| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Eureka Mining - time to spell it out (EKA)

tallsiii

- 11 Apr 2005 14:30

- 11 Apr 2005 14:30

EKA are expecting to mine 3.8 million lbs of Molybdenum this year. For the more sceptical amongst you, read this to confirm:

http://moneyam.uk-wire.com/cgi-bin/articles/200412150700023844G.html

They own the mine and the molydbenum in it has been independently varified as stated in the announcement linked above.

Molydbenum currently trades at around $38.50 per lb, you can check this at:

http://www.monterrico.co.uk/s/MetalPrices.asp

so do the sums 3.8m x $39.25 = $149m = 82m

Eureka Mining's market cap is 26m

In 2006 they expect to pull over 10,000 tonnes (20m lbs) of Moly out of that mine.

On top of all that they have recently aquired a mine in Russia with estimated contained metal of 3.32 million tonnes of copper, 3.26 million

ounces of gold and 98.9 million pounds of molybdenum. They hope to complete the feasibility study for this one in 2006:

http://moneyam.uk-wire.com/cgi-bin/articles/200501130700033169H.html

http://moneyam.uk-wire.com/cgi-bin/articles/200412150700023844G.html

They own the mine and the molydbenum in it has been independently varified as stated in the announcement linked above.

Molydbenum currently trades at around $38.50 per lb, you can check this at:

http://www.monterrico.co.uk/s/MetalPrices.asp

so do the sums 3.8m x $39.25 = $149m = 82m

Eureka Mining's market cap is 26m

In 2006 they expect to pull over 10,000 tonnes (20m lbs) of Moly out of that mine.

On top of all that they have recently aquired a mine in Russia with estimated contained metal of 3.32 million tonnes of copper, 3.26 million

ounces of gold and 98.9 million pounds of molybdenum. They hope to complete the feasibility study for this one in 2006:

http://moneyam.uk-wire.com/cgi-bin/articles/200501130700033169H.html

PapalPower

- 27 Dec 2005 14:45

- 156 of 215

- 27 Dec 2005 14:45

- 156 of 215

Production and sale of Moly is now within three months, so January/Feb should see this go significantly higher !

PapalPower

- 28 Dec 2005 05:52

- 157 of 215

- 28 Dec 2005 05:52

- 157 of 215

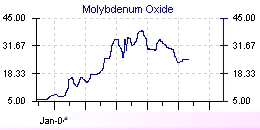

This is the only free graph I know of, its small though, but you can see the price is still well above 19$ and demand will cut in late Jan/Feb again to boost the price, so on that score its looking very good.

and from the company on Moly cash generation targets for first year (Q1 06 to Q1 07);

The Company has used a molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

and from the company on Moly cash generation targets for first year (Q1 06 to Q1 07);

The Company has used a molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

PapalPower

- 28 Dec 2005 05:53

- 158 of 215

- 28 Dec 2005 05:53

- 158 of 215

Once Moly is being delivered the cash flow from this will give EKA a very low PER ratio going forward, so this alone is one area where there is massive upside to come.

PapalPower

- 30 Dec 2005 00:16

- 159 of 215

- 30 Dec 2005 00:16

- 159 of 215

Excellent write up and full blown buy rating from the IC just released.

Also house broker Ambrian says Moly at 20$ should generate for EKA cash flow of 21.8m $ in 2006 and Ambrian has a price target of 175p.

Also house broker Ambrian says Moly at 20$ should generate for EKA cash flow of 21.8m $ in 2006 and Ambrian has a price target of 175p.

PapalPower

- 30 Dec 2005 07:37

- 160 of 215

- 30 Dec 2005 07:37

- 160 of 215

Should be blue today with the IC tip.

The article also says EKA "vehemently denies" the rumours of troubles with the Chelyabinsk license.

The article also says EKA "vehemently denies" the rumours of troubles with the Chelyabinsk license.

tallsiii

- 30 Dec 2005 08:15

- 161 of 215

- 30 Dec 2005 08:15

- 161 of 215

Cheers Papal, piled in for a load more this morning at 94/95. I pretty confident that that was the bottom. Worth getting out of bed for!

tallsiii

- 30 Dec 2005 08:42

- 162 of 215

- 30 Dec 2005 08:42

- 162 of 215

Am suprised that they set the target at 175p as that would still leave the co. on a PE of under 3. Cash generating with massive potential in Chelyabinsk. And as for the Moly price, looking at the historical chart it seems that it followed the last commodities boom to its peak in 79/80. There may still be more upside to come for moly!

