| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

Sirius Exploration -Green play? (SXX)

P J H - 30 Jun 2009 16:01

skinny

- 02 Sep 2016 15:56

- 727 of 976

- 02 Sep 2016 15:56

- 727 of 976

Had a small S/B today - now closed - another large volume day.

deltazero - 07 Sep 2016 10:52 - 728 of 976

here we go - new 75p buy rating today

http://www.proactiveinvestors.co.uk/companies/stocktube/5527/sirius-minerals-making-impressive-progress-says-investec-s-wrathall-5527.html

http://www.proactiveinvestors.co.uk/companies/stocktube/5527/sirius-minerals-making-impressive-progress-says-investec-s-wrathall-5527.html

skinny

- 14 Sep 2016 14:57

- 729 of 976

- 14 Sep 2016 14:57

- 729 of 976

mitzy - 28 Sep 2016 08:48 - 730 of 976

Top riser in the market.

chessplayer - 28 Sep 2016 15:22 - 731 of 976

A bit oversold, but 30 was a logical support level. I saw figures somewhere that suggests exports when and if all comes to fruition of £2 billion annually. - something like 7% of annual exports.

chessplayer - 28 Sep 2016 15:31 - 732 of 976

Can Sirius Minerals see a fresh rally back to 50p highs?

Share

11:31 28 Sep 2016

Chart guru Zak Mir reckons it is a real possibility, and says 35p is the trigger for new buyers to watch out for.

POLY4, the polyhalite product that will be made from the the new mine in North Yorkshire.

Polyhalite helps increase yields for crops, now is Sirius ready to grow its share price again?

Sirius Minerals PLC’s (LON:SXX) valuation pushed above £1bn this summer as the British mine developer advanced to around 50p per share; it has since fallen back to the 30p level, but could a fresh rally be on the way?

Chart guru Zak Mir reckons it is a real possibility, and he says a ‘buy’ trigger of 35p is what traders should be looking out for.

If this trigger occurs the popular resource stock could again rally higher to ‘re-test’ the 50p per share level, he says. The rally would likely happen in the two months following the trigger, Mir added.

WATCH: Zak’s analysis right now

Sirius Minerals is currently working on the project financing for its world-class fertiliser asset in Yorkshire, where earlier this year it hit major milestones by securing planning permission approval for the project.

In early September Sirius confirmed that the window for all appeals against the company’s giant fertiliser mine had slammed shut.

It follows the closure of the judicial review period for the mine’s proposed harbour facility on Teesside.

“As a result of this, all key planning and development consent approvals for the company's North Yorkshire Polyhalite Project have therefore been received and all related judicial review periods have expired without any objections being tabled,” Sirius said in short stock exchange statement.

Now, the focus will turn to actually building a mine that will, initially, churn out 10mln tonnes of this nutrient-rich polyhalite material to be transported 23 miles underground to the shipping site mentioned above.

The cost of the initial development is put at £833mln (US$1.09bn) to get the company producing its first exports by 2021.

There is the potential then to double capacity for a similar cost.

The project financing will come from the debt market, although investors may have to dig in their pockets one last time for the initial phase of the mine development.

Share

Share

11:31 28 Sep 2016

Chart guru Zak Mir reckons it is a real possibility, and says 35p is the trigger for new buyers to watch out for.

POLY4, the polyhalite product that will be made from the the new mine in North Yorkshire.

Polyhalite helps increase yields for crops, now is Sirius ready to grow its share price again?

Sirius Minerals PLC’s (LON:SXX) valuation pushed above £1bn this summer as the British mine developer advanced to around 50p per share; it has since fallen back to the 30p level, but could a fresh rally be on the way?

Chart guru Zak Mir reckons it is a real possibility, and he says a ‘buy’ trigger of 35p is what traders should be looking out for.

If this trigger occurs the popular resource stock could again rally higher to ‘re-test’ the 50p per share level, he says. The rally would likely happen in the two months following the trigger, Mir added.

WATCH: Zak’s analysis right now

Sirius Minerals is currently working on the project financing for its world-class fertiliser asset in Yorkshire, where earlier this year it hit major milestones by securing planning permission approval for the project.

