| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The Forex Thread (FX)

hilary

- 31 Dec 2003 13:00

- 31 Dec 2003 13:00

| Your browser does not support JavaScript! | Your browser does not support JavaScript! |

| Your browser does not support inline frames or is currently configured not to display inline frames. |

foale

- 15 Dec 2006 08:09

- 6991 of 11056

- 15 Dec 2006 08:09

- 6991 of 11056

1 min Hils.

I a looking at the traders chart...

which is now giving me a narrow range of play

from 1.9620 to just under 1.9700

the rounded bottom and long tails of the last 4-5 bars gives me cause to be slighly optimistic

I a looking at the traders chart...

which is now giving me a narrow range of play

from 1.9620 to just under 1.9700

the rounded bottom and long tails of the last 4-5 bars gives me cause to be slighly optimistic

foale

- 15 Dec 2006 12:00

- 6992 of 11056

- 15 Dec 2006 12:00

- 6992 of 11056

Hopes dashed again

Seymour Clearly

- 15 Dec 2006 12:03

- 6993 of 11056

- 15 Dec 2006 12:03

- 6993 of 11056

I'm short.... so I guess it's safe to go long :-0

Melnibone - 15 Dec 2006 12:13 - 6994 of 11056

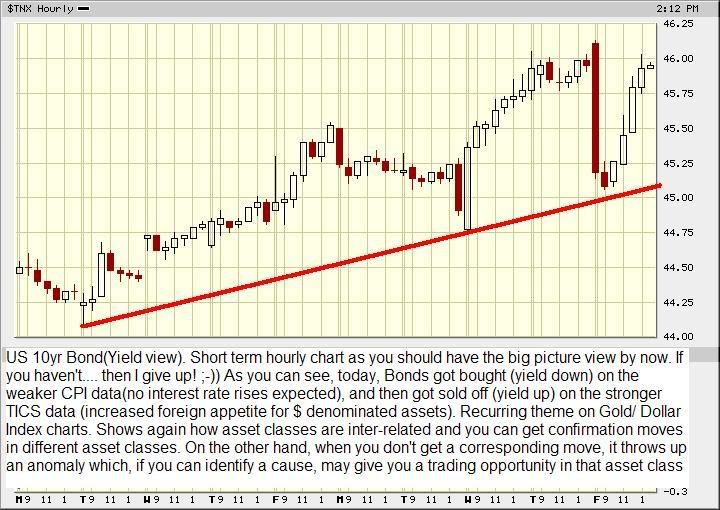

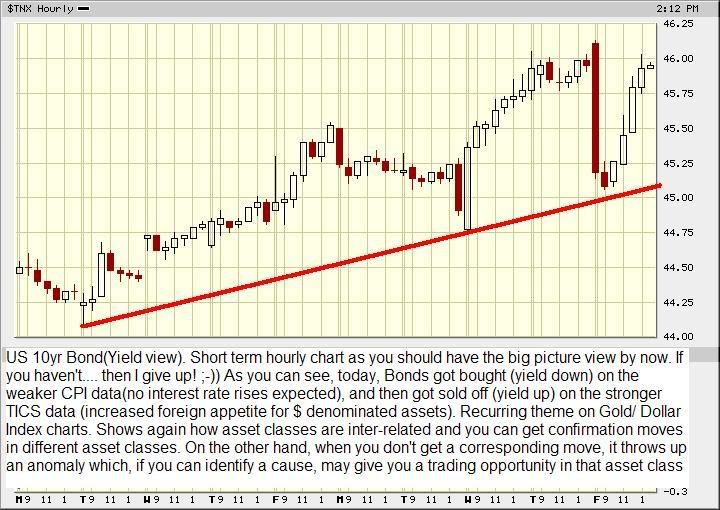

Watch your stops around 1330 and 1400 (UK Time) when we get

the US CPI and TICS data. If they're too far out of whack with

concensus estimates then expect some volatile trading in all asset

classes. (imho).

the US CPI and TICS data. If they're too far out of whack with

concensus estimates then expect some volatile trading in all asset

classes. (imho).

hilary

- 15 Dec 2006 13:20

- 6995 of 11056

- 15 Dec 2006 13:20

- 6995 of 11056

MACD on the 10-minute levelling off and possibly starting to turn up, but stochs still heading firmly down although oversold. No need to do anything yet imo except to tighten the stops on the shorts ahead of the data.

