| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

gazkaz - 15 Aug 2013 13:15 - 674 of 1034

Mike maloney's opinion

Here he discusses - The Hidden Secrets of Money and .....the 7 Stages of Empire.

- It was the collapse of the currency in the Weimar Republic... that paved the way for the rise of fascism, and ......

- Mike tells us we are in.......... stage 6

- of the collapse of the U.S. empire,

(and that....we are at risk of repeating history)

http://www.youtube.com/watch?v=Maloney/oh-dear/hold-on-tight

Here he discusses - The Hidden Secrets of Money and .....the 7 Stages of Empire.

- It was the collapse of the currency in the Weimar Republic... that paved the way for the rise of fascism, and ......

- Mike tells us we are in.......... stage 6

- of the collapse of the U.S. empire,

(and that....we are at risk of repeating history)

http://www.youtube.com/watch?v=Maloney/oh-dear/hold-on-tight

gazkaz - 15 Aug 2013 16:28 - 675 of 1034

Recall that

- registered gold is..... the gold held at the COMEX that is ....available for delivery

- while eligible gold ......is not “eligible” for delivery.

Just 3-1/2 years ago in early 2011,

- COMEX warehouses held more than .....11 million ounces of ....eligible gold,

(with JPM holding more than 3 million of these 11 million ounces.)

As of August 9, 2013, JPM’s..... "eligible gold"

- has fallen from.. 3+ million ounces.. to just 361,606 ounces.

Thus, it is safe to conclude

- that physical gold is being withdrawn from the COMEX warehouse

- due to a lack of trust in the global banking sector’s honesty and credibility

(As the "eligible" gold - is effectiely - punter gold...stored for safe keeping)

Moving along to registered gold

( the gold held at the COMEX that is available for delivery).

It is interesting to note that just since April,

- registered gold held at the COMEX depositories

- has collapsed from a total of 2,147,398 ounces

- to just 852,930 ounces.

That is a collapse of 60% of the registered gold inventory..... in less than 4 months!

To put this "tiny 853,000 oz comex gold - available - for delivery" - into perspective.

Data from Hong Kong gold exports reveal that China...... has imported

- an average of 200 metric tonnes of gold.... every month April, May, and June.

( 200 metric tonnes is equivalent to more than.... 6.4 million ounces... of gold).

So China has been importing.....6.4 Million oz ....per month

- and

- COMEX holds a total of just..... 852,930 ounces of registered gold

(available for delivery)........ at the current time.

Unlike the fiat fractional reserve ponzi

- in the gold fractional reserve ponzi.....you can't just quietly - print your way out - a run on physical bullion

- all you can do - is drive the price down....and pay out - in fiat paper.

- registered gold is..... the gold held at the COMEX that is ....available for delivery

- while eligible gold ......is not “eligible” for delivery.

Just 3-1/2 years ago in early 2011,

- COMEX warehouses held more than .....11 million ounces of ....eligible gold,

(with JPM holding more than 3 million of these 11 million ounces.)

As of August 9, 2013, JPM’s..... "eligible gold"

- has fallen from.. 3+ million ounces.. to just 361,606 ounces.

Thus, it is safe to conclude

- that physical gold is being withdrawn from the COMEX warehouse

- due to a lack of trust in the global banking sector’s honesty and credibility

(As the "eligible" gold - is effectiely - punter gold...stored for safe keeping)

Moving along to registered gold

( the gold held at the COMEX that is available for delivery).

It is interesting to note that just since April,

- registered gold held at the COMEX depositories

- has collapsed from a total of 2,147,398 ounces

- to just 852,930 ounces.

That is a collapse of 60% of the registered gold inventory..... in less than 4 months!

To put this "tiny 853,000 oz comex gold - available - for delivery" - into perspective.

Data from Hong Kong gold exports reveal that China...... has imported

- an average of 200 metric tonnes of gold.... every month April, May, and June.

( 200 metric tonnes is equivalent to more than.... 6.4 million ounces... of gold).

So China has been importing.....6.4 Million oz ....per month

- and

- COMEX holds a total of just..... 852,930 ounces of registered gold

(available for delivery)........ at the current time.

