| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Register now or login to post to this thread.

The really useful silver thread (AG)

squirrel888 - 12 Jun 2013 10:30

gazkaz - 13 Aug 2013 16:35 - 661 of 1034

I had the chance to reconnect with a source

- in the bullion management business,

- whose operations deal on a direct basis with... the shipping desks at the GLD.

(While remaining unnamed at this time, it was a powerful conversation, and he was quite liberal in sharing thought).

http://bullmarketthinking.com/gld-is-collapsing-its-shares-and-that-gold-is-being-shipped-directly-to-asia/

Speaking to what his group

- is hearing from ......the main GLD custodian,

- he noted that,

- “GLD is collapsing in [terms of] the number of share issuance,

- and [is] being redeemed…

- we are hearing from my end…

- that the GLD main custodian...... has been collapsing it and redeeming it,

- and that gold.... is just being shipped..... via their shipping desk.... directly to Asia.”

- in the bullion management business,

- whose operations deal on a direct basis with... the shipping desks at the GLD.

(While remaining unnamed at this time, it was a powerful conversation, and he was quite liberal in sharing thought).

http://bullmarketthinking.com/gld-is-collapsing-its-shares-and-that-gold-is-being-shipped-directly-to-asia/

Speaking to what his group

- is hearing from ......the main GLD custodian,

- he noted that,

- “GLD is collapsing in [terms of] the number of share issuance,

- and [is] being redeemed…

- we are hearing from my end…

- that the GLD main custodian...... has been collapsing it and redeeming it,

- and that gold.... is just being shipped..... via their shipping desk.... directly to Asia.”

Saturn6 - 13 Aug 2013 18:04 - 662 of 1034

Brilliant Gaz - You tickled me with that ever so eloquent yet devastatingly appropriate analogy of evolution.

Absolutely Spot On!!!

I used a similar scenario with a heating engineer whilst discussing his faith in evolution. Although he argued with me it was not a faith, I asked him where the proof was and he came out with multiple reasons why evolution happened but no proof. So I therefore made him realise that oit was a faith that he had without himself knowing. Such is the power of our education and programming. ;-/

Anyway the scenario I used was how he would react to stumbling across a fully complete and functioning domestic heating boiler in a field after being told it came into being by happenstance.... The look on his face was a picture.

Gaz - I noticed India has launched a home built aircraft carrier. The first to follow Britain, France, Russia and the United States to do so. Beating even China to do so.

Vikrant’s launch comes just two days after India announced that its first indigenously built nuclear submarine was ready for war trials.'

http://www.voanews.com/content/india-launches-indigenously-buit-aircraft-carrier/1727930.html

The Indian aircraft carrier is docked at a shipyard after its launch in Kochi, India, Aug. 12, 2013.

The Indian aircraft carrier is docked at a shipyard after its launch in Kochi, India, Aug. 12, 2013.

S.

Absolutely Spot On!!!

I used a similar scenario with a heating engineer whilst discussing his faith in evolution. Although he argued with me it was not a faith, I asked him where the proof was and he came out with multiple reasons why evolution happened but no proof. So I therefore made him realise that oit was a faith that he had without himself knowing. Such is the power of our education and programming. ;-/

Anyway the scenario I used was how he would react to stumbling across a fully complete and functioning domestic heating boiler in a field after being told it came into being by happenstance.... The look on his face was a picture.

Gaz - I noticed India has launched a home built aircraft carrier. The first to follow Britain, France, Russia and the United States to do so. Beating even China to do so.

Vikrant’s launch comes just two days after India announced that its first indigenously built nuclear submarine was ready for war trials.'

http://www.voanews.com/content/india-launches-indigenously-buit-aircraft-carrier/1727930.html

The Indian aircraft carrier is docked at a shipyard after its launch in Kochi, India, Aug. 12, 2013.

The Indian aircraft carrier is docked at a shipyard after its launch in Kochi, India, Aug. 12, 2013. S.

gazkaz - 13 Aug 2013 20:43 - 663 of 1034

Sahara - indeed people do have unquestioning faith in what they are taught in school and college.

(The Tavispook Institute works wonders).

The Indian carrier looks a bit short in the take off dept. Maybe you line the carriers up, like running across li-lo's in a swimming pool to get airborne.

- And call me old fashioned but it is traditional to have somewhere for the captain to sit. I think sitting in the lowered stern end with his hand on the rudder is going to give a very restricted view of where the pointy end is going.