[13:02 Data on Tap - CPI, Real Earnings, IP and Cap U, TICS] Boston, December

15. With the NY Fed having to formally release their Empire State Manufacturing

Survey yesterday afternoon (See 42300 ), the 13:30 time stamp is less cluttered.

Still, along with CPI come real earnings, which should slow dramatically after

gains of 1.0% and 1.3% in the two prior months, at 13.6% annual rate. Keep in

mind, there is also TIC data at 14:00, though IFR does neither surveys nor

forecasts for this series. In October, foreigners bought $53.7 bln in US

assets. Custody holdings have shown steady, large advances in foreign purchases

of Agency securities.

[Consumer Prices (Nov)] IFR expects no change in the all-items CPI and a

0.2% increase in the core index. The most significant benefits of the retreat in

energy prices have already been felt and toward the end of November commodity

prices had built a base of support to move higher. The housing index, which was

unchanged between September and October should prevent any increases in the

headline CPI and could post its first decline since April 2003. As housing

represents more than 40% of the total index, there could be a small drop in the

headline index even without a third straight drop in the transportation index

owing to lower fuel charges.

Commodities prices fell by 1.6% between October 2005 and October 2006, the

most in any 12-month period in the last 4.5 years. But services prices (+3.4%

y/y) remain elevated beyond the Fed's comfort level. A year-ago core CPI print

above 2.8% would spook the bond market while a print below would hardly soothe

it.

[Industrial Production and Capacity Utilization (Nov)] IFR sees no change in

industrial production in November. In October, we expected a 0.2% drop but our

call was overtaken by gains in mining and utilities, up 0.6% and 4.1%,

respectively. Manufacturing output, representing 87% of all industrial

production, declined 0.2% in October, generally as expected. Excluding motor

vehicles and parts, manufacturing output rose 0.1% in October.

Capacity use edged higher by 0.1 pp in October to 82.2%, though the factory

use rate declined for a second straight month. Capacity use in manufacturing

slowed to 80.7%, a 5-month low. Thanks to the profitability of petroleum

extraction, capacity use in mining stood at a 65-month high in October but is

seen moderating over the next several months.

DATE TIME RELEASE UNIT PER IFR Est PREV MEDIAN RANGE

15Dec 13:30 CPI %m/m Nov 0.0 -0.5 0.2 -0.1 0.3

15Dec 13:30 CPI Core %m/m Nov 0.2 0.1 0.2 0.0 0.3

15Dec 13:30 Industrial Prod %m/m Nov 0.2 0.2 0.0 -0.1 0.2

15Dec 13:30 Capacity Util. %,AR Nov 82.2 82.2 82.1 82.0 82.3

[13:02 Data on Tap - CPI, Real Earnings, IP and Cap U, TICS] Boston, December

15. With the NY Fed having to formally release their Empire State Manufacturing

Survey yesterday afternoon (See 42300 ), the 13:30 time stamp is less cluttered.

Still, along with CPI come real earnings, which should slow dramatically after

gains of 1.0% and 1.3% in the two prior months, at 13.6% annual rate. Keep in

mind, there is also TIC data at 14:00, though IFR does neither surveys nor

forecasts for this series. In October, foreigners bought $53.7 bln in US

assets. Custody holdings have shown steady, large advances in foreign purchases

of Agency securities.

[Consumer Prices (Nov)] IFR expects no change in the all-items CPI and a

0.2% increase in the core index. The most significant benefits of the retreat in

energy prices have already been felt and toward the end of November commodity

prices had built a base of support to move higher. The housing index, which was

unchanged between September and October should prevent any increases in the

headline CPI and could post its first decline since April 2003. As housing

represents more than 40% of the total index, there could be a small drop in the

headline index even without a third straight drop in the transportation index

owing to lower fuel charges.