Unlike the fiat fractional reserve ponzi

- in the gold fractional reserve ponzi.....you can't just quietly - print your way out - a run on physical bullion

- all you can do - is drive the price down....and pay out - in fiat paper.

gazkaz - 15 Aug 2013 16:49 - 676 of 1034

On April 16,

- just hours...... after the smashing of the gold price.

This is an article from ......the Chinese state press agency CNTV

(China Network Television),

The writer describes how soon after Nixon closed the gold window in 1971 - and the price of gold sky rocketed to $800 an ounce

- - the Fed started to combat the price of gold ........up until today

- in order to maintain the dollar hegemony.

- Their main tactics being ;

- leasing gold and shorting it.

So

- The Chinese ......are fully aware of this game

- and know exactly how it's going to end.

http://koosjansen.blogspot.nl/2013/08/chinese-state-press-on-how-fed-has-been.html

Nice read on..... what everybody knows .....but what western governments.... and mainstream media

- refuse to say.

Adding the - Cynical Spin

(As - the article was locked, loaded and ready to go...just hours...after such an "unfoseen smash)

Did China actually cooperate.... with the Western central banks' smashing of the gold price in April

- on the understanding that China then could pick up sharply discounted gold...... unloaded by panicked Western investors.

- The Chinese government also may have chosen April 16

- to publicize Western gold price suppression .....to it's domestic audience

- so that its own people..... would not..... be panicked out of their own gold.

Well if so - Part B worked.. and then some !!

- Not only were the Chinese public - not panicked... into selling on the price crash

- the Chinese were only panicked - into... besieging gold shops... to get still more metal.

- just hours...... after the smashing of the gold price.

This is an article from ......the Chinese state press agency CNTV

(China Network Television),

The writer describes how soon after Nixon closed the gold window in 1971 - and the price of gold sky rocketed to $800 an ounce

- - the Fed started to combat the price of gold ........up until today

- in order to maintain the dollar hegemony.

- Their main tactics being ;

- leasing gold and shorting it.

So

- The Chinese ......are fully aware of this game

- and know exactly how it's going to end.

http://koosjansen.blogspot.nl/2013/08/chinese-state-press-on-how-fed-has-been.html

Nice read on..... what everybody knows .....but what western governments.... and mainstream media

- refuse to say.

Adding the - Cynical Spin

(As - the article was locked, loaded and ready to go...just hours...after such an "unfoseen smash)

Did China actually cooperate.... with the Western central banks' smashing of the gold price in April

- on the understanding that China then could pick up sharply discounted gold...... unloaded by panicked Western investors.

- The Chinese government also may have chosen April 16

- to publicize Western gold price suppression .....to it's domestic audience

- so that its own people..... would not..... be panicked out of their own gold.

Well if so - Part B worked.. and then some !!

- Not only were the Chinese public - not panicked... into selling on the price crash

- the Chinese were only panicked - into... besieging gold shops... to get still more metal.

gazkaz - 15 Aug 2013 21:32 - 677 of 1034

Keith Barron, who consults with major companies around the world

"The Fed and the ECB are desperately trying to hold the system together, but at the end of the day

- they are losing the ability to control the rapid loss of confidence that is taking hold.

Western central banks claim that there is a lot of physical gold available for purchase.

- That is pure propaganda and a lie.

I now have reason to believe that Asian central banks

- are requesting that their gold, some of which has been stored in the West,

- be sent to Asia.

This is what is causing the short covering rally in gold.

- The Asians know the Western gold system is very close to collapse

- and they want the physical gold in their possession.

This is what is happening behind the scenes.

- A very large part of the 1,300 tons of gold that was shipped out of the Bank of England, .....and gold that is being shipped out of the Fed as well,

- is going into the vaults in China and other parts of Asia.

There is a massive run on physical gold right now and this is creating a squeeze.

The bottom line is the Western fractional reserve gold system

- is now on the edge of collapse

and the Asians know it.

"The Fed and the ECB are desperately trying to hold the system together, but at the end of the day

- they are losing the ability to control the rapid loss of confidence that is taking hold.

