| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

FTSE + FTSE 250 - consider trading (FTSE)

cynic

- 20 Oct 2007 12:12

- 20 Oct 2007 12:12

rather than pick out individual stocks to trade, it can often be worthwhile to trade the indices themselves, especially in times of high volatility.

for those so inclined, i attach below charts for FTSE and FTSE 250, though one might equally be tempted to trade Dow or S&P, which is significantly broader in its coverage, or even NASDAQ

for ease of reading, i have attached 1 year and 3 month charts in each instance

for those so inclined, i attach below charts for FTSE and FTSE 250, though one might equally be tempted to trade Dow or S&P, which is significantly broader in its coverage, or even NASDAQ

for ease of reading, i have attached 1 year and 3 month charts in each instance

cynic

- 12 Jun 2012 07:03

- 8353 of 21973

- 12 Jun 2012 07:03

- 8353 of 21973

very surprisingly (to me), ftse looking to open effectively unchanged

chuckles is clearly a very clever chap indeed .... even if he made no money on last night's escapade, he did unbelievably well ..... i am currently out of rhythm with the indices - i.e. if i traded them, i'ld have the timing wrong even if the general direction right - so have pretty much stopped trading them for now

chuckles is clearly a very clever chap indeed .... even if he made no money on last night's escapade, he did unbelievably well ..... i am currently out of rhythm with the indices - i.e. if i traded them, i'ld have the timing wrong even if the general direction right - so have pretty much stopped trading them for now

ahoj

- 12 Jun 2012 07:43

- 8354 of 21973

- 12 Jun 2012 07:43

- 8354 of 21973

Cynic,

The number of companies has been reducing over the last five years, but the demand and population has been rising.

Many of these companies are like gold now and worth much higher than these prices. The fall has been based on "fear", much of it unjustified.

The number of companies has been reducing over the last five years, but the demand and population has been rising.

Many of these companies are like gold now and worth much higher than these prices. The fall has been based on "fear", much of it unjustified.

Davai - 12 Jun 2012 12:16 - 8355 of 21973

Not sure how this will play out, but further to the previous chart, things are going according to plan. I am looking for two touchpoints one for a flag for a long set-up (blue line), but i also think we will build a bigger one for a short play later (red line)

I'm fairly certain that we have just seen a 5w move long and printing the abc that i expected as per the last chart. The very least we can expect therefore is another 5w move north once the corrective move finishes...

I'm fairly certain that we have just seen a 5w move long and printing the abc that i expected as per the last chart. The very least we can expect therefore is another 5w move north once the corrective move finishes...

cynic

- 12 Jun 2012 14:08

- 8356 of 21973

- 12 Jun 2012 14:08

- 8356 of 21973

peccavi! ...... have had a small dabble long dow at 12446 on the basis that europe did not fall o'night and has had a modestly successful morning

chuckles - 12 Jun 2012 19:21 - 8357 of 21973

cynic - 12 Jun 2012 07:03 - 8353 of 8356

chuckles is clearly a very clever chap indeed .... even if he made no money on last night's escapade, he did unbelievably well .....

Yes cynic, you should say clever, but then I have given you three trades, of which two banked 100 plus points each and the third a few.

I only post on here cos I'am a fan of davais (and then) from another site. Mind you, all this elliot wave stuff does make me chuckle.

PS You might want to consider buying some squids as opposed to green backs, but wait a bit first mind.

chuckles is clearly a very clever chap indeed .... even if he made no money on last night's escapade, he did unbelievably well .....

Yes cynic, you should say clever, but then I have given you three trades, of which two banked 100 plus points each and the third a few.

I only post on here cos I'am a fan of davais (and then) from another site. Mind you, all this elliot wave stuff does make me chuckle.

PS You might want to consider buying some squids as opposed to green backs, but wait a bit first mind.

cynic

- 12 Jun 2012 19:57

- 8358 of 21973

- 12 Jun 2012 19:57

- 8358 of 21973

thanks, but i pretty much follow my own inclination and have never understood trading forex and have always avoided .... btw, i have also know davai for a number of years

Davai - 13 Jun 2012 08:30 - 8359 of 21973

There's a strong possibility of us having been in an irregular 4th corrective wave, of which we may have finished at the high on Sunday night. The drop and subsequent rebound therefore would be Waves 1&2 of the next move down. If so we might be getting close to the turn now and things might start to look horrible again soon...

