| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

squirrel888 - 13 Nov 2013 05:38 - 884 of 1034

Some "street news" - friend of a friend had some gold jewellery valued in the UK & was given a price of £600 for the lot. She brought her jewellery to Qatar & went to the gold souq to get it valued?? Guess what they gave her £2000 for said jewellery. UK gold merchants ripping off our good citizens.

You get better prices for your "real money" here and they're happy to pay it as they understand value.

Shall check out the silver deals but right now the Indian community is buyiñg big time.

Keep it going Gaz.

You get better prices for your "real money" here and they're happy to pay it as they understand value.

Shall check out the silver deals but right now the Indian community is buyiñg big time.

Keep it going Gaz.

gazkaz - 13 Nov 2013 14:18 - 885 of 1034

Squirrell - cheers

- seems like it's not just the Indians that are buying big time.

US Mint - advised it's primary dealers it is - knocking production of - silver eagles...on the head.....for a very, very early xmas.....9th Dec until into the early weeks of Jan 2014.

With today’s update of 500,000 Silver Eagles sold, bringing November’s totals to a 1,000,000,

- the US Mint has already by Nov - just set an "annual" all-time sales record for Silver Eagles,

- eclipsing the previous annual record of 39,868,500 oz set in 2011.

It appears that the powers that be do not wish to allow ....2013′s all time silver eagle sales record

- to get ......too far out of hand :o)

- seems like it's not just the Indians that are buying big time.

US Mint - advised it's primary dealers it is - knocking production of - silver eagles...on the head.....for a very, very early xmas.....9th Dec until into the early weeks of Jan 2014.

With today’s update of 500,000 Silver Eagles sold, bringing November’s totals to a 1,000,000,

- the US Mint has already by Nov - just set an "annual" all-time sales record for Silver Eagles,

- eclipsing the previous annual record of 39,868,500 oz set in 2011.

It appears that the powers that be do not wish to allow ....2013′s all time silver eagle sales record

- to get ......too far out of hand :o)

gazkaz - 13 Nov 2013 14:26 - 886 of 1034

China just accepted delivery of ...a new (a new...as in just one ...new) vault that will house

- up to 2,000 tons of gold.

The official Chinese gold holdings still quote the 2009 figure of just over 1,000 tons

- they have obviously been accumulating.....over the last 4 years since then..and

- stacking it "somewhere"

It would seem they are expecting.....to stack the smack

- to the tune of......some considerable amount more

- in the...near future

From memory the Chinese also recently bought....The Rockerfeller buildng that was The Morgues former HQ

- the basement of which has....a rather large bullion vault :o)

- up to 2,000 tons of gold.

The official Chinese gold holdings still quote the 2009 figure of just over 1,000 tons

- they have obviously been accumulating.....over the last 4 years since then..and

- stacking it "somewhere"

It would seem they are expecting.....to stack the smack

- to the tune of......some considerable amount more

- in the...near future

From memory the Chinese also recently bought....The Rockerfeller buildng that was The Morgues former HQ

- the basement of which has....a rather large bullion vault :o)

gazkaz - 13 Nov 2013 15:01 - 887 of 1034

Former US Treasury Official Dr. Paul Craig Roberts recent opinion....on the future potential events.

Hard asset investors need to stay the course and keep doing the right thing by accumulating physical gold and silver.

- They need to ask themselves,

- ‘How long .....can this charade continue?’

I will tell you the answer:

- It can only go on .....until the new kinds of international payment arrangements are put in place,

- the ones that the BRIC countries are making -- Brazil, India, China, Russia, South Africa, etc.

Those arrangements .......will no longer use the US dollar.

- So, the demand for dollars will fall.

- We now have this arrangement between Japan and China, and Australia and China.

( Those countries will cease to use the dollar to settle their trade imbalances).

- Again, this means..... the demand for dollars in the currency markets will fall.

But

- the Fed is .......locked into printing dollars

- in order to finance the federal government,

- and to support the debt-related derivatives on the balance sheets of the banks that are too-big-to-fail.

So, you’ve got the supply of dollars growing,.... and the demand for dollars falling.

- This means the price has to fall over time.

- And when the price of the dollar falls,

that’s when it all hits the fan.

- That is when the dollar’s exchange rate to other currencies falls.

- This is also when the Federal Reserve loses control and the markets crash.

I don’t know when that’s going to happen,

- but I do know that the rest of the world is tired of US financial bullying, of US financial imperialism.

We know that the dollar as a reserve currency is being abused by the Fed printing over $1 trillion each year.

- And we know t

- he rest of the world is making arrangements to avoid being dependent on the dollar to settle their trade imbalances.

In other words,

- the writing is on the wall for the dollar,

- and when that plunge in the dollar occurs,

- these artificial profits in the stock market will all disappear very rapidly.”

"They can’t manipulate gold and silver ......when the dollar drops..... in exchange value to other currencies....... because the rest of the world stops using it.

What that means is that when the dollar drops

- they will no longer be able....... to stop the rise in gold and silver

- by going in there to short those markets.

That will all come to an abrupt end at that point.

But they will continue to try to cap the price of gold and silver as long as the dollar is somewhat stable.

- However, they will lose that ability when all of these alternative international settlement and trade mechanisms are in place,

- and countries cease to use the dollar to settle their accounts.

What I am saying is that the day is coming when they can no longer continue this manipulation of gold and silver.

- In fact, it will be chaos.

The bond market will collapse because they will lose control of interest rates.

The banks will collapse.

The stock market will collapse.

And the inflation will be imported because of the lower value of the dollar in foreign exchange markets.

The combination of the falling dollar and rising domestic prices .......will literally cause a stampede out of the US dollar.

That’s what is set up to happen. .....I just don’t see how...... they can avoid it.”

Hard asset investors need to stay the course and keep doing the right thing by accumulating physical gold and silver.

- They need to ask themselves,

- ‘How long .....can this charade continue?’

I will tell you the answer:

- It can only go on .....until the new kinds of international payment arrangements are put in place,

- the ones that the BRIC countries are making -- Brazil, India, China, Russia, South Africa, etc.

Those arrangements .......will no longer use the US dollar.

- So, the demand for dollars will fall.

- We now have this arrangement between Japan and China, and Australia and China.

( Those countries will cease to use the dollar to settle their trade imbalances).

- Again, this means..... the demand for dollars in the currency markets will fall.

But

- the Fed is .......locked into printing dollars

- in order to finance the federal government,

- and to support the debt-related derivatives on the balance sheets of the banks that are too-big-to-fail.

So, you’ve got the supply of dollars growing,.... and the demand for dollars falling.

- This means the price has to fall over time.

- And when the price of the dollar falls,

that’s when it all hits the fan.

- That is when the dollar’s exchange rate to other currencies falls.

- This is also when the Federal Reserve loses control and the markets crash.

I don’t know when that’s going to happen,

- but I do know that the rest of the world is tired of US financial bullying, of US financial imperialism.

We know that the dollar as a reserve currency is being abused by the Fed printing over $1 trillion each year.

- And we know t

- he rest of the world is making arrangements to avoid being dependent on the dollar to settle their trade imbalances.

In other words,

- the writing is on the wall for the dollar,

- and when that plunge in the dollar occurs,

- these artificial profits in the stock market will all disappear very rapidly.”

"They can’t manipulate gold and silver ......when the dollar drops..... in exchange value to other currencies....... because the rest of the world stops using it.