Western central banks claim that there is a lot of physical gold available for purchase.

- That is pure propaganda and a lie.

I now have reason to believe that Asian central banks

- are requesting that their gold, some of which has been stored in the West,

- be sent to Asia.

This is what is causing the short covering rally in gold.

- The Asians know the Western gold system is very close to collapse

- and they want the physical gold in their possession.

This is what is happening behind the scenes.

- A very large part of the 1,300 tons of gold that was shipped out of the Bank of England, .....and gold that is being shipped out of the Fed as well,

- is going into the vaults in China and other parts of Asia.

There is a massive run on physical gold right now and this is creating a squeeze.

The bottom line is the Western fractional reserve gold system

- is now on the edge of collapse

and the Asians know it.

gazkaz - 15 Aug 2013 21:46 - 678 of 1034

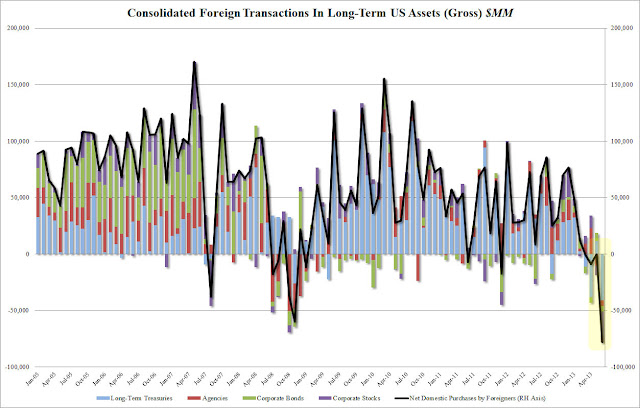

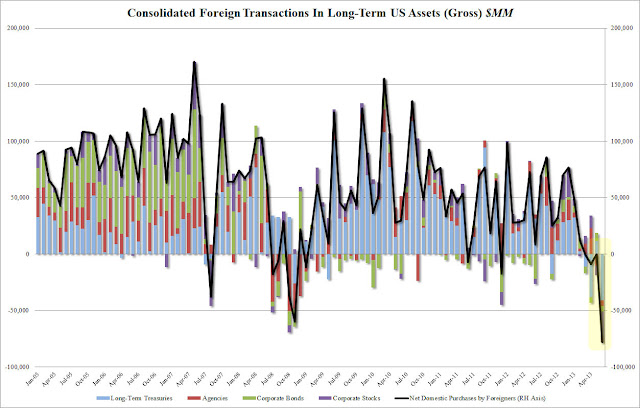

Johnny Foreigner - public & private - having a dumpfest of US T-Bonds

The TIC data came in quite negative this morning show

- a net outflow of over 67 billion

- as both public and private foreigners

- were dumping US Treasuries in size during June.

Seems like a trend too... not just in T-Bonds

-but....in ...... all - US long term assets

And if Johnny foreiner is not only....no longer buying

- but now selling too

The FEDy has to pick up the ever increasing slack.....even more

The TIC data came in quite negative this morning show

- a net outflow of over 67 billion

- as both public and private foreigners

- were dumping US Treasuries in size during June.

Seems like a trend too... not just in T-Bonds

-but....in ...... all - US long term assets

And if Johnny foreiner is not only....no longer buying

- but now selling too

The FEDy has to pick up the ever increasing slack.....even more

gazkaz - 16 Aug 2013 01:04 - 679 of 1034

India Bans All Gold Coin Imports, & ...Increases Capital Controls

As well as the....total ban .....on the importation of gold coins and medallions

- In an effort to "moderate outflows" of Rupee, the Indian central bank slashed the amount of money families can send out of the country per year to $75k... from $200k

- and limited overseas investment to 100% of net worth ..down from 400%.

"We will leave no stone unturned" to control the current account deficit and stabilize the rupee, the finance minister warned.

