| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

gazkaz - 11 Jul 2013 09:16 - 350 of 1034

Seems suprising nobody has mentioned .....that the Rothkiddies are working on plans to break up one of the big UK banks into - a good bank - and...a bad bank

- and report their plan to gov't - within 2 months

Good Bank/Bad Bank.....that's Cyprus style ??

- the BofE has been putting the paperwork is in place to apply the Cyprus template...in the UK

- and the Co-op bond holders, recently got a ...small taste of it ...in action

(with no MSM outcry, or blaze of publicity)

Jim Willie puts Barclays "on the brink" too

- and strangely no update since they were being investigated - for actually...

- lending the money - to the Saudis...to fund their own "non gov't bailout" of themselves.

I think before the end of the year, the sheeps, will be ..rudely stirred...from their snoozing

- and report their plan to gov't - within 2 months

Good Bank/Bad Bank.....that's Cyprus style ??

- the BofE has been putting the paperwork is in place to apply the Cyprus template...in the UK

- and the Co-op bond holders, recently got a ...small taste of it ...in action

(with no MSM outcry, or blaze of publicity)

Jim Willie puts Barclays "on the brink" too

- and strangely no update since they were being investigated - for actually...

- lending the money - to the Saudis...to fund their own "non gov't bailout" of themselves.

I think before the end of the year, the sheeps, will be ..rudely stirred...from their snoozing

gazkaz - 11 Jul 2013 14:53 - 351 of 1034

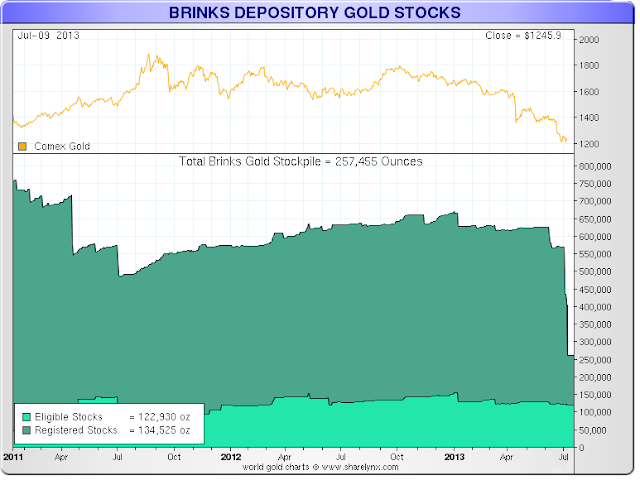

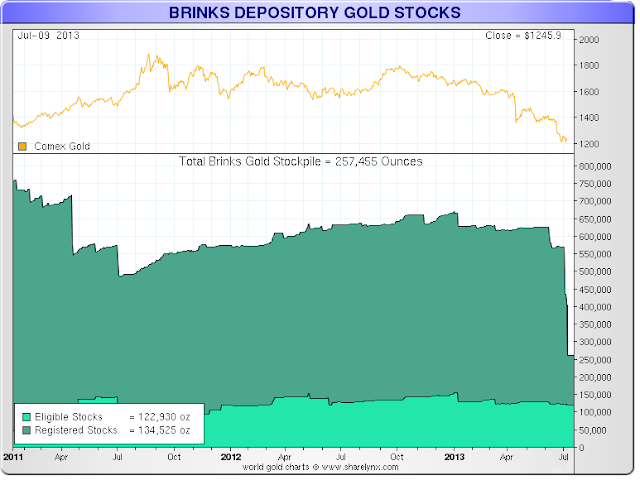

Nick Laird of Sharelynx.com informs- that Brinks is 'now being depleted'

- of ...private ...gold holdings.

In referring to the registered supply at Brinks, Nick notes that:

"Brinks is now being depleted.

- They have gone from 447,199 on July 3rd

- to 134,525 on July 9th which is ......a drop of 312,674 oz."

- If this is correct, then this is a decline of..... 70 percent .....in the gold "held in private accounts " at Brinks in....... just one week.

If this is data is correct, it would not be too much of a stretch to say that this has the appearance of .........'a run on the bank.'

Unless CME issues a correction ...... It seems almost incredible.

Where is the gold going?

- It was not transferred from the registered to eligible category,

- and does not seem to have been transferred to any other COMEX vault.

I suspect it is flowing East. And perhaps it is being taken to replace gold that ......has been rehypothecated from custodial vaults somewhere.

JessesC

- of ...private ...gold holdings.

In referring to the registered supply at Brinks, Nick notes that:

"Brinks is now being depleted.

- They have gone from 447,199 on July 3rd

- to 134,525 on July 9th which is ......a drop of 312,674 oz."

- If this is correct, then this is a decline of..... 70 percent .....in the gold "held in private accounts " at Brinks in....... just one week.

If this is data is correct, it would not be too much of a stretch to say that this has the appearance of .........'a run on the bank.'

Unless CME issues a correction ...... It seems almost incredible.

Where is the gold going?

- It was not transferred from the registered to eligible category,

- and does not seem to have been transferred to any other COMEX vault.

I suspect it is flowing East. And perhaps it is being taken to replace gold that ......has been rehypothecated from custodial vaults somewhere.

JessesC

gazkaz - 11 Jul 2013 15:23 - 352 of 1034

Make sense of this Bullsh@t from the FT

The cost of borrowing gold.... has risen to the highest since the post-Lehman Brothers...... scramble for supplies,

as the bullion market adjusts to a new era in which Western investor demand is less dominant.

The niche gold lending market, largely the preserve of a few big banks and central banks, has been uneventful in recent years as investors have built up large holdings and lent them out on the market, keeping rates depressed.

(Makes sense so far)

But as investors have .....turned sellers in recent months,

- availability of gold in the lending market .....has been squeezed, bankers said

(so everybody is selling - lol - but availabity of gold is......squeezed ????)

The squeeze has triggered..... a sharp rise in gold leasing rates

- the implied interest rate for lending gold in the market in exchange for dollars

- to the highest since early 2009.

The move reflects the dramatic shift in the gold market over the past few months as investors ....have liquidated their holdings en masse,..... triggering a 25 per cent collapse in prices since the start of the year.

(Liquidated en masse - & yet there's a shortage of available gold....forcing leasing rates higher ?????)

"There has been some borrowing interest recently.

- It's related to the demand..... for physical,"

said Joni Teves, precious metals strategist at UBS, noting that the price

- of physical gold - in China remained more than $40 an ounce above benchmark London spot prices.

