| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

gazkaz - 15 Nov 2013 00:53 - 893 of 1034

Chris Powell gives "inside off the record"

- information re his conversations

- with TWO Asian ....Central Bankers

(credibility factor....he is secretary to GATA)

“I was struck by the fact that .......one of the central bankers did volunteer to me that

- most central bankers are aware of the fractional reserve nature of the Western gold banking system, and its vulnerabilities.”

(Comment......In laymans terms - running a Gold Ponzi Scheme)

"He clearly acknowledged

- their understanding that gold does not back all of the claims to gold

- that are floating around the world financial system,

- particularly when it comes to the West.

You would probably never get a central banker to acknowledge that publicly, but that is precisely what he said to me off the record.”

" I would bet my life,

- that despite all of the public acrimony between the United States and China,

- the Fed and the People’s Bank of China

are on the phone every day consulting about the gold market.

"They are doing a very delicate dance

- as China tries to hedge its disproportionate US dollar foreign exchange reserves with gold and other hard assets,

- without exploding both markets (gold and the dollar).

- I don’t think anything major happens in the gold market from day to day without China’s consent.

China could blow up the gold market any time it wanted. It could also blow up the US dollar market, the US interest rate market and bond markets any time it wanted".

"As an example, .....another central banker admitted to me..... off the record that,

- yes, the gold price is......... ‘of profound interest to central bankers.’ the The reality is.....

- that the gold market is.... micro-managed, despite all the incessant denials.”

........................................................................................................................

His thoughts ??

We have seen this movie once before.

- This is exactly what happened....... when the London Gold Pool was drained.

The pool collapsed ......and there were emergency US Air Force transport flights, according to the Federal Open Market Committee Meeting Minutes, flying gold over from the United States to the Bank of England in 1968.

- This was at a time when the Bank of England was advancing its own gold into the market on behalf of the United States,

- in an attempt to hold the gold price at $35 an ounce.

In March of 1968, the outflow of gold had reached hundreds of tons per week. At that point, the nations participating in the Long Gold Pool realized they had only a few weeks’ worth of gold left at that staggering rate of outflow.

- So, they closed the London Gold Pool.

The dollar price of gold literally failed at that point.

- The price of gold was $35 an ounce of gold one day,

- and the next day there was no price at all because there was no official market.

I suspect that

- either that will happen, and the gold that is available will run out,

- or more likely the central banks will see what’s coming

- and arrange an international currency revaluation.

At that point there will be chaos in the gold and currency markets,

- but in the end

- this will mean ....substantially higher gold .....after the official reset of the international gold price.”

- information re his conversations

- with TWO Asian ....Central Bankers

(credibility factor....he is secretary to GATA)

“I was struck by the fact that .......one of the central bankers did volunteer to me that

- most central bankers are aware of the fractional reserve nature of the Western gold banking system, and its vulnerabilities.”

(Comment......In laymans terms - running a Gold Ponzi Scheme)

"He clearly acknowledged

- their understanding that gold does not back all of the claims to gold

- that are floating around the world financial system,

- particularly when it comes to the West.

You would probably never get a central banker to acknowledge that publicly, but that is precisely what he said to me off the record.”

" I would bet my life,

- that despite all of the public acrimony between the United States and China,

- the Fed and the People’s Bank of China

are on the phone every day consulting about the gold market.

"They are doing a very delicate dance

- as China tries to hedge its disproportionate US dollar foreign exchange reserves with gold and other hard assets,

- without exploding both markets (gold and the dollar).

- I don’t think anything major happens in the gold market from day to day without China’s consent.

China could blow up the gold market any time it wanted. It could also blow up the US dollar market, the US interest rate market and bond markets any time it wanted".

"As an example, .....another central banker admitted to me..... off the record that,

- yes, the gold price is......... ‘of profound interest to central bankers.’ the The reality is.....

- that the gold market is.... micro-managed, despite all the incessant denials.”

........................................................................................................................

His thoughts ??

We have seen this movie once before.

- This is exactly what happened....... when the London Gold Pool was drained.

The pool collapsed ......and there were emergency US Air Force transport flights, according to the Federal Open Market Committee Meeting Minutes, flying gold over from the United States to the Bank of England in 1968.

- This was at a time when the Bank of England was advancing its own gold into the market on behalf of the United States,

- in an attempt to hold the gold price at $35 an ounce.

In March of 1968, the outflow of gold had reached hundreds of tons per week. At that point, the nations participating in the Long Gold Pool realized they had only a few weeks’ worth of gold left at that staggering rate of outflow.

- So, they closed the London Gold Pool.

The dollar price of gold literally failed at that point.

- The price of gold was $35 an ounce of gold one day,

- and the next day there was no price at all because there was no official market.

I suspect that

- either that will happen, and the gold that is available will run out,

- or more likely the central banks will see what’s coming

- and arrange an international currency revaluation.

At that point there will be chaos in the gold and currency markets,

- but in the end

- this will mean ....substantially higher gold .....after the official reset of the international gold price.”

gazkaz - 15 Nov 2013 01:10 - 894 of 1034

Top Canadian Scientist (David SUZUKI) states

- if there is another tsunami/ 7.2 plus earthquake at Fukishima

- he puts the odds at.....95%....within the next 3yrs

Its a "Bye Bye....Japan"

- and "evacuation of the West Coast of the USA"

- if there is another tsunami/ 7.2 plus earthquake at Fukishima

- he puts the odds at.....95%....within the next 3yrs

Its a "Bye Bye....Japan"

- and "evacuation of the West Coast of the USA"

gazkaz - 15 Nov 2013 08:09 - 895 of 1034

Robin Griffiths Cazenove Capital

(appointed stockbroker to Her Majesty The Queen)

“We are now into the strong season of the year. We did not see the normal drop during the seasonally weak period of the year in the Western markets because of QE. So, if you can’t fall when you are supposed to fall, you usually go up when you are supposed to go up.

- But it is a bubble

- The Schiller P/E....... is now 25.

- The historic earnings multiple ....is 19.

This is a pretty weird place to start a new bull market from. In any event, the market has been rising for 5 solid years.

- This is as long as the market normally rises .....without some sort of correction.

The bad news is that if you normally have...... your 4-year setback

- in the 3rd year of the decade,

- this is like winding a spring for the 4th, 5th and 6th years of any decade to be strong.

The next time you run the risk is in the 7th year, going into the 8th year.

If you look back at the last several decades,

- it’s either 1987, 1997, or 2008

- when you get the really nasty corrections or bear markets.

Having said that, my work says..... this is not the start of a new secular bull market.

- You don’t start bullish secular trends ......from 25 times earnings, .....after a 5-year continuous rise.

If you look at the S&P 500, .....divided by the purchasing power or PPI,

- you will see what it buys....... in real dollars.

- It gives the image that....... this really is a secular downtrend that started in the year 2000,

- and in ‘real money’ .....we are absolutely nowhere near making a new high.

For that matter, neither are any of the Western markets.

But...... only in devalued money..... are the US, German, and British stock markets on the cusp of going into new highs,

- and in bubbles...... that’s what happens.

But people should understand that..... the ingredients for a crash

- going into early 2014...... are already in place.

“The secular trend for gold is still absolutely intact.

- The entire fall from $1,900 was similar to what we witnessed in the 1970s, and ...

- just a normal Fibonacci retracement in a bull market.

We will have to wait and see where....... the ultimate low is for gold,

- but the notion that the secular uptrend is dying is...... incorrect.

My bet

- is that $1,180 will probably hold,

- and next year .......not only will gold go through.... $1,900,

- but up to about..... $2,500.

- This will shock many market participants.

After that we go on........ in the next year to the..... $3,000 area.

........................................................................................................................

Miners ??

You also need to watch for....... when the directors of these companies start buying.

- They buy when they know something.

- Just to give you one example, the Chairman of Freeport McMoRan personally bought......... $37 million worth of shares the other day.

- Well,...... he knows something,..... doesn’t he?

- If he........ puts his money where his mouth is,

- I’ll put some of my money ......where his mouth is.

We might be..... a bit early, .....but I don’t think we are..... very early.”