- thats on top of the recent hike in gold import tax to..10% (from the recent increase to 8%)

- and the requirement to retain 20% of gold imports....for re-export

As well as the....total ban .....on the importation of gold coins and medallions

- In an effort to "moderate outflows" of Rupee, the Indian central bank slashed the amount of money families can send out of the country per year to $75k... from $200k

- and limited overseas investment to 100% of net worth ..down from 400%.

"We will leave no stone unturned" to control the current account deficit and stabilize the rupee, the finance minister warned.

- thats on top of the recent hike in gold import tax to..10% (from the recent increase to 8%)

- and the requirement to retain 20% of gold imports....for re-export

gazkaz - 16 Aug 2013 01:37 - 680 of 1034

10yr T-Bonds - break 2-75%

(thats up around 60% in a month or so)

Rising interest rates means...

- 1% higher rates on 17 Trillion debt....means more treasury income...gets swallowed up paying the higher interest

- equals escalating....budget deficit (more cuts/higher taxes)

- higher interest rate = problem re .....the Banksters lose income/have to pay out on.....interest rate swap derivatives

(from memory of the 1.3 Quadrillion derivatives market.....60% are interest rate swaps !!)

- higher interest rates ....all fixed bond capital values fall

- and the Banks - including the.... Central banks....predominantly hold .....fixed rate bonds

I would imagine on a "mark to market" basis.....the fall in capital values of US T-Bonds (as a result of higher interest rates)

- has probably wiped out... the tiny capital of the FEDY... 4/5 x over

- equals..... on a mark to market basis.....even the central bank....is insolvent.

(thats up around 60% in a month or so)

Rising interest rates means...

- 1% higher rates on 17 Trillion debt....means more treasury income...gets swallowed up paying the higher interest

- equals escalating....budget deficit (more cuts/higher taxes)

- higher interest rate = problem re .....the Banksters lose income/have to pay out on.....interest rate swap derivatives

(from memory of the 1.3 Quadrillion derivatives market.....60% are interest rate swaps !!)

- higher interest rates ....all fixed bond capital values fall

- and the Banks - including the.... Central banks....predominantly hold .....fixed rate bonds

I would imagine on a "mark to market" basis.....the fall in capital values of US T-Bonds (as a result of higher interest rates)

- has probably wiped out... the tiny capital of the FEDY... 4/5 x over

- equals..... on a mark to market basis.....even the central bank....is insolvent.

Saturn6 - 16 Aug 2013 08:29 - 681 of 1034

Nice work Gaz - Esp the talk on the Gold/Silver Ratio [GSR] in the SGT link with Maloney.

Looking at the GSR we see the Bearish 'Wedge' that forewarned of a drop has again been pertinent...

And remember the $BPGDM where I hi-lited the bottom at zero and the 'Triple Bottom' that formed and the 'breakout' along with the confirmation on price and GDX/GLD ratio 'Wedges' and thrust that ensued pushing miners from zero % on PnF buy signals to a tad over 50% currently. Which was one of the catalysts to get long the miners at the end of June, and which has thus far given us a 30% gain...

S.

Looking at the GSR we see the Bearish 'Wedge' that forewarned of a drop has again been pertinent...

And remember the $BPGDM where I hi-lited the bottom at zero and the 'Triple Bottom' that formed and the 'breakout' along with the confirmation on price and GDX/GLD ratio 'Wedges' and thrust that ensued pushing miners from zero % on PnF buy signals to a tad over 50% currently. Which was one of the catalysts to get long the miners at the end of June, and which has thus far given us a 30% gain...

S.

Saturn6 - 16 Aug 2013 08:45 - 682 of 1034

Saturn6 - 16 Aug 2013 08:58 - 683 of 1034

Talking of the lie foisted upon us from an early age and propounded by all the so called 'experts' in the field of evoolution, as we were the other day I thought it appropriate to forward a link I received where Dawkins sort of ties himself up in knots over nothing...

">

http://ppsimmons.blogspot.ca/2013/08/wow-richard-dawkins-knows-nothing-about.html

\\\\\\\\\\\\\\\\\\\\STAGGERING///////////

S.

