| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

gazkaz - 19 Oct 2013 10:15 - 843 of 1034

It is this fact

- that gives meat to the suspicion that Western central bank monetary gold is being supplied keep the price down,

Recorded demand for gold from China’s private sector has escalated to the point where their demand now accounts for

- significantly more than ....the rest of the world’s mine production.

The Shanghai Gold Exchange is the mainland monopoly for physical delivery, and Hong Kong acts as a separate interacting hub. Between them in the first eight months of 2013 they have delivered 1,730 tonnes into private hands, or

- an annualised rate of 2,600 tonnes.

http://www.goldmoney.com/en-gb/news-and-analysis/news-and-analysis-archive/china-and-gold.aspx?gmrefcode=gata

The world ex-China mines an estimated 2,260 tonnes,

- leaving a supply deficit for not only the rest of gold-hungry South-east Asia and India, but.......

- the rest of the world as well.

- that gives meat to the suspicion that Western central bank monetary gold is being supplied keep the price down,

Recorded demand for gold from China’s private sector has escalated to the point where their demand now accounts for

- significantly more than ....the rest of the world’s mine production.

The Shanghai Gold Exchange is the mainland monopoly for physical delivery, and Hong Kong acts as a separate interacting hub. Between them in the first eight months of 2013 they have delivered 1,730 tonnes into private hands, or

- an annualised rate of 2,600 tonnes.

http://www.goldmoney.com/en-gb/news-and-analysis/news-and-analysis-archive/china-and-gold.aspx?gmrefcode=gata

The world ex-China mines an estimated 2,260 tonnes,

- leaving a supply deficit for not only the rest of gold-hungry South-east Asia and India, but.......

- the rest of the world as well.

gazkaz - 19 Oct 2013 10:17 - 844 of 1034

Makes you go 'mmmm perhaps

China has just bought The Morgues....former head office - at Rockerchappy Plazza

- & - It houses....

- The Worlds LARGEST...commercial bullion Vault

China has just bought The Morgues....former head office - at Rockerchappy Plazza

- & - It houses....

- The Worlds LARGEST...commercial bullion Vault

gazkaz - 19 Oct 2013 10:22 - 845 of 1034

Andy Maguire highlights China's demand this way

The Chinese, through Shanghai, have.... already absorbed.... the bulk of all global mine production, if not .....all of it in its entirety.

In July alone, Shanghai gold imports exceeded........ all of the imports for 2012.

We also know that official Shanghai gold deliveries have... accelerated since that time.

Last week I reported the September numbers to you and it was

- over 225 tons of gold being delivered.

But as of today, for just ......the 9 delivery days .....of October,

- we already have over ......101 tons of gold delivered.

The Chinese, through Shanghai, have.... already absorbed.... the bulk of all global mine production, if not .....all of it in its entirety.

In July alone, Shanghai gold imports exceeded........ all of the imports for 2012.

We also know that official Shanghai gold deliveries have... accelerated since that time.

Last week I reported the September numbers to you and it was

- over 225 tons of gold being delivered.

But as of today, for just ......the 9 delivery days .....of October,

- we already have over ......101 tons of gold delivered.

gazkaz - 19 Oct 2013 10:29 - 846 of 1034

Eric Sprott:

“The United States is already insolvent.

- They announced their own GAAP budget deficit, which was $6 trillion last year.

$6 trillion!

- They (only) had revenues of $3 (trillion).

- And the combined debt and entitlements is now....... $60 - $70 trillion.

Now, can you expect somebody with .....$3 trillion of annual revenue

- to be able to deal with $60 trillion of debt?

- It’s impossible.

So, mathematically it’s over....

“I compare it to what’s happened in Detroit,

- where 10 years ago..... we knew they were broke,

- and then finally (10yrs later), one day they actually said..... they were ‘broke.’

The outcome of that was they told the pensioner,

- ‘You can only get 33 cents on the dollar.’

And the same will happen to the US (pensioners).

So....What happens when someone’s (social security or pension) check

- falls by 50% or 60%?

- The economic chaos that will ensue will be unbelievable.

But... it’s going to happen.

It’s so clear cut there is nothing that can be done about it. The whole world has this huge debt problem. If you have this view that the countries are insolvent,

- what does it mean for all of us?

I’m talking about, as human beings,

- how is everyone going to survive?

It’s a scary prospect.

“The United States is already insolvent.

- They announced their own GAAP budget deficit, which was $6 trillion last year.

$6 trillion!

- They (only) had revenues of $3 (trillion).

- And the combined debt and entitlements is now....... $60 - $70 trillion.

Now, can you expect somebody with .....$3 trillion of annual revenue

- to be able to deal with $60 trillion of debt?

- It’s impossible.

So, mathematically it’s over....

“I compare it to what’s happened in Detroit,

- where 10 years ago..... we knew they were broke,

- and then finally (10yrs later), one day they actually said..... they were ‘broke.’

The outcome of that was they told the pensioner,

- ‘You can only get 33 cents on the dollar.’

And the same will happen to the US (pensioners).

So....What happens when someone’s (social security or pension) check

- falls by 50% or 60%?

- The economic chaos that will ensue will be unbelievable.

But... it’s going to happen.

It’s so clear cut there is nothing that can be done about it. The whole world has this huge debt problem. If you have this view that the countries are insolvent,

- what does it mean for all of us?

I’m talking about, as human beings,

- how is everyone going to survive?

It’s a scary prospect.

gazkaz - 19 Oct 2013 10:42 - 847 of 1034

I've commented frequently on it before re GLD

But KWN - currently quotes

- The gold in GLD is disappearing fast.

- They have lost....... 34% of their gold,

- and yet you look at Eric Sprott’s Trust and he’s losing ........less than... 2%.

GLD had a huge amount of borrowed shares....sold short

(So if you buy the borrowed shares - you think you have shares backed by gold....and the person who owns....the shares that have been borrowed....also thinks he owns the shares....backed by Gold.....As Bones says....Yes Jim ...it's double counting....but not as we know it).

And of course - the fall in GLD ....is more likely....punters taking the option of physical delivery of their paper GLD holdings

- rather than cashing in and throwing in the towel.

Comex warehousing.....also doesn't seem to "add up" - when it comes to the amounts of gold....standing for delivery

- many commentators allege....they are getting settled in GLD shares

- and not physical

But KWN - currently quotes

- The gold in GLD is disappearing fast.

- They have lost....... 34% of their gold,

- and yet you look at Eric Sprott’s Trust and he’s losing ........less than... 2%.

GLD had a huge amount of borrowed shares....sold short

(So if you buy the borrowed shares - you think you have shares backed by gold....and the person who owns....the shares that have been borrowed....also thinks he owns the shares....backed by Gold.....As Bones says....Yes Jim ...it's double counting....but not as we know it).

