| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

THE TALK TO YOURSELF THREAD. (NOWT)

goldfinger

- 09 Jun 2005 12:25

- 09 Jun 2005 12:25

Thought Id start this one going because its rather dead on this board at the moment and I suppose all my usual muckers are either at the Stella tennis event watching Dim Tim (lose again) or at Henly Regatta eating cucumber sandwiches (they wish,...NOT).

Anyway please feel free to just talk to yourself blast away and let it go on any company or subject you wish. Just wish Id thought of this one before.

cheers GF.

Anyway please feel free to just talk to yourself blast away and let it go on any company or subject you wish. Just wish Id thought of this one before.

cheers GF.

MaxK - 31 Oct 2017 20:14 - 79355 of 81564

Quality article EL, real class.

ExecLine

- 01 Nov 2017 09:20

- 79356 of 81564

- 01 Nov 2017 09:20

- 79356 of 81564

We all know the British government chucks foreign aid away like confetti.

Jacob Rees-Mogg is trying to get the law changed, which stipulates we have to spend 0.7% of GDP every financial year on FA. This currently equates to around £13 BN or so. He reckons its not only wasteful and inefficient but he also reminds us, that amongst many silly things about what we are doing, we don't even have the GDP figures and so have to take a guess at it. He feels there are much better ways to do things and he wants to do something different with it:

In the first instance you can sign the petition at the Daily Express which he is supporting:

http://www.express.co.uk/news/uk/873658/wasteful-Jacob-Rees-Mogg-blasts-Cameron-Osborne-s-foreign-aid

Jacob Rees-Mogg is trying to get the law changed, which stipulates we have to spend 0.7% of GDP every financial year on FA. This currently equates to around £13 BN or so. He reckons its not only wasteful and inefficient but he also reminds us, that amongst many silly things about what we are doing, we don't even have the GDP figures and so have to take a guess at it. He feels there are much better ways to do things and he wants to do something different with it:

In the first instance you can sign the petition at the Daily Express which he is supporting:

http://www.express.co.uk/news/uk/873658/wasteful-Jacob-Rees-Mogg-blasts-Cameron-Osborne-s-foreign-aid

Stan

- 01 Nov 2017 09:37

- 79357 of 81564

- 01 Nov 2017 09:37

- 79357 of 81564

The DE? oh really... how very downmarket EL.

ExecLine

- 01 Nov 2017 10:48

- 79358 of 81564

- 01 Nov 2017 10:48

- 79358 of 81564

Here's one of the nicest clips I've seen in quite a while:

https://www.youtube.com/watch?v=L2zbq0QFFUk

https://www.youtube.com/watch?v=L2zbq0QFFUk

ExecLine

- 01 Nov 2017 10:53

- 79359 of 81564

- 01 Nov 2017 10:53

- 79359 of 81564

And if you like a beautiful voice and a beautiful body too, then try this:

https://www.youtube.com/watch?v=21CeGVuEV1c

https://www.youtube.com/watch?v=21CeGVuEV1c

MaxK - 01 Nov 2017 10:57 - 79360 of 81564

h/t to leeds across the road for this graph.

Should cheer up the doomsters no end :-)

Should cheer up the doomsters no end :-)

Fred1new

- 01 Nov 2017 16:26

- 79361 of 81564

- 01 Nov 2017 16:26

- 79361 of 81564

Karl,

Interesting, but have a look at:

Begbies Traynor flags big rise in distress

StockMarketWire.com

Nearly half a million businesses across the UK are in a state of 'significant' financial distress, even before the effects of a potential interest rate hike are felt, according to Begbies Traynor's latest Red Flag research.

The research showed that 448,011 businesses were experiencing 'significant' levels of financial distress at the end of the third quarter, up 27% on a year ago.

It said almost 250,000 of these companies (Q3 2107: 248,619) ended the period with negative net worth, representing a sizeable population of so called "zombie" companies that had managed to survive thanks to the prolonged low interest rate environment and flexible labour market, but which did not have adequate working capital to fund any growth or absorb rising input prices.

Begbies Traynor warned that with the prospect of an interest rate rise alongside increasing employment costs, due to changes in the minimum wage combined with HMRC's crackdown on personal service companies (often set up to avoid employers' national insurance), many of these struggling companies would not have the reserves available to survive.

