| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

gazkaz - 30 Oct 2013 08:44 - 867 of 1034

John Emby's opinion

Q: “John, you remember how the prices of gold and silver exploded roughly six times higher in price in the early 1970s as the London Gold Pool was overrun.

- Are we nearing a point where this latest Western ‘Gold Pool’ is going to be overrun?”

Embry:

- “Yes, but this time the fundamentals.... for higher gold and silver prices

- are ...materially better... than they were in the 1970s.

The other thing that doesn’t exist today is the capacity for doing what Paul Volcker did in 1980, and that is to hike interest rates to remove inflationary expectations.

This means

- that when the next inflation gets going... there will be no way to stop it.

So, on that premise the gold and silver prices are headed significantly higher

-- far beyond ...what 99% of the population ...thinks is possible.”

Embry added: “I just want to add that Andrew Maguire is exposing the truth about the true state of the gold market, and how vulnerable the paper gold Ponzi scheme is. The bottom line is gold and silver are going multiples higher than they are now, and he will be proven correct about the LBMA paper system imploding.”

Q: “John, you remember how the prices of gold and silver exploded roughly six times higher in price in the early 1970s as the London Gold Pool was overrun.

- Are we nearing a point where this latest Western ‘Gold Pool’ is going to be overrun?”

Embry:

- “Yes, but this time the fundamentals.... for higher gold and silver prices

- are ...materially better... than they were in the 1970s.

The other thing that doesn’t exist today is the capacity for doing what Paul Volcker did in 1980, and that is to hike interest rates to remove inflationary expectations.

This means

- that when the next inflation gets going... there will be no way to stop it.

So, on that premise the gold and silver prices are headed significantly higher

-- far beyond ...what 99% of the population ...thinks is possible.”

Embry added: “I just want to add that Andrew Maguire is exposing the truth about the true state of the gold market, and how vulnerable the paper gold Ponzi scheme is. The bottom line is gold and silver are going multiples higher than they are now, and he will be proven correct about the LBMA paper system imploding.”

gazkaz - 30 Oct 2013 08:47 - 868 of 1034

Doesn't look to....bode well.....as to where the roller coaster...may be heading

Adjusting that for inflation.....makes the amount of leveraged money.....even more apparent

Adjusting that for inflation.....makes the amount of leveraged money.....even more apparent

- if /when...they start heading for the exits

- the margin losses could prove to be .....a biblical type experience for many

- if/when - they start snowballing - & selling accross the shere...to cover margin losses

-could be....another one for the history books

Adjusting that for inflation.....makes the amount of leveraged money.....even more apparent

Adjusting that for inflation.....makes the amount of leveraged money.....even more apparent- if /when...they start heading for the exits

- the margin losses could prove to be .....a biblical type experience for many

- if/when - they start snowballing - & selling accross the shere...to cover margin losses

-could be....another one for the history books

gazkaz - 30 Oct 2013 09:07 - 869 of 1034

Von Greyez thoughts

But what is very interesting is that

- while the US stock market is making new highs,

- many European stock markets are well below their 1999/2000 highs.

The principle reason for this is that the US has printed so much more money than Europe, and a lot of this liquidity has gone into the US stock market.

According to the Nobel Prize winner, Schiller,

- the inflation-adjusted S&P 500 Index is now at..... a P/E of 25,

- which is the highest at any time since 1929.

So, the reality is that, technically,

- the European markets look set up for....... a major and long-lasting decline,

- and the US is very near the end of a bull market, with horrific consequences for the US and for the world.

But inflation will not remain subdued for much longer.

- As soon as the velocity of money accelerates, inflation will super-surge, and that is likely to start in 2014.

- The trigger for the turnaround in the US economy will be the fall of the US dollar.

A reserve currency cannot be based on debt ...that is increasing exponentially,

and this is why..... the world will soon dump the dollar at an accelerated pace.

It is this fall of the dollar which will be the trigger for the major economic decline. The stock market will fall,

- bonds will fall,

- and the money printing and the velocity of money will go up dramatically.

This will be the beginning of a hyperinflationary depression.

As the dollar falls, so will the euro, yen, and the pound, but at a slower rate. This is all part of the race to the bottom for these currencies.

But the fall of the dollar should not be measured in other currencies, instead it should be measured in gold.

- And gold will soon start an exponential rise..... measured in paper money.”

Greyerz added:

“Looking at gold demand from India and China, it continues unabated.

- Premiums in the Indian market reached $100 per ounce last week.

This is an indication of a massive shortage of supply.

Meanwhile, the UK has exported well over 1,000 tons of gold to Switzerland in just the first eight months of this year.

(This was against only 85 tons last year).

This is yet more proof of the demand for gold being so much greater than the production, - as Eric Sprott recently explained in his letter to the World Gold Council.

But the reason for this massive increase in gold going from the UK, which produces virtually no gold, to Switzerland, is the fact that the Swiss refiners could not get enough supply from the mining companies -- so they had to buy from the bullion banks.

And London has the biggest concentration of 400-ounce gold bars in the world, with a large stash of central bank gold being stored there.

- And this central bank gold .....is leased into the market.

But now a lot of it is gone to the East, via Switzerland and Swiss refiners.

This clearly emphasizes that there is a massive shortage of physical gold.

- And when the holders of paper gold demand delivery,

- there will be........ the most spectacular surge in the gold price.

The good news for gold bulls is the start of that historic rise is

- not far away.... in my view.”

But what is very interesting is that

- while the US stock market is making new highs,

- many European stock markets are well below their 1999/2000 highs.

The principle reason for this is that the US has printed so much more money than Europe, and a lot of this liquidity has gone into the US stock market.

According to the Nobel Prize winner, Schiller,

- the inflation-adjusted S&P 500 Index is now at..... a P/E of 25,

- which is the highest at any time since 1929.

So, the reality is that, technically,

- the European markets look set up for....... a major and long-lasting decline,

- and the US is very near the end of a bull market, with horrific consequences for the US and for the world.

But inflation will not remain subdued for much longer.

- As soon as the velocity of money accelerates, inflation will super-surge, and that is likely to start in 2014.

- The trigger for the turnaround in the US economy will be the fall of the US dollar.

A reserve currency cannot be based on debt ...that is increasing exponentially,

and this is why..... the world will soon dump the dollar at an accelerated pace.

It is this fall of the dollar which will be the trigger for the major economic decline. The stock market will fall,

- bonds will fall,

- and the money printing and the velocity of money will go up dramatically.

This will be the beginning of a hyperinflationary depression.

As the dollar falls, so will the euro, yen, and the pound, but at a slower rate. This is all part of the race to the bottom for these currencies.