Commodities prices fell by 1.6% between October 2005 and October 2006, the

most in any 12-month period in the last 4.5 years. But services prices (+3.4%

y/y) remain elevated beyond the Fed's comfort level. A year-ago core CPI print

above 2.8% would spook the bond market while a print below would hardly soothe

it.

[Industrial Production and Capacity Utilization (Nov)] IFR sees no change in

industrial production in November. In October, we expected a 0.2% drop but our

call was overtaken by gains in mining and utilities, up 0.6% and 4.1%,

respectively. Manufacturing output, representing 87% of all industrial

production, declined 0.2% in October, generally as expected. Excluding motor

vehicles and parts, manufacturing output rose 0.1% in October.

Capacity use edged higher by 0.1 pp in October to 82.2%, though the factory

use rate declined for a second straight month. Capacity use in manufacturing

slowed to 80.7%, a 5-month low. Thanks to the profitability of petroleum

extraction, capacity use in mining stood at a 65-month high in October but is

seen moderating over the next several months.

DATE TIME RELEASE UNIT PER IFR Est PREV MEDIAN RANGE

15Dec 13:30 CPI %m/m Nov 0.0 -0.5 0.2 -0.1 0.3

15Dec 13:30 CPI Core %m/m Nov 0.2 0.1 0.2 0.0 0.3

15Dec 13:30 Industrial Prod %m/m Nov 0.2 0.2 0.0 -0.1 0.2

15Dec 13:30 Capacity Util. %,AR Nov 82.2 82.2 82.1 82.0 82.3

hilary

- 15 Dec 2006 13:35

- 6996 of 11056

- 15 Dec 2006 13:35

- 6996 of 11056

Hmmmmm. The Ruskies were allegedly buying large slugs of fiber a few minutes before the data was released. Cue the conspiracy theorists.

:o)

:o)

hilary

- 15 Dec 2006 13:37

- 6997 of 11056

- 15 Dec 2006 13:37

- 6997 of 11056

I bet they've sold the squeeze now.

Seymour Clearly

- 15 Dec 2006 13:43

- 6998 of 11056

- 15 Dec 2006 13:43

- 6998 of 11056

Told you to go long :-(

bakko

- 15 Dec 2006 13:45

- 6999 of 11056

- 15 Dec 2006 13:45

- 6999 of 11056

Thanks SC :-)

Dil

- 15 Dec 2006 15:22

- 7000 of 11056

- 15 Dec 2006 15:22

- 7000 of 11056

Well I sold at my trigger of 1.9565 but not looking to day trade looking to catch the medium / longer term trends.

Trailing 100 stop loss.

Trailing 100 stop loss.

hodgins

- 15 Dec 2006 15:48

- 7001 of 11056

- 15 Dec 2006 15:48

- 7001 of 11056

happy GBP/Yen short here but why can't I concentrate on more than one cross at a time? Plenty of volatility

