| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Davai - 18 Apr 2012 11:13

Thread designed to record set-ups and targets on index and FX pairs.

'A market is only your enemy until you understand it, then it becomes your best friend.'

Any questions, please feel free to ask.

From time to time i may openly state an opinion regarding direction of a set-up and wish to add that in no way am i recommending a trade. I am sometimes only in trades for a matter of minutes and can't always update as to entry/exits taken.

As always, markets are dangerous places to be and must be respected as such. Always use stop losses and never over-leverage; 3% of your pot as a maximum per trade. As always, YOU are responsible for your own trades! Happy pip hunting!

Click HERE to visit me at FXtechnicals.net

Davai - 20 Dec 2012 15:52 - 170 of 423

Davai - 20 Dec 2012 16:05 - 171 of 423

Hopefully if any lurkers are following you can understand me?! Take the chart in 169, (i kept it simple), delete the A&B and replace it with 1&2 and you can see the opposite scenario exists, it would mean we are now in the 3rd and could go a long way south. Unfortunately, as easy as the Euro was to read last night, its currently not so obvious. When in doubt stay out... a bit more PA and it should become obvious!

My thoughts are that we didn't reach any important Fib level that i could see to call a top. There are many counts that this pullback could conform to and thus still be merely corrective. We will know soon enough.

My thoughts are that we didn't reach any important Fib level that i could see to call a top. There are many counts that this pullback could conform to and thus still be merely corrective. We will know soon enough.

Davai - 20 Dec 2012 16:11 - 172 of 423

Just as an aside, it might be a bit early to state this just yet, but, right now the Dow has also bounced cleanly off of its lower channel and as previously stated, i reckon it has further north to go yet and this is a corrective move... PA a little difficult to determine right now, but by rights we should now be in our 'B' wave, a clean break of the lower TL will gain attention.

I'm currently watching to see if i can recognise a minor 5w up or down. Again this afternoons data has made things a little harder to decipher... time for a cuppa instead!

*Edit* late Thurs eve, looks like being in minor 'C' of 'B', so 5w short to come?

I'm currently watching to see if i can recognise a minor 5w up or down. Again this afternoons data has made things a little harder to decipher... time for a cuppa instead!

*Edit* late Thurs eve, looks like being in minor 'C' of 'B', so 5w short to come?

Davai - 20 Dec 2012 19:54 - 173 of 423

Davai - 21 Dec 2012 09:06 - 174 of 423

Wow, some nasty spike down on the Dow. Hmmmmm, sometimes being GMT+2 can be a right pain in the arse! I feel that working 12 hours a day is quite enough! I felt last night, before shutting down, that we were in minor 'C' of 'B' with the 'C' wave short to come. However, it could have dragged on for all night for all i knew and my disciplined approach means i can't take a 'freestyle' short, there has to be the minor 5w down first to enable a stop placement (pip above the high). On top of that, who knows how severe the 'C' wave will be? It could be shallow, long, slow, diagonal etc etc, but its always annoying to wake up and see a really fast and deep one missed!

Ok, my own words, the market will still be there tomorrow...

It looks likely the top of the 5th of the 3rd was indeed reached as with the breach of the previous lower TL last night, it makes this a likely 4th. A break of 13,013 negates, (which also makes the low of the spike one hell of a good R:R trade), no good seeing it in hindsight admittedly, however!).

We should now be able to re-adjust our channel lines and start looking for projections as to a 5th wave;

As always, nothing is set in stone. The one thing to stress is that, views, targets change with more PA, a plan is exactly that, it can later be proved wrong, but so long as we adjust accordingly and only take the low risk trades, then we can beat the market. Its obvious that one wrong count can throw everything out and cause losses, that's where the discipline kicks in...

Right, looks like i'm missing tonnes of 4th waves right now... lots to do, little time!

Ok, my own words, the market will still be there tomorrow...

It looks likely the top of the 5th of the 3rd was indeed reached as with the breach of the previous lower TL last night, it makes this a likely 4th. A break of 13,013 negates, (which also makes the low of the spike one hell of a good R:R trade), no good seeing it in hindsight admittedly, however!).

We should now be able to re-adjust our channel lines and start looking for projections as to a 5th wave;

As always, nothing is set in stone. The one thing to stress is that, views, targets change with more PA, a plan is exactly that, it can later be proved wrong, but so long as we adjust accordingly and only take the low risk trades, then we can beat the market. Its obvious that one wrong count can throw everything out and cause losses, that's where the discipline kicks in...