And of course - the fall in GLD ....is more likely....punters taking the option of physical delivery of their paper GLD holdings

- rather than cashing in and throwing in the towel.

Comex warehousing.....also doesn't seem to "add up" - when it comes to the amounts of gold....standing for delivery

- many commentators allege....they are getting settled in GLD shares

- and not physical

gazkaz - 19 Oct 2013 10:46 - 848 of 1034

T Fergusson also highlights....the GLD positions & seemingly dodgy dealings too

http://www.tfmetalsreport.com/blog/5167/pillaging-gld

http://www.tfmetalsreport.com/blog/5167/pillaging-gld

gazkaz - 19 Oct 2013 12:01 - 849 of 1034

Can a HUUUUUGE secret be kept......and kept.... with no paper trail evidence

- like for example the rigging of Gold & more recntly.....the silver....manipulation ??

Well the London Gold Pool was....kept secret........and only revealed as history....after it ended.

How was such a mammoth, secret & complex system run ??

- don't forget it involved everyone from.....

- governments, central banks, bullion banks, markets & dealers

In his book “Gold Wars”, Swiss banker Ferdinand Lips

- wrote:

“It was decided to keep the gold pool.... secret at the time.

- Keeping with.... traditional practices...... at the BIS meetings,

- not a scrap of paper... was initialed

- or even exchanged;

- the word of each governor was as binding as any contract”.

(Lipps, Gold Wars, 2001: pg 53)

Why didn’t anyone present....... record the details of this agreement,

- so crucial that it would structure the major part of international trade for most of a decade?

Because what they were conspiring to do (and succeeded in doing for seven years)

- was illegal.

So at the very top......all verbal...like the mafia...no paper trail.

And that would then be passed ...down the line...& all verbally.

Until.....

- you hit the last high level.....in the chain

- The level....of head poncho....who has to then implement... in practice...the dictat from on high...

- what might be termed down thro' ....the rest of the "bona fide" remainder of the chain of implementation.....ie ......where "paper begins"

If the Brown hits the rotating

- evidence of complicity via a paper trail.....will only reach as far as the paper trail goes

- ie up to....the poor suckers....who carry the bag

So Crucially,- it places those ......actually conducting the day-to-day business of crime

- in a very difficult position

- they have no choice but to follow the orders of the powerful people in charge,

- but they know that they are on the hook for the crimes committed.

Now if you..... were in that uneviable position...and you could see the writing on the wall

- that soon the the day when the SHTF...was fast approaching

What would you do ???

Quitely and discreetly get out the loop....and hope the next guy takes the fall....and cover your tracks as best you can ??

.......................................................................................................................

Obviously this has no connection with the above :o)

In spite of compelling evidence of manipulation of the silver market

- eg

Andy Maguire - feeding the CFTC...evidence of when the silver market was to be hit.....hours in advance of it happening

- The above... later being pointed out. - in the official CFTC hearing 5yrs ago

...as having "already been provided" to the CFTC ...

- ie Andy Maguire had already repeatedly given the information....before the official investigation hearing began

(Recounted Bill Murphy....at the official CFTC hearing.....as Andy Maguire...srangely not allowed to..testify directly).

Plus TWO ex Morgue employees (one in management) whistleblowing re...their employer manipulation of the silver market.....being given to the CFTC

- 12 months ago

Plus the Smashdown....In May when Silver was taken down from $50

- plus multiple smashdowns ever since

ie when no one in their right minds (ie trying to sell to achieve the best return)

- would dump huge amounts of contacts representing many millions of oz

- in the wee small hours of the overnight illiquid trading.

And - much more that you will already be aware of, as you have followed the charade of the last five years

etc etc

The CFTC - found no evidence

(A famous one eyed sea lord in history put his telescope - to his blind eye....and also retorted.....I see no ships !)

........................................................................................................................

So in the light of .....that amazing/ nay stunning outcome

- what's been happening in

- the upper echelons of

- The paper trails stops here CFTC...players ??

Now here is where it gets interesting. Isn’t it peculiar that:

■CFTC commissioner Jill Sommers

- unexpectedly resigned, leaving her high-ranking position

- despite having no other job waiting for her .

Indeed, aside from giving the occasional paid talk about Dodd-Frank at a business conference or two, she appears to be....... still unemployed.

■Less than 10 days after the “no charges filed” announcement,

- CFTC Chairman Gary Gensler (whose term as chairman is up at the end of the year)

- very publicly.. turned ...the Obama Administration’s..... offer of a second term, in a Wall Street Journal article.

He will be leaving the CFTC at the end of the year

■Within a week of the “no charges filed” announcement,

- CFTC Chief of Enforcement Davd Miester

- unexpectedly resigned his position,

again despite apparently...... having no firm job offer ...or position.. he was leaving for.

.......................................................................................................................

If I remember Hank PAULSON...jumped ship from the FEDy some little while.....before the congressonal hearings began into

- where the hell ....and how much money

- went where and to whom

- and (cough) how the feck did SachsOFgold - get paid out IN FULL

etc

- when Lehman/AIG all fell apart.

......................................................................................................................

All just mere musings & conjecture of course.

Maybe at some point you start to think

- after the public have taken Ken Livingstone's advice to Londoners

- "hang a banker a week" until the industry improves.

Where might the public turn next ?

- and just get out whilst the goings good.

- like for example the rigging of Gold & more recntly.....the silver....manipulation ??

Well the London Gold Pool was....kept secret........and only revealed as history....after it ended.

How was such a mammoth, secret & complex system run ??

- don't forget it involved everyone from.....

- governments, central banks, bullion banks, markets & dealers

In his book “Gold Wars”, Swiss banker Ferdinand Lips

- wrote:

“It was decided to keep the gold pool.... secret at the time.

- Keeping with.... traditional practices...... at the BIS meetings,

- not a scrap of paper... was initialed

- or even exchanged;

- the word of each governor was as binding as any contract”.

(Lipps, Gold Wars, 2001: pg 53)

Why didn’t anyone present....... record the details of this agreement,

- so crucial that it would structure the major part of international trade for most of a decade?

Because what they were conspiring to do (and succeeded in doing for seven years)

- was illegal.

So at the very top......all verbal...like the mafia...no paper trail.

And that would then be passed ...down the line...& all verbally.

Until.....

- you hit the last high level.....in the chain

- The level....of head poncho....who has to then implement... in practice...the dictat from on high...

- what might be termed down thro' ....the rest of the "bona fide" remainder of the chain of implementation.....ie ......where "paper begins"

If the Brown hits the rotating

- evidence of complicity via a paper trail.....will only reach as far as the paper trail goes

- ie up to....the poor suckers....who carry the bag

So Crucially,- it places those ......actually conducting the day-to-day business of crime

- in a very difficult position

- they have no choice but to follow the orders of the powerful people in charge,

- but they know that they are on the hook for the crimes committed.

