| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The Forex Thread (FX)

hilary

- 31 Dec 2003 13:00

- 31 Dec 2003 13:00

| Your browser does not support JavaScript! | Your browser does not support JavaScript! |

| Your browser does not support inline frames or is currently configured not to display inline frames. |

foale

- 14 Nov 2006 12:51

- 6786 of 11056

- 14 Nov 2006 12:51

- 6786 of 11056

Hi Hils..I too installed IE7 last night

My power charts seem ok ...

My power charts seem ok ...

hilary

- 14 Nov 2006 12:55

- 6787 of 11056

- 14 Nov 2006 12:55

- 6787 of 11056

OK, thanks D.

PC problems normally happen exclusively to me.

:o)

PC problems normally happen exclusively to me.

:o)

Melnibone - 14 Nov 2006 13:06 - 6788 of 11056

What Data are you all looking at to have the biggest effect?

US PPI today?

Fed Minutes on Wed?

US CPI on Thurs?

Or are you looking at something else that may or may not be cross

specific?

US PPI today?

Fed Minutes on Wed?

US CPI on Thurs?

Or are you looking at something else that may or may not be cross

specific?

hilary

- 14 Nov 2006 13:09

- 6789 of 11056

- 14 Nov 2006 13:09

- 6789 of 11056

PPI today should move it, but the BoE Inflation Report tomorrow could be the big mover imo. The Government can doctor the CPI, PPI and RPI all they like but it's how the MPC view inflation and what they do about it that will affect if and when UK interest rates go up early in the new year.

foale

- 14 Nov 2006 13:48

- 6790 of 11056

- 14 Nov 2006 13:48

- 6790 of 11056

when are minutes of recent MPC out?

hilary

- 14 Nov 2006 13:52

- 6791 of 11056

- 14 Nov 2006 13:52

- 6791 of 11056

2 weeks after the decision itself, so that should be next week.

foale

- 14 Nov 2006 14:02

- 6792 of 11056

- 14 Nov 2006 14:02

- 6792 of 11056

ok thanks

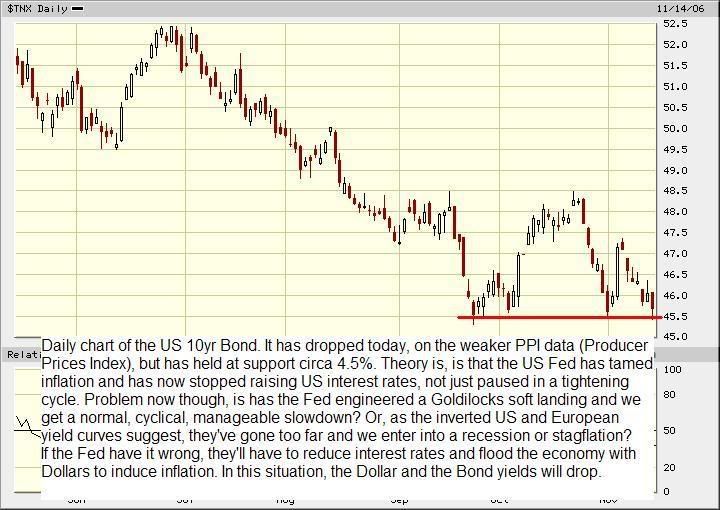

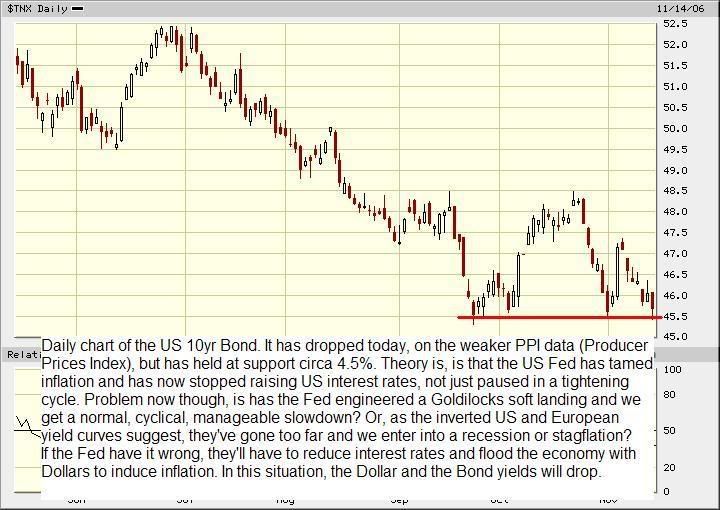

Melnibone - 14 Nov 2006 20:33 - 6793 of 11056

Evening, here's tonight's stuff for Miss M. with an extra /$ thrown in.

