| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

ellio - 15 May 2006 09:10

The market seems to be selling-off on the back of limited bad news imo, apart from the dollar that is.

If you can hold your nerve and apart from any short term requirements to offload poor performing stocks, I have a couple!!, my advice would be sit tight. This does not have the feel of the tech(mining!) bubble at all. Difference being there are a lot of good fundamentals, unlike in 2000 when there were a lot of over rated nothing companies.

If you can hold your nerve and apart from any short term requirements to offload poor performing stocks, I have a couple!!, my advice would be sit tight. This does not have the feel of the tech(mining!) bubble at all. Difference being there are a lot of good fundamentals, unlike in 2000 when there were a lot of over rated nothing companies.

PapalPower

- 18 Mar 2008 06:40

- 1512 of 1564

- 18 Mar 2008 06:40

- 1512 of 1564

http://www.fool.co.uk/news/investing/investing-strategy/2008/03/17/stearns-goes-pear-shaped-whos-next.aspx

Stearns Goes Pear Shaped...Who's Next?

It had to happen.

The US version of Northern Rock. Sort of.

For days, investors and central bankers had become ever more nervous about the collateral ....................

Stearns Goes Pear Shaped...Who's Next?

It had to happen.

The US version of Northern Rock. Sort of.

For days, investors and central bankers had become ever more nervous about the collateral ....................

required field - 18 Mar 2008 09:12 - 1513 of 1564

It's funny...you could come back in possibly ten years time and say :"you remember when you could buy such and such a stock at such a cheap price...if only..." that could be the situation now...the difficulty is calling the bottom !

hlyeo98 - 18 Mar 2008 21:11 - 1514 of 1564

It seems to be a recovering market from now on...

required field - 18 Mar 2008 23:41 - 1515 of 1564

For once...could be some serious blue tomorrow morning....good night guys and don't dream of stocks too much (pss. I know I do!).

PapalPower

- 19 Mar 2008 04:23

- 1516 of 1564

- 19 Mar 2008 04:23

- 1516 of 1564

AIM market is still way above the 2003 lows. What people often fail to appreciate is that the AIM market is very illiquid, which means it takes a much longer time for large institutional holdings to be sold off, and so, it becomes a long drawn out process as some private investors go into denial stage and keep "buying the bargain"....and the price continues to fall as the large holders keep on selling, for as long as it takes to dump the required amount of stock.

.

.

PapalPower

- 19 Mar 2008 04:24

- 1517 of 1564

- 19 Mar 2008 04:24

- 1517 of 1564

However, it does now seem to be forming a sharp downwards trend if you work from mid 2007 to now...........potential top and bottom points of the trend lines forming.

PapalPower

- 21 Mar 2008 15:10

- 1518 of 1564

- 21 Mar 2008 15:10

- 1518 of 1564

PapalPower

- 22 Mar 2008 03:07

- 1519 of 1564

- 22 Mar 2008 03:07

- 1519 of 1564

Very worrying. Do you get the feeling this is all being engineered, the HBOS scare thing being enigneering so that such measures as below can be passed through without causing too much panic, cause its all cause we want to stop these nasty traders and their rumours.........nothing to do with financial chaos thats getting out of control......... :

http://news.bbc.co.uk/1/hi/business/7306058.stm

...............The banks want to be able to use a wider range of collateral, including mortgages, for Bank of England loans.

Mr King had been reluctant to allow that so he would not be seen as bailing out banks that had behaved foolishly................

............. "Although the Governor of the Bank, Mervyn King, asked them not to divulge what they discussed, I have learned he signalled - for the first time - that he was sympathetic to their request that in an emergency they should be able to swap a wider range of assets, including their mortgages, for loans from the Bank of England," the BBC's business editor said. ............

http://news.bbc.co.uk/1/hi/business/7306058.stm

...............The banks want to be able to use a wider range of collateral, including mortgages, for Bank of England loans.

Mr King had been reluctant to allow that so he would not be seen as bailing out banks that had behaved foolishly................

