| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The Forex Thread (FX)

hilary

- 31 Dec 2003 13:00

- 31 Dec 2003 13:00

| Your browser does not support JavaScript! | Your browser does not support JavaScript! |

| Your browser does not support inline frames or is currently configured not to display inline frames. |

Dil

- 06 Dec 2006 19:40

- 6955 of 11056

- 06 Dec 2006 19:40

- 6955 of 11056

Who do you all use to trade with ?

I have only ever used Finspreads but now wish look at other options so any ideas welcome.

Does anyone use FXCM ?

Cheers

I have only ever used Finspreads but now wish look at other options so any ideas welcome.

Does anyone use FXCM ?

Cheers

foale

- 07 Dec 2006 07:15

- 6956 of 11056

- 07 Dec 2006 07:15

- 6956 of 11056

Dil FXCM very good imo...its used by a few of us on here I thnk..

Realistically it was a bit much to ask for cable to continue that climb to $2 without some pullback.. The fall back to 1.9650 area might provide a more sustainable base from which to rally to that objective now.

although we will need a clear breach of 1.9775 to firmly make $2 a possibility

Realistically it was a bit much to ask for cable to continue that climb to $2 without some pullback.. The fall back to 1.9650 area might provide a more sustainable base from which to rally to that objective now.

although we will need a clear breach of 1.9775 to firmly make $2 a possibility

bosley

- 07 Dec 2006 08:11

- 6957 of 11056

- 07 Dec 2006 08:11

- 6957 of 11056

dil, i've used finspreads and captial spreads. only used fxcm in demo mode but it seemed simple enough. you even get phone calls off joe krakowski from new jersey trying to get you to sign up but i think he struggled with my bolton accent a little and eventually gave up.

hilary

- 07 Dec 2006 09:21

- 6958 of 11056

- 07 Dec 2006 09:21

- 6958 of 11056

Dilbert,

I use FXCM and have no complaints.

I use FXCM and have no complaints.

Seymour Clearly

- 07 Dec 2006 12:09

- 6959 of 11056

- 07 Dec 2006 12:09

- 6959 of 11056

I'm still on 1 a point with CMC until I'm more confident with Fx trading - and have been requoted quite a lot over the last few days. On balance it's worked to my advantage but requotes @ 1 a point? Give me strength!

bakko

- 07 Dec 2006 12:21

- 6960 of 11056

- 07 Dec 2006 12:21

- 6960 of 11056

Dil...I'm using both Fins and FXCM atm.

Fins imo is a bag of sh**. Always has been and always will be with the usual tricks up their sleeves. I just use them for other things now.

No probs with FXCM or at least not yet as only been with them for a month.

Fins imo is a bag of sh**. Always has been and always will be with the usual tricks up their sleeves. I just use them for other things now.

No probs with FXCM or at least not yet as only been with them for a month.

hilary

- 07 Dec 2006 12:31

- 6961 of 11056

- 07 Dec 2006 12:31

- 6961 of 11056

I've got a rising support line on my 1-hour chart from the lows of 17 Nov. It's currently at 1.8645 so that bounce a short while ago was bang on cue.

Will that support hold?

Will that support hold?

MightyMicro

- 07 Dec 2006 15:53

- 6962 of 11056

- 07 Dec 2006 15:53

- 6962 of 11056

Forgot to post this from this morning. It's by the well-regarded analyst at Mizuho Corporate Bank, Nicole Elliott.

Re: Cable.

"Consolidating neatly in a small 'flag' despite trading at historically very high and scary levels. The overbought situation has eased quite a lot and bullish momentum is strong. For today we favour yet more consolidation below $1.9900, with the chance of a break above here increasing if we hold above $1.9600."

Re: Cable.

"Consolidating neatly in a small 'flag' despite trading at historically very high and scary levels. The overbought situation has eased quite a lot and bullish momentum is strong. For today we favour yet more consolidation below $1.9900, with the chance of a break above here increasing if we hold above $1.9600."