Maybe it did originally have a traditional elevated bridge in the middle for the captain, but they removed it, so the planes didn't have to slow down to go round it when taking off.

It really does look like someone sold them the plans... for the bow and stern,

- and the Indians didn't notice they were missing the 1/4 of a mile middle section.

(The Tavispook Institute works wonders).

The Indian carrier looks a bit short in the take off dept. Maybe you line the carriers up, like running across li-lo's in a swimming pool to get airborne.

- And call me old fashioned but it is traditional to have somewhere for the captain to sit. I think sitting in the lowered stern end with his hand on the rudder is going to give a very restricted view of where the pointy end is going.

Maybe it did originally have a traditional elevated bridge in the middle for the captain, but they removed it, so the planes didn't have to slow down to go round it when taking off.

It really does look like someone sold them the plans... for the bow and stern,

- and the Indians didn't notice they were missing the 1/4 of a mile middle section.

gazkaz - 13 Aug 2013 20:52 - 664 of 1034

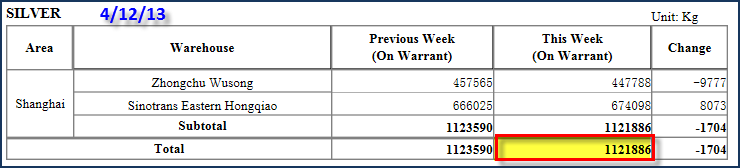

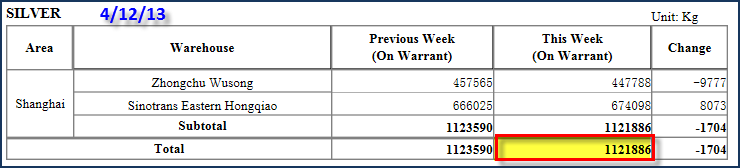

Shanghai silver stocks April 13

Then the p/metals take down, .....since when

- they have been bleeding silver stock

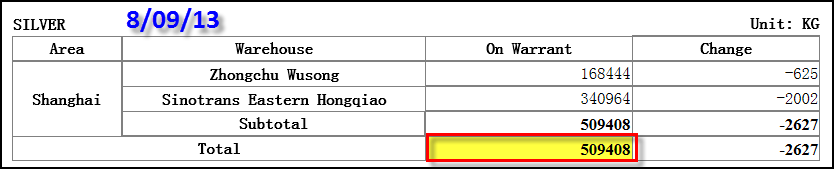

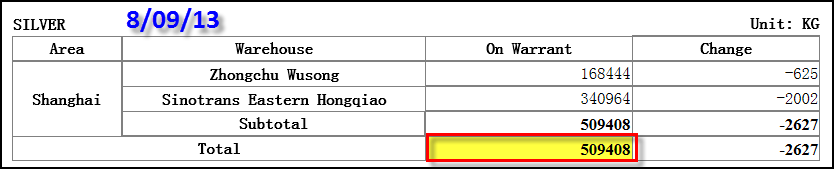

Shanghai silver stocks Aug 13

So in just a few post crash months......silver stocks have plummeted

- from 1,123 tonnes

- to 509 tonnes

- that's a whopping loss of 55% of inventory

- in just 16 weeks

Then the p/metals take down, .....since when

- they have been bleeding silver stock

Shanghai silver stocks Aug 13

So in just a few post crash months......silver stocks have plummeted

- from 1,123 tonnes

- to 509 tonnes

- that's a whopping loss of 55% of inventory

- in just 16 weeks

gazkaz - 14 Aug 2013 10:19 - 665 of 1034

Short and sweet - furthers sign/confirmation of near horizon....potential

- around 8 mins in and only 3 mins worth

http://www.youtube.com/watch?feature=player_embedded&v=a_FNXew7FHU

Insight from official documents - re the internment/resettlement Kamps

- been recruiting staff for them since 2010

- job description for one post....interesting

- as is the layout & design

(coneys a lot in just 3 mins)

- around 8 mins in and only 3 mins worth

http://www.youtube.com/watch?feature=player_embedded&v=a_FNXew7FHU

Insight from official documents - re the internment/resettlement Kamps

- been recruiting staff for them since 2010

- job description for one post....interesting

- as is the layout & design

(coneys a lot in just 3 mins)

gazkaz - 14 Aug 2013 14:50 - 666 of 1034

When caution is thrown to the wind and the sheeple get heady & giddy

- they not only jump in with both feet into the TPTB share casino

- they borrow on margin too

What happened last time when borrowed margin money was this high

(The downward red spikes - denote amount of borrowed margin money)

- 2000 Tech Bubble Pop - 2007 everything fell off the cliff

- AFTER - the crashes the margin accounts (post the rush for the exits)...spike up into credit green

Based on the past "experience" - what was the timescale from peak margin borrowing to ---stocks taking a nose dive ?