(appointed stockbroker to Her Majesty The Queen)

“We are now into the strong season of the year. We did not see the normal drop during the seasonally weak period of the year in the Western markets because of QE. So, if you can’t fall when you are supposed to fall, you usually go up when you are supposed to go up.

- But it is a bubble

- The Schiller P/E....... is now 25.

- The historic earnings multiple ....is 19.

This is a pretty weird place to start a new bull market from. In any event, the market has been rising for 5 solid years.

- This is as long as the market normally rises .....without some sort of correction.

The bad news is that if you normally have...... your 4-year setback

- in the 3rd year of the decade,

- this is like winding a spring for the 4th, 5th and 6th years of any decade to be strong.

The next time you run the risk is in the 7th year, going into the 8th year.

If you look back at the last several decades,

- it’s either 1987, 1997, or 2008

- when you get the really nasty corrections or bear markets.

Having said that, my work says..... this is not the start of a new secular bull market.

- You don’t start bullish secular trends ......from 25 times earnings, .....after a 5-year continuous rise.

If you look at the S&P 500, .....divided by the purchasing power or PPI,

- you will see what it buys....... in real dollars.

- It gives the image that....... this really is a secular downtrend that started in the year 2000,

- and in ‘real money’ .....we are absolutely nowhere near making a new high.

For that matter, neither are any of the Western markets.

But...... only in devalued money..... are the US, German, and British stock markets on the cusp of going into new highs,

- and in bubbles...... that’s what happens.

But people should understand that..... the ingredients for a crash

- going into early 2014...... are already in place.

“The secular trend for gold is still absolutely intact.

- The entire fall from $1,900 was similar to what we witnessed in the 1970s, and ...

- just a normal Fibonacci retracement in a bull market.

We will have to wait and see where....... the ultimate low is for gold,

- but the notion that the secular uptrend is dying is...... incorrect.

My bet

- is that $1,180 will probably hold,

- and next year .......not only will gold go through.... $1,900,

- but up to about..... $2,500.

- This will shock many market participants.

After that we go on........ in the next year to the..... $3,000 area.

........................................................................................................................

Miners ??

You also need to watch for....... when the directors of these companies start buying.

- They buy when they know something.

- Just to give you one example, the Chairman of Freeport McMoRan personally bought......... $37 million worth of shares the other day.

- Well,...... he knows something,..... doesn’t he?

- If he........ puts his money where his mouth is,

- I’ll put some of my money ......where his mouth is.

We might be..... a bit early, .....but I don’t think we are..... very early.”

gazkaz - 17 Nov 2013 16:56 - 896 of 1034

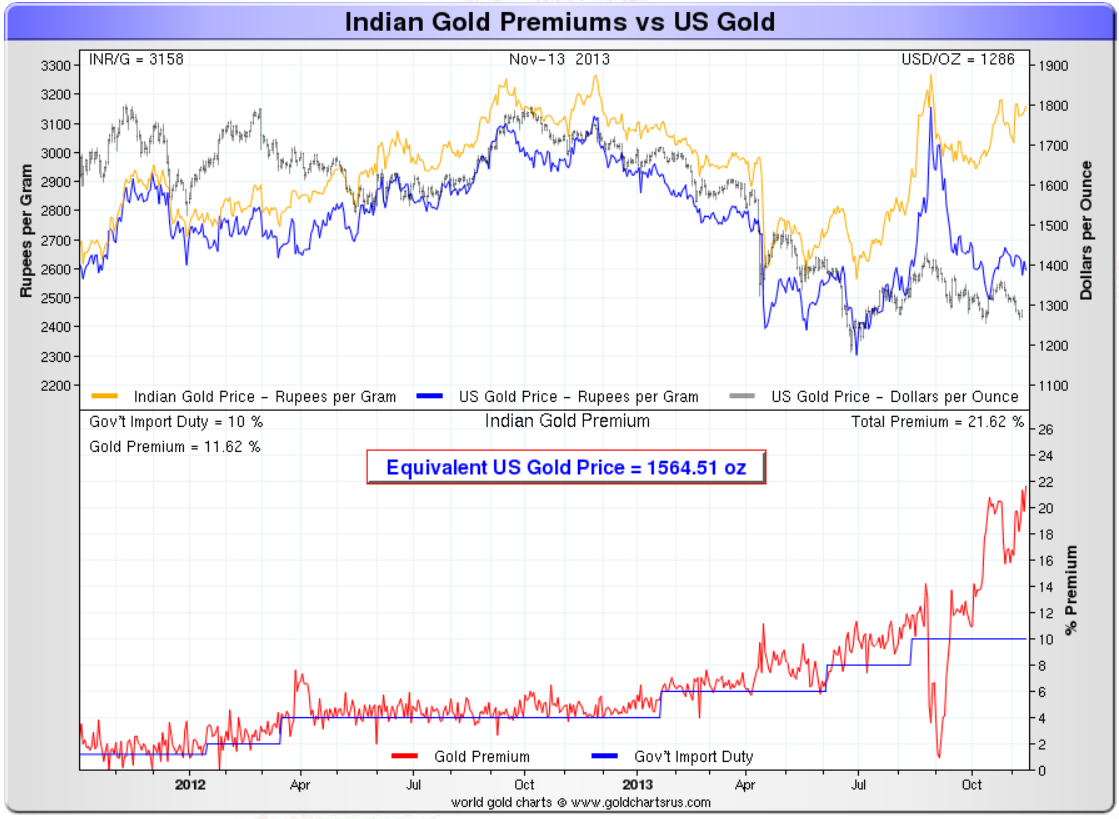

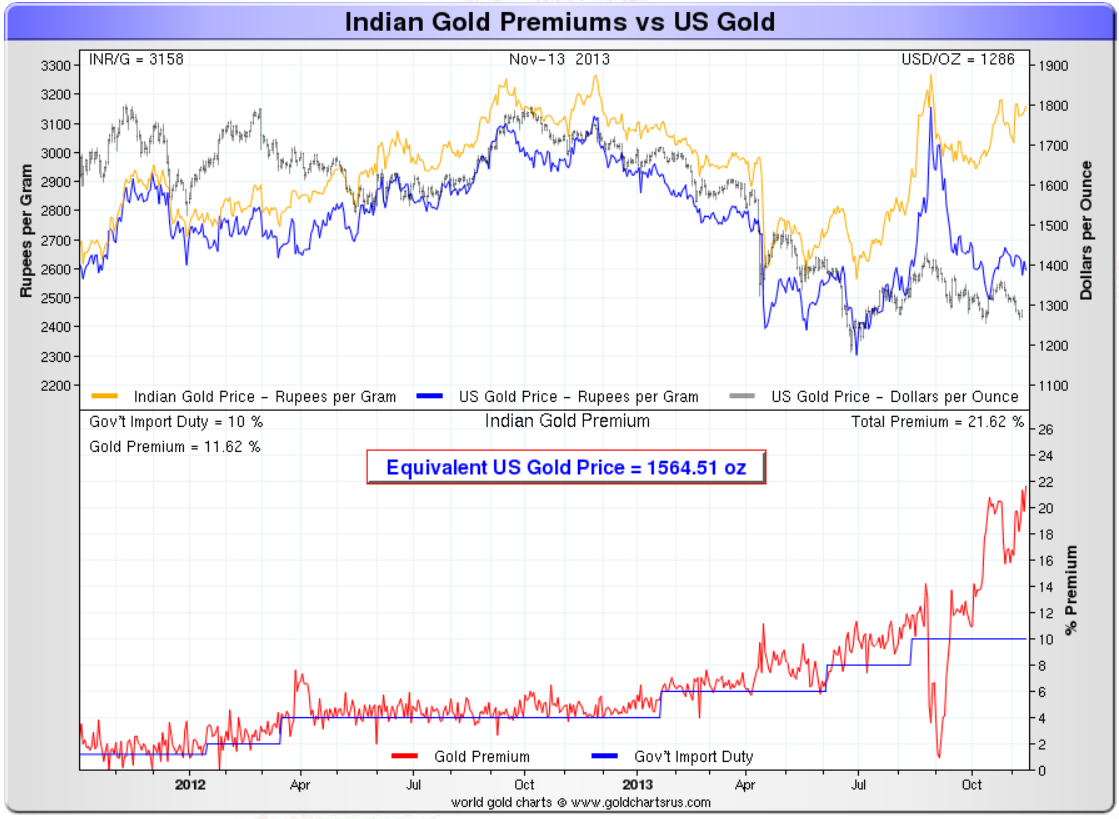

This chart shows the divergence in the price

- of US ...paper Gold

- -vs-....India - physical gold

Top yellow line - India Gold Price

Bottom grey line.....The UG paper gold price

And in case you missed it the bottom part....the red line gives the percentage ...divergence

The blue line ?? - in the bottom part - is the India ....import duty percentage

- as can be seen....