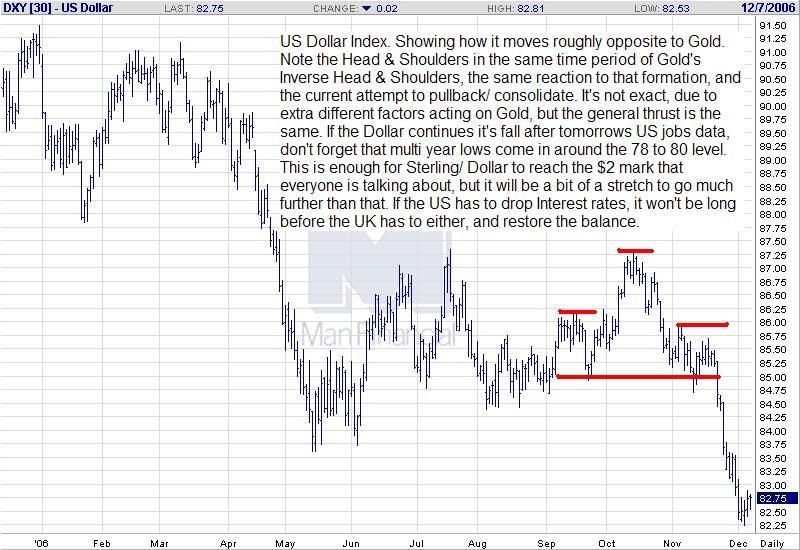

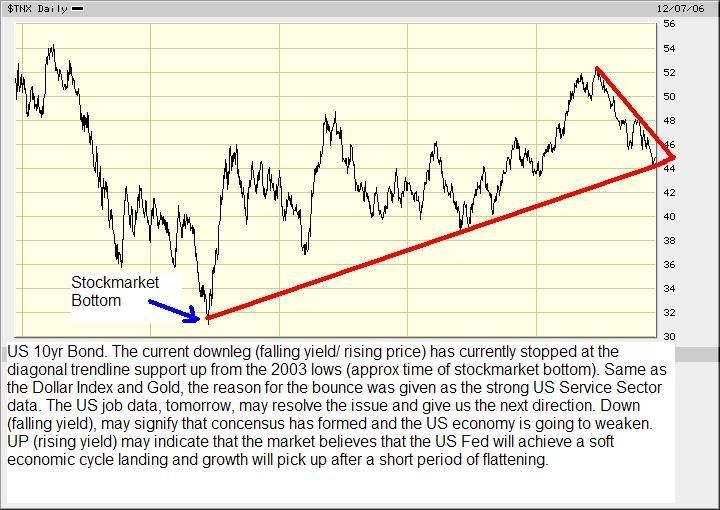

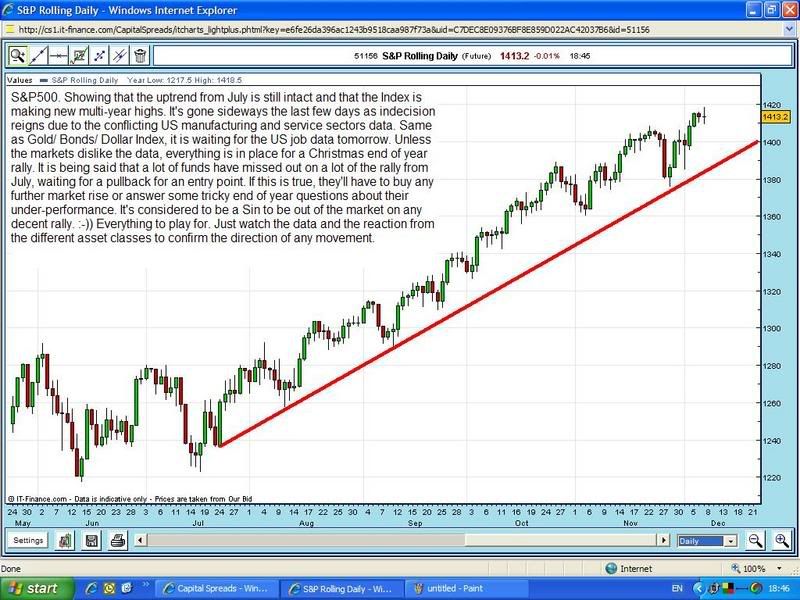

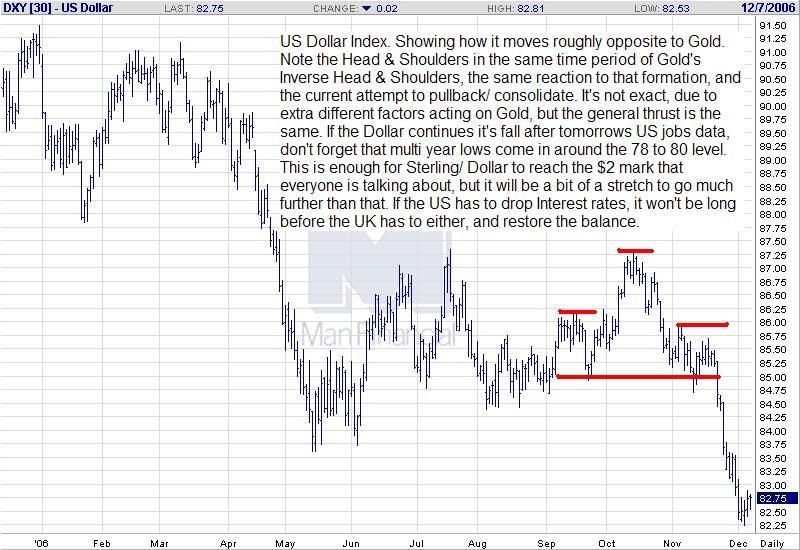

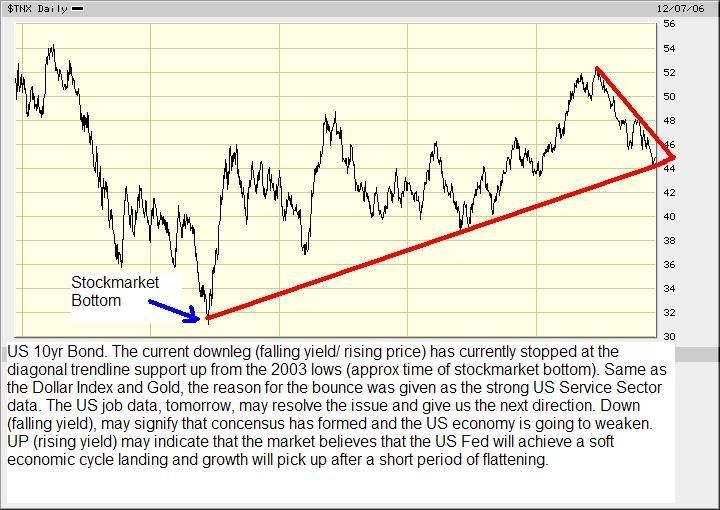

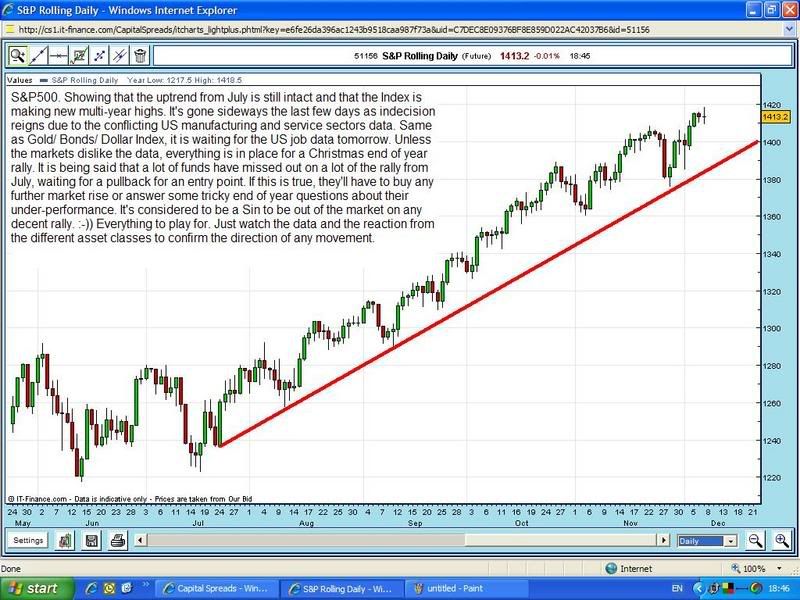

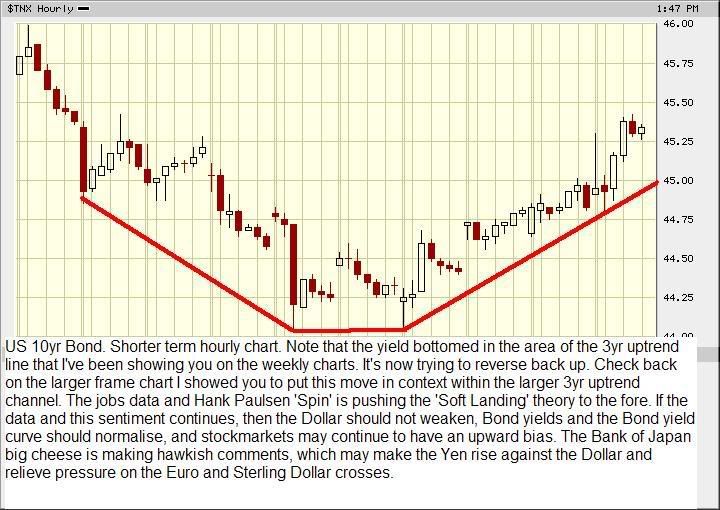

Melnibone - 07 Dec 2006 19:15 - 6963 of 11056

Evening. Haven't sent anything to Miss M the last few days due to everything

just messing about, waiting on the US jobs data. We just chatted on the phone

instead.

Banged some stuff together tonight, so that she can see the state of play and

what to watch for when/ if the markets make up their minds and move after the

data release.

Turns out that the 2 bods at the 2 investment banks that make the final

hiring/ firing decision are both away until nearly Christmas, so she might have to