Conclusion

- everybody ...has turned sellers & there has been "liquidation en masse"

- but the chinese are paying $40 premiums - refineries are working flat out to meet demand and lease rates have incresed due to - lack of....... available gold

- with the bonus that ......all this "turned sellers" & "liquidations en masse"

has resulted in

"The squeeze has triggered..... a sharp rise in gold leasing rates"

http://www.ft.com/intl/cms/s/0/bd819998-e8b2-11e2-8e9e-00144feabdc0.html#axzz2YXwV23J1

So the FT is arguing

- the price has falen due to holders selling and liquidations en masse

- yet

- due to lack of availability of - said gold

- they are resorting to....leasing it

- and due to a shortage of ....leased gold

- lease rates have jumped upwards

What a fecking crock of .....journalistic contradictory nonsensical SH!TE

The cost of borrowing gold.... has risen to the highest since the post-Lehman Brothers...... scramble for supplies,

as the bullion market adjusts to a new era in which Western investor demand is less dominant.

The niche gold lending market, largely the preserve of a few big banks and central banks, has been uneventful in recent years as investors have built up large holdings and lent them out on the market, keeping rates depressed.

(Makes sense so far)

But as investors have .....turned sellers in recent months,

- availability of gold in the lending market .....has been squeezed, bankers said

(so everybody is selling - lol - but availabity of gold is......squeezed ????)

The squeeze has triggered..... a sharp rise in gold leasing rates

- the implied interest rate for lending gold in the market in exchange for dollars

- to the highest since early 2009.

The move reflects the dramatic shift in the gold market over the past few months as investors ....have liquidated their holdings en masse,..... triggering a 25 per cent collapse in prices since the start of the year.

(Liquidated en masse - & yet there's a shortage of available gold....forcing leasing rates higher ?????)

"There has been some borrowing interest recently.

- It's related to the demand..... for physical,"

said Joni Teves, precious metals strategist at UBS, noting that the price

- of physical gold - in China remained more than $40 an ounce above benchmark London spot prices.

Conclusion

- everybody ...has turned sellers & there has been "liquidation en masse"

- but the chinese are paying $40 premiums - refineries are working flat out to meet demand and lease rates have incresed due to - lack of....... available gold

- with the bonus that ......all this "turned sellers" & "liquidations en masse"

has resulted in

"The squeeze has triggered..... a sharp rise in gold leasing rates"

http://www.ft.com/intl/cms/s/0/bd819998-e8b2-11e2-8e9e-00144feabdc0.html#axzz2YXwV23J1

So the FT is arguing

- the price has falen due to holders selling and liquidations en masse

- yet

- due to lack of availability of - said gold

- they are resorting to....leasing it

- and due to a shortage of ....leased gold

- lease rates have jumped upwards

What a fecking crock of .....journalistic contradictory nonsensical SH!TE

gazkaz - 11 Jul 2013 15:36 - 353 of 1034

The London Whale - LieBOR rigging, interest rate swap fiddling, Maddof, MFG co-mingling investor funds and re-hypothecation now

THIRD-largest-futures-broker-gets-RECORD FINE- for hft-stock-market-...MANIPULATION - but- NO ...Jail Time...AGAIN

THIRD-largest-futures-broker-gets-RECORD FINE- for hft-stock-market-...MANIPULATION - but- NO ...Jail Time...AGAIN

gazkaz - 11 Jul 2013 20:42 - 354 of 1034

New study finds antibiotics cause oxidative stress - and damages ....DNA

-app 3mins long

(Then see following article re....silver :o)

-app 3mins long

(Then see following article re....silver :o)

gazkaz - 11 Jul 2013 20:58 - 355 of 1034

James Collins, a biomedical engineer at Boston University in Massachusetts,

- has described how silver....... can disrupt bacteria,

- and shown that the ancient treatment could help to deal with the thoroughly modern...... scourge of antibiotic resistance.

- The work is published today..... in Science Translational Medicine.

“Resistance is growing, while the number of new antibiotics in development is dropping,” says Collins. “We wanted to find a way to make what we have work better.”

Collins and his team found that silver — in the form of dissolved ions — attacks bacterial cells in two main ways:

- it makes the cell membrane more permeable,

- and it interferes with the cell’s metabolism, leading to the overproduction of reactive, and often toxic, oxygen compounds.

Both mechanisms could potentially be harnessed to make today’s antibiotics more effective against resistant bacteria, Collins says.

Resistance is futile

Many antibiotics are thought to kill their targets by producing reactive oxygen compounds, and Collins and his team showed that

- when boosted with.... a small amount of silver..... these drugs could kill between

- 10 and...... 1,000 times as many bacteria.

The increased membrane permeability also allows more antibiotics to enter the bacterial cells, which may overwhelm the resistance mechanisms that rely on shuttling the drug back out.

That disruption to the cell membrane also increased the effectiveness of vancomycin, a large-molecule antibiotic, on Gram-negative bacteria — which have a protective outer coating. Gram-negative bacterial cells can often be impenetrable to antibiotics made of larger molecules.

“It’s not so much a silver bullet; more a silver spoon to help the Gram-negative bacteria take their medicine,” says Collins.

http://www.scientificamerican.com/article.cfm?id=....silver-makes-antibiotics...-thousands-of-times-more-effective

I think most board regulars/lurker readers :o)

Are aware of colloidal silver - trouble is they can't patent it

- so if c/s does what it says in the above, why the add antibiotics

(other than excuse to then charge the earth for a patentable product of course)

...as once c/s does the business ....your immune system (I will say.... probably :o)

- can probably finish the job

Plus side at least patients may benefit (at last) from the silver

- &....another demand booster for silver too !

- has described how silver....... can disrupt bacteria,

- and shown that the ancient treatment could help to deal with the thoroughly modern...... scourge of antibiotic resistance.

- The work is published today..... in Science Translational Medicine.

“Resistance is growing, while the number of new antibiotics in development is dropping,” says Collins. “We wanted to find a way to make what we have work better.”

Collins and his team found that silver — in the form of dissolved ions — attacks bacterial cells in two main ways:

- it makes the cell membrane more permeable,

- and it interferes with the cell’s metabolism, leading to the overproduction of reactive, and often toxic, oxygen compounds.

Both mechanisms could potentially be harnessed to make today’s antibiotics more effective against resistant bacteria, Collins says.

Resistance is futile

Many antibiotics are thought to kill their targets by producing reactive oxygen compounds, and Collins and his team showed that

- when boosted with.... a small amount of silver..... these drugs could kill between

- 10 and...... 1,000 times as many bacteria.

