| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The Forex Thread (FX)

hilary

- 31 Dec 2003 13:00

- 31 Dec 2003 13:00

| Your browser does not support JavaScript! | Your browser does not support JavaScript! |

| Your browser does not support inline frames or is currently configured not to display inline frames. |

Melnibone - 15 Nov 2006 19:29 - 6799 of 11056

Tonight's stuff to Miss M.

Would be nice to see some other folk's views and charts?

Would be nice to see some other folk's views and charts?

Sue 42

- 16 Nov 2006 08:44

- 6800 of 11056

- 16 Nov 2006 08:44

- 6800 of 11056

I haven't worked out how to paste pix & cahrts - but I wouldn't be able to add anything useful - I am a beginner and more of a follower than a leader!

Sue 42

- 16 Nov 2006 08:44

- 6801 of 11056

- 16 Nov 2006 08:44

- 6801 of 11056

I haven't worked out how to paste pix & charts - but I wouldn't be able to add anything useful - I am a beginner and more of a follower than a leader!

Melnibone - 16 Nov 2006 12:09 - 6802 of 11056

I wasn't knocking you (or anyone else), Sue :-)

It's just that there were always folk pasting charts and views here.

Reading around the boards, there seem to be a lot of folk having personal

and family health problems. So, understandably, their priorities don't include

Forex trading, atm.

Lot of market moving data today that the market is waiting for.

We have CPI (1330hrs) and SEP(1400hrs), followed by no less than 5 Fed

speakers putting out Bernanke's Spin. So stuff could get quite volatile.

The SEP figure should give the market a clue as to the appetite for US dollar

denominated assets. Looking at the previous and the expected figures in

the header, there seems to be quite a big difference.

No idea how much of that is factored in, or if the market is waiting for confirmation

before factoring it in. Could get interesting.

It's just that there were always folk pasting charts and views here.

Reading around the boards, there seem to be a lot of folk having personal

and family health problems. So, understandably, their priorities don't include

Forex trading, atm.

Lot of market moving data today that the market is waiting for.

We have CPI (1330hrs) and SEP(1400hrs), followed by no less than 5 Fed

speakers putting out Bernanke's Spin. So stuff could get quite volatile.

The SEP figure should give the market a clue as to the appetite for US dollar

denominated assets. Looking at the previous and the expected figures in

the header, there seems to be quite a big difference.

No idea how much of that is factored in, or if the market is waiting for confirmation

before factoring it in. Could get interesting.

Melnibone - 16 Nov 2006 12:40 - 6803 of 11056

bakko

- 16 Nov 2006 12:53

- 6804 of 11056

- 16 Nov 2006 12:53

- 6804 of 11056

Been away from forex for the last few weeks but will post up some charts as soon as I get back into it Mel.

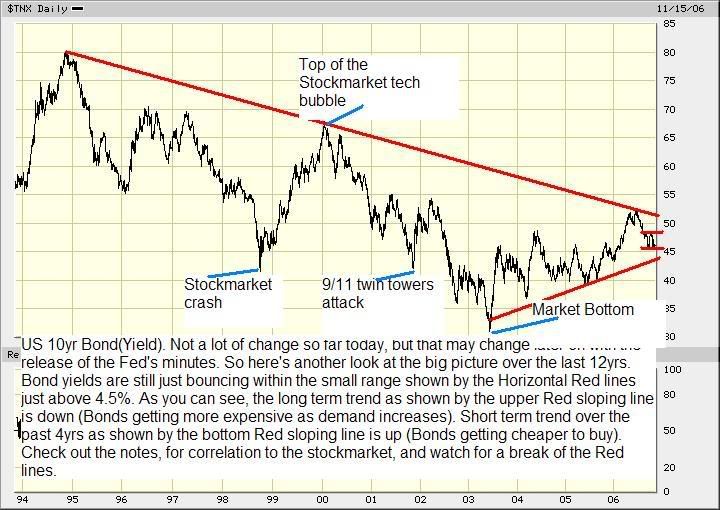

However, I came across this over the weekend.

It's a little dated and no doubt it's been all priced in but at least it gives the newbies the bigger fundamental picture.

However, I came across this over the weekend.

It's a little dated and no doubt it's been all priced in but at least it gives the newbies the bigger fundamental picture.

foale

- 16 Nov 2006 13:43

- 6805 of 11056

- 16 Nov 2006 13:43

- 6805 of 11056

Hils Choccy where are your blow by blow post figs breakdowns...

we need a 2 by Xmas post...ok 1.93 by Xmas will do :)

or at least 1.8840 looks like it might have been a temporary low...

Has anyone been making hay out of this..fall ?

we need a 2 by Xmas post...ok 1.93 by Xmas will do :)

or at least 1.8840 looks like it might have been a temporary low...

Has anyone been making hay out of this..fall ?

Seymour Clearly

- 16 Nov 2006 13:53

- 6806 of 11056

- 16 Nov 2006 13:53

- 6806 of 11056

OK Foale, corny jokes aside ;-)

I'm ready and waiting to go long now, have a limit buy in below 1.8900 but happy to wait a bit - I haven't made the hay like I should have this fall. No position at present.

I'm ready and waiting to go long now, have a limit buy in below 1.8900 but happy to wait a bit - I haven't made the hay like I should have this fall. No position at present.

hilary

- 16 Nov 2006 14:06

- 6807 of 11056

- 16 Nov 2006 14:06

- 6807 of 11056

I'll try to post a chart later if/when I get a bit more time. I'm quite busy atm though, so when I look in it's generally during an "in between moment" and I don't really have the time to get into protracted posts.

