| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

gazkaz - 10 Jul 2013 02:12 - 341 of 1034

Well it's 2am

- and I think that the above (barring an unforeseen black swan event) paints a favourable outlook for metals prices.

- and incidentally if the Morgue fully settled it's outstanding comex deliveries for May ?? and June

- from it's dealer invent/ory

- it would be nearly 100,000 oz....short (ie negative)

Goodnight.

- and I think that the above (barring an unforeseen black swan event) paints a favourable outlook for metals prices.

- and incidentally if the Morgue fully settled it's outstanding comex deliveries for May ?? and June

- from it's dealer invent/ory

- it would be nearly 100,000 oz....short (ie negative)

Goodnight.

squirrel888 - 10 Jul 2013 18:21 - 342 of 1034

This thread is LIT. Well done Gaz.

On vit D - I do not use suncreens. Dry off in sun after swimming & getting a lovely tan without burning. Also greater degree of insights/dreams.

Vit C - a lemon a day.

No supplements.

Swimming best exercise - although building muscle which weighs heavier than fat :-(

On vit D - I do not use suncreens. Dry off in sun after swimming & getting a lovely tan without burning. Also greater degree of insights/dreams.

Vit C - a lemon a day.

No supplements.

Swimming best exercise - although building muscle which weighs heavier than fat :-(

gazkaz - 10 Jul 2013 20:24 - 343 of 1034

Squirrell - it seems you are either already either wise, well informed, well read or just intuitive on the health fron (or maybe just ..all 4 :o)

gazkaz - 10 Jul 2013 20:30 - 344 of 1034

Interesting chart - highlighting the tops and bottoms -vs- "net" commercial overall positions

- this ends at the latest COT report

(The info I posted yesterday highlights the massive swing towards a net long, and the other article suggests since the last COT report...that swing will now have gone...net long)

“The COT data for week ending 7/2 show a 35% reduction in Net Commercial Position to ‐22,776 contracts ... the least Net Short reading since Jan 8, 2002

(when gold was $279/oz).

Based on the trend history & with a Net Long reading not far off (if not already achieved since cut off)

- a significant upside reversal for gold iwould seem ......clearly in the works.

- this ends at the latest COT report

(The info I posted yesterday highlights the massive swing towards a net long, and the other article suggests since the last COT report...that swing will now have gone...net long)

“The COT data for week ending 7/2 show a 35% reduction in Net Commercial Position to ‐22,776 contracts ... the least Net Short reading since Jan 8, 2002

(when gold was $279/oz).

Based on the trend history & with a Net Long reading not far off (if not already achieved since cut off)

- a significant upside reversal for gold iwould seem ......clearly in the works.

gazkaz - 10 Jul 2013 21:08 - 345 of 1034

Before the "public show" of FEDy dissunity

- taper now

- end puchases june

- end purchases Sept 2013/or 2014

Members show their "real unity" behind the scenes :o)

- taper now

- end puchases june

- end purchases Sept 2013/or 2014

Members show their "real unity" behind the scenes :o)

snurkle1 - 11 Jul 2013 07:43 - 346 of 1034

Hi Gaz,

Good to have you back buddy. Glad to hear you've had a good time on the 'other side'.

As of tomorrow I will be off the planet for 4 days as I'm on a little island in Holland spending QT with my family. There is no internet full stop and as my phone is still one from the 80's.... (it has buttons), no capability .........bliss.

The weather is to be great so timing couldn't have been better.

DE really is indeed a great cleanser.

I'll let them know next door you're back as they were asking after you.

Good to have you back buddy. Glad to hear you've had a good time on the 'other side'.

As of tomorrow I will be off the planet for 4 days as I'm on a little island in Holland spending QT with my family. There is no internet full stop and as my phone is still one from the 80's.... (it has buttons), no capability .........bliss.

The weather is to be great so timing couldn't have been better.

DE really is indeed a great cleanser.

I'll let them know next door you're back as they were asking after you.

gazkaz - 11 Jul 2013 08:51 - 347 of 1034

Snurkle

- have a really great time and enjoy time both with family - and being off planet.

It's quite rejuvenating, and lets you clear your mind of all trivial distractions, and contemplate the big picture of who & what is really important in life.

