| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The Forex Thread (FX)

hilary

- 31 Dec 2003 13:00

- 31 Dec 2003 13:00

| Your browser does not support JavaScript! | Your browser does not support JavaScript! |

| Your browser does not support inline frames or is currently configured not to display inline frames. |

MightyMicro

- 24 Nov 2006 16:21

- 6888 of 11056

- 24 Nov 2006 16:21

- 6888 of 11056

What ho, Choccie! Welcome back. Cable's warm though.

chocolat

- 24 Nov 2006 16:58

- 6889 of 11056

- 24 Nov 2006 16:58

- 6889 of 11056

Brrrrr.

Cheers Dezza ;)

Time for my pink hottie.

Cheers Dezza ;)

Time for my pink hottie.

bosley

- 24 Nov 2006 18:01

- 6890 of 11056

- 24 Nov 2006 18:01

- 6890 of 11056

'ow do, cockle. did you have a good time?

hope you brought back that table :S

hope you brought back that table :S

mg

- 24 Nov 2006 18:11

- 6891 of 11056

- 24 Nov 2006 18:11

- 6891 of 11056

Welcome back choccipops. Is that the pink thing shaped like a rabbit ?????

markusantonius

- 24 Nov 2006 18:42

- 6892 of 11056

- 24 Nov 2006 18:42

- 6892 of 11056

_

Seymour Clearly

- 26 Nov 2006 16:46

- 6893 of 11056

- 26 Nov 2006 16:46

- 6893 of 11056

From the Sunday Times:

THE pound could break the $2 barrier this week, analysts say, if last weeks dollar selling wave continues. The dollar fell sharply on Friday amid fears about the American economy, unsettling financial markets.

The dollars fall was felt in a range of markets. The price of crude oil rose in dollar terms as a direct reflection of the American currencys weakness.

Sterling has strengthened against the beleaguered dollar in spite of the fact that expectations of further British interest-rate rises have faded.

It closed at $1.93 on Friday, its highest for 18 months, even though American interest rates, at 5.25%, are higher than Britains 5% rate.

More significantly, the euro climbed above $1.30, hitting its highest level since April 2005.

The dollar is the big story, said Nick Stamenkovic, an economist with RIA Capital. The question is whether it has been exaggerated by thin markets. American trading was quiet ahead of the Thanksgiving weekend holiday.

Carsten Fritsch, a currency strategist at Commerzbank in Frankfurt, said: The break of $1.30 is a strong signal that the dollar has to weaken. The sentiment for the dollar is negative. In the eurozone, growth will remain strong.

Analysts believe that the Federal Reserve will cut interest rates next year in response to economic weakness, undermining the dollar.

Global Insight predicts that the euro will rise to $1.40 during 2007, implying that sterling will break through $2 and stay there.

THE pound could break the $2 barrier this week, analysts say, if last weeks dollar selling wave continues. The dollar fell sharply on Friday amid fears about the American economy, unsettling financial markets.

The dollars fall was felt in a range of markets. The price of crude oil rose in dollar terms as a direct reflection of the American currencys weakness.

Sterling has strengthened against the beleaguered dollar in spite of the fact that expectations of further British interest-rate rises have faded.

It closed at $1.93 on Friday, its highest for 18 months, even though American interest rates, at 5.25%, are higher than Britains 5% rate.

More significantly, the euro climbed above $1.30, hitting its highest level since April 2005.

The dollar is the big story, said Nick Stamenkovic, an economist with RIA Capital. The question is whether it has been exaggerated by thin markets. American trading was quiet ahead of the Thanksgiving weekend holiday.

Carsten Fritsch, a currency strategist at Commerzbank in Frankfurt, said: The break of $1.30 is a strong signal that the dollar has to weaken. The sentiment for the dollar is negative. In the eurozone, growth will remain strong.

Analysts believe that the Federal Reserve will cut interest rates next year in response to economic weakness, undermining the dollar.

Global Insight predicts that the euro will rise to $1.40 during 2007, implying that sterling will break through $2 and stay there.

Seymour Clearly

- 26 Nov 2006 22:19

- 6894 of 11056

- 26 Nov 2006 22:19

- 6894 of 11056

Erm, anyone looking tonight. Needless to say my stop got taken out!

Looks like we're on our way to $2

Looks like we're on our way to $2

MightyMicro

- 26 Nov 2006 23:23

- 6895 of 11056

- 26 Nov 2006 23:23

- 6895 of 11056

SC: Yep, although it's fallen back having poked at 1.9465.

