| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Eureka Mining - time to spell it out (EKA)

tallsiii

- 11 Apr 2005 14:30

- 11 Apr 2005 14:30

EKA are expecting to mine 3.8 million lbs of Molybdenum this year. For the more sceptical amongst you, read this to confirm:

http://moneyam.uk-wire.com/cgi-bin/articles/200412150700023844G.html

They own the mine and the molydbenum in it has been independently varified as stated in the announcement linked above.

Molydbenum currently trades at around $38.50 per lb, you can check this at:

http://www.monterrico.co.uk/s/MetalPrices.asp

so do the sums 3.8m x $39.25 = $149m = 82m

Eureka Mining's market cap is 26m

In 2006 they expect to pull over 10,000 tonnes (20m lbs) of Moly out of that mine.

On top of all that they have recently aquired a mine in Russia with estimated contained metal of 3.32 million tonnes of copper, 3.26 million

ounces of gold and 98.9 million pounds of molybdenum. They hope to complete the feasibility study for this one in 2006:

http://moneyam.uk-wire.com/cgi-bin/articles/200501130700033169H.html

http://moneyam.uk-wire.com/cgi-bin/articles/200412150700023844G.html

They own the mine and the molydbenum in it has been independently varified as stated in the announcement linked above.

Molydbenum currently trades at around $38.50 per lb, you can check this at:

http://www.monterrico.co.uk/s/MetalPrices.asp

so do the sums 3.8m x $39.25 = $149m = 82m

Eureka Mining's market cap is 26m

In 2006 they expect to pull over 10,000 tonnes (20m lbs) of Moly out of that mine.

On top of all that they have recently aquired a mine in Russia with estimated contained metal of 3.32 million tonnes of copper, 3.26 million

ounces of gold and 98.9 million pounds of molybdenum. They hope to complete the feasibility study for this one in 2006:

http://moneyam.uk-wire.com/cgi-bin/articles/200501130700033169H.html

PapalPower

- 24 Nov 2005 16:43

- 127 of 215

- 24 Nov 2005 16:43

- 127 of 215

A copy of a post I put on AFN today;

azalea, firstly there is an IC article today that fund managers are becoming more focussed on miners with near term production planned, and moving away from just exploration types, which given the Q1 06 for Eureka, is good news.

_____________

Second there is a tip from Hemscott today for another copper company (www.hemscott.com) and I will copy an extract on copper but removing the company name as its good info for copper.

" Certainly the long-term outlook for copper demand seems very much in ******** favour. With the metal fundamentally tied to economic growth in general, the rise of China and India in particular should ensure the current tightness in supply-demand will be with us for some time yet.

As the company points out, over the past few years demand for copper has grown on average more than the growth of copper production. That led to a supply shortfall in 2003 which widened further during the course of 2004, with the total deficit estimated by some industry experts to be between 600,000 and 1m tonnes.

This, together with the fact that US, China and Japan have all seen healthy industrial growth over the last two years, has led to a recent decline in stockpiles of copper held by the international exchange warehouses, such as the London Metal Exchange.

The world copper price in September 2005 traded above US$1.70/lb. Four years ago the price was US$0.61/lb and it fluctuated between US$0.61/lb and approximately US$0.80/lb over the ensuing two-year period. Towards the end of 2003 the copper price rose sharply and since then it has fluctuated between just under U.S.$1.20/lb and U.S$1.70/lb. Recent strikes in the industry have further curtailed supply and provided support for the price through the third quarter of 2005.

The copper supply-demand dynamic remains tight and, tellingly, ********* points out that he could (as of earlier this week) secure a 27 month forward copper contract at $1.37/lb if he so desired, effectively accounting for the first years supply from ******* at that level. "

__________________

The earlier IC article on EKA is a Buy recommendation at 146p on 15th July 05.

Here is an extract from it (www.investorschronicle.co.uk)

" Within one month of flotation, it had established offices in Kazakhstan and commenced drilling at its Shorskoye high-grade molybdenum project. By the end of that month, it had three diamond drill rigs operating 24 hours a day in temperatures down to -20c. By end-December 2004, almost 10,000 metres of drill core had been logged. And, egged on by sky-high molybdenum prices (used to strengthen and harden steel), the company has fast-tracked the development of part of this mine and hopes to produce the first concentrates by the end of this year - some 12 months earlier than expected. The development costs are likely to be under $10m, using nearby processing facilities.

But Shorskoye may prove to be a modest operation compared with the Chelyabinsk copper/gold project to the north-west, across the border in Russia. Eureka acquired a 51 per cent stake in the project in January for 250,000, with an option to buy the rest from local partners for as much as $6m. There are three separate deposits and, earlier this month, Barclays Capital (the investment banking arm of Barclays Bank) was appointed as adviser and lead financier on the project. Phase I covers work up to the production of a bankable feasibility study and debt structuring to maximise the borrowing facility; phase II involves sourcing development finance of possibly up to $300m. Barclays' remuneration is in the form of warrants and fees if, and when, finance is secured.

