap much longer.

azalea, firstly there is an IC article today that fund managers are becoming more focussed on miners with near term production planned, and moving away from just exploration types, which given the Q1 06 for Eureka, is good news.

_____________

Second there is a tip from Hemscott today for another copper company (www.hemscott.com) and I will copy an extract on copper but removing the company name as its good info for copper.

" Certainly the long-term outlook for copper demand seems very much in ******** favour. With the metal fundamentally tied to economic growth in general, the rise of China and India in particular should ensure the current tightness in supply-demand will be with us for some time yet.

As the company points out, over the past few years demand for copper has grown on average more than the growth of copper production. That led to a supply shortfall in 2003 which widened further during the course of 2004, with the total deficit estimated by some industry experts to be between 600,000 and 1m tonnes.

This, together with the fact that US, China and Japan have all seen healthy industrial growth over the last two years, has led to a recent decline in stockpiles of copper held by the international exchange warehouses, such as the London Metal Exchange.

The world copper price in September 2005 traded above US$1.70/lb. Four years ago the price was US$0.61/lb and it fluctuated between US$0.61/lb and approximately US$0.80/lb over the ensuing two-year period. Towards the end of 2003 the copper price rose sharply and since then it has fluctuated between just under U.S.$1.20/lb and U.S$1.70/lb. Recent strikes in the industry have further curtailed supply and provided support for the price through the third quarter of 2005.

The copper supply-demand dynamic remains tight and, tellingly, ********* points out that he could (as of earlier this week) secure a 27 month forward copper contract at $1.37/lb if he so desired, effectively accounting for the first years supply from ******* at that level. "

__________________

The earlier IC article on EKA is a Buy recommendation at 146p on 15th July 05.

Here is an extract from it (www.investorschronicle.co.uk)

" Within one month of flotation, it had established offices in Kazakhstan and commenced drilling at its Shorskoye high-grade molybdenum project. By the end of that month, it had three diamond drill rigs operating 24 hours a day in temperatures down to -20c. By end-December 2004, almost 10,000 metres of drill core had been logged. And, egged on by sky-high molybdenum prices (used to strengthen and harden steel), the company has fast-tracked the development of part of this mine and hopes to produce the first concentrates by the end of this year - some 12 months earlier than expected. The development costs are likely to be under $10m, using nearby processing facilities.

But Shorskoye may prove to be a modest operation compared with the Chelyabinsk copper/gold project to the north-west, across the border in Russia. Eureka acquired a 51 per cent stake in the project in January for 250,000, with an option to buy the rest from local partners for as much as $6m. There are three separate deposits and, earlier this month, Barclays Capital (the investment banking arm of Barclays Bank) was appointed as adviser and lead financier on the project. Phase I covers work up to the production of a bankable feasibility study and debt structuring to maximise the borrowing facility; phase II involves sourcing development finance of possibly up to $300m. Barclays' remuneration is in the form of warrants and fees if, and when, finance is secured.

Eureka is also working on two gold exploration projects at Dostyk in central Kazakhstan and at Kentau in the far south of the country close to the Kyrgyz Republic. An in-specie dividend in April 2004 reduced Celtic's shareholding from 44 per cent to 21 per cent. "

________________________________

A second article by the IC said buy at 142p on 29th July, saying the price would be higher by year end.

Extract here;

"Eureka Mining has signed a joint venture with Kazakhstan's state uranium company to accelerate the molybdenum production from Shorskoye. First production is planned for early 2006, which should make Eureka the first Aim company with a productive molybdenum mine"

_______________________________

Here is an extract from 23rd Sept IC article on Moly and Copper

" The most eye-catching of these lately has been number 42 in the periodic table - molybdenum. This alloying element only came into widespread industrial use in the 20th century, and it isn't even as if we use huge quantities of it today. World consumption of 'moly' amounts to around 155,000 tonnes a year, according to the International Molybdenum Association. But its price has rocketed over the past year to a peak of $40 a pound - or around $90,160 a tonne (see chart).

The main reason for this surge has been increasing demand. Molybdenum's main end use is as a hardening agent in the production of stainless and alloy steels, global output of which picked up sharply in 2004. As is so often the case these days, China was responsible for much of the hike in demand. The booming aerospace and defence industry has also contributed, owing to its heavy consumption of specialist heat-resistant alloys.