Right, looks like i'm missing tonnes of 4th waves right now... lots to do, little time!

Davai - 21 Dec 2012 09:09 - 175 of 423

Davai - 21 Dec 2012 09:32 - 176 of 423

That will teach me... posting on here instead of working... just missed what appears to be a 4th wave trade on the GbpJpy. Remember yesterday? A clear 5w 'A' down move. Obviously followed by B&C;

Now a close up of 'C';

Bit hastily done, so will try and determine a minor 5/3, in case its not too late for a trade...

*Edit*, hmmmm the 'C' wave of 4 isn't clear enough, so will watch this one with hands sat upon...

Now a close up of 'C';

Bit hastily done, so will try and determine a minor 5/3, in case its not too late for a trade...

*Edit*, hmmmm the 'C' wave of 4 isn't clear enough, so will watch this one with hands sat upon...

Davai - 21 Dec 2012 11:07 - 177 of 423

Quick update, post 155; Dax;

(The '5' was as far to the right of the screen as i could manage and not meant to be to scale!) I'm not pretending to be able to call the wave structure in advance. I never took this trade as i missed the best entry point (again!), the point is it that the prediction was higher to come... even banking at point 'a' would have seen a handsome profit. I need to get sharper...

Update;

(The '5' was as far to the right of the screen as i could manage and not meant to be to scale!) I'm not pretending to be able to call the wave structure in advance. I never took this trade as i missed the best entry point (again!), the point is it that the prediction was higher to come... even banking at point 'a' would have seen a handsome profit. I need to get sharper...

Update;

Davai - 21 Dec 2012 14:17 - 178 of 423

Post 176, GbpJpy... A frustrating day, missed entry by couple of minutes and the minor wave 2 was complex, thus impossible to read, todays missed trade;

Earlier;

Update;

That's 80 pips gone begging (and an original 35pip risk, although any deeper than the 38.2% retrace level and its highly unlikely to have been a 4th wave any longer, so feasibly, you could have reduced that to 10pips)

Primary target (the 61.8% extension) has been hit, not being able to read the 5th wave, would have seen me exit here. Nothing wrong in leaving a bit for the next man if it continues lower. It may head to its lower TL and the 100% level, but if the trade had been taken, i know in my heart the profit would have had to have been banked here! Look for the next set-up i guess...

Earlier;

Update;

That's 80 pips gone begging (and an original 35pip risk, although any deeper than the 38.2% retrace level and its highly unlikely to have been a 4th wave any longer, so feasibly, you could have reduced that to 10pips)

Primary target (the 61.8% extension) has been hit, not being able to read the 5th wave, would have seen me exit here. Nothing wrong in leaving a bit for the next man if it continues lower. It may head to its lower TL and the 100% level, but if the trade had been taken, i know in my heart the profit would have had to have been banked here! Look for the next set-up i guess...

Davai - 21 Dec 2012 16:44 - 179 of 423

Ok, so who shot Cable then? Come on, own up! I thought there was lower to come, but i didn't realise how poorly it was feeling.

Ok, well, time to get off of here. My friends King Kavod and Baron beer are here, so its better for all if i refrain from posting anymore tonight!

Have a great weekend all... )

Ok, well, time to get off of here. My friends King Kavod and Baron beer are here, so its better for all if i refrain from posting anymore tonight!

Have a great weekend all... )

Davai - 24 Dec 2012 17:00 - 180 of 423

One last one this side of Christmas! I say that, but for me, where i am, Christmas is 7th Jan and a very traditional affair... nothing to do with giving of gifts at all, so its not feeling particularly Christmassy for me at all right now, (apart from the fact there is three feet of snow outside)

Anyway, hour and half ago;

Update, (slight adjustment of lower TL req'd);

Merry Christmas all )

Anyway, hour and half ago;

Update, (slight adjustment of lower TL req'd);

Merry Christmas all )

Davai - 03 Jan 2013 13:12 - 181 of 423

So a Happy and (hopefully) prosperous New Year to everyone.