............. "Although the Governor of the Bank, Mervyn King, asked them not to divulge what they discussed, I have learned he signalled - for the first time - that he was sympathetic to their request that in an emergency they should be able to swap a wider range of assets, including their mortgages, for loans from the Bank of England," the BBC's business editor said. ............

Falcothou - 22 Mar 2008 09:05 - 1520 of 1564

From Telegraph...

Still, investors are clearly nervous. The euphoria which greeted the smaller than expected cut in the US base rate has given way to more sombre analysis, as investors have found themselves tripping over rumours of more and more banks in trouble. Those who have a more fatalistic outlook might be reminded of the old Jewish joke about a rabbi who falls out of a 20th-storey window and, as he passes each floor, mutters to himself: "So far, so good.

Still, investors are clearly nervous. The euphoria which greeted the smaller than expected cut in the US base rate has given way to more sombre analysis, as investors have found themselves tripping over rumours of more and more banks in trouble. Those who have a more fatalistic outlook might be reminded of the old Jewish joke about a rabbi who falls out of a 20th-storey window and, as he passes each floor, mutters to himself: "So far, so good.

required field - 22 Mar 2008 10:46 - 1521 of 1564

Good debate guys...(like reading your comments)...hope we can guess where the bottom is....could be some increases in the run up to Christmas...those that can short at the moment might make some money (I'm no good at cfd's and spreadbets) ...hopefully the markets will turn around soon !

PapalPower

- 22 Mar 2008 14:52

- 1522 of 1564

- 22 Mar 2008 14:52

- 1522 of 1564

I know I have of late been on about a late summer respite (US elections) before big problems in 2009.

Perhaps these quoted snippets might suggest that what happened before, might be happening all over again..........

If the signs are in the tea leaves, it might be wise to have no stock holdings before April 2009...........

QUOTE

"....this inflation of the money supply that led to an unsustainable boom in both asset prices (stocks and bonds) and in capital goods. By the time the Fed belatedly tightened in 1928, it was far too late....".

"...government efforts to prop up the economy after the crash of 1929 only made things worse."

"...the Federal Reserve purchased $1.1 billion of government securities from February to July 1932 which raised its total holding to $1.8 billion."

"The solution was the government must pump money into consumers' pockets. That is, it must redistribute purchasing power, maintain the industrial base, but re-inflate prices and wages to force as much of the inflationary increase in purchasing power into consumer spending."

"There was a brief recovery in the market into April 1930, but prices then started falling steadily again from there, not reaching a final bottom until July 1932."

"...the nominal interest rate is close or equal to zero, and the monetary

authority is unable to stimulate the economy with traditional monetary policy tools."

"...that a liquidity trap might have contributed to bank failures."

Source(s):

http://www.mises.org/Books/historyofmoney.pdf

http://www.greatdepressionsbook.com/

http://www.gusmorino.com/pag3/greatdepression/

UNQUOTE

Perhaps these quoted snippets might suggest that what happened before, might be happening all over again..........

If the signs are in the tea leaves, it might be wise to have no stock holdings before April 2009...........

QUOTE

"....this inflation of the money supply that led to an unsustainable boom in both asset prices (stocks and bonds) and in capital goods. By the time the Fed belatedly tightened in 1928, it was far too late....".

"...government efforts to prop up the economy after the crash of 1929 only made things worse."

"...the Federal Reserve purchased $1.1 billion of government securities from February to July 1932 which raised its total holding to $1.8 billion."

"The solution was the government must pump money into consumers' pockets. That is, it must redistribute purchasing power, maintain the industrial base, but re-inflate prices and wages to force as much of the inflationary increase in purchasing power into consumer spending."

"There was a brief recovery in the market into April 1930, but prices then started falling steadily again from there, not reaching a final bottom until July 1932."

"...the nominal interest rate is close or equal to zero, and the monetary

authority is unable to stimulate the economy with traditional monetary policy tools."

"...that a liquidity trap might have contributed to bank failures."