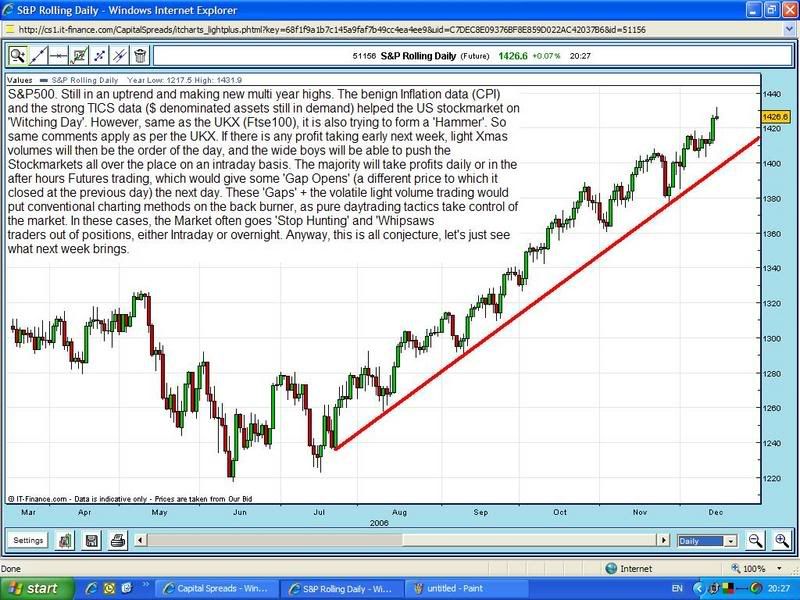

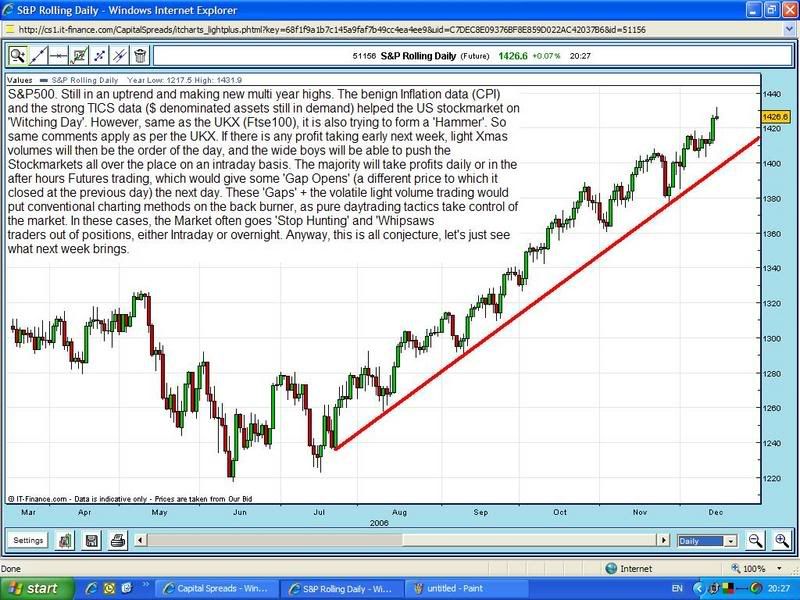

Melnibone - 15 Dec 2006 20:55 - 7002 of 11056

Evening.

Last missive of the week to Miss M. The folk who are going to be giving

her the deciding interviews for the Investment Banks are back off their Hols,

but they haven't told her if they'll be seeing her before Xmas or not yet.

So she's holding fire in London until Friday before coming home for Xmas.

I'm more nervous than she is. You'ld think it was me going for the

position, not her! She's not bothered either way!

Yoof, eh? Doncha just love it. :-)

Great to see some more folk on here saying why they're taking positions.

I like to hear other folk's perspectives. You're always learning in this game.

Last stuff of the week below.

Now for a well earned rest. :-)

Last missive of the week to Miss M. The folk who are going to be giving

her the deciding interviews for the Investment Banks are back off their Hols,

but they haven't told her if they'll be seeing her before Xmas or not yet.

So she's holding fire in London until Friday before coming home for Xmas.

I'm more nervous than she is. You'ld think it was me going for the

position, not her! She's not bothered either way!

Yoof, eh? Doncha just love it. :-)

Great to see some more folk on here saying why they're taking positions.

I like to hear other folk's perspectives. You're always learning in this game.

Last stuff of the week below.

Now for a well earned rest. :-)

MightyMicro

- 15 Dec 2006 21:04

- 7003 of 11056

- 15 Dec 2006 21:04

- 7003 of 11056

Mel:

So Miss M is in the Catherine Tate role: "Am I bovvered?"

Best of luck to her, if she's taken all the paternal tutoring in, she's well prepared.

MM

So Miss M is in the Catherine Tate role: "Am I bovvered?"

Best of luck to her, if she's taken all the paternal tutoring in, she's well prepared.

MM

Melnibone - 15 Dec 2006 21:17 - 7004 of 11056

Cheers MM, she deserves a break after what she's been through the

past 5yrs.

Maybe it was being so close to death and living under its shadow every

day is what gives her the Catherine Tate attitude.

There's probably a good message there for the rest of us.

Anyway, fingers and toes crossed. :-))

past 5yrs.