But the fall of the dollar should not be measured in other currencies, instead it should be measured in gold.

- And gold will soon start an exponential rise..... measured in paper money.”

Greyerz added:

“Looking at gold demand from India and China, it continues unabated.

- Premiums in the Indian market reached $100 per ounce last week.

This is an indication of a massive shortage of supply.

Meanwhile, the UK has exported well over 1,000 tons of gold to Switzerland in just the first eight months of this year.

(This was against only 85 tons last year).

This is yet more proof of the demand for gold being so much greater than the production, - as Eric Sprott recently explained in his letter to the World Gold Council.

But the reason for this massive increase in gold going from the UK, which produces virtually no gold, to Switzerland, is the fact that the Swiss refiners could not get enough supply from the mining companies -- so they had to buy from the bullion banks.

And London has the biggest concentration of 400-ounce gold bars in the world, with a large stash of central bank gold being stored there.

- And this central bank gold .....is leased into the market.

But now a lot of it is gone to the East, via Switzerland and Swiss refiners.

This clearly emphasizes that there is a massive shortage of physical gold.

- And when the holders of paper gold demand delivery,

- there will be........ the most spectacular surge in the gold price.

The good news for gold bulls is the start of that historic rise is

- not far away.... in my view.”

gazkaz - 31 Oct 2013 19:06 - 870 of 1034

We all know the US Banks have since near dawn of time itself - been forever net short the precious metal....and net short to a significantly higher ratio, than the non-US banks

- the.. non US banks.. traditionally run around a ratio of 1 : 2 Gross Shorts to Gross Long

But as we know the US banks in the participation report have since smack down...been taking full advantage to redress that position

- and....although we are aware they have ...managed to achieve a huge swing from their time eternal net short - to net long

The trend is quite significant.

MAY: U.S. Banks still NET SHORT but the ratio had declined.... to just 1.28:1

(this is the gargantuan swing - from the above net short....to a hefty...net long)

JUNE: For the first time, the U.S. Banks are NET LONG with a ratio of.... 2.09:1

JULY: The NET LONG ratio ...has grown to.... 2.79:1

AUGUST: A ....little higher at..... 2.89:1

SEPTEMBER: .....A little lower at.... 2.82:1

OK, let’s pause here for a moment.

Go back and look at the NET POSITION CHANGES

- Note that the July U.S. bank NET LONG POSITION was 44,867.

- In August, it rose to 59,473

- but, in September, it fell back to July levels at 44,906.

That’s a pretty big swing of over 30% but note that the NET LONG RATIOS barely changed over that time period.

Now let’s look at the October 1st numbers.

If we divide the 80,735 GROSS LONG position by...... the 22,368 GROSS SHORT position,

- we get a U.S. Bank NET LONG RATIO of 3.61:1

So since the beginning of the year - net short to

3.6 : 1 net long ratio

That is one helluva swing.

- the.. non US banks.. traditionally run around a ratio of 1 : 2 Gross Shorts to Gross Long

But as we know the US banks in the participation report have since smack down...been taking full advantage to redress that position

- and....although we are aware they have ...managed to achieve a huge swing from their time eternal net short - to net long

The trend is quite significant.

MAY: U.S. Banks still NET SHORT but the ratio had declined.... to just 1.28:1

(this is the gargantuan swing - from the above net short....to a hefty...net long)

JUNE: For the first time, the U.S. Banks are NET LONG with a ratio of.... 2.09:1

JULY: The NET LONG ratio ...has grown to.... 2.79:1

AUGUST: A ....little higher at..... 2.89:1

SEPTEMBER: .....A little lower at.... 2.82:1

OK, let’s pause here for a moment.

Go back and look at the NET POSITION CHANGES

- Note that the July U.S. bank NET LONG POSITION was 44,867.

- In August, it rose to 59,473

- but, in September, it fell back to July levels at 44,906.

That’s a pretty big swing of over 30% but note that the NET LONG RATIOS barely changed over that time period.

Now let’s look at the October 1st numbers.

If we divide the 80,735 GROSS LONG position by...... the 22,368 GROSS SHORT position,

- we get a U.S. Bank NET LONG RATIO of 3.61:1

So since the beginning of the year - net short to

3.6 : 1 net long ratio

That is one helluva swing.

Saturn6 - 01 Nov 2013 08:33 - 871 of 1034

Nice work Gaz - Keep it coming.

S.

S.

gazkaz - 04 Nov 2013 08:55 - 872 of 1034

Cheers Sahara/Squirrel

As bones would say on Star Trek

Yes Jim - Its Concerted Manipulation....just not named ..as we know it

........................................................................................................................

Jeff Christian - Comex expert and mouthpiece quoted by Bix Weir

Christian’s assertion was that

- the wild swings in the price of silver were not being caused by rogue market riggers but......

- by multiple computer algorithms and High Frequency Trading programs

- firing at....... the same time

- in the COMEX silver exchange based on....... the same program triggers.

Christian claims that

- the...... simultaneous nature..... of these trades

- spring from all trading houses

- using the same algorithms they learned in the same colleges.

........................................................................................................................

1)

So for ....brevity and in para-phrase

Andrew Maguire via Bill Murphy told the CFTC hearing on ...silver manipulation

JPM....flagged/signalled the market.....with direction

- all the big traders....then acted ...on cue ....& in unison.

As an independent trader....he just followed their cue too.

He also & - IN ADVANCE - emailed the CFTC ....several times

- PRIOR to the hearing

- showing how it worked.... in practice.

2)

- Jeff Christian

Party X :o).......trips - the algorithm triggers

- and they then - all fire at the same time

- and....in the same direction

........................................................................................................................

Spot the difference !

.

As bones would say on Star Trek

Yes Jim - Its Concerted Manipulation....just not named ..as we know it

........................................................................................................................

Jeff Christian - Comex expert and mouthpiece quoted by Bix Weir

Christian’s assertion was that

- the wild swings in the price of silver were not being caused by rogue market riggers but......

- by multiple computer algorithms and High Frequency Trading programs

- firing at....... the same time

- in the COMEX silver exchange based on....... the same program triggers.

Christian claims that

- the...... simultaneous nature..... of these trades

- spring from all trading houses

- using the same algorithms they learned in the same colleges.

........................................................................................................................

1)

So for ....brevity and in para-phrase

Andrew Maguire via Bill Murphy told the CFTC hearing on ...silver manipulation

JPM....flagged/signalled the market.....with direction

- all the big traders....then acted ...on cue ....& in unison.

As an independent trader....he just followed their cue too.