Euro; and i was getting all geared up to look further south earlier (after an ABC retrace)

however i notice that, looking on the daily, the 5-3-5 (Y wave) shown above (100% of each other) doesn't reach any Fib level of the first set (W) wave;

Therefore it is far more likely to be broken down into a further W-X-Y move of which we are near the end of the 'C' wave of the 'X'. This would see a further complete 5-3-5 to come (on the daily) taking us to approx 13,800 which will be 100% of the original 'W' wave...

The recent ABC count looks far more likely (imo).

Ok, so this is looking longer term and merely an overall plan; The next thing to look for will be minor 5 waves up ('A') breaching the prior 4th wave (reflex point), after a smaller ABC retrace ('B') we can get long, knowing at least we will have a 5w 'C' to follow.

Failing this, an (irregular) ABC will signal further weakness.

Euro; and i was getting all geared up to look further south earlier (after an ABC retrace)

however i notice that, looking on the daily, the 5-3-5 (Y wave) shown above (100% of each other) doesn't reach any Fib level of the first set (W) wave;

Therefore it is far more likely to be broken down into a further W-X-Y move of which we are near the end of the 'C' wave of the 'X'. This would see a further complete 5-3-5 to come (on the daily) taking us to approx 13,800 which will be 100% of the original 'W' wave...

The recent ABC count looks far more likely (imo).

Ok, so this is looking longer term and merely an overall plan; The next thing to look for will be minor 5 waves up ('A') breaching the prior 4th wave (reflex point), after a smaller ABC retrace ('B') we can get long, knowing at least we will have a 5w 'C' to follow.

Failing this, an (irregular) ABC will signal further weakness.