Regarding phones, I have gone to contract SIM only - as they couldn't offer me a phone with buttons at my contract renewal, then went a step further and went back to my phone before last (it was an early model with internet access capability, but never use it)

When I was away, there was a young girl (around 15) - spent about 3 days virtually sat in the car with her phone plugged in charge (presumably living on facebook). When she ventured out to the shower block, she hardly looked up from her phone, and when her parents drove off, she was nose glued to her phone.

(quite sad to be oblivious of the world and those around her)

I await the day, when someone says I have a bluetooth inserted in my rear end with a sensor, which has a live feed to my facebook.

- When I fart, it feeds an odour-ometer app on my phone that rates the smell and puts it straight up on my facebook page, and updates my chart position amongst my friends.

Have a fantastic time away...from it all.

- have a really great time and enjoy time both with family - and being off planet.

It's quite rejuvenating, and lets you clear your mind of all trivial distractions, and contemplate the big picture of who & what is really important in life.

Regarding phones, I have gone to contract SIM only - as they couldn't offer me a phone with buttons at my contract renewal, then went a step further and went back to my phone before last (it was an early model with internet access capability, but never use it)

When I was away, there was a young girl (around 15) - spent about 3 days virtually sat in the car with her phone plugged in charge (presumably living on facebook). When she ventured out to the shower block, she hardly looked up from her phone, and when her parents drove off, she was nose glued to her phone.

(quite sad to be oblivious of the world and those around her)

I await the day, when someone says I have a bluetooth inserted in my rear end with a sensor, which has a live feed to my facebook.

- When I fart, it feeds an odour-ometer app on my phone that rates the smell and puts it straight up on my facebook page, and updates my chart position amongst my friends.

Have a fantastic time away...from it all.

gazkaz - 11 Jul 2013 08:55 - 348 of 1034

I think everything above points to the bottom being in (or thereabouts), however TPTB can always take it where they wish - if they still want to drain GLD further, stock up with physical on the cheap, and book some more paper profits.

I would imagine the Morgue are delivering their outstanding contracts via baskets bought and delivered from GLD physical

(as mentioned above they are significantly short of dealer inventory metal - to meet their outstanding May (overdue) and June deliveries.

I would imagine the Morgue are delivering their outstanding contracts via baskets bought and delivered from GLD physical

(as mentioned above they are significantly short of dealer inventory metal - to meet their outstanding May (overdue) and June deliveries.

gazkaz - 11 Jul 2013 08:57 - 349 of 1034

Ever since the take-down of the price of silver in April, silver warehouse stocks

- have been declining in a large way at the Shanghai Futures Exchange.

- At the peak on April 12th, the Shanghai Futures Exchange held 1,124 tonnes of silver at its warehouses.

- However, just six weeks later, ........360 tonnes or 32% were removed.

- In less than 3 months, a total of... 511 tonnes (45%) of silver... have been removed from the Shanghai Futures exchange.

This is almost half... of all the silver stored at the exchange. [

- have been declining in a large way at the Shanghai Futures Exchange.

- At the peak on April 12th, the Shanghai Futures Exchange held 1,124 tonnes of silver at its warehouses.

- However, just six weeks later, ........360 tonnes or 32% were removed.

- In less than 3 months, a total of... 511 tonnes (45%) of silver... have been removed from the Shanghai Futures exchange.

This is almost half... of all the silver stored at the exchange. [

gazkaz - 11 Jul 2013 09:16 - 350 of 1034

Seems suprising nobody has mentioned .....that the Rothkiddies are working on plans to break up one of the big UK banks into - a good bank - and...a bad bank

- and report their plan to gov't - within 2 months

Good Bank/Bad Bank.....that's Cyprus style ??

- the BofE has been putting the paperwork is in place to apply the Cyprus template...in the UK

- and the Co-op bond holders, recently got a ...small taste of it ...in action

(with no MSM outcry, or blaze of publicity)

Jim Willie puts Barclays "on the brink" too

- and strangely no update since they were being investigated - for actually...

- lending the money - to the Saudis...to fund their own "non gov't bailout" of themselves.

I think before the end of the year, the sheeps, will be ..rudely stirred...from their snoozing

- and report their plan to gov't - within 2 months

Good Bank/Bad Bank.....that's Cyprus style ??

