| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Davai - 18 Apr 2012 11:13

Thread designed to record set-ups and targets on index and FX pairs.

'A market is only your enemy until you understand it, then it becomes your best friend.'

Any questions, please feel free to ask.

From time to time i may openly state an opinion regarding direction of a set-up and wish to add that in no way am i recommending a trade. I am sometimes only in trades for a matter of minutes and can't always update as to entry/exits taken.

As always, markets are dangerous places to be and must be respected as such. Always use stop losses and never over-leverage; 3% of your pot as a maximum per trade. As always, YOU are responsible for your own trades! Happy pip hunting!

Click HERE to visit me at FXtechnicals.net

Davai - 06 Feb 2013 15:48 - 320 of 423

The minor 5w long i mentioned above for Cable, now really appears to be a 'C' wave, so lower we shall go and as i posted last night, the lower TL of our weekly wedge is at approx 15,600. I seriously can't see much strength happening, so a running/irregular corrective looks ominous, before the abyss below...

Davai - 06 Feb 2013 16:22 - 321 of 423

Cable;

Now i had it that the last move up hit its 61.8% retrace of the drop, ('B', which it does to the pip - blue circle), however, could the market be playing a trick, it is only a small handful of pips more than if it was the 61.8% of wave A (red circle); this would fit perfectly with my prev counts and also explain why Cable simply wont get any strength from here. So instead of an ending diagonal, (as others are calling it) with a corrective ABC move to come, we will actually be starting the 3rd of the 3rd? sounds like a plan?!

The small 4th is what would trick most, but it fits the fibs perfectly and recognising it hopefully is the difference here;

The current count as i see it;

Now i had it that the last move up hit its 61.8% retrace of the drop, ('B', which it does to the pip - blue circle), however, could the market be playing a trick, it is only a small handful of pips more than if it was the 61.8% of wave A (red circle); this would fit perfectly with my prev counts and also explain why Cable simply wont get any strength from here. So instead of an ending diagonal, (as others are calling it) with a corrective ABC move to come, we will actually be starting the 3rd of the 3rd? sounds like a plan?!

The small 4th is what would trick most, but it fits the fibs perfectly and recognising it hopefully is the difference here;

The current count as i see it;

Davai - 06 Feb 2013 19:30 - 322 of 423

Davai - 06 Feb 2013 20:12 - 323 of 423

Ref above, i think the earlier chart where we reached the 38.2% level of 5th ext first thing this morning is correct;

It means a slightly truncated top, but it fits. Hence the 5w short today would be wave 1;

followed by an abc wave 2;

If correct, tomorrow will be a down day on markets too, lets see...

It means a slightly truncated top, but it fits. Hence the 5w short today would be wave 1;

followed by an abc wave 2;

If correct, tomorrow will be a down day on markets too, lets see...

