| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

FTSE + FTSE 250 - consider trading (FTSE)

cynic

- 20 Oct 2007 12:12

- 20 Oct 2007 12:12

rather than pick out individual stocks to trade, it can often be worthwhile to trade the indices themselves, especially in times of high volatility.

for those so inclined, i attach below charts for FTSE and FTSE 250, though one might equally be tempted to trade Dow or S&P, which is significantly broader in its coverage, or even NASDAQ

for ease of reading, i have attached 1 year and 3 month charts in each instance

for those so inclined, i attach below charts for FTSE and FTSE 250, though one might equally be tempted to trade Dow or S&P, which is significantly broader in its coverage, or even NASDAQ

for ease of reading, i have attached 1 year and 3 month charts in each instance

cynic

- 23 May 2012 16:54

- 8226 of 21973

- 23 May 2012 16:54

- 8226 of 21973

glad i missed the gloom though suspected it was under way as was playing golf in the hot sunshine

Davai - 23 May 2012 18:23 - 8227 of 21973

Looking for some previous last LH's to be breached for confirmation, but reckon its up from here...

cynic

- 23 May 2012 20:33

- 8228 of 21973

- 23 May 2012 20:33

- 8228 of 21973

well called as one hell of a recovery under way on Dow ..... with 30 minutes of trading left, only -40 after -180

looks like there were some vaguely positive mumblings from the greeks about staying in the eurozone ...... just shows how brittle the markets are

=============

chart guru reckoned ftse was a buy at 5240, which was the level it hit and is now 5315 and dow a buy at 12189, but it hasn't been that low (yet) - currently 12469 after 12309

looks like there were some vaguely positive mumblings from the greeks about staying in the eurozone ...... just shows how brittle the markets are

=============

chart guru reckoned ftse was a buy at 5240, which was the level it hit and is now 5315 and dow a buy at 12189, but it hasn't been that low (yet) - currently 12469 after 12309

Davai - 23 May 2012 21:02 - 8229 of 21973

My pointers this time were the NzdUsd and the UsdCad both hitting 5wave targets simultaneously. Will expect 3 wave (abc) pullbacks and thus some decent ground retraced on the markets before lower to come...

Not sure as to timeframes just yet, also don't know what form the pullbacks will take (flat/zigzag etc), but up we will go... Right now we are getting near the tops of some minor 5w advances, thus expect some downside soon, retracing some of this evenings gains...

Not sure as to timeframes just yet, also don't know what form the pullbacks will take (flat/zigzag etc), but up we will go... Right now we are getting near the tops of some minor 5w advances, thus expect some downside soon, retracing some of this evenings gains...

