| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

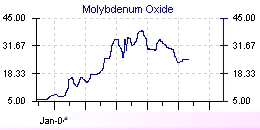

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 14 Sep 2006 14:37

- 201 of 213

- 14 Sep 2006 14:37

- 201 of 213

I would guess they know whats going on ??? perhaps........

http://www.advfn.com/p.php?pid=nmona&article=16836515

Thats a positive sign :)

PapalPower

- 14 Sep 2006 14:43

- 202 of 213

- 14 Sep 2006 14:43

- 202 of 213

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

PapalPower

- 15 Sep 2006 01:33

- 203 of 213

- 15 Sep 2006 01:33

- 203 of 213

Its a funny old world this one of mining corporate finance and sometimes compliance makes a mockery of common sense. On 31 August AIM listed Eureka Mining, which was a base metal spin-off from Celtic Resources at the beginning of 2004, announced that it had entered talks with an undisclosed party, but said there was no guarantee that a deal would materialise. That is one good way to get shares on the move and old Minews surmised that the most likely bidder must be Celtic Resources as it still has a holding of 18 per cent in Eureka and is stuffed with cash after being paid US$80 million for a diminished stake in the Nezhdaninskoye gold mine in Siberia. .. more ..

http://www.minesite.com/storyFull5.php?storySeq=3794

Lostandfound - 15 Sep 2006 12:03 - 204 of 213

I'm confused on this one. One minute they are short of funds and about to cease trading, or be bought out by some unknown group, the next they get $1.5m from sales - which they must have had some knowledge about.

Any idea what their cash burn rate is? Am I alone in thinking this odd?

PapalPower

- 19 Sep 2006 08:23

- 205 of 213

- 19 Sep 2006 08:23

- 205 of 213

The Moly sales will run operations there and pay back the local debt.

On the move again, seems to move a little everyday with minimal volume, and any run of buys pushes the price up fast :)

L2 now 1 v 1 @67/72

Looks to me like they are filling a buy order this present price action. Gradually lifting it up to mop up sells.

PapalPower

- 19 Sep 2006 10:51

- 206 of 213

- 19 Sep 2006 10:51

- 206 of 213

L2 now 2 v 1 @68/74

PapalPower

- 21 Sep 2006 10:16

- 207 of 213

- 21 Sep 2006 10:16

- 207 of 213

jon_s - 21 Sep'06 - 09:48 - 1554 of 1556

Hey all,

Off ill from work today - so I can spend some time digging around :-)

Anyone seen the Shares article? Quite a positive one in fact. I know PP is travelling around so here is a summary:

EKA has blamed Cenkos for the slump in SP.

Wording 'wrongly' implied the company was on the verge of collapse (for the reasons we all know).

EKA say that Cenkos insisted on a strict financial warning (at an early stage) despite EKA securing the first moly sale.

Jon Scott-Barrett says Cenkos has stopped EKA from announcing the Moly sale until two days later when the cash was in the bank.

He (JSB) said he was upset that SH value has been completely wiped due to uncertainties in the RNS.

Moly sale to cover costs (as we know).

Barclays Capital has promised to advise on financing EKA's Chelyabinsk project once the company has carried out a bankable fesability study (due late 2007).

Institutional investors saw a buying opportunity - RAB capital & Evolution Securities.

Cenkos said it has 'put the matter behind it' and was comitted to having a good working relationship. A spokesperson said, EKA has very attractive assets notwithstanding its funding position. Cenkos remains supportive of the business and its management.

PapalPower

- 21 Sep 2006 12:14

- 208 of 213

- 21 Sep 2006 12:14

- 208 of 213

25K T buy at 70p and 40K T buy at 70p today.

Someone has now started to buy up the slack, and why the price has been lifting up in recent days.

The world seems to ignore that any bid should be at minimum 120p.........potentially more and possibly a lot more.

PapalPower

- 22 Sep 2006 15:44

- 209 of 213

- 22 Sep 2006 15:44

- 209 of 213

PapalPower

- 12 Oct 2006 15:26

- 210 of 213

- 12 Oct 2006 15:26

- 210 of 213

Celtic Resources Holdings PLC

12 October 2006

Celtic Resources Holdings Plc

('Celtic' or 'the Company')

Celtic wins Arduina Appeal

Celtic is pleased to announce that on 10 October 2006 the High Court of Justice

in London dismissed Arduina Holding BV's (Arduina) appeal against the

arbitration award made in Celtic's favour. The Judge found that the Ardiuna

appeal was misconceived and awarded Celtic its costs of the appeal on the

indemnity basis. There is no leave to appeal this decision. Arduina was also

ordered to make a substantial interim payment on account of Celtic's costs.

Celtic reported to its shareholders in December 2005 that an award had been made in the Company's favour in the London Court of International Arbitration as a result of being the respondent in proceedings brought by Arduina. The claims arose from an unsuccessful association between the companies in November 2002. It then followed that Celtic was awarded its costs of approximately 916,000.

As the Company stated in its Interim results released in September 2006, Arduina appealed these awards and it is this appeal that was heard this week and dismissed.

Comment

Commenting on the Award, Celtic's Chairman, Peter Hannen said 'this judgement

confirms the Company's consistent belief that Arduina had no case and its

efforts were wasteful of Celtic's and the Courts time'