Maybe - this time "things will be..different" - as they say

(tho' somehow I doubt it - "those who learn from the mistakes of history.....are consigned to ....watch others repeat them"....again perhaps)

- they not only jump in with both feet into the TPTB share casino

- they borrow on margin too

What happened last time when borrowed margin money was this high

(The downward red spikes - denote amount of borrowed margin money)

- 2000 Tech Bubble Pop - 2007 everything fell off the cliff

- AFTER - the crashes the margin accounts (post the rush for the exits)...spike up into credit green

Based on the past "experience" - what was the timescale from peak margin borrowing to ---stocks taking a nose dive ?

Maybe - this time "things will be..different" - as they say

(tho' somehow I doubt it - "those who learn from the mistakes of history.....are consigned to ....watch others repeat them"....again perhaps)

gazkaz - 14 Aug 2013 15:03 - 667 of 1034

Perhaps looking at the previous post - another way

In addition

For the 5th time .....in the last 7 days,

- equity market internals have triggered an anxiety-implying Hindenburg Omen.

- Based on our data, this is ......the most concentrated cluster

- of new highs, new lows, advancing/declining based confusion on record.

The last few occurrences have not ended well (though obviously not disastrously) but as the creator of the 'Omen' notes,

- the more occurrences that cluster,..... the stronger the signal

But - maybe this time (in spite of a hat trick of indicators).....things will be - different.

.

In addition

For the 5th time .....in the last 7 days,

- equity market internals have triggered an anxiety-implying Hindenburg Omen.

- Based on our data, this is ......the most concentrated cluster

- of new highs, new lows, advancing/declining based confusion on record.

The last few occurrences have not ended well (though obviously not disastrously) but as the creator of the 'Omen' notes,

- the more occurrences that cluster,..... the stronger the signal

But - maybe this time (in spite of a hat trick of indicators).....things will be - different.

.

gazkaz - 14 Aug 2013 15:11 - 668 of 1034

How many banksters end up in jail (or even make it as far as - the dock)

So - How high & how well organised ?

(A deep, deep rabbit hole :o)

So - How high & how well organised ?

(A deep, deep rabbit hole :o)

gazkaz - 14 Aug 2013 15:32 - 669 of 1034

Wonder - what is driving the market higher

But

But

- let put it in a...concise nutshell in a simple grapic

And so in another nutshell....this time in words

And so in another nutshell....this time in words

So, thanks to the US Treasury, we know that between January 2009 and April 2013,

- on days in which the Fed POMO was more than $5 billion,

- the stock market............ rose a total of 570 points (up 54%)

- on days in which the POMO was less than $5 billion

- the cumulative stock market ............gain was "only" 141 points (up 15%)

and when there was no POMO ??

- the S&P gained... minus 51 points (Minus 2%)

But

But- let put it in a...concise nutshell in a simple grapic

And so in another nutshell....this time in words

And so in another nutshell....this time in wordsSo, thanks to the US Treasury, we know that between January 2009 and April 2013,

- on days in which the Fed POMO was more than $5 billion,

- the stock market............ rose a total of 570 points (up 54%)

- on days in which the POMO was less than $5 billion

- the cumulative stock market ............gain was "only" 141 points (up 15%)

and when there was no POMO ??

- the S&P gained... minus 51 points (Minus 2%)

gazkaz - 15 Aug 2013 09:11 - 670 of 1034

A view of gold demand in Dubai

"We have 90 days order logbook.

So..... we cannot fill the demand we have at this stage"

"We have 90 days order logbook.

So..... we cannot fill the demand we have at this stage"

gazkaz - 15 Aug 2013 09:21 - 671 of 1034

Further to my earler post that JPM had bought up virtually all comex July deliveries, for delivery...to it's own house account.

(& was beginning grabbing the August deliveries.....in the same manner)

Has JPM, flooded with demands for physical,

- finally thrown in the towel, and seeing that the deluge in delivery requests is "unrelenting",

- had no choice but to turn to...... the one place it has left to replenish its stocks:

- the market?