The divergence in US gold price - vs - India Gold price was......

- broadly....fully accounted for purely by....the India import duty

But since the summer - the premium in India has escalated away from the import duty impact by.........

- another 11.62% over and above the import duty.

- of US ...paper Gold

- -vs-....India - physical gold

Top yellow line - India Gold Price

Bottom grey line.....The UG paper gold price

And in case you missed it the bottom part....the red line gives the percentage ...divergence

The blue line ?? - in the bottom part - is the India ....import duty percentage

- as can be seen....

The divergence in US gold price - vs - India Gold price was......

- broadly....fully accounted for purely by....the India import duty

But since the summer - the premium in India has escalated away from the import duty impact by.........

- another 11.62% over and above the import duty.

gazkaz - 23 Nov 2013 14:29 - 897 of 1034

2 Doozy's

- the first seems to have been picked up on - not really seen comment on the second :o)

(Recall what happened when ....Saddam & Gaddafi .....gave the two figers - to payment in "dollars" for their oil ??)

1)

Nov 21 (Reuters) - The Shanghai Futures Exchange (SHFE) may price its crude oil futures contract.... in yuan

and use medium sour crude as its benchmark, its chairman said on Thursday, adding that the bourse is speeding up preparatory work to secure regulatory approvals.

China, which overtook the United States as the world's top oil importer in September, hopes the contract will become a benchmark in Asia and has said

- it would allow foreign investors to trade in the contract

- without setting up a local subsidiary.

http://www.reuters.com/article/2013/11/21/china-crudeoil-idUSL4N0J62M120131121

Comment

- So that's just ....the world's NO 1 - importer of oil (& thus mainstay prop of the.... petro-dollar ponzi-go-round.... giving the finger to the system)

2

People’s Bank of China said t

- The country .......does NOT BENEFIT.....any more .....from increases

- in its ......foreign-currency holdings, (comment....mainly...dollars)

adding to signs policy makers ......will rein in dollar purchases...... that limit the yuan’s appreciation.

“It’s no longer in China’s favor to accumulate foreign-exchange reserves,”

Yi Gang, a deputy governor at the central bank, said in a speech organized by China Economists 50 Forum at Tsinghua University yesterday.

The monetary authority will “basically” end normal intervention in the currency market and broaden the yuan’s daily trading range, Governor Zhou Xiaochuan wrote in an article in a guidebook explaining reforms outlined last week following a Communist Party meeting.

Neither Yi nor Zhou gave a timeframe for any changes.

http://www.bloomberg.com/news/2013-11-20/pboc-says-no-longer-in-china-s-favor-to-boost-record-reserves.html

Comment ....And that's one of the two monster dollar reserve holders (The other being Japan)

- giving the finger to collecting dollars....when they pass GO on the monopoly board

Begs the questions .......

- who is going to mop up all those ....fiat confetti US Dollars...being printed 24/7 & China leaves just washing into the market place.

What happens ....when China says...."It is no longer in the country's interest..... to continue accumulating US Debt/T-Bonds".

&...... what happens if China not only - stops.... accumulating the dollar & bonds....

- but then starts....disposing of them....into

- an already increasinly saturated dollar awash market ??

GAME CHANGERS

The pressure to drag - China &/or Russia....into conflict (via mutual defense pacts re Syria/Iran etc)

- is likely to......increase

- the first seems to have been picked up on - not really seen comment on the second :o)

(Recall what happened when ....Saddam & Gaddafi .....gave the two figers - to payment in "dollars" for their oil ??)

1)

Nov 21 (Reuters) - The Shanghai Futures Exchange (SHFE) may price its crude oil futures contract.... in yuan

and use medium sour crude as its benchmark, its chairman said on Thursday, adding that the bourse is speeding up preparatory work to secure regulatory approvals.

China, which overtook the United States as the world's top oil importer in September, hopes the contract will become a benchmark in Asia and has said

- it would allow foreign investors to trade in the contract

- without setting up a local subsidiary.

http://www.reuters.com/article/2013/11/21/china-crudeoil-idUSL4N0J62M120131121

Comment

- So that's just ....the world's NO 1 - importer of oil (& thus mainstay prop of the.... petro-dollar ponzi-go-round.... giving the finger to the system)

2

People’s Bank of China said t

- The country .......does NOT BENEFIT.....any more .....from increases

- in its ......foreign-currency holdings, (comment....mainly...dollars)

adding to signs policy makers ......will rein in dollar purchases...... that limit the yuan’s appreciation.

“It’s no longer in China’s favor to accumulate foreign-exchange reserves,”

Yi Gang, a deputy governor at the central bank, said in a speech organized by China Economists 50 Forum at Tsinghua University yesterday.

The monetary authority will “basically” end normal intervention in the currency market and broaden the yuan’s daily trading range, Governor Zhou Xiaochuan wrote in an article in a guidebook explaining reforms outlined last week following a Communist Party meeting.

Neither Yi nor Zhou gave a timeframe for any changes.

http://www.bloomberg.com/news/2013-11-20/pboc-says-no-longer-in-china-s-favor-to-boost-record-reserves.html

Comment ....And that's one of the two monster dollar reserve holders (The other being Japan)

- giving the finger to collecting dollars....when they pass GO on the monopoly board

Begs the questions .......

- who is going to mop up all those ....fiat confetti US Dollars...being printed 24/7 & China leaves just washing into the market place.

What happens ....when China says...."It is no longer in the country's interest..... to continue accumulating US Debt/T-Bonds".

&...... what happens if China not only - stops.... accumulating the dollar & bonds....

- but then starts....disposing of them....into

- an already increasinly saturated dollar awash market ??

GAME CHANGERS

The pressure to drag - China &/or Russia....into conflict (via mutual defense pacts re Syria/Iran etc)

- is likely to......increase

gazkaz - 23 Nov 2013 14:54 - 898 of 1034

Expanding of the above....a little further (Well quite a lot further really)

AS OF NOV 18th

- a former head trader for a major financial institution

- issued a harbinger

- and stated

- that 23 countries,

- and 60% .....of the world's GDP,

- are ........right now

Setting up

- new swap lines..... which bypass the dollar, SWIFT, and the BIS, - and will usher in a new global currency system

-

which will kill the dollar

http://www.examiner.com/article/harbinger-23-countries-begin-setting-up-swap-lines-to-bypass-dollar

Tick...Tick....Tick

AS OF NOV 18th

- a former head trader for a major financial institution

- issued a harbinger

- and stated

- that 23 countries,

- and 60% .....of the world's GDP,

- are ........right now

Setting up

- new swap lines..... which bypass the dollar, SWIFT, and the BIS, - and will usher in a new global currency system

-

which will kill the dollar

http://www.examiner.com/article/harbinger-23-countries-begin-setting-up-swap-lines-to-bypass-dollar

Tick...Tick....Tick

talltalk - 25 Nov 2013 16:10 - 899 of 1034

Thank you very much for posting all this .

We really do live in amazing times !

tt

We really do live in amazing times !

tt

gazkaz - 27 Nov 2013 00:58 - 900 of 1034

talktalk - cheers

Interesting comments from William Kaye (far east hedge fund manager) - re a sizeable bet on gold.....way out to 2015 (tying your optinon money up for a good long while)

“The most active series, currently, in the paper gold market is

- the option (contract) in .........December of 2015

- at a $3,000 strike (price).