PapalPower

- 30 Dec 2005 09:33

- 163 of 215

- 30 Dec 2005 09:33

- 163 of 215

Going well today, taking into account delayed trade reporting, its 6500 sells and all the rest are buys.

g64946 - 30 Dec 2005 10:00 - 164 of 215

IC has recommended this as a buy today. This has helped it move up in early trades

PapalPower

- 30 Dec 2005 10:26

- 165 of 215

- 30 Dec 2005 10:26

- 165 of 215

Yes g64946, it has.

tallsiii, I think the Ambrian note is quite old and conservative, they will surely put out a new one once we get the January (hope so) news on Chelyabinsk. Once actual cash generation starts and we know the trading range for Moly (which should be higher in Feb/March) then the targets will be raised again I think.

My target is over 200p come end of 2006 !

tallsiii, I think the Ambrian note is quite old and conservative, they will surely put out a new one once we get the January (hope so) news on Chelyabinsk. Once actual cash generation starts and we know the trading range for Moly (which should be higher in Feb/March) then the targets will be raised again I think.

My target is over 200p come end of 2006 !

tallsiii

- 30 Dec 2005 10:38

- 166 of 215

- 30 Dec 2005 10:38

- 166 of 215

Yes I can assure you that the two big sells were actually buys. Tempting to close today with a 2.5k profit, but am going to be in this one for a while. Positive news on Chelyabinsk and confirmation of cash flow could finally get the co. recognized.

PapalPower

- 30 Dec 2005 10:54

- 167 of 215

- 30 Dec 2005 10:54

- 167 of 215

That will be the key, the moment that Moly is sold and cash is coming in (at 3m $ a month please note when its in full swing around Q3 onwards) then EKA changes in the eyes of the big boys, and its a case of waiting to see now at what point they want to join in, or those already in, increase their holdings.

21.8m US$ in 2006 and Moly staying at 20$ then 36m US$ in 2007.

And thats just Moly and Shorskoye

21.8m US$ in 2006 and Moly staying at 20$ then 36m US$ in 2007.

And thats just Moly and Shorskoye

PapalPower

- 30 Dec 2005 13:03

- 168 of 215

- 30 Dec 2005 13:03

- 168 of 215

Up all the way to the close there tallsiii.

Looks good for a strong January, the fuse has been lit by The Times rumour and The IC BUY rating, now it just needs Kevin Foo to throw the petrol on with a news announcement early January, and it will be on fire.

Looks good for a strong January, the fuse has been lit by The Times rumour and The IC BUY rating, now it just needs Kevin Foo to throw the petrol on with a news announcement early January, and it will be on fire.

PapalPower

- 02 Jan 2006 10:54

- 169 of 215

- 02 Jan 2006 10:54

- 169 of 215

News this week or next tallsiii ?? Hope so, but anytime Jan would be fine.

The Ambrian old price target of 175p should be a distant memory by year end if everything goes to plan.

The Ambrian old price target of 175p should be a distant memory by year end if everything goes to plan.

PapalPower

- 02 Jan 2006 15:07

- 170 of 215

- 02 Jan 2006 15:07

- 170 of 215

Thanks to a post on AFN you can have a read from this copy;

StanFParker - 2 Jan'06 - 13:00 - 325 of 326

Part of Investers Chronicle buy tip for EKA (www.investorschronicle.co.uk)

30 December 2005

EUREKA MINING (EKA)

This year, Eureka has made great strides with its two projects in the former Soviet Union. Chief executive David Bartley swung a peach of a deal with a local uranium company, KazAtomProm,

in Kazakhstan earlier in the year: Eureka has divested 50 per cent of its Shorskoye molybdenum project in return for access to production facilities. And resources estimates at its Chelyabinsk project are looking good.

The key to the Shorskoye deal is the molybdenum price, which has been hovering above $30 a pound for most of 2005, but is likely to weaken. Eureka has used a $20 short-term molybdenum price in its modelling, but if full-scale production gets under way in the early

months of 2006 it should be able to secure sales at the current sky-high prices.

Even using a $20 molybdenum price, broker Ambrian estimates that Shorskoye should generate cash flow of $21.8m (12.4m) in 2006. At the current price, Eureka is looking at cash flow of $3m a month. So the company won't be saddled with large debt finance costs, and will therefore be able to use its $14m cash pile to leverage the Chelyabinsk copper-gold project in Russia, acquired in January 2005.

Chelyabinsk is at an earlier stage than Shorskoye, but with a new resource estimate of 1.66m tonnes of copper and 2.8m ounces of gold verified by independent industry consultant Snowden, it's showing real potential. A scoping study is to start in the next few weeks.