wait until the New Year for a yea or nay.

Never mind, it'll give me a chance to teach her all about the P&F pure price style

of charting when she comes up for Christmas. :-))

If that doesn't make her eyes glaze over, I don't know what will. :-)

It'll be get me own back time for all that psycho babble I had to sit through

when she was getting her degree.

What goes around, comes around! :-)))))))))

Anyway, here's the stuff.

just messing about, waiting on the US jobs data. We just chatted on the phone

instead.

Banged some stuff together tonight, so that she can see the state of play and

what to watch for when/ if the markets make up their minds and move after the

data release.

Turns out that the 2 bods at the 2 investment banks that make the final

hiring/ firing decision are both away until nearly Christmas, so she might have to

wait until the New Year for a yea or nay.

Never mind, it'll give me a chance to teach her all about the P&F pure price style

of charting when she comes up for Christmas. :-))

If that doesn't make her eyes glaze over, I don't know what will. :-)

It'll be get me own back time for all that psycho babble I had to sit through

when she was getting her degree.

What goes around, comes around! :-)))))))))

Anyway, here's the stuff.

Melnibone - 07 Dec 2006 19:17 - 6964 of 11056

First time I've posted a chart since installing IE7 this week.

A window popped up saying saying I had to allow scripted

windows or something or other?

Wassat all about then?

A window popped up saying saying I had to allow scripted

windows or something or other?

Wassat all about then?

foale

- 08 Dec 2006 15:10

- 6965 of 11056

- 08 Dec 2006 15:10

- 6965 of 11056

Is thats a reversal I smell?