Better get my Armageddon gear ready, eh Hil?

Better get my Armageddon gear ready, eh Hil?

Boyse

- 27 Nov 2006 09:27

- 6896 of 11056

- 27 Nov 2006 09:27

- 6896 of 11056

Drop the dollar

America has huge economic problems. Currently, the federal budget deficit is about 7% of GDP. Put plainly, the US is importing substantially more than it is exporting.

The problem is that for several years this trade gap has been financed by Asian central banks buying huge amounts of US Treasury bonds. In effect, the Asian central banks have indirectly lent money to American consumers and corporations, allowing them to carry on consuming. But this can't go on for ever.

Indeed, the flows are already slowing.

At the same time, foreigners are buying less dollar-denominated securities, so the demand for dollars from this source is falling too. This is the key reason to think that the dollar will keep depreciating.

Of course, there's much more to the story. Much, much more. But you'll discover that in your weekly issues of MoneyWeek. Each week, in our news roundup page we tell you not only what is happening in the world of money, but more importantly - what it MEANS.

What we're really seeing with the falling dollar is a consequence of 1971 - when the US Treasury cut the greenback loose from gold. This just goes to show how long these trends can be. This was inevitable, predictable and unavoidable. When people have the power to print money, sooner or later, they will print too much and destroy it. That's what has happened every time in history.

The fuse has been more than 30 years long, but now this TIME BOMB is set to blow up. Get out before it is too late.

America has huge economic problems. Currently, the federal budget deficit is about 7% of GDP. Put plainly, the US is importing substantially more than it is exporting.

The problem is that for several years this trade gap has been financed by Asian central banks buying huge amounts of US Treasury bonds. In effect, the Asian central banks have indirectly lent money to American consumers and corporations, allowing them to carry on consuming. But this can't go on for ever.

Indeed, the flows are already slowing.

At the same time, foreigners are buying less dollar-denominated securities, so the demand for dollars from this source is falling too. This is the key reason to think that the dollar will keep depreciating.

Of course, there's much more to the story. Much, much more. But you'll discover that in your weekly issues of MoneyWeek. Each week, in our news roundup page we tell you not only what is happening in the world of money, but more importantly - what it MEANS.

What we're really seeing with the falling dollar is a consequence of 1971 - when the US Treasury cut the greenback loose from gold. This just goes to show how long these trends can be. This was inevitable, predictable and unavoidable. When people have the power to print money, sooner or later, they will print too much and destroy it. That's what has happened every time in history.

The fuse has been more than 30 years long, but now this TIME BOMB is set to blow up. Get out before it is too late.

maddoctor - 27 Nov 2006 09:30 - 6897 of 11056

.

Seymour Clearly

- 27 Nov 2006 12:09

- 6898 of 11056

- 27 Nov 2006 12:09

- 6898 of 11056

I love the bit "speaking ...with the Stoke Sentinel", that bastion of financial journalism.

UK MPC's Besley says current high debt levels not major concern for rate-setters

Mon, Nov 27 2006, 12:04 GMT

http://www.afxnews.com

LONDON (AFX) - Tim Besley, a member of the Bank of England's Monetary Policy Committee, said high levels of debt in the UK are not a major concern for rate-setters at the moment.

Speaking in an interview with the Stoke Sentinel, Besley said personal debt levels are high but not high enough to affect the whole economy.

"When we are setting interest rates we wouldn't say at this point that is one of the major factors we are concerned about from a macroeconomics point," he said.

Debt levels are not sufficient to be creating "significant weakness in the demand side of the economy", Besley told the paper during a visit to North Staffordshire.

"If there was sufficiently many more people getting into difficulty then that would create an effect but I don't think it has reached that level," he said.

In the minutes of their November meeting, when interest rates were raised to 5.00 pct, the MPC acknowledged that the "burden of rising debt" could weigh more heavily on spending than had been allowed for in the Committee's central forecast.

Besley is one of the newer members of the MPC and joined the body on September 1.

The newspaper was quoting figures showing that the number of people declaring themselves bankrupt in the Stoke area this summer jumped by 80 pct to 144 from just 80 in 2005.

Recent figures have shown a sharp rise in the number of bankruptcies, though this is partly due to changes in the law, making it easier for individuals to file for insolvency.