I bet the Bears on the US Indices are hurting at the moment.

Funny old markets, these, aren't they.

I bet the Bears on the US Indices are hurting at the moment.

Funny old markets, these, aren't they.

cunningham

- 14 Nov 2006 23:01

- 6794 of 11056

- 14 Nov 2006 23:01

- 6794 of 11056

Mel, a great evening read as ever. Inspired me to go and find out more about the bond market (and yield curves - whatever they are).

Anyone any suggestions on a site that covers the basics?

Anyone any suggestions on a site that covers the basics?

Seymour Clearly

- 15 Nov 2006 07:15

- 6795 of 11056

- 15 Nov 2006 07:15

- 6795 of 11056

Mel, really enjoying your charts and commentary, it makes me realise I shouldn't only fix on Cable but look at other Fx combinations as well. Thanks.

foale

- 15 Nov 2006 10:18

- 6796 of 11056

- 15 Nov 2006 10:18

- 6796 of 11056

so when is this cable fall going to stop...anyone care to post a few support lines..

I am struggling to find any...

I am struggling to find any...

Melnibone - 15 Nov 2006 10:34 - 6797 of 11056

Glad you're enjoying this. I look forward to other views and

chart inputs.

Here is a link for some basic stuff on Bonds and Yields. There are

links on the page that take you to other simple explanations.

I like stuff to be Simple. :-))

Link to Bond Yields and Curves

chart inputs.

Here is a link for some basic stuff on Bonds and Yields. There are

links on the page that take you to other simple explanations.

I like stuff to be Simple. :-))

Link to Bond Yields and Curves

cunningham

- 15 Nov 2006 14:31

- 6798 of 11056

- 15 Nov 2006 14:31

- 6798 of 11056

Thanks for that Mel:-) that is simple. Also found an excellent tutourial on Bonds.