Davai - 07 Feb 2013 07:33 - 324 of 423

Davai - 07 Feb 2013 08:05 - 325 of 423

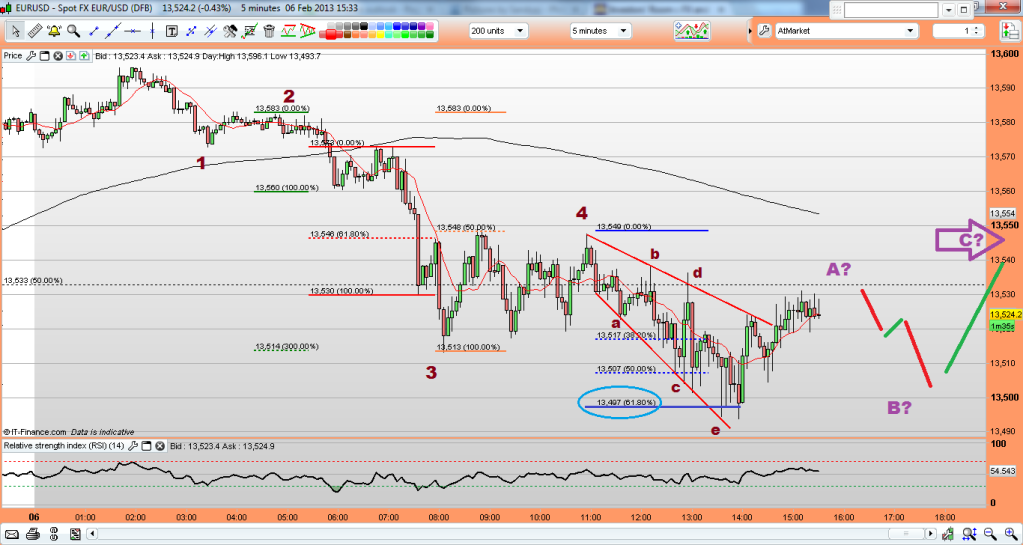

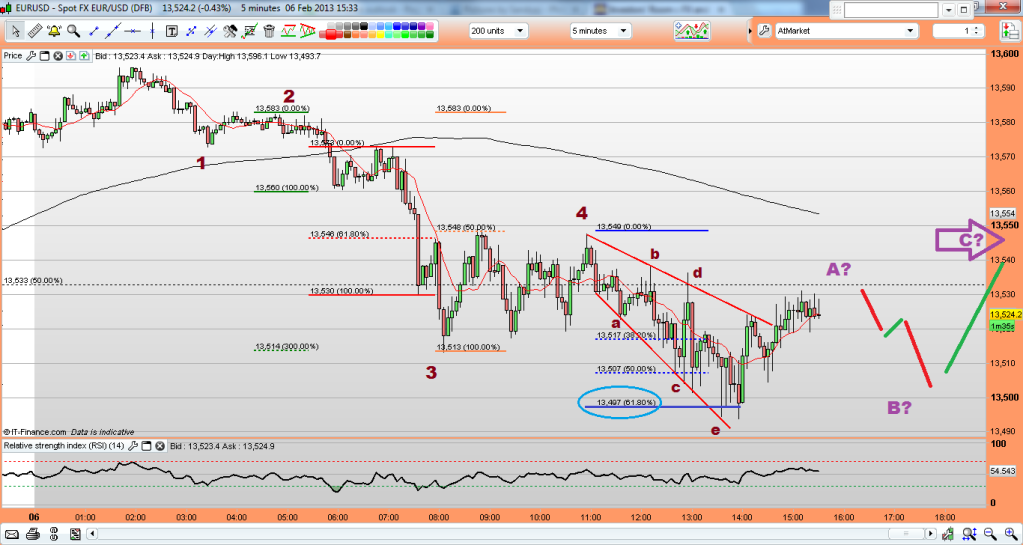

EU,

Waiting for a low risk entry;

Ok, might look a bit confusing, but i will try to explain my point. At the moment we have completed a (small) 5w long on the EU, this was expected as per prev charts as a 'C' wave, however, it could still be, simply of a larger wave 1 and thus still 4 more waves to come (typically as in the top purple circle. With the thinking in mind that this will be corrective, we shouldn't break the high of Tuesday, therefore if a count takes us up there, we can enter short near this point, with our stop a pip (plus spread) above the high, (stop2).

In the lower purple circle option, it would mean the minor 5w was our C wave completed. It is roughly the 76.4% fib of A, but not conclusive (and not a favourite fib level for me), however, if we drop, we should wait for a decisive break of the red TL, as this would likely indicate AB&C were complete. Our stop goes a pip above the peak of 'C'(stop1). The middle ground is higher risk, both in pips and evidence...

If the trade is wrong, at least we have minimised risk and/or maximised evidence.

Waiting for a low risk entry;

Ok, might look a bit confusing, but i will try to explain my point. At the moment we have completed a (small) 5w long on the EU, this was expected as per prev charts as a 'C' wave, however, it could still be, simply of a larger wave 1 and thus still 4 more waves to come (typically as in the top purple circle. With the thinking in mind that this will be corrective, we shouldn't break the high of Tuesday, therefore if a count takes us up there, we can enter short near this point, with our stop a pip (plus spread) above the high, (stop2).

In the lower purple circle option, it would mean the minor 5w was our C wave completed. It is roughly the 76.4% fib of A, but not conclusive (and not a favourite fib level for me), however, if we drop, we should wait for a decisive break of the red TL, as this would likely indicate AB&C were complete. Our stop goes a pip above the peak of 'C'(stop1). The middle ground is higher risk, both in pips and evidence...

If the trade is wrong, at least we have minimised risk and/or maximised evidence.

Davai - 07 Feb 2013 08:44 - 326 of 423

For me, looking at the current strength of the EU, it concerns me that it is a scenario playing out as in post 322, therefore the stop2 in last post will not be safe. Its too risky and i haven't seen a clear 4th wave yet, whereas Cable, is nearly good to go for the end of our C wave. It may extend into low 15,700's, but the 38.2% retrace of last drop is at 15,697...

*edit*, still printing 4th right now i think;

Will be trying to follow the 5th on small timescale to determine likely end. The speed of the rise is likely to deter, but must be respected, tight stops are order of the day, in case the count is wrong...

*edit*, still printing 4th right now i think;

Will be trying to follow the 5th on small timescale to determine likely end. The speed of the rise is likely to deter, but must be respected, tight stops are order of the day, in case the count is wrong...

Davai - 07 Feb 2013 08:55 - 327 of 423

Davai - 07 Feb 2013 09:05 - 328 of 423

Each leg of the abcde is broken down again into 3w (abc), there will likely be a fib relationship between a&c of each, more difficult to spot in the smaller ones, but in the last, c was 138.2% of a, (had me thinking it was the wave 3 relating to wave 1), i will also be watching this if it does follow the chart for our wave e, for a clue hopefully indicating a common level ending at approx 15,700

Davai - 07 Feb 2013 13:37 - 329 of 423

Ah, always the same! Just as you think you've got a good trade! Well, that spike is still well within rights of a C wave, indeed, it looks like a further high to come later. However, whichever way you look at it, it is strength and must be respected as such. No trade until i can recognise something fresh...