- the BofE has been putting the paperwork is in place to apply the Cyprus template...in the UK

- and the Co-op bond holders, recently got a ...small taste of it ...in action

(with no MSM outcry, or blaze of publicity)

Jim Willie puts Barclays "on the brink" too

- and strangely no update since they were being investigated - for actually...

- lending the money - to the Saudis...to fund their own "non gov't bailout" of themselves.

I think before the end of the year, the sheeps, will be ..rudely stirred...from their snoozing

gazkaz - 11 Jul 2013 14:53 - 351 of 1034

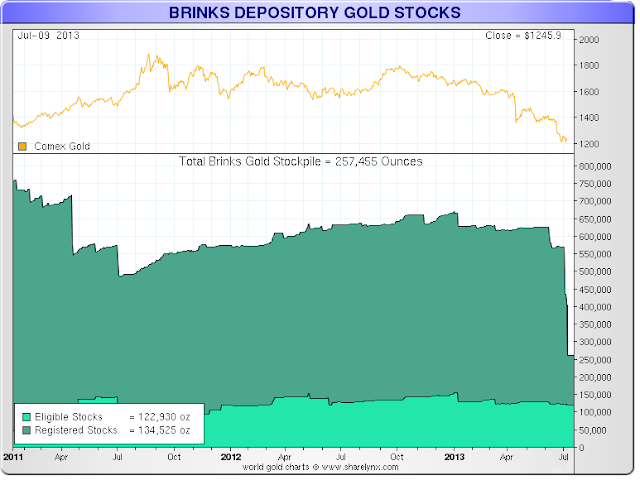

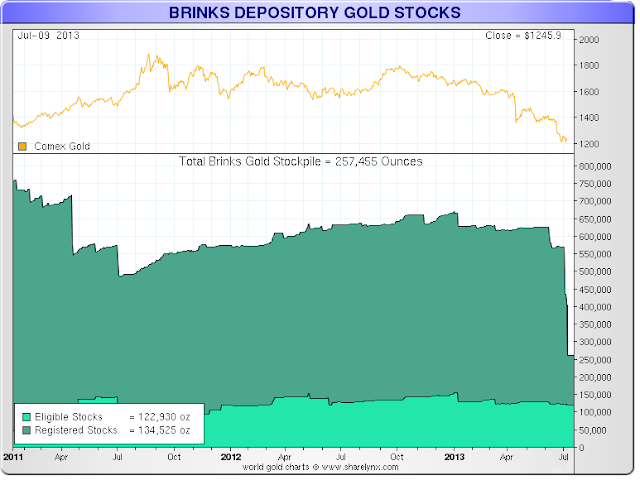

Nick Laird of Sharelynx.com informs- that Brinks is 'now being depleted'

- of ...private ...gold holdings.

In referring to the registered supply at Brinks, Nick notes that:

"Brinks is now being depleted.

- They have gone from 447,199 on July 3rd

- to 134,525 on July 9th which is ......a drop of 312,674 oz."

- If this is correct, then this is a decline of..... 70 percent .....in the gold "held in private accounts " at Brinks in....... just one week.

If this is data is correct, it would not be too much of a stretch to say that this has the appearance of .........'a run on the bank.'

Unless CME issues a correction ...... It seems almost incredible.

Where is the gold going?

- It was not transferred from the registered to eligible category,

- and does not seem to have been transferred to any other COMEX vault.

I suspect it is flowing East. And perhaps it is being taken to replace gold that ......has been rehypothecated from custodial vaults somewhere.

JessesC

- of ...private ...gold holdings.

In referring to the registered supply at Brinks, Nick notes that:

"Brinks is now being depleted.

- They have gone from 447,199 on July 3rd

- to 134,525 on July 9th which is ......a drop of 312,674 oz."

- If this is correct, then this is a decline of..... 70 percent .....in the gold "held in private accounts " at Brinks in....... just one week.

If this is data is correct, it would not be too much of a stretch to say that this has the appearance of .........'a run on the bank.'

Unless CME issues a correction ...... It seems almost incredible.

Where is the gold going?

- It was not transferred from the registered to eligible category,

- and does not seem to have been transferred to any other COMEX vault.

I suspect it is flowing East. And perhaps it is being taken to replace gold that ......has been rehypothecated from custodial vaults somewhere.