He also & - IN ADVANCE - emailed the CFTC ....several times

- PRIOR to the hearing

- showing how it worked.... in practice.

2)

- Jeff Christian

Party X :o).......trips - the algorithm triggers

- and they then - all fire at the same time

- and....in the same direction

........................................................................................................................

Spot the difference !

.

gazkaz - 04 Nov 2013 09:17 - 873 of 1034

The - colourfully eloquent......concluding 2 paras from Jim Willie's

- latest thoughts

(Make of it what you will - FWIW basis)

All the signals point to the same conclusion.

- The system is breaking down. The towers are falling. The paper mache structures have withered. The derivative machinery has been jammed. The confidence in the paper based system has vaporized.

Nobody can foretell ....when .....the new system will arrive,

- but its description can be offered in rough terms.

It will be from a Global Currency Reset,

- with a vast redemption of USTreasurys, a lost USDollar global currency reserve, and discredited sovereign bond backbone for all major currencies.

- It will feature a Gold Trade Standard,

- with trade settled on a net basis with gold bullion,

- supported by gold intermediary bankers.

- It will rely upon Gold Trade Notes that serve as Letters of Credit.

- It will see a massive Gold Trade Central Bank,

- whose embryonic form is noted in the BRICS Bank.

Expect the bank to function

- as a processing plant at a later date,

- to convert USTBonds into Gold bullion.

- The same bank will process UKGilts, EuroBonds, and JapGovtBonds into Gold Bullion.

- The de-centralized system will be trade based, not bank based.

- Trade rules will dictate banking rules, to displace the Anglo banker hegemony.

The New York and London offices, even the Swiss offices, will attempt ....to continue their sabotage.

- But they can only win delays.

- See the tactics exerted upon the G-20 Meetings.

The BRICS initiatives and formal progress are.... led by Russia & China.

- They cannot be stopped,

- mainly because they attempt survival by establishing the next chapter’s architecture.

The Grand Paradigm Shift is.... in progress.

- My sources indicate

- that the 5000 metric tons of Gold bullion moved from London to points East between April and July 2012.

- The flow eastward..... never stopped.

- The pace ....has continued.

- The Gold bullion continues to be shipped in.. enormous.. staggering.. volume.

- The Gold Community has only.... a rudimentary comprehension... of what is happening in the clandestine shipment of gold.

The pillars of the community seem either unaware or unwilling to report anything but the supersized Chinese purchases through the Hong Kong window, the Indian demand, and the Turkish demand.

My belief is they lack insider contacts

- on the phenomenal movement of gold by the White Dragon Family and their Triad escorts.

- The agreements have already been made on...

- the new Gold Trade Settlement system with its newly imposed Gold Trade Standard.

They have agreed on a .......$7000/oz gold price,

- with a similarly exalted silver price of .....at least $250/oz.

Decisions have .....been made final.

- The implementation is slow but steady.

The game is over. The King Dollar is dead.

- All that remains is the funeral, the war in its wake, and the retaliation from the Satanic fortress and its legion of diabolical subjects.

- latest thoughts

(Make of it what you will - FWIW basis)

All the signals point to the same conclusion.

- The system is breaking down. The towers are falling. The paper mache structures have withered. The derivative machinery has been jammed. The confidence in the paper based system has vaporized.

Nobody can foretell ....when .....the new system will arrive,

- but its description can be offered in rough terms.

It will be from a Global Currency Reset,

- with a vast redemption of USTreasurys, a lost USDollar global currency reserve, and discredited sovereign bond backbone for all major currencies.

- It will feature a Gold Trade Standard,

- with trade settled on a net basis with gold bullion,

- supported by gold intermediary bankers.

- It will rely upon Gold Trade Notes that serve as Letters of Credit.

- It will see a massive Gold Trade Central Bank,

- whose embryonic form is noted in the BRICS Bank.

Expect the bank to function

- as a processing plant at a later date,

- to convert USTBonds into Gold bullion.

- The same bank will process UKGilts, EuroBonds, and JapGovtBonds into Gold Bullion.

- The de-centralized system will be trade based, not bank based.

- Trade rules will dictate banking rules, to displace the Anglo banker hegemony.

The New York and London offices, even the Swiss offices, will attempt ....to continue their sabotage.

- But they can only win delays.

- See the tactics exerted upon the G-20 Meetings.

The BRICS initiatives and formal progress are.... led by Russia & China.

- They cannot be stopped,

- mainly because they attempt survival by establishing the next chapter’s architecture.

The Grand Paradigm Shift is.... in progress.

- My sources indicate

- that the 5000 metric tons of Gold bullion moved from London to points East between April and July 2012.

- The flow eastward..... never stopped.

- The pace ....has continued.

- The Gold bullion continues to be shipped in.. enormous.. staggering.. volume.

- The Gold Community has only.... a rudimentary comprehension... of what is happening in the clandestine shipment of gold.

The pillars of the community seem either unaware or unwilling to report anything but the supersized Chinese purchases through the Hong Kong window, the Indian demand, and the Turkish demand.

My belief is they lack insider contacts

- on the phenomenal movement of gold by the White Dragon Family and their Triad escorts.

- The agreements have already been made on...

- the new Gold Trade Settlement system with its newly imposed Gold Trade Standard.

They have agreed on a .......$7000/oz gold price,

- with a similarly exalted silver price of .....at least $250/oz.

Decisions have .....been made final.

- The implementation is slow but steady.

The game is over. The King Dollar is dead.

- All that remains is the funeral, the war in its wake, and the retaliation from the Satanic fortress and its legion of diabolical subjects.

gazkaz - 04 Nov 2013 09:24 - 874 of 1034

On Wednesday ....Finland

- gave in to public pressure

- and revealed where she stores her gold reserves.

The statement followed a press release by the..... Bank of Sweden... on similar lines released on Monday.

All was 'normal' until the head of communications added ....some more color on what

- exactly the...... Finnish central bank does... with its gold...

"half of the gold has been..... within investment activity.... over the years.

- Gold has been.... invested ....among OTHER THINGS in deposits

- similar to .......money market deposits

- and using ....gold interest rate..... swaps.

Gold investment activity is common for central banks.

" The evidence is mounting that Western central banks through the Bank of England have been

- feeding monetary gold into the market through.... leasing operations.

- This explains in part

- how the voracious appetite for gold by China, India and South-East Asia ....is being satisfied,

- without the gold price rising to reflect twithouhis demand.

zh

- gave in to public pressure

- and revealed where she stores her gold reserves.

The statement followed a press release by the..... Bank of Sweden... on similar lines released on Monday.

