| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The Forex Thread (FX)

hilary

- 31 Dec 2003 13:00

- 31 Dec 2003 13:00

| Your browser does not support JavaScript! | Your browser does not support JavaScript! |

| Your browser does not support inline frames or is currently configured not to display inline frames. |

MightyMicro

- 14 Dec 2006 20:29

- 6984 of 11056

- 14 Dec 2006 20:29

- 6984 of 11056

Mel:

To be honest, I never use IE anymore, especially the accursed IE7. I use either Firefox or Opera. Both now work with most sites. IE is a browser of last resort for me.

To be honest, I never use IE anymore, especially the accursed IE7. I use either Firefox or Opera. Both now work with most sites. IE is a browser of last resort for me.

Melnibone - 14 Dec 2006 20:46 - 6985 of 11056

Cheers MM.

Looks like I'll have to live with it. No point in taking the risk of

leaving myself open to attack. Bi$$y Gates must have put it in

IE7 for some reason.

I'll have a look round the Firefox one you recommend sometime.

Try it out on my old laptop first to see if it conflicts with any of my stuff.

I've noticed that since I've got WinXP I can no longer access CMC's

MarketLite web based version.

I just get little red boxes where the Log in and stuff should be and

messages about Jave error exceptions or something or other.

The trouble with the MarketMaker platform itself is that it grabs loads of computer

resources, and I like to have other Windows open, especially my

CapSpreads account.

Never mind. Worse things happen at sea, (or so I'm told) :-)

Looks like I'll have to live with it. No point in taking the risk of

leaving myself open to attack. Bi$$y Gates must have put it in

IE7 for some reason.

I'll have a look round the Firefox one you recommend sometime.

Try it out on my old laptop first to see if it conflicts with any of my stuff.

I've noticed that since I've got WinXP I can no longer access CMC's

MarketLite web based version.

I just get little red boxes where the Log in and stuff should be and

messages about Jave error exceptions or something or other.

The trouble with the MarketMaker platform itself is that it grabs loads of computer

resources, and I like to have other Windows open, especially my

CapSpreads account.

Never mind. Worse things happen at sea, (or so I'm told) :-)

Melnibone - 14 Dec 2006 21:03 - 6986 of 11056

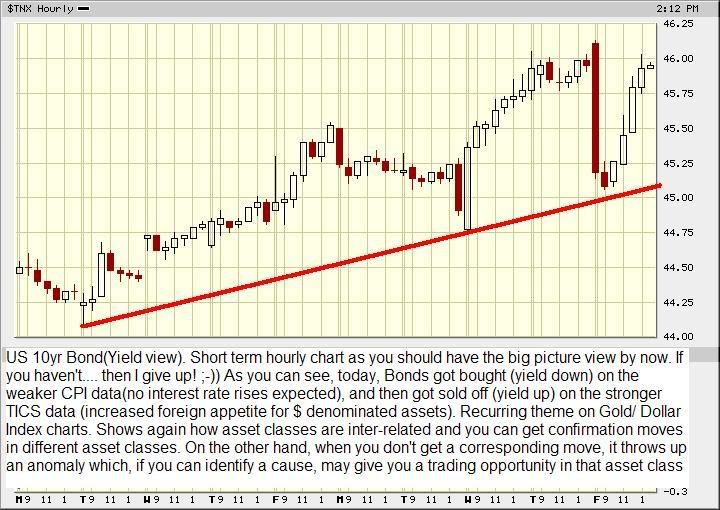

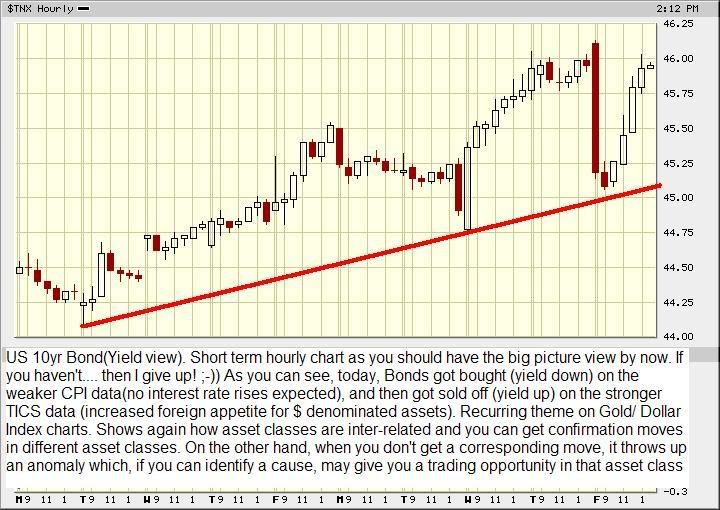

Looks like Bernanke's winning the fight with the Bond boys.