What that means is that when the dollar drops

- they will no longer be able....... to stop the rise in gold and silver

- by going in there to short those markets.

That will all come to an abrupt end at that point.

But they will continue to try to cap the price of gold and silver as long as the dollar is somewhat stable.

- However, they will lose that ability when all of these alternative international settlement and trade mechanisms are in place,

- and countries cease to use the dollar to settle their accounts.

What I am saying is that the day is coming when they can no longer continue this manipulation of gold and silver.

- In fact, it will be chaos.

The bond market will collapse because they will lose control of interest rates.

The banks will collapse.

The stock market will collapse.

And the inflation will be imported because of the lower value of the dollar in foreign exchange markets.

The combination of the falling dollar and rising domestic prices .......will literally cause a stampede out of the US dollar.

That’s what is set up to happen. .....I just don’t see how...... they can avoid it.”

gazkaz - 13 Nov 2013 15:09 - 888 of 1034

When it came to Banksters ....of the day

- Jesus ....didn't advocate his usual..... "Turn the other cheek"

- He drove them from the Temple.

Ken Livingstone touted ....."Hang a banker a day - until they got it right"

- Iran

- has taken heed

- and is set ....to hang a handful for fraud

Vietnam

- is about to pass judgement on a handful who committed fraud there too.

- There sentencing will either be....

- Life imprisonment.....or hanging

I'm not an advocate of capital punishment

- But nor am I an advocate of - too big to jail....

- just fine the company

And just get back to...business as usual.

- Jesus ....didn't advocate his usual..... "Turn the other cheek"

- He drove them from the Temple.

Ken Livingstone touted ....."Hang a banker a day - until they got it right"

- Iran

- has taken heed

- and is set ....to hang a handful for fraud

Vietnam

- is about to pass judgement on a handful who committed fraud there too.

- There sentencing will either be....

- Life imprisonment.....or hanging

I'm not an advocate of capital punishment

- But nor am I an advocate of - too big to jail....

- just fine the company

And just get back to...business as usual.

gazkaz - 13 Nov 2013 15:42 - 889 of 1034

Confession of a Feddy...."Quantative Easer"

Mr. Huszar, a senior fellow at Rutgers Business School, is a former Morgan Stanley managing director.

- In 2009-10, he managed the Federal Reserve's $1.25 trillion agency mortgage-backed security purchase program.

Here is his confession in the Wall St Journal

http://online.wsj.com/news/articles/SB10001424052702303763804579183680751473884#

(A few clips)

I can only say: I'm sorry, America.

As a former Federal Reserve official, I was responsible for executing

- the centerpiece program of the Fed's first plunge into the bond-buying experiment

- known as quantitative easing.

The central bank continues to spin QE as a tool for helping Main Street

But I've come to recognize the program for what it really is

: the greatest backdoor Wall Street bailout of all time.

My part of the story began

Having been at the Fed for seven years,

- until early 2008,

- I was working on Wall Street in spring 2009 when I got an unexpected phone call.

- Would I come back to work on...... the Fed's trading floor?

- The job:

- managing what was at the heart of QE's bond-buying spree

- a wild attempt

- to buy $1.25 trillion in mortgage bonds in 12 months.

Incredibly, the Fed was calling to ask if I wanted to quarterback the largest economic stimulus in U.S. history.

I had left the Fed out of frustration, having witnessed the institution deferring more and more to Wall Street.

Independence is at the heart of any central bank's credibility, and I had come to believe that the Fed's independence was eroding.

Senior Fed officials, though, were publicly acknowledging mistakes and several of those officials emphasized to me how committed they were to a major Wall Street revamp. I could also see that they desperately needed reinforcements. I took a leap of faith.

In its almost 100-year history, the Fed had never bought one mortgage bond.

- Now

- my program was buying so many each day through active, unscripted trading

- that we constantly risked driving bond prices too high and crashing global confidence in key financial markets.

We were working feverishly to preserve the impression that the Fed knew what it was doing.

It wasn't long before my old doubts resurfaced. Despite the Fed's rhetoric, my program wasn't helping to make credit any more accessible for the average American. The banks were only issuing fewer and fewer loans. More insidiously, whatever credit they were extending wasn't getting much cheaper. QE may have been driving down the wholesale cost for banks to make loans,

- but Wall Street was pocketing most of the extra cash.

From the trenches,

- several other Fed managers also began voicing the concern that QE wasn't working as planned.

- Our warnings fell on deaf ears.

- In the past, Fed leaders—even if they ultimately erred—would have worried obsessively about the costs versus the benefits of any major initiative.

Now the only obsession seemed to be

- with the newest survey of financial-market expectations or the latest in-person feedback from Wall Street's leading bankers and hedge-fund managers.

Sorry, U.S. taxpayer.

Trading for the first round of QE ended on March 31, 2010. The final results confirmed that,

- while there had been only trivial relief.... for Main Street,

- the U.S. central bank's bond purchases had been an absolute coup for Wall Street.

- The banks hadn't just benefited from the lower cost of making loans.

- They'd also enjoyed huge capital gains on the rising values of their securities holdings

- and fat commissions from brokering most of the Fed's QE transactions.

Wall Street had experienced its most profitable year ever in 2009, and 2010 was starting off in much the same way.

You'd think the Fed would have finally stopped to question the wisdom of QE. Think again.

- Only a few months later

- after a 14% drop in the U.S. stock market and renewed weakening in the banking sector

- The Fed announced ........a new round of bond buying: QE2.

Germany's finance minister, Wolfgang Schäuble, immediately called the decision "clueless."

That was when I realized

- the Fed had lost any remaining ability to think independently from Wall Street. Demoralized, I returned to the private sector.

........................................................................................................................

Cont.....

Where are we today?

- The Fed keeps buying roughly $85 billion in bonds a month, chronically delaying so much as a minor QE taper. Over five years, its bond purchases have come to more than $4 trillion. Amazingly, in a supposedly free-market nation,

- QE has become the largest financial-markets intervention by any government in world history.

And the impact?

Even by the Fed's sunniest calculations, aggressive QE over five years has generated only a few percentage points of U.S. growth.

- By contrast,

- experts outside the Fed, such as Mohammed El Erian at the Pimco investment firm, suggest that the Fed may have created and spent over $4 trillion for a total return of as little as 0.25% of GDP (i.e., a mere $40 billion bump in U.S. economic output).

Both of those estimates indicate that QE isn't really working.

Unless you're Wall Street.

- Having racked up hundreds of billions of dollars in opaque Fed subsidies,

- U.S. banks have seen their collective stock price triple since March 2009.

- The biggest ones have only become more of a cartel:

0.2% of them now control more than 70% of the U.S. bank assets.

Even when acknowledging QE's shortcomings,

- Chairman Bernanke argues that some action by the Fed ......is better than none

- (a position that his likely successor, Fed Vice Chairwoman Janet Yellen, also embraces).

The implication is that the Fed is dutifully compensating for .....the rest of Washington's dysfunction.

- But the Fed is at the center of that dysfunction.

Case in point:

- It has allowed QE to become Wall Street's new "too big to fail" policy.

........................................................................................................................

Do you know something

- as each day goes by.....

- the Ken livingstone, Iran, Vietnam approach

- gains a certain "Je ne sais quoi"

(Maybe - Kens...one a day...could even be setting the bar....a tadge low)

Mr. Huszar, a senior fellow at Rutgers Business School, is a former Morgan Stanley managing director.

