| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

IronRidge - A force to be reckoned with (IRR)

mentor - 25 Apr 2017 09:40

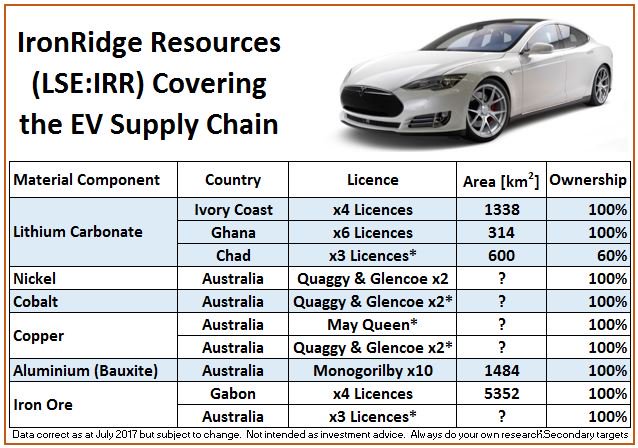

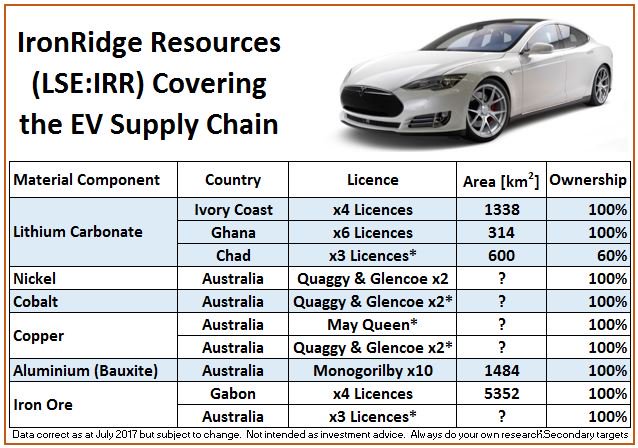

IronRidge Resources is an AIM listed mineral exploration company with assets in African and Australia.

The Company's flagship project is located in Gabon, West Africa with permits in two areas - Belinga Sud and Tchibanga.

These permits cover at total area of 3,974km2 and were awarded by the Minister for Mines and Industry in June 2013.

IronRidge's corporate strategy is to create and sustain shareholder value through the discovery of world-class iron ore deposits.

CEO Nick Mather's track record is there for all to see.

The geologists continue to uncover quality

Exploration

Titanium 1.1billion tonnes @ 3.5% TiO2

Top Five:

1- Tchibanga (Iron Ore Gabon)

2- Monogorilby (Bauxite Aus)

3- Dorothe & Family (Gold Chad)

4- Monogorilby (Titanium Aus)

5- May Queen & EPM19419 (Gold & Copper Aus)

That leaves out:

1- All Ivory Coast assets (Gold & Lithium)

2- All Ghanian assets (Lithium +)

3- Belinga Sud (Gabon)

4- Quaggy & Glencoe x2 (Nickel, Copper, Cobalt)

5- Waya Waya x2 (Graphite Chad)

At present after some retracement share price has reached a bottom 37.50p and twice bounce from that 38p offer.

The Company's flagship project is located in Gabon, West Africa with permits in two areas - Belinga Sud and Tchibanga.

These permits cover at total area of 3,974km2 and were awarded by the Minister for Mines and Industry in June 2013.

IronRidge's corporate strategy is to create and sustain shareholder value through the discovery of world-class iron ore deposits.

CEO Nick Mather's track record is there for all to see.

The geologists continue to uncover quality

Exploration

Titanium 1.1billion tonnes @ 3.5% TiO2

Top Five:

1- Tchibanga (Iron Ore Gabon)

2- Monogorilby (Bauxite Aus)

3- Dorothe & Family (Gold Chad)

4- Monogorilby (Titanium Aus)

5- May Queen & EPM19419 (Gold & Copper Aus)

That leaves out:

1- All Ivory Coast assets (Gold & Lithium)

2- All Ghanian assets (Lithium +)

3- Belinga Sud (Gabon)

4- Quaggy & Glencoe x2 (Nickel, Copper, Cobalt)

5- Waya Waya x2 (Graphite Chad)

At present after some retracement share price has reached a bottom 37.50p and twice bounce from that 38p offer.

mentor - 27 Apr 2017 09:06 - 6 of 9

42.50p +1.50 (+3.66%)

The early buying got the momentum and movement up trend since yesterday.