In early September Sirius confirmed that the window for all appeals against the company’s giant fertiliser mine had slammed shut.

It follows the closure of the judicial review period for the mine’s proposed harbour facility on Teesside.

“As a result of this, all key planning and development consent approvals for the company's North Yorkshire Polyhalite Project have therefore been received and all related judicial review periods have expired without any objections being tabled,” Sirius said in short stock exchange statement.

Now, the focus will turn to actually building a mine that will, initially, churn out 10mln tonnes of this nutrient-rich polyhalite material to be transported 23 miles underground to the shipping site mentioned above.

The cost of the initial development is put at £833mln (US$1.09bn) to get the company producing its first exports by 2021.

There is the potential then to double capacity for a similar cost.

The project financing will come from the debt market, although investors may have to dig in their pockets one last time for the initial phase of the mine development.

Share

mentor - 05 Oct 2016 10:22 - 733 of 976

Well it is ready now to move higher again, the 34p does not want to go on the offer so that is it 33.75 v 34.25p

I bought some under the offer price 34.25p

Time to pounce at the stock if there is money for it, at this point the retracement is done.

&MA=&IND=MACD(26,12,9);RSI(14);SlowSTO(8,3,3);&Layout=2Line;Default;Price;HisDate&XCycle=&XFormat=) -

-

I bought some under the offer price 34.25p

Time to pounce at the stock if there is money for it, at this point the retracement is done.

mentor - 06 Oct 2016 11:15 - 734 of 976

34.375p +0.375p

China on the market for potash?........

South China Morning Post - 06 October, 2016 Business/Commodities

Low potash stocks could push China into buying early supplies in fertilizer market

Dwindling inventories of the crop nutrient potash held by Chinese buyers could lead to an earlier 2017 sales contract with Canpotex Ltd, the offshore sales arm for Canadian mines operated by Potash Corp of Saskatchewan, Mosaic Co and Agrium Inc , the chief executive of Canpotex said.

Low potash stocks could push China into buying early supplies in fertilizer market

China on the market for potash?........

South China Morning Post - 06 October, 2016 Business/Commodities

Low potash stocks could push China into buying early supplies in fertilizer market

Dwindling inventories of the crop nutrient potash held by Chinese buyers could lead to an earlier 2017 sales contract with Canpotex Ltd, the offshore sales arm for Canadian mines operated by Potash Corp of Saskatchewan, Mosaic Co and Agrium Inc , the chief executive of Canpotex said.

Low potash stocks could push China into buying early supplies in fertilizer market

mentor - 06 Oct 2016 16:42 - 735 of 976

A late rally got the stock up to 35.50p +1.50p

Closing with a 35p UT

Closing with a 35p UT

mentor - 20 Oct 2016 11:27 - 736 of 976

35.50p +2p

is moving out of the side ways with volume picking up a sign of further movement up on the next days, possible with news.

Volume the same as yesterday after 3 hours of trading

is moving out of the side ways with volume picking up a sign of further movement up on the next days, possible with news.

Volume the same as yesterday after 3 hours of trading

HARRYCAT

- 25 Oct 2016 08:35

- 737 of 976

- 25 Oct 2016 08:35

- 737 of 976

StockMarketWire.com

Sirius Minerals has entered into a royalty financing agreement for its North Yorkshire polyhalite project with Hancock British Holdings, a subsidiary of Hancock Prospecting Pty.

Under the agreement, Hancock has agreed to: purchase a royalty on the Project of 5% gross revenue on the first 13 million tonnes per annum (mtpa) of sales produced in each calendar year and 1 per cent for sales volumes above 13 mtpa in return for $250m.

It had also agreed that upon drawdown of the Royalty purchase amount, Hancock would subscribe for new ordinary shares in the Company in an amount of $50m, subject to certain conditions.

"The structure of the Royalty Financing Agreement is similar to that of the arrangements with mineral rights holders and runs for the life of the Project or 70 years, whichever is longer," said Sirius in a statement.