Source(s):

http://www.mises.org/Books/historyofmoney.pdf

http://www.greatdepressionsbook.com/

http://www.gusmorino.com/pag3/greatdepression/

UNQUOTE

PapalPower

- 24 Mar 2008 04:26

- 1523 of 1564

- 24 Mar 2008 04:26

- 1523 of 1564

Lots of media articles now suggesting "time to buy" and historically at least this may be correct. Tax year end selling is nearly over, and so, as this hits of lots shares, shares are usually cheap now, which gives a rally in April, before the "Sell in May" happens and then the markets go into their summer state of depression.

So yes, perhaps there could be 4 to 6 weeks of respite ahead and cheerier markets, but will it all end in tears again in May/June ?

The question this year will no doubt be more focussed on the "Sell in May" and how many will utilise any April rally to bail out. There must be some serious margin pressure around with the falls of late.

Attached is the AIM chart for 07 to 08. The AIM index is presently at the bottom of the trend line imv, so its time to bounce up for a while at least, and looking at last year April was good, so again it would suggest that potential for a few weeks it might turn bullish, before the summer selling strikes come May.

At a guess, good time to buy for a short term rally, but beware as it is very likely to turn down again before too long. Of course, any bad news from the US or Europe could smack any rally down at any stage. Also, how much are insitutions still looking for cash and will sell into any rally, which in effect will mute its power ?

Lots of questions, and a multitude of potenial opinions, in general means volatility.

So yes, perhaps there could be 4 to 6 weeks of respite ahead and cheerier markets, but will it all end in tears again in May/June ?

The question this year will no doubt be more focussed on the "Sell in May" and how many will utilise any April rally to bail out. There must be some serious margin pressure around with the falls of late.

Attached is the AIM chart for 07 to 08. The AIM index is presently at the bottom of the trend line imv, so its time to bounce up for a while at least, and looking at last year April was good, so again it would suggest that potential for a few weeks it might turn bullish, before the summer selling strikes come May.

At a guess, good time to buy for a short term rally, but beware as it is very likely to turn down again before too long. Of course, any bad news from the US or Europe could smack any rally down at any stage. Also, how much are insitutions still looking for cash and will sell into any rally, which in effect will mute its power ?

Lots of questions, and a multitude of potenial opinions, in general means volatility.