Eureka is also working on two gold exploration projects at Dostyk in central Kazakhstan and at Kentau in the far south of the country close to the Kyrgyz Republic. An in-specie dividend in April 2004 reduced Celtic's shareholding from 44 per cent to 21 per cent. "

________________________________

A second article by the IC said buy at 142p on 29th July, saying the price would be higher by year end.

Extract here;

"Eureka Mining has signed a joint venture with Kazakhstan's state uranium company to accelerate the molybdenum production from Shorskoye. First production is planned for early 2006, which should make Eureka the first Aim company with a productive molybdenum mine"

_______________________________

Here is an extract from 23rd Sept IC article on Moly and Copper

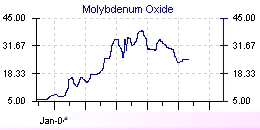

" The most eye-catching of these lately has been number 42 in the periodic table - molybdenum. This alloying element only came into widespread industrial use in the 20th century, and it isn't even as if we use huge quantities of it today. World consumption of 'moly' amounts to around 155,000 tonnes a year, according to the International Molybdenum Association. But its price has rocketed over the past year to a peak of $40 a pound - or around $90,160 a tonne (see chart).

The main reason for this surge has been increasing demand. Molybdenum's main end use is as a hardening agent in the production of stainless and alloy steels, global output of which picked up sharply in 2004. As is so often the case these days, China was responsible for much of the hike in demand. The booming aerospace and defence industry has also contributed, owing to its heavy consumption of specialist heat-resistant alloys.

Until recently, supply of molybdenum has been relatively unresponsive to this rising demand. According to the US Geological Survey, this inelasticity is because around half the world's moly - and around three-quarters of western world supply - is mined as a by-product of copper. Only in China is moly mined extensively as a primary mineral, and accidents at mines there are another reason for the spike in prices.

Its main benefit to copper miners was that separating and selling moly reduced the net cash cost of mining the copper - spectacularly so in recent times. During the first half, soaring moly prices meant cash copper-mining costs at Antofagasta's giant Los Pelambres mine were actually negative. Indeed, the company could have let the copper pile up unsold and still made cash profits of 48 cents on each 1lb! "

________________________________

All in all things are very positive in this area, and with EKA on for Q1 06 with Moly, be prepared for a large rise, either before year end or just after, it should not be staying this cheap much longer.

azalea, firstly there is an IC article today that fund managers are becoming more focussed on miners with near term production planned, and moving away from just exploration types, which given the Q1 06 for Eureka, is good news.

_____________

Second there is a tip from Hemscott today for another copper company (www.hemscott.com) and I will copy an extract on copper but removing the company name as its good info for copper.

" Certainly the long-term outlook for copper demand seems very much in ******** favour. With the metal fundamentally tied to economic growth in general, the rise of China and India in particular should ensure the current tightness in supply-demand will be with us for some time yet.

As the company points out, over the past few years demand for copper has grown on average more than the growth of copper production. That led to a supply shortfall in 2003 which widened further during the course of 2004, with the total deficit estimated by some industry experts to be between 600,000 and 1m tonnes.

This, together with the fact that US, China and Japan have all seen healthy industrial growth over the last two years, has led to a recent decline in stockpiles of copper held by the international exchange warehouses, such as the London Metal Exchange.

The world copper price in September 2005 traded above US$1.70/lb. Four years ago the price was US$0.61/lb and it fluctuated between US$0.61/lb and approximately US$0.80/lb over the ensuing two-year period. Towards the end of 2003 the copper price rose sharply and since then it has fluctuated between just under U.S.$1.20/lb and U.S$1.70/lb. Recent strikes in the industry have further curtailed supply and provided support for the price through the third quarter of 2005.

The copper supply-demand dynamic remains tight and, tellingly, ********* points out that he could (as of earlier this week) secure a 27 month forward copper contract at $1.37/lb if he so desired, effectively accounting for the first years supply from ******* at that level. "

__________________

The earlier IC article on EKA is a Buy recommendation at 146p on 15th July 05.

Here is an extract from it (www.investorschronicle.co.uk)

" Within one month of flotation, it had established offices in Kazakhstan and commenced drilling at its Shorskoye high-grade molybdenum project. By the end of that month, it had three diamond drill rigs operating 24 hours a day in temperatures down to -20c. By end-December 2004, almost 10,000 metres of drill core had been logged. And, egged on by sky-high molybdenum prices (used to strengthen and harden steel), the company has fast-tracked the development of part of this mine and hopes to produce the first concentrates by the end of this year - some 12 months earlier than expected. The development costs are likely to be under $10m, using nearby processing facilities.

But Shorskoye may prove to be a modest operation compared with the Chelyabinsk copper/gold project to the north-west, across the border in Russia. Eureka acquired a 51 per cent stake in the project in January for 250,000, with an option to buy the rest from local partners for as much as $6m. There are three separate deposits and, earlier this month, Barclays Capital (the investment banking arm of Barclays Bank) was appointed as adviser and lead financier on the project. Phase I covers work up to the production of a bankable feasibility study and debt structuring to maximise the borrowing facility; phase II involves sourcing development finance of possibly up to $300m. Barclays' remuneration is in the form of warrants and fees if, and when, finance is secured.