All was 'normal' until the head of communications added ....some more color on what

- exactly the...... Finnish central bank does... with its gold...

"half of the gold has been..... within investment activity.... over the years.

- Gold has been.... invested ....among OTHER THINGS in deposits

- similar to .......money market deposits

- and using ....gold interest rate..... swaps.

Gold investment activity is common for central banks.

" The evidence is mounting that Western central banks through the Bank of England have been

- feeding monetary gold into the market through.... leasing operations.

- This explains in part

- how the voracious appetite for gold by China, India and South-East Asia ....is being satisfied,

- without the gold price rising to reflect twithouhis demand.

zh

gazkaz - 06 Nov 2013 22:55 - 875 of 1034

You really, really, can't make....this kinda stff up

Former Sachs of Golder sponsers the US bill and......

- members of congress get over 20 million in campaign funds - from The Banksters & Boyz

- who....want...and GET

Congress to vote on a bill - to reverse the banking safety measures

- introduced after..... the 2008 crash

- intended to .....stop ...it happening again

REVERSED 5yrs later

....and even patially written/edited....by....The 2008 culprits ...themselves.

http://daily.represent.us/theres-something-absolutely-insane-happening-house-right-now/

Former Sachs of Golder sponsers the US bill and......

- members of congress get over 20 million in campaign funds - from The Banksters & Boyz

- who....want...and GET

Congress to vote on a bill - to reverse the banking safety measures

- introduced after..... the 2008 crash

- intended to .....stop ...it happening again

REVERSED 5yrs later

....and even patially written/edited....by....The 2008 culprits ...themselves.

http://daily.represent.us/theres-something-absolutely-insane-happening-house-right-now/

gazkaz - 10 Nov 2013 15:40 - 876 of 1034

John Hathaway - comments that the gold market got hit with 90 (ninety) Tonne paper gold hit on Friday.

He also added

- “I just want to come back to this idea that what you see going on..... in the paper market is..... an unregulated playpen... for macro-investors.

- Paper gold has enormous capacity to absorb these trades, and

- it doesn’t really tell the story of what’s taking place in the physical market.

So there is a disconnect between the two, and as I say,....

- it’s going to get..... resolved.

You are already seeing gold...... bypassing the LBMA,

(which is a ‘Dark Pool’ in London, where nobody understands what’s going on except the bullion banks)

- , and miners are dealing....... directly with China

- and not clearing that metal through London.

And once London loses its grip on the flow of physical gold, which I think is starting to happen,

- the game will be much tougher for.... paper gold players.

- The same thing is true of Comex.

That’s the direction we are going in.”

He also added

- “I just want to come back to this idea that what you see going on..... in the paper market is..... an unregulated playpen... for macro-investors.

- Paper gold has enormous capacity to absorb these trades, and

- it doesn’t really tell the story of what’s taking place in the physical market.

So there is a disconnect between the two, and as I say,....

- it’s going to get..... resolved.

You are already seeing gold...... bypassing the LBMA,

(which is a ‘Dark Pool’ in London, where nobody understands what’s going on except the bullion banks)

- , and miners are dealing....... directly with China

- and not clearing that metal through London.

And once London loses its grip on the flow of physical gold, which I think is starting to happen,

- the game will be much tougher for.... paper gold players.

- The same thing is true of Comex.

That’s the direction we are going in.”

gazkaz - 10 Nov 2013 15:54 - 877 of 1034

Bill Flecksteins t'penneth

Having recently cautioned there was a danger that ........“all hell is going to break loose,” today Bill Fleckenstein warned

- “this will be the last hurrah” for “maniacal central bankers.”

“It’s very difficult ......to keep your sanity these days

- because if you are trying to do something to protect yourself from what the Fed is doing,

- i.e. owning the precious metals, all you do is

- get hit in the face with a shovel..... every day.

If you don’t want to speculate on a momentum-oriented stock market, you are not making any money.

- You can’t own bonds because it’s a complete fool’s game

- and you know that’s never going to work.

So, it’s one of those periods .......where it seems like there is nothing you can do

....but sit and be tortured or frustrated.

That’s the way it was in the late 1990s for..... any sane person.

- From, say, the fall of 1998 through early 2000, it was a very trying period if you thought....... 1 + 1 equalled 2,

- and what the Fed was doing was wrong.

Similarly, from 2005 to late 2007, the same was true in the real estate mania.

So, the last 25 years are sort of.... unusual...... in all of financial history

....... in that we’ve had this whole world on a fiat currency regime.

- And we’ve seen.... three bubbles.... here in America

-- the stock bubble, the real estate bubble, and the....... bond bubble

( where the Fed has forced the bond market to trade in a place that is so wrong,

.... so massively distorted, .....that it’s like a bubble,

....even though there is no real euphoria).

The suspension of disbelief is at work though,

- and it’s very difficult ......to try to stay sane in this environment.

But you have to remember that you’ve seen this movie before.

As frustrating as it is, you can’t start doing stupid things,

- and you have to know that this is a Potemkin village, but ....

- the chickens may not come home to roost ....for a while.

That’s the frustrating part.

All you can do is wait for sanity to break out

- because we’ve got these ......complete maniacal central bankers

- that have made us all try to operate in a world..... that makes no sense.

And they are doing it (creating bubbles) again,

- but I think this will be the last hurrah

- the last go around.”

“The reason people own precious metals is because they don’t trust the monetary stewards, or they don’t trust the government.

- For a long time that ......was part of the reason that the (Gold) ETF kept taking in a lot of ounces was ........a lot of more mainstream type of investors said,

‘We’re not sure what’s going to happen.’

At the margin they (mainstream investors) bought gold and we had a new buyer, and that helped push the price (of gold) up.

- I think when people finally realize that the Fed is doing the wrong thing, these policies won’t work, that they are trapped and they are going to print forever and inflation is going to pick up,

- when ...that psychology changes....... there will be an enormous run in the metals.

Part of what’s happened is there have been huge transfers as metal (gold) has moved out of G-7 countries, towards Asia.

- I don’t think that metal is going to come back.

- So, if you put Western buyers on top of the Asian buyers,

- and then you take the shorts out of the market,

- and the momentum starts to the upside,

- and you bring in more money on top of the investment money,

I think there will be a very powerful and large move higher in gold and silver and these mining entities.

I don’t see how ....it can’t happen.”

Having recently cautioned there was a danger that ........“all hell is going to break loose,” today Bill Fleckenstein warned

- “this will be the last hurrah” for “maniacal central bankers.”