JessesC

gazkaz - 11 Jul 2013 15:23 - 352 of 1034

Make sense of this Bullsh@t from the FT

The cost of borrowing gold.... has risen to the highest since the post-Lehman Brothers...... scramble for supplies,

as the bullion market adjusts to a new era in which Western investor demand is less dominant.

The niche gold lending market, largely the preserve of a few big banks and central banks, has been uneventful in recent years as investors have built up large holdings and lent them out on the market, keeping rates depressed.

(Makes sense so far)

But as investors have .....turned sellers in recent months,

- availability of gold in the lending market .....has been squeezed, bankers said

(so everybody is selling - lol - but availabity of gold is......squeezed ????)

The squeeze has triggered..... a sharp rise in gold leasing rates

- the implied interest rate for lending gold in the market in exchange for dollars

- to the highest since early 2009.

The move reflects the dramatic shift in the gold market over the past few months as investors ....have liquidated their holdings en masse,..... triggering a 25 per cent collapse in prices since the start of the year.

(Liquidated en masse - & yet there's a shortage of available gold....forcing leasing rates higher ?????)

"There has been some borrowing interest recently.

- It's related to the demand..... for physical,"

said Joni Teves, precious metals strategist at UBS, noting that the price

- of physical gold - in China remained more than $40 an ounce above benchmark London spot prices.

Conclusion

- everybody ...has turned sellers & there has been "liquidation en masse"

- but the chinese are paying $40 premiums - refineries are working flat out to meet demand and lease rates have incresed due to - lack of....... available gold

- with the bonus that ......all this "turned sellers" & "liquidations en masse"

has resulted in

"The squeeze has triggered..... a sharp rise in gold leasing rates"

http://www.ft.com/intl/cms/s/0/bd819998-e8b2-11e2-8e9e-00144feabdc0.html#axzz2YXwV23J1

So the FT is arguing

- the price has falen due to holders selling and liquidations en masse

- yet

- due to lack of availability of - said gold

- they are resorting to....leasing it

- and due to a shortage of ....leased gold

- lease rates have jumped upwards

What a fecking crock of .....journalistic contradictory nonsensical SH!TE

The cost of borrowing gold.... has risen to the highest since the post-Lehman Brothers...... scramble for supplies,

as the bullion market adjusts to a new era in which Western investor demand is less dominant.

The niche gold lending market, largely the preserve of a few big banks and central banks, has been uneventful in recent years as investors have built up large holdings and lent them out on the market, keeping rates depressed.

(Makes sense so far)

But as investors have .....turned sellers in recent months,

- availability of gold in the lending market .....has been squeezed, bankers said

(so everybody is selling - lol - but availabity of gold is......squeezed ????)

The squeeze has triggered..... a sharp rise in gold leasing rates

- the implied interest rate for lending gold in the market in exchange for dollars

- to the highest since early 2009.

The move reflects the dramatic shift in the gold market over the past few months as investors ....have liquidated their holdings en masse,..... triggering a 25 per cent collapse in prices since the start of the year.

(Liquidated en masse - & yet there's a shortage of available gold....forcing leasing rates higher ?????)

"There has been some borrowing interest recently.

- It's related to the demand..... for physical,"

said Joni Teves, precious metals strategist at UBS, noting that the price

- of physical gold - in China remained more than $40 an ounce above benchmark London spot prices.

Conclusion

- everybody ...has turned sellers & there has been "liquidation en masse"

- but the chinese are paying $40 premiums - refineries are working flat out to meet demand and lease rates have incresed due to - lack of....... available gold

- with the bonus that ......all this "turned sellers" & "liquidations en masse"

has resulted in

"The squeeze has triggered..... a sharp rise in gold leasing rates"

http://www.ft.com/intl/cms/s/0/bd819998-e8b2-11e2-8e9e-00144feabdc0.html#axzz2YXwV23J1

So the FT is arguing

- the price has falen due to holders selling and liquidations en masse

- yet

- due to lack of availability of - said gold

- they are resorting to....leasing it

- and due to a shortage of ....leased gold

- lease rates have jumped upwards

What a fecking crock of .....journalistic contradictory nonsensical SH!TE

gazkaz - 11 Jul 2013 15:36 - 353 of 1034

The London Whale - LieBOR rigging, interest rate swap fiddling, Maddof, MFG co-mingling investor funds and re-hypothecation now