">

http://ppsimmons.blogspot.ca/2013/08/wow-richard-dawkins-knows-nothing-about.html

\\\\\\\\\\\\\\\\\\\\STAGGERING///////////

S.

gazkaz - 16 Aug 2013 09:59 - 684 of 1034

sahara

- Einstein (allegedy the greatest mathematician) and Max Planc (allegedly the greatest particle physicist) both said in paraphrase

- it would not suprise them if it was discovered one day that reality...was created by conciousnous.

- the latest string/membrane theory - is that eveything is just energy & vibration.

- the physics "measurement problem" is that - nothing exists until it is..viewed or measured.

- in my perspective it is a given that if an atoms nucleus was the size of a kids marble...the nearest electron would be - 2 miles away.

- hence physical matter is 99.99999999999999 nothing

- and that 99.99....nothing....only makes up only 14% of the cosmos

- the other 86% of the cosmos is dark energy & dark matter.....of which they don't know what it is made of....and can't measure.

- so at least there is a definite...0-00000000000001% ...something

Got this in my many - to wander rounds - at some point

http://www.crystalinks.com/fabricofthecosmos.html

Somehow I think my brain.... will hurt a little afterwards :o)

- Einstein (allegedy the greatest mathematician) and Max Planc (allegedly the greatest particle physicist) both said in paraphrase

- it would not suprise them if it was discovered one day that reality...was created by conciousnous.

- the latest string/membrane theory - is that eveything is just energy & vibration.

- the physics "measurement problem" is that - nothing exists until it is..viewed or measured.

- in my perspective it is a given that if an atoms nucleus was the size of a kids marble...the nearest electron would be - 2 miles away.

- hence physical matter is 99.99999999999999 nothing

- and that 99.99....nothing....only makes up only 14% of the cosmos

- the other 86% of the cosmos is dark energy & dark matter.....of which they don't know what it is made of....and can't measure.

- so at least there is a definite...0-00000000000001% ...something

Got this in my many - to wander rounds - at some point

http://www.crystalinks.com/fabricofthecosmos.html

Somehow I think my brain.... will hurt a little afterwards :o)

gazkaz - 16 Aug 2013 10:08 - 685 of 1034

Interesting 5/15/30 year "seasonality" overlays in the price of gold

The "you are here" reminds me of the old tourist maps in city centres, where you pressed the button........and a light illuminated on the map with "you are here"

- happy days

(mind you sat navs on phones in your pocket are easier to find....than in the old days wandering around....trying to just find the city centre tourist map itself ..so you could then press...the button)

The "you are here" reminds me of the old tourist maps in city centres, where you pressed the button........and a light illuminated on the map with "you are here"

- happy days

(mind you sat navs on phones in your pocket are easier to find....than in the old days wandering around....trying to just find the city centre tourist map itself ..so you could then press...the button)

Saturn6 - 16 Aug 2013 10:17 - 686 of 1034

Yes - I am fascinated with conciousness evoked reality. I will try and get around the rights restrictions in my area preventing veiwing of the video you posted.

I have tried in the past to use my conciousness to bend space to my will, but was unsuccesful. The only way I could get what I wanted was to devise a strategy and work towards it.

Also if I were to be unconcious for a time then my reality would cease to exist whereas when I were to regain my conciousness my reality had continued without me conciously knowing.

Eerie stuff.

S.

I have tried in the past to use my conciousness to bend space to my will, but was unsuccesful. The only way I could get what I wanted was to devise a strategy and work towards it.

Also if I were to be unconcious for a time then my reality would cease to exist whereas when I were to regain my conciousness my reality had continued without me conciously knowing.

Eerie stuff.

S.

gazkaz - 16 Aug 2013 15:38 - 687 of 1034

Sahara - this ressonated with me when i watched it earlier today....7 mins

Effectively....we are all in this same reality room - we're just perceiving different channels

- most are tuned in to the.. 3 main channels

- channel 7 (the denial channel) or,

- channel 13 (The ignorance is bliss channel)

- Sky Sports

http://www.youtube.com/watch?feature=player_embedded&v=CZo1sXsC-68

Effectively....we are all in this same reality room - we're just perceiving different channels

- most are tuned in to the.. 3 main channels

- channel 7 (the denial channel) or,

- channel 13 (The ignorance is bliss channel)

- Sky Sports

http://www.youtube.com/watch?feature=player_embedded&v=CZo1sXsC-68

gazkaz - 16 Aug 2013 15:46 - 688 of 1034

'mmm - has JPM now loaded up to the gunnels

The Morgues precious metals team

- now sees a number of reasons....... to be long gold.