“It’s very difficult ......to keep your sanity these days

- because if you are trying to do something to protect yourself from what the Fed is doing,

- i.e. owning the precious metals, all you do is

- get hit in the face with a shovel..... every day.

If you don’t want to speculate on a momentum-oriented stock market, you are not making any money.

- You can’t own bonds because it’s a complete fool’s game

- and you know that’s never going to work.

So, it’s one of those periods .......where it seems like there is nothing you can do

....but sit and be tortured or frustrated.

That’s the way it was in the late 1990s for..... any sane person.

- From, say, the fall of 1998 through early 2000, it was a very trying period if you thought....... 1 + 1 equalled 2,

- and what the Fed was doing was wrong.

Similarly, from 2005 to late 2007, the same was true in the real estate mania.

So, the last 25 years are sort of.... unusual...... in all of financial history

....... in that we’ve had this whole world on a fiat currency regime.

- And we’ve seen.... three bubbles.... here in America

-- the stock bubble, the real estate bubble, and the....... bond bubble

( where the Fed has forced the bond market to trade in a place that is so wrong,

.... so massively distorted, .....that it’s like a bubble,

....even though there is no real euphoria).

The suspension of disbelief is at work though,

- and it’s very difficult ......to try to stay sane in this environment.

But you have to remember that you’ve seen this movie before.

As frustrating as it is, you can’t start doing stupid things,

- and you have to know that this is a Potemkin village, but ....

- the chickens may not come home to roost ....for a while.

That’s the frustrating part.

All you can do is wait for sanity to break out

- because we’ve got these ......complete maniacal central bankers

- that have made us all try to operate in a world..... that makes no sense.

And they are doing it (creating bubbles) again,

- but I think this will be the last hurrah

- the last go around.”

“The reason people own precious metals is because they don’t trust the monetary stewards, or they don’t trust the government.

- For a long time that ......was part of the reason that the (Gold) ETF kept taking in a lot of ounces was ........a lot of more mainstream type of investors said,

‘We’re not sure what’s going to happen.’

At the margin they (mainstream investors) bought gold and we had a new buyer, and that helped push the price (of gold) up.

- I think when people finally realize that the Fed is doing the wrong thing, these policies won’t work, that they are trapped and they are going to print forever and inflation is going to pick up,

- when ...that psychology changes....... there will be an enormous run in the metals.

Part of what’s happened is there have been huge transfers as metal (gold) has moved out of G-7 countries, towards Asia.

- I don’t think that metal is going to come back.

- So, if you put Western buyers on top of the Asian buyers,

- and then you take the shorts out of the market,

- and the momentum starts to the upside,

- and you bring in more money on top of the investment money,

I think there will be a very powerful and large move higher in gold and silver and these mining entities.

I don’t see how ....it can’t happen.”

mabel - 10 Nov 2013 20:12 - 878 of 1034

As Bitcoin Plunges 25% On Government Scrutiny, The First BTC "Fair Value" Reco Has A Stunning Price Target

Submitted by Tyler Durden on 11/10/2013 - 12:39

Let’s use a broad guesstimate. One Bitcoin should theoretically be worth 700 ounces of gold or pretty close to $1,000,000, if we adjust existing supply of both to equal eachother. One BTC is currently worth 0.14 ounces of gold. That gives BTC an upside of 5000 times to equal the current price of gold, supply adjusted. Clearly, I and everyone else believes that Gold may well be much higher than here in the next 5 to 10 years, thus versus the US Dollar the upside for BTC could be multiples of that. Now, before you shake your head, simply go back to the chart of Gold versus the US Dollar and just recognise that it has risen 8750% since the 1920s. And just remember that Microsoft rose 61,000% from its IPO to it’s peak. Considering what we know about the world, I personally believe that Bitcoin may well explode in value as more and more people begin to use it. If you stuck $5,000 into Bitcoins and each Bitcoin did go up to a gold equivalent of let’s say, only 100 ounces of gold (not the potential fair value of 700), then at current prices your Bitcoin stash would be worth $3.3m.

The above is from zerohedge.

I remember looking at Bitcoin when they were about $60 and thinking it might be a good thing to buy, but no matter how much I read, I just could not grasp the whole concept.

If I could have bought them through a stockbroker, like shares, I most likely would have done so, but the whole idea of having to mine them and keep them in a virtual wallet (or whatever) was like talking chinese to a french poodle.

It seems so risky and I can't imagine TPTB allowing something that they cannot have control over, but it seems that for the brave there is the potential for gains beyond your wildest dreams.

Anyone here got any views?

mabel

gazkaz - 12 Nov 2013 15:04 - 879 of 1034

Mabel

- If you bought a few hundred in B/C at the outset - in glorious 20/20 hindsight

- you would be in millionaire territory today.

Personally - one step beyond paper IOU fiat....arrives at "virtual reality" fiat

- TPTB can crash it at any point

- they took out the Silver liberty dollar guy - as soon as his "real" silver money gained traction.

- In the meantime - I would imagine they will tolerate literally anything that keeps the punters away from ........"real... tangible... gold & silver" money

- If you bought a few hundred in B/C at the outset - in glorious 20/20 hindsight

- you would be in millionaire territory today.

Personally - one step beyond paper IOU fiat....arrives at "virtual reality" fiat

- TPTB can crash it at any point

- they took out the Silver liberty dollar guy - as soon as his "real" silver money gained traction.

- In the meantime - I would imagine they will tolerate literally anything that keeps the punters away from ........"real... tangible... gold & silver" money

gazkaz - 12 Nov 2013 15:26 - 880 of 1034

Just in case ...anyone...has any "tiny" last vestiges of - the time, energy, high level and relentless efforts of TPTB...to demonetise Gold

- by manipulation/suppression

- and indeed "any means"...fair or foul.

Here's some former secret/classified stuff

1) - recently declassified top secret 1968 telegram to the Secretary of State from the American Embassy in Paris,

Quote

If we want to have a chance to remain........ the masters of gold

- an international agreement....... on the rules of the game

- as outlined above seems to be a matter of urgency.

We would fool ourselves

- in thinking that we have time enough to wait and see how..... the S.D.R.'s.... will develop.

- In fact, the challenge .......really seems to be to achieve ......by international agreement....... within a very short period of time

- what otherwise could only have been the outcome of a gradual development of many years.

(unquote)

(Comment)

The SDR was of course an "IMF Invention"

- as such

This then puts into question just what the true purpose of the IMF is.