Davai - 23 May 2012 21:54 - 8230 of 21973

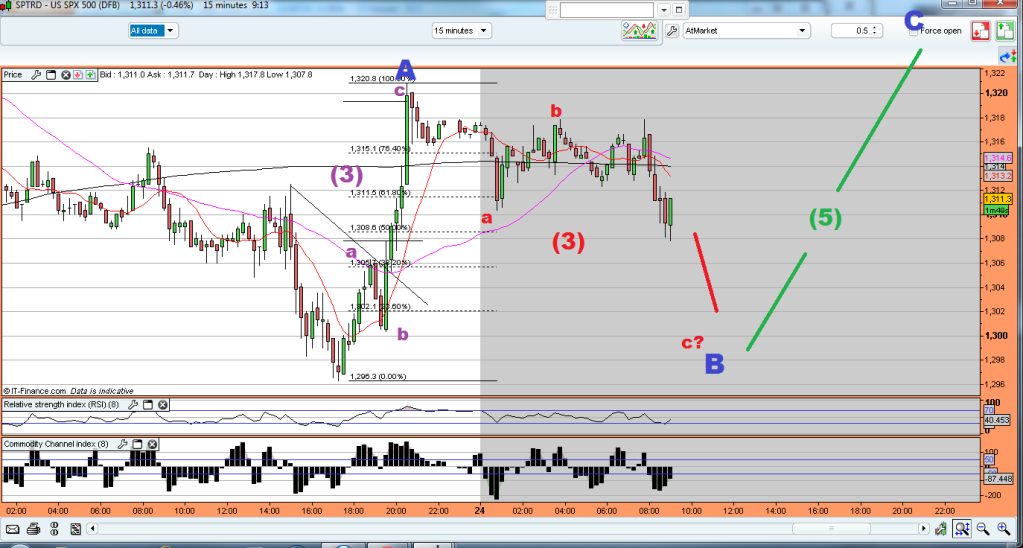

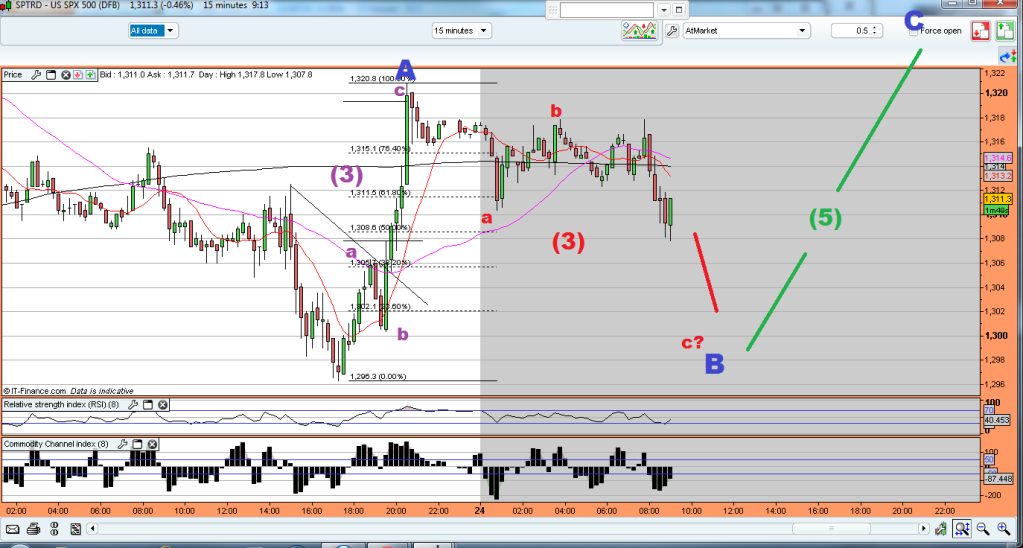

Davai - 24 May 2012 08:33 - 8231 of 21973

So the above chart now appears to look like a 3move 'A' instead of the 5w (as suggested), this means a 3move 'B' back down for either a flat or irregular, before a 5w 'C' taking us somewhere higher than last nights high...

cynic

- 24 May 2012 08:37

- 8232 of 21973

- 24 May 2012 08:37

- 8232 of 21973

try that in english - you're sounding like tomasz!

Davai - 24 May 2012 09:25 - 8233 of 21973

Sorry Rich! My theory is that it no longer looks like a 5wave move for 'A', it looks more like an abc 3wave move (as per chart below), this means that the whole larger ABC move will be either flat or irregular (a 3-3-5). 'B' must retrace at least 61.8% of 'A' in 3 moves, (it can even make a fresh low, if irregular), before we get a 5wave 'C' to take us higher...

There, clear as mud?!

There's still a chance of the original chart, but it does appear that the 4th wave is disproportionate to the 1&2, (although overnight action could cause this)...

If so, we have a zigzag and much higher to come by early next week...

There, clear as mud?!

There's still a chance of the original chart, but it does appear that the 4th wave is disproportionate to the 1&2, (although overnight action could cause this)...

If so, we have a zigzag and much higher to come by early next week...

ahoj

- 24 May 2012 09:33

- 8234 of 21973

- 24 May 2012 09:33

- 8234 of 21973

badbakht shodam agah, bala mire?

cynic

- 24 May 2012 09:41

- 8235 of 21973

- 24 May 2012 09:41

- 8235 of 21973

.

cynic

- 24 May 2012 09:44

- 8236 of 21973

- 24 May 2012 09:44

- 8236 of 21973

reverting to the above ..... guru also remains quite bullish; however there will be some very uncomfortable weeks ahead as the greeks determine which way will be the least painful in the long-term and/or if they want greece to be of similar standing to ethiopia ....

meanwhile, the unelected EU bureaucrats will continue their merry self-important way on the juicy gravy train

meanwhile, the unelected EU bureaucrats will continue their merry self-important way on the juicy gravy train

ahoj

- 24 May 2012 09:45

- 8237 of 21973

- 24 May 2012 09:45

- 8237 of 21973

same to mine PLEASE, helper1341@yahoo.co.uk

Cheers

Cheers

Davai - 24 May 2012 09:45 - 8238 of 21973

Received mate. Also just seen something else which means a very bullish day today by close...

skinny

- 24 May 2012 09:52

- 8239 of 21973

- 24 May 2012 09:52

- 8239 of 21973

The Greece conundrum :-

Davai - 24 May 2012 10:11 - 8240 of 21973

Trouble is when you give an opinion, you have to back it up everytime you change your mind!

My current thoughts are with my original chart of last night. We have just played out an abc 4th, which was far longer in timescale due to overnight futures. We head up for a 5th and then back down in an abc corrective (probably tonight), this would mean much higher early next week, (as suggested above);

My current thoughts are with my original chart of last night. We have just played out an abc 4th, which was far longer in timescale due to overnight futures. We head up for a 5th and then back down in an abc corrective (probably tonight), this would mean much higher early next week, (as suggested above);

HARRYCAT

- 24 May 2012 10:21

- 8241 of 21973

- 24 May 2012 10:21

- 8241 of 21973

Really interesting stuff and way beyond my comprehension of TA, but am I correct in saying that these basically ignore the day to day news and only reflect a charting perspective? If the answer is yes, then surely the chart will follow the news. If no, then I am even more out of my depth than I first thought!