But the shares haven't performed well this year as Mr Bartley has spent most of his time abroad, unable to reassure markets spooked by Eureka's association with Celtic Resources. There have also been stories circulating in the press - vehemently denied by Eureka - that the Chelyabinsk licence isn't secure. That sort of story is all in the nature of doing business in Russia, though, and with big-hitters such as Gerard Holden of Barclays and Joe Nally of Cenkos behind it, Eureka stands as good a chance as any of weathering the storm. Ambrian sets a target price of 175p. BUY

Net cash: $14m

Market makers: 6

Normal market size: 2,000

BULL POINTS

Full-scale molybdenum production is imminent

Attractive assets

Well-funded and backed

StanFParker - 2 Jan'06 - 13:00 - 325 of 326

Part of Investers Chronicle buy tip for EKA (www.investorschronicle.co.uk)

30 December 2005

EUREKA MINING (EKA)

This year, Eureka has made great strides with its two projects in the former Soviet Union. Chief executive David Bartley swung a peach of a deal with a local uranium company, KazAtomProm,

in Kazakhstan earlier in the year: Eureka has divested 50 per cent of its Shorskoye molybdenum project in return for access to production facilities. And resources estimates at its Chelyabinsk project are looking good.

The key to the Shorskoye deal is the molybdenum price, which has been hovering above $30 a pound for most of 2005, but is likely to weaken. Eureka has used a $20 short-term molybdenum price in its modelling, but if full-scale production gets under way in the early

months of 2006 it should be able to secure sales at the current sky-high prices.

Even using a $20 molybdenum price, broker Ambrian estimates that Shorskoye should generate cash flow of $21.8m (12.4m) in 2006. At the current price, Eureka is looking at cash flow of $3m a month. So the company won't be saddled with large debt finance costs, and will therefore be able to use its $14m cash pile to leverage the Chelyabinsk copper-gold project in Russia, acquired in January 2005.

Chelyabinsk is at an earlier stage than Shorskoye, but with a new resource estimate of 1.66m tonnes of copper and 2.8m ounces of gold verified by independent industry consultant Snowden, it's showing real potential. A scoping study is to start in the next few weeks.

But the shares haven't performed well this year as Mr Bartley has spent most of his time abroad, unable to reassure markets spooked by Eureka's association with Celtic Resources. There have also been stories circulating in the press - vehemently denied by Eureka - that the Chelyabinsk licence isn't secure. That sort of story is all in the nature of doing business in Russia, though, and with big-hitters such as Gerard Holden of Barclays and Joe Nally of Cenkos behind it, Eureka stands as good a chance as any of weathering the storm. Ambrian sets a target price of 175p. BUY

Net cash: $14m

Market makers: 6

Normal market size: 2,000

BULL POINTS

Full-scale molybdenum production is imminent

Attractive assets

Well-funded and backed

PapalPower

- 03 Jan 2006 08:52

- 171 of 215

- 03 Jan 2006 08:52

- 171 of 215

Good to see some blue today, this could be the start of a long run of mostly blue into that first production and sales of Molybdenum in a couple of months time.

tallsiii

- 03 Jan 2006 08:56

- 172 of 215

- 03 Jan 2006 08:56

- 172 of 215

Yes, can't seeing getting below a pound again now... barring a disaster.

PapalPower

- 03 Jan 2006 09:33

- 173 of 215

- 03 Jan 2006 09:33

- 173 of 215

I just hope that Kevin has some good news for us this week or next, that should take us past the 150p barrier with good news on Chelyabinsk some time this month.

PapalPower

- 04 Jan 2006 00:49

- 174 of 215

- 04 Jan 2006 00:49

- 174 of 215

The other thing is that the start of year weakness in Moly should go later this month or Feb and the price will shoot up again just before EKA starts selling. The outlook for Moly long term is a much higher price and here is just one example why.

SynFuel, the Petroleum Alternative

Zach Fross

December 7th, 2005

With the coming oil crisis looming directly ahead, there are going to be many opportunities in the energy sector to cash-in. One such opportunity will be alternative petroleum sources such as coal-to-liquid-fuel and natural gas-to-liquid fuel (GTL), otherwise known as synthetic fuel or SynFuel. SynFuel is rapidly becoming a popular alternative to increasingly expensive petroleum.

According to the U.S.E.I.A, the Middle East has an estimated 1.4 trillion cubic feet of untapped natural gas resources. In comparison the U.S. uses approximately 22.4 million cubic feet of natural gas per year. The problem for the Middle East is that it is difficult to get these vast resources to market; there is no existing infrastructure (i.e. pipelines, transport, etc.). With GTL technology, the natural gas is converted to liquid fuel (diesel, naphtha, and kerosene) and then transported to market utilizing existing infrastructure. This enables the Middle East to exploit vast natural gas resources and bring natural gas to market cheaply and efficiently.