"The funding obligations of Hancock under the Royalty Financing Agreement are guaranteed by Hancock Prospecting Pty Ltd.

"The Royalty Financing Agreement is conditional upon the Company completing its Stage 1 financing (taking into consideration amounts received under the Royalty Financing Agreement) and two confirmatory due diligence items which will be satisfied prior to the Stage 1 financing being finalised.

"Once completed, drawdown of funds under the Royalty Financing Agreement is conditional on, inter alia, notice having been given to Hancock that the Company has expended $630 million of the total amount of its stage 1 financing; creation of the royalty interest including the granting of certain obligations and arrangements to secure such obligations in favour of Hancock, to ensure that the Royalty attaches to certain assets which comprise the Project; all material permits, commercial arrangements and authorisations for the Project remaining in place; and other drawdown conditions typical for an agreement of this nature."

Sirius Minerals has entered into a royalty financing agreement for its North Yorkshire polyhalite project with Hancock British Holdings, a subsidiary of Hancock Prospecting Pty.

Under the agreement, Hancock has agreed to: purchase a royalty on the Project of 5% gross revenue on the first 13 million tonnes per annum (mtpa) of sales produced in each calendar year and 1 per cent for sales volumes above 13 mtpa in return for $250m.

It had also agreed that upon drawdown of the Royalty purchase amount, Hancock would subscribe for new ordinary shares in the Company in an amount of $50m, subject to certain conditions.

"The structure of the Royalty Financing Agreement is similar to that of the arrangements with mineral rights holders and runs for the life of the Project or 70 years, whichever is longer," said Sirius in a statement.

"The funding obligations of Hancock under the Royalty Financing Agreement are guaranteed by Hancock Prospecting Pty Ltd.

"The Royalty Financing Agreement is conditional upon the Company completing its Stage 1 financing (taking into consideration amounts received under the Royalty Financing Agreement) and two confirmatory due diligence items which will be satisfied prior to the Stage 1 financing being finalised.

"Once completed, drawdown of funds under the Royalty Financing Agreement is conditional on, inter alia, notice having been given to Hancock that the Company has expended $630 million of the total amount of its stage 1 financing; creation of the royalty interest including the granting of certain obligations and arrangements to secure such obligations in favour of Hancock, to ensure that the Royalty attaches to certain assets which comprise the Project; all material permits, commercial arrangements and authorisations for the Project remaining in place; and other drawdown conditions typical for an agreement of this nature."

mentor - 25 Oct 2016 10:18 - 738 of 976

35.50p +1.25p

Nice agreement and confidence on the company ( Australian mining billionaire Gina Rinehart's company to become an investor in and backer of fertiliser company).

Expect lots of positives views from the press on benefits to UK economy that the Government is trying to encourage ...............

Proactive Investor - -07:23 25 Oct 2016

Sirius Minerals strikes US$300mln deal with Gina Rinehart company

The pact with a subsidiary Gina Rhinehart’s Hancock Prospecting will form an important plank of the overall funding package for the AIM-listed group’s North Yorkshire Polyhalite Project.

Sirius Minerals PLC has signed a financing deal worth up to US$300mln with the company controlled by one of the world’s richest woman.

The pact with a subsidiary Gina Rhinehart’s Hancock Prospecting will form an important plank of the overall funding package for the AIM-listed group’s North Yorkshire Polyhalite Project.

Under the terms of the agreement, Hancock British Holdings is acquiring a 5% royalty on the first 13mln tonnes of fertiliser produced every year and 1% on anything over that output figure at a cost of US$250mln.

Hancock has also agreed to acquire US$50mln-worth of Sirius shares.

Hancock deal values Sirius Minerals Yorkshire project at US$3.9bn

Sirius Minerals seen as compelling for responsible investment

Time to be serious about Sirius?

The deal is subject to a number of conditions, the main one being Sirius must secure Stage-One funding for the mine, sited near Scarborough in Yorkshire, which is put at just over US$1.6bn.

The company said it is making good progress in this regard.