Eureka is also working on two gold exploration projects at Dostyk in central Kazakhstan and at Kentau in the far south of the country close to the Kyrgyz Republic. An in-specie dividend in April 2004 reduced Celtic's shareholding from 44 per cent to 21 per cent. "

________________________________

A second article by the IC said buy at 142p on 29th July, saying the price would be higher by year end.

Extract here;

"Eureka Mining has signed a joint venture with Kazakhstan's state uranium company to accelerate the molybdenum production from Shorskoye. First production is planned for early 2006, which should make Eureka the first Aim company with a productive molybdenum mine"

_______________________________

Here is an extract from 23rd Sept IC article on Moly and Copper

" The most eye-catching of these lately has been number 42 in the periodic table - molybdenum. This alloying element only came into widespread industrial use in the 20th century, and it isn't even as if we use huge quantities of it today. World consumption of 'moly' amounts to around 155,000 tonnes a year, according to the International Molybdenum Association. But its price has rocketed over the past year to a peak of $40 a pound - or around $90,160 a tonne (see chart).

The main reason for this surge has been increasing demand. Molybdenum's main end use is as a hardening agent in the production of stainless and alloy steels, global output of which picked up sharply in 2004. As is so often the case these days, China was responsible for much of the hike in demand. The booming aerospace and defence industry has also contributed, owing to its heavy consumption of specialist heat-resistant alloys.

Until recently, supply of molybdenum has been relatively unresponsive to this rising demand. According to the US Geological Survey, this inelasticity is because around half the world's moly - and around three-quarters of western world supply - is mined as a by-product of copper. Only in China is moly mined extensively as a primary mineral, and accidents at mines there are another reason for the spike in prices.

Its main benefit to copper miners was that separating and selling moly reduced the net cash cost of mining the copper - spectacularly so in recent times. During the first half, soaring moly prices meant cash copper-mining costs at Antofagasta's giant Los Pelambres mine were actually negative. Indeed, the company could have let the copper pile up unsold and still made cash profits of 48 cents on each 1lb! "

________________________________

All in all things are very positive in this area, and with EKA on for Q1 06 with Moly, be prepared for a large rise, either before year end or just after, it should not be staying this cheap much longer.

tallsiii

- 28 Nov 2005 16:02

- 128 of 215

- 28 Nov 2005 16:02

- 128 of 215

If EKA don't delay their production (as they have done before), then their price should definately see a very large spike up over the next 6-12 months. Hang on in there, but it could be a choppy ride.

PapalPower

- 29 Nov 2005 06:26

- 129 of 215

- 29 Nov 2005 06:26

- 129 of 215

PapalPower

- 29 Nov 2005 06:28

- 130 of 215

- 29 Nov 2005 06:28

- 130 of 215

PapalPower

- 03 Dec 2005 16:21

- 131 of 215

- 03 Dec 2005 16:21

- 131 of 215

MARKET TALK:

Thu Dec 1, 2005 9:42 AM GMT

Link

UBS RAISES MINER PRICE TARGETS

Investment bank UBS raised its share price targets and earnings per share estimates on several UK-listed mining firms on Thursday, following upgrades to its copper, gold and molybdenum price forecasts.

"Strong Chinese demand combined with the declining quality of ore reserves should underpin copper prices. Strong jewellery demand and further growth in investment demand should boost the gold price in 2006," UBS said in a research note.

Thu Dec 1, 2005 9:42 AM GMT

Link

UBS RAISES MINER PRICE TARGETS

Investment bank UBS raised its share price targets and earnings per share estimates on several UK-listed mining firms on Thursday, following upgrades to its copper, gold and molybdenum price forecasts.

"Strong Chinese demand combined with the declining quality of ore reserves should underpin copper prices. Strong jewellery demand and further growth in investment demand should boost the gold price in 2006," UBS said in a research note.

PapalPower

- 04 Dec 2005 06:35

- 132 of 215

- 04 Dec 2005 06:35

- 132 of 215

PapalPower

- 04 Dec 2005 10:22

- 133 of 215

- 04 Dec 2005 10:22

- 133 of 215

Still find it amazing with Moly production and cash generation due in Q1 06, things are not hotter here.

I am expecting some news in the next couple of weeks, maybe this week, just my opinion.

I am expecting some news in the next couple of weeks, maybe this week, just my opinion.

PapalPower

- 05 Dec 2005 10:19

- 134 of 215

- 05 Dec 2005 10:19

- 134 of 215

Molybdenum - the '21 st Century Metal'

By Ken Reser

September 12, 2005

The unique properties of Molybdenum alloys are utilized in many different applications

Corrosion resistance and strength in stainless steel, wrought alloys and super alloys. These uses accounted for approximately 75% of Moly consumption in 2004.

High temperature heating elements, radiation shields, forging dies, rotating X-ray anodes in clinical diagnostics, glass melting furnace electrodes, heat sinks for matching silicon for semiconductor chip mounts, interconnects on integrated circuit chips, coatings for piston rings and machine components.