Now if you..... were in that uneviable position...and you could see the writing on the wall

- that soon the the day when the SHTF...was fast approaching

What would you do ???

Quitely and discreetly get out the loop....and hope the next guy takes the fall....and cover your tracks as best you can ??

.......................................................................................................................

Obviously this has no connection with the above :o)

In spite of compelling evidence of manipulation of the silver market

- eg

Andy Maguire - feeding the CFTC...evidence of when the silver market was to be hit.....hours in advance of it happening

- The above... later being pointed out. - in the official CFTC hearing 5yrs ago

...as having "already been provided" to the CFTC ...

- ie Andy Maguire had already repeatedly given the information....before the official investigation hearing began

(Recounted Bill Murphy....at the official CFTC hearing.....as Andy Maguire...srangely not allowed to..testify directly).

Plus TWO ex Morgue employees (one in management) whistleblowing re...their employer manipulation of the silver market.....being given to the CFTC

- 12 months ago

Plus the Smashdown....In May when Silver was taken down from $50

- plus multiple smashdowns ever since

ie when no one in their right minds (ie trying to sell to achieve the best return)

- would dump huge amounts of contacts representing many millions of oz

- in the wee small hours of the overnight illiquid trading.

And - much more that you will already be aware of, as you have followed the charade of the last five years

etc etc

The CFTC - found no evidence

(A famous one eyed sea lord in history put his telescope - to his blind eye....and also retorted.....I see no ships !)

........................................................................................................................

So in the light of .....that amazing/ nay stunning outcome

- what's been happening in

- the upper echelons of

- The paper trails stops here CFTC...players ??

Now here is where it gets interesting. Isn’t it peculiar that:

■CFTC commissioner Jill Sommers

- unexpectedly resigned, leaving her high-ranking position

- despite having no other job waiting for her .

Indeed, aside from giving the occasional paid talk about Dodd-Frank at a business conference or two, she appears to be....... still unemployed.

■Less than 10 days after the “no charges filed” announcement,

- CFTC Chairman Gary Gensler (whose term as chairman is up at the end of the year)

- very publicly.. turned ...the Obama Administration’s..... offer of a second term, in a Wall Street Journal article.

He will be leaving the CFTC at the end of the year

■Within a week of the “no charges filed” announcement,

- CFTC Chief of Enforcement Davd Miester

- unexpectedly resigned his position,

again despite apparently...... having no firm job offer ...or position.. he was leaving for.

.......................................................................................................................

If I remember Hank PAULSON...jumped ship from the FEDy some little while.....before the congressonal hearings began into

- where the hell ....and how much money

- went where and to whom

- and (cough) how the feck did SachsOFgold - get paid out IN FULL

etc

- when Lehman/AIG all fell apart.

......................................................................................................................

All just mere musings & conjecture of course.

Maybe at some point you start to think

- after the public have taken Ken Livingstone's advice to Londoners

- "hang a banker a week" until the industry improves.

Where might the public turn next ?

- and just get out whilst the goings good.

gazkaz - 21 Oct 2013 22:27 - 850 of 1034

Thank goodness the US has ironed out the root cause of it's bankruptcy problem

- 70/80 plus ish Trillion Debt and Unfunded Liabilities

- and a tax take income of 3 Trillion

By just ....removing their OD Limit facility completely

- and just running with it and see how they go...till Feb next year

And the day after...they sorted the problem

- IN JUST ONE DAY

- their debt went up.....A Third of a TRILLION

-....in a..day !!!

http://www.goldcore.com/goldcore_blog/us-national-debt-over-17-trillion-surges-328-billion-single-day

- 70/80 plus ish Trillion Debt and Unfunded Liabilities

- and a tax take income of 3 Trillion

By just ....removing their OD Limit facility completely

- and just running with it and see how they go...till Feb next year

And the day after...they sorted the problem

- IN JUST ONE DAY

- their debt went up.....A Third of a TRILLION

-....in a..day !!!

http://www.goldcore.com/goldcore_blog/us-national-debt-over-17-trillion-surges-328-billion-single-day

gazkaz - 21 Oct 2013 22:42 - 851 of 1034

No "ifs" & No "buts"....no suspicions or tin foil hatter thoughts....

- the banksters DO have.....a carte blance...."get out of jail free" card

(& it's got....no expirey)

This is... THE... US Attorney General ....Testifying to - THE US Senate

- And as you can see in the bottom part, it's not just - a worry - that

- it could happen

- HSBC proves it... IS.... happening.

..............................................................................

When

- the Attorney General .....of the United States admits

- some banks

..... are simply too big to prosecute,

- it might be time to admit ......we have a problem

(and that goes for both the financial and..... justice systems).

Eric Holder made this........ rather startling... confession

- in testimony .......before the Senate Judiciary Committee on Wednesday,

"I am concerned that the size of some of these institutions becomes so large that......

- it does become difficult... for us......... to prosecute them

- if you do bring a criminal charge,

..........it will have a negative impact on the national economy,

......... perhaps even the world economy,"

...............................................................................

And it's not just......theory

The New York Times reported last year,

- they actually declined to prosecute HSBC

- for flagrant, ....years-long violations.... of money-laundering laws,

- out of fear that doing so .......would hurt the global economy.

http://www.huffingtonpost.com/2013/03/06/eric-holder-banks-too-big_n_2821741.html

...............................................................................

So there is.... the LAW

- but.. it doesn't apply to... Bankster Corporations...or their Senior Partners/Directors etc

- the banksters DO have.....a carte blance...."get out of jail free" card

(& it's got....no expirey)

This is... THE... US Attorney General ....Testifying to - THE US Senate

- And as you can see in the bottom part, it's not just - a worry - that

- it could happen

- HSBC proves it... IS.... happening.

..............................................................................

When

- the Attorney General .....of the United States admits

- some banks

..... are simply too big to prosecute,

- it might be time to admit ......we have a problem

(and that goes for both the financial and..... justice systems).

Eric Holder made this........ rather startling... confession

- in testimony .......before the Senate Judiciary Committee on Wednesday,

"I am concerned that the size of some of these institutions becomes so large that......

- it does become difficult... for us......... to prosecute them

- if you do bring a criminal charge,

..........it will have a negative impact on the national economy,

......... perhaps even the world economy,"

...............................................................................

And it's not just......theory

The New York Times reported last year,

- they actually declined to prosecute HSBC

- for flagrant, ....years-long violations.... of money-laundering laws,

- out of fear that doing so .......would hurt the global economy.

http://www.huffingtonpost.com/2013/03/06/eric-holder-banks-too-big_n_2821741.html

...............................................................................