Chief executive Chris Fraser told investors: "We are delighted to have signed this agreement with such an experienced party in the mining industry, as well as one that has very successful and strong leadership and a long term and growing agricultural interest."

Hancock Prospecting owns the rights to large tracts of the Pilbara in Western Australia, the world’s largest iron ore deposit.

Rinehart, who is Australia’s richest person and owns almost 77% of the private company, took over it over from her late father and the firm’s founder, legendary prospector entrepreneur Lang Hancock.

Gina Rinehart with Indian Prime Minister Narendra Modi (left).

Nice agreement and confidence on the company ( Australian mining billionaire Gina Rinehart's company to become an investor in and backer of fertiliser company).

Expect lots of positives views from the press on benefits to UK economy that the Government is trying to encourage ...............

Proactive Investor - -07:23 25 Oct 2016

Sirius Minerals strikes US$300mln deal with Gina Rinehart company

The pact with a subsidiary Gina Rhinehart’s Hancock Prospecting will form an important plank of the overall funding package for the AIM-listed group’s North Yorkshire Polyhalite Project.

Sirius Minerals PLC has signed a financing deal worth up to US$300mln with the company controlled by one of the world’s richest woman.

The pact with a subsidiary Gina Rhinehart’s Hancock Prospecting will form an important plank of the overall funding package for the AIM-listed group’s North Yorkshire Polyhalite Project.

Under the terms of the agreement, Hancock British Holdings is acquiring a 5% royalty on the first 13mln tonnes of fertiliser produced every year and 1% on anything over that output figure at a cost of US$250mln.

Hancock has also agreed to acquire US$50mln-worth of Sirius shares.

Hancock deal values Sirius Minerals Yorkshire project at US$3.9bn

Sirius Minerals seen as compelling for responsible investment

Time to be serious about Sirius?

The deal is subject to a number of conditions, the main one being Sirius must secure Stage-One funding for the mine, sited near Scarborough in Yorkshire, which is put at just over US$1.6bn.

The company said it is making good progress in this regard.

Chief executive Chris Fraser told investors: "We are delighted to have signed this agreement with such an experienced party in the mining industry, as well as one that has very successful and strong leadership and a long term and growing agricultural interest."

Hancock Prospecting owns the rights to large tracts of the Pilbara in Western Australia, the world’s largest iron ore deposit.

Rinehart, who is Australia’s richest person and owns almost 77% of the private company, took over it over from her late father and the firm’s founder, legendary prospector entrepreneur Lang Hancock.

Gina Rinehart with Indian Prime Minister Narendra Modi (left).

HARRYCAT

- 25 Oct 2016 12:53

- 739 of 976

- 25 Oct 2016 12:53

- 739 of 976

Shore Capital note today (last para is the important bit!):

"Sirius is developing the paradigm-shifting North Yorkshire polyhalite project (henceforth, ‘the project’) in England. The company has devised a two-stage construction financing plan, and the first pieces of Stage 1 have fallen into place today. Australian billionaire Gina Rinehart’s Hancock Prospecting has agreed to provide US$300m of the US$1.09bn Stage 1 requirement, comprising US$250m in royalty financing and US$50m in equity funding. We see this as a resounding endorsement of the project, given that Hancock (as Sirius puts it) is “such an experienced party in the mining industry and also one with a strong agricultural interest”.

· Equity investment would be concurrent with royalty drawdown: Hancock’s US$50m equity investment would occur concurrently with drawdown by Sirius of funds from the royalty financing. We understand from Sirius that the issue price will be determined following further progress with remainder of the Stage 1 financing package.

· Royalty equivalent to 3.6% on 20Mtpa: In return for providing US$250m, Hancock is to receive 5% of the gross revenue on the first 13Mtpa of sales for each calendar year, and 1% for any volumes above 13Mtpa (effectively, 3.6% on 20Mtpa at steady-state production). This will continue for the longer of the life of the project or 70 years. The royalty financing agreement is conditional upon completion of Stage 1 financing, and two confirmatory due diligence items that will be satisfied prior to the ‘remainder’ of the Stage 1 equity and structured capital raises being finalised.

