| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Davai - 18 Apr 2012 11:13

Thread designed to record set-ups and targets on index and FX pairs.

'A market is only your enemy until you understand it, then it becomes your best friend.'

Any questions, please feel free to ask.

From time to time i may openly state an opinion regarding direction of a set-up and wish to add that in no way am i recommending a trade. I am sometimes only in trades for a matter of minutes and can't always update as to entry/exits taken.

As always, markets are dangerous places to be and must be respected as such. Always use stop losses and never over-leverage; 3% of your pot as a maximum per trade. As always, YOU are responsible for your own trades! Happy pip hunting!

Click HERE to visit me at FXtechnicals.net

Davai - 04 May 2012 16:58 - 81 of 423

Davai - 04 May 2012 17:30 - 82 of 423

Interesting to note this;

(from last night's analysis);

'Better post this one on here as well i guess. Possibile alternative play on the Dax with a triangle in play. This shows far less upside before the drop;'

Indeed, the 'E' wave was very short underlining the weakness of the markets today. Similar happened on the Euro, with a very short 'C' wave before the drop...

(from last night's analysis);

'Better post this one on here as well i guess. Possibile alternative play on the Dax with a triangle in play. This shows far less upside before the drop;'

Indeed, the 'E' wave was very short underlining the weakness of the markets today. Similar happened on the Euro, with a very short 'C' wave before the drop...

Davai - 10 May 2012 08:25 - 83 of 423

Davai - 11 May 2012 16:06 - 84 of 423

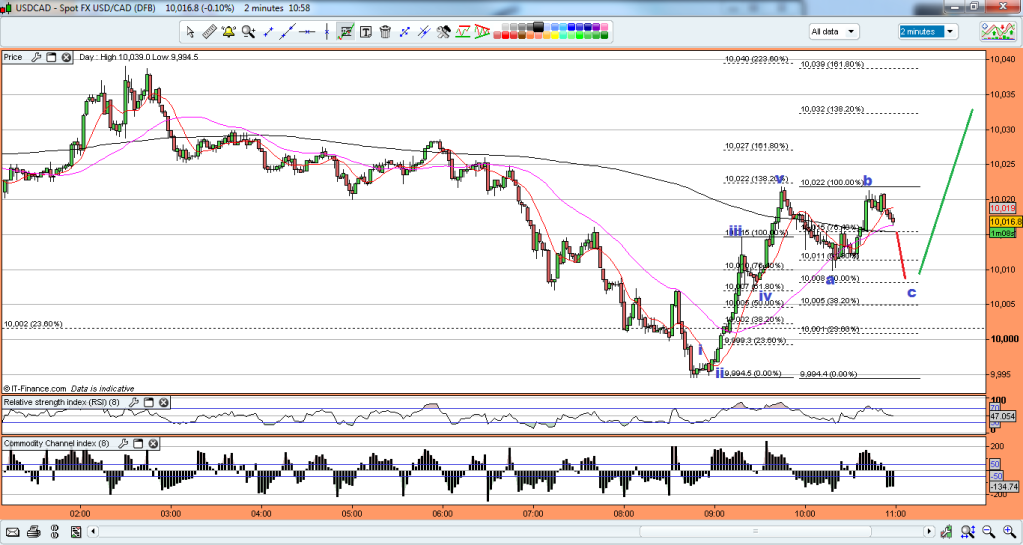

Unfortunately, looks like more downside next week for index's (and thus strength for dollar). Getting close to some great long entries on a few pairs. The Loonie looks like it wants up from here...

Davai - 11 May 2012 16:14 - 85 of 423

Davai - 14 May 2012 20:33 - 86 of 423

Davai - 14 May 2012 21:30 - 87 of 423

Back to; Davai - 18 Apr 2012 20:48 - 13 of 86

Very clear 5 wave advance on the EurJpy, if this corrective move plays out it will be good to go long and strong;

Update;

and now im watching the small 5 wave advance since hitting my blue line earlier. Hopefully we will get a clear abc and a bounce off of a fib level. I must add, i'm expecting dollar strength tomorrow though therefore the Eur needs to be somewhat resilient, (or it may do a 100% retrace, so long as it doesn't make a fresh low), this just may be the start of a lengthy run for the Euro, (yes, just when all the current Greek problems seem to mean the opposite)...