Until recently, supply of molybdenum has been relatively unresponsive to this rising demand. According to the US Geological Survey, this inelasticity is because around half the world's moly - and around three-quarters of western world supply - is mined as a by-product of copper. Only in China is moly mined extensively as a primary mineral, and accidents at mines there are another reason for the spike in prices.

Its main benefit to copper miners was that separating and selling moly reduced the net cash cost of mining the copper - spectacularly so in recent times. During the first half, soaring moly prices meant cash copper-mining costs at Antofagasta's giant Los Pelambres mine were actually negative. Indeed, the company could have let the copper pile up unsold and still made cash profits of 48 cents on each 1lb! "

________________________________

All in all things are very positive in this area, and with EKA on for Q1 06 with Moly, be prepared for a large rise, either before year end or just after, it should not be staying this cheap much longer.

tallsiii

- 28 Nov 2005 16:02

- 128 of 215

- 28 Nov 2005 16:02

- 128 of 215

If EKA don't delay their production (as they have done before), then their price should definately see a very large spike up over the next 6-12 months. Hang on in there, but it could be a choppy ride.

PapalPower

- 29 Nov 2005 06:26

- 129 of 215

- 29 Nov 2005 06:26

- 129 of 215

PapalPower

- 29 Nov 2005 06:28

- 130 of 215

- 29 Nov 2005 06:28

- 130 of 215

PapalPower

- 03 Dec 2005 16:21

- 131 of 215

- 03 Dec 2005 16:21

- 131 of 215

MARKET TALK:

Thu Dec 1, 2005 9:42 AM GMT

Link

UBS RAISES MINER PRICE TARGETS

Investment bank UBS raised its share price targets and earnings per share estimates on several UK-listed mining firms on Thursday, following upgrades to its copper, gold and molybdenum price forecasts.

"Strong Chinese demand combined with the declining quality of ore reserves should underpin copper prices. Strong jewellery demand and further growth in investment demand should boost the gold price in 2006," UBS said in a research note.

Thu Dec 1, 2005 9:42 AM GMT

Link

UBS RAISES MINER PRICE TARGETS

Investment bank UBS raised its share price targets and earnings per share estimates on several UK-listed mining firms on Thursday, following upgrades to its copper, gold and molybdenum price forecasts.

"Strong Chinese demand combined with the declining quality of ore reserves should underpin copper prices. Strong jewellery demand and further growth in investment demand should boost the gold price in 2006," UBS said in a research note.

PapalPower

- 04 Dec 2005 06:35

- 132 of 215

- 04 Dec 2005 06:35

- 132 of 215

PapalPower

- 04 Dec 2005 10:22

- 133 of 215

- 04 Dec 2005 10:22

- 133 of 215

Still find it amazing with Moly production and cash generation due in Q1 06, things are not hotter here.

I am expecting some news in the next couple of weeks, maybe this week, just my opinion.

I am expecting some news in the next couple of weeks, maybe this week, just my opinion.

PapalPower

- 05 Dec 2005 10:19

- 134 of 215

- 05 Dec 2005 10:19

- 134 of 215

Molybdenum - the '21 st Century Metal'

By Ken Reser

September 12, 2005

The unique properties of Molybdenum alloys are utilized in many different applications

Corrosion resistance and strength in stainless steel, wrought alloys and super alloys. These uses accounted for approximately 75% of Moly consumption in 2004.

High temperature heating elements, radiation shields, forging dies, rotating X-ray anodes in clinical diagnostics, glass melting furnace electrodes, heat sinks for matching silicon for semiconductor chip mounts, interconnects on integrated circuit chips, coatings for piston rings and machine components.

Smoke suppressants & solid lubricants to reduce friction, Moly lubricants ie: grease & oils, engine corrosion inhibitors in coolants, lubricants in space vehicles.

Chemical processing equipment, vessels, tanks & pipelines, flame retardants, dry lubricants, light bulb filaments, inorganic paint pigments, chemical catalysts and desulfurization catalysts.

Non-ferrous alloys (super alloys) or nimonics account for about 3% of total demand for Moly. They are used in jet engine turbines, nuclear plants, gas turbines, space exploration and general aviation.

Nuclear reactor vessels. The reactor vessel serves to contain and support the reactor core and vessel internals. It is constructed of Moly carbon steel, lined with stainless Moly steel and has 8 inch thick walls.

Molybdenum is used for scrubbers in flue gas desulfurization (FGD) in coal fired power stations around the world. 9% to 16% Moly is used in inconel alloys for this process.

Soil supplement in agriculture as well as human and animal supplements.