· Confidence in production profile implied: The Hancock funds will become available once Sirius has expended US$630m of the total amount of the Stage 1 financing (the total includes the Hancock funds). The royalty returns an IRR (yield) of c.19-21% (depending on exact timing of drawdown) on our 20Mtpa 50-year ‘base case’. With 20% typically targeted by mining investors, this implies confidence in the production profile’s achievability, we believe.

· Good progress on two-stage financing plan: According to Sirius, “good progress” continues to be made on its two-stage financing plan. Details of (the remainder of) the Stage 1 capital structure and timing will be subject to further announcement “at an appropriate time.

We continue to anticipate the conclusion of Stage 1 financing during the autumn of 2016. If all goes to plan, there would be no further need to raise equity thereafter, dilution would cease to be a concern, and we believe the resulting improved clarity on potential equity returns could trigger a significant re-rating. While Sirius is currently at development stage and still some years from becoming a cash flow-generating company, an investment in Sirius will become progressively de-risked and should enjoy significant value uplift as it advances towards production, we believe. Our latest Risked NPV estimate is 70p/share post-Stage 1 financing (previously: 75p/share); we reiterate our BUY recommendation."

"Sirius is developing the paradigm-shifting North Yorkshire polyhalite project (henceforth, ‘the project’) in England. The company has devised a two-stage construction financing plan, and the first pieces of Stage 1 have fallen into place today. Australian billionaire Gina Rinehart’s Hancock Prospecting has agreed to provide US$300m of the US$1.09bn Stage 1 requirement, comprising US$250m in royalty financing and US$50m in equity funding. We see this as a resounding endorsement of the project, given that Hancock (as Sirius puts it) is “such an experienced party in the mining industry and also one with a strong agricultural interest”.

· Equity investment would be concurrent with royalty drawdown: Hancock’s US$50m equity investment would occur concurrently with drawdown by Sirius of funds from the royalty financing. We understand from Sirius that the issue price will be determined following further progress with remainder of the Stage 1 financing package.

· Royalty equivalent to 3.6% on 20Mtpa: In return for providing US$250m, Hancock is to receive 5% of the gross revenue on the first 13Mtpa of sales for each calendar year, and 1% for any volumes above 13Mtpa (effectively, 3.6% on 20Mtpa at steady-state production). This will continue for the longer of the life of the project or 70 years. The royalty financing agreement is conditional upon completion of Stage 1 financing, and two confirmatory due diligence items that will be satisfied prior to the ‘remainder’ of the Stage 1 equity and structured capital raises being finalised.

· Confidence in production profile implied: The Hancock funds will become available once Sirius has expended US$630m of the total amount of the Stage 1 financing (the total includes the Hancock funds). The royalty returns an IRR (yield) of c.19-21% (depending on exact timing of drawdown) on our 20Mtpa 50-year ‘base case’. With 20% typically targeted by mining investors, this implies confidence in the production profile’s achievability, we believe.

· Good progress on two-stage financing plan: According to Sirius, “good progress” continues to be made on its two-stage financing plan. Details of (the remainder of) the Stage 1 capital structure and timing will be subject to further announcement “at an appropriate time.

We continue to anticipate the conclusion of Stage 1 financing during the autumn of 2016. If all goes to plan, there would be no further need to raise equity thereafter, dilution would cease to be a concern, and we believe the resulting improved clarity on potential equity returns could trigger a significant re-rating. While Sirius is currently at development stage and still some years from becoming a cash flow-generating company, an investment in Sirius will become progressively de-risked and should enjoy significant value uplift as it advances towards production, we believe. Our latest Risked NPV estimate is 70p/share post-Stage 1 financing (previously: 75p/share); we reiterate our BUY recommendation."