The research also showed that 'significant' financial distress rose across every sector and region of the UK over the past year, with the professional and financial services sectors being worst affected, increasing 42% to 26,113 and 34% to 11,079 struggling businesses respectively.

http://www.moneyam.com/action/news/showArticle?id=5725858

Interesting, but have a look at:

Begbies Traynor flags big rise in distress

StockMarketWire.com

Nearly half a million businesses across the UK are in a state of 'significant' financial distress, even before the effects of a potential interest rate hike are felt, according to Begbies Traynor's latest Red Flag research.

The research showed that 448,011 businesses were experiencing 'significant' levels of financial distress at the end of the third quarter, up 27% on a year ago.

It said almost 250,000 of these companies (Q3 2107: 248,619) ended the period with negative net worth, representing a sizeable population of so called "zombie" companies that had managed to survive thanks to the prolonged low interest rate environment and flexible labour market, but which did not have adequate working capital to fund any growth or absorb rising input prices.

Begbies Traynor warned that with the prospect of an interest rate rise alongside increasing employment costs, due to changes in the minimum wage combined with HMRC's crackdown on personal service companies (often set up to avoid employers' national insurance), many of these struggling companies would not have the reserves available to survive.

The research also showed that 'significant' financial distress rose across every sector and region of the UK over the past year, with the professional and financial services sectors being worst affected, increasing 42% to 26,113 and 34% to 11,079 struggling businesses respectively.

http://www.moneyam.com/action/news/showArticle?id=5725858

2517GEORGE

- 01 Nov 2017 16:44

- 79362 of 81564

- 01 Nov 2017 16:44

- 79362 of 81564

From post 79361

''It said almost 250,000 of these companies (Q3 2107: 248,619) ended the period with negative net worth, representing a sizeable population of so called "zombie" companies that had managed to survive thanks to the prolonged low interest rate environment and flexible labour market, but which did not have adequate working capital to fund any growth or absorb rising input prices''.

Sad though it is for so many employers and employees it is a fact of business life, many will fail for various reasons, many of these ''zombie'' companies would have gone to the wall years ago, had it not been for the Central Banks mis-management

BTW nice crystal ball (Q3 2107)

''It said almost 250,000 of these companies (Q3 2107: 248,619) ended the period with negative net worth, representing a sizeable population of so called "zombie" companies that had managed to survive thanks to the prolonged low interest rate environment and flexible labour market, but which did not have adequate working capital to fund any growth or absorb rising input prices''.

Sad though it is for so many employers and employees it is a fact of business life, many will fail for various reasons, many of these ''zombie'' companies would have gone to the wall years ago, had it not been for the Central Banks mis-management

BTW nice crystal ball (Q3 2107)

Fred1new

- 02 Nov 2017 08:37

- 79363 of 81564

- 02 Nov 2017 08:37

- 79363 of 81564

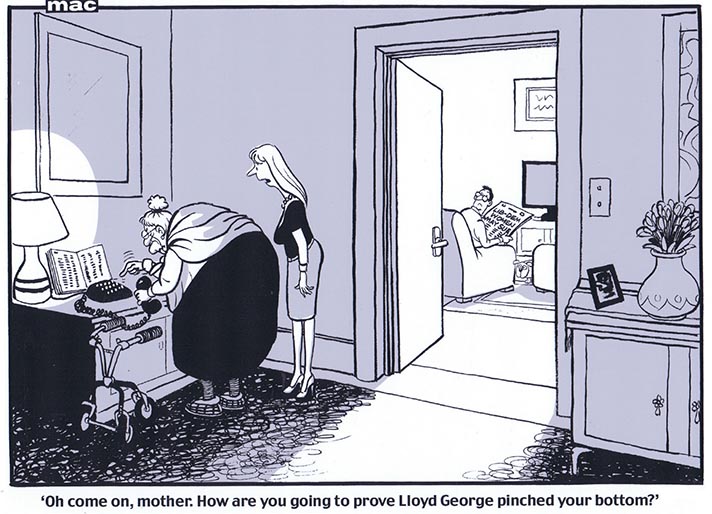

Will T Maybe's tory period government be known as the Groping government, for its groping in cabinet, groping in the EU and groping in the dark?

