| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The Forex Thread (FX)

hilary

- 31 Dec 2003 13:00

- 31 Dec 2003 13:00

| Your browser does not support JavaScript! | Your browser does not support JavaScript! |

| Your browser does not support inline frames or is currently configured not to display inline frames. |

Harlosh

- 07 Mar 2007 15:26

- 7628 of 11056

- 07 Mar 2007 15:26

- 7628 of 11056

Afternoon - short bout of illness (again) has kept me away for a couple of days.

Now long Cable 9497

And congratulations to Miss Mel, Mel :-))

Now long Cable 9497

And congratulations to Miss Mel, Mel :-))

mg

- 07 Mar 2007 15:37

- 7629 of 11056

- 07 Mar 2007 15:37

- 7629 of 11056

Maybe I ought to place more "boredom" trades. Looks like USD/JPY is beginning to show a bit of spunk 8-D

Ooops, where's my manners - hope you're feeling better Harlosh.

Ooops, where's my manners - hope you're feeling better Harlosh.

Melnibone - 07 Mar 2007 15:47 - 7630 of 11056

Cheers Chocco and Harlosh.

Glad you're better Harlosh.

Your trade's looking good Mg. Are you trying out Dil's coin tossing strategy

with this 'boredom' trade. ;-)

If so, I assume you'll be raising your stop to lock in a profit to keep the money

management part of Dil's strategy on track.

Glad you're better Harlosh.

Your trade's looking good Mg. Are you trying out Dil's coin tossing strategy

with this 'boredom' trade. ;-)

If so, I assume you'll be raising your stop to lock in a profit to keep the money

management part of Dil's strategy on track.

Harlosh

- 07 Mar 2007 16:02

- 7631 of 11056

- 07 Mar 2007 16:02

- 7631 of 11056

Thanks chaps but I have them so often you'll soon get fed up of sympathising with me :-))

mg

- 07 Mar 2007 18:04

- 7632 of 11056

- 07 Mar 2007 18:04

- 7632 of 11056

Picked up my third lot on that drop - now fully loaded so it had better start trending the right way. Stops for all of 'em @ 600.

chocolat

- 08 Mar 2007 00:48

- 7633 of 11056

- 08 Mar 2007 00:48

- 7633 of 11056

Smokin', meggers :(

Bummer.

Pretty sure, though, that quite a few of your trades have been good for 50 points apiece. That's the way this baby moves.

Highly likely the furtling will carry on perhaps at least until options expiries, beginning 15th and ending with the quarterlies, on 30th. I still reckon (hope) that it won't fall too much below 114 if it doesn't find its bearings soon.

Bummer.

Pretty sure, though, that quite a few of your trades have been good for 50 points apiece. That's the way this baby moves.

Highly likely the furtling will carry on perhaps at least until options expiries, beginning 15th and ending with the quarterlies, on 30th. I still reckon (hope) that it won't fall too much below 114 if it doesn't find its bearings soon.

Harlosh

- 08 Mar 2007 00:59

- 7634 of 11056

- 08 Mar 2007 00:59

- 7634 of 11056

Hmmm. Didn't like the look of it myself.

Hope it ain't too bad mg.

Hope it ain't too bad mg.

mg

- 08 Mar 2007 06:40

- 7635 of 11056

- 08 Mar 2007 06:40

- 7635 of 11056

Doncha just f@@ing hate it when that happens. Stops triggered as per good management and then it flies away in the right direction after kicking you in the wotsits.

Net loss of 75 points :(

Net loss of 75 points :(

Harlosh

- 08 Mar 2007 07:58

- 7636 of 11056

- 08 Mar 2007 07:58

- 7636 of 11056

Sorry mg - great recovery overnight too :-(

Still long Cable here.

Still long Cable here.

MightyMicro

- 08 Mar 2007 10:59

- 7637 of 11056

- 08 Mar 2007 10:59

- 7637 of 11056

furtling -- another one for the FX lexicon.