HARRYCAT

- 25 Oct 2016 12:57

- 740 of 976

- 25 Oct 2016 12:57

- 740 of 976

Liberum Capital today reaffirms its buy investment rating on Sirius Minerals PLC (LON:SXX) and set its price target at 50p.

mentor - 25 Oct 2016 23:08 - 741 of 976

.png)

mentor - 25 Oct 2016 23:10 - 742 of 976

Australia's richest woman backs Sirius Minerals - By Lee Wild | Tue, 25th October 2016 - 11:37

Australia's richest woman backs Sirius Minerals In a major coup for Sirius Minerals (SXX), Australia's richest woman has just backed the AIM-listed firm's North Yorkshire potash mine. Gina Rinehart's Hancock Prospecting Group (HPPL) will pay Sirius US$250 million (£204 million) in cash and acquire $50million of Sirius shares to secure access to the company's high-quality agricultural fertilizer.

As part of what is Sirius's first royalty financing agreement, privately-owned Hancock will receive a 5% royalty stream on revenue from the first 13 million tonnes per annum (Mtpa) of sales every calendar year, and 1% for volumes above that.

Hancock, headed by Rinehart since her father and company founder Lang Hancock died in 1992, also gets the right to buy up to 20,000 tonnes of product every year for use on its Australian agricultural operations.

Sirius is rightly chuffed with the deal, which is part of managing director and CEO Chris Fraser's plan, flagged back in March, and again last month.

"Considering Mrs Rinehart's and Hancock's expertise in each of mining and agriculture, this investment is a significant vote of confidence in not only our project, but also our product," said Fraser.

Of course, the big money which will bankroll the project is yet to appear, although we're told that Sirius continue to make "good progress" on its two-stage approach to financing. We'll get more on the Stage One capital structure and timing "at an appropriate time".

"On our numbers, with full production of 13Mt/a of Polyhalite and a forecast sales price of $150 per tonne (WH Ireland est), this equates to $98 million/year," says WH Ireland analyst Paul Smith, who repeats his 'buy' rating and 60p price target for Sirius.

"The effect of this would be to reduce our EBITDA at the mine of ~$1,500 million by $98 million. The mine has a large operating cash margin with operating costs of only $30/t and Sirius has always guided that a royalty sale was a potential source of some mine finance".

The royalty deal is still conditional upon Sirius completing its Stage 1 financing and two confirmatory due diligence items which will be satisfied prior to the Stage 1 financing being finalised.

Then, drawdown of funds under the agreement is conditional on, among a long list of other criteria, Sirius informing Hancock that it has spent US$630 million of its Stage 1 financing.

"This project delivers a new and natural product which is relevant to Hancock’s focus on agriculture and after years of field tests and across many crop types, demonstrated improved yields," says Rinehart. "Sirius has a large, high quality mineral resource and is located in a stable jurisdiction with a competitive tax rate."

"Through the North Yorkshire Polyhalite project, Sirius Minerals is focused on the development of what we believe to be the world’s largest high-grade known polyhalite deposit and our patented multi-nutrient fertilizer product."

Australia's richest woman backs Sirius Minerals In a major coup for Sirius Minerals (SXX), Australia's richest woman has just backed the AIM-listed firm's North Yorkshire potash mine. Gina Rinehart's Hancock Prospecting Group (HPPL) will pay Sirius US$250 million (£204 million) in cash and acquire $50million of Sirius shares to secure access to the company's high-quality agricultural fertilizer.

As part of what is Sirius's first royalty financing agreement, privately-owned Hancock will receive a 5% royalty stream on revenue from the first 13 million tonnes per annum (Mtpa) of sales every calendar year, and 1% for volumes above that.

Hancock, headed by Rinehart since her father and company founder Lang Hancock died in 1992, also gets the right to buy up to 20,000 tonnes of product every year for use on its Australian agricultural operations.

Sirius is rightly chuffed with the deal, which is part of managing director and CEO Chris Fraser's plan, flagged back in March, and again last month.

"Considering Mrs Rinehart's and Hancock's expertise in each of mining and agriculture, this investment is a significant vote of confidence in not only our project, but also our product," said Fraser.

Of course, the big money which will bankroll the project is yet to appear, although we're told that Sirius continue to make "good progress" on its two-stage approach to financing. We'll get more on the Stage One capital structure and timing "at an appropriate time".