Fred1new

- 02 Nov 2017 09:07

- 79364 of 81564

- 02 Nov 2017 09:07

- 79364 of 81564

Fred1new

- 02 Nov 2017 09:38

- 79365 of 81564

- 02 Nov 2017 09:38

- 79365 of 81564

Ps. Are all tory nights like Fall Down?

VICTIM - 02 Nov 2017 09:46 - 79366 of 81564

Obsession , by Freda available at any amusement arcade near you .

Dil

- 02 Nov 2017 11:16

- 79367 of 81564

- 02 Nov 2017 11:16

- 79367 of 81564

if everyone who has done anything inappropriate by today's standards all handed themselves in at the local police station the system would be over run.

If we take touching someone's knee without permission as a starting point then it's going to take me about two days to write my confession.

I will also be reporting a few ladies for their inappropriate suggestions to me when I was a teenager and two ladies who would whistle at me every Tuesday night for 20 weeks when I worked in the Theatre at Butlins.

Bloody worlds gone mad.

If we take touching someone's knee without permission as a starting point then it's going to take me about two days to write my confession.

I will also be reporting a few ladies for their inappropriate suggestions to me when I was a teenager and two ladies who would whistle at me every Tuesday night for 20 weeks when I worked in the Theatre at Butlins.

Bloody worlds gone mad.

Dil

- 02 Nov 2017 11:16

- 79368 of 81564

- 02 Nov 2017 11:16

- 79368 of 81564

i so miss those days now :-)

ExecLine

- 02 Nov 2017 11:45

- 79369 of 81564

- 02 Nov 2017 11:45

- 79369 of 81564

Any B of E Interest Rate hike opinions?

I think, that since the economy looks slightly fragile because of Brexit, the B of E will NOT raise the interest rate.

I think, that since the economy looks slightly fragile because of Brexit, the B of E will NOT raise the interest rate.

ExecLine

- 02 Nov 2017 11:52

- 79370 of 81564

- 02 Nov 2017 11:52

- 79370 of 81564

Hmmm?

Those were the days.... Remembering what me and my mates used to brag/talk about when we were younger, maybe the jails should be full?

But things were different in those days - and then first came 'electricity' (Yes. Electricity! Lots of farms, homes and small-holdings in the country side were too remote and didn't have any electricity), 'the 60s' and 'the pill' and 'flower power' and 'supermarkets' and 'colour tv' and 'mini skirts' and 'Alf Garnett' and 'the likely lads'.

Anyhow, not necessarily in that order, but things were very, very different back then. Particularly the way one sex would be viewed by the other.

Those were the days.... Remembering what me and my mates used to brag/talk about when we were younger, maybe the jails should be full?

But things were different in those days - and then first came 'electricity' (Yes. Electricity! Lots of farms, homes and small-holdings in the country side were too remote and didn't have any electricity), 'the 60s' and 'the pill' and 'flower power' and 'supermarkets' and 'colour tv' and 'mini skirts' and 'Alf Garnett' and 'the likely lads'.

Anyhow, not necessarily in that order, but things were very, very different back then. Particularly the way one sex would be viewed by the other.

KidA - 02 Nov 2017 12:05 - 79371 of 81564

Women murder, are perpetrators of domestic and sexual abuse - both psychological and physical, they manipulate - including emotional and sexual manipulation, make false accusations which ruin lives, touch and talk in an inappropriate way - at work, in pubs, in clubs ..., bitch about men, bitch about each other, consider cutting the lawn and house maintenance a hobby rather than work, moan about the toilet seat but never think of putting it up for him, have a vocal group who pick and choose equality where it suits - marching under its banner when misandry is more appropriate, etc., etc., etc.

Chris Carson

- 02 Nov 2017 13:16

- 79372 of 81564

- 02 Nov 2017 13:16

- 79372 of 81564

Burn the bra LOL! Getting a bit silly now :0)

jimmy b

- 02 Nov 2017 14:47

- 79373 of 81564

- 02 Nov 2017 14:47

- 79373 of 81564

Dil i got whistled at by these two the other day . Best i could manage .

KidA - 02 Nov 2017 14:53 - 79374 of 81564

Don't let the NUS see that picture.