All MMs have moved prices by now and I too

-------------

The early buying got the momentum and movement up trend since yesterday.

All MMs have moved prices by now and I too

-------------

mentor - 31 Jul 2017 09:02 - 7 of 9

IronRidge excited by progress at Ghana lithium projects

IronRidge is excited by the rapid exploration progress and positive results it is generating on its lithium projects in Ghana.

It said ongoing trenching and mapping at the Barari licence, Ewoyaa and Abunko projects, continued to intersect wide spodumene dominant lithium pegmatites within the Cape Coast lithium project area.

The company said it was working towards a maiden drill programme later this year. IronRidge said the ultra-high resolution helicopter borne magnetics and radiometrics survey had now been completed with 3,804 line kilometres flown over the Barari and Apam licence areas.

It said preliminary data from the survey indicated a strong correlation between mapped lithium pegmatites to date and radiometrics response.

And it said multiple additional pegmatite targets were evident within the preliminary data.

Chief executive Vincent Mascolo said: "We are excited with the rapid exploration progress and positive results we are generating on our lithium projects in Ghana.

"IronRidge has defined a blueprint for rapid and successful identification which we intend to apply to other areas.

"With the demand for lithium and the renewable and stored energy space continuing to grow at an unprecedented pace, IronRidge is ideally positioned to take advantage of the current and expanding global initiatives.

"We are very pleased with the rapid development of our Ghana lithium project portfolio and look forward to keeping shareholders and investors updated as more news becomes available."

IronRidge is excited by the rapid exploration progress and positive results it is generating on its lithium projects in Ghana.

It said ongoing trenching and mapping at the Barari licence, Ewoyaa and Abunko projects, continued to intersect wide spodumene dominant lithium pegmatites within the Cape Coast lithium project area.

The company said it was working towards a maiden drill programme later this year. IronRidge said the ultra-high resolution helicopter borne magnetics and radiometrics survey had now been completed with 3,804 line kilometres flown over the Barari and Apam licence areas.

It said preliminary data from the survey indicated a strong correlation between mapped lithium pegmatites to date and radiometrics response.

And it said multiple additional pegmatite targets were evident within the preliminary data.

Chief executive Vincent Mascolo said: "We are excited with the rapid exploration progress and positive results we are generating on our lithium projects in Ghana.

"IronRidge has defined a blueprint for rapid and successful identification which we intend to apply to other areas.

"With the demand for lithium and the renewable and stored energy space continuing to grow at an unprecedented pace, IronRidge is ideally positioned to take advantage of the current and expanding global initiatives.

"We are very pleased with the rapid development of our Ghana lithium project portfolio and look forward to keeping shareholders and investors updated as more news becomes available."

mentor - 06 Sep 2017 10:42 - 8 of 9

32.25p +1p

Is moving ahead after yesterday's positive RNS, after being at bottom recently ( summer blues )..........

IronRidge completes acquisition of Tekton Minerals - 5 Sep '17

IronRidge Resources has completed its acquisition of 100% of Tekton Minerals Pte.

This give IronRidge full ownership of a highly prospective gold exploration portfolio in Chad.

---------------

today - Corporate Presentation - Africa Down Under - 6 Sep '17

IronRidge Resources Limited (AIM: IRR, 'IronRidge' or the 'Company') is pleased to provide shareholders and interested investors of the release of the Company's latest presentation which is being made available at the Africa Down Under Conference in Perth, Australia.

The presentation includes the Company's current unaudited cash figure of USD12.3 million.

Is moving ahead after yesterday's positive RNS, after being at bottom recently ( summer blues )..........

IronRidge completes acquisition of Tekton Minerals - 5 Sep '17

IronRidge Resources has completed its acquisition of 100% of Tekton Minerals Pte.

This give IronRidge full ownership of a highly prospective gold exploration portfolio in Chad.

---------------

today - Corporate Presentation - Africa Down Under - 6 Sep '17

IronRidge Resources Limited (AIM: IRR, 'IronRidge' or the 'Company') is pleased to provide shareholders and interested investors of the release of the Company's latest presentation which is being made available at the Africa Down Under Conference in Perth, Australia.

The presentation includes the Company's current unaudited cash figure of USD12.3 million.

mentor - 07 Sep 2017 16:50 - 9 of 9

Another move up today to 33.75p +1.50p

That is what "toro" says .......