Smoke suppressants & solid lubricants to reduce friction, Moly lubricants ie: grease & oils, engine corrosion inhibitors in coolants, lubricants in space vehicles.

Chemical processing equipment, vessels, tanks & pipelines, flame retardants, dry lubricants, light bulb filaments, inorganic paint pigments, chemical catalysts and desulfurization catalysts.

Non-ferrous alloys (super alloys) or nimonics account for about 3% of total demand for Moly. They are used in jet engine turbines, nuclear plants, gas turbines, space exploration and general aviation.

Nuclear reactor vessels. The reactor vessel serves to contain and support the reactor core and vessel internals. It is constructed of Moly carbon steel, lined with stainless Moly steel and has 8 inch thick walls.

Molybdenum is used for scrubbers in flue gas desulfurization (FGD) in coal fired power stations around the world. 9% to 16% Moly is used in inconel alloys for this process.

Soil supplement in agriculture as well as human and animal supplements.

Molybdenum alloyed with Rhenium (Mo-41Re & Mo-47.5Re) is used in electronics, space programs & nuclear industries. Moly-25% & Rhenium alloys are used for rocket engine components and liquid metal heat exchangers.

Moly steel is used extensively in the millions of miles of oil, gas and water pipelines around the world. (ie; 2 million mi of oil pipelines in USA and 1.3 million mi of gas pipelines) (source-U.S. Dept of Energy) the EIA in a working paper states that "to meet the U.S. Energy demand for natural gas alone the pipeline mileage must increase by 30% or more. (cost est. $150 b). By 2025 EIA expects the US will need 47% more oil & 54% more natural gas.

Now one must consider how many of the pipelines built between 1930 and 1969 (over 2/3 of the current lines in use today) need replacement, and how many 100s of thousands of miles of new pipelines will be needed around the world for our booming oil & gas industry and ever-increasing demands. Consider the refineries and gas plants that need to be built as well. Molybdenum plays a very big part in all of these endeavors.

One of the largest uses of Molybdenum is in drill stem steel tubing. In the 1970's when oil boomed so did the price of Molybdenum rise. The many 1000s of onshore and offshore drill rigs (and service rigs) in the world constantly replace this drill tubing due to heat and metal fatigue, especially with the depths now reached by our technology, and the heat encountered at the greater depths & with the down-hole weight of the drill stem stretching over many thousands of feet. This may be one of the times in history when the demands on Moly won't ease as the frantic search for new oil & gas supplies due to peak oil having been reached will give a new constant impetus to drill exploration.

On the immediate horizon for stainless steel and Moly use also is the fact that new maritime regulations now stipulate that all single hulled oil tankers built before 1987 must be decommissioned by 2010, and thus will be replaced by double hulled tankers. From the information available it appears that 170 vessels will be affected by this law by Apr. 5th 2005, the oil containment tanks in these ships are constructed of a Moly alloy steel also. Coupled with China's maritime fleet building in progress (military and commercial) it looks like a bright future for Moly in this area as well. There are at present about 3,600 tankers in the world. 1/3 of the world's oil is transported by just 435 of them, the large VLCCs (very large crude carriers).

Now to the space age and future of Molybdenum

(This is the interesting part)

The SAFE-400 space fission reactor (safe affordable fission engine) is a 400 kWt HPS producing 100 kWe to power a space vehicle using two Brayton Power Systems gas turbines driven directly by the hot gas from the reactor. The heat exchanger outlet temperature is 880 degrees. The reactor has 127 identical heat pipe modules made of Molybdenum.

Wall material for space reactors. Thin 99.9% purity Molybdenum foils for use in gas core reactors. Temperature ranges from 1500 to 2000 K.

Molybdenum Rhenium alloys for spacecraft reactor applications.

Molybdenum in ION space thrusters.

Molybdenum wire in radio telescopes.

NEXT generation ION thrusters, currently being developed as well as near term Nuclear Electric Propulsion (NEP) Program. Molybdenum & Carbon.

Multi layering in space telescopes with Molybdenum, Carbide and Silicon. TRACE (Transition Region And Corona Explorer) revealing the secrets of the Sun.

Molybdenum, Lithium "heat pipe." Los Alamos N.M. A pencil sized tube of Molybdenum, with Lithium core that moves heat from one end to the other may someday allow astronauts to travel to Mars and beyond. The heat pipes on NASA spacecraft will be in groups from 5 feet to 24 feet long. NASA's Marshall Space Flight Center is working to develop heat pipes for use in nuclear reactors to produce propulsion and generate electricity for spacecraft to travel the outer limits of the solar system. Heat pipes have been tested in space from shuttle missions & performed flawlessly.

Now you can possibly see why the world is viewing Molybdenum in a different light and it isn't just the demand from China, India and developing nations that is driving the price and uses. Moly is truly a metal of the future in many ways and we may never see the same past monetary values placed on it in our future. The era of the second industrial revolution is upon us and it 'is' the 3rd world coming into the 21st century at a very rapid rate that is placing great pressure on base metal demand, but it also is the age of new and ever-changing metal technologies, and I personally think Molybdenum will play a very important part in this new era and will be a major component of any base metal bull market.