THIRD-largest-futures-broker-gets-RECORD FINE- for hft-stock-market-...MANIPULATION - but- NO ...Jail Time...AGAIN

THIRD-largest-futures-broker-gets-RECORD FINE- for hft-stock-market-...MANIPULATION - but- NO ...Jail Time...AGAIN

gazkaz - 11 Jul 2013 20:42 - 354 of 1034

New study finds antibiotics cause oxidative stress - and damages ....DNA

-app 3mins long

(Then see following article re....silver :o)

-app 3mins long

(Then see following article re....silver :o)

gazkaz - 11 Jul 2013 20:58 - 355 of 1034

James Collins, a biomedical engineer at Boston University in Massachusetts,

- has described how silver....... can disrupt bacteria,

- and shown that the ancient treatment could help to deal with the thoroughly modern...... scourge of antibiotic resistance.

- The work is published today..... in Science Translational Medicine.

“Resistance is growing, while the number of new antibiotics in development is dropping,” says Collins. “We wanted to find a way to make what we have work better.”

Collins and his team found that silver — in the form of dissolved ions — attacks bacterial cells in two main ways:

- it makes the cell membrane more permeable,

- and it interferes with the cell’s metabolism, leading to the overproduction of reactive, and often toxic, oxygen compounds.

Both mechanisms could potentially be harnessed to make today’s antibiotics more effective against resistant bacteria, Collins says.

Resistance is futile

Many antibiotics are thought to kill their targets by producing reactive oxygen compounds, and Collins and his team showed that

- when boosted with.... a small amount of silver..... these drugs could kill between

- 10 and...... 1,000 times as many bacteria.

The increased membrane permeability also allows more antibiotics to enter the bacterial cells, which may overwhelm the resistance mechanisms that rely on shuttling the drug back out.

That disruption to the cell membrane also increased the effectiveness of vancomycin, a large-molecule antibiotic, on Gram-negative bacteria — which have a protective outer coating. Gram-negative bacterial cells can often be impenetrable to antibiotics made of larger molecules.

“It’s not so much a silver bullet; more a silver spoon to help the Gram-negative bacteria take their medicine,” says Collins.

http://www.scientificamerican.com/article.cfm?id=....silver-makes-antibiotics...-thousands-of-times-more-effective

I think most board regulars/lurker readers :o)

Are aware of colloidal silver - trouble is they can't patent it

- so if c/s does what it says in the above, why the add antibiotics

(other than excuse to then charge the earth for a patentable product of course)

...as once c/s does the business ....your immune system (I will say.... probably :o)

- can probably finish the job

Plus side at least patients may benefit (at last) from the silver

- &....another demand booster for silver too !

- has described how silver....... can disrupt bacteria,

- and shown that the ancient treatment could help to deal with the thoroughly modern...... scourge of antibiotic resistance.

- The work is published today..... in Science Translational Medicine.

“Resistance is growing, while the number of new antibiotics in development is dropping,” says Collins. “We wanted to find a way to make what we have work better.”

Collins and his team found that silver — in the form of dissolved ions — attacks bacterial cells in two main ways:

- it makes the cell membrane more permeable,

- and it interferes with the cell’s metabolism, leading to the overproduction of reactive, and often toxic, oxygen compounds.

Both mechanisms could potentially be harnessed to make today’s antibiotics more effective against resistant bacteria, Collins says.

Resistance is futile

Many antibiotics are thought to kill their targets by producing reactive oxygen compounds, and Collins and his team showed that

- when boosted with.... a small amount of silver..... these drugs could kill between

- 10 and...... 1,000 times as many bacteria.

The increased membrane permeability also allows more antibiotics to enter the bacterial cells, which may overwhelm the resistance mechanisms that rely on shuttling the drug back out.

That disruption to the cell membrane also increased the effectiveness of vancomycin, a large-molecule antibiotic, on Gram-negative bacteria — which have a protective outer coating. Gram-negative bacterial cells can often be impenetrable to antibiotics made of larger molecules.