If it takes three factors to line up for a good trade, then two factors doesn't cut it. discipline discipline dicsipline... speeling test

If it takes three factors to line up for a good trade, then two factors doesn't cut it. discipline discipline dicsipline... speeling test

Davai - 07 Feb 2013 14:29 - 330 of 423

Davai - 07 Feb 2013 14:59 - 331 of 423

FWIW, Cable, (for now at least), is certainly not doing what i expected and although it hasn't broken any particular rules to conform with my count, i am now expecting my prior count to be proved wrong. The EU does make up for it, so will have to make do!

Davai - 07 Feb 2013 16:49 - 332 of 423

Davai - 08 Feb 2013 08:46 - 333 of 423

Trend now well and truly down for the EJ. We are near, or possibly have just completed 5waves down from the top daily TL, where we finished our 5w cycle of the 5th. At this stage its inconclusive as to whether it was the overall 5th or the 5th of the overall 3rd.

The top Daily TL is drawn off what should be waves 2&4, therefore it suggests it was the overall top.

The action since then as of the 5th wave is now complete;

Wave 3 was 100% of wave 1

Wave 4 retraced 50% of wave 3

Wave 5 reached the top TL and approx 38.2% ext

We now have a nice 5w count short;

Wave 3 was 161.8% of wave 1

Wave 4 retraced 38.2% of wave 3

Wave 4 also retested the break of the Green TL overnight

Wave 5 has now reached its 61.8% ext

Caution as the 5th may extend yet.

Once complete, we will now correct back up in 3 wave abc, but the least we will have after this is another 5w short and poss, this is complete trend change for the foreseeable future. I will be looking to short this pair after each abc retrace.

The top Daily TL is drawn off what should be waves 2&4, therefore it suggests it was the overall top.

The action since then as of the 5th wave is now complete;

Wave 3 was 100% of wave 1

Wave 4 retraced 50% of wave 3

Wave 5 reached the top TL and approx 38.2% ext

We now have a nice 5w count short;

Wave 3 was 161.8% of wave 1

Wave 4 retraced 38.2% of wave 3

Wave 4 also retested the break of the Green TL overnight

Wave 5 has now reached its 61.8% ext

Caution as the 5th may extend yet.

Once complete, we will now correct back up in 3 wave abc, but the least we will have after this is another 5w short and poss, this is complete trend change for the foreseeable future. I will be looking to short this pair after each abc retrace.

Davai - 08 Feb 2013 09:17 - 334 of 423

In virtually the time it took to draw the chart, post it along with the above update, go and make a cup of tea, i see it has already bounced some 100 pips from the 61.8% level i have on the chart for its 5th wave target. Doesn't look like any extension! Wow, it loves to move, so i will be leaving wave A and B, but by then we will know if a zigzag,flat etc and can trade the C wave long with the benefit of our fibs from wave A... Capiche?

Davai - 08 Feb 2013 09:26 - 335 of 423

Anybody interested in my FTSE view?

Iain

- 08 Feb 2013 09:52

- 336 of 423

- 08 Feb 2013 09:52

- 336 of 423

Go on then

My tea leaves say 5080

My tea leaves say 5080

Davai - 08 Feb 2013 10:15 - 337 of 423

Well, i don't want to try to predict too far in advance. The last chart showed a clear end of 5w;

and that of this daily cycle Y=W;

So the least we can expect is a decent correction in the form of an X wave;

I can only highlight what i see, so what you do with anything shown is up to you! But it looks very much like a complex correction so far. The fact that we appear to have had two lots of abc moves, with the 2nd ('b') reaching 123.6% of the first set ('a').

Next comes a 5w ('c') long. Its difficult to determine where this will end and i see we have already reacted off of the 61.8% fib level of 'a'. Seeing the 100% at 6299, i thought that would have been the obvious target, but if this count is correct we will go down (imo) in either a C wave or a wave 3...

*edit* (obviously i meant '3/C' in the chart!)

and that of this daily cycle Y=W;

So the least we can expect is a decent correction in the form of an X wave;

I can only highlight what i see, so what you do with anything shown is up to you! But it looks very much like a complex correction so far. The fact that we appear to have had two lots of abc moves, with the 2nd ('b') reaching 123.6% of the first set ('a').

Next comes a 5w ('c') long. Its difficult to determine where this will end and i see we have already reacted off of the 61.8% fib level of 'a'. Seeing the 100% at 6299, i thought that would have been the obvious target, but if this count is correct we will go down (imo) in either a C wave or a wave 3...

*edit* (obviously i meant '3/C' in the chart!)

Davai - 08 Feb 2013 10:21 - 338 of 423

If it is a smaller count then its possible we are in some kind of ending diagonal right now with the above blue 'a' being red 'b' instead. Its the fact that we hit the 123.6% so precisely for 'b', that makes me think otherwise...

Davai - 08 Feb 2013 10:38 - 339 of 423

Isn't it strange how charting can coincide with fundamentals? I read this article earlier about Aso stating that the Yen had weakened more than they expected, which would back up the analysis that the Yen is to strengthen further;

http://www.reuters.com/article/2013/02/08/japan-economy-aso-idUSL4N0B84SR20130208

http://www.reuters.com/article/2013/02/08/japan-economy-aso-idUSL4N0B84SR20130208