- In 2009-10, he managed the Federal Reserve's $1.25 trillion agency mortgage-backed security purchase program.

Here is his confession in the Wall St Journal

http://online.wsj.com/news/articles/SB10001424052702303763804579183680751473884#

(A few clips)

I can only say: I'm sorry, America.

As a former Federal Reserve official, I was responsible for executing

- the centerpiece program of the Fed's first plunge into the bond-buying experiment

- known as quantitative easing.

The central bank continues to spin QE as a tool for helping Main Street

But I've come to recognize the program for what it really is

: the greatest backdoor Wall Street bailout of all time.

My part of the story began

Having been at the Fed for seven years,

- until early 2008,

- I was working on Wall Street in spring 2009 when I got an unexpected phone call.

- Would I come back to work on...... the Fed's trading floor?

- The job:

- managing what was at the heart of QE's bond-buying spree

- a wild attempt

- to buy $1.25 trillion in mortgage bonds in 12 months.

Incredibly, the Fed was calling to ask if I wanted to quarterback the largest economic stimulus in U.S. history.

I had left the Fed out of frustration, having witnessed the institution deferring more and more to Wall Street.

Independence is at the heart of any central bank's credibility, and I had come to believe that the Fed's independence was eroding.

Senior Fed officials, though, were publicly acknowledging mistakes and several of those officials emphasized to me how committed they were to a major Wall Street revamp. I could also see that they desperately needed reinforcements. I took a leap of faith.

In its almost 100-year history, the Fed had never bought one mortgage bond.

- Now

- my program was buying so many each day through active, unscripted trading

- that we constantly risked driving bond prices too high and crashing global confidence in key financial markets.

We were working feverishly to preserve the impression that the Fed knew what it was doing.

It wasn't long before my old doubts resurfaced. Despite the Fed's rhetoric, my program wasn't helping to make credit any more accessible for the average American. The banks were only issuing fewer and fewer loans. More insidiously, whatever credit they were extending wasn't getting much cheaper. QE may have been driving down the wholesale cost for banks to make loans,

- but Wall Street was pocketing most of the extra cash.

From the trenches,

- several other Fed managers also began voicing the concern that QE wasn't working as planned.

- Our warnings fell on deaf ears.

- In the past, Fed leaders—even if they ultimately erred—would have worried obsessively about the costs versus the benefits of any major initiative.

Now the only obsession seemed to be

- with the newest survey of financial-market expectations or the latest in-person feedback from Wall Street's leading bankers and hedge-fund managers.

Sorry, U.S. taxpayer.

Trading for the first round of QE ended on March 31, 2010. The final results confirmed that,

- while there had been only trivial relief.... for Main Street,

- the U.S. central bank's bond purchases had been an absolute coup for Wall Street.

- The banks hadn't just benefited from the lower cost of making loans.

- They'd also enjoyed huge capital gains on the rising values of their securities holdings

- and fat commissions from brokering most of the Fed's QE transactions.

Wall Street had experienced its most profitable year ever in 2009, and 2010 was starting off in much the same way.

You'd think the Fed would have finally stopped to question the wisdom of QE. Think again.

- Only a few months later

- after a 14% drop in the U.S. stock market and renewed weakening in the banking sector

- The Fed announced ........a new round of bond buying: QE2.

Germany's finance minister, Wolfgang Schäuble, immediately called the decision "clueless."

That was when I realized

- the Fed had lost any remaining ability to think independently from Wall Street. Demoralized, I returned to the private sector.

........................................................................................................................

Cont.....

Where are we today?

- The Fed keeps buying roughly $85 billion in bonds a month, chronically delaying so much as a minor QE taper. Over five years, its bond purchases have come to more than $4 trillion. Amazingly, in a supposedly free-market nation,

- QE has become the largest financial-markets intervention by any government in world history.

And the impact?

Even by the Fed's sunniest calculations, aggressive QE over five years has generated only a few percentage points of U.S. growth.

- By contrast,

- experts outside the Fed, such as Mohammed El Erian at the Pimco investment firm, suggest that the Fed may have created and spent over $4 trillion for a total return of as little as 0.25% of GDP (i.e., a mere $40 billion bump in U.S. economic output).

Both of those estimates indicate that QE isn't really working.

Unless you're Wall Street.

- Having racked up hundreds of billions of dollars in opaque Fed subsidies,

- U.S. banks have seen their collective stock price triple since March 2009.

- The biggest ones have only become more of a cartel:

0.2% of them now control more than 70% of the U.S. bank assets.

Even when acknowledging QE's shortcomings,

- Chairman Bernanke argues that some action by the Fed ......is better than none

- (a position that his likely successor, Fed Vice Chairwoman Janet Yellen, also embraces).

The implication is that the Fed is dutifully compensating for .....the rest of Washington's dysfunction.

- But the Fed is at the center of that dysfunction.

Case in point:

- It has allowed QE to become Wall Street's new "too big to fail" policy.

........................................................................................................................

Do you know something

- as each day goes by.....

- the Ken livingstone, Iran, Vietnam approach

- gains a certain "Je ne sais quoi"

(Maybe - Kens...one a day...could even be setting the bar....a tadge low)

gazkaz - 14 Nov 2013 00:36 - 890 of 1034

Whistleblower - algorithm developer .and....trader

- reveals the truth about algo high frequency trading.

When his successful & profitable algo HFT model - suddenly ceased.....to have it's orders actioned

- he spent a year....analysing a million lines of his code...to find the problem

He found out over drinks.....it wasn't his code & it wasn't his programme.....that was the problem

The exchanges were..... working hand in glove with "the usual suspects"

- ensuring "their trades" front ran... both... the market

- and also...his trades - & ensuring his got.....shut out.

He has testified and reported - this little known & mutually unhealthy (but profitable) "cosy" relationship......between the Exchanges & "Usual Suspect" firms to...

- the SEC

- 2 Years on.....they are still....looking into it

- reveals the truth about algo high frequency trading.

When his successful & profitable algo HFT model - suddenly ceased.....to have it's orders actioned

- he spent a year....analysing a million lines of his code...to find the problem

He found out over drinks.....it wasn't his code & it wasn't his programme.....that was the problem

The exchanges were..... working hand in glove with "the usual suspects"

- ensuring "their trades" front ran... both... the market

- and also...his trades - & ensuring his got.....shut out.

He has testified and reported - this little known & mutually unhealthy (but profitable) "cosy" relationship......between the Exchanges & "Usual Suspect" firms to...

- the SEC

- 2 Years on.....they are still....looking into it

gazkaz - 14 Nov 2013 23:36 - 891 of 1034

The Dow.....no comment required

gazkaz - 15 Nov 2013 00:25 - 892 of 1034

SHTF time looming ...on the nearing horizon...for many US borrowers......

- as they reach the 10yr anniversaries of their finance agreements

- The switch kicks in

- Interest only payments cease

- and CAPITAL and interest payments....begin

Many borrowers could see OVER $500....PER MONTH....increase in their repayments

.......................................................................................................................

From the LA Times:

Some mortgage and credit experts worry that .....billions of dollars of home equity credit lines

- that were extended..... a decade ago

(during the housing boom)

- could be heading for big trouble soon, creating a new wave of defaults for banks and homeowners.

That’s because these credit lines, which are....... second mortgages

- with floating rates and flexible withdrawal terms,

- carry mandatory “resets”

- requiring borrowers to begin paying both principal and interest on their balances after 10 years.