So there is.... the LAW

- but.. it doesn't apply to... Bankster Corporations...or their Senior Partners/Directors etc

gazkaz - 22 Oct 2013 14:19 - 852 of 1034

Eric Sptotts observations

"There is an interesting thing going on there, Eric

We get data out of India.

- They consumed slightly less than 2,000 tons ...of silver late year.

- It would appear they are going to consume...... 6,000 tons this year....

"It might be a little early for me to say that because as gold has been restricted, that number might even..... be well above..... that (total of 6,000 tons of silver).

- In the first 8 months there were something like 4,000 tons (already consumed), so we are just extrapolating that trend,

but .....the trend was gaining strength as the year went on.

But when you (as India) buy an ......extra 4,000 tons..... of silver in a year,

- you are buying......... an extra 17%

- of the (entire global) market.

So we have a new entrant into the (silver) market who takes down...... 17% of the supply, and...... the price goes down.

- It’s the same analogy as China buying gold. They (China) buy 25% more of the (entire global) market and the price (of gold) goes down.

Those things don’t hold together. .........Logically this should not happen

(the price of silver going down).

So, I’m very optimistic on.... silver.

The US Mint silver sales have just been booming here.

- They are still 50/1.... in terms of the physical relationship to gold at the US Mint.

- We (only) produce ..11-times ...more silver (than gold).

- We (only) have about... 3-times ....more silver (available) for investment,

- and yet investors, via the (US) Mint, are buying it at.... a 50/1 ratio to gold.

That cannot persist too long without the price of silver going..... up

.....(substantially)."

"There is an interesting thing going on there, Eric

We get data out of India.

- They consumed slightly less than 2,000 tons ...of silver late year.

- It would appear they are going to consume...... 6,000 tons this year....

"It might be a little early for me to say that because as gold has been restricted, that number might even..... be well above..... that (total of 6,000 tons of silver).

- In the first 8 months there were something like 4,000 tons (already consumed), so we are just extrapolating that trend,

but .....the trend was gaining strength as the year went on.

But when you (as India) buy an ......extra 4,000 tons..... of silver in a year,

- you are buying......... an extra 17%

- of the (entire global) market.

So we have a new entrant into the (silver) market who takes down...... 17% of the supply, and...... the price goes down.

- It’s the same analogy as China buying gold. They (China) buy 25% more of the (entire global) market and the price (of gold) goes down.

Those things don’t hold together. .........Logically this should not happen

(the price of silver going down).

So, I’m very optimistic on.... silver.

The US Mint silver sales have just been booming here.

- They are still 50/1.... in terms of the physical relationship to gold at the US Mint.

- We (only) produce ..11-times ...more silver (than gold).

- We (only) have about... 3-times ....more silver (available) for investment,

- and yet investors, via the (US) Mint, are buying it at.... a 50/1 ratio to gold.

That cannot persist too long without the price of silver going..... up

.....(substantially)."

gazkaz - 22 Oct 2013 15:36 - 853 of 1034

GLD ETF now 882.23 metric tonnes,

DOWN 467.69 metric tonnes

- or 34.65% year-to-date.

•The Sprott Physical Gold Trust (PHYS) Down..... 1.3% year-to-date.

•The iShares Silver Trust (SLV) held 10,084.96 metric tonnes of silver on 12/31/12. YET with the silver price down 28% year-to-date,

- the SLV shows an "inventory" of 10,391.35 metric tonnes,

UP 3% year-to-date.

......................................................................................................................

Last Wed'Thur - GLD - lost.... 6.9....Tonnes

JP Morgue....Eligible...Shot up...4 tiny oz short of exactly 6 Tonnes

The 3 Major Comex players have only actually got skin in the game to a Grand Total Of Dealer Inventory of

i) Scotia: 162,121.611 oz ....or 5.043 tonnes

ii) HSBC: 131,673.323. oz.... or 4.09 tonnes

iii) JPMorgan: 283,102.634 oz.... or 8.805 tonnes

(Total App 18 Tonnes)

Just 18 Tiny Tonnes - plays the COMEX Market......when 6.9 Tonnes

- moves ....in ONE DAY

......................................................................................................................

If my memory serves me correctly - around 6 months ago - a Huuuuge 10% ish of GLD shares had been.....borrowed....and then sold......or more interestingly

REDEEMED in 100,000 share baskets.....for physical

In round figures GLD is 800 tonnes by way of gold backing their shares

- if 10% OF THE SHARES HAVE BEEN BORROWED AND SOLD

- There are 10% more holders....than there is gold backing their shates

- 10% of 800 tonnes therefore equals

- 80 "phantom" tonnes of gold

In terms of a 2400 tonnes mine production p.a

- thats a huge 3% equivalent in annual mine production....of "Phantom Physical Gold"

- just in respect of...just the GLD ETF

........................................................................................................................

Musing thought

So Sprott physical has lost just over 1% physical ytd, yet

GLD has Lost ..............................35%

& GLD has 80+ tonnes of...."phantom gold" backed shares washing around

And the Big Three Comex Bank.....are playing the international gold Comex Market

- with a tiny dealer inventory..... between them of

-....just 18 tonnes

And as seen above SEVEN tonnes can move...in ONE day

Add to that the B of E - had 1,300 tonnes difference in its published figures......just go walkabout :o)

Plus Comex Gold inventory (Dealer & Customer) - has totally fallen off a cliff ytd

.......................................................................................................................

Whilst true demand for real gold - has been subdued by

- unallocated gold accounts,

- gold tracking products

- unbacked Gold ETFs

- Gold backed ETFs

- spot/futures/options dealing

There is currently still a staggering demand for actual physical

China & India alone - will account for the whole 2,400 tonne newly mined output this year.

- So where is all the gold supplying Rssia and a long list of other sovereign buyers coming from

- The US & Canadian mints sales- account for more than all the gold mined in the US & Canada tis year

- and even that mine output figure has already been counted - as taken by China & India in te above 2,400 world mining output figure.

- and ....US & Canadian - "Private" mints - sell several multiples worth....of what the National Mints themselves Sell

- And refineries were working 24/7 and running 6/8 week delivery delays

And you know the rest on....... the huuuuuge demand side

So whee is all the gold coming from ?????

........................................................................................................................

Do you really think this .....ever really ended ?

In his book “Gold Wars”, Swiss banker Ferdinand Lips

- wrote:

“It was decided to keep the gold pool.... secret at the time.

- Keeping with.... traditional practices...... at the BIS meetings,

- not a scrap of paper... was initialed

- or even exchanged;

- the word of each governor was as binding as any contract”.

(Lipps, Gold Wars, 2001: pg 53)

......................................................................................................................

DOWN 467.69 metric tonnes

- or 34.65% year-to-date.

•The Sprott Physical Gold Trust (PHYS) Down..... 1.3% year-to-date.