The increased membrane permeability also allows more antibiotics to enter the bacterial cells, which may overwhelm the resistance mechanisms that rely on shuttling the drug back out.

That disruption to the cell membrane also increased the effectiveness of vancomycin, a large-molecule antibiotic, on Gram-negative bacteria — which have a protective outer coating. Gram-negative bacterial cells can often be impenetrable to antibiotics made of larger molecules.

“It’s not so much a silver bullet; more a silver spoon to help the Gram-negative bacteria take their medicine,” says Collins.

http://www.scientificamerican.com/article.cfm?id=....silver-makes-antibiotics...-thousands-of-times-more-effective

I think most board regulars/lurker readers :o)

Are aware of colloidal silver - trouble is they can't patent it

- so if c/s does what it says in the above, why the add antibiotics

(other than excuse to then charge the earth for a patentable product of course)

...as once c/s does the business ....your immune system (I will say.... probably :o)

- can probably finish the job

Plus side at least patients may benefit (at last) from the silver

- &....another demand booster for silver too !

gazkaz - 12 Jul 2013 14:15 - 356 of 1034

Andrew Maguire has been noting to subscribers that,

- for about the past three weeks,

- there has been .....a large, institutional buyer.... appearing at each and every London silver fix.

- Because of the size of the orders, this buyer could only be a Bullion Bank and he has deduced that is likely..... JPM.

- So, if Andy is correct,....... then suddenly JPM has taken to quietly acquiring.... as much physical silver as they can.

Now, add to that what has been going on this month at The Comex.

- Ted Butler has been all over this since the first of the month.

- Back on Saturday he wrote this:

“I believe the statistics from the first six days of the July COMEX silver futures contract provide enough data for attention.

- The standout feature for the first week of deliveries against the July silver contract indicates

- that JPMorgan has... taken roughly 90%..... of the metal offered for delivery,

( or a total of 1637 contracts out of a cumulative total of 1828 delivered so far).

- In turn, of the silver contracts stopped or accepted by JPMorgan, 90% (1479 contracts) were ......for JPMorgan’s ...own house or proprietary trading account.

- In other words, JPMorgan ...took delivery

- of roughly 7.4 million ounces of silver in the COMEX warehouses...... for their own benefit and risk”.

He followed that up yesterday with this:

“A quick note on JPMorgan’s unusual taking of delivery of silver in the current July contract I first mentioned on Saturday.

- In the two delivery days since that review, JPMorgan has taken (stopped) an additional 369 contracts,

- 350 of which were for the bank’s house or proprietary trading account.

Of the 2220 total contracts delivered so far in the July COMEX contract,

- JPM has taken 2006 contracts, including 1829 contracts..... for the bank’s own house account.

- Over the past two days, customers of JPMorgan have delivered close to 200 silver contracts as well, raising the question if JPMorgan is double dealing.

Another point is that the 1829 contracts (9.145 million oz) that JPM has taken in its own name

- is above the level of 1500 contracts that COMEX rules dictate....... can’t be exceeded in any one delivery month by any single trader.

- But...Hey – have you ever heard of a rule or regulation that JPMorgan couldn’t evade?

- Me, neither.”

There are still about 1,200 July contracts that remain to be settled so we’ll see where those go…but what the heck is going on here? Of the 2,220 July13 contracts that have been settled so far this month,

- JPM has claimed over 90% of them.

- Further, 90% of those have gone directly into ......JPM’s own house account!

So we’ve got JPM soaking up as much Comex silver as they can without disturbing the price downtrend

- AND ......we’ve also got JPM appearing each day at The Fix, buying up as much silver as possible there, too.

Connecting these dots ????

- for about the past three weeks,

- there has been .....a large, institutional buyer.... appearing at each and every London silver fix.

- Because of the size of the orders, this buyer could only be a Bullion Bank and he has deduced that is likely..... JPM.

- So, if Andy is correct,....... then suddenly JPM has taken to quietly acquiring.... as much physical silver as they can.

Now, add to that what has been going on this month at The Comex.

- Ted Butler has been all over this since the first of the month.

- Back on Saturday he wrote this:

“I believe the statistics from the first six days of the July COMEX silver futures contract provide enough data for attention.

- The standout feature for the first week of deliveries against the July silver contract indicates

- that JPMorgan has... taken roughly 90%..... of the metal offered for delivery,

( or a total of 1637 contracts out of a cumulative total of 1828 delivered so far).

- In turn, of the silver contracts stopped or accepted by JPMorgan, 90% (1479 contracts) were ......for JPMorgan’s ...own house or proprietary trading account.

- In other words, JPMorgan ...took delivery

- of roughly 7.4 million ounces of silver in the COMEX warehouses...... for their own benefit and risk”.

He followed that up yesterday with this:

“A quick note on JPMorgan’s unusual taking of delivery of silver in the current July contract I first mentioned on Saturday.

- In the two delivery days since that review, JPMorgan has taken (stopped) an additional 369 contracts,

- 350 of which were for the bank’s house or proprietary trading account.

Of the 2220 total contracts delivered so far in the July COMEX contract,

- JPM has taken 2006 contracts, including 1829 contracts..... for the bank’s own house account.

- Over the past two days, customers of JPMorgan have delivered close to 200 silver contracts as well, raising the question if JPMorgan is double dealing.

Another point is that the 1829 contracts (9.145 million oz) that JPM has taken in its own name

- is above the level of 1500 contracts that COMEX rules dictate....... can’t be exceeded in any one delivery month by any single trader.

- But...Hey – have you ever heard of a rule or regulation that JPMorgan couldn’t evade?

- Me, neither.”

There are still about 1,200 July contracts that remain to be settled so we’ll see where those go…but what the heck is going on here? Of the 2,220 July13 contracts that have been settled so far this month,

- JPM has claimed over 90% of them.

- Further, 90% of those have gone directly into ......JPM’s own house account!

So we’ve got JPM soaking up as much Comex silver as they can without disturbing the price downtrend

- AND ......we’ve also got JPM appearing each day at The Fix, buying up as much silver as possible there, too.

Connecting these dots ????

gazkaz - 12 Jul 2013 14:31 - 357 of 1034

2 mins of Rick Santelli - Blowing his stack chicago style

Re this...chart

- 2 + 2 does not add up - health of the economy two indicators

(after all they...used to...broadly correlate...but recently ???)

Re this...chart

- 2 + 2 does not add up - health of the economy two indicators

(after all they...used to...broadly correlate...but recently ???)

gazkaz - 12 Jul 2013 21:32 - 358 of 1034

Sometimes you just look at three charts and you can make a decision

- fiat paper and fiat paper denominated assets

- or precious metal

Official - Debt to GDP ratio(in Red)

Debt to GDP ratios....including "unfunded liabilities" (pensions & healthcare) - in grey

So....