(During the initial 10-year draw period, .....only interest payments..... are required).

But the difference between the interest-only and reset payments on these credit lines can be substantial

— $500 to $600 or more per month in some cases.

According to federal financial regulators,

- about $30 billion in home equity lines dating to 2004 are due for resets.... next year,

- $53 billion the following year

and

- a staggering $111 billion in 2018.

Amy Crews Cutts, chief economist for Equifax, one of the three national credit bureaus,

- calls this a looming “wave of disaster”

- because large numbers of borrowers will... be unable to handle the higher payments.

This will force banks to either foreclose, refinance the borrower or modify their loans

- as they reach the 10yr anniversaries of their finance agreements

- The switch kicks in

- Interest only payments cease

- and CAPITAL and interest payments....begin

Many borrowers could see OVER $500....PER MONTH....increase in their repayments

.......................................................................................................................

From the LA Times:

Some mortgage and credit experts worry that .....billions of dollars of home equity credit lines

- that were extended..... a decade ago

(during the housing boom)

- could be heading for big trouble soon, creating a new wave of defaults for banks and homeowners.

That’s because these credit lines, which are....... second mortgages

- with floating rates and flexible withdrawal terms,

- carry mandatory “resets”

- requiring borrowers to begin paying both principal and interest on their balances after 10 years.

(During the initial 10-year draw period, .....only interest payments..... are required).

But the difference between the interest-only and reset payments on these credit lines can be substantial

— $500 to $600 or more per month in some cases.

According to federal financial regulators,

- about $30 billion in home equity lines dating to 2004 are due for resets.... next year,

- $53 billion the following year

and

- a staggering $111 billion in 2018.

Amy Crews Cutts, chief economist for Equifax, one of the three national credit bureaus,

- calls this a looming “wave of disaster”

- because large numbers of borrowers will... be unable to handle the higher payments.

This will force banks to either foreclose, refinance the borrower or modify their loans

gazkaz - 15 Nov 2013 00:53 - 893 of 1034

Chris Powell gives "inside off the record"

- information re his conversations

- with TWO Asian ....Central Bankers

(credibility factor....he is secretary to GATA)

“I was struck by the fact that .......one of the central bankers did volunteer to me that

- most central bankers are aware of the fractional reserve nature of the Western gold banking system, and its vulnerabilities.”

(Comment......In laymans terms - running a Gold Ponzi Scheme)

"He clearly acknowledged

- their understanding that gold does not back all of the claims to gold

- that are floating around the world financial system,

- particularly when it comes to the West.

You would probably never get a central banker to acknowledge that publicly, but that is precisely what he said to me off the record.”

" I would bet my life,

- that despite all of the public acrimony between the United States and China,

- the Fed and the People’s Bank of China

are on the phone every day consulting about the gold market.

"They are doing a very delicate dance

- as China tries to hedge its disproportionate US dollar foreign exchange reserves with gold and other hard assets,

- without exploding both markets (gold and the dollar).

- I don’t think anything major happens in the gold market from day to day without China’s consent.

China could blow up the gold market any time it wanted. It could also blow up the US dollar market, the US interest rate market and bond markets any time it wanted".

"As an example, .....another central banker admitted to me..... off the record that,

- yes, the gold price is......... ‘of profound interest to central bankers.’ the The reality is.....

- that the gold market is.... micro-managed, despite all the incessant denials.”

........................................................................................................................

His thoughts ??

We have seen this movie once before.

- This is exactly what happened....... when the London Gold Pool was drained.

The pool collapsed ......and there were emergency US Air Force transport flights, according to the Federal Open Market Committee Meeting Minutes, flying gold over from the United States to the Bank of England in 1968.

- This was at a time when the Bank of England was advancing its own gold into the market on behalf of the United States,

- in an attempt to hold the gold price at $35 an ounce.

In March of 1968, the outflow of gold had reached hundreds of tons per week. At that point, the nations participating in the Long Gold Pool realized they had only a few weeks’ worth of gold left at that staggering rate of outflow.

- So, they closed the London Gold Pool.

The dollar price of gold literally failed at that point.

- The price of gold was $35 an ounce of gold one day,

- and the next day there was no price at all because there was no official market.

I suspect that

- either that will happen, and the gold that is available will run out,

- or more likely the central banks will see what’s coming

- and arrange an international currency revaluation.

At that point there will be chaos in the gold and currency markets,

- but in the end

- this will mean ....substantially higher gold .....after the official reset of the international gold price.”

- information re his conversations

- with TWO Asian ....Central Bankers

(credibility factor....he is secretary to GATA)

“I was struck by the fact that .......one of the central bankers did volunteer to me that

- most central bankers are aware of the fractional reserve nature of the Western gold banking system, and its vulnerabilities.”

(Comment......In laymans terms - running a Gold Ponzi Scheme)

"He clearly acknowledged

- their understanding that gold does not back all of the claims to gold

- that are floating around the world financial system,

- particularly when it comes to the West.

You would probably never get a central banker to acknowledge that publicly, but that is precisely what he said to me off the record.”

" I would bet my life,

- that despite all of the public acrimony between the United States and China,

- the Fed and the People’s Bank of China

are on the phone every day consulting about the gold market.

"They are doing a very delicate dance

- as China tries to hedge its disproportionate US dollar foreign exchange reserves with gold and other hard assets,

- without exploding both markets (gold and the dollar).

- I don’t think anything major happens in the gold market from day to day without China’s consent.

China could blow up the gold market any time it wanted. It could also blow up the US dollar market, the US interest rate market and bond markets any time it wanted".

"As an example, .....another central banker admitted to me..... off the record that,

- yes, the gold price is......... ‘of profound interest to central bankers.’ the The reality is.....

- that the gold market is.... micro-managed, despite all the incessant denials.”

........................................................................................................................

His thoughts ??

We have seen this movie once before.

- This is exactly what happened....... when the London Gold Pool was drained.

The pool collapsed ......and there were emergency US Air Force transport flights, according to the Federal Open Market Committee Meeting Minutes, flying gold over from the United States to the Bank of England in 1968.

- This was at a time when the Bank of England was advancing its own gold into the market on behalf of the United States,

- in an attempt to hold the gold price at $35 an ounce.

In March of 1968, the outflow of gold had reached hundreds of tons per week. At that point, the nations participating in the Long Gold Pool realized they had only a few weeks’ worth of gold left at that staggering rate of outflow.

- So, they closed the London Gold Pool.

The dollar price of gold literally failed at that point.

- The price of gold was $35 an ounce of gold one day,

- and the next day there was no price at all because there was no official market.

I suspect that

- either that will happen, and the gold that is available will run out,

- or more likely the central banks will see what’s coming

- and arrange an international currency revaluation.

At that point there will be chaos in the gold and currency markets,

- but in the end

- this will mean ....substantially higher gold .....after the official reset of the international gold price.”

gazkaz - 15 Nov 2013 01:10 - 894 of 1034

Top Canadian Scientist (David SUZUKI) states

- if there is another tsunami/ 7.2 plus earthquake at Fukishima

- he puts the odds at.....95%....within the next 3yrs

Its a "Bye Bye....Japan"

- and "evacuation of the West Coast of the USA"

- if there is another tsunami/ 7.2 plus earthquake at Fukishima

- he puts the odds at.....95%....within the next 3yrs

Its a "Bye Bye....Japan"

- and "evacuation of the West Coast of the USA"

gazkaz - 15 Nov 2013 08:09 - 895 of 1034

Robin Griffiths Cazenove Capital

(appointed stockbroker to Her Majesty The Queen)

“We are now into the strong season of the year. We did not see the normal drop during the seasonally weak period of the year in the Western markets because of QE. So, if you can’t fall when you are supposed to fall, you usually go up when you are supposed to go up.