The firm's House accounts just saw

- the largest Stop (i.e. taking delivery) since December of 2012,

- amounting to over 210K oz.

(& was beginning grabbing the August deliveries.....in the same manner)

Has JPM, flooded with demands for physical,

- finally thrown in the towel, and seeing that the deluge in delivery requests is "unrelenting",

- had no choice but to turn to...... the one place it has left to replenish its stocks:

- the market?

The firm's House accounts just saw

- the largest Stop (i.e. taking delivery) since December of 2012,

- amounting to over 210K oz.

gazkaz - 15 Aug 2013 10:52 - 672 of 1034

My take on 2 charts

- for every dollar lent to the punters by the banks

- by the time it has been run around the fractional reserve system it creates....

- $10 dollars into the ponzi money supply game

Conversely for every dollar the punters ...repay

- it takes $10 - out - the ponzi game

- for every dollar written off in bankruptcy...it to takes $10 out the ponzi game

So what would we see in this converse scenario

- less money in the ponzi

- so not much less movement (velocity) of what money - is left...in the game

Voila !!

When - money - is no longer going into a ponzi game....a ponzi starts to fail

- when money is ....also....being taken out the ponzi

- it collapses ...quicker

But if you can actually - just "print" more money

- to put in..... to the ponzi scheme

- the illusion continues

voila

And those - step jumps higher....in the moey supply...since 2008

- yep the ponzi printing of.....QE I, II & III

But is it....working ?

Check out the grey shaded verticle lines - in the - TOP chart

- they indicate US recessions

-money velocity plunges = recessions

Check out where the blue line ends on the right....and.... the direction....it is

- still........ heading in

In conclusion.....so far-

- all the ponzi printing in the - bottom chart - since 2008

- has not fed into the economy & into increasing the velocity of money

- in fact...the exact reverse....velocity is "plunging"

- and in just a velocity "fall" you get a recession per the- top chart - grey areas

- So - what do you get....when it plunges.

- heading for 1930's.....MK II ????

So where is all the printed ponzi money going ?

Well Meyer Rothkiddy....created wars....and funded both/all sides....got the governments into huge debts....printed them the money....and charged them... interest.

Move on a century or so.......the military indusrial complex....is still sucking at the taxpayers teat....with the cost + interest of it's military adventures

- but the game has moved on....and governments now also

- run up huge borrowings... on banking encouraged...debt funded....interest chargeable (taxpayer liability)

- welfare programmes

- and healthcare programmes etc

So the FEDy prints up the fiat out of thin air

- runs it round the primary dealer 3 card monty

- collects the T-Bonds back off the government in return

- and creams the taxpayer for the bond interest

- plus ......uses the printing to buy.....

- Mortgage backed security - real tangible assets

- and creams the mortgage holders for....the mortgage interest.

And in standard - rinse ad repeat fashion

- as you can see the bottom chart looks like velocity of money plunging

- suggests 1930's MK II depression territory

Then the central bankers and friends - pick up all the economic depression distressed assets at.....

Firesale - pennies on the dollar

- who bought up all the Greek - Nationalised State Assets....in their fire sale ?

Who ended up owning - the maggie gifts - of privatatising.....water, electricity, the railways etc etc

- The Bankster owned international conglomerates

In the end,

A simple game of rinse and repeat when it comes down to it

- just - hidden by the complexites of the smoke and mirrors of..... complex financial & economic....jargon

JFK tried to..... cut out the middleman central bankers... above game

- shame that "just that - one crazy guy :o)"

- stopped him.

-

- for every dollar lent to the punters by the banks

- by the time it has been run around the fractional reserve system it creates....

- $10 dollars into the ponzi money supply game

Conversely for every dollar the punters ...repay

- it takes $10 - out - the ponzi game

- for every dollar written off in bankruptcy...it to takes $10 out the ponzi game

So what would we see in this converse scenario

- less money in the ponzi

- so not much less movement (velocity) of what money - is left...in the game

Voila !!

When - money - is no longer going into a ponzi game....a ponzi starts to fail

- when money is ....also....being taken out the ponzi

- it collapses ...quicker

But if you can actually - just "print" more money

- to put in..... to the ponzi scheme

- the illusion continues

voila

And those - step jumps higher....in the moey supply...since 2008

- yep the ponzi printing of.....QE I, II & III

But is it....working ?

