| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Davai - 18 Apr 2012 11:13

Thread designed to record set-ups and targets on index and FX pairs.

'A market is only your enemy until you understand it, then it becomes your best friend.'

Any questions, please feel free to ask.

From time to time i may openly state an opinion regarding direction of a set-up and wish to add that in no way am i recommending a trade. I am sometimes only in trades for a matter of minutes and can't always update as to entry/exits taken.

As always, markets are dangerous places to be and must be respected as such. Always use stop losses and never over-leverage; 3% of your pot as a maximum per trade. As always, YOU are responsible for your own trades! Happy pip hunting!

Click HERE to visit me at FXtechnicals.net

Davai - 31 Jan 2013 18:42 - 284 of 423

Closer inspection makes this pullback a minor 4th, so higher to come later... 14,450/70 target area. Also have higher poss at around 12,465 for EJ too.

Davai - 01 Feb 2013 08:50 - 285 of 423

Have been run down with a cold lately, nothing major, but its surprising how tiredness affects you, feeling brighter this morning and a bit more on the ball.

I like this following chart a lot, it means higher to come yet for GJ before finishing the overall 3rd wave, (after a pullback minor 4th today and ignoring last nights chart!), this also coincides with my Cable call that we will print a B wave today (as of last nights chart, post 282).

I like this following chart a lot, it means higher to come yet for GJ before finishing the overall 3rd wave, (after a pullback minor 4th today and ignoring last nights chart!), this also coincides with my Cable call that we will print a B wave today (as of last nights chart, post 282).

Davai - 01 Feb 2013 10:09 - 286 of 423

Currently long EJ and trialling what i hope is a fantastic trading plan to be able to ride 3rd waves, small posi, but hoping this will prove itself... more about that later, but here's the chart to work to;

The reason i like it is because of the fib's. EW means little without them. The reaction at 300% of minor wave 'i' for top of 'iii' and then the minor 'v' hitting its 50% level as well as the top of the channel for end of wave 1 etc... lets see...

The reason i like it is because of the fib's. EW means little without them. The reaction at 300% of minor wave 'i' for top of 'iii' and then the minor 'v' hitting its 50% level as well as the top of the channel for end of wave 1 etc... lets see...

Davai - 01 Feb 2013 10:10 - 287 of 423

Davai - 01 Feb 2013 16:08 - 288 of 423

He he, what did i say earlier....? I'm not here to pick a top! I reckon we could possibly see a top very soon for Dow, wouldn't like to say how significant, just keeping an eye on some fibs converging at 14,070/80 as per previously posted...

That doesn't mean i'm recommending shorting it at that point, trend is up until proved otherwise...

That doesn't mean i'm recommending shorting it at that point, trend is up until proved otherwise...

Davai - 01 Feb 2013 16:19 - 289 of 423

Davai - 01 Feb 2013 16:28 - 290 of 423

Dow, if this is a top of a degree, there is lots of time to get short. Somehow can't see this rise ending in a fast turn around, there is too much momentum and printing going on, so i am now actually doubting it, (compared to when i posted up in Jan), but that's how it works, nobody thought we could get here so fast, remember, 'you don't want to be fighting the trend', there have been far too many bears around to keep feeding the flames.

Now we are here, everyone is bullish, perfect time for the rug to be pulled... Who know's? I posted 14,070 a few hundred points ago, now its close, maybe it will carry on. There are a plenty of other targets further up it can head too yet...