PapalPower

- 28 Mar 2008 05:52

- 1524 of 1564

- 28 Mar 2008 05:52

- 1524 of 1564

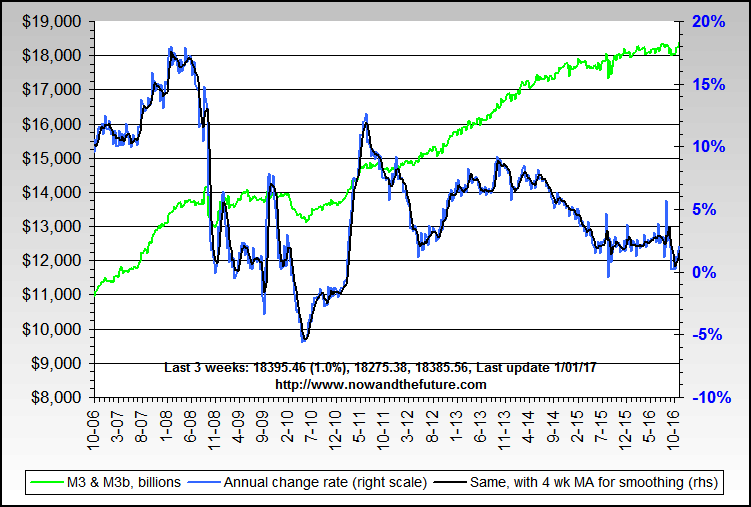

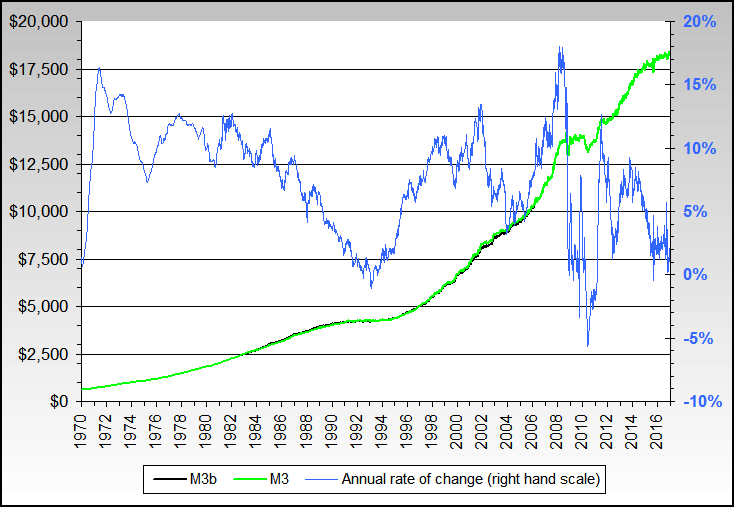

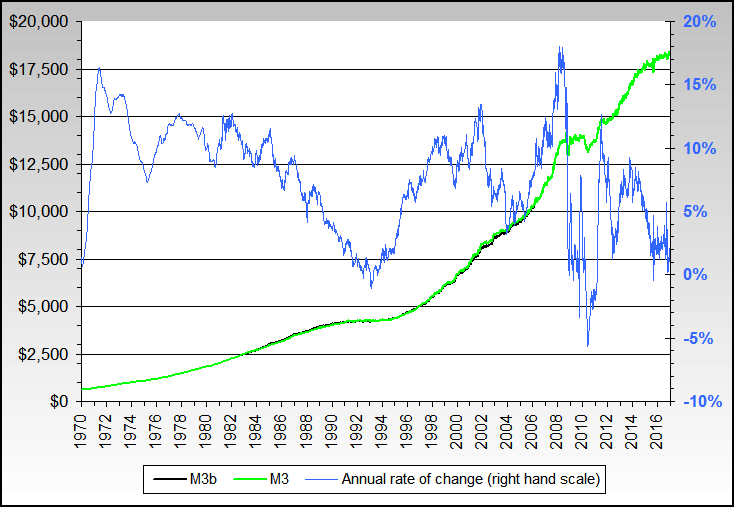

Sadly the FED hid the M3 figures from mid 2006 onwards, they say it was not important, however its more likely that it was showing in advance that everything was going to go very very bad. So, the data was hidden.

This is the chart up to mid 2006, and it shows where the "house price boom" came from.

I just wonder what the chart looks like from mid 2006 to today...........

.

This is the chart up to mid 2006, and it shows where the "house price boom" came from.

I just wonder what the chart looks like from mid 2006 to today...........

.

PapalPower

- 28 Mar 2008 05:59

- 1525 of 1564

- 28 Mar 2008 05:59

- 1525 of 1564

As to the markets going forward, I would suggest keeping an eye on US inflation figures in the next couple of quarters. If they do not start to dip back down, then the FED will have to forget about recession and change direction to counter inflation. This will mean interest rates start going back up and fast. Recession is not nice, but its generally over quickly, inflation can be with you for years , many years and is a bigger problem.

If the markets get a sniff that inflationary pressure is not subsiding, I think there will be a strong sell off in the markets as they anticipate rising interest rates on the horizon.

If the markets get a sniff that inflationary pressure is not subsiding, I think there will be a strong sell off in the markets as they anticipate rising interest rates on the horizon.

PapalPower

- 02 Apr 2008 07:24

- 1526 of 1564

- 02 Apr 2008 07:24

- 1526 of 1564

Interesting chart posted by "mdtrader" over at sharecrazy.com

Whilst people will always say that valuations have not gone to 2000 levels, they seem to think bubbles and falls are caused by one reason, obviously they are not. The Depression of the 30's was not caused by high PE's, it was caused by "imaginary money"......yes, lots of credit and nothing behind it. As is now, property valuations have been "hyped" up on lots of credit and nothing behind it, and as the imaginery money must be turned into real money, well you know what happens ahead. Things are sold off to raise money to back up the imaginary. Certainly worth keeping an eye on the charts to see if history does repeat itself with the credit crises.