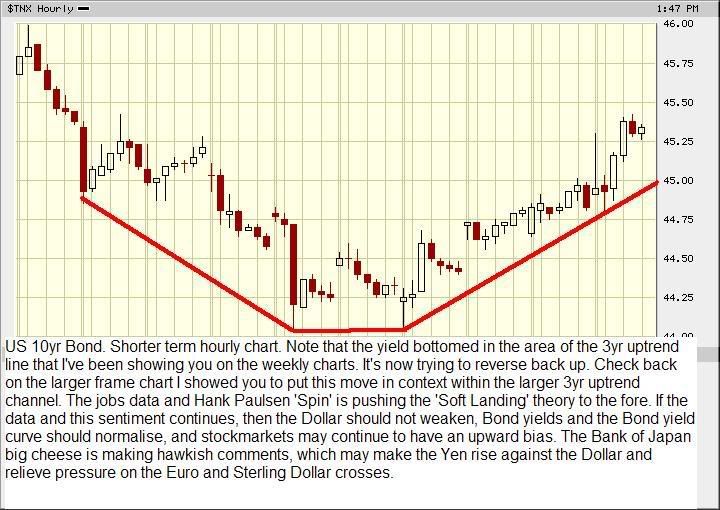

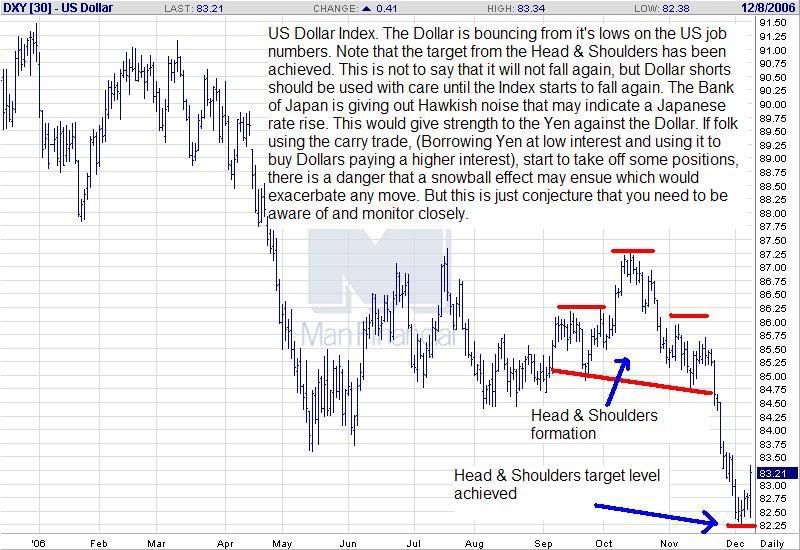

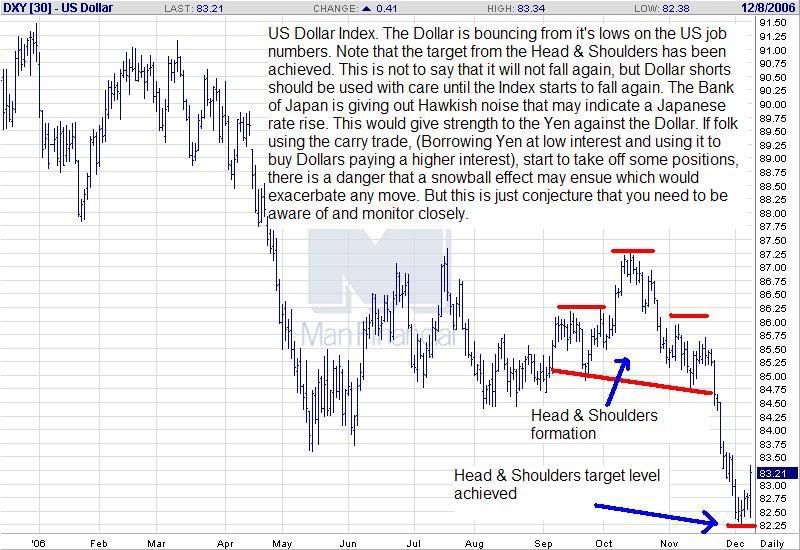

Melnibone - 08 Dec 2006 20:30 - 6966 of 11056

Evening. Very quiet on here. I suppose they're all at the Xmas

bash, doing stuff they wish they hadn't when they wake up

tomorrow. :-)