If one considers that Moly mines may have a new and more secure future than in the past then one should consider that a "primary pure Molybdenum mine" has no sulfides or copper to leach out of the finished product. The Moly when crushed can be floated off by using a simple soap or diesel fuel additive to the floatation tanks or columns and agitated. The Moly particles adhere to the air bubbles and rise to the surface to be collected (skimmed off). This is a very simple, cost efficient and environmentally friendly process. It is generally accepted that in the Moly by-product production of copper mines, it takes 10 lbs. of CU produced to acquire 1lb of Molybdenum. There are few primary Moly mines at present in the world and fewer still coming to future production.

Let us not forget the adage. "If the whole world had the lifestyle, material comfort and luxuries of the western world, we'd need another planet for the supply of natural resources." Because that transformation is coming fast and the resources are finite, the cost of base metals and energy sources is obviously going to get much more expensive as time & world growth progresses. Mankind's demands on base metals in our future will prove historical.

The 2005 Moly price projection - in a survey done by "Ryan's Notes" in a presentation by Alice Agoo, given in Ryan's Notes' 2005 Molybdenum meeting. This survey was taken from 17 end users of Moly & 20 producers (sellers).

The consensus forecast of each group in the survey is the overall average, as are the combined forecasts.

http://www.kitcometals.com/commentaries/Reser/sep122005.html

By Ken Reser

September 12, 2005

The unique properties of Molybdenum alloys are utilized in many different applications

Corrosion resistance and strength in stainless steel, wrought alloys and super alloys. These uses accounted for approximately 75% of Moly consumption in 2004.

High temperature heating elements, radiation shields, forging dies, rotating X-ray anodes in clinical diagnostics, glass melting furnace electrodes, heat sinks for matching silicon for semiconductor chip mounts, interconnects on integrated circuit chips, coatings for piston rings and machine components.

Smoke suppressants & solid lubricants to reduce friction, Moly lubricants ie: grease & oils, engine corrosion inhibitors in coolants, lubricants in space vehicles.

Chemical processing equipment, vessels, tanks & pipelines, flame retardants, dry lubricants, light bulb filaments, inorganic paint pigments, chemical catalysts and desulfurization catalysts.

Non-ferrous alloys (super alloys) or nimonics account for about 3% of total demand for Moly. They are used in jet engine turbines, nuclear plants, gas turbines, space exploration and general aviation.

Nuclear reactor vessels. The reactor vessel serves to contain and support the reactor core and vessel internals. It is constructed of Moly carbon steel, lined with stainless Moly steel and has 8 inch thick walls.

Molybdenum is used for scrubbers in flue gas desulfurization (FGD) in coal fired power stations around the world. 9% to 16% Moly is used in inconel alloys for this process.

Soil supplement in agriculture as well as human and animal supplements.

Molybdenum alloyed with Rhenium (Mo-41Re & Mo-47.5Re) is used in electronics, space programs & nuclear industries. Moly-25% & Rhenium alloys are used for rocket engine components and liquid metal heat exchangers.

Moly steel is used extensively in the millions of miles of oil, gas and water pipelines around the world. (ie; 2 million mi of oil pipelines in USA and 1.3 million mi of gas pipelines) (source-U.S. Dept of Energy) the EIA in a working paper states that "to meet the U.S. Energy demand for natural gas alone the pipeline mileage must increase by 30% or more. (cost est. $150 b). By 2025 EIA expects the US will need 47% more oil & 54% more natural gas.

Now one must consider how many of the pipelines built between 1930 and 1969 (over 2/3 of the current lines in use today) need replacement, and how many 100s of thousands of miles of new pipelines will be needed around the world for our booming oil & gas industry and ever-increasing demands. Consider the refineries and gas plants that need to be built as well. Molybdenum plays a very big part in all of these endeavors.

One of the largest uses of Molybdenum is in drill stem steel tubing. In the 1970's when oil boomed so did the price of Molybdenum rise. The many 1000s of onshore and offshore drill rigs (and service rigs) in the world constantly replace this drill tubing due to heat and metal fatigue, especially with the depths now reached by our technology, and the heat encountered at the greater depths & with the down-hole weight of the drill stem stretching over many thousands of feet. This may be one of the times in history when the demands on Moly won't ease as the frantic search for new oil & gas supplies due to peak oil having been reached will give a new constant impetus to drill exploration.

On the immediate horizon for stainless steel and Moly use also is the fact that new maritime regulations now stipulate that all single hulled oil tankers built before 1987 must be decommissioned by 2010, and thus will be replaced by double hulled tankers. From the information available it appears that 170 vessels will be affected by this law by Apr. 5th 2005, the oil containment tanks in these ships are constructed of a Moly alloy steel also. Coupled with China's maritime fleet building in progress (military and commercial) it looks like a bright future for Moly in this area as well. There are at present about 3,600 tankers in the world. 1/3 of the world's oil is transported by just 435 of them, the large VLCCs (very large crude carriers).