It’s been extremely active in the last two trading days.

- You have to ask yourself,

- ‘Why would anyone in their right mind, with gold languishing around the $1,250 level, have any interest at all in an option series .....2-years out, ....struck at $3,000, .....(which is) well in excess of the current price?’

And the answer is somebody thinks

- we are going to get there.

- That’s the only reason.

You’ve got enormous leverage at a fairly cheap price if you are right. I personally would not have any interest from a buy-and-hold strategy in that series,

- because I think the Comex..... shuts down long before you see $3,000.

The system itself is so leveraged that they (the Comex) would declare,

( as two bullion banks already have),

- a force majeure

- long before we saw $3,000

because I think that would potentially bankrupt the Comex and the bullion banks. But .......those footprints are extremely bullish.

- Someone is making a bet,

- essentially an important bet,

that we are going to see levels in excess of $3,000 an ounce within the next 2 years.”

Interesting comments from William Kaye (far east hedge fund manager) - re a sizeable bet on gold.....way out to 2015 (tying your optinon money up for a good long while)

“The most active series, currently, in the paper gold market is

- the option (contract) in .........December of 2015

- at a $3,000 strike (price).

It’s been extremely active in the last two trading days.

- You have to ask yourself,

- ‘Why would anyone in their right mind, with gold languishing around the $1,250 level, have any interest at all in an option series .....2-years out, ....struck at $3,000, .....(which is) well in excess of the current price?’

And the answer is somebody thinks

- we are going to get there.

- That’s the only reason.

You’ve got enormous leverage at a fairly cheap price if you are right. I personally would not have any interest from a buy-and-hold strategy in that series,

- because I think the Comex..... shuts down long before you see $3,000.

The system itself is so leveraged that they (the Comex) would declare,

( as two bullion banks already have),

- a force majeure

- long before we saw $3,000

because I think that would potentially bankrupt the Comex and the bullion banks. But .......those footprints are extremely bullish.

- Someone is making a bet,

- essentially an important bet,

that we are going to see levels in excess of $3,000 an ounce within the next 2 years.”

gazkaz - 27 Nov 2013 01:14 - 901 of 1034

Lies, damn lies & gov't statistics

In the US, since the beginning of the 1980s the Bureau of Labor Statistics has “adjusted” the methodology of its inflation model a whopping.... 24 times

The blue line on the chart - restates inflation since 1980 back to that based on the original 1980 model.

So why do they do it ?

“When the government causes the money to deteriorate

- in order to...... cheat all creditors,

- this procedure is...... politely called inflation.”

( George Bernard Shaw)

And - we all .....get cheated.

The reason for showing lower inflation is .....

- Numerous expenditures hinge on it

- national insurance,

- government transfers,

- the salaries of civil servants,

- food stamps etc.

And - This way, ......real GDP growth..... is also fictionally.....revised up,

(since nominal economic growth is divided by the price index).

And even the BULLSHIrT we are told generally

- that “an inflation rate of just ....2%... is healthy”,

Even this fudged artificially ficticious lie

- still translates into .....a loss in purchase power of 50% ....within 35 years.

In the US, since the beginning of the 1980s the Bureau of Labor Statistics has “adjusted” the methodology of its inflation model a whopping.... 24 times

The blue line on the chart - restates inflation since 1980 back to that based on the original 1980 model.

So why do they do it ?

“When the government causes the money to deteriorate

- in order to...... cheat all creditors,

- this procedure is...... politely called inflation.”

( George Bernard Shaw)

And - we all .....get cheated.

The reason for showing lower inflation is .....

- Numerous expenditures hinge on it

- national insurance,

- government transfers,

- the salaries of civil servants,

- food stamps etc.

And - This way, ......real GDP growth..... is also fictionally.....revised up,

(since nominal economic growth is divided by the price index).

And even the BULLSHIrT we are told generally

- that “an inflation rate of just ....2%... is healthy”,

Even this fudged artificially ficticious lie

- still translates into .....a loss in purchase power of 50% ....within 35 years.

gazkaz - 27 Nov 2013 01:28 - 902 of 1034

A few more thoughts by Bill Kaye.

Comex

- “What we do know,........major bullion banks led my JP Morgan, which is the largest player,

- are now very long gold.

- however....that said

there is an enormous OTC market which is ..........extremely opaque,

- and so it is very possible that they are net-short, and possibly very short in a very highly-levered but opaque...... OTC market.

Unallocated gold.

Another area that we have very little vision into are all of these....... unallocated gold accounts.

- I’ve been unable to find anything that estimates

- the ongoing liability from the... IOU’s.... that are outstanding from all of these unallocated gold accounts that JP Morgan, Goldman Sachs, and the other bullion banks possess.

What these unallocated gold accounts amount to are (just)...... massive IOU’s

- that I suspect can never be repaid.

Now, there is reason to believe my suspicion is accurate because we already have had...... two defaults earlier in the year.

The first was ABN AMRO defaulting in April, and subsequently their sister-bank, Rabobank, precisely because

- they had issued IOU’s for which they did not have physical gold.

So they simply forced everyone to settle in cash.

What that tells you is you have major problems with many of these bullion banks, two of which have already defaulted.

- You’ve got major problems with this unallocated gold system,

- which is nothing more than a very highly-levered fractional reserve system for gold,

- in which the banks possess just a tiny fraction of the gold.

My suspicion is

- the entire (fractional reserve gold) system, ultimately, probably within the next year, will go the way of ABN AMRO and Rabobank.

- They will all settle for cash when the market begins to make an important up-move which could be first quarter or second quarter of next year,

- and people will be scrambling for gold because they are going to be forced out for cash,

- and they are going to want to put themselves in a position..... they thought they were in ....when owning .....unallocated gold.

GLD ETF

Certainly we’ve noticed some of these suspects

- converting at very attractive prices

- their holdings of GLD...... into physical.

This typically gets reported in the mainstream media as Soros, or name another elite, selling or reducing their stake. And this....... just isn’t right.

For the most part these entities are converting their (paper) gold

- into physical (gold)

- in lots of 100,000 (shares of GLD).

They......... have the wealth to do that

Comex

- “What we do know,........major bullion banks led my JP Morgan, which is the largest player,

- are now very long gold.

- however....that said

there is an enormous OTC market which is ..........extremely opaque,

- and so it is very possible that they are net-short, and possibly very short in a very highly-levered but opaque...... OTC market.

Unallocated gold.

Another area that we have very little vision into are all of these....... unallocated gold accounts.

- I’ve been unable to find anything that estimates

- the ongoing liability from the... IOU’s.... that are outstanding from all of these unallocated gold accounts that JP Morgan, Goldman Sachs, and the other bullion banks possess.

What these unallocated gold accounts amount to are (just)...... massive IOU’s

- that I suspect can never be repaid.

Now, there is reason to believe my suspicion is accurate because we already have had...... two defaults earlier in the year.

The first was ABN AMRO defaulting in April, and subsequently their sister-bank, Rabobank, precisely because

- they had issued IOU’s for which they did not have physical gold.

So they simply forced everyone to settle in cash.

What that tells you is you have major problems with many of these bullion banks, two of which have already defaulted.

- You’ve got major problems with this unallocated gold system,

- which is nothing more than a very highly-levered fractional reserve system for gold,

- in which the banks possess just a tiny fraction of the gold.

My suspicion is

- the entire (fractional reserve gold) system, ultimately, probably within the next year, will go the way of ABN AMRO and Rabobank.

- They will all settle for cash when the market begins to make an important up-move which could be first quarter or second quarter of next year,

- and people will be scrambling for gold because they are going to be forced out for cash,

- and they are going to want to put themselves in a position..... they thought they were in ....when owning .....unallocated gold.

GLD ETF

Certainly we’ve noticed some of these suspects

- converting at very attractive prices

- their holdings of GLD...... into physical.

This typically gets reported in the mainstream media as Soros, or name another elite, selling or reducing their stake. And this....... just isn’t right.

For the most part these entities are converting their (paper) gold

- into physical (gold)

- in lots of 100,000 (shares of GLD).