“It’s not so much a silver bullet; more a silver spoon to help the Gram-negative bacteria take their medicine,” says Collins.

http://www.scientificamerican.com/article.cfm?id=....silver-makes-antibiotics...-thousands-of-times-more-effective

I think most board regulars/lurker readers :o)

Are aware of colloidal silver - trouble is they can't patent it

- so if c/s does what it says in the above, why the add antibiotics

(other than excuse to then charge the earth for a patentable product of course)

...as once c/s does the business ....your immune system (I will say.... probably :o)

- can probably finish the job

Plus side at least patients may benefit (at last) from the silver

- &....another demand booster for silver too !

gazkaz - 12 Jul 2013 14:15 - 356 of 1034

Andrew Maguire has been noting to subscribers that,

- for about the past three weeks,

- there has been .....a large, institutional buyer.... appearing at each and every London silver fix.

- Because of the size of the orders, this buyer could only be a Bullion Bank and he has deduced that is likely..... JPM.

- So, if Andy is correct,....... then suddenly JPM has taken to quietly acquiring.... as much physical silver as they can.

Now, add to that what has been going on this month at The Comex.

- Ted Butler has been all over this since the first of the month.

- Back on Saturday he wrote this:

“I believe the statistics from the first six days of the July COMEX silver futures contract provide enough data for attention.

- The standout feature for the first week of deliveries against the July silver contract indicates

- that JPMorgan has... taken roughly 90%..... of the metal offered for delivery,

( or a total of 1637 contracts out of a cumulative total of 1828 delivered so far).

- In turn, of the silver contracts stopped or accepted by JPMorgan, 90% (1479 contracts) were ......for JPMorgan’s ...own house or proprietary trading account.

- In other words, JPMorgan ...took delivery

- of roughly 7.4 million ounces of silver in the COMEX warehouses...... for their own benefit and risk”.

He followed that up yesterday with this:

“A quick note on JPMorgan’s unusual taking of delivery of silver in the current July contract I first mentioned on Saturday.

- In the two delivery days since that review, JPMorgan has taken (stopped) an additional 369 contracts,

- 350 of which were for the bank’s house or proprietary trading account.

Of the 2220 total contracts delivered so far in the July COMEX contract,

- JPM has taken 2006 contracts, including 1829 contracts..... for the bank’s own house account.

- Over the past two days, customers of JPMorgan have delivered close to 200 silver contracts as well, raising the question if JPMorgan is double dealing.

Another point is that the 1829 contracts (9.145 million oz) that JPM has taken in its own name

- is above the level of 1500 contracts that COMEX rules dictate....... can’t be exceeded in any one delivery month by any single trader.

- But...Hey – have you ever heard of a rule or regulation that JPMorgan couldn’t evade?

- Me, neither.”

There are still about 1,200 July contracts that remain to be settled so we’ll see where those go…but what the heck is going on here? Of the 2,220 July13 contracts that have been settled so far this month,

- JPM has claimed over 90% of them.

- Further, 90% of those have gone directly into ......JPM’s own house account!

So we’ve got JPM soaking up as much Comex silver as they can without disturbing the price downtrend

- AND ......we’ve also got JPM appearing each day at The Fix, buying up as much silver as possible there, too.

Connecting these dots ????

- for about the past three weeks,

- there has been .....a large, institutional buyer.... appearing at each and every London silver fix.

- Because of the size of the orders, this buyer could only be a Bullion Bank and he has deduced that is likely..... JPM.

- So, if Andy is correct,....... then suddenly JPM has taken to quietly acquiring.... as much physical silver as they can.

Now, add to that what has been going on this month at The Comex.

- Ted Butler has been all over this since the first of the month.

- Back on Saturday he wrote this:

“I believe the statistics from the first six days of the July COMEX silver futures contract provide enough data for attention.

- The standout feature for the first week of deliveries against the July silver contract indicates

- that JPMorgan has... taken roughly 90%..... of the metal offered for delivery,

( or a total of 1637 contracts out of a cumulative total of 1828 delivered so far).

- In turn, of the silver contracts stopped or accepted by JPMorgan, 90% (1479 contracts) were ......for JPMorgan’s ...own house or proprietary trading account.

- In other words, JPMorgan ...took delivery

- of roughly 7.4 million ounces of silver in the COMEX warehouses...... for their own benefit and risk”.

He followed that up yesterday with this:

“A quick note on JPMorgan’s unusual taking of delivery of silver in the current July contract I first mentioned on Saturday.

