| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

THE BUCKET SHOP (SHOP)

moonblue

- 21 Jul 2004 08:51

- 141 of 240

- 21 Jul 2004 08:51

- 141 of 240

This is a Team based FTSE Investment Game visit The Cafe

Each team starts with 1 million pounds to invest

The Team leader will be reponsible for posting their teams investment selection

Each team can select between 1 to 10 FTSE / AIM stocks for their portfolio

Every weekend each team may make one trade (must be complete stock) or new investment; post before 6pm Sundays

Buying into a stock you already own will be classed as a new stock and not added. (see example below)

The Game will last 10 weeks.

The team with the biggest profit after 10 weeks wins the game.

Team members should email each other or post on this thread their investment ideas for the Team captain. The Team Captain must make the final investment decisions.

Teams can only invest and not go short. Buying at offer and selling at bid price.

Dividend payments will not be included. The game is based solely on the price of a share.

There is a maximum of 10 players per Team.

Game starts 30th July, Team Captains should post first investments choices before 6pm Sunday 1st August.

This Game is only a bit of fun and Golddog reserves the right to do what he likes (mutley snigger)

Eligible players from GD's Tea rooms have already been placed into teams, if you do not wish to play then you can either tell me or just become a silent member of the team. Or you may request transfer to another team.

If you would like to play along then please post which team you would like to be placed in. (anyone may join in). The girls team is for girls only. If a group of you would like to set up your own team then just let Golddog know!

Please ask any questions?

Other than that we shall make it up as we go along? :-)

Teams should select a Team Captain or Golddog will choose.

example of Team Leader posting;

buy 250,000 Barclays barc

buy 300,000 bodyshop bos

buy 280,000 Lloyds-TSB Group lloy

example of following weekend posting;

sell barclays

buy 200,000 Lloyds-TSB Group lloy

Portfolio will then be as follows;

1. 300,000 worth of bodyshop bos

2. 280,000 worth of Lloyds-TSB Group lloy

3. 200,000 worth of Lloyds-TSB Group lloy

Each team starts with 1 million pounds to invest

The Team leader will be reponsible for posting their teams investment selection

Each team can select between 1 to 10 FTSE / AIM stocks for their portfolio

Every weekend each team may make one trade (must be complete stock) or new investment; post before 6pm Sundays

Buying into a stock you already own will be classed as a new stock and not added. (see example below)

The Game will last 10 weeks.

The team with the biggest profit after 10 weeks wins the game.

Team members should email each other or post on this thread their investment ideas for the Team captain. The Team Captain must make the final investment decisions.

Teams can only invest and not go short. Buying at offer and selling at bid price.

Dividend payments will not be included. The game is based solely on the price of a share.

There is a maximum of 10 players per Team.

Game starts 30th July, Team Captains should post first investments choices before 6pm Sunday 1st August.

This Game is only a bit of fun and Golddog reserves the right to do what he likes (mutley snigger)

Eligible players from GD's Tea rooms have already been placed into teams, if you do not wish to play then you can either tell me or just become a silent member of the team. Or you may request transfer to another team.

If you would like to play along then please post which team you would like to be placed in. (anyone may join in). The girls team is for girls only. If a group of you would like to set up your own team then just let Golddog know!

Please ask any questions?

Other than that we shall make it up as we go along? :-)

Teams should select a Team Captain or Golddog will choose.

example of Team Leader posting;

buy 250,000 Barclays barc

buy 300,000 bodyshop bos

buy 280,000 Lloyds-TSB Group lloy

example of following weekend posting;

sell barclays

buy 200,000 Lloyds-TSB Group lloy

Portfolio will then be as follows;

1. 300,000 worth of bodyshop bos

2. 280,000 worth of Lloyds-TSB Group lloy

3. 200,000 worth of Lloyds-TSB Group lloy

mick p - 21 Jul 2004 09:20 - 142 of 240

no shorts? What kind of investment is this? Where is the protection/balance?

Answers on a postcard to:

Saturday Soup Kitchen

Platform 1

Euston Station

BRO KEN

or email

Iwanttoloose50%ofmyinvestmentsagaininthesamedecade@pauper.bum

Investing is no longer about B&H izzit? Thought the bulls had been taught an expensive lesson already.......

Answers on a postcard to:

Saturday Soup Kitchen

Platform 1

Euston Station

BRO KEN

or email

Iwanttoloose50%ofmyinvestmentsagaininthesamedecade@pauper.bum

Investing is no longer about B&H izzit? Thought the bulls had been taught an expensive lesson already.......

moonblue

- 21 Jul 2004 09:23

- 143 of 240

- 21 Jul 2004 09:23

- 143 of 240

yeh but 30th is fibo turn date mick,,so it might go up...ill have gsk,barc as mine

mick p - 21 Jul 2004 09:42 - 144 of 240

yea but we can do both....... longs and shorts, don't understand this fixation with buying and holding till the Trumpet sounds.

Longs may already be the way to go, if you believe saxo. Yesterday looked like an excuse to turn it, Ali G said nowt that should have rallied mkts, so if daz boyz want it back up, so be it, I ain't standing in front of them.

I have gsk on watch too. 1000 was huge support last year.