- But it is a bubble

- The Schiller P/E....... is now 25.

- The historic earnings multiple ....is 19.

This is a pretty weird place to start a new bull market from. In any event, the market has been rising for 5 solid years.

- This is as long as the market normally rises .....without some sort of correction.

The bad news is that if you normally have...... your 4-year setback

- in the 3rd year of the decade,

- this is like winding a spring for the 4th, 5th and 6th years of any decade to be strong.

The next time you run the risk is in the 7th year, going into the 8th year.

If you look back at the last several decades,

- it’s either 1987, 1997, or 2008

- when you get the really nasty corrections or bear markets.

Having said that, my work says..... this is not the start of a new secular bull market.

- You don’t start bullish secular trends ......from 25 times earnings, .....after a 5-year continuous rise.

If you look at the S&P 500, .....divided by the purchasing power or PPI,

- you will see what it buys....... in real dollars.

- It gives the image that....... this really is a secular downtrend that started in the year 2000,

- and in ‘real money’ .....we are absolutely nowhere near making a new high.

For that matter, neither are any of the Western markets.

But...... only in devalued money..... are the US, German, and British stock markets on the cusp of going into new highs,

- and in bubbles...... that’s what happens.

But people should understand that..... the ingredients for a crash

- going into early 2014...... are already in place.

“The secular trend for gold is still absolutely intact.

- The entire fall from $1,900 was similar to what we witnessed in the 1970s, and ...

- just a normal Fibonacci retracement in a bull market.

We will have to wait and see where....... the ultimate low is for gold,

- but the notion that the secular uptrend is dying is...... incorrect.

My bet

- is that $1,180 will probably hold,

- and next year .......not only will gold go through.... $1,900,

- but up to about..... $2,500.

- This will shock many market participants.

After that we go on........ in the next year to the..... $3,000 area.

........................................................................................................................

Miners ??

You also need to watch for....... when the directors of these companies start buying.

- They buy when they know something.

- Just to give you one example, the Chairman of Freeport McMoRan personally bought......... $37 million worth of shares the other day.

- Well,...... he knows something,..... doesn’t he?

- If he........ puts his money where his mouth is,

- I’ll put some of my money ......where his mouth is.

We might be..... a bit early, .....but I don’t think we are..... very early.”

(appointed stockbroker to Her Majesty The Queen)

“We are now into the strong season of the year. We did not see the normal drop during the seasonally weak period of the year in the Western markets because of QE. So, if you can’t fall when you are supposed to fall, you usually go up when you are supposed to go up.

- But it is a bubble

- The Schiller P/E....... is now 25.

- The historic earnings multiple ....is 19.

This is a pretty weird place to start a new bull market from. In any event, the market has been rising for 5 solid years.

- This is as long as the market normally rises .....without some sort of correction.

The bad news is that if you normally have...... your 4-year setback

- in the 3rd year of the decade,

- this is like winding a spring for the 4th, 5th and 6th years of any decade to be strong.

The next time you run the risk is in the 7th year, going into the 8th year.

If you look back at the last several decades,

- it’s either 1987, 1997, or 2008

- when you get the really nasty corrections or bear markets.

Having said that, my work says..... this is not the start of a new secular bull market.

- You don’t start bullish secular trends ......from 25 times earnings, .....after a 5-year continuous rise.

If you look at the S&P 500, .....divided by the purchasing power or PPI,

- you will see what it buys....... in real dollars.

- It gives the image that....... this really is a secular downtrend that started in the year 2000,

- and in ‘real money’ .....we are absolutely nowhere near making a new high.

For that matter, neither are any of the Western markets.

But...... only in devalued money..... are the US, German, and British stock markets on the cusp of going into new highs,

- and in bubbles...... that’s what happens.

But people should understand that..... the ingredients for a crash

- going into early 2014...... are already in place.

“The secular trend for gold is still absolutely intact.

- The entire fall from $1,900 was similar to what we witnessed in the 1970s, and ...

- just a normal Fibonacci retracement in a bull market.

We will have to wait and see where....... the ultimate low is for gold,

- but the notion that the secular uptrend is dying is...... incorrect.

My bet

- is that $1,180 will probably hold,

- and next year .......not only will gold go through.... $1,900,

- but up to about..... $2,500.

- This will shock many market participants.

After that we go on........ in the next year to the..... $3,000 area.

........................................................................................................................

Miners ??

You also need to watch for....... when the directors of these companies start buying.

- They buy when they know something.

- Just to give you one example, the Chairman of Freeport McMoRan personally bought......... $37 million worth of shares the other day.

- Well,...... he knows something,..... doesn’t he?

- If he........ puts his money where his mouth is,

- I’ll put some of my money ......where his mouth is.

We might be..... a bit early, .....but I don’t think we are..... very early.”