http://www.investopedia.com/university/bonds/

http://www.investopedia.com/university/bonds/

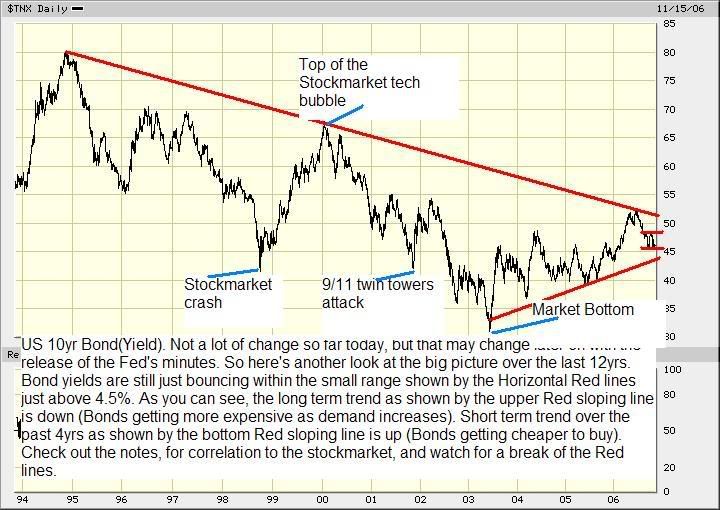

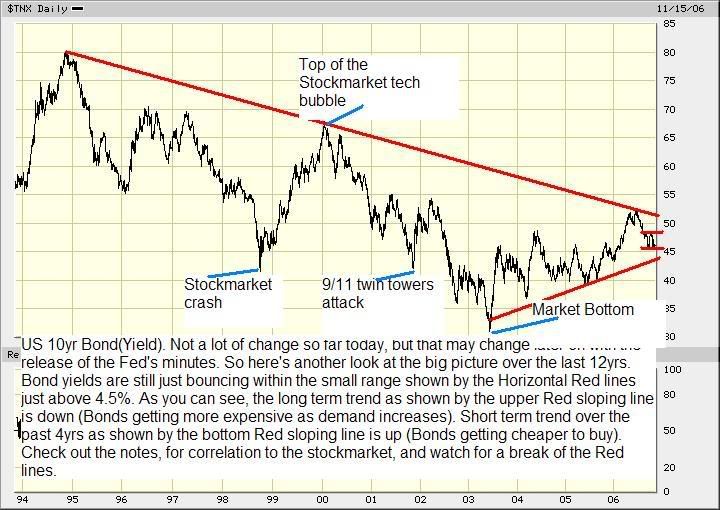

Melnibone - 15 Nov 2006 19:29 - 6799 of 11056

Tonight's stuff to Miss M.

Would be nice to see some other folk's views and charts?

Would be nice to see some other folk's views and charts?

Sue 42

- 16 Nov 2006 08:44

- 6800 of 11056

- 16 Nov 2006 08:44

- 6800 of 11056

I haven't worked out how to paste pix & cahrts - but I wouldn't be able to add anything useful - I am a beginner and more of a follower than a leader!

Sue 42

- 16 Nov 2006 08:44

- 6801 of 11056

- 16 Nov 2006 08:44

- 6801 of 11056

I haven't worked out how to paste pix & charts - but I wouldn't be able to add anything useful - I am a beginner and more of a follower than a leader!

Melnibone - 16 Nov 2006 12:09 - 6802 of 11056

I wasn't knocking you (or anyone else), Sue :-)

It's just that there were always folk pasting charts and views here.

Reading around the boards, there seem to be a lot of folk having personal

and family health problems. So, understandably, their priorities don't include

Forex trading, atm.

Lot of market moving data today that the market is waiting for.

We have CPI (1330hrs) and SEP(1400hrs), followed by no less than 5 Fed

speakers putting out Bernanke's Spin. So stuff could get quite volatile.

The SEP figure should give the market a clue as to the appetite for US dollar

denominated assets. Looking at the previous and the expected figures in

the header, there seems to be quite a big difference.

No idea how much of that is factored in, or if the market is waiting for confirmation

before factoring it in. Could get interesting.

It's just that there were always folk pasting charts and views here.

Reading around the boards, there seem to be a lot of folk having personal

and family health problems. So, understandably, their priorities don't include

Forex trading, atm.

Lot of market moving data today that the market is waiting for.

We have CPI (1330hrs) and SEP(1400hrs), followed by no less than 5 Fed

speakers putting out Bernanke's Spin. So stuff could get quite volatile.

The SEP figure should give the market a clue as to the appetite for US dollar

denominated assets. Looking at the previous and the expected figures in

the header, there seems to be quite a big difference.

No idea how much of that is factored in, or if the market is waiting for confirmation

before factoring it in. Could get interesting.

Melnibone - 16 Nov 2006 12:40 - 6803 of 11056

bakko

- 16 Nov 2006 12:53

- 6804 of 11056

- 16 Nov 2006 12:53

- 6804 of 11056

Been away from forex for the last few weeks but will post up some charts as soon as I get back into it Mel.

However, I came across this over the weekend.

It's a little dated and no doubt it's been all priced in but at least it gives the newbies the bigger fundamental picture.

However, I came across this over the weekend.

It's a little dated and no doubt it's been all priced in but at least it gives the newbies the bigger fundamental picture.

foale

- 16 Nov 2006 13:43

- 6805 of 11056

- 16 Nov 2006 13:43

- 6805 of 11056

Hils Choccy where are your blow by blow post figs breakdowns...

we need a 2 by Xmas post...ok 1.93 by Xmas will do :)

or at least 1.8840 looks like it might have been a temporary low...

Has anyone been making hay out of this..fall ?

we need a 2 by Xmas post...ok 1.93 by Xmas will do :)

or at least 1.8840 looks like it might have been a temporary low...

Has anyone been making hay out of this..fall ?