My first target has always been 100p. Once this is hit I will re-evaluate based on information available at the time. However, I believe that 100p is exceptionally conservative and here’s why….

1. Based upon our current JORC at Monogorilby, only 1 target drilled so far, extrapolate this out to include all 6 targets and we have an estimate of 330Mt of Bauxite valued at ~$6bn (using $49.5/t).

2. Also at Monogorilby, we have the Titanium which could be up to 1.1bt at 3.8 - 5.2%. Let's be unbelievably cautious and say that there's only 10% of this resource in the ground and that it’s all at the low end of the grade – 110Mt at 3.5% - that's ~$13.4bn in the ground (using £3500/t).

3. Mapped lithium pegmatites from just one of our Ghanaian licences are about the same size as Prem’s Zulu which has recently yielded a resource estimate of 526,000 tonnes of LCE for just 35% of the total pegmatite length. Using a very conservative $10k/t, that’s $5.2bn in the ground.

4. May Queen has been compared to both Cracow and Gympie in Australia which are both multi-million ounce deposits. Airing on the side of caution, let's say we have 1MOz, that's $1.3bn in the ground.

5. VM said that Chad's Dorothe could hold 'several million ounces' and Am Ouchar and Echbara 'could mirror this'. Let's carry on with cautionary numbers and say that we have just 3MOz total from all three licences, that's $3.9bn in the ground.

6. Multiple IC gold licences in the middle of ‘gold country’ with some great initial DD numbers. Conservatively estimating that we’ll find ~2MOz from all of these areas and that’s $2.6bn in the ground.

7. Iron ore prices have recovered recently but VM is quoted as saying that the Gabon Assets (Tchibanga and Tchibanga Nord) are feasible at $60 so the current NPV (based on an already stupidly conservative resource estimate) will be around $4.8bn. I’ve not included Belinga Sud here either.

Add all of the above together and we have a total of $37.2 billion. Let’s say, for arguments sake, that someone would pay only 1% to acquire these assets – that’s $372m (or £284m) or a share price of 104p.

In summary, I have justified a 300% increase in sp by using less than 1% of the projected value of just 50% of our assets. Just think about that for a second!

That is what "toro" says .......

My first target has always been 100p. Once this is hit I will re-evaluate based on information available at the time. However, I believe that 100p is exceptionally conservative and here’s why….

1. Based upon our current JORC at Monogorilby, only 1 target drilled so far, extrapolate this out to include all 6 targets and we have an estimate of 330Mt of Bauxite valued at ~$6bn (using $49.5/t).

2. Also at Monogorilby, we have the Titanium which could be up to 1.1bt at 3.8 - 5.2%. Let's be unbelievably cautious and say that there's only 10% of this resource in the ground and that it’s all at the low end of the grade – 110Mt at 3.5% - that's ~$13.4bn in the ground (using £3500/t).

3. Mapped lithium pegmatites from just one of our Ghanaian licences are about the same size as Prem’s Zulu which has recently yielded a resource estimate of 526,000 tonnes of LCE for just 35% of the total pegmatite length. Using a very conservative $10k/t, that’s $5.2bn in the ground.

4. May Queen has been compared to both Cracow and Gympie in Australia which are both multi-million ounce deposits. Airing on the side of caution, let's say we have 1MOz, that's $1.3bn in the ground.

5. VM said that Chad's Dorothe could hold 'several million ounces' and Am Ouchar and Echbara 'could mirror this'. Let's carry on with cautionary numbers and say that we have just 3MOz total from all three licences, that's $3.9bn in the ground.

6. Multiple IC gold licences in the middle of ‘gold country’ with some great initial DD numbers. Conservatively estimating that we’ll find ~2MOz from all of these areas and that’s $2.6bn in the ground.

7. Iron ore prices have recovered recently but VM is quoted as saying that the Gabon Assets (Tchibanga and Tchibanga Nord) are feasible at $60 so the current NPV (based on an already stupidly conservative resource estimate) will be around $4.8bn. I’ve not included Belinga Sud here either.

Add all of the above together and we have a total of $37.2 billion. Let’s say, for arguments sake, that someone would pay only 1% to acquire these assets – that’s $372m (or £284m) or a share price of 104p.

In summary, I have justified a 300% increase in sp by using less than 1% of the projected value of just 50% of our assets. Just think about that for a second!

- Page:

- 1