gazkaz - 17 Nov 2013 16:56 - 896 of 1034

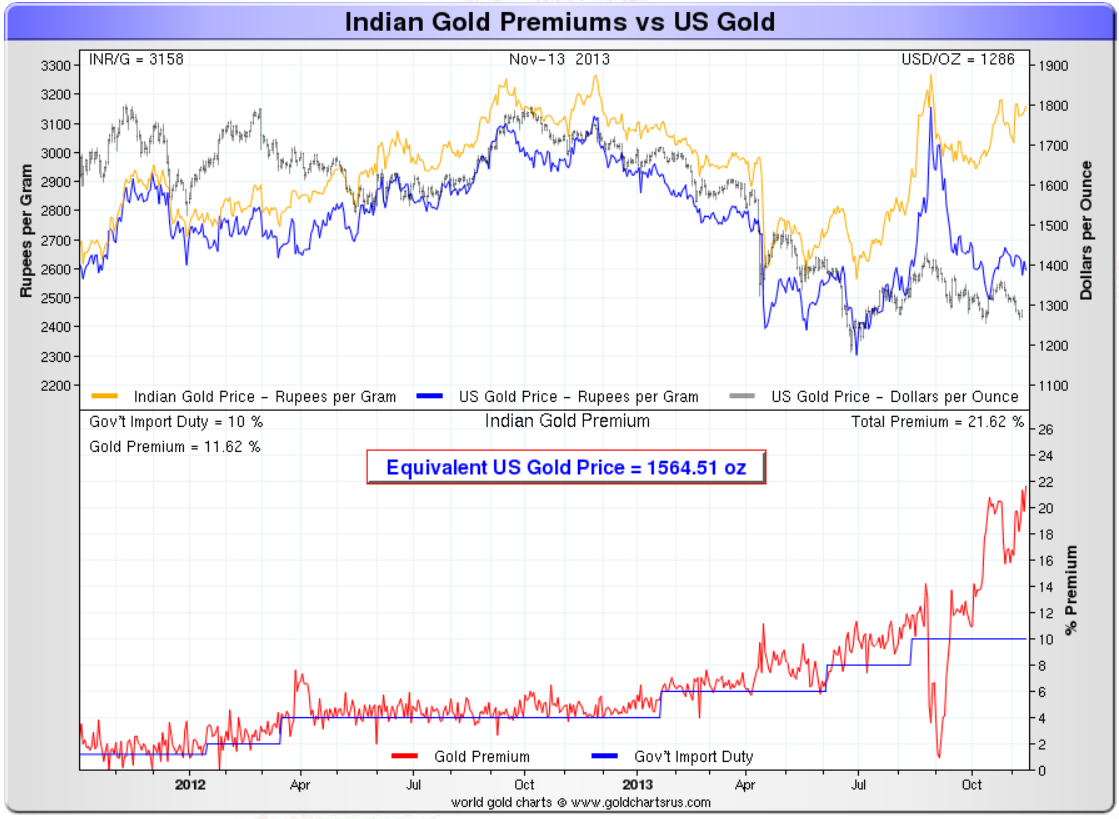

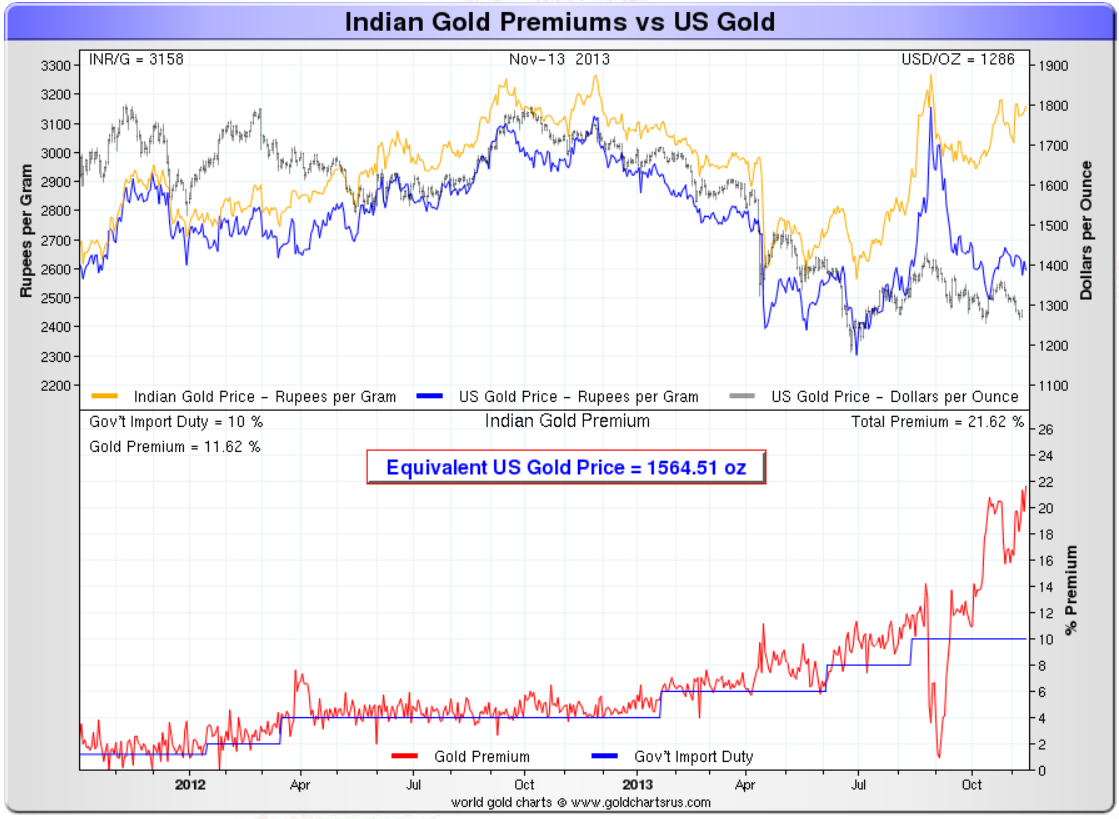

This chart shows the divergence in the price

- of US ...paper Gold

- -vs-....India - physical gold

Top yellow line - India Gold Price

Bottom grey line.....The UG paper gold price

And in case you missed it the bottom part....the red line gives the percentage ...divergence

The blue line ?? - in the bottom part - is the India ....import duty percentage

- as can be seen....

The divergence in US gold price - vs - India Gold price was......

- broadly....fully accounted for purely by....the India import duty

But since the summer - the premium in India has escalated away from the import duty impact by.........

- another 11.62% over and above the import duty.

- of US ...paper Gold

- -vs-....India - physical gold

Top yellow line - India Gold Price

Bottom grey line.....The UG paper gold price

And in case you missed it the bottom part....the red line gives the percentage ...divergence

The blue line ?? - in the bottom part - is the India ....import duty percentage

- as can be seen....

The divergence in US gold price - vs - India Gold price was......

- broadly....fully accounted for purely by....the India import duty

But since the summer - the premium in India has escalated away from the import duty impact by.........

- another 11.62% over and above the import duty.

gazkaz - 23 Nov 2013 14:29 - 897 of 1034

2 Doozy's

- the first seems to have been picked up on - not really seen comment on the second :o)

(Recall what happened when ....Saddam & Gaddafi .....gave the two figers - to payment in "dollars" for their oil ??)

1)

Nov 21 (Reuters) - The Shanghai Futures Exchange (SHFE) may price its crude oil futures contract.... in yuan

and use medium sour crude as its benchmark, its chairman said on Thursday, adding that the bourse is speeding up preparatory work to secure regulatory approvals.

China, which overtook the United States as the world's top oil importer in September, hopes the contract will become a benchmark in Asia and has said

- it would allow foreign investors to trade in the contract

- without setting up a local subsidiary.

http://www.reuters.com/article/2013/11/21/china-crudeoil-idUSL4N0J62M120131121

Comment

- So that's just ....the world's NO 1 - importer of oil (& thus mainstay prop of the.... petro-dollar ponzi-go-round.... giving the finger to the system)

2

People’s Bank of China said t

- The country .......does NOT BENEFIT.....any more .....from increases

- in its ......foreign-currency holdings, (comment....mainly...dollars)

adding to signs policy makers ......will rein in dollar purchases...... that limit the yuan’s appreciation.

“It’s no longer in China’s favor to accumulate foreign-exchange reserves,”

Yi Gang, a deputy governor at the central bank, said in a speech organized by China Economists 50 Forum at Tsinghua University yesterday.

The monetary authority will “basically” end normal intervention in the currency market and broaden the yuan’s daily trading range, Governor Zhou Xiaochuan wrote in an article in a guidebook explaining reforms outlined last week following a Communist Party meeting.

Neither Yi nor Zhou gave a timeframe for any changes.

http://www.bloomberg.com/news/2013-11-20/pboc-says-no-longer-in-china-s-favor-to-boost-record-reserves.html

Comment ....And that's one of the two monster dollar reserve holders (The other being Japan)

- giving the finger to collecting dollars....when they pass GO on the monopoly board

Begs the questions .......

- who is going to mop up all those ....fiat confetti US Dollars...being printed 24/7 & China leaves just washing into the market place.

What happens ....when China says...."It is no longer in the country's interest..... to continue accumulating US Debt/T-Bonds".

&...... what happens if China not only - stops.... accumulating the dollar & bonds....

- but then starts....disposing of them....into

- an already increasinly saturated dollar awash market ??

GAME CHANGERS

The pressure to drag - China &/or Russia....into conflict (via mutual defense pacts re Syria/Iran etc)

- is likely to......increase

- the first seems to have been picked up on - not really seen comment on the second :o)

(Recall what happened when ....Saddam & Gaddafi .....gave the two figers - to payment in "dollars" for their oil ??)