Harlosh

- 08 Mar 2007 11:36

- 7638 of 11056

- 08 Mar 2007 11:36

- 7638 of 11056

Out of my long now and looking to short if the BOE keep rates on hold.

Harlosh

- 08 Mar 2007 12:08

- 7639 of 11056

- 08 Mar 2007 12:08

- 7639 of 11056

Short from 330

mg

- 08 Mar 2007 13:04

- 7640 of 11056

- 08 Mar 2007 13:04

- 7640 of 11056

Great entry H - I'm still sulking - no positions - but did fancy shorting cable on BOE news - but didn't if you know what I mean :(

Harlosh

- 08 Mar 2007 17:01

- 7641 of 11056

- 08 Mar 2007 17:01

- 7641 of 11056

Thanks mg though stopped out in the end for +30.

And I know how you feel - had plenty of days sulking myself!

I'm thinking we will see Cable fall at some stage to unwind the shorter term stochs after which we should see some upside (and hopefully some movement).

And I know how you feel - had plenty of days sulking myself!

I'm thinking we will see Cable fall at some stage to unwind the shorter term stochs after which we should see some upside (and hopefully some movement).

Harlosh

- 09 Mar 2007 14:40

- 7642 of 11056

- 09 Mar 2007 14:40

- 7642 of 11056

Well I'm +92 so far on my first $/Yen trade - currently long :-))