- These figures are absolutely astronomical and prove

- that most governments in the world will be .....totally incapable.... of repaying their debts...... or funding the pensions or medical care which they have committed to.

It doesn’t matter however much governments cut expenditure or raise taxes,

- all these countries are insolvent and ......nothing can save them.

Next.....

A 100 years - showing the value of all the major fiat paper currencies.......priced in gold

In conclusion

- it's the 1st time ever - that all major fiat currencies have engaged in a race to the bottom.....ultimately their intrinsic value... which is nil

Looking at the long evidence of history in times of....less "total global" SHTF in progress turbulence.......precious metals seem to have (understatement)....a decent track record

So perhaps in todays GLOBAL TURMOIL.....they may ....fair rather well

- at the other end of the tunnel

- fiat paper and fiat paper denominated assets

- or precious metal

Official - Debt to GDP ratio(in Red)

Debt to GDP ratios....including "unfunded liabilities" (pensions & healthcare) - in grey

So....

- These figures are absolutely astronomical and prove

- that most governments in the world will be .....totally incapable.... of repaying their debts...... or funding the pensions or medical care which they have committed to.

It doesn’t matter however much governments cut expenditure or raise taxes,

- all these countries are insolvent and ......nothing can save them.

Next.....

A 100 years - showing the value of all the major fiat paper currencies.......priced in gold

In conclusion

- it's the 1st time ever - that all major fiat currencies have engaged in a race to the bottom.....ultimately their intrinsic value... which is nil

Looking at the long evidence of history in times of....less "total global" SHTF in progress turbulence.......precious metals seem to have (understatement)....a decent track record

So perhaps in todays GLOBAL TURMOIL.....they may ....fair rather well

- at the other end of the tunnel

gazkaz - 12 Jul 2013 21:39 - 359 of 1034

Well I seem to be in a minority of one....and no two way info - or evidence of anyone reading again, so

- will leave it for now, untill or if there's signs of life out there :o)

- will leave it for now, untill or if there's signs of life out there :o)

MaxK - 14 Jul 2013 00:28 - 360 of 1034

tDon't give up gaz, we are reading.

Bu the boards in general seem to be fucked up at the moment.

Keep on truckin!

Bu the boards in general seem to be fucked up at the moment.

Keep on truckin!

mabel - 14 Jul 2013 10:10 - 361 of 1034

Hi gaz,

Have been away for a few days but I certainly am reading at every opportunity.

I do know where you are coming from though when you say this is one way traffic.

You do all the supplying and the rest of us do all the reading - it's just that you are so good in the supply department, and you obviously have the ability to read and absorb at a tremendous rate.

I think the problem is that there are not enough people on this site compared to the other side.

A lot of the terminology etc in some of the data that you bring to our attention is way above my head and although I might get the gist generally, I'm not in a position to make a well informed comment.

The off topic stuff I love, and appreciate very much what you bring to the board.

The Youtube clip about the Red Cross denial of the effects of MMS is an absolute eye opener and after all the other things that have been brought to my attention regarding big pharma's firm grip on the health industry, I find I am no longer surprised at very much.

Incidentally, I place the national charities in the same league for out and out deception and misrepresentation, as big pharma and government. They have their own agenda and are solely concerned with maintaining their own interests and privileged position. They misinform rather than inform, and what we get is propaganda.

To think, for years I direct debited to the Red Cross, Oxfam, MAP and Greenpeace to the absolute limits of what I could afford, and guess what, they used to ring me up and ask for more, and I did send more for 'special' situations or particular disasters.

Not any more. All direct debits have been cancelled and it was not easy to take that step, but thanks to the education I have received here, I don't feel uncomfortable about it.

Anyway, ramble over, but many thanks to you for what you bring to the party, and if you are no longer going to post here, I hope you will post on the other side occasionally.

mabel

Have been away for a few days but I certainly am reading at every opportunity.

I do know where you are coming from though when you say this is one way traffic.

You do all the supplying and the rest of us do all the reading - it's just that you are so good in the supply department, and you obviously have the ability to read and absorb at a tremendous rate.

I think the problem is that there are not enough people on this site compared to the other side.

A lot of the terminology etc in some of the data that you bring to our attention is way above my head and although I might get the gist generally, I'm not in a position to make a well informed comment.

The off topic stuff I love, and appreciate very much what you bring to the board.

The Youtube clip about the Red Cross denial of the effects of MMS is an absolute eye opener and after all the other things that have been brought to my attention regarding big pharma's firm grip on the health industry, I find I am no longer surprised at very much.

Incidentally, I place the national charities in the same league for out and out deception and misrepresentation, as big pharma and government. They have their own agenda and are solely concerned with maintaining their own interests and privileged position. They misinform rather than inform, and what we get is propaganda.

To think, for years I direct debited to the Red Cross, Oxfam, MAP and Greenpeace to the absolute limits of what I could afford, and guess what, they used to ring me up and ask for more, and I did send more for 'special' situations or particular disasters.

Not any more. All direct debits have been cancelled and it was not easy to take that step, but thanks to the education I have received here, I don't feel uncomfortable about it.

Anyway, ramble over, but many thanks to you for what you bring to the party, and if you are no longer going to post here, I hope you will post on the other side occasionally.

mabel

eric716 - 14 Jul 2013 12:48 - 362 of 1034

Thanks for the updates gaz, good to see you back. have been watching from a distance but doing other things whilst waiting for the turn in pms to take hold in case I get tempted to sell at the bottom.

Interesting from atkinson today they're asking peeps to sell them their gold and siver coins at these low prices, supply must be getting quite tight for this type of request to appear I'd of thought?

Silver Bars

Prices based on 13.17 per ounce - 13/07/2013

**Gold & Silver Coins Urgently Required** Please call us on 0800 6446 375

or email us on info@atkinsonsthejewellers.com

http://www.atkinsonsthejewellers.com/silver-bars

Interesting from atkinson today they're asking peeps to sell them their gold and siver coins at these low prices, supply must be getting quite tight for this type of request to appear I'd of thought?