Molybdenum alloyed with Rhenium (Mo-41Re & Mo-47.5Re) is used in electronics, space programs & nuclear industries. Moly-25% & Rhenium alloys are used for rocket engine components and liquid metal heat exchangers.

Moly steel is used extensively in the millions of miles of oil, gas and water pipelines around the world. (ie; 2 million mi of oil pipelines in USA and 1.3 million mi of gas pipelines) (source-U.S. Dept of Energy) the EIA in a working paper states that "to meet the U.S. Energy demand for natural gas alone the pipeline mileage must increase by 30% or more. (cost est. $150 b). By 2025 EIA expects the US will need 47% more oil & 54% more natural gas.

Now one must consider how many of the pipelines built between 1930 and 1969 (over 2/3 of the current lines in use today) need replacement, and how many 100s of thousands of miles of new pipelines will be needed around the world for our booming oil & gas industry and ever-increasing demands. Consider the refineries and gas plants that need to be built as well. Molybdenum plays a very big part in all of these endeavors.

One of the largest uses of Molybdenum is in drill stem steel tubing. In the 1970's when oil boomed so did the price of Molybdenum rise. The many 1000s of onshore and offshore drill rigs (and service rigs) in the world constantly replace this drill tubing due to heat and metal fatigue, especially with the depths now reached by our technology, and the heat encountered at the greater depths & with the down-hole weight of the drill stem stretching over many thousands of feet. This may be one of the times in history when the demands on Moly won't ease as the frantic search for new oil & gas supplies due to peak oil having been reached will give a new constant impetus to drill exploration.

On the immediate horizon for stainless steel and Moly use also is the fact that new maritime regulations now stipulate that all single hulled oil tankers built before 1987 must be decommissioned by 2010, and thus will be replaced by double hulled tankers. From the information available it appears that 170 vessels will be affected by this law by Apr. 5th 2005, the oil containment tanks in these ships are constructed of a Moly alloy steel also. Coupled with China's maritime fleet building in progress (military and commercial) it looks like a bright future for Moly in this area as well. There are at present about 3,600 tankers in the world. 1/3 of the world's oil is transported by just 435 of them, the large VLCCs (very large crude carriers).

Now to the space age and future of Molybdenum

(This is the interesting part)

The SAFE-400 space fission reactor (safe affordable fission engine) is a 400 kWt HPS producing 100 kWe to power a space vehicle using two Brayton Power Systems gas turbines driven directly by the hot gas from the reactor. The heat exchanger outlet temperature is 880 degrees. The reactor has 127 identical heat pipe modules made of Molybdenum.

Wall material for space reactors. Thin 99.9% purity Molybdenum foils for use in gas core reactors. Temperature ranges from 1500 to 2000 K.

Molybdenum Rhenium alloys for spacecraft reactor applications.

Molybdenum in ION space thrusters.

Molybdenum wire in radio telescopes.

NEXT generation ION thrusters, currently being developed as well as near term Nuclear Electric Propulsion (NEP) Program. Molybdenum & Carbon.

Multi layering in space telescopes with Molybdenum, Carbide and Silicon. TRACE (Transition Region And Corona Explorer) revealing the secrets of the Sun.

Molybdenum, Lithium "heat pipe." Los Alamos N.M. A pencil sized tube of Molybdenum, with Lithium core that moves heat from one end to the other may someday allow astronauts to travel to Mars and beyond. The heat pipes on NASA spacecraft will be in groups from 5 feet to 24 feet long. NASA's Marshall Space Flight Center is working to develop heat pipes for use in nuclear reactors to produce propulsion and generate electricity for spacecraft to travel the outer limits of the solar system. Heat pipes have been tested in space from shuttle missions & performed flawlessly.

Now you can possibly see why the world is viewing Molybdenum in a different light and it isn't just the demand from China, India and developing nations that is driving the price and uses. Moly is truly a metal of the future in many ways and we may never see the same past monetary values placed on it in our future. The era of the second industrial revolution is upon us and it 'is' the 3rd world coming into the 21st century at a very rapid rate that is placing great pressure on base metal demand, but it also is the age of new and ever-changing metal technologies, and I personally think Molybdenum will play a very important part in this new era and will be a major component of any base metal bull market.