Check out the grey shaded verticle lines - in the - TOP chart

- they indicate US recessions

-money velocity plunges = recessions

Check out where the blue line ends on the right....and.... the direction....it is

- still........ heading in

In conclusion.....so far-

- all the ponzi printing in the - bottom chart - since 2008

- has not fed into the economy & into increasing the velocity of money

- in fact...the exact reverse....velocity is "plunging"

- and in just a velocity "fall" you get a recession per the- top chart - grey areas

- So - what do you get....when it plunges.

- heading for 1930's.....MK II ????

So where is all the printed ponzi money going ?

Well Meyer Rothkiddy....created wars....and funded both/all sides....got the governments into huge debts....printed them the money....and charged them... interest.

Move on a century or so.......the military indusrial complex....is still sucking at the taxpayers teat....with the cost + interest of it's military adventures

- but the game has moved on....and governments now also

- run up huge borrowings... on banking encouraged...debt funded....interest chargeable (taxpayer liability)

- welfare programmes

- and healthcare programmes etc

So the FEDy prints up the fiat out of thin air

- runs it round the primary dealer 3 card monty

- collects the T-Bonds back off the government in return

- and creams the taxpayer for the bond interest

- plus ......uses the printing to buy.....

- Mortgage backed security - real tangible assets

- and creams the mortgage holders for....the mortgage interest.

And in standard - rinse ad repeat fashion

- as you can see the bottom chart looks like velocity of money plunging

- suggests 1930's MK II depression territory

Then the central bankers and friends - pick up all the economic depression distressed assets at.....

Firesale - pennies on the dollar

- who bought up all the Greek - Nationalised State Assets....in their fire sale ?

Who ended up owning - the maggie gifts - of privatatising.....water, electricity, the railways etc etc

- The Bankster owned international conglomerates

In the end,

A simple game of rinse and repeat when it comes down to it

- just - hidden by the complexites of the smoke and mirrors of..... complex financial & economic....jargon

JFK tried to..... cut out the middleman central bankers... above game

- shame that "just that - one crazy guy :o)"

- stopped him.

-

gazkaz - 15 Aug 2013 13:09 - 673 of 1034

Marc Faber - calls it at - only - a 20% (plus maybe more) fall in stocks this autumn

(so not quite a '29 crash ....on into the 1930's experience....yet, by Faber)

Faber compared the current action in the stock market to...

- that in the late summer of 1987,

- and predicted that a similar massive stock market crash/panic is coming this fall.

“In 1987, we had a very powerful rally, but also earnings were no longer rising substantially, and the market became very overbought. The final rally into Aug. 25 occurred with a diminishing number of stocks hitting 52-week highs. In other words, the new-high list was contracting, and we have several breaks in different stocks.

- That’s exactly where we find ourselves...... this August.“

(so not quite a '29 crash ....on into the 1930's experience....yet, by Faber)

Faber compared the current action in the stock market to...

- that in the late summer of 1987,

- and predicted that a similar massive stock market crash/panic is coming this fall.

“In 1987, we had a very powerful rally, but also earnings were no longer rising substantially, and the market became very overbought. The final rally into Aug. 25 occurred with a diminishing number of stocks hitting 52-week highs. In other words, the new-high list was contracting, and we have several breaks in different stocks.

- That’s exactly where we find ourselves...... this August.“

gazkaz - 15 Aug 2013 13:15 - 674 of 1034

Mike maloney's opinion

Here he discusses - The Hidden Secrets of Money and .....the 7 Stages of Empire.

- It was the collapse of the currency in the Weimar Republic... that paved the way for the rise of fascism, and ......

- Mike tells us we are in.......... stage 6

- of the collapse of the U.S. empire,

(and that....we are at risk of repeating history)

http://www.youtube.com/watch?v=Maloney/oh-dear/hold-on-tight

Here he discusses - The Hidden Secrets of Money and .....the 7 Stages of Empire.

- It was the collapse of the currency in the Weimar Republic... that paved the way for the rise of fascism, and ......

- Mike tells us we are in.......... stage 6

- of the collapse of the U.S. empire,

(and that....we are at risk of repeating history)

http://www.youtube.com/watch?v=Maloney/oh-dear/hold-on-tight

gazkaz - 15 Aug 2013 16:28 - 675 of 1034

Recall that

- registered gold is..... the gold held at the COMEX that is ....available for delivery

- while eligible gold ......is not “eligible” for delivery.