Should support Dollar crosses as well.

Link to today's action

NEW YORK (MarketWatch) - Treasury prices closed lower Thursday afternoon,

pushing the benchmark yield to its highest level in three weeks, after the Labor

Department reported an unexpected rise in import prices for last month alongside

a drop in jobless claims in the latest week.

and from yesterday

Link to weak auction

Treasurys dented by strong retail sales report

A tepid response to an auction of 10-year notes compounds selling pressure

Limp demand for a sale of $8 billion in new 10-year notes added to the pressure on

prices.

Should support Dollar crosses as well.

Link to today's action

NEW YORK (MarketWatch) - Treasury prices closed lower Thursday afternoon,

pushing the benchmark yield to its highest level in three weeks, after the Labor

Department reported an unexpected rise in import prices for last month alongside

a drop in jobless claims in the latest week.

and from yesterday

Link to weak auction

Treasurys dented by strong retail sales report

A tepid response to an auction of 10-year notes compounds selling pressure

Limp demand for a sale of $8 billion in new 10-year notes added to the pressure on

prices.

hodgins

- 14 Dec 2006 21:26

- 6987 of 11056

- 14 Dec 2006 21:26

- 6987 of 11056

All the action, UK based anyway on the pound and the Euro lately, has been centred on the dollar.

Yen hasn't been tracking that though and GBP/Yen highest it's been for some time. USD/Yen also at times heading in opposite direction to pound/dollar.

Likelihood of no rate rise there next week now presumed and Tankan survey tonight may start counter moves. If it moves thin Christmas markets (similar to Thanksgiving) might see it move more than it otherwise might.

Anyone got COT type? figures on this.

Have gone small short GBP/Yen

Yen hasn't been tracking that though and GBP/Yen highest it's been for some time. USD/Yen also at times heading in opposite direction to pound/dollar.

Likelihood of no rate rise there next week now presumed and Tankan survey tonight may start counter moves. If it moves thin Christmas markets (similar to Thanksgiving) might see it move more than it otherwise might.

Anyone got COT type? figures on this.

Have gone small short GBP/Yen

Ranjith

- 14 Dec 2006 21:43

- 6988 of 11056

- 14 Dec 2006 21:43

- 6988 of 11056

Hey Bak congratulations of the good news just looking thro the forex thread trying to get back to it

foale

- 15 Dec 2006 07:05

- 6989 of 11056

- 15 Dec 2006 07:05

- 6989 of 11056

1.9600 a possible floor to go long on this am..

its is on a rising support line

Its obvoiusly going to $2 its just the case of when...

1.9700 the big hurdle

its is on a rising support line

Its obvoiusly going to $2 its just the case of when...

1.9700 the big hurdle

hilary

- 15 Dec 2006 07:41

- 6990 of 11056

- 15 Dec 2006 07:41

- 6990 of 11056

It seems to be constrained by the Asian boundaries atm - 1.9593 to 1.9622. 10-minute says up, but that could easily change with the downleg on the 1-minute.

What's happened to the Global Calendar on Squawk Box? Says it's moved to 2417, but how do I get that? I've been around so little lately that I haven't even printed a calendar for this week and it's Friday already.

What's happened to the Global Calendar on Squawk Box? Says it's moved to 2417, but how do I get that? I've been around so little lately that I haven't even printed a calendar for this week and it's Friday already.

foale

- 15 Dec 2006 08:09

- 6991 of 11056

- 15 Dec 2006 08:09

- 6991 of 11056

1 min Hils.

I a looking at the traders chart...

which is now giving me a narrow range of play

from 1.9620 to just under 1.9700

the rounded bottom and long tails of the last 4-5 bars gives me cause to be slighly optimistic

I a looking at the traders chart...

which is now giving me a narrow range of play

from 1.9620 to just under 1.9700

the rounded bottom and long tails of the last 4-5 bars gives me cause to be slighly optimistic

foale

- 15 Dec 2006 12:00

- 6992 of 11056

- 15 Dec 2006 12:00

- 6992 of 11056

Hopes dashed again

Seymour Clearly

- 15 Dec 2006 12:03

- 6993 of 11056

- 15 Dec 2006 12:03

- 6993 of 11056

I'm short.... so I guess it's safe to go long :-0

Melnibone - 15 Dec 2006 12:13 - 6994 of 11056

Watch your stops around 1330 and 1400 (UK Time) when we get

the US CPI and TICS data. If they're too far out of whack with

concensus estimates then expect some volatile trading in all asset

classes. (imho).