Now to the space age and future of Molybdenum

(This is the interesting part)

The SAFE-400 space fission reactor (safe affordable fission engine) is a 400 kWt HPS producing 100 kWe to power a space vehicle using two Brayton Power Systems gas turbines driven directly by the hot gas from the reactor. The heat exchanger outlet temperature is 880 degrees. The reactor has 127 identical heat pipe modules made of Molybdenum.

Wall material for space reactors. Thin 99.9% purity Molybdenum foils for use in gas core reactors. Temperature ranges from 1500 to 2000 K.

Molybdenum Rhenium alloys for spacecraft reactor applications.

Molybdenum in ION space thrusters.

Molybdenum wire in radio telescopes.

NEXT generation ION thrusters, currently being developed as well as near term Nuclear Electric Propulsion (NEP) Program. Molybdenum & Carbon.

Multi layering in space telescopes with Molybdenum, Carbide and Silicon. TRACE (Transition Region And Corona Explorer) revealing the secrets of the Sun.

Molybdenum, Lithium "heat pipe." Los Alamos N.M. A pencil sized tube of Molybdenum, with Lithium core that moves heat from one end to the other may someday allow astronauts to travel to Mars and beyond. The heat pipes on NASA spacecraft will be in groups from 5 feet to 24 feet long. NASA's Marshall Space Flight Center is working to develop heat pipes for use in nuclear reactors to produce propulsion and generate electricity for spacecraft to travel the outer limits of the solar system. Heat pipes have been tested in space from shuttle missions & performed flawlessly.

Now you can possibly see why the world is viewing Molybdenum in a different light and it isn't just the demand from China, India and developing nations that is driving the price and uses. Moly is truly a metal of the future in many ways and we may never see the same past monetary values placed on it in our future. The era of the second industrial revolution is upon us and it 'is' the 3rd world coming into the 21st century at a very rapid rate that is placing great pressure on base metal demand, but it also is the age of new and ever-changing metal technologies, and I personally think Molybdenum will play a very important part in this new era and will be a major component of any base metal bull market.

If one considers that Moly mines may have a new and more secure future than in the past then one should consider that a "primary pure Molybdenum mine" has no sulfides or copper to leach out of the finished product. The Moly when crushed can be floated off by using a simple soap or diesel fuel additive to the floatation tanks or columns and agitated. The Moly particles adhere to the air bubbles and rise to the surface to be collected (skimmed off). This is a very simple, cost efficient and environmentally friendly process. It is generally accepted that in the Moly by-product production of copper mines, it takes 10 lbs. of CU produced to acquire 1lb of Molybdenum. There are few primary Moly mines at present in the world and fewer still coming to future production.

Let us not forget the adage. "If the whole world had the lifestyle, material comfort and luxuries of the western world, we'd need another planet for the supply of natural resources." Because that transformation is coming fast and the resources are finite, the cost of base metals and energy sources is obviously going to get much more expensive as time & world growth progresses. Mankind's demands on base metals in our future will prove historical.

The 2005 Moly price projection - in a survey done by "Ryan's Notes" in a presentation by Alice Agoo, given in Ryan's Notes' 2005 Molybdenum meeting. This survey was taken from 17 end users of Moly & 20 producers (sellers).

The consensus forecast of each group in the survey is the overall average, as are the combined forecasts.

http://www.kitcometals.com/commentaries/Reser/sep122005.html

tallsiii

- 05 Dec 2005 15:04

- 135 of 215

- 05 Dec 2005 15:04

- 135 of 215

I agree with what you are saying Papal. Considering that they floated two years ago at 1.25 and since then, they have fast tracked Shorsyke, and bought chebinsk. Also the moly price is several times what it was back then while copper and gold have climbed substantially.

But still, the market does not like them at the moment. If the production or cash flow were to be delayed at this point, then you'd probably see the SP halve from here. But if do live up to their PR, then it would be difficult for the market to argue with real cash flow.

But still, the market does not like them at the moment. If the production or cash flow were to be delayed at this point, then you'd probably see the SP halve from here. But if do live up to their PR, then it would be difficult for the market to argue with real cash flow.

PapalPower

- 05 Dec 2005 18:31

- 136 of 215

- 05 Dec 2005 18:31

- 136 of 215

Agreed tallsiii.

A post from konil at afn;

konil - 5 Dec'05 - 18:22 - 242 of 242

rui sa, please refer to page 23 of this report

http://www.eurekamining.co.uk/documents/Archive/Eureka_Report_210605.pdf

the base case sp is 4.57 based on total asset value of $141m, of which shorskoye contributes $48m and there is cash of $8m. Chelyabinsk, Dostyk and Kentau total $85m, with an overall total of $141m. So stripping out $85m will give a base case value of

48(shorskoye) + 8(cash) / 141(includes chelyabinsk et al) * 4.57 = 1.81.

in arriving at these numbers the authors have used a moly price of $20/lb in 2006, $15/lb in 2007 and $10/lb thereafter and a discount rate of 20%.

this compares to a current price c. $35/lb with indications of continuing strong prices. furthermore a discount rate of 20% bears no resemblance to reality (the authors state this is to account for uncertainty over the moly price but they have already used pessimistic figures for this) and even the more normal 10% discount rate is not a realistic figure but is used to account for various risks in mining projects. however, barring some unforseen disaster shorskoye is funded and will be producing in 3 months, not 3 years.