Just 3-1/2 years ago in early 2011,

- COMEX warehouses held more than .....11 million ounces of ....eligible gold,

(with JPM holding more than 3 million of these 11 million ounces.)

As of August 9, 2013, JPM’s..... "eligible gold"

- has fallen from.. 3+ million ounces.. to just 361,606 ounces.

Thus, it is safe to conclude

- that physical gold is being withdrawn from the COMEX warehouse

- due to a lack of trust in the global banking sector’s honesty and credibility

(As the "eligible" gold - is effectiely - punter gold...stored for safe keeping)

Moving along to registered gold

( the gold held at the COMEX that is available for delivery).

It is interesting to note that just since April,

- registered gold held at the COMEX depositories

- has collapsed from a total of 2,147,398 ounces

- to just 852,930 ounces.

That is a collapse of 60% of the registered gold inventory..... in less than 4 months!

To put this "tiny 853,000 oz comex gold - available - for delivery" - into perspective.

Data from Hong Kong gold exports reveal that China...... has imported

- an average of 200 metric tonnes of gold.... every month April, May, and June.

( 200 metric tonnes is equivalent to more than.... 6.4 million ounces... of gold).

So China has been importing.....6.4 Million oz ....per month

- and

- COMEX holds a total of just..... 852,930 ounces of registered gold

(available for delivery)........ at the current time.

Unlike the fiat fractional reserve ponzi

- in the gold fractional reserve ponzi.....you can't just quietly - print your way out - a run on physical bullion

- all you can do - is drive the price down....and pay out - in fiat paper.

- registered gold is..... the gold held at the COMEX that is ....available for delivery

- while eligible gold ......is not “eligible” for delivery.

Just 3-1/2 years ago in early 2011,

- COMEX warehouses held more than .....11 million ounces of ....eligible gold,

(with JPM holding more than 3 million of these 11 million ounces.)

As of August 9, 2013, JPM’s..... "eligible gold"

- has fallen from.. 3+ million ounces.. to just 361,606 ounces.

Thus, it is safe to conclude

- that physical gold is being withdrawn from the COMEX warehouse

- due to a lack of trust in the global banking sector’s honesty and credibility

(As the "eligible" gold - is effectiely - punter gold...stored for safe keeping)

Moving along to registered gold

( the gold held at the COMEX that is available for delivery).

It is interesting to note that just since April,

- registered gold held at the COMEX depositories

- has collapsed from a total of 2,147,398 ounces

- to just 852,930 ounces.

That is a collapse of 60% of the registered gold inventory..... in less than 4 months!

To put this "tiny 853,000 oz comex gold - available - for delivery" - into perspective.

Data from Hong Kong gold exports reveal that China...... has imported

- an average of 200 metric tonnes of gold.... every month April, May, and June.

( 200 metric tonnes is equivalent to more than.... 6.4 million ounces... of gold).

So China has been importing.....6.4 Million oz ....per month

- and

- COMEX holds a total of just..... 852,930 ounces of registered gold

(available for delivery)........ at the current time.

Unlike the fiat fractional reserve ponzi

- in the gold fractional reserve ponzi.....you can't just quietly - print your way out - a run on physical bullion

- all you can do - is drive the price down....and pay out - in fiat paper.

gazkaz - 15 Aug 2013 16:49 - 676 of 1034

On April 16,

- just hours...... after the smashing of the gold price.

This is an article from ......the Chinese state press agency CNTV

(China Network Television),

The writer describes how soon after Nixon closed the gold window in 1971 - and the price of gold sky rocketed to $800 an ounce

- - the Fed started to combat the price of gold ........up until today

- in order to maintain the dollar hegemony.

- Their main tactics being ;

- leasing gold and shorting it.

So

- The Chinese ......are fully aware of this game

- and know exactly how it's going to end.

http://koosjansen.blogspot.nl/2013/08/chinese-state-press-on-how-fed-has-been.html

Nice read on..... what everybody knows .....but what western governments.... and mainstream media

- refuse to say.

Adding the - Cynical Spin

(As - the article was locked, loaded and ready to go...just hours...after such an "unfoseen smash)

Did China actually cooperate.... with the Western central banks' smashing of the gold price in April

- on the understanding that China then could pick up sharply discounted gold...... unloaded by panicked Western investors.

- The Chinese government also may have chosen April 16

- to publicize Western gold price suppression .....to it's domestic audience

- so that its own people..... would not..... be panicked out of their own gold.

Well if so - Part B worked.. and then some !!