Davai - 24 May 2012 10:29 - 8242 of 21973

Yep Harry, true chartists believe that the market must adhere to certain rules. Of course there is massive scope within those rules for patterns to morph into something else etc, but with enough experience (and i'm not pretending i possess enough yet!), its possible to predict the likely course of action... I had forgotten about this thread when i started my FX/Index trading header, but i really only use that as a diary.

I find that news events will only take PA (price action) to the max it is allowed to under a particular set-up... this is why bad news seems to do nothing (aside from a minor setback) when the market is bullish and yet is the kiss of death in the opposite scenario... The market already knows where it has to get too...

I find that news events will only take PA (price action) to the max it is allowed to under a particular set-up... this is why bad news seems to do nothing (aside from a minor setback) when the market is bullish and yet is the kiss of death in the opposite scenario... The market already knows where it has to get too...

jonuk76

- 24 May 2012 10:53

- 8243 of 21973

- 24 May 2012 10:53

- 8243 of 21973

In a charting program I use I've acquired some pre-built algorithmic trading systems. Of them all, when backtesting (on UK shares) the Elliot Wave systems come out as one of the most profitable overall. This is in contrast to things like the famous 'Turtle trader' system which in my testing seems to perform very poorly on shares. I don't really understand it and don't know why it works but maybe there's something in it... ;-)

gibby - 24 May 2012 14:21 - 8244 of 21973

testing week ahead think i will continue shorting gla

jonuk76

- 24 May 2012 16:02

- 8245 of 21973

- 24 May 2012 16:02

- 8245 of 21973

From Dow Jones newswire:

DJ Kansas City Fed May Manufacturing Composite Index Rebounds To 9

NEW YORK (Dow Jones)--Manufacturing activity in the Federal Reserve Bank of Kansas City's district this month recovered all the ground lost in April, according to a report released by the bank Thursday.

The Kansas City Fed's manufacturing composite index--an average of the indexes covering production, new orders, employment, delivery times and raw-materials inventories--rebounded to 9 in May after falling to 3 in April from 9 in March.

Readings above zero denote expansion.

On a year-over-year comparison, the composite index increased to 27 from 24.

Recent readings on manufacturing have been mixed. The Kansas City Fed survey follows results from other regional Fed banks. The New York Fed reported an acceleration in its region's factory activity, but the Richmond Fed and Philadelphia Fed reported weakness.

On Thursday, the Commerce Department reported total U.S. orders for durable goods edged up 0.2% in April. But the category covering capital spending--new orders for nondefense capital goods excluding aircraft--decreased a large 1.9% last month.

Within the Kansas City report, the new orders index, in a month-over-month comparison, jumped to 10 from -8 in April. The production index increased to 17 from zero.

The employment index slowed to 8 in May from 12 but the workweek index improved to -2 from -10.

Businesses found further relief on costs. The prices-paid index dropped to 11 from 19 in April. The prices-received index fell to zero from 7.

Expectations about the next six months also improved this month.

The composite expectations index rebounded to 17 from 12. The production expectations index jumped to 40 from 26. The future employment index improved to 18 from 15.

The Kansas City Fed district includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico and western Missouri.

DJ Kansas City Fed May Manufacturing Composite Index Rebounds To 9

NEW YORK (Dow Jones)--Manufacturing activity in the Federal Reserve Bank of Kansas City's district this month recovered all the ground lost in April, according to a report released by the bank Thursday.

The Kansas City Fed's manufacturing composite index--an average of the indexes covering production, new orders, employment, delivery times and raw-materials inventories--rebounded to 9 in May after falling to 3 in April from 9 in March.

Readings above zero denote expansion.

On a year-over-year comparison, the composite index increased to 27 from 24.

Recent readings on manufacturing have been mixed. The Kansas City Fed survey follows results from other regional Fed banks. The New York Fed reported an acceleration in its region's factory activity, but the Richmond Fed and Philadelphia Fed reported weakness.

On Thursday, the Commerce Department reported total U.S. orders for durable goods edged up 0.2% in April. But the category covering capital spending--new orders for nondefense capital goods excluding aircraft--decreased a large 1.9% last month.

Within the Kansas City report, the new orders index, in a month-over-month comparison, jumped to 10 from -8 in April. The production index increased to 17 from zero.

The employment index slowed to 8 in May from 12 but the workweek index improved to -2 from -10.

Businesses found further relief on costs. The prices-paid index dropped to 11 from 19 in April. The prices-received index fell to zero from 7.

Expectations about the next six months also improved this month.

The composite expectations index rebounded to 17 from 12. The production expectations index jumped to 40 from 26. The future employment index improved to 18 from 15.

The Kansas City Fed district includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico and western Missouri.