- In the two delivery days since that review, JPMorgan has taken (stopped) an additional 369 contracts,

- 350 of which were for the bank’s house or proprietary trading account.

Of the 2220 total contracts delivered so far in the July COMEX contract,

- JPM has taken 2006 contracts, including 1829 contracts..... for the bank’s own house account.

- Over the past two days, customers of JPMorgan have delivered close to 200 silver contracts as well, raising the question if JPMorgan is double dealing.

Another point is that the 1829 contracts (9.145 million oz) that JPM has taken in its own name

- is above the level of 1500 contracts that COMEX rules dictate....... can’t be exceeded in any one delivery month by any single trader.

- But...Hey – have you ever heard of a rule or regulation that JPMorgan couldn’t evade?

- Me, neither.”

There are still about 1,200 July contracts that remain to be settled so we’ll see where those go…but what the heck is going on here? Of the 2,220 July13 contracts that have been settled so far this month,

- JPM has claimed over 90% of them.

- Further, 90% of those have gone directly into ......JPM’s own house account!

So we’ve got JPM soaking up as much Comex silver as they can without disturbing the price downtrend

- AND ......we’ve also got JPM appearing each day at The Fix, buying up as much silver as possible there, too.

Connecting these dots ????

gazkaz - 12 Jul 2013 14:31 - 357 of 1034

2 mins of Rick Santelli - Blowing his stack chicago style

Re this...chart

- 2 + 2 does not add up - health of the economy two indicators

(after all they...used to...broadly correlate...but recently ???)

Re this...chart

- 2 + 2 does not add up - health of the economy two indicators

(after all they...used to...broadly correlate...but recently ???)

gazkaz - 12 Jul 2013 21:32 - 358 of 1034

Sometimes you just look at three charts and you can make a decision

- fiat paper and fiat paper denominated assets

- or precious metal

Official - Debt to GDP ratio(in Red)

Debt to GDP ratios....including "unfunded liabilities" (pensions & healthcare) - in grey

So....

- These figures are absolutely astronomical and prove

- that most governments in the world will be .....totally incapable.... of repaying their debts...... or funding the pensions or medical care which they have committed to.

It doesn’t matter however much governments cut expenditure or raise taxes,

- all these countries are insolvent and ......nothing can save them.

Next.....

A 100 years - showing the value of all the major fiat paper currencies.......priced in gold

In conclusion

- it's the 1st time ever - that all major fiat currencies have engaged in a race to the bottom.....ultimately their intrinsic value... which is nil

Looking at the long evidence of history in times of....less "total global" SHTF in progress turbulence.......precious metals seem to have (understatement)....a decent track record

So perhaps in todays GLOBAL TURMOIL.....they may ....fair rather well

- at the other end of the tunnel

- fiat paper and fiat paper denominated assets

- or precious metal

Official - Debt to GDP ratio(in Red)

Debt to GDP ratios....including "unfunded liabilities" (pensions & healthcare) - in grey

So....

- These figures are absolutely astronomical and prove

- that most governments in the world will be .....totally incapable.... of repaying their debts...... or funding the pensions or medical care which they have committed to.

It doesn’t matter however much governments cut expenditure or raise taxes,

- all these countries are insolvent and ......nothing can save them.

Next.....

A 100 years - showing the value of all the major fiat paper currencies.......priced in gold

In conclusion

- it's the 1st time ever - that all major fiat currencies have engaged in a race to the bottom.....ultimately their intrinsic value... which is nil

Looking at the long evidence of history in times of....less "total global" SHTF in progress turbulence.......precious metals seem to have (understatement)....a decent track record

So perhaps in todays GLOBAL TURMOIL.....they may ....fair rather well

- at the other end of the tunnel

gazkaz - 12 Jul 2013 21:39 - 359 of 1034

Well I seem to be in a minority of one....and no two way info - or evidence of anyone reading again, so

- will leave it for now, untill or if there's signs of life out there :o)

- will leave it for now, untill or if there's signs of life out there :o)

MaxK - 14 Jul 2013 00:28 - 360 of 1034

tDon't give up gaz, we are reading.

Bu the boards in general seem to be fucked up at the moment.

Keep on truckin!

Bu the boards in general seem to be fucked up at the moment.

Keep on truckin!