- Not only were the Chinese public - not panicked... into selling on the price crash

- the Chinese were only panicked - into... besieging gold shops... to get still more metal.

- just hours...... after the smashing of the gold price.

This is an article from ......the Chinese state press agency CNTV

(China Network Television),

The writer describes how soon after Nixon closed the gold window in 1971 - and the price of gold sky rocketed to $800 an ounce

- - the Fed started to combat the price of gold ........up until today

- in order to maintain the dollar hegemony.

- Their main tactics being ;

- leasing gold and shorting it.

So

- The Chinese ......are fully aware of this game

- and know exactly how it's going to end.

http://koosjansen.blogspot.nl/2013/08/chinese-state-press-on-how-fed-has-been.html

Nice read on..... what everybody knows .....but what western governments.... and mainstream media

- refuse to say.

Adding the - Cynical Spin

(As - the article was locked, loaded and ready to go...just hours...after such an "unfoseen smash)

Did China actually cooperate.... with the Western central banks' smashing of the gold price in April

- on the understanding that China then could pick up sharply discounted gold...... unloaded by panicked Western investors.

- The Chinese government also may have chosen April 16

- to publicize Western gold price suppression .....to it's domestic audience

- so that its own people..... would not..... be panicked out of their own gold.

Well if so - Part B worked.. and then some !!

- Not only were the Chinese public - not panicked... into selling on the price crash

- the Chinese were only panicked - into... besieging gold shops... to get still more metal.

gazkaz - 15 Aug 2013 21:32 - 677 of 1034

Keith Barron, who consults with major companies around the world

"The Fed and the ECB are desperately trying to hold the system together, but at the end of the day

- they are losing the ability to control the rapid loss of confidence that is taking hold.

Western central banks claim that there is a lot of physical gold available for purchase.

- That is pure propaganda and a lie.

I now have reason to believe that Asian central banks

- are requesting that their gold, some of which has been stored in the West,

- be sent to Asia.

This is what is causing the short covering rally in gold.

- The Asians know the Western gold system is very close to collapse

- and they want the physical gold in their possession.

This is what is happening behind the scenes.

- A very large part of the 1,300 tons of gold that was shipped out of the Bank of England, .....and gold that is being shipped out of the Fed as well,

- is going into the vaults in China and other parts of Asia.

There is a massive run on physical gold right now and this is creating a squeeze.

The bottom line is the Western fractional reserve gold system

- is now on the edge of collapse

and the Asians know it.

"The Fed and the ECB are desperately trying to hold the system together, but at the end of the day

- they are losing the ability to control the rapid loss of confidence that is taking hold.

Western central banks claim that there is a lot of physical gold available for purchase.

- That is pure propaganda and a lie.

I now have reason to believe that Asian central banks

- are requesting that their gold, some of which has been stored in the West,

- be sent to Asia.

This is what is causing the short covering rally in gold.

- The Asians know the Western gold system is very close to collapse

- and they want the physical gold in their possession.

This is what is happening behind the scenes.

- A very large part of the 1,300 tons of gold that was shipped out of the Bank of England, .....and gold that is being shipped out of the Fed as well,

- is going into the vaults in China and other parts of Asia.

There is a massive run on physical gold right now and this is creating a squeeze.

The bottom line is the Western fractional reserve gold system

- is now on the edge of collapse

and the Asians know it.