•The iShares Silver Trust (SLV) held 10,084.96 metric tonnes of silver on 12/31/12. YET with the silver price down 28% year-to-date,

- the SLV shows an "inventory" of 10,391.35 metric tonnes,

UP 3% year-to-date.

......................................................................................................................

Last Wed'Thur - GLD - lost.... 6.9....Tonnes

JP Morgue....Eligible...Shot up...4 tiny oz short of exactly 6 Tonnes

The 3 Major Comex players have only actually got skin in the game to a Grand Total Of Dealer Inventory of

i) Scotia: 162,121.611 oz ....or 5.043 tonnes

ii) HSBC: 131,673.323. oz.... or 4.09 tonnes

iii) JPMorgan: 283,102.634 oz.... or 8.805 tonnes

(Total App 18 Tonnes)

Just 18 Tiny Tonnes - plays the COMEX Market......when 6.9 Tonnes

- moves ....in ONE DAY

......................................................................................................................

If my memory serves me correctly - around 6 months ago - a Huuuuge 10% ish of GLD shares had been.....borrowed....and then sold......or more interestingly

REDEEMED in 100,000 share baskets.....for physical

In round figures GLD is 800 tonnes by way of gold backing their shares

- if 10% OF THE SHARES HAVE BEEN BORROWED AND SOLD

- There are 10% more holders....than there is gold backing their shates

- 10% of 800 tonnes therefore equals

- 80 "phantom" tonnes of gold

In terms of a 2400 tonnes mine production p.a

- thats a huge 3% equivalent in annual mine production....of "Phantom Physical Gold"

- just in respect of...just the GLD ETF

........................................................................................................................

Musing thought

So Sprott physical has lost just over 1% physical ytd, yet

GLD has Lost ..............................35%

& GLD has 80+ tonnes of...."phantom gold" backed shares washing around

And the Big Three Comex Bank.....are playing the international gold Comex Market

- with a tiny dealer inventory..... between them of

-....just 18 tonnes

And as seen above SEVEN tonnes can move...in ONE day

Add to that the B of E - had 1,300 tonnes difference in its published figures......just go walkabout :o)

Plus Comex Gold inventory (Dealer & Customer) - has totally fallen off a cliff ytd

.......................................................................................................................

Whilst true demand for real gold - has been subdued by

- unallocated gold accounts,

- gold tracking products

- unbacked Gold ETFs

- Gold backed ETFs

- spot/futures/options dealing

There is currently still a staggering demand for actual physical

China & India alone - will account for the whole 2,400 tonne newly mined output this year.

- So where is all the gold supplying Rssia and a long list of other sovereign buyers coming from

- The US & Canadian mints sales- account for more than all the gold mined in the US & Canada tis year

- and even that mine output figure has already been counted - as taken by China & India in te above 2,400 world mining output figure.

- and ....US & Canadian - "Private" mints - sell several multiples worth....of what the National Mints themselves Sell

- And refineries were working 24/7 and running 6/8 week delivery delays

And you know the rest on....... the huuuuuge demand side

So whee is all the gold coming from ?????

........................................................................................................................

Do you really think this .....ever really ended ?

In his book “Gold Wars”, Swiss banker Ferdinand Lips

- wrote:

“It was decided to keep the gold pool.... secret at the time.

- Keeping with.... traditional practices...... at the BIS meetings,

- not a scrap of paper... was initialed

- or even exchanged;

- the word of each governor was as binding as any contract”.

(Lipps, Gold Wars, 2001: pg 53)

......................................................................................................................

gazkaz - 23 Oct 2013 08:22 - 854 of 1034

'Aint no stoppin' 'em now

- US just removes the debt ceiling limit

- and now....

FITCH revises the rating goalposts....just for the US

(Can't have US T-Bonds falling out the....acceptable collateral category...into just junk-bonds...can we :o)

................................................................................

Fitch Ratings says in a new report that even for a sovereign with

- the strongest credit fundamentals,

- there will be a gross general government debt (GGGD)/GDP level above which

- Fitch believes its rating is no longer compatible..... with 'AAA'.

This is usually.... 80%-90%,

- but (There it is - the famour US "but" get out)

- can be higher .......for sovereigns

- with exceptional financing flexibility,

- such as benchmark borrowers with...(Here we go).... reserve currency status.

As we have highlighted before, for France, Germany and the UK,

- this threshold is ......currently....... 90%-100%,

- and (Drum Roll).... for the US,

- it is currently 110%,

provided debt is... then placed... on a firm downward path over the medium term.

(& I would imagine... downward path....in Fitch definition is

- can keep going up and up with a prospect of ....still going up & up, but more slowly...at ....some point)

........................................................................................................................

And just in case - FITCH needs another get out of downgrading the US card to play.....here comes "Leeway" and "Temporary" too)

............................................................................................................................

"Fitch... gives... a 'AAA' rated sovereign

- some leeway

- in allowing a temporary rise

in its GGGD/GDP ratio before a downgrade".

- US just removes the debt ceiling limit

- and now....

FITCH revises the rating goalposts....just for the US

(Can't have US T-Bonds falling out the....acceptable collateral category...into just junk-bonds...can we :o)

................................................................................

Fitch Ratings says in a new report that even for a sovereign with

- the strongest credit fundamentals,

- there will be a gross general government debt (GGGD)/GDP level above which

- Fitch believes its rating is no longer compatible..... with 'AAA'.

This is usually.... 80%-90%,

- but (There it is - the famour US "but" get out)

- can be higher .......for sovereigns

- with exceptional financing flexibility,

- such as benchmark borrowers with...(Here we go).... reserve currency status.

As we have highlighted before, for France, Germany and the UK,

- this threshold is ......currently....... 90%-100%,

- and (Drum Roll).... for the US,

- it is currently 110%,

provided debt is... then placed... on a firm downward path over the medium term.

(& I would imagine... downward path....in Fitch definition is

- can keep going up and up with a prospect of ....still going up & up, but more slowly...at ....some point)

........................................................................................................................

And just in case - FITCH needs another get out of downgrading the US card to play.....here comes "Leeway" and "Temporary" too)

............................................................................................................................

"Fitch... gives... a 'AAA' rated sovereign

- some leeway

- in allowing a temporary rise

in its GGGD/GDP ratio before a downgrade".

gazkaz - 23 Oct 2013 08:31 - 855 of 1034

Eric SPROTT

- highlights that the Gold Industry WGC....doesn't ...really work for ..THE Industry's benefit

- and....fiddles the figures.....to the detriment...of - The Industry

.......................................................................................................................

To illustrate my point, Table 1 below contrasts mine production with demand from some of the world’s largest gold consumers.

- According to WGC/GFMS data, the world will mine, on an annualized basis, about 2,800 tonnes of gold for 2013.

But, I adjusted these figures

- to reflect mine production from China and Russia,

- which never leaves the country and is used solely to satisfy domestic demand.