the US CPI and TICS data. If they're too far out of whack with

concensus estimates then expect some volatile trading in all asset

classes. (imho).

hilary

- 15 Dec 2006 13:20

- 6995 of 11056

- 15 Dec 2006 13:20

- 6995 of 11056

MACD on the 10-minute levelling off and possibly starting to turn up, but stochs still heading firmly down although oversold. No need to do anything yet imo except to tighten the stops on the shorts ahead of the data.

[13:02 Data on Tap - CPI, Real Earnings, IP and Cap U, TICS] Boston, December

15. With the NY Fed having to formally release their Empire State Manufacturing

Survey yesterday afternoon (See 42300 ), the 13:30 time stamp is less cluttered.

Still, along with CPI come real earnings, which should slow dramatically after

gains of 1.0% and 1.3% in the two prior months, at 13.6% annual rate. Keep in

mind, there is also TIC data at 14:00, though IFR does neither surveys nor

forecasts for this series. In October, foreigners bought $53.7 bln in US

assets. Custody holdings have shown steady, large advances in foreign purchases

of Agency securities.

[Consumer Prices (Nov)] IFR expects no change in the all-items CPI and a

0.2% increase in the core index. The most significant benefits of the retreat in

energy prices have already been felt and toward the end of November commodity

prices had built a base of support to move higher. The housing index, which was

unchanged between September and October should prevent any increases in the

headline CPI and could post its first decline since April 2003. As housing

represents more than 40% of the total index, there could be a small drop in the

headline index even without a third straight drop in the transportation index

owing to lower fuel charges.

Commodities prices fell by 1.6% between October 2005 and October 2006, the

most in any 12-month period in the last 4.5 years. But services prices (+3.4%

y/y) remain elevated beyond the Fed's comfort level. A year-ago core CPI print

above 2.8% would spook the bond market while a print below would hardly soothe

it.

[Industrial Production and Capacity Utilization (Nov)] IFR sees no change in

industrial production in November. In October, we expected a 0.2% drop but our

call was overtaken by gains in mining and utilities, up 0.6% and 4.1%,

respectively. Manufacturing output, representing 87% of all industrial

production, declined 0.2% in October, generally as expected. Excluding motor

vehicles and parts, manufacturing output rose 0.1% in October.

Capacity use edged higher by 0.1 pp in October to 82.2%, though the factory

use rate declined for a second straight month. Capacity use in manufacturing

slowed to 80.7%, a 5-month low. Thanks to the profitability of petroleum

extraction, capacity use in mining stood at a 65-month high in October but is

seen moderating over the next several months.

DATE TIME RELEASE UNIT PER IFR Est PREV MEDIAN RANGE

15Dec 13:30 CPI %m/m Nov 0.0 -0.5 0.2 -0.1 0.3

15Dec 13:30 CPI Core %m/m Nov 0.2 0.1 0.2 0.0 0.3

15Dec 13:30 Industrial Prod %m/m Nov 0.2 0.2 0.0 -0.1 0.2

15Dec 13:30 Capacity Util. %,AR Nov 82.2 82.2 82.1 82.0 82.3

[13:02 Data on Tap - CPI, Real Earnings, IP and Cap U, TICS] Boston, December

15. With the NY Fed having to formally release their Empire State Manufacturing

Survey yesterday afternoon (See 42300 ), the 13:30 time stamp is less cluttered.

Still, along with CPI come real earnings, which should slow dramatically after

gains of 1.0% and 1.3% in the two prior months, at 13.6% annual rate. Keep in

mind, there is also TIC data at 14:00, though IFR does neither surveys nor

forecasts for this series. In October, foreigners bought $53.7 bln in US

assets. Custody holdings have shown steady, large advances in foreign purchases

of Agency securities.

[Consumer Prices (Nov)] IFR expects no change in the all-items CPI and a

0.2% increase in the core index. The most significant benefits of the retreat in

energy prices have already been felt and toward the end of November commodity

prices had built a base of support to move higher. The housing index, which was

unchanged between September and October should prevent any increases in the

headline CPI and could post its first decline since April 2003. As housing

represents more than 40% of the total index, there could be a small drop in the

headline index even without a third straight drop in the transportation index

owing to lower fuel charges.