Silver Bars

Prices based on 13.17 per ounce - 13/07/2013

**Gold & Silver Coins Urgently Required** Please call us on 0800 6446 375

or email us on info@atkinsonsthejewellers.com

http://www.atkinsonsthejewellers.com/silver-bars

gazkaz - 14 Jul 2013 13:03 - 363 of 1034

Mabel - as long as you, max, eric, snurkle, squirrel etc are still reading (& putting your t'penneth in, on or off topic that's great - just seemed eerily too quiet)

The following is worth reading re big pharma

http://www4.dr-rath-foundation.org/features/death_by_medicine.html

Gather you have passed on the "forbidden Cures" re cancer cures to a few people.

This Egward G Griffin YouT is worth passing along too

(helps substantiate further...cures)

http://www.youtube.com/watch?v=QeYMduufa-E&feature=gv

And if they still have doubts :o)

This one shows the west approach - "if people cure cancer with natural productc

(yes - even aftet chemo/radiation etc) - docs say they didn't really have cancer, or just a mild case" -

(& yes there is a top US oncologists in the film that says thay !!!)

- vs -

Yet in the east (japan etc) their medical people... are all over( using/trialing and adding "the cure/therapy")......it...like a rash.

http://vimeo.com/18582324

The following is worth reading re big pharma

http://www4.dr-rath-foundation.org/features/death_by_medicine.html

Gather you have passed on the "forbidden Cures" re cancer cures to a few people.

This Egward G Griffin YouT is worth passing along too

(helps substantiate further...cures)

http://www.youtube.com/watch?v=QeYMduufa-E&feature=gv

And if they still have doubts :o)

This one shows the west approach - "if people cure cancer with natural productc

(yes - even aftet chemo/radiation etc) - docs say they didn't really have cancer, or just a mild case" -

(& yes there is a top US oncologists in the film that says thay !!!)

- vs -

Yet in the east (japan etc) their medical people... are all over( using/trialing and adding "the cure/therapy")......it...like a rash.

http://vimeo.com/18582324

mabel - 14 Jul 2013 16:48 - 364 of 1034

Have just listened to the Edward G Griffin stuff and will certainly pass this on.

It is so difficult for people who have the diagnosis because they are too frightened to go with anything other than what the doctor recommends, and only see alternatives as 'last chance saloons.

Those in possession of this type of info can only hope to inform rather than actively persuade, and you hope they will at least WATCH the thing in the first place.

I personally have good reason not to trust the medical profession, as between them they very nearly killed my son.

I'll try to be brief.

Over the course of a year he went to the doctor with abdominal pain which latterly became almost constant.

His GP diagnosed irritable bowel and several months in refused to refer him.

By the time he was referred he was literally skin and bone having lost 25% of his body weight.

He was finally referred to a gastroenterologist and had colonoscopy and scan.

Result being -

There is nothing wrong with you.

You are probably abusing drugs.

You are anorexic.

This is attention seeking behaviour.

You need to see a psychiatrist.

All this to someone who has no history of drug abuse and who had never even consulted any doctor with any mental health issue ever.

4 days later he consults again with GP.

Faints on entering consulting room. GP tells him "This is pathetic".

Collapses in waiting room while making further appointment. GP tells him he is OK to go home with his dad.

Had informed GP about large, black bowel motion and was told that he had just been given the cleanest bill of health it was possible to have. Black bowel motion is internal bleeding apparantly.

GP records in his notes, Widely dilating pupils. Pale. Cachectic. Looks shocking.

Did not examine him at any time.

The next day he collapsed again and was admitted to hospital with a haemaglobin of 6.6. He had to have blood transfusions before a gastroscopy could be performed.

He was found to have a huge duodenal ulcer which had pierced an artery and was spurting blood. He was lucky to survive.

This just 5 days after being discharged and told to see a psychiatrist.

And guess what. The GMC did not want to know. They said there was no case to answer.

mabel

It is so difficult for people who have the diagnosis because they are too frightened to go with anything other than what the doctor recommends, and only see alternatives as 'last chance saloons.

Those in possession of this type of info can only hope to inform rather than actively persuade, and you hope they will at least WATCH the thing in the first place.

I personally have good reason not to trust the medical profession, as between them they very nearly killed my son.

I'll try to be brief.

Over the course of a year he went to the doctor with abdominal pain which latterly became almost constant.

His GP diagnosed irritable bowel and several months in refused to refer him.

By the time he was referred he was literally skin and bone having lost 25% of his body weight.

He was finally referred to a gastroenterologist and had colonoscopy and scan.

Result being -

There is nothing wrong with you.

You are probably abusing drugs.

You are anorexic.

This is attention seeking behaviour.

You need to see a psychiatrist.

All this to someone who has no history of drug abuse and who had never even consulted any doctor with any mental health issue ever.

4 days later he consults again with GP.

Faints on entering consulting room. GP tells him "This is pathetic".

Collapses in waiting room while making further appointment. GP tells him he is OK to go home with his dad.

Had informed GP about large, black bowel motion and was told that he had just been given the cleanest bill of health it was possible to have. Black bowel motion is internal bleeding apparantly.

GP records in his notes, Widely dilating pupils. Pale. Cachectic. Looks shocking.

Did not examine him at any time.

The next day he collapsed again and was admitted to hospital with a haemaglobin of 6.6. He had to have blood transfusions before a gastroscopy could be performed.

He was found to have a huge duodenal ulcer which had pierced an artery and was spurting blood. He was lucky to survive.

This just 5 days after being discharged and told to see a psychiatrist.

And guess what. The GMC did not want to know. They said there was no case to answer.

mabel

squirrel888 - 14 Jul 2013 19:31 - 365 of 1034

I'm reading & absorbing. Humidity at 66% here. Managed to join a ladies walking group who walk around an air con mall for an hour. Swimming on hold as water is too warm & someone got an ear infection so as I'd already guessed - bacteria infested pool - so knocked that on the head & swapped it for the walking.

Reading alot.

Keep feeding us Gaz - we're like hungry chicks & its all helping my sanity.

Reading alot.

Keep feeding us Gaz - we're like hungry chicks & its all helping my sanity.

gazkaz - 15 Jul 2013 00:30 - 366 of 1034

Mabel - hard to have faith

- how many people are led blindly - to chemotherapy

The Fred Hutchinson Cancer Institute has published research showing that

- The extremely aggressive therapy, which kills both cancerous and healthy cells indiscriminately, can

- cause healthy cells to secrete a protein

- that sustains...... tumor growth.... and

- resistance.... to further treatment.

http://www.nydailynews.com/life-style/health/shock-study-chemotherapy-backfire-cancer-worse-triggering-tumor-growth-article-1.1129897#ixzz2Z3wBzcHo

It's actually been known sice the 70's - but even so - when a recent study shows it.....