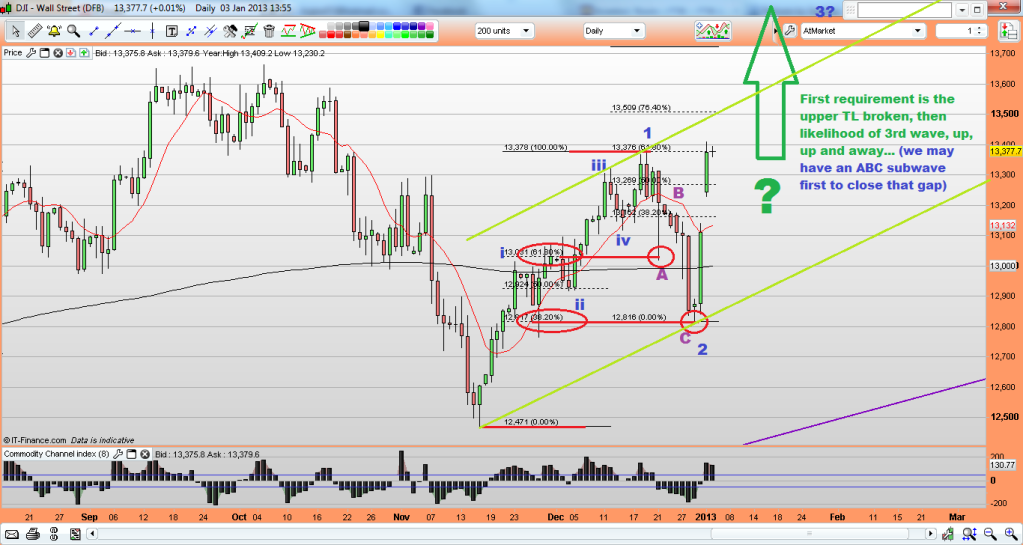

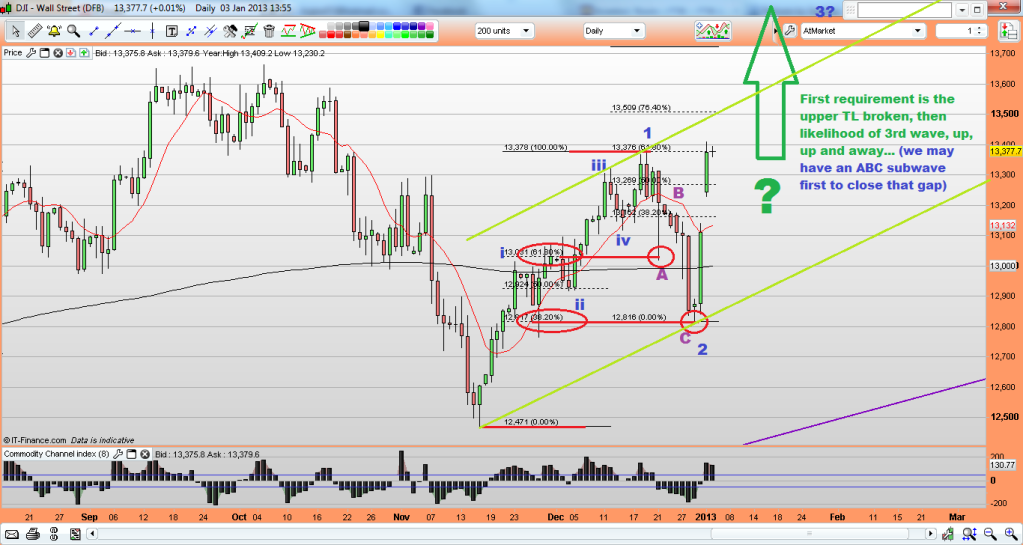

03 Jan, I have conflicting ideas for labeling;

and more recent, 23 Jan;

Going by the first count, we will certainly have further to go, 14,070 is 138.2% of wave 1 (if it can be labeled in 5), but it would be normal to expect 161.8%, so a few more hundred poss... Hmmmm, right now my head is scrambled from an arduous day and i'm about to have a nipple.... errrrrrr i mean tipple.

Like i said, don't fight the trend. none of the above really matters! Buy the pullbacks, until it breaks a prior reflex point and starts making LL's/LH's...

Now we are here, everyone is bullish, perfect time for the rug to be pulled... Who know's? I posted 14,070 a few hundred points ago, now its close, maybe it will carry on. There are a plenty of other targets further up it can head too yet...

03 Jan, I have conflicting ideas for labeling;

and more recent, 23 Jan;

Going by the first count, we will certainly have further to go, 14,070 is 138.2% of wave 1 (if it can be labeled in 5), but it would be normal to expect 161.8%, so a few more hundred poss... Hmmmm, right now my head is scrambled from an arduous day and i'm about to have a nipple.... errrrrrr i mean tipple.

Like i said, don't fight the trend. none of the above really matters! Buy the pullbacks, until it breaks a prior reflex point and starts making LL's/LH's...

Davai - 01 Feb 2013 16:54 - 291 of 423

Thing is i need a 'C' wave back up for cable early next week, oh the possibilities are endless!

Post 281, i showed a zigzag correction and also an irregular, the other poss was a flat, which is what it currently looks like printing. If it has a couple of up day's early next week, i will keep a watch for a likely turning point. If it all works out, short the crap out of it cos its heading to 1.25...

Post 281, i showed a zigzag correction and also an irregular, the other poss was a flat, which is what it currently looks like printing. If it has a couple of up day's early next week, i will keep a watch for a likely turning point. If it all works out, short the crap out of it cos its heading to 1.25...