Davai - 03 Jan 2013 14:09 - 182 of 423

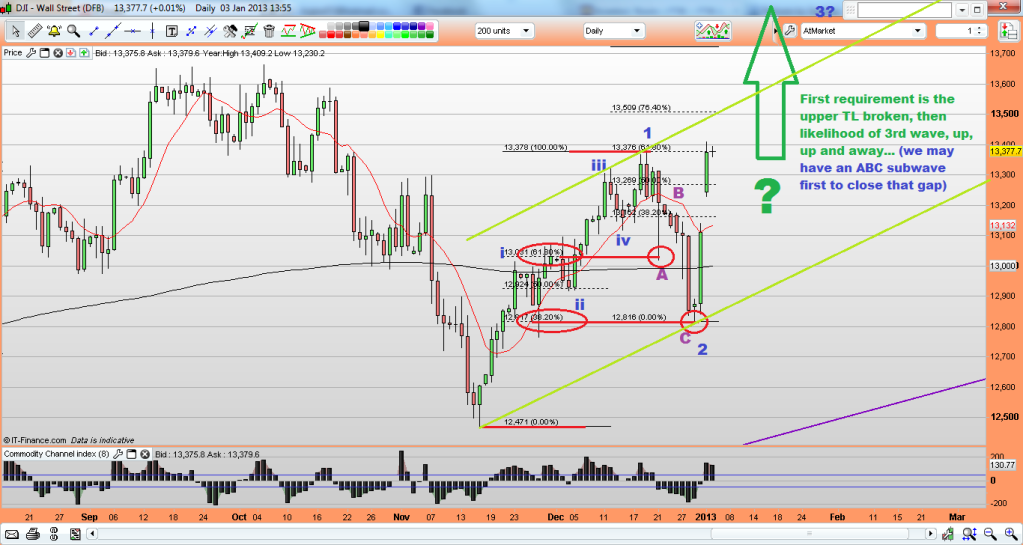

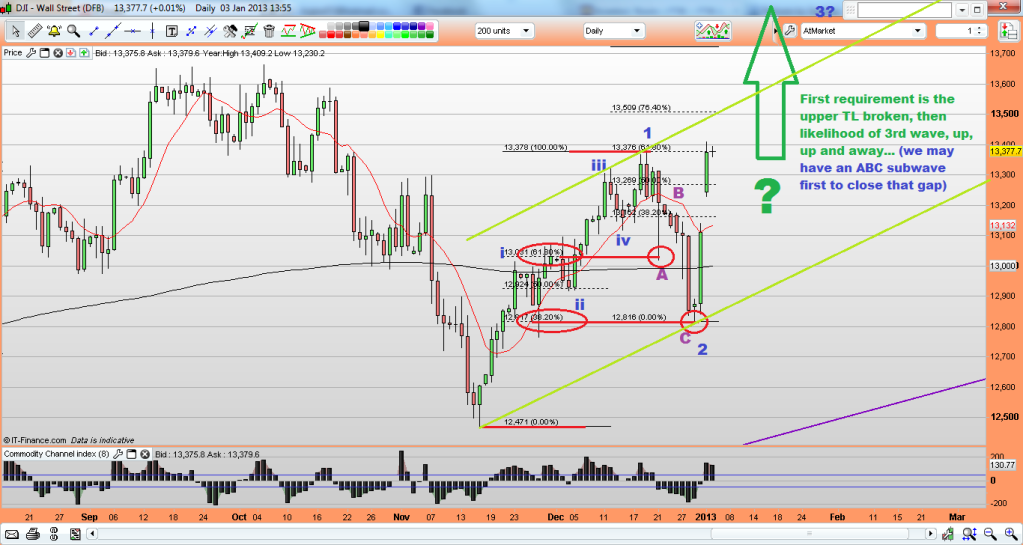

Bit of fun with the Dow, needs more evidence yet, but the way it respected the 61.8% & 38.2% fib levels on the recent pullback, looks ominously like ('A' & 'C' corrective waves);

Remember we have a couple of months yet before the 'Fiscal Cliff and debt ceiling prob's will resurface, so it's certainly a possibility... still lots of shorters around to fuel the rally...

Remember we have a couple of months yet before the 'Fiscal Cliff and debt ceiling prob's will resurface, so it's certainly a possibility... still lots of shorters around to fuel the rally...

Davai - 03 Jan 2013 20:12 - 183 of 423

Ok, so i've mentioned having an overall trading plan, but that i trade on smaller timescales. Here is an example;

Post 181, earlier this afternoon contained this chart;

Its the 4hr Euro showing the fibs of wave A replicated to wave C. I also have a trendline (in grey) meeting the common 161.8% extension at approx 13,060, so this was a valid target.

Now looking closer at the C wave, i have my Elliott channel lines and fib extensions drawn in. I also have a 61.8% extension at the 13.060 level. Add to this that the PA this afternoon (purple circle) looked decidedly corrective, it started to look even more like a certainty...

Here i have zoomed into that area to further explain;

I couldn't label it any other way than to be corrective and breaking down the subwaves, it was possible to have confidence in entering short near the top of the 'C' wave. With the channel lines in place, the stop point was just above the top TL (nothing is set in stone!).

However, shorting at 13,115, stop at 13,140 and target of 13,062, was both high probability and also good R:R.

An earlier flag system trade also gave a lower target of 13,046.

The Euro has certainly been weak the last couple of days and i'm struggling to label the wave count right now. Being able to determine corrective pullbacks whilst within the channel lines is all that is really necessary. When the top TL gets broken, its time to stop shorting! I have no idea right now if the grey TL will provide support or if the 61.8% level (mentioned above will provide the bounce). This is why i wouldn't advocate just going long at an area that you perceive to be a target. Better to gather evidence first. A trade requires planning, so its either short the next pullback if corrective, or if not, the impulsive 5w advance should breach a prior 'reflex' point to confirm trend change...

Post 181, earlier this afternoon contained this chart;

Its the 4hr Euro showing the fibs of wave A replicated to wave C. I also have a trendline (in grey) meeting the common 161.8% extension at approx 13,060, so this was a valid target.

Now looking closer at the C wave, i have my Elliott channel lines and fib extensions drawn in. I also have a 61.8% extension at the 13.060 level. Add to this that the PA this afternoon (purple circle) looked decidedly corrective, it started to look even more like a certainty...

Here i have zoomed into that area to further explain;

I couldn't label it any other way than to be corrective and breaking down the subwaves, it was possible to have confidence in entering short near the top of the 'C' wave. With the channel lines in place, the stop point was just above the top TL (nothing is set in stone!).

However, shorting at 13,115, stop at 13,140 and target of 13,062, was both high probability and also good R:R.

An earlier flag system trade also gave a lower target of 13,046.

The Euro has certainly been weak the last couple of days and i'm struggling to label the wave count right now. Being able to determine corrective pullbacks whilst within the channel lines is all that is really necessary. When the top TL gets broken, its time to stop shorting! I have no idea right now if the grey TL will provide support or if the 61.8% level (mentioned above will provide the bounce). This is why i wouldn't advocate just going long at an area that you perceive to be a target. Better to gather evidence first. A trade requires planning, so its either short the next pullback if corrective, or if not, the impulsive 5w advance should breach a prior 'reflex' point to confirm trend change...