- why are they still giving people something that - sustains the cancer

- and....makes it more agressive and treatment resistant

.....than you began with ?????

Strange - they keep pushing....mammograms...too

John W. Gofman, M.D., Ph.D., an authority on the health effects of ionizing radiation, spent 30 years studying the effects of low-dose radiation on humans. He estimates that

- 75% of breast cancer

- could be prevented by avoiding or minimizing

- exposure to the ionizing radiation from......

- mammography,........ X rays, and other medical sources.

Does he know his onions...on the subject

John William Gofman is

- Professor Emeritus of Molecular and Cell Biology in the University of California at Berkeley,

- and Lecturer at the Department of Medicine, University of California School of Medicine at San Francisco.

He is the author of several books and

- more than a hundred....... scientific papers in peer-review journals

in the fields of nuclear / physical chemistry, coronary heart disease, ultracentrifugal analysis of the serum lipoproteins, the relationship of human chromosomes to cancer, and the biological effects of radiation, with especial reference to causation of cancer and hereditary injury.

Re Mammograms

British Journal Of radiology on.. pubmed.gov

- low energy X-rays

- as used in .....mammography are approximately..... four times

- but possibly as much .....as six times

- more effective in....... causing mutational damage (than higher energy X-rays)

http://www.ncbi.nlm.nih.gov/pubmed/16498030

And.....after they have finished using "more cancer causing low energy" radiation for mamograms

- causing up to 75% ...of breast cancers

When they.....find the breast cancer

an independent review set up...by the government

(following years of scientific controversy surrounding the NHS programme).

Found...

4,000 women will undergo .......unnecessary treatment, including

- surgery,

- radiotherapy

- and chemotherapy,

for a cancer

- they would not otherwise have known about and....

- which would have done them......***** no harm in their lifetime*****.

Some breast cancers are so tiny and slow growing that they would....

- never be a threat...... to a woman's health,

the review says.

http://www.guardian.co.uk/society/2012/oct/30/breast-cancer-screenings-damaging-women

Conclusion

So in the light of all the above......why do they keep batting on regardless

- using "more cancer causing" low energy radiation...for mamograms

- & doing things that cause 75% of breast cancers (Per Dr Gofman)

- treating women with - radiation/surgery/chemo......who would never have any threat to their health ....in their lifetime...had they done nothing

- and....when giving chemo....knowingly doing so....even tho' the Fred Hutchinson Cancer institute.....has proven

- it causes the body to release a protein that.....actually sustains the tumour

- and makes it more....treatment resistant .

Answer ?

- sadly..... a simple one

- the same reason the Red Cross suppresses Jim Humbles....malaria cure

(there would otherwise be millions of African babies - surviving)

ie...

If they didn't keep causing cancer and supressing the cure

- Trillions in lost profits

- &....billion more people on the planet

In the style of Bones as he used to say to Captain Kirk on Star Trek

"It's just Eugenics Jim....but not as we know it"

- how many people are led blindly - to chemotherapy

The Fred Hutchinson Cancer Institute has published research showing that

- The extremely aggressive therapy, which kills both cancerous and healthy cells indiscriminately, can

- cause healthy cells to secrete a protein

- that sustains...... tumor growth.... and

- resistance.... to further treatment.

http://www.nydailynews.com/life-style/health/shock-study-chemotherapy-backfire-cancer-worse-triggering-tumor-growth-article-1.1129897#ixzz2Z3wBzcHo

It's actually been known sice the 70's - but even so - when a recent study shows it.....

- why are they still giving people something that - sustains the cancer

- and....makes it more agressive and treatment resistant

.....than you began with ?????

Strange - they keep pushing....mammograms...too

John W. Gofman, M.D., Ph.D., an authority on the health effects of ionizing radiation, spent 30 years studying the effects of low-dose radiation on humans. He estimates that

- 75% of breast cancer

- could be prevented by avoiding or minimizing

- exposure to the ionizing radiation from......

- mammography,........ X rays, and other medical sources.

Does he know his onions...on the subject

John William Gofman is

- Professor Emeritus of Molecular and Cell Biology in the University of California at Berkeley,

- and Lecturer at the Department of Medicine, University of California School of Medicine at San Francisco.

He is the author of several books and

- more than a hundred....... scientific papers in peer-review journals

in the fields of nuclear / physical chemistry, coronary heart disease, ultracentrifugal analysis of the serum lipoproteins, the relationship of human chromosomes to cancer, and the biological effects of radiation, with especial reference to causation of cancer and hereditary injury.

Re Mammograms

British Journal Of radiology on.. pubmed.gov

- low energy X-rays

- as used in .....mammography are approximately..... four times

- but possibly as much .....as six times

- more effective in....... causing mutational damage (than higher energy X-rays)

http://www.ncbi.nlm.nih.gov/pubmed/16498030

And.....after they have finished using "more cancer causing low energy" radiation for mamograms

- causing up to 75% ...of breast cancers

When they.....find the breast cancer

an independent review set up...by the government

(following years of scientific controversy surrounding the NHS programme).

Found...

4,000 women will undergo .......unnecessary treatment, including

- surgery,

- radiotherapy

- and chemotherapy,

for a cancer

- they would not otherwise have known about and....

- which would have done them......***** no harm in their lifetime*****.

Some breast cancers are so tiny and slow growing that they would....

- never be a threat...... to a woman's health,

the review says.

http://www.guardian.co.uk/society/2012/oct/30/breast-cancer-screenings-damaging-women

Conclusion

So in the light of all the above......why do they keep batting on regardless

- using "more cancer causing" low energy radiation...for mamograms

- & doing things that cause 75% of breast cancers (Per Dr Gofman)

- treating women with - radiation/surgery/chemo......who would never have any threat to their health ....in their lifetime...had they done nothing

- and....when giving chemo....knowingly doing so....even tho' the Fred Hutchinson Cancer institute.....has proven

- it causes the body to release a protein that.....actually sustains the tumour

- and makes it more....treatment resistant .

Answer ?

- sadly..... a simple one

- the same reason the Red Cross suppresses Jim Humbles....malaria cure

(there would otherwise be millions of African babies - surviving)

ie...

If they didn't keep causing cancer and supressing the cure

- Trillions in lost profits

- &....billion more people on the planet

In the style of Bones as he used to say to Captain Kirk on Star Trek

"It's just Eugenics Jim....but not as we know it"

gazkaz - 16 Jul 2013 09:17 - 367 of 1034

Interesting update from Ned of Cheviot Asset Management

Worth noting in the written report .....The Gov't/BofE....is WORRIED about

- BARCLAYS (Leverage now a huge 40 : 1)

The reason I mention it - is as I have pointed out previously - there was an investigation into...... Barclays - "illegally" lending the money to - the Saudi wealth fund money

- to fund... "its own bailout"....to avoid the strings of a Gov't bailout

- tantamount to a bankrupt - writing out a cheque on his ...own bank account...to repay his own debts !!