.

Whilst people will always say that valuations have not gone to 2000 levels, they seem to think bubbles and falls are caused by one reason, obviously they are not. The Depression of the 30's was not caused by high PE's, it was caused by "imaginary money"......yes, lots of credit and nothing behind it. As is now, property valuations have been "hyped" up on lots of credit and nothing behind it, and as the imaginery money must be turned into real money, well you know what happens ahead. Things are sold off to raise money to back up the imaginary. Certainly worth keeping an eye on the charts to see if history does repeat itself with the credit crises.

.

PapalPower

- 02 Apr 2008 12:50

- 1527 of 1564

- 02 Apr 2008 12:50

- 1527 of 1564

http://business.timesonline.co.uk/tol/business/money/property_and_mortgages/article3666670.ece

From Times Online

April 2, 2008

Mortgage brokers braced for Halifax to pull dealsRebecca O'Connor

Halifax, the UK's biggest mortgage lender, is expected to pull its current home loan deals.....................

From Times Online

April 2, 2008

Mortgage brokers braced for Halifax to pull dealsRebecca O'Connor

Halifax, the UK's biggest mortgage lender, is expected to pull its current home loan deals.....................

PapalPower

- 05 Apr 2008 04:08

- 1528 of 1564

- 05 Apr 2008 04:08

- 1528 of 1564

When people were spouting "credit crisis over" were they simply saying that the Fed was printing money like nobodies business, and so credit was there to be had. Does not really solve the underlying problems does it, and not very surprising to see the amount being borrowed rising, not falling.

I think the printing press answer to money problems was recently demonstrated in Zimbabwe..............

Is it any wonder the FED starting hiding the M3 figures............

http://money.cnn.com/2008/04/03/news/economy/fed_credit_crisis.ap/index.htm

Investment firms tap Fed for billions

Wall Street banks take advantage of Fed's emergency loan program, borrowing an average of $38.1 billion a day last week.

Last Updated: April 3, 2008: 6:26 PM EDT

WASHINGTON (AP) -- Big Wall Street investment companies are stepping up their borrowing a bit from the Federal Reserve's unprecedented emergency lending program.

The Federal Reserve reported Thursday that those firms averaged $38.1 billion in daily borrowing over the past week from the new lending program. That compared with $32.9 billion in the previous week and $13.4 billion in the first week the lending facility opened.

The program, which began on March..............

I think the printing press answer to money problems was recently demonstrated in Zimbabwe..............

Is it any wonder the FED starting hiding the M3 figures............

http://money.cnn.com/2008/04/03/news/economy/fed_credit_crisis.ap/index.htm

Investment firms tap Fed for billions

Wall Street banks take advantage of Fed's emergency loan program, borrowing an average of $38.1 billion a day last week.

Last Updated: April 3, 2008: 6:26 PM EDT

WASHINGTON (AP) -- Big Wall Street investment companies are stepping up their borrowing a bit from the Federal Reserve's unprecedented emergency lending program.

The Federal Reserve reported Thursday that those firms averaged $38.1 billion in daily borrowing over the past week from the new lending program. That compared with $32.9 billion in the previous week and $13.4 billion in the first week the lending facility opened.

The program, which began on March..............