We are sat on the 50% retrace right now, i will run a few fibs in a mo to try to get a better picture. The FTSE version of above looks far more obvious.

*Edit*

Christ, as unlikely as it looked, i am now sure the above is correct. Wave 'B' is 200% of 'A' and wave 'C' is 261.8% (very popular) length of 'A'. In my opinion we have several hundred points to drop over the coming couple of weeks...

We are sat on the 50% retrace right now, i will run a few fibs in a mo to try to get a better picture. The FTSE version of above looks far more obvious.

*Edit*

Christ, as unlikely as it looked, i am now sure the above is correct. Wave 'B' is 200% of 'A' and wave 'C' is 261.8% (very popular) length of 'A'. In my opinion we have several hundred points to drop over the coming couple of weeks...

HARRYCAT

- 13 Jun 2012 08:39

- 8360 of 21973

- 13 Jun 2012 08:39

- 8360 of 21973

Lots of 'mights' in there. Can we have a few more 'definitely wills' please? ;o)

Davai - 13 Jun 2012 08:43 - 8361 of 21973

Just edited the above Harry! ^^^

But you do need to read the caveat on my thread! Its all just an opinion based on my experience. I actually don't trade this stuff freestyle, i use a system which although relies on the overall direction being correct, is on a much shorter time frame. HH's and LL's is all that ultimately matters!

But you do need to read the caveat on my thread! Its all just an opinion based on my experience. I actually don't trade this stuff freestyle, i use a system which although relies on the overall direction being correct, is on a much shorter time frame. HH's and LL's is all that ultimately matters!

skinny

- 13 Jun 2012 08:52

- 8362 of 21973

- 13 Jun 2012 08:52

- 8362 of 21973

Enter Brucie stage left :-)

Davai - 13 Jun 2012 08:54 - 8363 of 21973

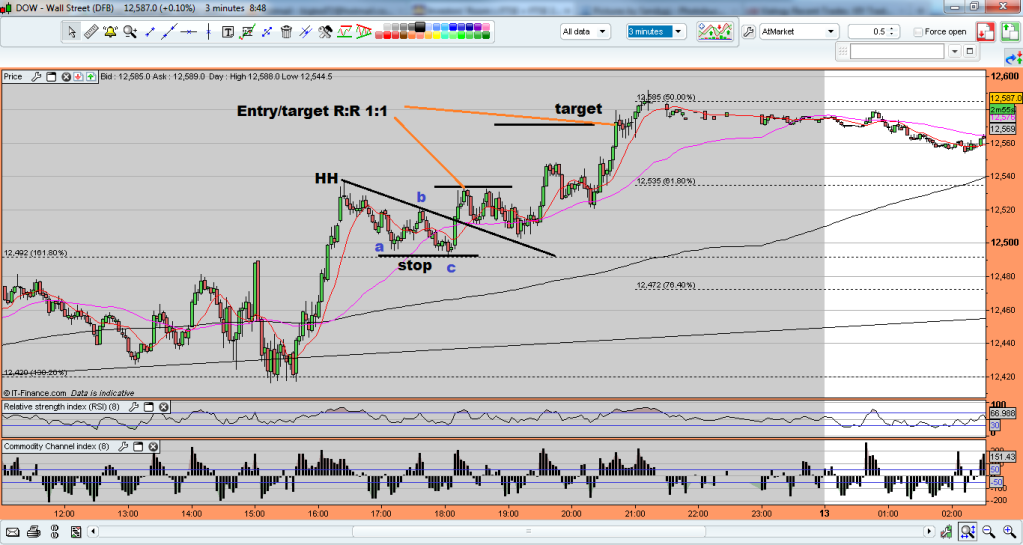

I can't give the game away, but here's an example;

First the HH, then the abc pullback to form a flag. If it breaks in a certain way, i get a trigger and can work out my target which is always a Risk:Reward of 1:1, but very high probability. From entry, you can see we took a little 'heat' but just a standard retest of the flagline before going up to target;

First the HH, then the abc pullback to form a flag. If it breaks in a certain way, i get a trigger and can work out my target which is always a Risk:Reward of 1:1, but very high probability. From entry, you can see we took a little 'heat' but just a standard retest of the flagline before going up to target;

HARRYCAT

- 13 Jun 2012 09:08

- 8364 of 21973

- 13 Jun 2012 09:08

- 8364 of 21973

Just teasing Davai! Keep going and don't mind me! Always interested in other's statagies.