"On our numbers, with full production of 13Mt/a of Polyhalite and a forecast sales price of $150 per tonne (WH Ireland est), this equates to $98 million/year," says WH Ireland analyst Paul Smith, who repeats his 'buy' rating and 60p price target for Sirius.

"The effect of this would be to reduce our EBITDA at the mine of ~$1,500 million by $98 million. The mine has a large operating cash margin with operating costs of only $30/t and Sirius has always guided that a royalty sale was a potential source of some mine finance".

The royalty deal is still conditional upon Sirius completing its Stage 1 financing and two confirmatory due diligence items which will be satisfied prior to the Stage 1 financing being finalised.

Then, drawdown of funds under the agreement is conditional on, among a long list of other criteria, Sirius informing Hancock that it has spent US$630 million of its Stage 1 financing.

"This project delivers a new and natural product which is relevant to Hancock’s focus on agriculture and after years of field tests and across many crop types, demonstrated improved yields," says Rinehart. "Sirius has a large, high quality mineral resource and is located in a stable jurisdiction with a competitive tax rate."

"Through the North Yorkshire Polyhalite project, Sirius Minerals is focused on the development of what we believe to be the world’s largest high-grade known polyhalite deposit and our patented multi-nutrient fertilizer product."

mentor - 26 Oct 2016 10:36 - 743 of 976

38.50p +3p

By SARAH MEDDINGS CITY CORRESPONDENT FOR THE DAILY MAIL, 26 October 2016

Australian tycoon pours £250m into UK mine: Country's richest woman backs dig for fertiliser in the North Yorkshire Moors

The North York Polyhalite Project will dig for fertiliser a MILE down

One of the UK’s most ambitious mining projects for decades has secured nearly £250million of investment from Australia’s richest woman.

The North York Polyhalite Project to dig for fertiliser a mile below the North York Moors National Park has been given backing from mining tycoon Gina Rinehart.

Sirius Minerals, the company behind the scheme, revealed yesterday that Mrs Rinehart has agreed to pour £247million into the mine, which is thought to contain 2.2billion tonnes of a specialist mineral used in fertiliser............

Australian tycoon pours £250m into UK mine SXX

By SARAH MEDDINGS CITY CORRESPONDENT FOR THE DAILY MAIL, 26 October 2016

Australian tycoon pours £250m into UK mine: Country's richest woman backs dig for fertiliser in the North Yorkshire Moors

The North York Polyhalite Project will dig for fertiliser a MILE down

One of the UK’s most ambitious mining projects for decades has secured nearly £250million of investment from Australia’s richest woman.

The North York Polyhalite Project to dig for fertiliser a mile below the North York Moors National Park has been given backing from mining tycoon Gina Rinehart.

Sirius Minerals, the company behind the scheme, revealed yesterday that Mrs Rinehart has agreed to pour £247million into the mine, which is thought to contain 2.2billion tonnes of a specialist mineral used in fertiliser............

Australian tycoon pours £250m into UK mine SXX

mentor - 26 Oct 2016 15:28 - 744 of 976

Has moved upon early demand after various comments and then profit taking has started to take place and now holding around the 39.25.