UK MPC's Besley says current high debt levels not major concern for rate-setters

Mon, Nov 27 2006, 12:04 GMT

http://www.afxnews.com

LONDON (AFX) - Tim Besley, a member of the Bank of England's Monetary Policy Committee, said high levels of debt in the UK are not a major concern for rate-setters at the moment.

Speaking in an interview with the Stoke Sentinel, Besley said personal debt levels are high but not high enough to affect the whole economy.

"When we are setting interest rates we wouldn't say at this point that is one of the major factors we are concerned about from a macroeconomics point," he said.

Debt levels are not sufficient to be creating "significant weakness in the demand side of the economy", Besley told the paper during a visit to North Staffordshire.

"If there was sufficiently many more people getting into difficulty then that would create an effect but I don't think it has reached that level," he said.

In the minutes of their November meeting, when interest rates were raised to 5.00 pct, the MPC acknowledged that the "burden of rising debt" could weigh more heavily on spending than had been allowed for in the Committee's central forecast.

Besley is one of the newer members of the MPC and joined the body on September 1.

The newspaper was quoting figures showing that the number of people declaring themselves bankrupt in the Stoke area this summer jumped by 80 pct to 144 from just 80 in 2005.

Recent figures have shown a sharp rise in the number of bankruptcies, though this is partly due to changes in the law, making it easier for individuals to file for insolvency.

Melnibone - 27 Nov 2006 19:16 - 6899 of 11056

Evening. Apparently BT have finally got Miss M online. They reckon the Firewall I

put on her laptop was stopping their Broadband working. They better not be making

her use their product without a Firewall. It took me 2 days to chase all the nastys

out of her machine the last time she brought it home. (P2P music file sharing. Grr! )

She's had a tour round the Investment Bank that she may be getting a position

with. She may go into their IPO section, so that she can learn from grass roots

what makes a company tick and how to value companies properly with the

knowledge that she gains.

Hee-hee, the mentor started talking about how she would be useful for 'Spin'.

To which she replied, after me telling her all about financial spin, "you mean lies".

He was taken aback, and said something about Northeners being rather blunt. :-)

Apparently, they also know the Trading section as 'The Essex Boys'. :-))

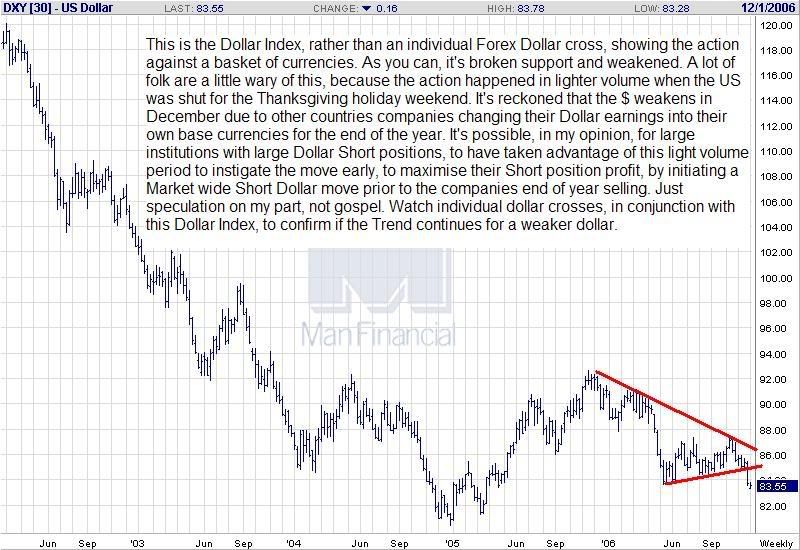

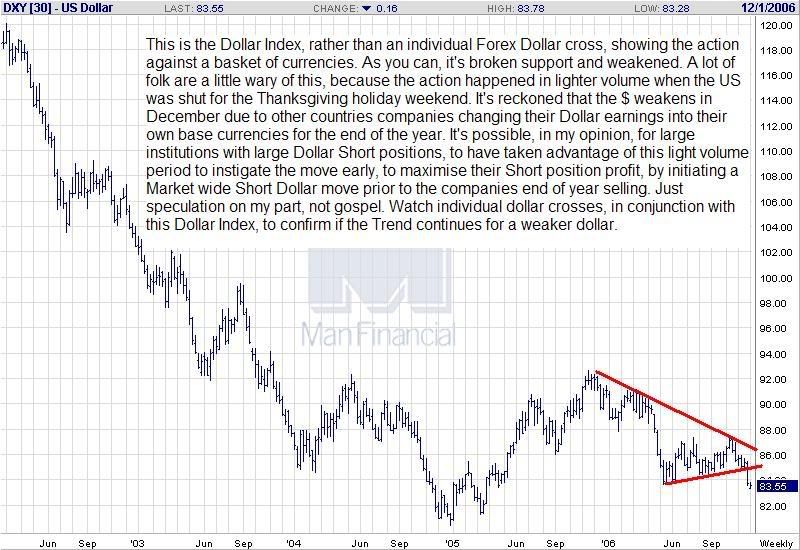

Anyway, here's tonight's basic stuff.

