| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

This week I am mainly shorting these stocks (DOWN)

Juzzle

- 12 Dec 2003 05:25

- 12 Dec 2003 05:25

SEE LATEST CHOICE IN LATEST POST

SEE LATEST CHOICE IN LATEST POSTThere are existing threads specific to betting short or long on indices.

On this one I plan to stick to individual UK stocks, and will post other examples of favourite fallers.

My downbets are sometimes just an hour or so, sometimes days, weeks, months. So bear in mind(!) that some of the charts shown may become irrelevant within days.

I mainly use IG Index, but also Spreadex

SEE LATEST CHOICE IN LATEST POST

cynic

- 10 Dec 2014 09:49

- 56 of 80

- 10 Dec 2014 09:49

- 56 of 80

QPP must also surely be for the knacker's yard though the main "fun" has now gone

aldwickk

- 10 Dec 2014 10:02

- 57 of 80

- 10 Dec 2014 10:02

- 57 of 80

Might bounce back if the account's are seen to be kosher

aldwickk

- 10 Dec 2014 10:02

- 58 of 80

- 10 Dec 2014 10:02

- 58 of 80

ps Will bounce back

cynic

- 10 Dec 2014 10:14

- 59 of 80

- 10 Dec 2014 10:14

- 59 of 80

very hard to believe that they really are, no matter how hard the management tries to spin the findings

Juzzle

- 11 Dec 2014 13:15

- 60 of 80

- 11 Dec 2014 13:15

- 60 of 80

Downbets on Parkmead (PMG) and Igas (IGAS) continuing nicely.

Juzzle

- 15 Dec 2014 16:23

- 61 of 80

- 15 Dec 2014 16:23

- 61 of 80

---

Juzzle

- 07 Jan 2015 09:33

- 62 of 80

- 07 Jan 2015 09:33

- 62 of 80

Opened a tentative downbet on AA. Also increased my downbet on CARD.

Juzzle

- 14 Jan 2015 10:44

- 63 of 80

- 14 Jan 2015 10:44

- 63 of 80

One for the candlechart specialists. Ibex Global (IBEX) has not produced one positive candle since mid-December 2013. Downbets are taken online at Spreadex or by phone at IG.

I have been short of it in the past, but after closing my position last August, I forgot about it till this week.

They operate call centres in various parts of the world but are a tiny player in this field (market cap around £40m now having halved in 12 months)

Chart fell heavily in March and October (HY and FY Results).

Juzzle

- 14 Jan 2015 17:47

- 64 of 80

- 14 Jan 2015 17:47

- 64 of 80

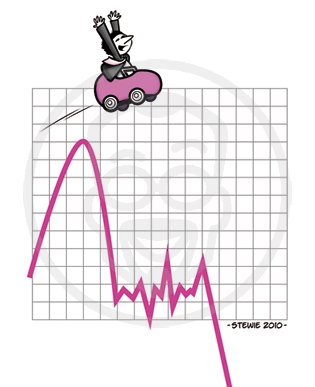

APR Energy (APR) develops and operates a fleet of readymade containerised electricity generation plants that can be quickly shipped to wherever needed. Their share price has been falling since October 2013 - down more than 80% so far.

Juzzle

- 15 Jan 2015 09:34

- 65 of 80

- 15 Jan 2015 09:34

- 65 of 80

IBEX (post 63) falling again - down 6.3% already this morning.

Juzzle

- 15 Jan 2015 10:35

- 66 of 80

- 15 Jan 2015 10:35

- 66 of 80

---

Juzzle

- 20 Jan 2015 10:19

- 67 of 80

- 20 Jan 2015 10:19

- 67 of 80

APR still sliding. Lost half its value in the last 11 weeks. Down a whopping 85% from Oct 2013 peak.

It would need to grow sevenfold to get back to its highs.

The ongoing suspension of its operations in Libya (biggest contract by far) is reportedly costing it an estimated $17m per month in lost revenue.

(chart in Post 64)

It would need to grow sevenfold to get back to its highs.

The ongoing suspension of its operations in Libya (biggest contract by far) is reportedly costing it an estimated $17m per month in lost revenue.

(chart in Post 64)

Juzzle

- 23 Jan 2015 09:29

- 68 of 80

- 23 Jan 2015 09:29

- 68 of 80

Good luck to all who are buying in on the basis of APR's asset value and in anticipation of a sharp bounce on any good news from Libya. Libyan government ratification of APR's contract extension could prompt a very sudden spike upwards in its share price.

But latest news on the overall situation in Libya remains grim and understandably affects the share price of all listed companies operating there, deterring many investors:

New York Times latest from Libya

In the event that the Libyan situation is not resolved in APR's favour, there must be doubts about how the company would ship its generators elsewhere - with so much disruption of ports and airports - and the risk of equipment being seized by fighters. About a fifth of APR's fleet is in Libya. The country is desparately short of electricity, and APR's equipment is something that various factions might relish control of.

But latest news on the overall situation in Libya remains grim and understandably affects the share price of all listed companies operating there, deterring many investors:

New York Times latest from Libya

In the event that the Libyan situation is not resolved in APR's favour, there must be doubts about how the company would ship its generators elsewhere - with so much disruption of ports and airports - and the risk of equipment being seized by fighters. About a fifth of APR's fleet is in Libya. The country is desparately short of electricity, and APR's equipment is something that various factions might relish control of.

Juzzle

- 26 Jan 2015 08:22

- 69 of 80

- 26 Jan 2015 08:22

- 69 of 80

So, APR has conceded defeat and thrown in the towel on its biggest contract. It now has the problem of getting its equipment out of war torn Libya without any faction seizing it.

cynic

- 26 Jan 2015 08:40

- 70 of 80

- 26 Jan 2015 08:40

- 70 of 80

wow .... if you were short there, then very well done indeed

for myself, have just opened a small short on QPP at 107.25 as the news of the potential sale of one the assets wasn't quite accurate

for myself, have just opened a small short on QPP at 107.25 as the news of the potential sale of one the assets wasn't quite accurate

Juzzle

- 26 Jan 2015 09:00

- 71 of 80

- 26 Jan 2015 09:00

- 71 of 80

Yep, was short APR ;o)

aldwickk

- 26 Jan 2015 09:14

- 72 of 80

- 26 Jan 2015 09:14

- 72 of 80

What's your view on Afren ? upside more then downside now

cynic

- 26 Jan 2015 09:30

- 73 of 80

- 26 Jan 2015 09:30

- 73 of 80

your choice, but i think this is now dead in the water as far as PIs are concerned

aldwickk

- 26 Jan 2015 14:15

- 74 of 80

- 26 Jan 2015 14:15

- 74 of 80

No one seems to know its value , except those who have looked at the books even that depends who want's to take it on

cp1 - 26 Jan 2015 14:38 - 75 of 80

FXPO could pretty much collapse to nothing from here. Iron ore plunged again overnight down 4% to near 6 year low.

Operating in Ukraine as well.........

Operating in Ukraine as well.........