Davai - 01 Feb 2013 17:58 - 292 of 423

Davai - 03 Feb 2013 19:43 - 293 of 423

Like i said, i don't like to try to call a top, usually end up looking silly, but we are 70 pips away from my target suggested a couple weeks ago (14,070). Now look at this for the S&P. This is an awesome chart with fib relationships working perfectly everywhere. It doesn't however, give me more than the top trend line of the ending diagonal for a top, until i go down the timescales, i have a rough guesstimate at around 1525/30ish (50%fib at 1533), but with the strength around at the moment it would lead you to think it will be a rolling top as opposed to a spike, if we are indeed thereabouts. Who knows, maybe N.Korea will kick start proceedings and then debt will become the overall proverbial straw?!

Davai - 03 Feb 2013 20:12 - 294 of 423

Davai - 03 Feb 2013 20:43 - 295 of 423

Just in case, (for the not so familiar with counting and impulse/corrective etc); it means this is a large overall ABC 5-3-5 corrective move, of which we are very near the end of the 3w B, we have 5w short to come. This doesn't mean it has to be like the crash of 2008 and doesn't even have to drop so far. minimum would be 50% though. Being a C wave it could be an ending diagonal and last for years...

The caveat is as to whether the crash of 2008 was the 'C' wave and thus we are now in an impulse move. In which case, this simply wont stop climbing. I like the corrective count especially the way the fib ratios work, however, as i keep stressing, the trend is up (until it isn't!). I doubt anyone would want to work on a 1/2/5 year timescale and besides, if we do see a 'C' wave back down, which turns out to be an ending diagonal, it could take years and see many massive upswings along the way...

Its buy the ABC pullbacks until it doesn't work any longer and then we find a different sequence of impulse moves short (LL's/LH's).

The caveat is as to whether the crash of 2008 was the 'C' wave and thus we are now in an impulse move. In which case, this simply wont stop climbing. I like the corrective count especially the way the fib ratios work, however, as i keep stressing, the trend is up (until it isn't!). I doubt anyone would want to work on a 1/2/5 year timescale and besides, if we do see a 'C' wave back down, which turns out to be an ending diagonal, it could take years and see many massive upswings along the way...

Its buy the ABC pullbacks until it doesn't work any longer and then we find a different sequence of impulse moves short (LL's/LH's).

Davai - 04 Feb 2013 10:11 - 296 of 423

Davai - 04 Feb 2013 12:10 - 297 of 423

Time to short the Euro?

Ok, so need to be keeping a close eye on it now. Back at the turn of the year;

recent;

and a little closer shows possibility that of this 'Y' wave, 'C' reached exactly the 138.2% level of wave 'A';

Current action on other Euro crosses looks corrective, so am mindful that a wave 3 on the EU would also equal a fib level of wave 1 (instead of a&c).

Ok, so need to be keeping a close eye on it now. Back at the turn of the year;

recent;

and a little closer shows possibility that of this 'Y' wave, 'C' reached exactly the 138.2% level of wave 'A';

Current action on other Euro crosses looks corrective, so am mindful that a wave 3 on the EU would also equal a fib level of wave 1 (instead of a&c).

Davai - 04 Feb 2013 12:25 - 298 of 423

Thoughts are EJ is in a 4th of its current degree, so higher yet, may coincide with the EU heading back up, (but with trend change and in a corrective wave 2 instead). Will try and confirm a count, but its not actually trending very nicely to read right now... £ needs to sort itself out too, if it is to become a 'C' wave, it looks far more like a 4th this morning of a larger 5w set short. Really want to get short on cable, but can't read current action, despite, so far doing what i printed last week.

Iain

- 04 Feb 2013 13:35

- 299 of 423

- 04 Feb 2013 13:35

- 299 of 423

Yes......but!

Davai - 04 Feb 2013 13:47 - 300 of 423

but what Iain?

Iain

- 04 Feb 2013 13:53

- 301 of 423

- 04 Feb 2013 13:53

- 301 of 423

I'm just trying to bring a little balance. A devil's advocate etc

Davai - 04 Feb 2013 14:02 - 302 of 423

Of course! Trend is still up on practically everything, i'm just highlighting events as they happen. If they happen some time after initially being flagged, its always good to question if you have a change of heart once they are met. Most of the targets i had in mind a month ago are being reached, but now we are here, i feel even more bullish! Does that mean it is a time to be cautious? Isn't that how it all works?!

For me it doesn't really matter as i work on smaller timescales and as i keep saying, trend is up, (until it really isn't anymore).

For me it doesn't really matter as i work on smaller timescales and as i keep saying, trend is up, (until it really isn't anymore).

Iain

- 04 Feb 2013 14:04

- 303 of 423

- 04 Feb 2013 14:04

- 303 of 423

Im with you "Currently"