A post from konil at afn;

konil - 5 Dec'05 - 18:22 - 242 of 242

rui sa, please refer to page 23 of this report

http://www.eurekamining.co.uk/documents/Archive/Eureka_Report_210605.pdf

the base case sp is 4.57 based on total asset value of $141m, of which shorskoye contributes $48m and there is cash of $8m. Chelyabinsk, Dostyk and Kentau total $85m, with an overall total of $141m. So stripping out $85m will give a base case value of

48(shorskoye) + 8(cash) / 141(includes chelyabinsk et al) * 4.57 = 1.81.

in arriving at these numbers the authors have used a moly price of $20/lb in 2006, $15/lb in 2007 and $10/lb thereafter and a discount rate of 20%.

this compares to a current price c. $35/lb with indications of continuing strong prices. furthermore a discount rate of 20% bears no resemblance to reality (the authors state this is to account for uncertainty over the moly price but they have already used pessimistic figures for this) and even the more normal 10% discount rate is not a realistic figure but is used to account for various risks in mining projects. however, barring some unforseen disaster shorskoye is funded and will be producing in 3 months, not 3 years.

tallsiii

- 06 Dec 2005 14:41

- 137 of 215

- 06 Dec 2005 14:41

- 137 of 215

That is an interesting report. All we need to see is some real moly sold to real customers for real money and EKA are likely to acheive the valuations in that report and more. Nevertheless, the risk remains at the moment.

PapalPower

- 07 Dec 2005 08:56

- 138 of 215

- 07 Dec 2005 08:56

- 138 of 215

SynFuel, the Petroleum Alternative

Zach Fross

December 7th, 2005

With the coming oil crisis looming directly ahead, there are going to be many opportunities in the energy sector to cash-in. One such opportunity will be alternative petroleum sources such as coal-to-liquid-fuel and natural gas-to-liquid fuel (GTL), otherwise known as synthetic fuel or SynFuel. SynFuel is rapidly becoming a popular alternative to increasingly expensive petroleum.

According to the U.S.E.I.A, the Middle East has an estimated 1.4 trillion cubic feet of untapped natural gas resources. In comparison the U.S. uses approximately 22.4 million cubic feet of natural gas per year. The problem for the Middle East is that it is difficult to get these vast resources to market; there is no existing infrastructure (i.e. pipelines, transport, etc.). With GTL technology, the natural gas is converted to liquid fuel (diesel, naphtha, and kerosene) and then transported to market utilizing existing infrastructure. This enables the Middle East to exploit vast natural gas resources and bring natural gas to market cheaply and efficiently.

The International Energy Agency recently released a report detailing the projected energy demand to grow over 50% by 2030. The estimated dollar amount to bring the energy supply inline with the increasing energy demand is $17 trillion. It is highly unlikely that the funds will be invested in enough time to keep the energy market from reaching supply deficiencies. This means that the price of oil will increase until the increasing demand is met with an increasing supply.

Two progressively more popular petroleum alternatives are coal liquefaction and natural gas-to-liquid fuel; otherwise respectively know as Clean Coal Technology and GTL. Recently, a company called Waste Management and Processors Inc. (WMPI) received government approval along with $100 million in federal funds to build the United States first waste coal liquefaction facility in Pennsylvania. The major technology used in liquefaction and GTL technology is the Fischer-Tropsch (FT) process.

The primary materials used in the FT catalytic conversion process are nickel, cobalt, and molybdenum. The better the catalytic material, the more liquid output obtained from the process. Molybdenum is the best catalyst and is becoming the most widely used. A full-scale SynFuel operation uses several tons of catalytic material per day ! As more and more countries around the globe begin utilizing the FT process to convert coal and natural gas into liquid fuel demand for catalytic material will proportionately increase.

Look for investment opportunities in the catalyst and catalyst materials markets. As new SynFuel plants come online, the demand for materials like molybdenum and cobalt will rise dramatically.

12/07/2005

Zach Fross

Zach Fross

December 7th, 2005

With the coming oil crisis looming directly ahead, there are going to be many opportunities in the energy sector to cash-in. One such opportunity will be alternative petroleum sources such as coal-to-liquid-fuel and natural gas-to-liquid fuel (GTL), otherwise known as synthetic fuel or SynFuel. SynFuel is rapidly becoming a popular alternative to increasingly expensive petroleum.

According to the U.S.E.I.A, the Middle East has an estimated 1.4 trillion cubic feet of untapped natural gas resources. In comparison the U.S. uses approximately 22.4 million cubic feet of natural gas per year. The problem for the Middle East is that it is difficult to get these vast resources to market; there is no existing infrastructure (i.e. pipelines, transport, etc.). With GTL technology, the natural gas is converted to liquid fuel (diesel, naphtha, and kerosene) and then transported to market utilizing existing infrastructure. This enables the Middle East to exploit vast natural gas resources and bring natural gas to market cheaply and efficiently.