They......... have the wealth to do that

gazkaz - 27 Nov 2013 01:43 - 903 of 1034

Alistaire McLeod - mirrors Sprotts thoughts on - World Gold Council "official fiction"

The amount of gold absorbed by private sector purchases in Hong Kong and China amount to .....at least 2,130.7 tonnes in the first nine months of this year,

- or 2,841 tonnes annualised.

This compares with the WGC’s estimates from their quarterly Gold Demand Trends of only..... 818.6 tonnes.... for the same period, or....... 1,091.5 annualised.

Given the hard evidence of Hong Kong and SGE statistics it appears that the WGC’s figures....... substantially understate the true position.

Estimates of China’s demand .....also exclude government purchases of gold in foreign markets,

- and gold that may have been acquired and imported by wealthy Chinese from foreign locations .......without going through Hong Kong or the SGE.

So without taking into account these extra factors, China and Hong Kong’s combined imports from the rest of the world

- exceeds all other mine supply....... by at least 580 tonnes

- on an annualised basis.

It now becomes clear that .....without significant leasing by Western central banks

- total Asian demand could not be satisfied at current prices,

- because there is no evidence of material selling by existing holders of above-ground stocks.

Comment - and as seen Kaye and others - believe

- the huge fall in GLD physical

- has not been redemtions & supply into the market

- but wealthy elites - exchanging their GLD paper.....for the real physical stuff.

Hence the real true shortfall in production/supply & demand.....is being met by the central banks

(London Gold Pool Style)

The amount of gold absorbed by private sector purchases in Hong Kong and China amount to .....at least 2,130.7 tonnes in the first nine months of this year,

- or 2,841 tonnes annualised.

This compares with the WGC’s estimates from their quarterly Gold Demand Trends of only..... 818.6 tonnes.... for the same period, or....... 1,091.5 annualised.

Given the hard evidence of Hong Kong and SGE statistics it appears that the WGC’s figures....... substantially understate the true position.

Estimates of China’s demand .....also exclude government purchases of gold in foreign markets,

- and gold that may have been acquired and imported by wealthy Chinese from foreign locations .......without going through Hong Kong or the SGE.

So without taking into account these extra factors, China and Hong Kong’s combined imports from the rest of the world

- exceeds all other mine supply....... by at least 580 tonnes

- on an annualised basis.

It now becomes clear that .....without significant leasing by Western central banks

- total Asian demand could not be satisfied at current prices,

- because there is no evidence of material selling by existing holders of above-ground stocks.

Comment - and as seen Kaye and others - believe

- the huge fall in GLD physical

- has not been redemtions & supply into the market

- but wealthy elites - exchanging their GLD paper.....for the real physical stuff.

Hence the real true shortfall in production/supply & demand.....is being met by the central banks

(London Gold Pool Style)

gazkaz - 27 Nov 2013 01:45 - 904 of 1034

The world’s largest jewellery group, Chow Tai Fook Jewellery Group Ltd. , established in 1929,

- report sales jumped.... 49%

during the first half of 2013.

sd

Friday saw deliveries of physical gold.... at 17 tonnes into the Shanghai gold exchange.

- Total for the month:..... 216 tonnes.

The world produces 175 tonnes of gold per month so Shanghai is delivering

- 123% of monthly global gold production.

- report sales jumped.... 49%

during the first half of 2013.

sd

Friday saw deliveries of physical gold.... at 17 tonnes into the Shanghai gold exchange.

- Total for the month:..... 216 tonnes.

The world produces 175 tonnes of gold per month so Shanghai is delivering

- 123% of monthly global gold production.

gazkaz - 27 Nov 2013 01:50 - 905 of 1034

Venezuala

After Hugo Chavez retrieved some of their gold back to Venezuala

- after ongoing financial problems the new Gov has

- agreed with SachsOFgold

- that they can do what GS do....with some of their gold

By the time that GS have leveraged, fractionalised, hypothecated and re-hypothecated it

- it should keep the paper players game afloat for a while

After Hugo Chavez retrieved some of their gold back to Venezuala

- after ongoing financial problems the new Gov has

- agreed with SachsOFgold

- that they can do what GS do....with some of their gold

By the time that GS have leveraged, fractionalised, hypothecated and re-hypothecated it

- it should keep the paper players game afloat for a while

gazkaz - 27 Nov 2013 08:01 - 906 of 1034

Some excitement about the stokellator.....re silver

- allegedly....the position of the stokeillator (14,7,7 Stochastics series)

- is spectacular,

- and very close to flashing a crossover buy signal.

Sorry the technicals of "14,7,7 Stochasics" is over my head

(- need Sahara on that one :o)

- allegedly....the position of the stokeillator (14,7,7 Stochastics series)

- is spectacular,

- and very close to flashing a crossover buy signal.

Sorry the technicals of "14,7,7 Stochasics" is over my head

(- need Sahara on that one :o)

Saturn6 - 27 Nov 2013 10:43 - 907 of 1034

Cheers again Gaz ffor all your posts.

What do you think of the comet ISON?

Could it be 'Wormwood'?? Is it even a comet/?

"The third angel blew his trumpet, and a great star fell from heaven, blazing like a torch, and it fell on a third of the rivers and on the springs of water. The name of the star is Wormwood. A third of the waters became wormwood, and many died from the water, because it was made bitter." (Revelation 8:10–11,

S.

What do you think of the comet ISON?

Could it be 'Wormwood'?? Is it even a comet/?

"The third angel blew his trumpet, and a great star fell from heaven, blazing like a torch, and it fell on a third of the rivers and on the springs of water. The name of the star is Wormwood. A third of the waters became wormwood, and many died from the water, because it was made bitter." (Revelation 8:10–11,

S.

gazkaz - 29 Nov 2013 15:10 - 908 of 1034

Cheers Sahara

Nice to know that although you are probably too busy doing what you do, that you get the chance to read "the stuff" & my musings :o)

Been reading and watching y/t's re ISON along the way. Doesn't seem to have lived up to the hype of ..up to 10x brighter than a full moon, visible by day, and a tail arcing up to 60% accross the night sky (at least on the run into towards the sun).

- If it makes it round the sun....the ouward leg is still to come tho'.

There are a few vids on y/tube re it's passing of mars (if you search.. ISON Mars Coma..should throw them up)

- suggests ISON "lit up" mars (significantly brightened it and also gave it a ready-brek surrounding glow).

No official records... re its mars passing....as unfortunately along with the "coincidental" ..US gov't shut down

- all the "automatic feeds" from the space based telsecopes/mars rover etc

- were ..also.. "on furlow" ...along with their gov't staff/NASA etc

(these coincidences - do regrettably tend to happen at...interesting times).

I assume there is all the tail debris which we "may" at some point have the pleasure of encountering from the inward run....and possibly any outward run.

- additionally if it doesn't end up.... crashing into the sun

- if it breaks up ....that equals "big lumps of debris"...in the neighbourhood.

Hopefully they can take out any dangerous big stuff with the land/space based exotic beam weapons (Courtessy of Reagans...successful...space hardware).

(Hopefully & all fingers crossed on that coincidence).

Prof James McCanney

- does some good lectures/interviews on Y/Tube - that knocks the comet "Dirty Snownall" official theory - well and truly into a cocked hat (& beyond)

- generally - they are sold lumps and charged (in accordance with...the electric universe/thunderbolt project....style priciples....if you have read/watched any of that)

- which would potentially account for the above....ready-brek effect...as it passed Mars.

There is another....great lump coming by...in March 2014.

(As well as ISON's outbound run -in early 2014....if.... it gets round the sun)

- again just coincidence that....congress kicked the "debt limit can"...forward to Mar 2014, of course.

(All fingers crossed...on that being a rare ...genuine coincidence :o)

Biblical

Sorry I don't keep the links - so can only mention from memory, but

- the (or ...an old testament "only" followers version) bible

- makes reference to .....what is generally, if not actually quoted as such, then assumed to be "Blood Moons"

(which from memory are eclipses that accurr on a particular faiths festival....pass over springs to mind).

- obviously the chances of eclipses occurring on such festival dates are ...rare

- but....in their biblical end times count down....the requisite number blood moons mentioned

- are ...all due to occur.... in just the next few years

(3 or 4 spring to mind....but I may be wrong on that count).

