| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Traders Thread - Monday 7th August (TRAD)

Greystone

- 06 Aug 2006 16:57

- 2 of 16

- 06 Aug 2006 16:57

- 2 of 16

Greystone

- 06 Aug 2006 16:58

- 3 of 16

- 06 Aug 2006 16:58

- 3 of 16

Greystone

- 06 Aug 2006 16:58

- 4 of 16

- 06 Aug 2006 16:58

- 4 of 16

Greystone

- 06 Aug 2006 16:59

- 5 of 16

- 06 Aug 2006 16:59

- 5 of 16

| A Brief Look At The Week Ahead | |

| It is another week with a heavy financial bias as insurance giants and the last of the major banks reveal their numbers. Before that, low-cost airline easyJet is set to deliver impressive growth at Monday's trading update, following in Ryanair's footsteps. The company upgraded its guidance last month when it said full-year pre-tax profits would increase by between 40% and 50% this year, compared with previous guidance of 10% to 15%. It has benefited from strong passenger numbers, ticket price rises and some hedging against rising fuel costs. The company may also comment further on issues such as plans for a new European hub and discussions about starting a franchise with aviation partners in the Middle East. Standard Chartered, the last of the big UK banks to present its interim results, reports on Tuesday this week. Like many of its peers, debts are expected to feature prominently. Deutsche Bank predicts a 76% increase in Standard Chartered's bad debt provision to $588m, mainly due to problems in Taiwan. However, the bank indicated just over a month ago that it had achieved double-digit growth in consumer and wholesale banking after enjoying buoyant conditions across Asia. It may also comment further on its acquisition plans after being linked to various potential targets including Pakistan's sixth-largest lender, Union Bank. UK's biggest insurer, Aviva, will present its interim results on Wednesday. The company said last month that sales growth in the first half of the year was up 20% on last year. At the same time, it announced the $2.9bn acquisition of US life insurer AmerUs as part of its strategy to expand into the American market. The group continues to face tough price competition in the UK general and life insurance sectors. Royal & SunAlliance, will be under pressure to impress the market again on Thursday. It set a high standard in the first quarter, producing a 29% rise in operating profits to 207m. The increase was driven by careful management of the pricing of its products, as well as favourable weather conditions which limited the number of claims. The key issues for the insurer are investment returns and reducing its exposure to asbestos claims in the US. The group may reveal more detail of its plans to cut 1,550 jobs over the next two years; around 1,000 of these going in the UK. Amongst others in the spotlight this week are :- Friends Provident and Scottish & Newcastle on Tuesday; ITV on Wednesday; International Power on Thursday and Schroders on Friday. So, another week of heavyweight blue chip action. Good hunting! Greystone (Greystone is Alan English, City Editor at MoneyAM.) | |

Greystone

- 07 Aug 2006 06:32

- 6 of 16

- 07 Aug 2006 06:32

- 6 of 16

Good morning traders!

In Asia today, the Hang Seng ended the morning down 20.65 points at 16,867.15, while the Nikkei was recently down 237.82 points at 15,261.36.

New York's main oil contract, light sweet crude for delivery in September, had surged $1.14 to $75.90 a barrel from its close of 74.76 usd in the US Friday.

Happy trading!

G.

In Asia today, the Hang Seng ended the morning down 20.65 points at 16,867.15, while the Nikkei was recently down 237.82 points at 15,261.36.

New York's main oil contract, light sweet crude for delivery in September, had surged $1.14 to $75.90 a barrel from its close of 74.76 usd in the US Friday.

Happy trading!

G.

Druid2

- 07 Aug 2006 07:18

- 7 of 16

- 07 Aug 2006 07:18

- 7 of 16

Good morning all.

KEAYDIAN

- 07 Aug 2006 08:42

- 8 of 16

- 07 Aug 2006 08:42

- 8 of 16

Rather grey today.

Stan

- 07 Aug 2006 09:56

- 9 of 16

- 07 Aug 2006 09:56

- 9 of 16

Morning All,

Where's Melnibone?

Where's Melnibone?

Melnibone - 07 Aug 2006 10:39 - 10 of 16

Hi, Stan, wasn't going to post much until after the Fed on Tuesday

evening.

Folk are worried about the balance between slowing US growth and inflation,

and what will happen if the Fed gets it wrong and one over balances the other.

Should get the market's concensus and reaction after Bernanke's words of

wisdom on Tuesday.