If one considers that Moly mines may have a new and more secure future than in the past then one should consider that a "primary pure Molybdenum mine" has no sulfides or copper to leach out of the finished product. The Moly when crushed can be floated off by using a simple soap or diesel fuel additive to the floatation tanks or columns and agitated. The Moly particles adhere to the air bubbles and rise to the surface to be collected (skimmed off). This is a very simple, cost efficient and environmentally friendly process. It is generally accepted that in the Moly by-product production of copper mines, it takes 10 lbs. of CU produced to acquire 1lb of Molybdenum. There are few primary Moly mines at present in the world and fewer still coming to future production.

Let us not forget the adage. "If the whole world had the lifestyle, material comfort and luxuries of the western world, we'd need another planet for the supply of natural resources." Because that transformation is coming fast and the resources are finite, the cost of base metals and energy sources is obviously going to get much more expensive as time & world growth progresses. Mankind's demands on base metals in our future will prove historical.

The 2005 Moly price projection - in a survey done by "Ryan's Notes" in a presentation by Alice Agoo, given in Ryan's Notes' 2005 Molybdenum meeting. This survey was taken from 17 end users of Moly & 20 producers (sellers).

The consensus forecast of each group in the survey is the overall average, as are the combined forecasts.

http://www.kitcometals.com/commentaries/Reser/sep122005.html

By Ken Reser

September 12, 2005

The unique properties of Molybdenum alloys are utilized in many different applications

Corrosion resistance and strength in stainless steel, wrought alloys and super alloys. These uses accounted for approximately 75% of Moly consumption in 2004.

High temperature heating elements, radiation shields, forging dies, rotating X-ray anodes in clinical diagnostics, glass melting furnace electrodes, heat sinks for matching silicon for semiconductor chip mounts, interconnects on integrated circuit chips, coatings for piston rings and machine components.

Smoke suppressants & solid lubricants to reduce friction, Moly lubricants ie: grease & oils, engine corrosion inhibitors in coolants, lubricants in space vehicles.

Chemical processing equipment, vessels, tanks & pipelines, flame retardants, dry lubricants, light bulb filaments, inorganic paint pigments, chemical catalysts and desulfurization catalysts.

Non-ferrous alloys (super alloys) or nimonics account for about 3% of total demand for Moly. They are used in jet engine turbines, nuclear plants, gas turbines, space exploration and general aviation.

Nuclear reactor vessels. The reactor vessel serves to contain and support the reactor core and vessel internals. It is constructed of Moly carbon steel, lined with stainless Moly steel and has 8 inch thick walls.

Molybdenum is used for scrubbers in flue gas desulfurization (FGD) in coal fired power stations around the world. 9% to 16% Moly is used in inconel alloys for this process.

Soil supplement in agriculture as well as human and animal supplements.

Molybdenum alloyed with Rhenium (Mo-41Re & Mo-47.5Re) is used in electronics, space programs & nuclear industries. Moly-25% & Rhenium alloys are used for rocket engine components and liquid metal heat exchangers.

Moly steel is used extensively in the millions of miles of oil, gas and water pipelines around the world. (ie; 2 million mi of oil pipelines in USA and 1.3 million mi of gas pipelines) (source-U.S. Dept of Energy) the EIA in a working paper states that "to meet the U.S. Energy demand for natural gas alone the pipeline mileage must increase by 30% or more. (cost est. $150 b). By 2025 EIA expects the US will need 47% more oil & 54% more natural gas.

Now one must consider how many of the pipelines built between 1930 and 1969 (over 2/3 of the current lines in use today) need replacement, and how many 100s of thousands of miles of new pipelines will be needed around the world for our booming oil & gas industry and ever-increasing demands. Consider the refineries and gas plants that need to be built as well. Molybdenum plays a very big part in all of these endeavors.

One of the largest uses of Molybdenum is in drill stem steel tubing. In the 1970's when oil boomed so did the price of Molybdenum rise. The many 1000s of onshore and offshore drill rigs (and service rigs) in the world constantly replace this drill tubing due to heat and metal fatigue, especially with the depths now reached by our technology, and the heat encountered at the greater depths & with the down-hole weight of the drill stem stretching over many thousands of feet. This may be one of the times in history when the demands on Moly won't ease as the frantic search for new oil & gas supplies due to peak oil having been reached will give a new constant impetus to drill exploration.