After adjustments, we have a total world mine supply of about ...2,140 tonnes.

(Sprott - then calculates REAL DEMAND at .......5,184 Tonnes)

http://www.zerohedge.com/news/2013-10-22/eric-sprotts-open-letter-world-gold-council

http://www.zerohedge.com/news/2013-10-22/eric-sprotts-open-letter-world-gold-council

And what happens to prices.....when

- demand rockets up

- to more than....double supply

- of course.....prices tank :o)

Yes that's the law of supply & demand

(At least in the world of...secret........."London Gold Pool" style markets)

- highlights that the Gold Industry WGC....doesn't ...really work for ..THE Industry's benefit

- and....fiddles the figures.....to the detriment...of - The Industry

.......................................................................................................................

To illustrate my point, Table 1 below contrasts mine production with demand from some of the world’s largest gold consumers.

- According to WGC/GFMS data, the world will mine, on an annualized basis, about 2,800 tonnes of gold for 2013.

But, I adjusted these figures

- to reflect mine production from China and Russia,

- which never leaves the country and is used solely to satisfy domestic demand.

After adjustments, we have a total world mine supply of about ...2,140 tonnes.

(Sprott - then calculates REAL DEMAND at .......5,184 Tonnes)

http://www.zerohedge.com/news/2013-10-22/eric-sprotts-open-letter-world-gold-council

http://www.zerohedge.com/news/2013-10-22/eric-sprotts-open-letter-world-gold-councilAnd what happens to prices.....when

- demand rockets up

- to more than....double supply

- of course.....prices tank :o)

Yes that's the law of supply & demand

(At least in the world of...secret........."London Gold Pool" style markets)

gazkaz - 24 Oct 2013 10:11 - 856 of 1034

Paints a story

- in the past (although no real indication of the future, as they say)

- when the "net commercial position" gets around this sort of....territory

- a noticeable rally ....tends...to ensue thereafter,

once the net position has completed its climb towards "net neutral/0"....and turned the corner

- in the past (although no real indication of the future, as they say)

- when the "net commercial position" gets around this sort of....territory

- a noticeable rally ....tends...to ensue thereafter,

once the net position has completed its climb towards "net neutral/0"....and turned the corner

gazkaz - 24 Oct 2013 10:22 - 857 of 1034

Incidentally - re GLD - (potentially being raided and raped of it's physical)

- GLD a few days back lost just under 11 Tonnes.....in one day

Ball park wise - that's around 1.3% of its total holding

- in ONE DAY

Recollect a few posts back..Sprott Physical ETF

(General opinion ....backed by real tangible physical)

Lost just 1.3% .....in the whole YEAR to date

- GLD a few days back lost just under 11 Tonnes.....in one day

Ball park wise - that's around 1.3% of its total holding

- in ONE DAY

Recollect a few posts back..Sprott Physical ETF

(General opinion ....backed by real tangible physical)

Lost just 1.3% .....in the whole YEAR to date

gazkaz - 24 Oct 2013 13:17 - 858 of 1034

Just - interesting....going back a couple of years ...but still interesting

A new report prepared for Prime Minister Putin by the Federal Security Service (FSB) says that former International Monetary Fund (IMF) Chief

- Dominique Strauss-Kahn

- was charged and jailed in the US for sex crimes on May 14th

- after his discovery that

- all of the gold held in the United States Bullion Depository located at Fort Knox was ‘missing and/or unaccounted’ for.

http://www.eutimes.net/2011/05/russia-says-imf-chief-jailed-for-discovering-all-us-gold-is-gone/

According to this FSB secret report, Strauss-Kahn had become “increasingly concerned” earlier this month

- after the United States began........ “stalling”

- its pledged delivery to....... the IMF of 191.3 tons of gold

(agreed to under the Second Amendment of the Articles of Agreement signed by the Executive Board in April 1978 that were to be sold to fund what are called Special Drawing Rights (SDRs) as an alternative to what are called reserve currencies).

.......................................................................................................................

Coincidentally - The IMF's own WEB PAGE makes mention of exactly the 191.3 tons mentioned above

http://www.imf.org/external/np/exr/facts/gold.htm

Quote

"In February 2010, the IMF announced the beginning of sales of gold on the market. At that time, a total of .....191.3 tons of gold remained to be sold.

In order to avoid disrupting the gold market, the on market sales were to be conducted in a phased manner over time.

.......................................................................................................................

Of course "the bad guys" - have much more time and resources

- to create strawman style dis-info

- than the good guys have in searching for.....the truth.

But - the WORLD BANK - table I posted a little while back - had US total reserves inclusive of...GOLD (At Market price - ie NOT the oft quoted $35 FEDy figure)....at a grand total figure

- which was - way below just what ...the gold value alone ....should have significantly exceeded .

Silly example (to illustrate the above)

- "alleged" market value of US Gold Reserves $1,000

- but the world bank total of ...all US reserves (Inc Gold & at prevailing market price)

- showing as only.. totalling... $500

- ie the above alleged gold alone should....have given a Total Reserve Holding....

- exceeding the $1,000 (used in this example)

.......................................................................................................................

It's some while since I posted it (in the other place) so it's from memory

- but an alleged credible eye witness....logged (in para phrase)...convoys of large tonnage lorries...leaving Ft.Knox,... fully loaded

- around a couple of years....after...Nixon ....closed the US Gold Window.

(Destination.....Unknown :o)

A new report prepared for Prime Minister Putin by the Federal Security Service (FSB) says that former International Monetary Fund (IMF) Chief

- Dominique Strauss-Kahn

- was charged and jailed in the US for sex crimes on May 14th

- after his discovery that

- all of the gold held in the United States Bullion Depository located at Fort Knox was ‘missing and/or unaccounted’ for.

http://www.eutimes.net/2011/05/russia-says-imf-chief-jailed-for-discovering-all-us-gold-is-gone/

According to this FSB secret report, Strauss-Kahn had become “increasingly concerned” earlier this month

- after the United States began........ “stalling”

- its pledged delivery to....... the IMF of 191.3 tons of gold

(agreed to under the Second Amendment of the Articles of Agreement signed by the Executive Board in April 1978 that were to be sold to fund what are called Special Drawing Rights (SDRs) as an alternative to what are called reserve currencies).

.......................................................................................................................

Coincidentally - The IMF's own WEB PAGE makes mention of exactly the 191.3 tons mentioned above

http://www.imf.org/external/np/exr/facts/gold.htm

Quote

"In February 2010, the IMF announced the beginning of sales of gold on the market. At that time, a total of .....191.3 tons of gold remained to be sold.

In order to avoid disrupting the gold market, the on market sales were to be conducted in a phased manner over time.

.......................................................................................................................

Of course "the bad guys" - have much more time and resources

- to create strawman style dis-info

- than the good guys have in searching for.....the truth.