Chris Carson

- 13 Jun 2012 09:15

- 8365 of 21973

- 13 Jun 2012 09:15

- 8365 of 21973

Fabulous Davai, any chance of posting your entry,target and stop just to be certain mate :O)

cynic

- 13 Jun 2012 10:00

- 8366 of 21973

- 13 Jun 2012 10:00

- 8366 of 21973

i am a cautious wuss for once so have banked my useful dow long profit

Davai - 13 Jun 2012 11:03 - 8367 of 21973

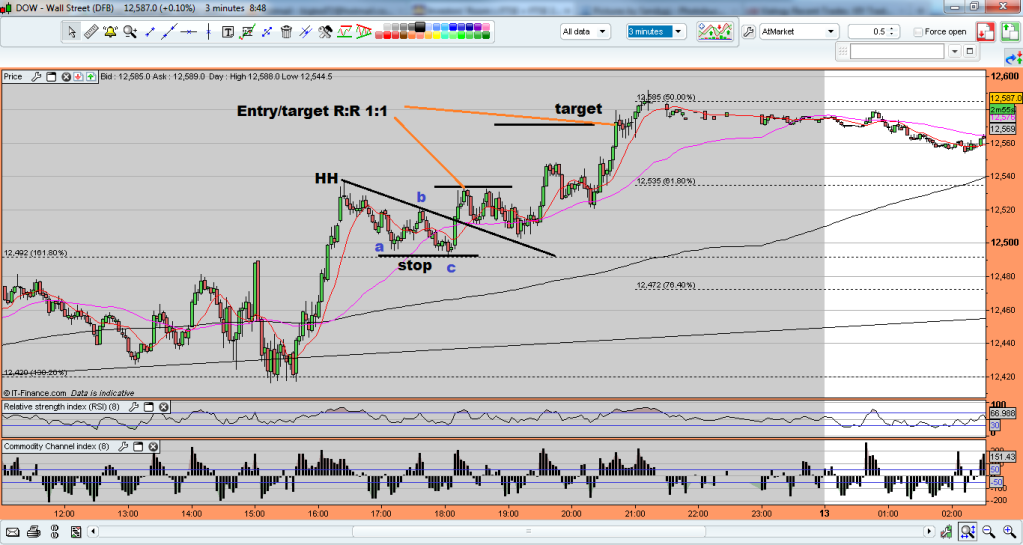

Combining Elliott wave again with my system. First, the HH, then an 'X' wave pullback, followed by an irregular ABC, the key is recognising the 3-3-5 structure of the ABC. wave 'C' is always a 5w move. Breakout of the flagline, trigger and target. Note the retest of the flagline after trigger again to finish subwave 'ii';

These EW doubters! It is the only way to trade (imo), forgive me while i 'chuckle'! ;)

These EW doubters! It is the only way to trade (imo), forgive me while i 'chuckle'! ;)

cynic

- 13 Jun 2012 11:49

- 8368 of 21973

- 13 Jun 2012 11:49

- 8368 of 21973

davai - my own "guru" uses GANN theory, which is at least as effective, and certainly he suggests plenty more upside for dow ...... however, i decided i would rather bank the profit for now and perhaps trade again (or not) in due course ...... but have leave my (new) holding in AAPL to run - this and GOOG are the 2 stocks i trade on nasdaq

cynic

- 13 Jun 2012 13:00

- 8369 of 21973

- 13 Jun 2012 13:00

- 8369 of 21973

davai / chuckles - would you concur that it will be an no-brainer short on friday just ahead of the elections in greece?

Davai - 13 Jun 2012 13:50 - 8370 of 21973

You would think so Cynic wouldn't you, that's probably reason enough to be cautious!

I'm purely chartist and take no notice whatsoever of news, imo it makes no difference to the path of the markets, merely speeds it up or slows it down...

I'm purely chartist and take no notice whatsoever of news, imo it makes no difference to the path of the markets, merely speeds it up or slows it down...

cynic

- 13 Jun 2012 14:56

- 8371 of 21973

- 13 Jun 2012 14:56

- 8371 of 21973

having banked my small profit in AAPL and opened a small short on dow 12510 - bit late as had been out of the office

Shortie - 13 Jun 2012 17:43 - 8372 of 21973

I'm considering going short on the DOW also. The DAX is another interesting one having bounced off 6000 support.