(I remember that feeling very well. ;-)

Here's the end of week stuff to Miss M. Hope you're still finding

this useful. Folk on here did seem to.

What happened to all the charts and views Forex traders used

to post on here?

Do you find that the Dollar Index/ Gold/ Bond charts are helping

with your Dollar cross trade positions?

I don't want to waste your/my time in posting stuff that nobody

wants.

bash, doing stuff they wish they hadn't when they wake up

tomorrow. :-)

(I remember that feeling very well. ;-)

Here's the end of week stuff to Miss M. Hope you're still finding

this useful. Folk on here did seem to.

What happened to all the charts and views Forex traders used

to post on here?

Do you find that the Dollar Index/ Gold/ Bond charts are helping

with your Dollar cross trade positions?

I don't want to waste your/my time in posting stuff that nobody

wants.

Melnibone - 09 Dec 2006 15:09 - 6967 of 11056

Link to latest Yen news

Whoops. Looks like events have overtaken me after posting the Bullish Yen

stuff.

I'm starting to feel a bit like Oil traders must feel like....................a member

of the Fukarwi Tribe. ;-))

the Yen posted pronounced drops on news that the Bank of Japan would not

raise interest rates at its upcoming meeting. Japans JiJi newswire claimed an

anonymous source saying

Whoops. Looks like events have overtaken me after posting the Bullish Yen

stuff.

I'm starting to feel a bit like Oil traders must feel like....................a member

of the Fukarwi Tribe. ;-))

the Yen posted pronounced drops on news that the Bank of Japan would not

raise interest rates at its upcoming meeting. Japans JiJi newswire claimed an

anonymous source saying

Divetime

- 09 Dec 2006 21:07

- 6968 of 11056

- 09 Dec 2006 21:07

- 6968 of 11056

Melnibone brilliant post, when you start doing courses can I be your first student, after your daughter of coarse, went to the IX Forex Trader Event at Olympia on Friday the seminars were very good especially Tom Hougaard.

hodgins

- 10 Dec 2006 22:37

- 6969 of 11056

- 10 Dec 2006 22:37

- 6969 of 11056

Mel, I will certainly be glad as long as you keep posting.

Divetime, I too planning (eventually) on attending Tom Hougaard Fibonacci seminar. Square roots very relevant. Interesting that his entries differ from that taught at www.spreadbettingtowin.com combination of both may give even more better entries?

Divetime, I too planning (eventually) on attending Tom Hougaard Fibonacci seminar. Square roots very relevant. Interesting that his entries differ from that taught at www.spreadbettingtowin.com combination of both may give even more better entries?