Commodities prices fell by 1.6% between October 2005 and October 2006, the

most in any 12-month period in the last 4.5 years. But services prices (+3.4%

y/y) remain elevated beyond the Fed's comfort level. A year-ago core CPI print

above 2.8% would spook the bond market while a print below would hardly soothe

it.

[Industrial Production and Capacity Utilization (Nov)] IFR sees no change in

industrial production in November. In October, we expected a 0.2% drop but our

call was overtaken by gains in mining and utilities, up 0.6% and 4.1%,

respectively. Manufacturing output, representing 87% of all industrial

production, declined 0.2% in October, generally as expected. Excluding motor

vehicles and parts, manufacturing output rose 0.1% in October.

Capacity use edged higher by 0.1 pp in October to 82.2%, though the factory

use rate declined for a second straight month. Capacity use in manufacturing

slowed to 80.7%, a 5-month low. Thanks to the profitability of petroleum

extraction, capacity use in mining stood at a 65-month high in October but is

seen moderating over the next several months.

DATE TIME RELEASE UNIT PER IFR Est PREV MEDIAN RANGE

15Dec 13:30 CPI %m/m Nov 0.0 -0.5 0.2 -0.1 0.3

15Dec 13:30 CPI Core %m/m Nov 0.2 0.1 0.2 0.0 0.3

15Dec 13:30 Industrial Prod %m/m Nov 0.2 0.2 0.0 -0.1 0.2

15Dec 13:30 Capacity Util. %,AR Nov 82.2 82.2 82.1 82.0 82.3

hilary

- 15 Dec 2006 13:35

- 6996 of 11056

- 15 Dec 2006 13:35

- 6996 of 11056

Hmmmmm. The Ruskies were allegedly buying large slugs of fiber a few minutes before the data was released. Cue the conspiracy theorists.

:o)

:o)

hilary

- 15 Dec 2006 13:37

- 6997 of 11056

- 15 Dec 2006 13:37

- 6997 of 11056

I bet they've sold the squeeze now.

Seymour Clearly

- 15 Dec 2006 13:43

- 6998 of 11056

- 15 Dec 2006 13:43

- 6998 of 11056

Told you to go long :-(

bakko

- 15 Dec 2006 13:45

- 6999 of 11056

- 15 Dec 2006 13:45

- 6999 of 11056

Thanks SC :-)

Dil

- 15 Dec 2006 15:22

- 7000 of 11056

- 15 Dec 2006 15:22

- 7000 of 11056

Well I sold at my trigger of 1.9565 but not looking to day trade looking to catch the medium / longer term trends.

Trailing 100 stop loss.

Trailing 100 stop loss.

hodgins

- 15 Dec 2006 15:48

- 7001 of 11056

- 15 Dec 2006 15:48

- 7001 of 11056

happy GBP/Yen short here but why can't I concentrate on more than one cross at a time? Plenty of volatility

Melnibone - 15 Dec 2006 20:55 - 7002 of 11056

Evening.

Last missive of the week to Miss M. The folk who are going to be giving

her the deciding interviews for the Investment Banks are back off their Hols,

but they haven't told her if they'll be seeing her before Xmas or not yet.

So she's holding fire in London until Friday before coming home for Xmas.

I'm more nervous than she is. You'ld think it was me going for the

position, not her! She's not bothered either way!

Yoof, eh? Doncha just love it. :-)

Great to see some more folk on here saying why they're taking positions.

I like to hear other folk's perspectives. You're always learning in this game.

Last stuff of the week below.

Now for a well earned rest. :-)

Last missive of the week to Miss M. The folk who are going to be giving

her the deciding interviews for the Investment Banks are back off their Hols,

but they haven't told her if they'll be seeing her before Xmas or not yet.

So she's holding fire in London until Friday before coming home for Xmas.

I'm more nervous than she is. You'ld think it was me going for the

position, not her! She's not bothered either way!

Yoof, eh? Doncha just love it. :-)

Great to see some more folk on here saying why they're taking positions.

I like to hear other folk's perspectives. You're always learning in this game.

Last stuff of the week below.

Now for a well earned rest. :-)

MightyMicro

- 15 Dec 2006 21:04

- 7003 of 11056

- 15 Dec 2006 21:04

- 7003 of 11056

Mel:

So Miss M is in the Catherine Tate role: "Am I bovvered?"

Best of luck to her, if she's taken all the paternal tutoring in, she's well prepared.

MM

So Miss M is in the Catherine Tate role: "Am I bovvered?"

Best of luck to her, if she's taken all the paternal tutoring in, she's well prepared.

MM