- Because while its stated role of preserving the stability in developing, and increasingly more so, developed, countries is a noble one,

- what appears to have been ......the real motive .....behind the monetary fund's creation,

- was to promote and encourage the development of ....a substitute reserve currency, .....the SDR,

- and to ultimately use it as the de facto buffer and intermediary, for conversion of all the outstanding "barbarous relic" hard currency,...... namely gold,

- into the fiat........ of the future

2) - Below is a memo written in 1974 by Sidney Weintraub, Deputy Assistant Secretary of State for International Finance and Development, to Paul Volcker, when he was still just Under Secretary of the Treasury for Monetary Affairs and not yet head of the Federal Reserve.

The source of the memo was found in the National Archives, RG 56, Office of the Under Secretary of the Treasury, Files of Under Secretary Volcker, 1969–1974, Accession 56–79–15, Box 1, Gold—8/15/71–2/9/72.

http://history.state.gov/historicaldocuments/frus1969-76v31/d61#fn1

Quote

U.S. objectives...... for world monetary system

—a durable, stable system, with the SDR ..... as a strong reserve asset ....at its center

— are incompatible with a continued important role for gold as a reserve asset....

- It is the U.S. concern that any substantial increase now in the price at which official gold transactions are made would strengthen the position of gold in the system, and cripple the SDR

(Comment the strong dollar/reserve currency - has in effect fulfilled the role.....intended for the SDR.....the above intended onslaught against gold....has nonetheless....taken place)

Quote....continued

To encourage and facilitate the eventual demonetization of gold, our position is

- to keep .......the present gold price,

- maintain the present Bretton Woods agreement ban....... against official gold purchases .......at above the official price

- and encourage .....the gradual disposition of monetary gold

- through sales in the private market.

An alternative route to demonetization

- could involve a substitution of SDRs for gold with the IMF,

- with the latter....... selling the gold ......gradually on the private market,

- and allocating the profits on such sales either to the original gold holders, or by other agreement....

Any redefinition of the role of gold

- must be based on the principle stated above:

- that SDR must become the center of the system

- and that there can be no question of introducing a new form of gold– paper and gold–metal bimetallism,

- in which the SDR and gold would be in competition.

(unquote)

........................................................................................................................

Option 3:

- Complete short-term demonetization of gold through an IMF substitution facility.

Countries could give up their gold holdings to the IMF in exchange for SDRs.

- The gold could then be sold gradually, over time, by the IMF to the private market. Profits from the gold sales could be distributed in part to the original holders of the gold, allowing them to realize at least part of the capital gains, while part of the profits could be utilized for other purposes, such as aid to LDCs.

Advantages:

This would achieve our goal of demonetization and relieve the problem of gold immobility,

- since the SDRs received in exchange could be used for settlement with no fear of foregoing capital gains.

Disadvantages:

- This might be a more rapid..... demonetization

- than several countries would accept.

There would be no benefit from the viewpoint of financing oil imports with gold sales to Arabs (although it is not necessarily incompatible with such an arrangement).

.......................................................................................................................

And finally, was there the tiniest hint of a proposed alternative system

- to the PetroDollar.

Namely, PetroGold?

"There is a belief among certain Europeans

- that a higher price of gold for settlement purposes

- would facilitate financing of oil imports... Although mobilization of gold for intra-EC settlement would help in the financing of imbalances among EC countries,

- it would not, of itself, .....provide resources for the financing of the anticipated deficit with the oil producers.

For this purpose, it would be useful if the oil producers

- would invest some of their excess revenues .......in gold purchases

- from deficit EC countries at close to a market price.

- This would be an attractive proposalfor European countries, and for the U.S., in

- that ......it would not involve future interest burdens

- and would avoid immediate problems arising from increased Arab ownership of European and American industry.

- (The Arabs could both sell the gold and use the proceeds for direct investment, so that the industry ownership problem would not be completely solved.)

From the Arab point of view such an asset would have the advantages of being protected from exchange-rate changes and inflation, and subject to absolute national control.

........................................................................................................................

The Paul Volcker memo

http://history.state.gov/historicaldocuments/frus1969-76v31/d61

......................................................................................................................

Kinda removes "all doubt" really

- and the rest.....as they say

Is....(NOW) ....history

- by manipulation/suppression

- and indeed "any means"...fair or foul.

Here's some former secret/classified stuff

1) - recently declassified top secret 1968 telegram to the Secretary of State from the American Embassy in Paris,

Quote

If we want to have a chance to remain........ the masters of gold

- an international agreement....... on the rules of the game

- as outlined above seems to be a matter of urgency.

We would fool ourselves

- in thinking that we have time enough to wait and see how..... the S.D.R.'s.... will develop.

- In fact, the challenge .......really seems to be to achieve ......by international agreement....... within a very short period of time

- what otherwise could only have been the outcome of a gradual development of many years.

(unquote)

(Comment)

The SDR was of course an "IMF Invention"

- as such

This then puts into question just what the true purpose of the IMF is.

- Because while its stated role of preserving the stability in developing, and increasingly more so, developed, countries is a noble one,

- what appears to have been ......the real motive .....behind the monetary fund's creation,

- was to promote and encourage the development of ....a substitute reserve currency, .....the SDR,

- and to ultimately use it as the de facto buffer and intermediary, for conversion of all the outstanding "barbarous relic" hard currency,...... namely gold,

- into the fiat........ of the future

2) - Below is a memo written in 1974 by Sidney Weintraub, Deputy Assistant Secretary of State for International Finance and Development, to Paul Volcker, when he was still just Under Secretary of the Treasury for Monetary Affairs and not yet head of the Federal Reserve.

The source of the memo was found in the National Archives, RG 56, Office of the Under Secretary of the Treasury, Files of Under Secretary Volcker, 1969–1974, Accession 56–79–15, Box 1, Gold—8/15/71–2/9/72.

http://history.state.gov/historicaldocuments/frus1969-76v31/d61#fn1

Quote

U.S. objectives...... for world monetary system

—a durable, stable system, with the SDR ..... as a strong reserve asset ....at its center

— are incompatible with a continued important role for gold as a reserve asset....

- It is the U.S. concern that any substantial increase now in the price at which official gold transactions are made would strengthen the position of gold in the system, and cripple the SDR

(Comment the strong dollar/reserve currency - has in effect fulfilled the role.....intended for the SDR.....the above intended onslaught against gold....has nonetheless....taken place)

Quote....continued

To encourage and facilitate the eventual demonetization of gold, our position is

- to keep .......the present gold price,

- maintain the present Bretton Woods agreement ban....... against official gold purchases .......at above the official price

- and encourage .....the gradual disposition of monetary gold

- through sales in the private market.

An alternative route to demonetization

- could involve a substitution of SDRs for gold with the IMF,

- with the latter....... selling the gold ......gradually on the private market,

- and allocating the profits on such sales either to the original gold holders, or by other agreement....