The International Energy Agency recently released a report detailing the projected energy demand to grow over 50% by 2030. The estimated dollar amount to bring the energy supply inline with the increasing energy demand is $17 trillion. It is highly unlikely that the funds will be invested in enough time to keep the energy market from reaching supply deficiencies. This means that the price of oil will increase until the increasing demand is met with an increasing supply.

Two progressively more popular petroleum alternatives are coal liquefaction and natural gas-to-liquid fuel; otherwise respectively know as Clean Coal Technology and GTL. Recently, a company called Waste Management and Processors Inc. (WMPI) received government approval along with $100 million in federal funds to build the United States first waste coal liquefaction facility in Pennsylvania. The major technology used in liquefaction and GTL technology is the Fischer-Tropsch (FT) process.

The primary materials used in the FT catalytic conversion process are nickel, cobalt, and molybdenum. The better the catalytic material, the more liquid output obtained from the process. Molybdenum is the best catalyst and is becoming the most widely used. A full-scale SynFuel operation uses several tons of catalytic material per day ! As more and more countries around the globe begin utilizing the FT process to convert coal and natural gas into liquid fuel demand for catalytic material will proportionately increase.

Look for investment opportunities in the catalyst and catalyst materials markets. As new SynFuel plants come online, the demand for materials like molybdenum and cobalt will rise dramatically.

12/07/2005

Zach Fross

tallsiii

- 07 Dec 2005 09:05

- 139 of 215

- 07 Dec 2005 09:05

- 139 of 215

Moly is in demand for many things at the moment. As the copper price rises, more mines are likely to be working flat out and will generate more Moly by-product. So there will be more supply, but the increasing demand for moly is likely to outpace. The expected fall off in the price of moly has been widely expected, but so far has failed to materialise. It will be interesting to see if it ever does materialise before the end of this commodity super cycle.

PapalPower

- 07 Dec 2005 09:08

- 140 of 215

- 07 Dec 2005 09:08

- 140 of 215

The Times

Rumour of the day

Eureka Mining, the base metals explorer in which Celtic Resources owns 15 per cent, firmed 1p to 107p on AIM amid word that it was close to buying the 49 per cent of Russias Chelyabinsk copper and gold project it does not own. The company, which has an option to buy the stake for $6 million (3.5 million), raised 9 million at 125p in September, in part to fund the purchase.

Rumour of the day

Eureka Mining, the base metals explorer in which Celtic Resources owns 15 per cent, firmed 1p to 107p on AIM amid word that it was close to buying the 49 per cent of Russias Chelyabinsk copper and gold project it does not own. The company, which has an option to buy the stake for $6 million (3.5 million), raised 9 million at 125p in September, in part to fund the purchase.

tallsiii

- 07 Dec 2005 11:32

- 141 of 215

- 07 Dec 2005 11:32

- 141 of 215

My understanding was that they were only planning to pay for the other 49% when they completed a successful feasability study. If they have done so, then we could be in for a big lift!

PapalPower

- 07 Dec 2005 12:02

- 142 of 215

- 07 Dec 2005 12:02

- 142 of 215

News due soon I think.

tallsiii

- 08 Dec 2005 11:29

- 143 of 215

- 08 Dec 2005 11:29

- 143 of 215

Has anyone phoned the company to recently? I am sure that Bartley or Foo might be able to either confirm or dispel rumours that are going around at the moment.

PapalPower

- 09 Dec 2005 08:15

- 144 of 215

- 09 Dec 2005 08:15

- 144 of 215

The anti Celtic Resources rumour mill are hitting Foo's VOG and EKA with lots of negative stories, like the one recently on EKA about permits. Now they are having a go at VOG again I see.

A conspiracy going on ?

Anyway, good top up time with the price of EKA now and Molybednum production on line and generating cash in Q1 06.

A conspiracy going on ?

Anyway, good top up time with the price of EKA now and Molybednum production on line and generating cash in Q1 06.

PapalPower

- 11 Dec 2005 06:05

- 145 of 215

- 11 Dec 2005 06:05

- 145 of 215

Major Shareholders

Celtic Resources Holdings PLC 15.02%

Gartmore 5.57%

Henderson Global Investors Ltd 4.18%

JP Morgan 4.18%

RAB Capital 3.83%

RCM 3.11% (Holdings of M James and D Bartley)

Directors

Kevin Alfred Foo 1.923%

David Bartley 1.198%

Malcolm Raymond James 1.151%

Andrzej S Sliwa 0.605%

Jonathan Scott-Barrett 0.177%

Presentation Link

Celtic Resources Holdings PLC 15.02%

Gartmore 5.57%

Henderson Global Investors Ltd 4.18%

JP Morgan 4.18%

RAB Capital 3.83%

RCM 3.11% (Holdings of M James and D Bartley)

Directors

Kevin Alfred Foo 1.923%

David Bartley 1.198%

Malcolm Raymond James 1.151%

Andrzej S Sliwa 0.605%

Jonathan Scott-Barrett 0.177%

Presentation Link

tallsiii

- 12 Dec 2005 14:24

- 146 of 215

- 12 Dec 2005 14:24

- 146 of 215

Maybe the person putting out the rumours is topping up also!!