I'm expecting to see circa 1.85 or 1.86 from this move over the next week or two, although I acknowledge that it could easily rally back up to around 1.90 shorter term.

I'm expecting to see circa 1.85 or 1.86 from this move over the next week or two, although I acknowledge that it could easily rally back up to around 1.90 shorter term.

foale

- 16 Nov 2006 14:46

- 6808 of 11056

- 16 Nov 2006 14:46

- 6808 of 11056

thanks for the quick replies... not an east one ot call atm

Melnibone - 16 Nov 2006 15:08 - 6809 of 11056

Bit confusing atm. The data to me suggested weaker $ crosses.

Gold has made a Bullish technical set-up. Standard swing 3 down days

in an uptrend ending with a 'Hanging Man' candle, followed by a break

of the previous day's high.

Yet at 2pm on the release of the SEP Gold dropped????????

And $ crosses don't really look that weak.

Seems to back up Hils' view of Sterling dropping if this continues to go opposite

to what the Data and chart set-up suggests.

Lot to learn here. :-(

Gold has made a Bullish technical set-up. Standard swing 3 down days

in an uptrend ending with a 'Hanging Man' candle, followed by a break

of the previous day's high.

Yet at 2pm on the release of the SEP Gold dropped????????

And $ crosses don't really look that weak.

Seems to back up Hils' view of Sterling dropping if this continues to go opposite

to what the Data and chart set-up suggests.

Lot to learn here. :-(

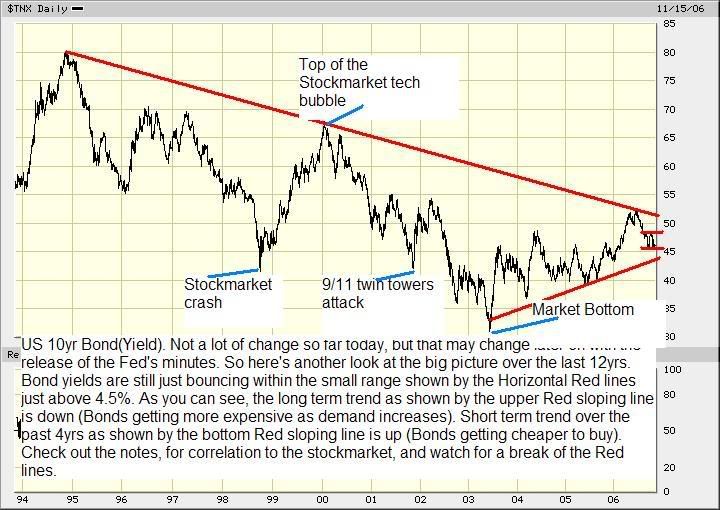

Melnibone - 16 Nov 2006 16:04 - 6810 of 11056

With the way the market seems to be interpreting the data, if the

Philly Fed data comes in strong at 1700hrs we could see a bid to

the Dollar. I guess the market must be concentrating on the Hawkish

Fed minutes last night. But if that's the case, why aren't the Bond

prices dropping (yield up)?

Philly Fed data comes in strong at 1700hrs we could see a bid to

the Dollar. I guess the market must be concentrating on the Hawkish

Fed minutes last night. But if that's the case, why aren't the Bond

prices dropping (yield up)?

hilary

- 16 Nov 2006 17:06

- 6811 of 11056

- 16 Nov 2006 17:06

- 6811 of 11056

I said I'd paste a chart. Taken a few minutes before the Philly Fed.

Seymour Clearly

- 16 Nov 2006 18:14

- 6812 of 11056

- 16 Nov 2006 18:14

- 6812 of 11056

Hmmm, bit of a hard one to call atm. I went long at 1.8885, but not sure where we're going, I'm obviously hoping for a quick retrace up. Stop is just below the recent lows.

Melnibone - 16 Nov 2006 19:51 - 6813 of 11056

Evening, Miss Mel is away for a few days

so I won't bother with the UKX/ S&P tonight.

But nothing lost there. Everyone can see that the S&P is scrapping with

1400 and the UKX is up to the top of the range again. I don't think anyone

on this Forex thread is much interested in them anyway.

so I won't bother with the UKX/ S&P tonight.

But nothing lost there. Everyone can see that the S&P is scrapping with

1400 and the UKX is up to the top of the range again. I don't think anyone

on this Forex thread is much interested in them anyway.

maddoctor - 16 Nov 2006 22:10 - 6814 of 11056

falling oil has taken gold with it - the link comes and goes , very confusing

foale

- 17 Nov 2006 08:36

- 6815 of 11056

- 17 Nov 2006 08:36

- 6815 of 11056

1.8840 area still looking more of a short term support as we bounce off it again...

hodgins

- 17 Nov 2006 08:40

- 6816 of 11056

- 17 Nov 2006 08:40

- 6816 of 11056

Long Euro here on similar ideas and previous support

foale

- 17 Nov 2006 15:43

- 6817 of 11056

- 17 Nov 2006 15:43

- 6817 of 11056

Cable...all I can say is

LONG may it continue...

LONG may it continue...

Boyse

- 17 Nov 2006 17:19

- 6818 of 11056

- 17 Nov 2006 17:19

- 6818 of 11056

The dollar fell against the euro and yen in mid-morning trade Friday on market talk that a major hedge fund is in trouble."Rumors of a major U.S. hedge fund collapse appear to be behind the dollar's latest dip," said Brian Dolan, director of research at Forex.com, a division of Gain Capital. The euro was last up 0.2% at $1.2822, while the dollar fell 0.5% at 117.69 yen.