Any redefinition of the role of gold

- must be based on the principle stated above:

- that SDR must become the center of the system

- and that there can be no question of introducing a new form of gold– paper and gold–metal bimetallism,

- in which the SDR and gold would be in competition.

(unquote)

........................................................................................................................

Option 3:

- Complete short-term demonetization of gold through an IMF substitution facility.

Countries could give up their gold holdings to the IMF in exchange for SDRs.

- The gold could then be sold gradually, over time, by the IMF to the private market. Profits from the gold sales could be distributed in part to the original holders of the gold, allowing them to realize at least part of the capital gains, while part of the profits could be utilized for other purposes, such as aid to LDCs.

Advantages:

This would achieve our goal of demonetization and relieve the problem of gold immobility,

- since the SDRs received in exchange could be used for settlement with no fear of foregoing capital gains.

Disadvantages:

- This might be a more rapid..... demonetization

- than several countries would accept.

There would be no benefit from the viewpoint of financing oil imports with gold sales to Arabs (although it is not necessarily incompatible with such an arrangement).

.......................................................................................................................

And finally, was there the tiniest hint of a proposed alternative system

- to the PetroDollar.

Namely, PetroGold?

"There is a belief among certain Europeans

- that a higher price of gold for settlement purposes

- would facilitate financing of oil imports... Although mobilization of gold for intra-EC settlement would help in the financing of imbalances among EC countries,

- it would not, of itself, .....provide resources for the financing of the anticipated deficit with the oil producers.

For this purpose, it would be useful if the oil producers

- would invest some of their excess revenues .......in gold purchases

- from deficit EC countries at close to a market price.

- This would be an attractive proposalfor European countries, and for the U.S., in

- that ......it would not involve future interest burdens

- and would avoid immediate problems arising from increased Arab ownership of European and American industry.

- (The Arabs could both sell the gold and use the proceeds for direct investment, so that the industry ownership problem would not be completely solved.)

From the Arab point of view such an asset would have the advantages of being protected from exchange-rate changes and inflation, and subject to absolute national control.

........................................................................................................................

The Paul Volcker memo

http://history.state.gov/historicaldocuments/frus1969-76v31/d61

......................................................................................................................

Kinda removes "all doubt" really

- and the rest.....as they say

Is....(NOW) ....history

gazkaz - 12 Nov 2013 18:10 - 881 of 1034

Wonder why they are dotting more T's & I's

- no expectation of "intended use"

- when the Co-op bond-holder/Cyprus style bail-ins ....roll out

Regulators from the U.S., U.K., Germany and Switzerland ...have asked ISDA

- to include a short-term suspension ......of early-termination rights

- in its master agreement when it comes to....... bank resolutions.

Many derivatives market participants .....oppose the move.

http://www.dailylead.com/11/08/13/suspension-early-termination-rights-raises-concerns#.UoEFXeKmYrC

The regulators say the suspension, preferably no more than 48 hours,

- gives resolution officials........ time to switch derivatives contracts

- to a third party or bridging entity, when necessary.

- no expectation of "intended use"

- when the Co-op bond-holder/Cyprus style bail-ins ....roll out

Regulators from the U.S., U.K., Germany and Switzerland ...have asked ISDA

- to include a short-term suspension ......of early-termination rights

- in its master agreement when it comes to....... bank resolutions.

Many derivatives market participants .....oppose the move.

http://www.dailylead.com/11/08/13/suspension-early-termination-rights-raises-concerns#.UoEFXeKmYrC

The regulators say the suspension, preferably no more than 48 hours,

- gives resolution officials........ time to switch derivatives contracts

- to a third party or bridging entity, when necessary.

gazkaz - 12 Nov 2013 18:15 - 882 of 1034

Quote from - Mr. Huszar, a senior fellow at Rutgers Business School, is a former Morgan Stanley managing director.

- In 2009-10, he managed the Federal Reserve's $1.25 trillion agency mortgage-backed security purchase program.

http://online.wsj.com/news/articles/SB10001424052702303763804579183680751473884

"I can only say:......

I'm sorry, America.

- As a former Federal Reserve official,

- I was responsible for executing the centerpiece program of the Fed's first plunge into the bond-buying experiment known as quantitative easing.... We were working feverishly....... to preserve

- the impression that....... the Fed knew what it was doing..

- In 2009-10, he managed the Federal Reserve's $1.25 trillion agency mortgage-backed security purchase program.

http://online.wsj.com/news/articles/SB10001424052702303763804579183680751473884

"I can only say:......

I'm sorry, America.

- As a former Federal Reserve official,

- I was responsible for executing the centerpiece program of the Fed's first plunge into the bond-buying experiment known as quantitative easing.... We were working feverishly....... to preserve

- the impression that....... the Fed knew what it was doing..