Noting the market's shrugging off of Paulson's unwind ("delivering an exclamation mark to define the end of the fall in gold stocks"),

- JPMorgan (ironically) suggests the questionable price action in the paper markets in light of unprecedented physical demand combined with the seasonal positives (and physical supply restrictions)

- all points to....... "getting long the gold space,"

The Morgues precious metals team

- now sees a number of reasons....... to be long gold.

Noting the market's shrugging off of Paulson's unwind ("delivering an exclamation mark to define the end of the fall in gold stocks"),

- JPMorgan (ironically) suggests the questionable price action in the paper markets in light of unprecedented physical demand combined with the seasonal positives (and physical supply restrictions)

- all points to....... "getting long the gold space,"

snurkle1 - 17 Aug 2013 06:34 - 689 of 1034

Thanks guys for all your posts of late and giving me a shed load to read, watch and listen.

Some very interesting stuff indeed.

In addition to your fab posts, 2 peaches for you all,

Here's the latest Bill Holter

http://blog.milesfranklin.com/10-yr-treasury-2-75

and the latest Jeff Nielson.

http://www.bullionbullscanada.com/gold-commentary/26300-q2-gold-demand-wgc-cant-spell-decoupling

Some very interesting stuff indeed.

In addition to your fab posts, 2 peaches for you all,

Here's the latest Bill Holter

http://blog.milesfranklin.com/10-yr-treasury-2-75

and the latest Jeff Nielson.

http://www.bullionbullscanada.com/gold-commentary/26300-q2-gold-demand-wgc-cant-spell-decoupling

gazkaz - 18 Aug 2013 11:36 - 690 of 1034

How did this get on CNBC - without the customary - cut to ad break - or swamp out by the talking heads ??

In response to the question of why gold is going up,

Hathaway begins:

"The first thing is that there is a big short squeeze taking place. ...

- People who have paper claims on gold, which would be futures, derivatives, ETFs and so forth .........are demanding settlement in terms of physical gold.

Why that's important is because the paper gold market is leveraged more than 100 to 1 versus the underlying bullion.

- So it looks like to me that people are losing confidence in the traditional intermediaries....... between the paper and physical markets.

And you can see that with the dramatic drawdown in registered COMEX warehouse stocks..."

Hathaway reasserts that, taking a long term view, the reason for being in gold is monetary debasement,

- to which, given the actions of the world's central banks, there is no end in sight.

Hathaway’s contention that a short squeeze is underway is of course supported by backwardation on the COMEX, a negative gold forward offered rate or GOFO in London (currently negative out to 6-months), a dramatic downdraft of registered gold stocks in COMEX warehouses and by the price action of both gold and silver in our opinion.

Right after Hathaway’s interview the CNBC talking heads took a dim view of gold.

( No surprise there),

- but it is very comforting to gold bulls to see it!

In response to the question of why gold is going up,

Hathaway begins:

"The first thing is that there is a big short squeeze taking place. ...

- People who have paper claims on gold, which would be futures, derivatives, ETFs and so forth .........are demanding settlement in terms of physical gold.

Why that's important is because the paper gold market is leveraged more than 100 to 1 versus the underlying bullion.

- So it looks like to me that people are losing confidence in the traditional intermediaries....... between the paper and physical markets.

And you can see that with the dramatic drawdown in registered COMEX warehouse stocks..."

Hathaway reasserts that, taking a long term view, the reason for being in gold is monetary debasement,

- to which, given the actions of the world's central banks, there is no end in sight.

Hathaway’s contention that a short squeeze is underway is of course supported by backwardation on the COMEX, a negative gold forward offered rate or GOFO in London (currently negative out to 6-months), a dramatic downdraft of registered gold stocks in COMEX warehouses and by the price action of both gold and silver in our opinion.