mentor - 27 Oct 2016 22:41 - 745 of 976

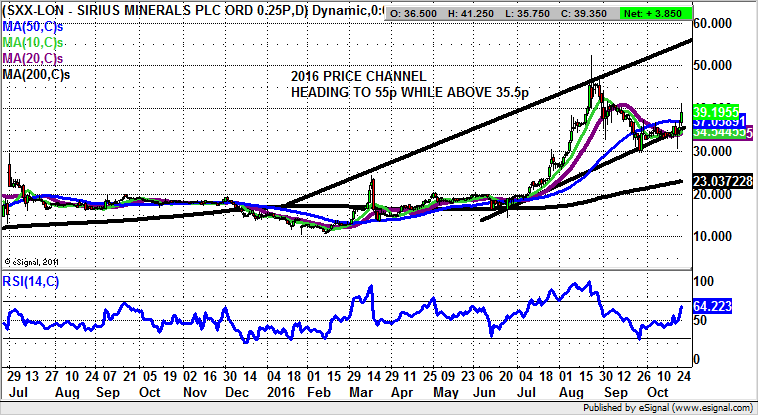

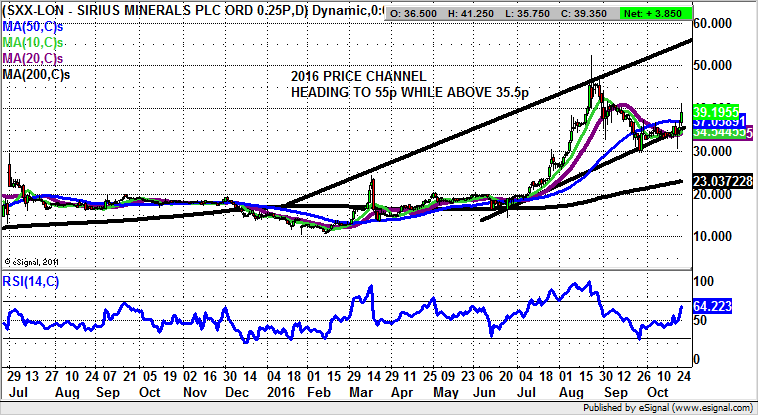

Sirius Minerals: Technicals target 55p post Rinehart intervention - By Zak Mir - 26 October 2016

Sirius Minerals: Technicals target 55p post Rinehart intervention

It has certainly been a long journey for fans of the would-be Yorkshire Potash miner Sirius Minerals. As most of us are aware, it is usually the case that for mining companies the key is less about the digging, and more about the funding. This is of course, whether or not there is actually anything under the ground.

But at least it would appear that things are starting to take shape in a reasonably positive way. Indeed, this comment could be regarded as something of an understatement given the announcement of the intervention of one of the world’s richest women. Gina Rinehart’s Hancock Prospecting is set to back the Sirius Project, now valued at up to $4bn, to the tune of $300m.

The intervention is probably the reason the shares have gone back on the front foot over the past 24 hours, with the technical breakthrough being the push back above the 50 day moving average, currently at 37.05p. The message at the moment is that provided there is no decline back below the floor of a rising trend channel from the beginning of the year at 35.5p, one would be looking to a technical target here as high as the January resistance line projection at 55p over the next 1-2 months. In the meantime, any dips towards the floor of this year’s channel can be regarded as buying opportunities.

Sirius Minerals: Technicals target 55p post Rinehart intervention

It has certainly been a long journey for fans of the would-be Yorkshire Potash miner Sirius Minerals. As most of us are aware, it is usually the case that for mining companies the key is less about the digging, and more about the funding. This is of course, whether or not there is actually anything under the ground.

But at least it would appear that things are starting to take shape in a reasonably positive way. Indeed, this comment could be regarded as something of an understatement given the announcement of the intervention of one of the world’s richest women. Gina Rinehart’s Hancock Prospecting is set to back the Sirius Project, now valued at up to $4bn, to the tune of $300m.

The intervention is probably the reason the shares have gone back on the front foot over the past 24 hours, with the technical breakthrough being the push back above the 50 day moving average, currently at 37.05p. The message at the moment is that provided there is no decline back below the floor of a rising trend channel from the beginning of the year at 35.5p, one would be looking to a technical target here as high as the January resistance line projection at 55p over the next 1-2 months. In the meantime, any dips towards the floor of this year’s channel can be regarded as buying opportunities.

mentor - 31 Oct 2016 10:31 - 746 of 976

Close position earlier 38.375p

31 Oct '16 - 08:40 - 13 of 13

SXX 38.50p -1p

Profit taking since last Friday, after not able to go higher on the Intraday of the day before, Indicators have reached also overbought

&IND=MACD(26,12,9);RSI(14);SlowSTO(14,3,3)&Layout=2Line;Default;Price;HisDate&XCycle=&XFormat=)

31 Oct '16 - 08:40 - 13 of 13

SXX 38.50p -1p

Profit taking since last Friday, after not able to go higher on the Intraday of the day before, Indicators have reached also overbought