gazkaz - 12 Nov 2013 18:23 - 883 of 1034

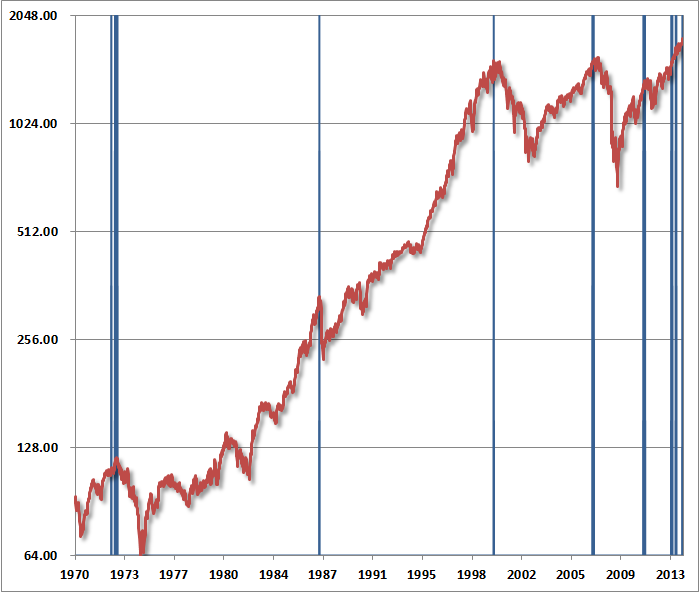

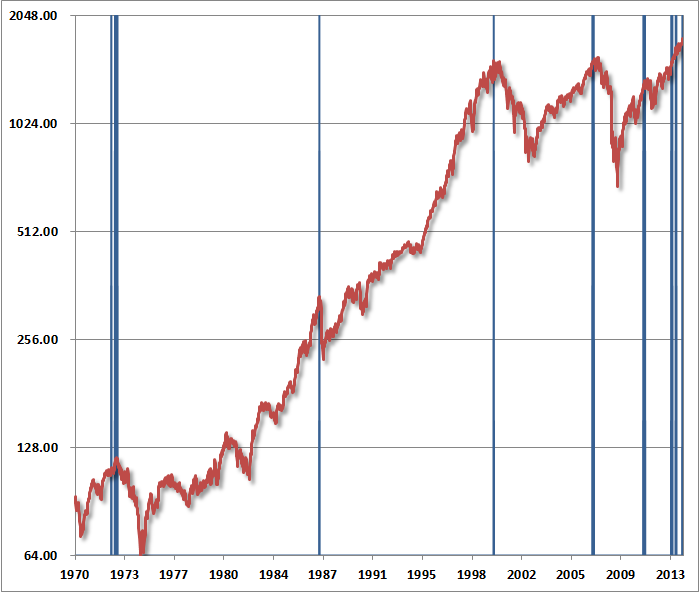

These concerns are easily ignored since we also observed them at lower levels this year, both in February and in May. Still, the fact is that this syndrome of overvalued, overbought, overbullish, rising-yield conditions

- has emerged

- near the most significant market peaks

– and preceded the most severe market declines – in history:

1. S&P 500 Index overvalued, with the Shiller P/E (S&P 500 divided by the 10-year average of inflation-adjusted earnings) greater than 18. The present multiple is actually 25.

2. S&P 500 Index overbought, with the index more than 7% above its 52-week smoothing, at least 50% above its 4-year low, and within 3% of its upper Bollinger bands (2 standard deviations above the 20-period moving average) at daily, weekly, and monthly resolutions. Presently, the S&P 500 is either at or slightly through each of those bands.

3. Investor sentiment overbullish (Investors Intelligence), with the 2-week average of advisory bulls greater than 52% and bearishness below 28%. The most recent weekly figures were 55.2% vs. 15.6%. The sentiment figures we use for 1929 are imputed using the extent and volatility of prior market movements, which explains a significant amount of variation in investor sentiment over time.

4. Yields rising, with the 10-year Treasury yield higher than 6 months earlier.

The blue bars in the chart below depict the complete set of instances since 1970 when these conditions have been observed.

Is it better to look foolish......Before......OR.....After

Is it better to look foolish......Before......OR.....After

- has emerged

- near the most significant market peaks

– and preceded the most severe market declines – in history:

1. S&P 500 Index overvalued, with the Shiller P/E (S&P 500 divided by the 10-year average of inflation-adjusted earnings) greater than 18. The present multiple is actually 25.

2. S&P 500 Index overbought, with the index more than 7% above its 52-week smoothing, at least 50% above its 4-year low, and within 3% of its upper Bollinger bands (2 standard deviations above the 20-period moving average) at daily, weekly, and monthly resolutions. Presently, the S&P 500 is either at or slightly through each of those bands.

3. Investor sentiment overbullish (Investors Intelligence), with the 2-week average of advisory bulls greater than 52% and bearishness below 28%. The most recent weekly figures were 55.2% vs. 15.6%. The sentiment figures we use for 1929 are imputed using the extent and volatility of prior market movements, which explains a significant amount of variation in investor sentiment over time.

4. Yields rising, with the 10-year Treasury yield higher than 6 months earlier.

The blue bars in the chart below depict the complete set of instances since 1970 when these conditions have been observed.

Is it better to look foolish......Before......OR.....After

Is it better to look foolish......Before......OR.....After

squirrel888 - 13 Nov 2013 05:38 - 884 of 1034

Some "street news" - friend of a friend had some gold jewellery valued in the UK & was given a price of £600 for the lot. She brought her jewellery to Qatar & went to the gold souq to get it valued?? Guess what they gave her £2000 for said jewellery. UK gold merchants ripping off our good citizens.

You get better prices for your "real money" here and they're happy to pay it as they understand value.

Shall check out the silver deals but right now the Indian community is buyiñg big time.

Keep it going Gaz.

You get better prices for your "real money" here and they're happy to pay it as they understand value.

Shall check out the silver deals but right now the Indian community is buyiñg big time.

Keep it going Gaz.

gazkaz - 13 Nov 2013 14:18 - 885 of 1034

Squirrell - cheers

- seems like it's not just the Indians that are buying big time.

US Mint - advised it's primary dealers it is - knocking production of - silver eagles...on the head.....for a very, very early xmas.....9th Dec until into the early weeks of Jan 2014.

With today’s update of 500,000 Silver Eagles sold, bringing November’s totals to a 1,000,000,

- the US Mint has already by Nov - just set an "annual" all-time sales record for Silver Eagles,

- eclipsing the previous annual record of 39,868,500 oz set in 2011.

It appears that the powers that be do not wish to allow ....2013′s all time silver eagle sales record

- to get ......too far out of hand :o)

- seems like it's not just the Indians that are buying big time.

US Mint - advised it's primary dealers it is - knocking production of - silver eagles...on the head.....for a very, very early xmas.....9th Dec until into the early weeks of Jan 2014.

With today’s update of 500,000 Silver Eagles sold, bringing November’s totals to a 1,000,000,

- the US Mint has already by Nov - just set an "annual" all-time sales record for Silver Eagles,

- eclipsing the previous annual record of 39,868,500 oz set in 2011.

It appears that the powers that be do not wish to allow ....2013′s all time silver eagle sales record

- to get ......too far out of hand :o)

gazkaz - 13 Nov 2013 14:26 - 886 of 1034

China just accepted delivery of ...a new (a new...as in just one ...new) vault that will house

- up to 2,000 tons of gold.

The official Chinese gold holdings still quote the 2009 figure of just over 1,000 tons

- they have obviously been accumulating.....over the last 4 years since then..and

- stacking it "somewhere"

It would seem they are expecting.....to stack the smack

- to the tune of......some considerable amount more

- in the...near future

From memory the Chinese also recently bought....The Rockerfeller buildng that was The Morgues former HQ

- the basement of which has....a rather large bullion vault :o)

- up to 2,000 tons of gold.

The official Chinese gold holdings still quote the 2009 figure of just over 1,000 tons

- they have obviously been accumulating.....over the last 4 years since then..and

- stacking it "somewhere"

It would seem they are expecting.....to stack the smack

- to the tune of......some considerable amount more

- in the...near future

From memory the Chinese also recently bought....The Rockerfeller buildng that was The Morgues former HQ

- the basement of which has....a rather large bullion vault :o)