But - the WORLD BANK - table I posted a little while back - had US total reserves inclusive of...GOLD (At Market price - ie NOT the oft quoted $35 FEDy figure)....at a grand total figure

- which was - way below just what ...the gold value alone ....should have significantly exceeded .

Silly example (to illustrate the above)

- "alleged" market value of US Gold Reserves $1,000

- but the world bank total of ...all US reserves (Inc Gold & at prevailing market price)

- showing as only.. totalling... $500

- ie the above alleged gold alone should....have given a Total Reserve Holding....

- exceeding the $1,000 (used in this example)

.......................................................................................................................

It's some while since I posted it (in the other place) so it's from memory

- but an alleged credible eye witness....logged (in para phrase)...convoys of large tonnage lorries...leaving Ft.Knox,... fully loaded

- around a couple of years....after...Nixon ....closed the US Gold Window.

(Destination.....Unknown :o)

gazkaz - 25 Oct 2013 20:32 - 859 of 1034

One of my contacts with one of the largest European precious metals brokers told me this morning that

- they could not find... any... silver.

All the refiners they contacted

- could not take their orders

- and could not give any delay.

“Call us next next month”, they said.

( This is the first time that such an event has occurred).

On Wednesday, he attempted to source a ton of silver (32,000 oz),

- from... the... three main Swiss refiners.

- Two of them .....refused to take the order entirely,

- and the third refiner stated delivery would take 2 weeks.

The refiners claimed they had been very busy during the last month trying to fulfill an...... “enormous” Chinese order.

(Cyrille Jubert, Author of Silver Throughout History)

- they could not find... any... silver.

All the refiners they contacted

- could not take their orders

- and could not give any delay.

“Call us next next month”, they said.

( This is the first time that such an event has occurred).

On Wednesday, he attempted to source a ton of silver (32,000 oz),

- from... the... three main Swiss refiners.

- Two of them .....refused to take the order entirely,

- and the third refiner stated delivery would take 2 weeks.

The refiners claimed they had been very busy during the last month trying to fulfill an...... “enormous” Chinese order.

(Cyrille Jubert, Author of Silver Throughout History)

gazkaz - 25 Oct 2013 20:53 - 860 of 1034

Rememer a few months back - Comex suddenly added a disclaimer

- to its published figures

- to the effect we don't check..we just publish what the Banksters tell us

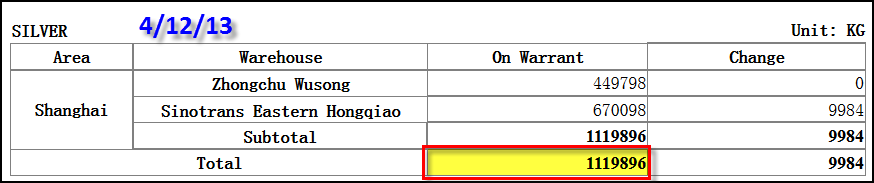

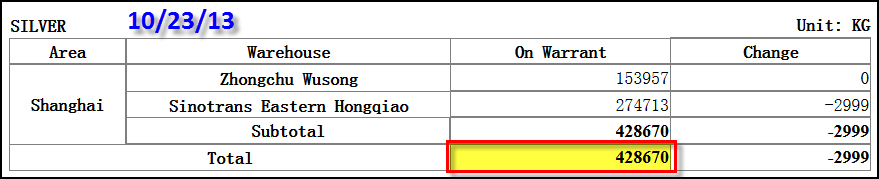

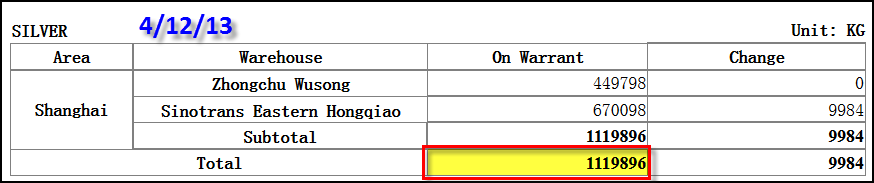

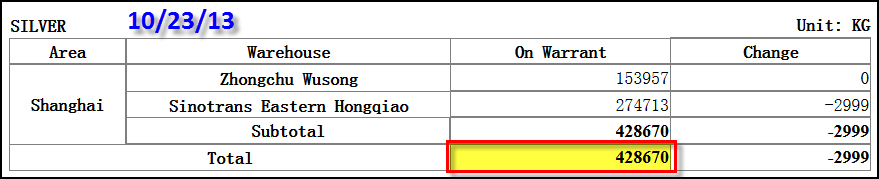

Have a look at Shanghai - silver stocks...."trend"

So In a little more than a half a year,

- the silver stocks at the Shanghai warehouses

- have declined 692 tonnes

- or 62% - of their total before the April 12th silver & gold price take-down

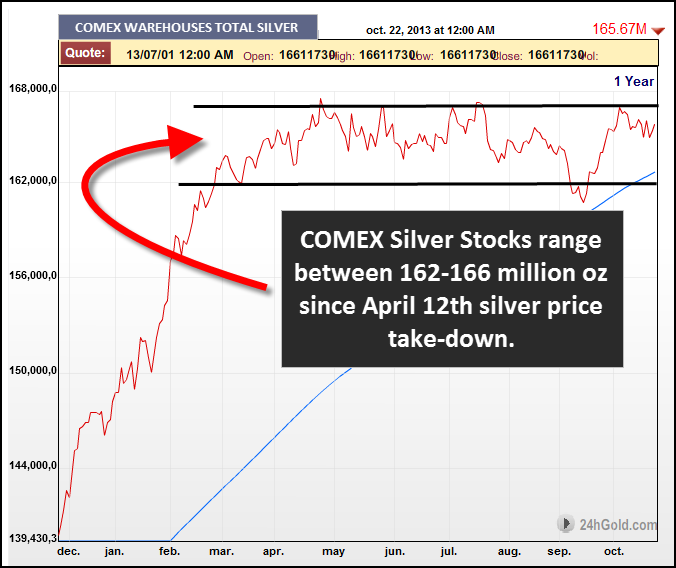

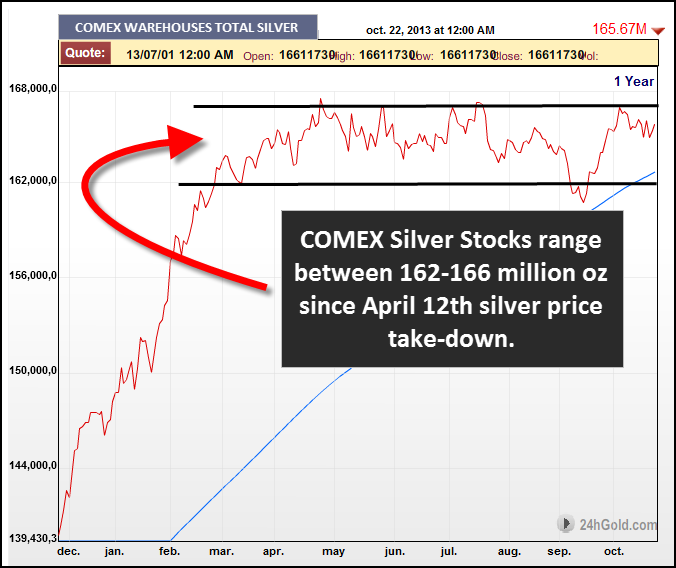

So after having seen the huuuuuge.....plummet in Shanghai Silver Stocks

- what would you expect to see happening....