Right after Hathaway’s interview the CNBC talking heads took a dim view of gold.

( No surprise there),

- but it is very comforting to gold bulls to see it!

gazkaz - 18 Aug 2013 11:39 - 691 of 1034

COT report

Those commercials like JPM etc that have been short in silver added a monstrous

- 11,969 contracts to their short side.

(& silver has nonetheless been - rising)

If the commercials did not supply this massive amount of silver contracts

- you could imagine what silver's price.... would have been

Those commercials like JPM etc that have been short in silver added a monstrous

- 11,969 contracts to their short side.

(& silver has nonetheless been - rising)

If the commercials did not supply this massive amount of silver contracts

- you could imagine what silver's price.... would have been

gazkaz - 19 Aug 2013 18:49 - 692 of 1034

The O'Barmy had a big meeting with the Banksters around 12th April

- as they say the rest is history.

With crashing comex inventory

- Bond yields on the rise

- Significant PM premiums in the East

- GLD being milked of physical

- LBMA having requested delivery times be extended 66% (From 3 days to 5)

- GOFO rates being negative for 30 days plus

- The Morgue not having made.. it's June silver deliveries yet

Any guesses what this meeting could be about

Mark Knoller ✔ @markknoller

Meeting with POTUS tomorrow are heads of

- the CFPB,

- FHFA,

- the Fed,

- CFTC,

- FDIC,

- NCUA,

- the SEC

- & Comptroller of the Currency.

(via z/hedge)

Could be an interesting week

(They have tried the big hammer of brute paper force & it backfired....what next ??)

- as they say the rest is history.

With crashing comex inventory

- Bond yields on the rise

- Significant PM premiums in the East

- GLD being milked of physical

- LBMA having requested delivery times be extended 66% (From 3 days to 5)

- GOFO rates being negative for 30 days plus

- The Morgue not having made.. it's June silver deliveries yet

Any guesses what this meeting could be about

Mark Knoller ✔ @markknoller

Meeting with POTUS tomorrow are heads of

- the CFPB,

- FHFA,

- the Fed,

- CFTC,

- FDIC,

- NCUA,

- the SEC

- & Comptroller of the Currency.

(via z/hedge)

Could be an interesting week

(They have tried the big hammer of brute paper force & it backfired....what next ??)

gazkaz - 20 Aug 2013 01:49 - 693 of 1034

Posted August 18th, 2013 at 9:03 AM (CST)

- by Jim Sinclair & filed under General Editorial.

My Dear Mr. Paulson and Extended Family,

What a mess Western inspired and conducted "Arab Spring" has brought on US interests.

China using the Northern Passage for shipping with the USA having no effective ice breakers is a major trade game changer.

Every weakness the West has economically and politically is being utilized to bring the BRICS into a position to float the new BRICs "Euro R4 standard currency."

Gold is for saving, Mr. Paulson, not the Big Kahuna speculation. Fiat currency is for transactions.

Close that new gold swap you have,

- buy your full of bullion position back ....as bullion gold

- and double it in the next few weeks.

It will be the last chance you all have to buy physical gold at anything near these discounted gold prices.

Respectfully,

Jim

http://www.jsmineset.com/2013/08/18/the-mess-arab-spring-has-brought/

- by Jim Sinclair & filed under General Editorial.

My Dear Mr. Paulson and Extended Family,

What a mess Western inspired and conducted "Arab Spring" has brought on US interests.

China using the Northern Passage for shipping with the USA having no effective ice breakers is a major trade game changer.

Every weakness the West has economically and politically is being utilized to bring the BRICS into a position to float the new BRICs "Euro R4 standard currency."

Gold is for saving, Mr. Paulson, not the Big Kahuna speculation. Fiat currency is for transactions.

Close that new gold swap you have,

- buy your full of bullion position back ....as bullion gold

- and double it in the next few weeks.

It will be the last chance you all have to buy physical gold at anything near these discounted gold prices.

Respectfully,

Jim

http://www.jsmineset.com/2013/08/18/the-mess-arab-spring-has-brought/