| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Traders Thread - Wednesday 13th August (TRAD)

skinny

- 13 Aug 2014 05:53

- 2 of 16

- 13 Aug 2014 05:53

- 2 of 16

Morning!

In the US last night, the Dow fell 9 points to 16,561, the Nasdaq fell 12 points to

4,389 and the S&P 500 lost 3 points at 1,934.

In Asia today, the Nikkei was recently up 49.89 points at 15,218.76 and the Hang Seng

down 58.48 points at 24,630.93.

WTI crude oil traded at $97.37 a barrel and Brent at $103.02.

Gold settled at $1,285 an ounce.

Live long and prosper!

In the US last night, the Dow fell 9 points to 16,561, the Nasdaq fell 12 points to

4,389 and the S&P 500 lost 3 points at 1,934.

In Asia today, the Nikkei was recently up 49.89 points at 15,218.76 and the Hang Seng

down 58.48 points at 24,630.93.

WTI crude oil traded at $97.37 a barrel and Brent at $103.02.

Gold settled at $1,285 an ounce.

Live long and prosper!

skinny

- 13 Aug 2014 09:25

- 3 of 16

- 13 Aug 2014 09:25

- 3 of 16

skinny

- 13 Aug 2014 09:31

- 4 of 16

- 13 Aug 2014 09:31

- 4 of 16

GBP Average Earnings Index 3m/y -0.2% -0.1% 0.3%

GBP Claimant Count Change -33.6K -29.7K -36.3K

GBP Unemployment Rate 6.4% 6.4% 6.5%

GBP Claimant Count Change -33.6K -29.7K -36.3K

GBP Unemployment Rate 6.4% 6.4% 6.5%

skinny

- 13 Aug 2014 09:42

- 5 of 16

- 13 Aug 2014 09:42

- 5 of 16

skinny

- 13 Aug 2014 10:00

- 6 of 16

- 13 Aug 2014 10:00

- 6 of 16

CHF ZEW Economic Expectations 2.5 0.1

EUR Industrial Production m/m -0.3% 0.5% -1.1%

EUR Industrial Production m/m -0.3% 0.5% -1.1%

skinny

- 13 Aug 2014 10:39

- 7 of 16

- 13 Aug 2014 10:39

- 7 of 16

skinny

- 13 Aug 2014 10:46

- 8 of 16

- 13 Aug 2014 10:46

- 8 of 16

German 10-y Bond Auction 1.08|1.6 1.20|1.6

skinny

- 13 Aug 2014 10:56

- 9 of 16

- 13 Aug 2014 10:56

- 9 of 16

skinny

- 13 Aug 2014 11:03

- 10 of 16

- 13 Aug 2014 11:03

- 10 of 16

midknight

- 13 Aug 2014 12:11

- 11 of 16

- 13 Aug 2014 12:11

- 11 of 16

ExecLine

- 13 Aug 2014 12:22

- 12 of 16

- 13 Aug 2014 12:22

- 12 of 16

August 13, 2014

BoE sharply cuts wage growth forecast

It is noted that the Bank of England has sharply cut its forecast for wage growth this year as it confirmed interest rate rises will be gradual, striking a doveish tone in its latest assessment.

In its quarterly Inflation Report, the BoE lowered its wage estimate for 2014 from 2.5 per cent to 1.25 per cent, also shading down its estimate for 2015.

The Bank also cut its unemployment forecast sharply and also signalled wage growth has become its key indicator for determining when interest rates are likely to rise. The assessment used data which showed, despite further declines in unemployment, wages were being squeezed as they fell for the first time since 2009, pushing the pound down to a ten-week low.

“The Committee will be placing particular importance on the prospective paths for wages and unit labour costs,” Mr Carney said, while emphasing the Monetary Policy Committee did not have a new “wages threshold” to determine when rates would start to rise.

The estimate for the amount of slack in the economy has been reduced from 1-1.5 per cent to 1 per cent, but there was little change to the inflation forecast, with the outlook for 2015 reduced to 1.7 per cent from 1.8 per cent and in 2016 to 1.8 per cent from 1.9 per cent.