Melnibone - 11 Mar 2007 18:28 - 7643 of 11056

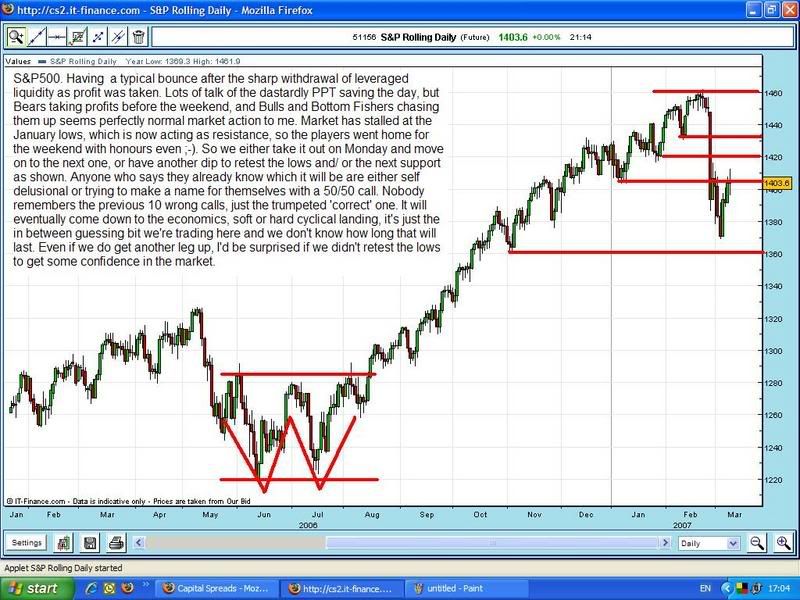

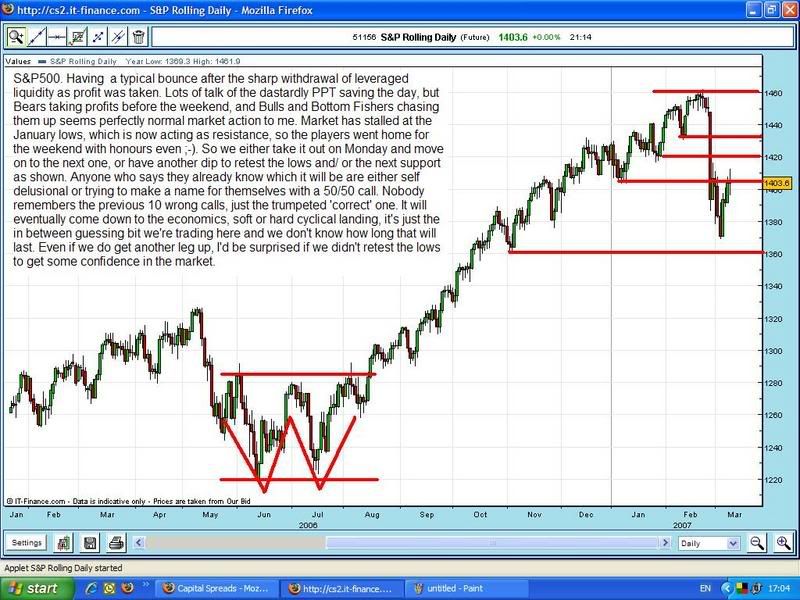

Evening. Stuck some charts together, with some comments to show what

I'm looking at and thinking about at the moment.

Just had transfer a few more K to Miss Mel's account. Apparently you have

to pay 500 up front in fees for your finance exams. They know how to

bleedin' charge, don't they?

And the rest is for yet more power dressing trouser suits.

" But dad, they're de rigueur for young ladies who are something in the city!"

What do they make the bleedin' things out of these days? Spun Gold?

Think I'm getting conned a bit here, as usual :-)

Talk about wrapped around her little finger. Daughters and their dads, eh. :-)

I'm looking at and thinking about at the moment.

Just had transfer a few more K to Miss Mel's account. Apparently you have

to pay 500 up front in fees for your finance exams. They know how to

bleedin' charge, don't they?

And the rest is for yet more power dressing trouser suits.

" But dad, they're de rigueur for young ladies who are something in the city!"

What do they make the bleedin' things out of these days? Spun Gold?

Think I'm getting conned a bit here, as usual :-)

Talk about wrapped around her little finger. Daughters and their dads, eh. :-)

Melnibone - 11 Mar 2007 22:14 - 7644 of 11056

Just a bit of musing, so make your own mind up and look for correlation

in other asset classes.

I've put on the 3 ma's you guys seem to like on your Hourly charts, even

though this is a Daily chart. Not sure if you use them outside the Hourly

charts.

If you do, they give a different view on this one as opposed to the shorter

term charts.

in other asset classes.

I've put on the 3 ma's you guys seem to like on your Hourly charts, even

though this is a Daily chart. Not sure if you use them outside the Hourly

charts.

If you do, they give a different view on this one as opposed to the shorter

term charts.

hodgins

- 11 Mar 2007 23:03

- 7645 of 11056

- 11 Mar 2007 23:03

- 7645 of 11056

Swiss National bank interest rate decision, and they only do it quarterly, this week.Upward revision expected, priced in-maybe not?

As secondary beneficiary of carry trade, upward revision and implied loss of liquidity may have more impact on other crosses (yen) than generally anticipated.

As secondary beneficiary of carry trade, upward revision and implied loss of liquidity may have more impact on other crosses (yen) than generally anticipated.

ptholden

- 12 Mar 2007 09:33

- 7646 of 11056

- 12 Mar 2007 09:33

- 7646 of 11056

First post for many months, but back into the fray once more. Left a sell order at 11820 ($/Yen) last night, jumped the 2 hourly MACD a little early, but hoping it will fall through 18200.

Baks - congratulations on your recent addition :)

pth

Baks - congratulations on your recent addition :)

pth

MightyMicro

- 12 Mar 2007 11:44

- 7647 of 11056

- 12 Mar 2007 11:44

- 7647 of 11056

Forexers, The Economic Data Release Calendar is not all it should be. Our source is DailyFX and, unfortunately, they have screwed up the formatting and even the spelling of the title. I have downloaded the Excel spreadsheet, fixed the spelling(!) and constructed a couple of gifs, but they are cut off in their prime for some reason. I'll try and sort it out later.