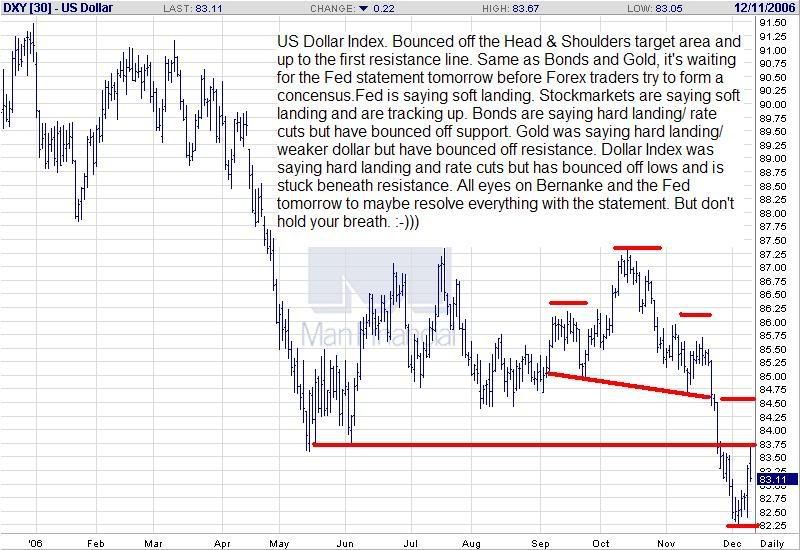

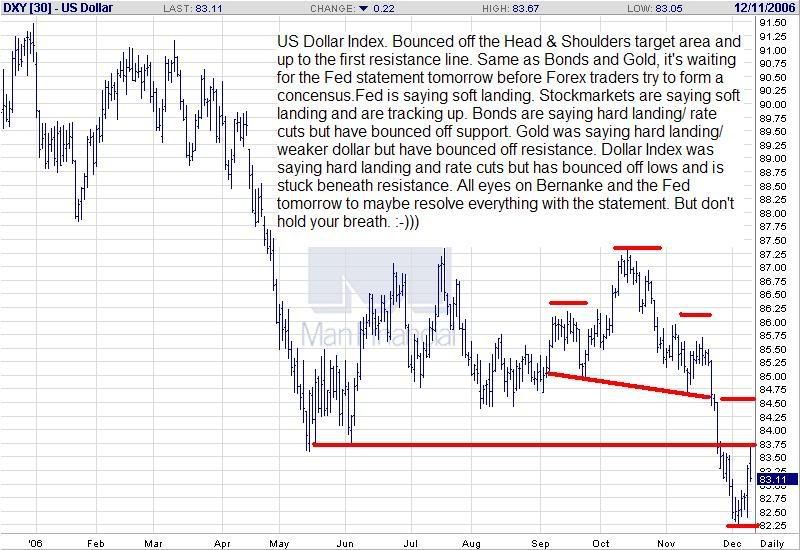

Melnibone - 11 Dec 2006 19:20 - 6970 of 11056

Evening. Hard to get a word in edgeways here. :-)

Tonight's stuff to Miss M. Not a lot changed, markets are all waiting

to see what the Fed says.

Tonight's stuff to Miss M. Not a lot changed, markets are all waiting

to see what the Fed says.

jeffmack

- 12 Dec 2006 11:07

- 6971 of 11056

- 12 Dec 2006 11:07

- 6971 of 11056

Hils

I see this thread won Thread of the Year. Looks like you will have one more trophy than Chelski this year.

I see this thread won Thread of the Year. Looks like you will have one more trophy than Chelski this year.

MightyMicro

- 12 Dec 2006 11:21

- 6972 of 11056

- 12 Dec 2006 11:21

- 6972 of 11056

To help the Hilary "$2 by Xmas" attempt . . .

Claude Mattern, BNP Paribas, quoth this morning: "Sterling/dollar rebounding from a former ascending line (at $1.9460), is seen as consolidating the rally of the past few weeks. A rise towards $2.01 is expected later on." (Whatever that means.)

Claude Mattern, BNP Paribas, quoth this morning: "Sterling/dollar rebounding from a former ascending line (at $1.9460), is seen as consolidating the rally of the past few weeks. A rise towards $2.01 is expected later on." (Whatever that means.)

foale

- 12 Dec 2006 13:46

- 6973 of 11056

- 12 Dec 2006 13:46

- 6973 of 11056

encouraging rally back up after figures initally knocked cable again..

someome wake me when we cross 1.9740

someome wake me when we cross 1.9740

MightyMicro

- 12 Dec 2006 22:27

- 6974 of 11056

- 12 Dec 2006 22:27

- 6974 of 11056

Fed: No change, no surprise. But they've noticed the "substantial" cooling of the housing market. So no change in rates for the next few months with possibly a slightly deflationary pressure.