Davai - 06 Jan 2013 12:49 - 184 of 423

Couple of updates;

The Euro went further in its channel to its 200% level of 'A' which co-incided with 13,000. Like i said earlier, stay short until it breaks out of the channel. We get a nice CCI trigger at the same time;

The Audi also bounced off of its 261.8% level for 'C' ending with a nice flag trade too;

Update;

The Euro went further in its channel to its 200% level of 'A' which co-incided with 13,000. Like i said earlier, stay short until it breaks out of the channel. We get a nice CCI trigger at the same time;

The Audi also bounced off of its 261.8% level for 'C' ending with a nice flag trade too;

Update;

Davai - 07 Jan 2013 10:25 - 185 of 423

Been looking at the best pair to get positioned long this morning. The picture does appear to be long almost everything, but of course that doesn't mean take any old position. Patience is still required so as to get a low risk entry. The EurJpy looked to be the pick of the bunch;

It appears to have the 5w up after breaking out of the corrective down channel last week, followed by a nice ABC back down overnight/this morning. The A&C waves respecting Fib levels along with the minor 5th of the 'C' hitting its 61.8% simultaneously. I missed going long right there, so waited for another minor 5w up, abc back and went long on a fresh high treating it as a 123 reversal. Stop is below the indicated point 'C' so quite low risk, but not as ideal as going long off of the Fib level itself with a typical 10 pip stop. Lets see what happens. I'm evidence gathering right now and only have an initial small position, i want to get heavily long if possible. A flag trade would be nice, failing that it looks like it will take out the prior 4th and then retrace yet again. If i can follow it on a small timescale and determine another abc, we should really be able to have confidence in this trade....

It appears to have the 5w up after breaking out of the corrective down channel last week, followed by a nice ABC back down overnight/this morning. The A&C waves respecting Fib levels along with the minor 5th of the 'C' hitting its 61.8% simultaneously. I missed going long right there, so waited for another minor 5w up, abc back and went long on a fresh high treating it as a 123 reversal. Stop is below the indicated point 'C' so quite low risk, but not as ideal as going long off of the Fib level itself with a typical 10 pip stop. Lets see what happens. I'm evidence gathering right now and only have an initial small position, i want to get heavily long if possible. A flag trade would be nice, failing that it looks like it will take out the prior 4th and then retrace yet again. If i can follow it on a small timescale and determine another abc, we should really be able to have confidence in this trade....

Davai - 07 Jan 2013 10:32 - 186 of 423

The point about EW is not that it is some miracle way of trading. Having only one count in mind is dangerous and will undoubtedly lead to failure. Its a case of adjusting to the PA as it unfolds. I am using this thread as a diary. My thoughts change consistently as various points get breached and its difficult to record every change in my thought process. Right now i am biased long on the Euro, the Yen pairs, the Audi, Kiwi, markets.... yep just about everything... that is a dangerous thought and i'm still mindful of deep corrective moves, so discipline remains key. Placing a trade and hoping is pointless as is not having confidence behind your trade. I am looking for a flag trade because i have a system which gives very very high probability if triggered correctly, its these trades that breed the confidence to stake heavily and make a real difference.... Right back to the screens...

Davai - 08 Jan 2013 12:16 - 187 of 423

Euro;

Breaking down the ABC;

If so, some very deep 4th waves. (subwave 'iv' & 4 itself) of 'C' retracing to the absolute max within the rules, ie, to within a pip of their respective wave 1's.

This is possibly only the abc of 'A' as its quite short, so 'B' & 'C' to follow, (of which 'B' might have completed.

We have a flag trade setting up above which should only trigger when the full ABC is complete, lets see...

Breaking down the ABC;

If so, some very deep 4th waves. (subwave 'iv' & 4 itself) of 'C' retracing to the absolute max within the rules, ie, to within a pip of their respective wave 1's.

This is possibly only the abc of 'A' as its quite short, so 'B' & 'C' to follow, (of which 'B' might have completed.

We have a flag trade setting up above which should only trigger when the full ABC is complete, lets see...