put on her laptop was stopping their Broadband working. They better not be making

her use their product without a Firewall. It took me 2 days to chase all the nastys

out of her machine the last time she brought it home. (P2P music file sharing. Grr! )

She's had a tour round the Investment Bank that she may be getting a position

with. She may go into their IPO section, so that she can learn from grass roots

what makes a company tick and how to value companies properly with the

knowledge that she gains.

Hee-hee, the mentor started talking about how she would be useful for 'Spin'.

To which she replied, after me telling her all about financial spin, "you mean lies".

He was taken aback, and said something about Northeners being rather blunt. :-)

Apparently, they also know the Trading section as 'The Essex Boys'. :-))

Anyway, here's tonight's basic stuff.

Boyse

- 28 Nov 2006 08:15

- 6900 of 11056

- 28 Nov 2006 08:15

- 6900 of 11056

Monday view: Paulson re-activates secretive support team to prevent markets meltdown

Monday view: Paulson re-activates secretive support team to prevent markets meltdown Judging by their body language, the US authorities believe the roaring bull market this autumn is just a suckers' rally before the inevitable storm hits.

Hank Paulson, the market-wise Treasury Secretary who built a $700m fortune at Goldman Sachs, is re-activating the 'plunge protection team' (PPT), a shadowy body with powers to support stock index, currency, and credit futures in a crash.

Story

Monday view: Paulson re-activates secretive support team to prevent markets meltdown Judging by their body language, the US authorities believe the roaring bull market this autumn is just a suckers' rally before the inevitable storm hits.

Hank Paulson, the market-wise Treasury Secretary who built a $700m fortune at Goldman Sachs, is re-activating the 'plunge protection team' (PPT), a shadowy body with powers to support stock index, currency, and credit futures in a crash.

Story

foale

- 28 Nov 2006 08:59

- 6901 of 11056

- 28 Nov 2006 08:59

- 6901 of 11056

nice article Boyse..

Cable behaving nicely atm..

Cable behaving nicely atm..

goforit

- 28 Nov 2006 13:35

- 6902 of 11056

- 28 Nov 2006 13:35

- 6902 of 11056

Hi all, hope your all going well. Just like to add my thanks to melnibone for all your posting, findind it very informative and helpful. Slowly getting myself sorted, not trading at the moment as have been doing alot of other things as well.

Can anyone tell me how to use photobucket to upload charts from fxcm as seem unable to get it to work

Can anyone tell me how to use photobucket to upload charts from fxcm as seem unable to get it to work

Seymour Clearly

- 28 Nov 2006 13:44

- 6903 of 11056

- 28 Nov 2006 13:44

- 6903 of 11056

gfi, do a "Print screen", then save the image or edit it then save on your hard disc, then use photobucket to browse your hard disc for the location and upload from there.

goforit

- 28 Nov 2006 13:59

- 6904 of 11056

- 28 Nov 2006 13:59

- 6904 of 11056

ta SC

foale

- 28 Nov 2006 14:00

- 6905 of 11056

- 28 Nov 2006 14:00

- 6905 of 11056

Cable 1.9500 will she... wont she

Can someone please post the date that 1 buys $2's thats would really help me atm.

Can someone please post the date that 1 buys $2's thats would really help me atm.

hodgins

- 28 Nov 2006 14:04

- 6906 of 11056

- 28 Nov 2006 14:04

- 6906 of 11056

Short Euro 3175

Retest break just below 1.30 and not stay above high of Monday?

Now see me get shot down?

Retest break just below 1.30 and not stay above high of Monday?

Now see me get shot down?

hodgins

- 28 Nov 2006 19:09

- 6907 of 11056

- 28 Nov 2006 19:09

- 6907 of 11056

"gainlocked" out for +5 on Euro but will look for another entry short?