Very clear 5 wave advance on the EurJpy, if this corrective move plays out it will be good to go long and strong;

Update;

and now im watching the small 5 wave advance since hitting my blue line earlier. Hopefully we will get a clear abc and a bounce off of a fib level. I must add, i'm expecting dollar strength tomorrow though therefore the Eur needs to be somewhat resilient, (or it may do a 100% retrace, so long as it doesn't make a fresh low), this just may be the start of a lengthy run for the Euro, (yes, just when all the current Greek problems seem to mean the opposite)...

Davai - 15 May 2012 11:41 - 88 of 423

Davai - 15 May 2012 12:24 - 89 of 423

Davai - 15 May 2012 20:19 - 90 of 423

Davai - 15 May 2012 21:01 - 91 of 423

Davai - 16 May 2012 13:36 - 92 of 423

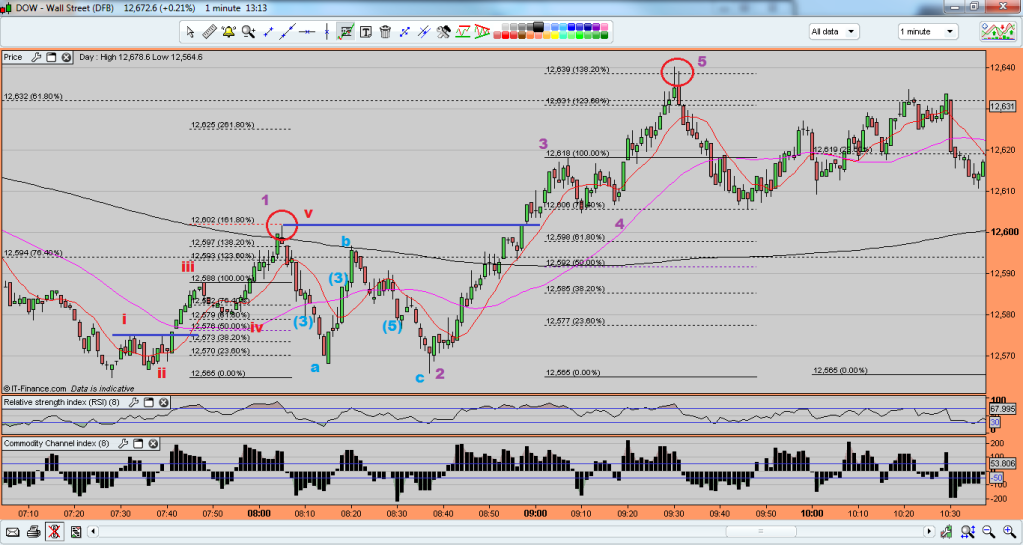

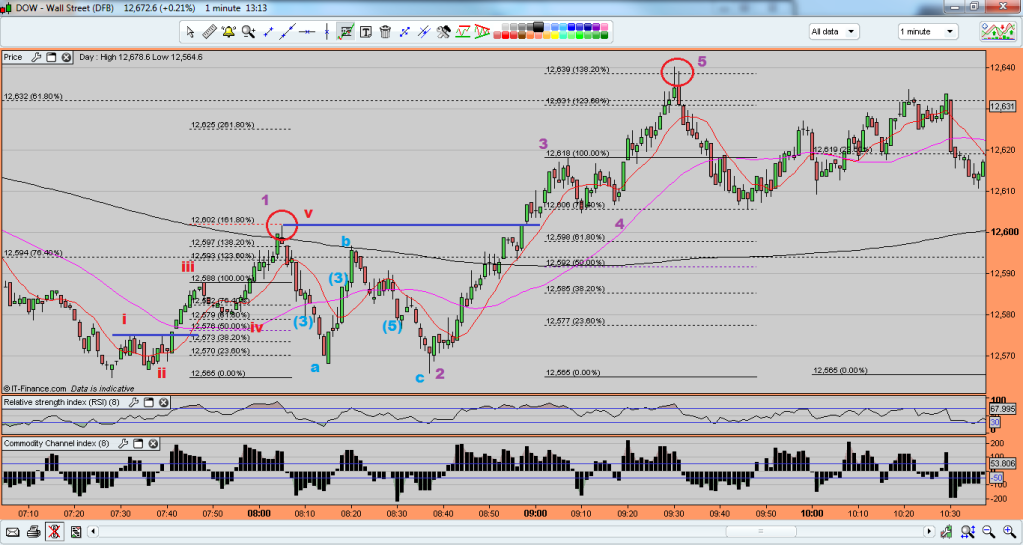

If the first small 'i'/'ii' is too risky to determine, we look for a follow on 5w up, half position entered long on pullback to a fib level. In this instance such a deep pullback, gives a fantastic low risk entry at points 'a' & 'c', wave structure here is very important, with 'a' being down in 3, it was going to be either a flat or irregular correction, sure enough, 'b' heads right back up nearly retracing all of 'a' and 'c' making a slightly LL. More confirmation comes with a break of the top of '1' by a full pip, enter second half of position long and look to fibs for target once the 3rd can be determined...

Davai - 16 May 2012 19:50 - 93 of 423

Davai - 18 May 2012 08:37 - 94 of 423

Davai - 18 May 2012 08:38 - 95 of 423

Davai - 18 May 2012 10:58 - 96 of 423

Davai - 18 May 2012 11:57 - 97 of 423

Davai - 18 May 2012 13:22 - 98 of 423

Davai - 22 May 2012 14:47 - 99 of 423

A perfect trade;

After a recent short target was reached on the above chart, coinciding with my Cad target (above) and the Dow twin Fib targets, i was suspecting a bounce;

(Davai - 18 May 2012 08:37 - 94 of 98

'Respite for the markets. This is a perfect 5w count;'),