PapalPower

- 05 Apr 2008 04:17

- 1529 of 1564

- 05 Apr 2008 04:17

- 1529 of 1564

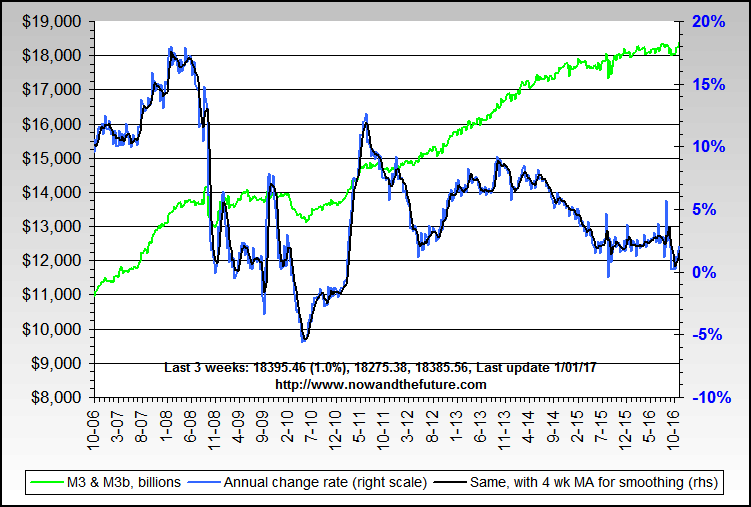

The latest M3 stats are starting to looking scary, very scary.

http://www.nowandfutures.com/key_stats.html

M3 Green Line is where the FED reported it, they decided to stop (guess why) and the M3b black line is the continuation by others reporting what the FED decided to stop reporting...... ;)

http://www.nowandfutures.com/key_stats.html

M3 Green Line is where the FED reported it, they decided to stop (guess why) and the M3b black line is the continuation by others reporting what the FED decided to stop reporting...... ;)

PapalPower

- 05 Apr 2008 04:48

- 1530 of 1564

- 05 Apr 2008 04:48

- 1530 of 1564

And "something for the weekend sir" ?

If you have the spare time at some time, I would recommend watching, if you have not seen it before, the BBC 4 part series "The Century of Self".

Its free to watch on Google, links below :

Part 1 http://video.google.com/videoplay?docid=8953172273825999151&q=%22The+Century+of+the+Self%22&total=488&start=0&num=10&so=0&type=search&plindex=0

Part 2 http://video.google.com/videoplay?docid=-678466363224520614&q=%22The+Century+of+the+Self%22&total=488&start=0&num=10&so=0&type=search&plindex=1

Part 3 http://video.google.com/videoplay?docid=-6111922724894802811&q=%22The+Century+of+the+Self%22&total=488&start=0&num=10&so=0&type=search&plindex=4

Part 4 http://video.google.com/videoplay?docid=1122532358497501036&q=%22The+Century+of+the+Self%22&total=488&start=0&num=10&so=0&type=search&plindex=2

.

If you have the spare time at some time, I would recommend watching, if you have not seen it before, the BBC 4 part series "The Century of Self".

Its free to watch on Google, links below :

Part 1 http://video.google.com/videoplay?docid=8953172273825999151&q=%22The+Century+of+the+Self%22&total=488&start=0&num=10&so=0&type=search&plindex=0

Part 2 http://video.google.com/videoplay?docid=-678466363224520614&q=%22The+Century+of+the+Self%22&total=488&start=0&num=10&so=0&type=search&plindex=1

Part 3 http://video.google.com/videoplay?docid=-6111922724894802811&q=%22The+Century+of+the+Self%22&total=488&start=0&num=10&so=0&type=search&plindex=4

Part 4 http://video.google.com/videoplay?docid=1122532358497501036&q=%22The+Century+of+the+Self%22&total=488&start=0&num=10&so=0&type=search&plindex=2

.

PapalPower

- 14 Apr 2008 02:21

- 1531 of 1564

- 14 Apr 2008 02:21

- 1531 of 1564

Worth a read of this thread, and listen to Bert ....

http://boards.fool.co.uk/Message.asp?mid=11010684&sort=whole

Author: BertEEE Number: 107772 of 107804

QUOTEBert are credit markets continuing to improve? UNQUOTE

Hi, sorry I can barely use TMF at the moment as I get loads of error and security alerts and can't access my favourates list. God knows what they're doing.