- to Comex Silver Stock

- over broadly the smae period ??

Very much in the...

Very much in the...

- "No change here boys & girls.....just steady as you go. Move along, nothing to see here"

Genre

Perhaps Comex

- added the "they could be telling us a load of old tosh...for us to publish"

Disclaimer....for a reason

- to its published figures

- to the effect we don't check..we just publish what the Banksters tell us

Have a look at Shanghai - silver stocks...."trend"

So In a little more than a half a year,

- the silver stocks at the Shanghai warehouses

- have declined 692 tonnes

- or 62% - of their total before the April 12th silver & gold price take-down

So after having seen the huuuuuge.....plummet in Shanghai Silver Stocks

- what would you expect to see happening....

- to Comex Silver Stock

- over broadly the smae period ??

Very much in the...

Very much in the... - "No change here boys & girls.....just steady as you go. Move along, nothing to see here"

Genre

Perhaps Comex

- added the "they could be telling us a load of old tosh...for us to publish"

Disclaimer....for a reason

gazkaz - 25 Oct 2013 21:12 - 861 of 1034

In addition, all the old....... French silver coins

- seem to have vanished.

My contacts who used to trade..... 500 kilos a day between 2007 and 2011,

- told me in spring 2012, that they..... didn’t trade this amount.... in a month.

For the past 6 months,

- the coins dealers have had ........no French silver coins to sell

(and even the black market..... seems to be completely dry).

Cyrille Jubert,

Author of Silver Throughout History

- seem to have vanished.

My contacts who used to trade..... 500 kilos a day between 2007 and 2011,

- told me in spring 2012, that they..... didn’t trade this amount.... in a month.

For the past 6 months,

- the coins dealers have had ........no French silver coins to sell

(and even the black market..... seems to be completely dry).

Cyrille Jubert,

Author of Silver Throughout History

gazkaz - 25 Oct 2013 21:45 - 862 of 1034

Gold & Silver bars - very rarely meet the "perfect" good delivery weight, to the exact round ounce.....and are in fact quoted by weight

- right down to 3 decimal places

So the odds of getting a delivery to the perfect round.... XXX.000 oz

- is statistically odds of.....a thousand : one

Well last Friday

JPM eligible addition was a flat, round number.

- Not only that, the round number in question is 192,900.000 troy ounces.

- What is so significant about that number?

- Well, the generally-accepted number of ounces in a metric ton is 32,150.

- If you multiply that number by six, you get 192,900.

So, last Friday,

JPMorgan booked into their eligible account exactly and precisely six metric tonnes of gold........right down to three decimal places - 192,000.000

(getting all those odd weigh bars to exactly to the perfect round oz of .000 must have been a challenge.....1,000 : 1 odds in fact)

But hold on....on this Monday

Not only did JPMorgan magically book in......... another

- precise and round number,

- the actual increase in eligible gold was reported as 96,450.000 ounces.

(You’re probably pretty good with math so I imagine you’ve already figured out)

- that that is precisely three metric tonnes.

- again to the perfect round oz .000

- that on it's own is odds of ......1,000 :1

So two days running.....odds of 1,000,000 :1

What's the odds of a ....Hat Trick ??

What do you think we saw on Weds ?

- Could JPMorgan have the audacity to report another perfect to the exact round ounce.....another number multiple of metric tons ?

- Nope.

- They simply reported.... one single metric ton !

- Again, nothing to the right... of the decimal point.

- Just 32,150.000 troy ounces, ......exact and on the nose to 3 decimal places

So that makes hat trick running odds of.....1,000,000,000 :1

Anybody thinkg - the Physical - wasn't delivered by pallet & forlift truck

- more likely fantasy paper metal....delivered in...an envelope

The reason Comex - added the disclaimer becoming even more....evident ???

Recall that back in 2007, Morgan Stanley

- paid $4.4MM to customers to settle a lawsuit

- brought by customers who had been charged storage fees on....... paper metal.

http://www.reuters.com/article/2007/06/12/idUSN1228014520070612

Old habbits ....die hard perhaps

- right down to 3 decimal places

So the odds of getting a delivery to the perfect round.... XXX.000 oz

- is statistically odds of.....a thousand : one

Well last Friday

JPM eligible addition was a flat, round number.

- Not only that, the round number in question is 192,900.000 troy ounces.

- What is so significant about that number?

- Well, the generally-accepted number of ounces in a metric ton is 32,150.

- If you multiply that number by six, you get 192,900.

So, last Friday,

JPMorgan booked into their eligible account exactly and precisely six metric tonnes of gold........right down to three decimal places - 192,000.000

(getting all those odd weigh bars to exactly to the perfect round oz of .000 must have been a challenge.....1,000 : 1 odds in fact)

But hold on....on this Monday

Not only did JPMorgan magically book in......... another

- precise and round number,

- the actual increase in eligible gold was reported as 96,450.000 ounces.

(You’re probably pretty good with math so I imagine you’ve already figured out)

- that that is precisely three metric tonnes.

- again to the perfect round oz .000

- that on it's own is odds of ......1,000 :1

So two days running.....odds of 1,000,000 :1

What's the odds of a ....Hat Trick ??

What do you think we saw on Weds ?

- Could JPMorgan have the audacity to report another perfect to the exact round ounce.....another number multiple of metric tons ?

- Nope.

- They simply reported.... one single metric ton !

- Again, nothing to the right... of the decimal point.

- Just 32,150.000 troy ounces, ......exact and on the nose to 3 decimal places

So that makes hat trick running odds of.....1,000,000,000 :1

Anybody thinkg - the Physical - wasn't delivered by pallet & forlift truck

- more likely fantasy paper metal....delivered in...an envelope

The reason Comex - added the disclaimer becoming even more....evident ???

Recall that back in 2007, Morgan Stanley

- paid $4.4MM to customers to settle a lawsuit

- brought by customers who had been charged storage fees on....... paper metal.

http://www.reuters.com/article/2007/06/12/idUSN1228014520070612

Old habbits ....die hard perhaps