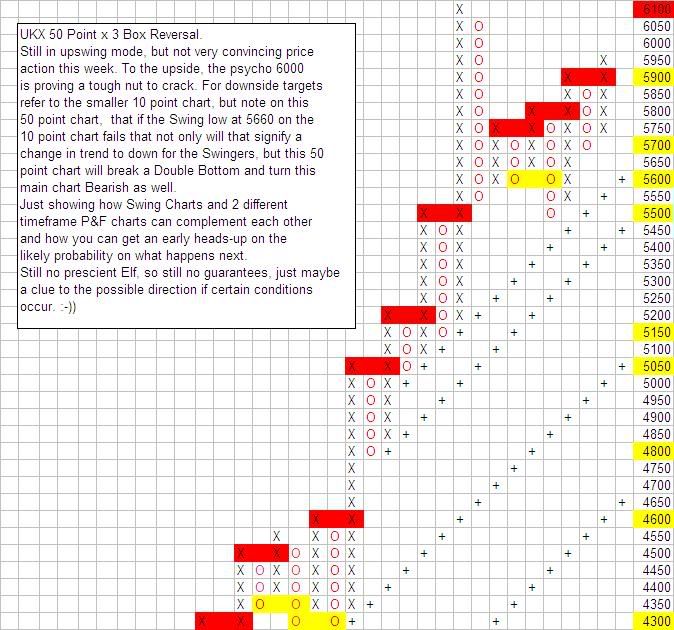

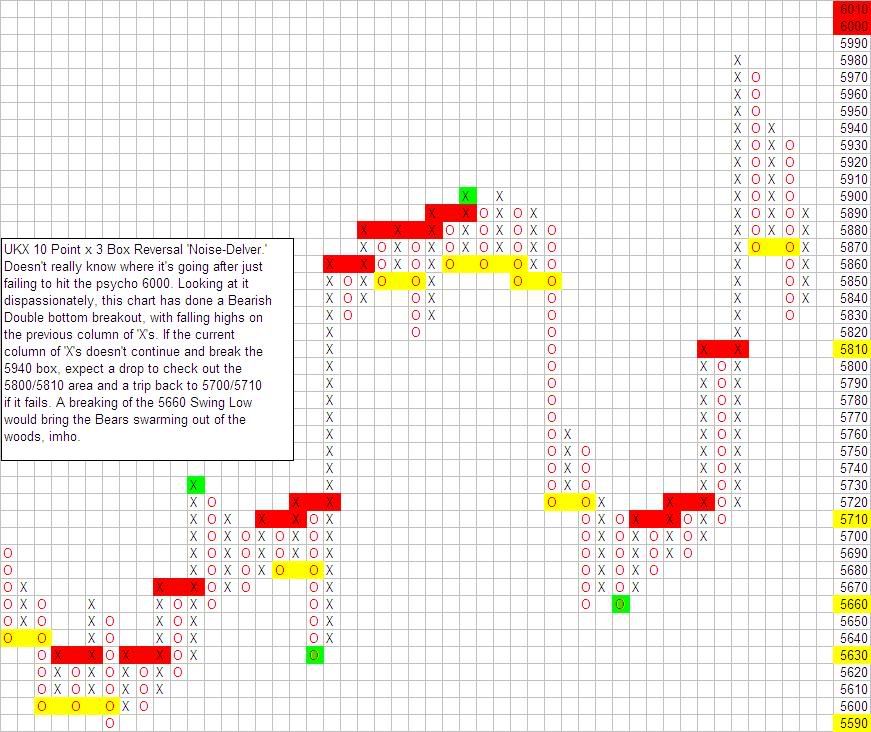

Here's a few charts to keep you going until then. Two P&F charts on the

Ftse, one showing the big picture and one showing the current 'noise'.

The third is a big picture view of the Eustox50 showing why stuff is a bit

hesitant at the moment.

evening.

Folk are worried about the balance between slowing US growth and inflation,

and what will happen if the Fed gets it wrong and one over balances the other.

Should get the market's concensus and reaction after Bernanke's words of

wisdom on Tuesday.

Here's a few charts to keep you going until then. Two P&F charts on the

Ftse, one showing the big picture and one showing the current 'noise'.

The third is a big picture view of the Eustox50 showing why stuff is a bit

hesitant at the moment.

Melnibone - 07 Aug 2006 10:39 - 11 of 16

Melnibone - 07 Aug 2006 10:40 - 12 of 16

Melnibone - 07 Aug 2006 10:40 - 13 of 16

Melnibone - 07 Aug 2006 10:43 - 14 of 16

All the above charts are using Friday's closing prices.

Today's action not included, but you can see how the UKX smaller

10 point chart has identified the initial support for the Ftse

in today's action so far.

Doesn't mean it will hold here, but it's your starter for 10. ;-)

Maybe catch you later.

Today's action not included, but you can see how the UKX smaller

10 point chart has identified the initial support for the Ftse

in today's action so far.

Doesn't mean it will hold here, but it's your starter for 10. ;-)

Maybe catch you later.

Greystone

- 07 Aug 2006 12:27

- 15 of 16

- 07 Aug 2006 12:27

- 15 of 16

Greystone

- 07 Aug 2006 17:08

- 16 of 16

- 07 Aug 2006 17:08

- 16 of 16

- Page:

- 1