Maybe it was being so close to death and living under its shadow every

day is what gives her the Catherine Tate attitude.

There's probably a good message there for the rest of us.

Anyway, fingers and toes crossed. :-))

MightyMicro

- 18 Dec 2006 14:50

- 7005 of 11056

- 18 Dec 2006 14:50

- 7005 of 11056

Nicole Elliott, Mizuho Corporate Bank, on Cable:

"Consolidating a lot more neatly than some other currency pairs in what is very much corrective mode. It is an A, B, C-type move where C equals 61 percent of A. Cable is no longer overbought and momentum is still bullish. Ballooning open interest is a little scary. For this morning expect consolidation between $1.9500 and $1.9650."

"Consolidating a lot more neatly than some other currency pairs in what is very much corrective mode. It is an A, B, C-type move where C equals 61 percent of A. Cable is no longer overbought and momentum is still bullish. Ballooning open interest is a little scary. For this morning expect consolidation between $1.9500 and $1.9650."

Dil

- 18 Dec 2006 15:29

- 7006 of 11056

- 18 Dec 2006 15:29

- 7006 of 11056

Closed 1/3 of my position at 1.9465 , trailing stop loss on rest now moved to 1.9540.

Melnibone - 18 Dec 2006 19:07 - 7007 of 11056

Evening.

First missive of the week to Miss M.

I can't be bothered with Oil at the moment. When it breaks the range

I've been showing, or if we get a significant news item, then we'll

comment on it.

Being weighing stuff up, and if the data releases this week don't change

anything, I'm looking to get a long / position (as near to 0.6700 as possible),

for a longer term hold for 2007.

I'm looking for the interest rate differential to close and Sterling to weaken generally

against crosses other than the Dollar (don't know which way to call the Dollar).

Anyone else got a view on this cross?

First missive of the week to Miss M.

I can't be bothered with Oil at the moment. When it breaks the range

I've been showing, or if we get a significant news item, then we'll

comment on it.

Being weighing stuff up, and if the data releases this week don't change

anything, I'm looking to get a long / position (as near to 0.6700 as possible),

for a longer term hold for 2007.

I'm looking for the interest rate differential to close and Sterling to weaken generally

against crosses other than the Dollar (don't know which way to call the Dollar).

Anyone else got a view on this cross?

hilary

- 18 Dec 2006 20:05

- 7008 of 11056

- 18 Dec 2006 20:05

- 7008 of 11056

Mel,

Sorry a bit too busy to post in detail or give detailed reasons, but:

a) Chunnel's like watching paint dry. I'd give it a wide berth personally. Cable & Sterling/Yen are where the parties are at.

b) There's a tasty falling resistance line on your Dollar Index chart passing down through the highs since mid-October. I would've thought that the World, his wife and their pet poodle are going to be spraying the damn thing all over the shop as soon as it gets within touching distance of it. That could also coincide with a break of US Crude to the topside of the range at $64.

Sorry a bit too busy to post in detail or give detailed reasons, but:

a) Chunnel's like watching paint dry. I'd give it a wide berth personally. Cable & Sterling/Yen are where the parties are at.

b) There's a tasty falling resistance line on your Dollar Index chart passing down through the highs since mid-October. I would've thought that the World, his wife and their pet poodle are going to be spraying the damn thing all over the shop as soon as it gets within touching distance of it. That could also coincide with a break of US Crude to the topside of the range at $64.

Melnibone - 18 Dec 2006 21:09 - 7009 of 11056

Thanks for the reply, Hilary.

The Sterling/ Yen cross sounds interesting, especially with the sentiment

leaning towards a BOJ interest rate rise circa February and my leanings

towards Sterling topping out against crosses other than the Dollar.

I'll check it out.

The Sterling/ Yen cross sounds interesting, especially with the sentiment

leaning towards a BOJ interest rate rise circa February and my leanings

towards Sterling topping out against crosses other than the Dollar.

I'll check it out.

Dil

- 18 Dec 2006 23:05

- 7010 of 11056

- 18 Dec 2006 23:05

- 7010 of 11056

I have now moved stop loss to 1.9515