(then .....silence re the outcome)

PLUS

Jim Willie states heaven and earth is being moved on a daily basis by the Banksters to stop 3 Banks going tits up

- Barclays....Deutsche & Citi

The written short update newsletter

http://www.scribd.com/doc/152683206/Gold-Update-July-2013

Ned interviewed by GoldMoney ...on the content of the above gold report update

Ned also points out the fiat system is broken

- as - in a stable fiat system

- gold should just "sit.... backing the paper currency" and not really - move much.

- and the paper currency should - move around at reasonable velocity.

In the present system

- Fiat money is parked in "financial assets - Gov't T Bonds, Stock Market, Bank accounts etc

(& incidentally Trillions are parked by the Banks at Central Banks - as they are ...unwilling....to risk....lending...to each other. 2 Trillion parked by the banks ..at the FEDy alone !!)

- ie fiat paper is... not moving...with sufficient velocity

And....

- it is ...Physical Gold..... that is.... moving

- and with...... increased velocity

He also points out - that there are only 2 measures of the value of "money"

- gold backing...and interest rates

(interest rates being compensation for.... the "risk" of holding fiat paper)

- and both are being heavily manipulated..to suppress/hide the massively falling "value" of fiat paper

The fiat system is broken completely

(as has always happened throughout history....to all paper based money systems)

- and this time, fot the first time - it's ....global

Worth noting in the written report .....The Gov't/BofE....is WORRIED about

- BARCLAYS (Leverage now a huge 40 : 1)

The reason I mention it - is as I have pointed out previously - there was an investigation into...... Barclays - "illegally" lending the money to - the Saudi wealth fund money

- to fund... "its own bailout"....to avoid the strings of a Gov't bailout

- tantamount to a bankrupt - writing out a cheque on his ...own bank account...to repay his own debts !!

(then .....silence re the outcome)

PLUS

Jim Willie states heaven and earth is being moved on a daily basis by the Banksters to stop 3 Banks going tits up

- Barclays....Deutsche & Citi

The written short update newsletter

http://www.scribd.com/doc/152683206/Gold-Update-July-2013

Ned interviewed by GoldMoney ...on the content of the above gold report update

Ned also points out the fiat system is broken

- as - in a stable fiat system

- gold should just "sit.... backing the paper currency" and not really - move much.

- and the paper currency should - move around at reasonable velocity.

In the present system

- Fiat money is parked in "financial assets - Gov't T Bonds, Stock Market, Bank accounts etc

(& incidentally Trillions are parked by the Banks at Central Banks - as they are ...unwilling....to risk....lending...to each other. 2 Trillion parked by the banks ..at the FEDy alone !!)

- ie fiat paper is... not moving...with sufficient velocity

And....

- it is ...Physical Gold..... that is.... moving

- and with...... increased velocity

He also points out - that there are only 2 measures of the value of "money"

- gold backing...and interest rates

(interest rates being compensation for.... the "risk" of holding fiat paper)

- and both are being heavily manipulated..to suppress/hide the massively falling "value" of fiat paper

The fiat system is broken completely

(as has always happened throughout history....to all paper based money systems)

- and this time, fot the first time - it's ....global

gazkaz - 16 Jul 2013 09:58 - 368 of 1034

An opinion from 58-year market veteran

- Ron Rosen, who has been at this business for almost ...six decades

- that silver ....will advance roughly 800%

and gold is set to soar over $3,000 from current levels.

We are looking at a massive move in front of us that will top ..sometime in 2014.

- At that point there will be a correction.

- Then,..... a massive blowoff

- will take us probably into early 2016.

People who have been tortured by this long corrective phase, they will be thrilled if they have the ability to hang on. They just need patience here.

I expect the gold price to hit $4,300 in early 2016, but

- the really fascinating thing here is..... the silver chart

- because there have been three peaks.

The first peak increased two times from the previous low. The low was $4.01 and silver went over $8 in that move. (x2)

The second peak was $21.44. So silver increased four times the previous low, which was $5.45. (x4)

The third peak was $49.82, and that was six times the previous low, which was $8.40. (x6)

You’ve got an old guy like me who has been at this business for almost six decades, and he sees....... 2, 4, 6.

There’s only one number that comes up next, ....8.

- We then multiply 8 times the low of $18.17, and we have a silver price

- of over.... $148 sometime in early ....2016.

It’s as clear to me as the sun rising and setting.”

---------------------------------------------------------------------------------------------

Rick Rule comments on how he & Eric Sprott became.....wealthy

One of the things that occurs to me is that this is my fourth major market cycle. The three previous down-cycles that I’ve been through previously were the cause of my personal wealth, and Eric Sprott’s.... personal wealth

“It’s interesting that at age 60 I have a lot more patience

- than I did when I was age 30.

And I think one of the things that’s happening right now is the fact that markets and conditions have caused me to be a 3-to-5-year thinker, and most of the people I compete with, who are 20 years younger than me, have a.... 2-to-3-week time frame.

And the idea that somebody who has a 2-to-3-week times frame can compete with somebody who has a 3-to-5-year time frame is very problematic. What Eric and I are trying to do in very crass terms is go from being quite wealthy,

- to being....... ludicrously wealthy.

This is my fourth major downturn, and in the first one I was really terrified because I hadn’t been through it before. But in the last three downturns

- I have known in every case that bear markets cause bull markets

- and that I was going to come out of it doing very well.

I just didn’t know how well or how long it was going to take.

I need to tell you that in each prior instance that I came out of it doing much better than I anticipated, and this time I believe that

- I am going to do incredibly well coming out of this market.

People need to remember that neither want nor hope are... investment techniques,

- they are emotions.

-people need to think .....as opposed to wanting or hoping.

- And if they do that, and they lengthen their time frames,

- they will do much, much better with their portfolios as this market turns and heads to the upside.”

“We need to remind ourselves,

- that the narrative with regards to precious metals

- has not changed between 2010 and today.

The only thing that has changed is the price.

Investors sometimes need me to hold their hands.... on gold and silver.

- People need to ...hold their own hands.

They need to decide for themselves

- whether they want to do.... what I do,

- which is own things they (governments) can’t print,

- or whether or not they want to default, as an example, to the U.S. 10-Year Treasury which our friend Jim Grant famously described as.... ‘return-free risk.’