On the immediate horizon for stainless steel and Moly use also is the fact that new maritime regulations now stipulate that all single hulled oil tankers built before 1987 must be decommissioned by 2010, and thus will be replaced by double hulled tankers. From the information available it appears that 170 vessels will be affected by this law by Apr. 5th 2005, the oil containment tanks in these ships are constructed of a Moly alloy steel also. Coupled with China's maritime fleet building in progress (military and commercial) it looks like a bright future for Moly in this area as well. There are at present about 3,600 tankers in the world. 1/3 of the world's oil is transported by just 435 of them, the large VLCCs (very large crude carriers).

Now to the space age and future of Molybdenum

(This is the interesting part)

The SAFE-400 space fission reactor (safe affordable fission engine) is a 400 kWt HPS producing 100 kWe to power a space vehicle using two Brayton Power Systems gas turbines driven directly by the hot gas from the reactor. The heat exchanger outlet temperature is 880 degrees. The reactor has 127 identical heat pipe modules made of Molybdenum.

Wall material for space reactors. Thin 99.9% purity Molybdenum foils for use in gas core reactors. Temperature ranges from 1500 to 2000 K.

Molybdenum Rhenium alloys for spacecraft reactor applications.

Molybdenum in ION space thrusters.

Molybdenum wire in radio telescopes.

NEXT generation ION thrusters, currently being developed as well as near term Nuclear Electric Propulsion (NEP) Program. Molybdenum & Carbon.

Multi layering in space telescopes with Molybdenum, Carbide and Silicon. TRACE (Transition Region And Corona Explorer) revealing the secrets of the Sun.

Molybdenum, Lithium "heat pipe." Los Alamos N.M. A pencil sized tube of Molybdenum, with Lithium core that moves heat from one end to the other may someday allow astronauts to travel to Mars and beyond. The heat pipes on NASA spacecraft will be in groups from 5 feet to 24 feet long. NASA's Marshall Space Flight Center is working to develop heat pipes for use in nuclear reactors to produce propulsion and generate electricity for spacecraft to travel the outer limits of the solar system. Heat pipes have been tested in space from shuttle missions & performed flawlessly.

Now you can possibly see why the world is viewing Molybdenum in a different light and it isn't just the demand from China, India and developing nations that is driving the price and uses. Moly is truly a metal of the future in many ways and we may never see the same past monetary values placed on it in our future. The era of the second industrial revolution is upon us and it 'is' the 3rd world coming into the 21st century at a very rapid rate that is placing great pressure on base metal demand, but it also is the age of new and ever-changing metal technologies, and I personally think Molybdenum will play a very important part in this new era and will be a major component of any base metal bull market.

If one considers that Moly mines may have a new and more secure future than in the past then one should consider that a "primary pure Molybdenum mine" has no sulfides or copper to leach out of the finished product. The Moly when crushed can be floated off by using a simple soap or diesel fuel additive to the floatation tanks or columns and agitated. The Moly particles adhere to the air bubbles and rise to the surface to be collected (skimmed off). This is a very simple, cost efficient and environmentally friendly process. It is generally accepted that in the Moly by-product production of copper mines, it takes 10 lbs. of CU produced to acquire 1lb of Molybdenum. There are few primary Moly mines at present in the world and fewer still coming to future production.

Let us not forget the adage. "If the whole world had the lifestyle, material comfort and luxuries of the western world, we'd need another planet for the supply of natural resources." Because that transformation is coming fast and the resources are finite, the cost of base metals and energy sources is obviously going to get much more expensive as time & world growth progresses. Mankind's demands on base metals in our future will prove historical.

The 2005 Moly price projection - in a survey done by "Ryan's Notes" in a presentation by Alice Agoo, given in Ryan's Notes' 2005 Molybdenum meeting. This survey was taken from 17 end users of Moly & 20 producers (sellers).

The consensus forecast of each group in the survey is the overall average, as are the combined forecasts.

http://www.kitcometals.com/commentaries/Reser/sep122005.html

tallsiii

- 05 Dec 2005 15:04

- 135 of 215

- 05 Dec 2005 15:04

- 135 of 215

I agree with what you are saying Papal. Considering that they floated two years ago at 1.25 and since then, they have fast tracked Shorsyke, and bought chebinsk. Also the moly price is several times what it was back then while copper and gold have climbed substantially.

But still, the market does not like them at the moment. If the production or cash flow were to be delayed at this point, then you'd probably see the SP halve from here. But if do live up to their PR, then it would be difficult for the market to argue with real cash flow.

But still, the market does not like them at the moment. If the production or cash flow were to be delayed at this point, then you'd probably see the SP halve from here. But if do live up to their PR, then it would be difficult for the market to argue with real cash flow.