The International Energy Agency recently released a report detailing the projected energy demand to grow over 50% by 2030. The estimated dollar amount to bring the energy supply inline with the increasing energy demand is $17 trillion. It is highly unlikely that the funds will be invested in enough time to keep the energy market from reaching supply deficiencies. This means that the price of oil will increase until the increasing demand is met with an increasing supply.

Two progressively more popular petroleum alternatives are coal liquefaction and natural gas-to-liquid fuel; otherwise respectively know as Clean Coal Technology and GTL. Recently, a company called Waste Management and Processors Inc. (WMPI) received government approval along with $100 million in federal funds to build the United States first waste coal liquefaction facility in Pennsylvania. The major technology used in liquefaction and GTL technology is the Fischer-Tropsch (FT) process.

The primary materials used in the FT catalytic conversion process are nickel, cobalt, and molybdenum. The better the catalytic material, the more liquid output obtained from the process. Molybdenum is the best catalyst and is becoming the most widely used. A full-scale SynFuel operation uses several tons of catalytic material per day ! As more and more countries around the globe begin utilizing the FT process to convert coal and natural gas into liquid fuel demand for catalytic material will proportionately increase.

Look for investment opportunities in the catalyst and catalyst materials markets. As new SynFuel plants come online, the demand for materials like molybdenum and cobalt will rise dramatically.

12/07/2005

Zach Fross

SynFuel, the Petroleum Alternative

Zach Fross

December 7th, 2005

With the coming oil crisis looming directly ahead, there are going to be many opportunities in the energy sector to cash-in. One such opportunity will be alternative petroleum sources such as coal-to-liquid-fuel and natural gas-to-liquid fuel (GTL), otherwise known as synthetic fuel or SynFuel. SynFuel is rapidly becoming a popular alternative to increasingly expensive petroleum.

According to the U.S.E.I.A, the Middle East has an estimated 1.4 trillion cubic feet of untapped natural gas resources. In comparison the U.S. uses approximately 22.4 million cubic feet of natural gas per year. The problem for the Middle East is that it is difficult to get these vast resources to market; there is no existing infrastructure (i.e. pipelines, transport, etc.). With GTL technology, the natural gas is converted to liquid fuel (diesel, naphtha, and kerosene) and then transported to market utilizing existing infrastructure. This enables the Middle East to exploit vast natural gas resources and bring natural gas to market cheaply and efficiently.

The International Energy Agency recently released a report detailing the projected energy demand to grow over 50% by 2030. The estimated dollar amount to bring the energy supply inline with the increasing energy demand is $17 trillion. It is highly unlikely that the funds will be invested in enough time to keep the energy market from reaching supply deficiencies. This means that the price of oil will increase until the increasing demand is met with an increasing supply.

Two progressively more popular petroleum alternatives are coal liquefaction and natural gas-to-liquid fuel; otherwise respectively know as Clean Coal Technology and GTL. Recently, a company called Waste Management and Processors Inc. (WMPI) received government approval along with $100 million in federal funds to build the United States first waste coal liquefaction facility in Pennsylvania. The major technology used in liquefaction and GTL technology is the Fischer-Tropsch (FT) process.

The primary materials used in the FT catalytic conversion process are nickel, cobalt, and molybdenum. The better the catalytic material, the more liquid output obtained from the process. Molybdenum is the best catalyst and is becoming the most widely used. A full-scale SynFuel operation uses several tons of catalytic material per day ! As more and more countries around the globe begin utilizing the FT process to convert coal and natural gas into liquid fuel demand for catalytic material will proportionately increase.

Look for investment opportunities in the catalyst and catalyst materials markets. As new SynFuel plants come online, the demand for materials like molybdenum and cobalt will rise dramatically.

12/07/2005

Zach Fross

PapalPower

- 04 Jan 2006 14:50

- 175 of 215

- 04 Jan 2006 14:50

- 175 of 215

Well if Eureka has had a Celtic Resources shadow cast over it and dragging it down, then things will soon look better I think. Simon Cawkwell hears things will soon be all ok for Celtic and is backing our beloved Kevin Foo (All in his latest diary entry at www.t1ps.com)

This could mean a nice big news item coming for Eureka as well, now are we expecting some licencing news at EKA this month ??

This could mean a nice big news item coming for Eureka as well, now are we expecting some licencing news at EKA this month ??