1)

Nov 21 (Reuters) - The Shanghai Futures Exchange (SHFE) may price its crude oil futures contract.... in yuan

and use medium sour crude as its benchmark, its chairman said on Thursday, adding that the bourse is speeding up preparatory work to secure regulatory approvals.

China, which overtook the United States as the world's top oil importer in September, hopes the contract will become a benchmark in Asia and has said

- it would allow foreign investors to trade in the contract

- without setting up a local subsidiary.

http://www.reuters.com/article/2013/11/21/china-crudeoil-idUSL4N0J62M120131121

Comment

- So that's just ....the world's NO 1 - importer of oil (& thus mainstay prop of the.... petro-dollar ponzi-go-round.... giving the finger to the system)

2

People’s Bank of China said t

- The country .......does NOT BENEFIT.....any more .....from increases

- in its ......foreign-currency holdings, (comment....mainly...dollars)

adding to signs policy makers ......will rein in dollar purchases...... that limit the yuan’s appreciation.

“It’s no longer in China’s favor to accumulate foreign-exchange reserves,”

Yi Gang, a deputy governor at the central bank, said in a speech organized by China Economists 50 Forum at Tsinghua University yesterday.

The monetary authority will “basically” end normal intervention in the currency market and broaden the yuan’s daily trading range, Governor Zhou Xiaochuan wrote in an article in a guidebook explaining reforms outlined last week following a Communist Party meeting.

Neither Yi nor Zhou gave a timeframe for any changes.

http://www.bloomberg.com/news/2013-11-20/pboc-says-no-longer-in-china-s-favor-to-boost-record-reserves.html

Comment ....And that's one of the two monster dollar reserve holders (The other being Japan)

- giving the finger to collecting dollars....when they pass GO on the monopoly board

Begs the questions .......

- who is going to mop up all those ....fiat confetti US Dollars...being printed 24/7 & China leaves just washing into the market place.

What happens ....when China says...."It is no longer in the country's interest..... to continue accumulating US Debt/T-Bonds".

&...... what happens if China not only - stops.... accumulating the dollar & bonds....

- but then starts....disposing of them....into

- an already increasinly saturated dollar awash market ??

GAME CHANGERS

The pressure to drag - China &/or Russia....into conflict (via mutual defense pacts re Syria/Iran etc)

- is likely to......increase

gazkaz - 23 Nov 2013 14:54 - 898 of 1034

Expanding of the above....a little further (Well quite a lot further really)

AS OF NOV 18th

- a former head trader for a major financial institution

- issued a harbinger

- and stated

- that 23 countries,

- and 60% .....of the world's GDP,

- are ........right now

Setting up

- new swap lines..... which bypass the dollar, SWIFT, and the BIS, - and will usher in a new global currency system

-

which will kill the dollar

http://www.examiner.com/article/harbinger-23-countries-begin-setting-up-swap-lines-to-bypass-dollar

Tick...Tick....Tick

AS OF NOV 18th

- a former head trader for a major financial institution

- issued a harbinger

- and stated

- that 23 countries,

- and 60% .....of the world's GDP,

- are ........right now

Setting up

- new swap lines..... which bypass the dollar, SWIFT, and the BIS, - and will usher in a new global currency system

-

which will kill the dollar

http://www.examiner.com/article/harbinger-23-countries-begin-setting-up-swap-lines-to-bypass-dollar

Tick...Tick....Tick

talltalk - 25 Nov 2013 16:10 - 899 of 1034

Thank you very much for posting all this .

We really do live in amazing times !

tt

We really do live in amazing times !

tt

gazkaz - 27 Nov 2013 00:58 - 900 of 1034

talktalk - cheers

Interesting comments from William Kaye (far east hedge fund manager) - re a sizeable bet on gold.....way out to 2015 (tying your optinon money up for a good long while)

“The most active series, currently, in the paper gold market is

- the option (contract) in .........December of 2015

- at a $3,000 strike (price).

It’s been extremely active in the last two trading days.

- You have to ask yourself,

- ‘Why would anyone in their right mind, with gold languishing around the $1,250 level, have any interest at all in an option series .....2-years out, ....struck at $3,000, .....(which is) well in excess of the current price?’

And the answer is somebody thinks

- we are going to get there.

- That’s the only reason.

You’ve got enormous leverage at a fairly cheap price if you are right. I personally would not have any interest from a buy-and-hold strategy in that series,

- because I think the Comex..... shuts down long before you see $3,000.

The system itself is so leveraged that they (the Comex) would declare,

( as two bullion banks already have),

- a force majeure

- long before we saw $3,000

because I think that would potentially bankrupt the Comex and the bullion banks. But .......those footprints are extremely bullish.

- Someone is making a bet,

- essentially an important bet,

that we are going to see levels in excess of $3,000 an ounce within the next 2 years.”

Interesting comments from William Kaye (far east hedge fund manager) - re a sizeable bet on gold.....way out to 2015 (tying your optinon money up for a good long while)

“The most active series, currently, in the paper gold market is

- the option (contract) in .........December of 2015

- at a $3,000 strike (price).

It’s been extremely active in the last two trading days.

- You have to ask yourself,

- ‘Why would anyone in their right mind, with gold languishing around the $1,250 level, have any interest at all in an option series .....2-years out, ....struck at $3,000, .....(which is) well in excess of the current price?’

And the answer is somebody thinks

- we are going to get there.

- That’s the only reason.

You’ve got enormous leverage at a fairly cheap price if you are right. I personally would not have any interest from a buy-and-hold strategy in that series,

- because I think the Comex..... shuts down long before you see $3,000.

The system itself is so leveraged that they (the Comex) would declare,

( as two bullion banks already have),

- a force majeure

- long before we saw $3,000

because I think that would potentially bankrupt the Comex and the bullion banks. But .......those footprints are extremely bullish.

- Someone is making a bet,

- essentially an important bet,

that we are going to see levels in excess of $3,000 an ounce within the next 2 years.”

gazkaz - 27 Nov 2013 01:14 - 901 of 1034

Lies, damn lies & gov't statistics

In the US, since the beginning of the 1980s the Bureau of Labor Statistics has “adjusted” the methodology of its inflation model a whopping.... 24 times

The blue line on the chart - restates inflation since 1980 back to that based on the original 1980 model.

So why do they do it ?

“When the government causes the money to deteriorate

- in order to...... cheat all creditors,

- this procedure is...... politely called inflation.”

( George Bernard Shaw)

And - we all .....get cheated.

The reason for showing lower inflation is .....

- Numerous expenditures hinge on it

- national insurance,

- government transfers,

- the salaries of civil servants,

- food stamps etc.

And - This way, ......real GDP growth..... is also fictionally.....revised up,

(since nominal economic growth is divided by the price index).

And even the BULLSHIrT we are told generally

- that “an inflation rate of just ....2%... is healthy”,

Even this fudged artificially ficticious lie

- still translates into .....a loss in purchase power of 50% ....within 35 years.

In the US, since the beginning of the 1980s the Bureau of Labor Statistics has “adjusted” the methodology of its inflation model a whopping.... 24 times

The blue line on the chart - restates inflation since 1980 back to that based on the original 1980 model.

So why do they do it ?

“When the government causes the money to deteriorate

- in order to...... cheat all creditors,

- this procedure is...... politely called inflation.”