.....................................................................................................................

I think all those inter-connected damn big bunkers

- seed vaults

- vatican owned... space/terrestrial telescopes

(One of their ....space based projests is L.U.C.I.F.E.R...(I forget what it stands for)

- relatively recent south pole telescope

(& if my memory serves me correctly - I think it's Australia that have a space project actually called "wormwood")

- plus sudden deaths of a clutch of deep space astronomers in....interesting circumstances in the last decade or so

- all points to.....send answers on a postcard to :o)

.......................................................................................................................

Wow Sahara - just back read... this post

- a bit lengthy answer ...for just a short question

(& I was trying so hard to keep it as short as posssible too, and missed lots out as well - I read far too much "stuff")

.....................................................................................................................

Sahara - update

The Blood moons aspect - I think relate to this :-

“And I will show wonders in the heavens, and in the earth, blood and fire and pillars of smoke.

The sun shall be turned into darkness, and the moon into blood, before the coming of the great and awesome day of the Lord.”

(Joel 2:30-31)

Update 2

A quick search - throws this reference up

http://www.examiner.com/list/four-blood-moons-something-is-about-to-change-by-john-hagee

The final part concerns .....the four ....blood moons

- of the past, present and future, the meanings behind solar and lunar eclipses and how two Feasts, Passover and Sukkot,

- relate to NASA’s forecast of the blood moons.

Hagee writes,

“It is very rare that Scripture, science, and historical events align with one another, yet

- the last three Four Blood Moon series, or Tetrad’s..... have done exactly that.”

These events happened..... three times in the past 500 years

- and are scheduled to happen again

- next year and the year after.

Hagee asks, “…are we listening?”

........................................................................................................................

2015

- does seem to crop up regularly in a lot of diverse aspects

- must make diary note for late 2014

- buy tin foil, a military helmet & consider digging bunker, as well as increase stock of tinned beans ( &... Air Freshener :o)

Sorry Sahara - an even ...longer....answer now.

- Have a great weekend

Nice to know that although you are probably too busy doing what you do, that you get the chance to read "the stuff" & my musings :o)

Been reading and watching y/t's re ISON along the way. Doesn't seem to have lived up to the hype of ..up to 10x brighter than a full moon, visible by day, and a tail arcing up to 60% accross the night sky (at least on the run into towards the sun).

- If it makes it round the sun....the ouward leg is still to come tho'.

There are a few vids on y/tube re it's passing of mars (if you search.. ISON Mars Coma..should throw them up)

- suggests ISON "lit up" mars (significantly brightened it and also gave it a ready-brek surrounding glow).

No official records... re its mars passing....as unfortunately along with the "coincidental" ..US gov't shut down

- all the "automatic feeds" from the space based telsecopes/mars rover etc

- were ..also.. "on furlow" ...along with their gov't staff/NASA etc

(these coincidences - do regrettably tend to happen at...interesting times).

I assume there is all the tail debris which we "may" at some point have the pleasure of encountering from the inward run....and possibly any outward run.

- additionally if it doesn't end up.... crashing into the sun

- if it breaks up ....that equals "big lumps of debris"...in the neighbourhood.

Hopefully they can take out any dangerous big stuff with the land/space based exotic beam weapons (Courtessy of Reagans...successful...space hardware).

(Hopefully & all fingers crossed on that coincidence).

Prof James McCanney

- does some good lectures/interviews on Y/Tube - that knocks the comet "Dirty Snownall" official theory - well and truly into a cocked hat (& beyond)

- generally - they are sold lumps and charged (in accordance with...the electric universe/thunderbolt project....style priciples....if you have read/watched any of that)

- which would potentially account for the above....ready-brek effect...as it passed Mars.

There is another....great lump coming by...in March 2014.

(As well as ISON's outbound run -in early 2014....if.... it gets round the sun)

- again just coincidence that....congress kicked the "debt limit can"...forward to Mar 2014, of course.

(All fingers crossed...on that being a rare ...genuine coincidence :o)

Biblical

Sorry I don't keep the links - so can only mention from memory, but

- the (or ...an old testament "only" followers version) bible

- makes reference to .....what is generally, if not actually quoted as such, then assumed to be "Blood Moons"

(which from memory are eclipses that accurr on a particular faiths festival....pass over springs to mind).

- obviously the chances of eclipses occurring on such festival dates are ...rare

- but....in their biblical end times count down....the requisite number blood moons mentioned

- are ...all due to occur.... in just the next few years

(3 or 4 spring to mind....but I may be wrong on that count).

.....................................................................................................................

I think all those inter-connected damn big bunkers

- seed vaults

- vatican owned... space/terrestrial telescopes

(One of their ....space based projests is L.U.C.I.F.E.R...(I forget what it stands for)

- relatively recent south pole telescope

(& if my memory serves me correctly - I think it's Australia that have a space project actually called "wormwood")

- plus sudden deaths of a clutch of deep space astronomers in....interesting circumstances in the last decade or so

- all points to.....send answers on a postcard to :o)

.......................................................................................................................

Wow Sahara - just back read... this post

- a bit lengthy answer ...for just a short question

(& I was trying so hard to keep it as short as posssible too, and missed lots out as well - I read far too much "stuff")

.....................................................................................................................

Sahara - update

The Blood moons aspect - I think relate to this :-

“And I will show wonders in the heavens, and in the earth, blood and fire and pillars of smoke.

The sun shall be turned into darkness, and the moon into blood, before the coming of the great and awesome day of the Lord.”

(Joel 2:30-31)

Update 2

A quick search - throws this reference up

http://www.examiner.com/list/four-blood-moons-something-is-about-to-change-by-john-hagee

The final part concerns .....the four ....blood moons

- of the past, present and future, the meanings behind solar and lunar eclipses and how two Feasts, Passover and Sukkot,

- relate to NASA’s forecast of the blood moons.

Hagee writes,

“It is very rare that Scripture, science, and historical events align with one another, yet

- the last three Four Blood Moon series, or Tetrad’s..... have done exactly that.”

These events happened..... three times in the past 500 years

- and are scheduled to happen again

- next year and the year after.

Hagee asks, “…are we listening?”

........................................................................................................................

2015

- does seem to crop up regularly in a lot of diverse aspects

- must make diary note for late 2014

- buy tin foil, a military helmet & consider digging bunker, as well as increase stock of tinned beans ( &... Air Freshener :o)

Sorry Sahara - an even ...longer....answer now.

- Have a great weekend

Saturn6 - 29 Nov 2013 17:20 - 909 of 1034

Thnaks Gaz - It looks as if ISON failed to make it around the sun....

http://abcnews.go.com/Technology/comet-ison-disintegrate-passes-sun-today/story?id=21041610

Yes the four 'Blood Mooons' are due on the festival days 2014/15. We had four consecutive lunar eclipses in 2003/4 but actually the days are slightly off for eg the feast of Passover is a couple of days earlier than the 'blood moon'.

Also the prophetic verses in scripture referencing 'Blood Moons' are all in conjunction with the sun being darkened/blacckened, which is iimplied as more than just an eclipse.

See (Joel 2:30-31) "And I will show wonders in the heavens and in the earth:

Blood and fire and pillars of smoke. The sun shall be turned into darkness,

And the moon into blood, Before the coming of the great and awesome day of the Lord.

Also Book of Acts (Acts 2:17-21) 'And it shall come to pass in the last days, says God, That I will pour out of My Spirit on all flesh; Your sons and your daughters shall prophesy, your young men shall see visions, your old men shall dream dreams. And on My menservants and on My maidservants I will pour out My Spirit in those days;

And they shall prophesy. I will show wonders in heaven above. And signs in the earth beneath: blood and fire and vapor of smoke. The sun shall be turned into darkness, and the moon into blood, before the coming of the great and awesome day of the Lord. And it shall come to pass that whoever calls on the name of the Lord

shall be saved.'