gazkaz - 15 Aug 2013 21:46 - 678 of 1034

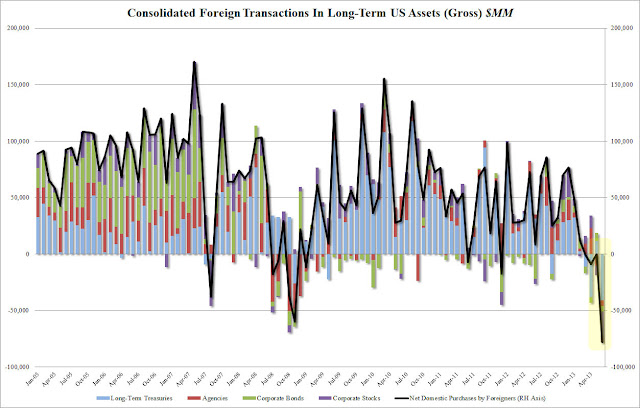

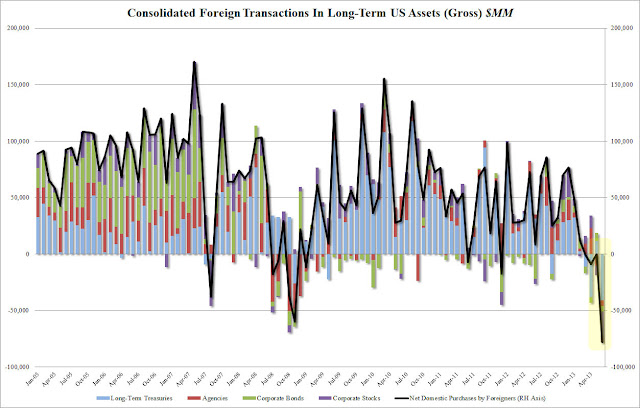

Johnny Foreigner - public & private - having a dumpfest of US T-Bonds

The TIC data came in quite negative this morning show

- a net outflow of over 67 billion

- as both public and private foreigners

- were dumping US Treasuries in size during June.

Seems like a trend too... not just in T-Bonds

-but....in ...... all - US long term assets

And if Johnny foreiner is not only....no longer buying

- but now selling too

The FEDy has to pick up the ever increasing slack.....even more

The TIC data came in quite negative this morning show

- a net outflow of over 67 billion

- as both public and private foreigners

- were dumping US Treasuries in size during June.

Seems like a trend too... not just in T-Bonds

-but....in ...... all - US long term assets

And if Johnny foreiner is not only....no longer buying

- but now selling too

The FEDy has to pick up the ever increasing slack.....even more

gazkaz - 16 Aug 2013 01:04 - 679 of 1034

India Bans All Gold Coin Imports, & ...Increases Capital Controls

As well as the....total ban .....on the importation of gold coins and medallions

- In an effort to "moderate outflows" of Rupee, the Indian central bank slashed the amount of money families can send out of the country per year to $75k... from $200k

- and limited overseas investment to 100% of net worth ..down from 400%.

"We will leave no stone unturned" to control the current account deficit and stabilize the rupee, the finance minister warned.

- thats on top of the recent hike in gold import tax to..10% (from the recent increase to 8%)

- and the requirement to retain 20% of gold imports....for re-export

As well as the....total ban .....on the importation of gold coins and medallions

- In an effort to "moderate outflows" of Rupee, the Indian central bank slashed the amount of money families can send out of the country per year to $75k... from $200k

- and limited overseas investment to 100% of net worth ..down from 400%.

"We will leave no stone unturned" to control the current account deficit and stabilize the rupee, the finance minister warned.

- thats on top of the recent hike in gold import tax to..10% (from the recent increase to 8%)

- and the requirement to retain 20% of gold imports....for re-export

gazkaz - 16 Aug 2013 01:37 - 680 of 1034

10yr T-Bonds - break 2-75%

(thats up around 60% in a month or so)

Rising interest rates means...

- 1% higher rates on 17 Trillion debt....means more treasury income...gets swallowed up paying the higher interest

- equals escalating....budget deficit (more cuts/higher taxes)

- higher interest rate = problem re .....the Banksters lose income/have to pay out on.....interest rate swap derivatives

(from memory of the 1.3 Quadrillion derivatives market.....60% are interest rate swaps !!)

- higher interest rates ....all fixed bond capital values fall

- and the Banks - including the.... Central banks....predominantly hold .....fixed rate bonds

I would imagine on a "mark to market" basis.....the fall in capital values of US T-Bonds (as a result of higher interest rates)

- has probably wiped out... the tiny capital of the FEDY... 4/5 x over

- equals..... on a mark to market basis.....even the central bank....is insolvent.

(thats up around 60% in a month or so)

Rising interest rates means...

- 1% higher rates on 17 Trillion debt....means more treasury income...gets swallowed up paying the higher interest

- equals escalating....budget deficit (more cuts/higher taxes)

- higher interest rate = problem re .....the Banksters lose income/have to pay out on.....interest rate swap derivatives

(from memory of the 1.3 Quadrillion derivatives market.....60% are interest rate swaps !!)

- higher interest rates ....all fixed bond capital values fall

- and the Banks - including the.... Central banks....predominantly hold .....fixed rate bonds

I would imagine on a "mark to market" basis.....the fall in capital values of US T-Bonds (as a result of higher interest rates)

- has probably wiped out... the tiny capital of the FEDY... 4/5 x over

- equals..... on a mark to market basis.....even the central bank....is insolvent.