( George Bernard Shaw)

And - we all .....get cheated.

The reason for showing lower inflation is .....

- Numerous expenditures hinge on it

- national insurance,

- government transfers,

- the salaries of civil servants,

- food stamps etc.

And - This way, ......real GDP growth..... is also fictionally.....revised up,

(since nominal economic growth is divided by the price index).

And even the BULLSHIrT we are told generally

- that “an inflation rate of just ....2%... is healthy”,

Even this fudged artificially ficticious lie

- still translates into .....a loss in purchase power of 50% ....within 35 years.

gazkaz - 27 Nov 2013 01:28 - 902 of 1034

A few more thoughts by Bill Kaye.

Comex

- “What we do know,........major bullion banks led my JP Morgan, which is the largest player,

- are now very long gold.

- however....that said

there is an enormous OTC market which is ..........extremely opaque,

- and so it is very possible that they are net-short, and possibly very short in a very highly-levered but opaque...... OTC market.

Unallocated gold.

Another area that we have very little vision into are all of these....... unallocated gold accounts.

- I’ve been unable to find anything that estimates

- the ongoing liability from the... IOU’s.... that are outstanding from all of these unallocated gold accounts that JP Morgan, Goldman Sachs, and the other bullion banks possess.

What these unallocated gold accounts amount to are (just)...... massive IOU’s

- that I suspect can never be repaid.

Now, there is reason to believe my suspicion is accurate because we already have had...... two defaults earlier in the year.

The first was ABN AMRO defaulting in April, and subsequently their sister-bank, Rabobank, precisely because

- they had issued IOU’s for which they did not have physical gold.

So they simply forced everyone to settle in cash.

What that tells you is you have major problems with many of these bullion banks, two of which have already defaulted.

- You’ve got major problems with this unallocated gold system,

- which is nothing more than a very highly-levered fractional reserve system for gold,

- in which the banks possess just a tiny fraction of the gold.

My suspicion is

- the entire (fractional reserve gold) system, ultimately, probably within the next year, will go the way of ABN AMRO and Rabobank.

- They will all settle for cash when the market begins to make an important up-move which could be first quarter or second quarter of next year,

- and people will be scrambling for gold because they are going to be forced out for cash,

- and they are going to want to put themselves in a position..... they thought they were in ....when owning .....unallocated gold.

GLD ETF

Certainly we’ve noticed some of these suspects

- converting at very attractive prices

- their holdings of GLD...... into physical.

This typically gets reported in the mainstream media as Soros, or name another elite, selling or reducing their stake. And this....... just isn’t right.

For the most part these entities are converting their (paper) gold

- into physical (gold)

- in lots of 100,000 (shares of GLD).

They......... have the wealth to do that

Comex

- “What we do know,........major bullion banks led my JP Morgan, which is the largest player,

- are now very long gold.

- however....that said

there is an enormous OTC market which is ..........extremely opaque,

- and so it is very possible that they are net-short, and possibly very short in a very highly-levered but opaque...... OTC market.

Unallocated gold.

Another area that we have very little vision into are all of these....... unallocated gold accounts.

- I’ve been unable to find anything that estimates

- the ongoing liability from the... IOU’s.... that are outstanding from all of these unallocated gold accounts that JP Morgan, Goldman Sachs, and the other bullion banks possess.

What these unallocated gold accounts amount to are (just)...... massive IOU’s

- that I suspect can never be repaid.

Now, there is reason to believe my suspicion is accurate because we already have had...... two defaults earlier in the year.

The first was ABN AMRO defaulting in April, and subsequently their sister-bank, Rabobank, precisely because

- they had issued IOU’s for which they did not have physical gold.

So they simply forced everyone to settle in cash.

What that tells you is you have major problems with many of these bullion banks, two of which have already defaulted.

- You’ve got major problems with this unallocated gold system,

- which is nothing more than a very highly-levered fractional reserve system for gold,

- in which the banks possess just a tiny fraction of the gold.

My suspicion is

- the entire (fractional reserve gold) system, ultimately, probably within the next year, will go the way of ABN AMRO and Rabobank.

- They will all settle for cash when the market begins to make an important up-move which could be first quarter or second quarter of next year,

- and people will be scrambling for gold because they are going to be forced out for cash,

- and they are going to want to put themselves in a position..... they thought they were in ....when owning .....unallocated gold.

GLD ETF

Certainly we’ve noticed some of these suspects

- converting at very attractive prices

- their holdings of GLD...... into physical.

This typically gets reported in the mainstream media as Soros, or name another elite, selling or reducing their stake. And this....... just isn’t right.

For the most part these entities are converting their (paper) gold

- into physical (gold)

- in lots of 100,000 (shares of GLD).

They......... have the wealth to do that

gazkaz - 27 Nov 2013 01:43 - 903 of 1034

Alistaire McLeod - mirrors Sprotts thoughts on - World Gold Council "official fiction"

The amount of gold absorbed by private sector purchases in Hong Kong and China amount to .....at least 2,130.7 tonnes in the first nine months of this year,

- or 2,841 tonnes annualised.

This compares with the WGC’s estimates from their quarterly Gold Demand Trends of only..... 818.6 tonnes.... for the same period, or....... 1,091.5 annualised.

Given the hard evidence of Hong Kong and SGE statistics it appears that the WGC’s figures....... substantially understate the true position.

Estimates of China’s demand .....also exclude government purchases of gold in foreign markets,

- and gold that may have been acquired and imported by wealthy Chinese from foreign locations .......without going through Hong Kong or the SGE.

So without taking into account these extra factors, China and Hong Kong’s combined imports from the rest of the world

- exceeds all other mine supply....... by at least 580 tonnes

- on an annualised basis.

It now becomes clear that .....without significant leasing by Western central banks

- total Asian demand could not be satisfied at current prices,

- because there is no evidence of material selling by existing holders of above-ground stocks.

Comment - and as seen Kaye and others - believe

- the huge fall in GLD physical

- has not been redemtions & supply into the market

- but wealthy elites - exchanging their GLD paper.....for the real physical stuff.

Hence the real true shortfall in production/supply & demand.....is being met by the central banks

(London Gold Pool Style)

The amount of gold absorbed by private sector purchases in Hong Kong and China amount to .....at least 2,130.7 tonnes in the first nine months of this year,

- or 2,841 tonnes annualised.

This compares with the WGC’s estimates from their quarterly Gold Demand Trends of only..... 818.6 tonnes.... for the same period, or....... 1,091.5 annualised.

Given the hard evidence of Hong Kong and SGE statistics it appears that the WGC’s figures....... substantially understate the true position.

Estimates of China’s demand .....also exclude government purchases of gold in foreign markets,

- and gold that may have been acquired and imported by wealthy Chinese from foreign locations .......without going through Hong Kong or the SGE.

So without taking into account these extra factors, China and Hong Kong’s combined imports from the rest of the world

- exceeds all other mine supply....... by at least 580 tonnes

- on an annualised basis.

It now becomes clear that .....without significant leasing by Western central banks

- total Asian demand could not be satisfied at current prices,

- because there is no evidence of material selling by existing holders of above-ground stocks.

Comment - and as seen Kaye and others - believe

- the huge fall in GLD physical

- has not been redemtions & supply into the market

- but wealthy elites - exchanging their GLD paper.....for the real physical stuff.

Hence the real true shortfall in production/supply & demand.....is being met by the central banks

(London Gold Pool Style)