And (Revelation 6:12-15) I looked when He opened the sixth seal, and behold, there was a great earthquake; and the sun became black as sackcloth of hair, and the moon became like blood. And the stars of heaven fell to the earth, as a fig tree drops its late figs when it is shaken by a mighty wind. Then the sky receded as a scroll when it is rolled up, and every mountain and island was moved out of its place.

Notice apart from the sun being black the blood moons are relative to the 'Sixth Seal' being opened, and if we look back to the 5th Seal we can see it is the startof the 'Greta Tribulation' (Revelation 6:9) which has not even begun yet and I cannot see it happening before 2018, and perhaps much later//?

Yahushua refers to the time in (Matthew 24:29-31) ...Immediately after the tribulation of those days the sun will be darkened, and the moon will not give its light; the stars will fall from heaven, and the powers of the heavens will be shaken. Then the sign of the Son of Man will appear in heaven, and then all the tribes of the earth will mourn, and they will see the Son of Man coming on the clouds of heaven with power and great glory. And He will send His angels with a great sound of a trumpet, and they will gather together His elect from the four winds, from one end of heaven to the other.

Also there will be a roaring of the seas.

So while some occurrences throughout history were preceded by blood moons not all were. The ones we should be alarmed about are the ones that are accompanied by a black sun.

Meanwhile....'And what I say unto you I say unto all, Watch.' Mark 13:37

S.

http://abcnews.go.com/Technology/comet-ison-disintegrate-passes-sun-today/story?id=21041610

Yes the four 'Blood Mooons' are due on the festival days 2014/15. We had four consecutive lunar eclipses in 2003/4 but actually the days are slightly off for eg the feast of Passover is a couple of days earlier than the 'blood moon'.

Also the prophetic verses in scripture referencing 'Blood Moons' are all in conjunction with the sun being darkened/blacckened, which is iimplied as more than just an eclipse.

See (Joel 2:30-31) "And I will show wonders in the heavens and in the earth:

Blood and fire and pillars of smoke. The sun shall be turned into darkness,

And the moon into blood, Before the coming of the great and awesome day of the Lord.

Also Book of Acts (Acts 2:17-21) 'And it shall come to pass in the last days, says God, That I will pour out of My Spirit on all flesh; Your sons and your daughters shall prophesy, your young men shall see visions, your old men shall dream dreams. And on My menservants and on My maidservants I will pour out My Spirit in those days;

And they shall prophesy. I will show wonders in heaven above. And signs in the earth beneath: blood and fire and vapor of smoke. The sun shall be turned into darkness, and the moon into blood, before the coming of the great and awesome day of the Lord. And it shall come to pass that whoever calls on the name of the Lord

shall be saved.'

And (Revelation 6:12-15) I looked when He opened the sixth seal, and behold, there was a great earthquake; and the sun became black as sackcloth of hair, and the moon became like blood. And the stars of heaven fell to the earth, as a fig tree drops its late figs when it is shaken by a mighty wind. Then the sky receded as a scroll when it is rolled up, and every mountain and island was moved out of its place.

Notice apart from the sun being black the blood moons are relative to the 'Sixth Seal' being opened, and if we look back to the 5th Seal we can see it is the startof the 'Greta Tribulation' (Revelation 6:9) which has not even begun yet and I cannot see it happening before 2018, and perhaps much later//?

Yahushua refers to the time in (Matthew 24:29-31) ...Immediately after the tribulation of those days the sun will be darkened, and the moon will not give its light; the stars will fall from heaven, and the powers of the heavens will be shaken. Then the sign of the Son of Man will appear in heaven, and then all the tribes of the earth will mourn, and they will see the Son of Man coming on the clouds of heaven with power and great glory. And He will send His angels with a great sound of a trumpet, and they will gather together His elect from the four winds, from one end of heaven to the other.

Also there will be a roaring of the seas.

So while some occurrences throughout history were preceded by blood moons not all were. The ones we should be alarmed about are the ones that are accompanied by a black sun.

Meanwhile....'And what I say unto you I say unto all, Watch.' Mark 13:37

S.

gazkaz - 29 Nov 2013 22:25 - 910 of 1034

Sahara - yes looks like officially - ISON has broken up.

& I assume most of the big stuff should get sucked into the sun.

Although - the amateurs - seem to be producing stuff - suggesting ISON... survived

http://www.youtube.com/watch?feature=player_embedded&v=qt6ZEkty4Rw

Either way

- This video from a couple of months ago

- shows some of the early preceeeding fireballs that earth experienced (dislodged by ISON on the way through the asteroid belt).

The alleged opinion midway thro' states - we should start hitting.... the ISON inbound run to the sun.... tail debris

- in the next few days.

http://www.youtube.com/watch?v=DKFXcaR5UaM

The Bible prophecies will probably tend to be like Nostradamus.....so damned obvious (as many things are ...with the benefit of 20/20 hindsight :o)

At the moment (& indeed....for some while) I just get the gut feeling

- so much is totally topsy turvy & doesn't stack up in a sane world of common sense, that...

- it seems ..anything and everything... is being done to ....

- snooze the masses into believing that everything is - totally normal & all tickety boo.

(The sort of ....."pending" Hollywood Presidential stuff of - "we can't save everybody...why instill panic.....leave them with the bliss of ignorance as long as possible".....type scenario)

Whilst - back at the ranch - a myriad of diverse "stuff" - suggests that on the near horizon....all is definitely not .....

- "all normal & tickety boo"

- in fact quite the opposite

........................................................................................................................

eg....just one...quite obscure unusual & abnormal event (I haven't previously mentioned)

TEN.... major volcanoes

- have erupted along the Ring of Fire during.... the past few months,

(and the mainstream media in the United States has been.... strangely silent about this).

But this is a very big deal.

- We are seeing eruptions at some volcanoes that have been... dormant for decades.

- Yes, it is certainly not unusual for... two or three... major volcanoes along the Ring of Fire to be active at the same time,

- but what we are witnessing right now is highly unusual.

And if the U.S. media is not concerned about this yet, the truth is that they should be. Approximately 90 percent of all earthquakes and approximately 80 percent of all volcanic eruptions occur along the Ring of Fire, and.......

- it runs directly up the west coast of the United States.

http://thetruthwins.com/archives/why-have-10-major-volcanoes-along-the-ring-of-fire-suddenly-roared-to-life

As if - in the cross hairs FUKISHIMA ....doesn't have ....enough trouble already

As if - in the cross hairs FUKISHIMA ....doesn't have ....enough trouble already

& I assume most of the big stuff should get sucked into the sun.

Although - the amateurs - seem to be producing stuff - suggesting ISON... survived

http://www.youtube.com/watch?feature=player_embedded&v=qt6ZEkty4Rw

Either way

- This video from a couple of months ago

- shows some of the early preceeeding fireballs that earth experienced (dislodged by ISON on the way through the asteroid belt).

The alleged opinion midway thro' states - we should start hitting.... the ISON inbound run to the sun.... tail debris

- in the next few days.

http://www.youtube.com/watch?v=DKFXcaR5UaM

The Bible prophecies will probably tend to be like Nostradamus.....so damned obvious (as many things are ...with the benefit of 20/20 hindsight :o)

At the moment (& indeed....for some while) I just get the gut feeling

- so much is totally topsy turvy & doesn't stack up in a sane world of common sense, that...

- it seems ..anything and everything... is being done to ....

- snooze the masses into believing that everything is - totally normal & all tickety boo.

(The sort of ....."pending" Hollywood Presidential stuff of - "we can't save everybody...why instill panic.....leave them with the bliss of ignorance as long as possible".....type scenario)

Whilst - back at the ranch - a myriad of diverse "stuff" - suggests that on the near horizon....all is definitely not .....

- "all normal & tickety boo"

- in fact quite the opposite

........................................................................................................................

eg....just one...quite obscure unusual & abnormal event (I haven't previously mentioned)

TEN.... major volcanoes

- have erupted along the Ring of Fire during.... the past few months,

(and the mainstream media in the United States has been.... strangely silent about this).

But this is a very big deal.

- We are seeing eruptions at some volcanoes that have been... dormant for decades.

- Yes, it is certainly not unusual for... two or three... major volcanoes along the Ring of Fire to be active at the same time,

- but what we are witnessing right now is highly unusual.