The assessment comes amid heightened expectations of interest rate increases, with some economists predicting a move as soon as this year. However, while our BoE acknowledged the sharp improvement in the jobs market, it laid special emphasis on the weakness of wages as an indicator of slack.

“It seems likely that slack over the past year or two has been greater than previously thought and it also seems likely that slack is being used up at a faster rate than expected,” was the assessment.

“In light of the heightened uncertainty about the current degree of slack, the committee noted the importance of monitoring the expected path of costs, particularly wages, in assessing inflationary pressures.”

Accordingly, the BoE reiterated its previous views on the interest rate outlook in the report: “When the Bank Rate begins to rise, the committee expects it will do so only gradually, and probably to a level materially below its historic average.”

On the timing of any future rate rise Mark Carney, BoE governor, refused to be specific, saying only that he would not comment on “precise jumping around on timing”, but that we should expect there to be some increase in interest rates over the next three years.

Mr Carney said that the majority of households, in the absence of wage increases, would have to take “significant expenditure adjustments” if rates increased to 2 per cent, providing another reason for why he expects interest rate increases to “move gradually” when they do begin. Low, stable, predictable inflation remains “resolutely the focus”, he added.

An economist at Markit, said that while calls to raise rates will probably gain momentum over the next few months, it was unlikely to reach a majority vote until around February, unless wages pick up enough to consider a move in November.

“The report and recent rhetoric from policy makers gives the impression that rates will not rise until wage growth is showing clear signs of picking up,” he said.

In its outlook the MPC increased its growth forecasts for 2014 slightly to 3.5 per cent from 3.4 per cent, and to 3 per cent from 2.9 per cent in 2015, reflecting confidence in the strength of the UK’s economic recovery. Mr Carney said that the recovery was not a debt-fuelled one, and relatively broad based and he also stressed that the big question was whether productivity growth would accelerate.

“I would not be definitive that this is a healthy, sustainable path of growth, it’s still part of a transition to a more balanced economy,” he said.

The BoE's unemployment forecast was cut dramatically in 2014 to 5.9 per cent from 6.3 per cent as hiring continues to accelerate.

BoE sharply cuts wage growth forecast

It is noted that the Bank of England has sharply cut its forecast for wage growth this year as it confirmed interest rate rises will be gradual, striking a doveish tone in its latest assessment.

In its quarterly Inflation Report, the BoE lowered its wage estimate for 2014 from 2.5 per cent to 1.25 per cent, also shading down its estimate for 2015.

The Bank also cut its unemployment forecast sharply and also signalled wage growth has become its key indicator for determining when interest rates are likely to rise. The assessment used data which showed, despite further declines in unemployment, wages were being squeezed as they fell for the first time since 2009, pushing the pound down to a ten-week low.

“The Committee will be placing particular importance on the prospective paths for wages and unit labour costs,” Mr Carney said, while emphasing the Monetary Policy Committee did not have a new “wages threshold” to determine when rates would start to rise.

The estimate for the amount of slack in the economy has been reduced from 1-1.5 per cent to 1 per cent, but there was little change to the inflation forecast, with the outlook for 2015 reduced to 1.7 per cent from 1.8 per cent and in 2016 to 1.8 per cent from 1.9 per cent.

The assessment comes amid heightened expectations of interest rate increases, with some economists predicting a move as soon as this year. However, while our BoE acknowledged the sharp improvement in the jobs market, it laid special emphasis on the weakness of wages as an indicator of slack.

“It seems likely that slack over the past year or two has been greater than previously thought and it also seems likely that slack is being used up at a faster rate than expected,” was the assessment.

“In light of the heightened uncertainty about the current degree of slack, the committee noted the importance of monitoring the expected path of costs, particularly wages, in assessing inflationary pressures.”