So we watch for an ABC. The important part is that 'A' breaches the last significant high, (as shown by the blue line in the above chart), now we wait for 'B' to retrace and then turn back upwards, to start wave 'C'. This will be in 5 waves. With that knowledge, we wait for wave 1 to end and draw our fib levels, wave 2 should retrace in 3 minor waves and bounce off of one of those fib levels. we can now draw a flagline starting from the top of 'A' and touching the top of wave 1. Using my system, i get a trigger upon breakout where i can determine a target price for the set-up. Stop is a pip below the lowest point of the pullback ('B'), target is equal distance away from entry, thus a risk:reward of 1:1, but very high probability. This rises still further when you look at the fib level of 261.8%. This is often a target off of wave 1 for either the end of the 3rd wave or even the whole 5 waves, look how it is identical to my system generated target...

It looks like this is ABC of A, followed by tonights drop being ABC of 'B', so a larger 5 wave C to come over next couple of days, this should also mean higher yet for index's before one more drop...

After a recent short target was reached on the above chart, coinciding with my Cad target (above) and the Dow twin Fib targets, i was suspecting a bounce;

(Davai - 18 May 2012 08:37 - 94 of 98

'Respite for the markets. This is a perfect 5w count;'),

So we watch for an ABC. The important part is that 'A' breaches the last significant high, (as shown by the blue line in the above chart), now we wait for 'B' to retrace and then turn back upwards, to start wave 'C'. This will be in 5 waves. With that knowledge, we wait for wave 1 to end and draw our fib levels, wave 2 should retrace in 3 minor waves and bounce off of one of those fib levels. we can now draw a flagline starting from the top of 'A' and touching the top of wave 1. Using my system, i get a trigger upon breakout where i can determine a target price for the set-up. Stop is a pip below the lowest point of the pullback ('B'), target is equal distance away from entry, thus a risk:reward of 1:1, but very high probability. This rises still further when you look at the fib level of 261.8%. This is often a target off of wave 1 for either the end of the 3rd wave or even the whole 5 waves, look how it is identical to my system generated target...

It looks like this is ABC of A, followed by tonights drop being ABC of 'B', so a larger 5 wave C to come over next couple of days, this should also mean higher yet for index's before one more drop...