Of course I am....betting

- that it will be much wiser........ to own things that governments can’t print.”

.................................................................................................................

Overall patience - common sense - on how you personally join the dots of the info which adds up to the true, real....big picture....that's coming down the track

- and cutting through TPTB owned MSM.....hype, talking heads and...

- well ....general deceptive ...Bullsh!t

Generally the "freethinkers" tend to be right...on the big picture outcome

- but just see it....too early

- then doubt their own conclusions...during the lull

- often they then ....jump back in the game

- only to find out....they had been right all along in the first place.

As I put it - "if" you are correct in the foresight

- that all the pointers are that....the brown stuff is going to hit the rotating blades...at some point in...the near future"

"Is it better to be...prepared

- a year or two..early

- or one day....too late ??"

- Ron Rosen, who has been at this business for almost ...six decades

- that silver ....will advance roughly 800%

and gold is set to soar over $3,000 from current levels.

We are looking at a massive move in front of us that will top ..sometime in 2014.

- At that point there will be a correction.

- Then,..... a massive blowoff

- will take us probably into early 2016.

People who have been tortured by this long corrective phase, they will be thrilled if they have the ability to hang on. They just need patience here.

I expect the gold price to hit $4,300 in early 2016, but

- the really fascinating thing here is..... the silver chart

- because there have been three peaks.

The first peak increased two times from the previous low. The low was $4.01 and silver went over $8 in that move. (x2)

The second peak was $21.44. So silver increased four times the previous low, which was $5.45. (x4)

The third peak was $49.82, and that was six times the previous low, which was $8.40. (x6)

You’ve got an old guy like me who has been at this business for almost six decades, and he sees....... 2, 4, 6.

There’s only one number that comes up next, ....8.

- We then multiply 8 times the low of $18.17, and we have a silver price

- of over.... $148 sometime in early ....2016.

It’s as clear to me as the sun rising and setting.”

---------------------------------------------------------------------------------------------

Rick Rule comments on how he & Eric Sprott became.....wealthy

One of the things that occurs to me is that this is my fourth major market cycle. The three previous down-cycles that I’ve been through previously were the cause of my personal wealth, and Eric Sprott’s.... personal wealth

“It’s interesting that at age 60 I have a lot more patience

- than I did when I was age 30.

And I think one of the things that’s happening right now is the fact that markets and conditions have caused me to be a 3-to-5-year thinker, and most of the people I compete with, who are 20 years younger than me, have a.... 2-to-3-week time frame.

And the idea that somebody who has a 2-to-3-week times frame can compete with somebody who has a 3-to-5-year time frame is very problematic. What Eric and I are trying to do in very crass terms is go from being quite wealthy,

- to being....... ludicrously wealthy.

This is my fourth major downturn, and in the first one I was really terrified because I hadn’t been through it before. But in the last three downturns

- I have known in every case that bear markets cause bull markets

- and that I was going to come out of it doing very well.

I just didn’t know how well or how long it was going to take.

I need to tell you that in each prior instance that I came out of it doing much better than I anticipated, and this time I believe that

- I am going to do incredibly well coming out of this market.

People need to remember that neither want nor hope are... investment techniques,

- they are emotions.

-people need to think .....as opposed to wanting or hoping.

- And if they do that, and they lengthen their time frames,

- they will do much, much better with their portfolios as this market turns and heads to the upside.”

“We need to remind ourselves,

- that the narrative with regards to precious metals

- has not changed between 2010 and today.

The only thing that has changed is the price.

Investors sometimes need me to hold their hands.... on gold and silver.

- People need to ...hold their own hands.

They need to decide for themselves

- whether they want to do.... what I do,

- which is own things they (governments) can’t print,

- or whether or not they want to default, as an example, to the U.S. 10-Year Treasury which our friend Jim Grant famously described as.... ‘return-free risk.’

Of course I am....betting

- that it will be much wiser........ to own things that governments can’t print.”

.................................................................................................................

Overall patience - common sense - on how you personally join the dots of the info which adds up to the true, real....big picture....that's coming down the track

- and cutting through TPTB owned MSM.....hype, talking heads and...

- well ....general deceptive ...Bullsh!t

Generally the "freethinkers" tend to be right...on the big picture outcome

- but just see it....too early

- then doubt their own conclusions...during the lull

- often they then ....jump back in the game

- only to find out....they had been right all along in the first place.

As I put it - "if" you are correct in the foresight

- that all the pointers are that....the brown stuff is going to hit the rotating blades...at some point in...the near future"

"Is it better to be...prepared

- a year or two..early

- or one day....too late ??"

gazkaz - 16 Jul 2013 13:36 - 369 of 1034

Another pointer (re above - near term....the brown stuff impacting the rotating)

The European "bail out fund" itself

- has been - downgraded

(you really coiuldn't make this stuff up)

Published July 15, 2013

Associated Press

LONDON – Fitch Ratings has cut its credit grade for

- the European fund that provides .....rescue loans to Greece, Ireland and Portugal.

The agency says it lowered the rating for the European Financial Stability Facility — or EFSF

— by one notch from AAA to AA+

as a result of its downgrade of France last week.

(The EFSF’s creditworthiness ....depends on that of the countries that provide its financing, which includes France).

Monday’s downgrade of the EFSF means the fund could have to pay higher interest rates to raise money.

Fitch’s rivals Standard & Poor’s and Moody’s have already downgraded it.

(No great suprise - but most sheeple don't grasp - it's predominantly the - insolvent nations - guaranteeing......

- the bailouts....of insolvent nations

(yes - the crazy world of...smoke and mirrors)

The European "bail out fund" itself

- has been - downgraded

(you really coiuldn't make this stuff up)

Published July 15, 2013

Associated Press

LONDON – Fitch Ratings has cut its credit grade for

- the European fund that provides .....rescue loans to Greece, Ireland and Portugal.

The agency says it lowered the rating for the European Financial Stability Facility — or EFSF

— by one notch from AAA to AA+

as a result of its downgrade of France last week.

(The EFSF’s creditworthiness ....depends on that of the countries that provide its financing, which includes France).

Monday’s downgrade of the EFSF means the fund could have to pay higher interest rates to raise money.

Fitch’s rivals Standard & Poor’s and Moody’s have already downgraded it.

(No great suprise - but most sheeple don't grasp - it's predominantly the - insolvent nations - guaranteeing......

- the bailouts....of insolvent nations

(yes - the crazy world of...smoke and mirrors)