And if the U.S. media is not concerned about this yet, the truth is that they should be. Approximately 90 percent of all earthquakes and approximately 80 percent of all volcanic eruptions occur along the Ring of Fire, and.......

- it runs directly up the west coast of the United States.

http://thetruthwins.com/archives/why-have-10-major-volcanoes-along-the-ring-of-fire-suddenly-roared-to-life

As if - in the cross hairs FUKISHIMA ....doesn't have ....enough trouble already

As if - in the cross hairs FUKISHIMA ....doesn't have ....enough trouble already

gazkaz - 29 Nov 2013 22:54 - 911 of 1034

Interesting chart....particularly the very bottom section.

Whilst I recognise that with gold....like oil

- many players on futures....never intend to ever take - actual physical delivery of a commodity

(Speculation /hedging and the like)

However the bottom section in the follwing chart shows

- that the ratio - of comex open interest

- -vs- physical comex gold available

- has rocketed from....sub 20:1 to almost 70:1

- during just ...this year to date

In my speak

- at the beginning of this year

- had all open interest stood for deivery

- at a ratio of 20/1....1 would receive delivery & 19 people would have ...not....received delivery

Whilst curently at a ratio of nearly .......70/1

- Only ONE person would receive physical.....whilst SIXTY NINE...would obviously have to settle for being paid out....in fiat paper.

I keep an eye on HarveyO's figures.....and very little (often none at all) seems to enter the main four players inventory in recent months

- and additionally when for example JPM has to deliver

- inventory is sucked - as necessary....from the other 3 majors

(All reminiscent of...the London Gold Pool)

The second chart from the bottom....illustrates such a nose dive - in comex inventory available

- that even this "gold Pool" style....3 card monty inventory shuffling

- may not have much...legs left.

Especially if the "owners per ounce ...available"

- continues to rocket beyond the current.....70 : 1 ratio

Coupled together

- As inventory falls & the ratio of "owners per ounce" rises

- it takes....an ever decreasing ratio of open interest....to then stand for delivery

- before comex supply..... is wiped out completely.

(That doesn't bode well on the war.... or "Falsie Flaggy" front...either)

Whilst I recognise that with gold....like oil

- many players on futures....never intend to ever take - actual physical delivery of a commodity

(Speculation /hedging and the like)

However the bottom section in the follwing chart shows

- that the ratio - of comex open interest

- -vs- physical comex gold available

- has rocketed from....sub 20:1 to almost 70:1

- during just ...this year to date

In my speak

- at the beginning of this year

- had all open interest stood for deivery

- at a ratio of 20/1....1 would receive delivery & 19 people would have ...not....received delivery

Whilst curently at a ratio of nearly .......70/1

- Only ONE person would receive physical.....whilst SIXTY NINE...would obviously have to settle for being paid out....in fiat paper.

I keep an eye on HarveyO's figures.....and very little (often none at all) seems to enter the main four players inventory in recent months

- and additionally when for example JPM has to deliver

- inventory is sucked - as necessary....from the other 3 majors

(All reminiscent of...the London Gold Pool)

The second chart from the bottom....illustrates such a nose dive - in comex inventory available

- that even this "gold Pool" style....3 card monty inventory shuffling

- may not have much...legs left.

Especially if the "owners per ounce ...available"

- continues to rocket beyond the current.....70 : 1 ratio

Coupled together

- As inventory falls & the ratio of "owners per ounce" rises

- it takes....an ever decreasing ratio of open interest....to then stand for delivery

- before comex supply..... is wiped out completely.

(That doesn't bode well on the war.... or "Falsie Flaggy" front...either)

gazkaz - 30 Nov 2013 00:24 - 912 of 1034

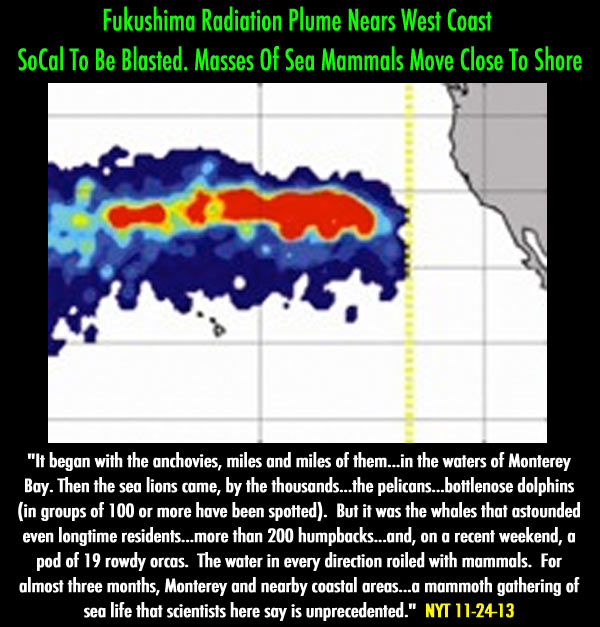

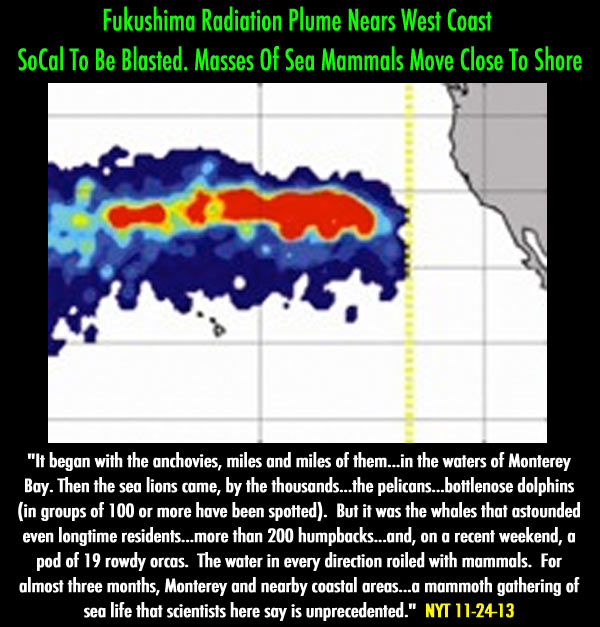

It began

(This is West Coast USA)

- with the anchovies, ....miles and miles of them,

- their silvery blue bodies thick in the waters of Monterey Bay.

- Then ......the sea lions came, .....by the thousands,

(from up and down the California coast),

- and the pelicans, arriving.... in one long V-formation.... after another.

Fleets .....of bottlenose dolphins.... joined them. But it was ...

- the whales ....that astounded ....even longtime residents

– more than 200 humpbacks..... lunging, breaching, blowing and tail flapping

– and, on a recent weekend, a pod of ....19 rowdy orcas that briefly crashed the party, picking off sea lions along the way.

“I can’t tell you where to look,” Nancy Black, a marine biologist leading a boat full of whale watchers said

- as the water in every direction roiled with mammals.

“It’s all around.”

For almost three months,

Monterey and nearby coastal areas have played host to..... a mammoth convocation of sea life

- that scientists here say is ........unprecedented in their memories

Maybe 2 + 2 = "the above"

(This is West Coast USA)

- with the anchovies, ....miles and miles of them,

- their silvery blue bodies thick in the waters of Monterey Bay.

- Then ......the sea lions came, .....by the thousands,

(from up and down the California coast),

- and the pelicans, arriving.... in one long V-formation.... after another.

Fleets .....of bottlenose dolphins.... joined them. But it was ...

- the whales ....that astounded ....even longtime residents

– more than 200 humpbacks..... lunging, breaching, blowing and tail flapping

– and, on a recent weekend, a pod of ....19 rowdy orcas that briefly crashed the party, picking off sea lions along the way.

“I can’t tell you where to look,” Nancy Black, a marine biologist leading a boat full of whale watchers said

- as the water in every direction roiled with mammals.

“It’s all around.”

For almost three months,

Monterey and nearby coastal areas have played host to..... a mammoth convocation of sea life

- that scientists here say is ........unprecedented in their memories

Maybe 2 + 2 = "the above"