Accordingly, the BoE reiterated its previous views on the interest rate outlook in the report: “When the Bank Rate begins to rise, the committee expects it will do so only gradually, and probably to a level materially below its historic average.”

On the timing of any future rate rise Mark Carney, BoE governor, refused to be specific, saying only that he would not comment on “precise jumping around on timing”, but that we should expect there to be some increase in interest rates over the next three years.

Mr Carney said that the majority of households, in the absence of wage increases, would have to take “significant expenditure adjustments” if rates increased to 2 per cent, providing another reason for why he expects interest rate increases to “move gradually” when they do begin. Low, stable, predictable inflation remains “resolutely the focus”, he added.

An economist at Markit, said that while calls to raise rates will probably gain momentum over the next few months, it was unlikely to reach a majority vote until around February, unless wages pick up enough to consider a move in November.

“The report and recent rhetoric from policy makers gives the impression that rates will not rise until wage growth is showing clear signs of picking up,” he said.

In its outlook the MPC increased its growth forecasts for 2014 slightly to 3.5 per cent from 3.4 per cent, and to 3 per cent from 2.9 per cent in 2015, reflecting confidence in the strength of the UK’s economic recovery. Mr Carney said that the recovery was not a debt-fuelled one, and relatively broad based and he also stressed that the big question was whether productivity growth would accelerate.

“I would not be definitive that this is a healthy, sustainable path of growth, it’s still part of a transition to a more balanced economy,” he said.

The BoE's unemployment forecast was cut dramatically in 2014 to 5.9 per cent from 6.3 per cent as hiring continues to accelerate.

skinny

- 13 Aug 2014 13:34

- 13 of 16

- 13 Aug 2014 13:34

- 13 of 16

USD Core Retail Sales m/m 0.1% 0.4% 0.4%

USD Retail Sales m/m 0.0% 0.2% 0.2%

USD Retail Sales m/m 0.0% 0.2% 0.2%

midknight

- 13 Aug 2014 15:28

- 14 of 16

- 13 Aug 2014 15:28

- 14 of 16

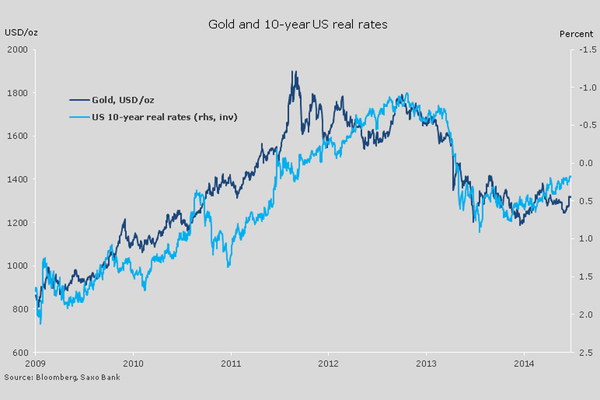

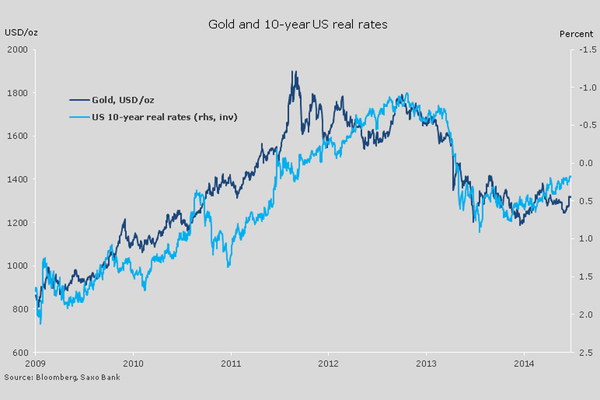

US Interest rates v Gold with chart.

skinny

- 13 Aug 2014 15:34

- 15 of 16

- 13 Aug 2014 15:34

- 15 of 16

The chart from post 14.

skinny

- 13 Aug 2014 17:06

- 16 of 16

- 13 Aug 2014 17:06

- 16 of 16

- Page:

- 1