Spreads have widened again marginally but lots of new deals, some of which are being upsized due to demand - thats so important, if we can keep this up then the liquidity crisis will be over. But we then move onto the developing economic crisis, I would imagine that GE's earnings cut is just the start basically.

****************************************************

Author: BertEEE Number: 107791 of 107804

QUOTEWhile I'm on my high horse - I'm sick of everyone making such a fuss about the US. Yep, they are a big part of the global economy. In the 87 Crash they the phrase 'when America sneezes the rest of the world catches a cold' was batted about and it was true. But have you seen how much the rest of the world has grown up since? The US was about 40% of the global economy then. The rest of the world has torn them apart for growth in that time and the US Dollar has fallen by over 50% or more since then too. The US is now about 15% of global GDP in $ terms compared to then. Decadence eventually gets to all great empires - look at Britain the Romans use to be - I think we have to live with the US decline or reduced growth and look to the rest of the world myself. Was nice knowing you Uncle Sam.

China, India nd Russia together have the same GDP as the US. They are growing at about 8% across the board and more than offsetting any decline of 0-1% in the US.UNQUOTE

Total tosh I'm afraid, together they are just a fraction of the US. You're looking at it on a PPP basis. So purchasing power parity. Totally meaningless figure really.

The US, Europe and Japan make up around 70% of global GDP. Frankly all three economies currently look shite. If you honestly believe that China can continue to grow strongly when their central bank is doing everything it can to moderate domestic demand to contain inflation and exports growth is likely to slow significantly (if not actually decline) then good luck to you. The UK especially would very much struggle to cope with a US decline. Fortunately the current decline is likely to be short lived, unfortunately we're currently in the stage where people haven't twigged that economies work with lags and so whats happening in the US is now washing out to the rest of the world but simply isn't so apparant yet.

The US was first in and is also likely to be first out.

B

.

http://boards.fool.co.uk/Message.asp?mid=11010684&sort=whole

Author: BertEEE Number: 107772 of 107804

QUOTEBert are credit markets continuing to improve? UNQUOTE

Hi, sorry I can barely use TMF at the moment as I get loads of error and security alerts and can't access my favourates list. God knows what they're doing.

Spreads have widened again marginally but lots of new deals, some of which are being upsized due to demand - thats so important, if we can keep this up then the liquidity crisis will be over. But we then move onto the developing economic crisis, I would imagine that GE's earnings cut is just the start basically.

****************************************************

Author: BertEEE Number: 107791 of 107804

QUOTEWhile I'm on my high horse - I'm sick of everyone making such a fuss about the US. Yep, they are a big part of the global economy. In the 87 Crash they the phrase 'when America sneezes the rest of the world catches a cold' was batted about and it was true. But have you seen how much the rest of the world has grown up since? The US was about 40% of the global economy then. The rest of the world has torn them apart for growth in that time and the US Dollar has fallen by over 50% or more since then too. The US is now about 15% of global GDP in $ terms compared to then. Decadence eventually gets to all great empires - look at Britain the Romans use to be - I think we have to live with the US decline or reduced growth and look to the rest of the world myself. Was nice knowing you Uncle Sam.

China, India nd Russia together have the same GDP as the US. They are growing at about 8% across the board and more than offsetting any decline of 0-1% in the US.UNQUOTE

Total tosh I'm afraid, together they are just a fraction of the US. You're looking at it on a PPP basis. So purchasing power parity. Totally meaningless figure really.

The US, Europe and Japan make up around 70% of global GDP. Frankly all three economies currently look shite. If you honestly believe that China can continue to grow strongly when their central bank is doing everything it can to moderate domestic demand to contain inflation and exports growth is likely to slow significantly (if not actually decline) then good luck to you. The UK especially would very much struggle to cope with a US decline. Fortunately the current decline is likely to be short lived, unfortunately we're currently in the stage where people haven't twigged that economies work with lags and so whats happening in the US is now washing out to the rest of the world but simply isn't so apparant yet.

The US was first in and is also likely to be first out.

B

.