Closed a small nrk long +7. Look at it now +22. I hate going long.......lol

Longs may already be the way to go, if you believe saxo. Yesterday looked like an excuse to turn it, Ali G said nowt that should have rallied mkts, so if daz boyz want it back up, so be it, I ain't standing in front of them.

I have gsk on watch too. 1000 was huge support last year.

Closed a small nrk long +7. Look at it now +22. I hate going long.......lol

moonblue

- 21 Jul 2004 13:27

- 145 of 240

- 21 Jul 2004 13:27

- 145 of 240

mitzooos mg..same as it ever was

moonblue

- 21 Jul 2004 13:28

- 146 of 240

- 21 Jul 2004 13:28

- 146 of 240

what was the boe vote ...been out

Golddog

- 21 Jul 2004 13:31

- 147 of 240

- 21 Jul 2004 13:31

- 147 of 240

Glad to see you have an interest in the game. Just let me know all the names that want to be in your team and select yourself a Team Captain. It's only a bit of fun and sorry about no shorting! :-)

hijeff - 21 Jul 2004 13:56 - 148 of 240

affanoon,team games eh,but not for bears.

mick p - 21 Jul 2004 14:11 - 149 of 240

yea, its discrimination, just cos we smell and don't eat grass.......

moonblue

- 21 Jul 2004 14:17

- 150 of 240

- 21 Jul 2004 14:17

- 150 of 240

gold ..its easy we just sell first and buy back second...surely u can accomadate that?

moonblue

- 21 Jul 2004 14:18

- 151 of 240

- 21 Jul 2004 14:18

- 151 of 240

team is

moregas

mick p

hijeff

dickster

moonblue

hedge66

kevinmcm

ps499

moregas

mick p

hijeff

dickster

moonblue

hedge66

kevinmcm

ps499

hijeff - 21 Jul 2004 14:43 - 152 of 240

one team member there i dont know,dickster,did you have anover name elsewhere?

moonblue

- 21 Jul 2004 14:52

- 153 of 240

- 21 Jul 2004 14:52

- 153 of 240

he is dickster on advfn,i asked him on phone ,he said yes,he posts on moneyam traders room...

hijeff - 21 Jul 2004 14:55 - 154 of 240

moonie the dial code wasnt spain then.lol

moonblue

- 21 Jul 2004 15:06

- 155 of 240

- 21 Jul 2004 15:06

- 155 of 240

lol..

moonblue

- 21 Jul 2004 15:07

- 156 of 240

- 21 Jul 2004 15:07

- 156 of 240

bet greenspan turns the usd roundat 320pm...

moregas - 21 Jul 2004 15:14 - 157 of 240

chaps I really donn't know if I've got the time. I t takes me ages to do things anyway and theres a lot of other things id rather be doing. No offoenc e meant.

moonblue

- 21 Jul 2004 15:26

- 158 of 240

- 21 Jul 2004 15:26

- 158 of 240

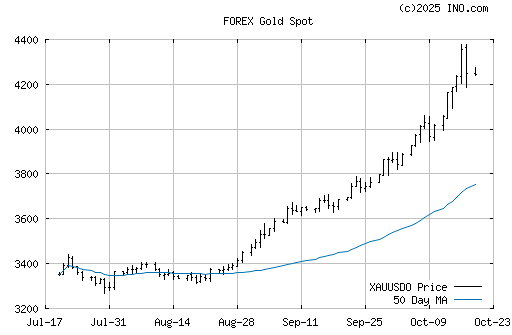

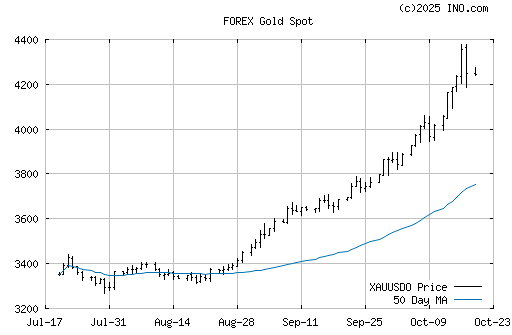

gold at support

moonblue

- 21 Jul 2004 15:26

- 159 of 240

- 21 Jul 2004 15:26

- 159 of 240

anyone else want to volunterr?

moonblue

- 21 Jul 2004 16:10

- 160 of 240

- 21 Jul 2004 16:10

- 160 of 240

21 Jul 2004 16:04 BS =DJ Special Summary Of Fed Chairman Greenspan's Testimony

The following is a special summary of U.S. Federal Reserve Chairman Alan Greenspan's testimony before the House Financial Services Committee. For full coverage of the events and a complete verbatim text of Greenspan's comments, please search the code G/FED.

Greenspan Reiterates Fed Sees Gradual Interest-Rate Rise

Federal Reserve Chairman Alan Greenspan said Wednesday the U.S. central bank aims to continue raising interest rates at a gradual clip over the next 18 months or so, but is ready to "respond promptly and flexibly" if inflation proves to be higher than policymakers now expect.

In the second round of his semi-annual testimony to Congress on monetary policy, Greenspan said the latest economic data show the U.S. economic recovery has become "broad-based" and "self-sustaining." He downplayed worries that the recovery is losing steam, saying the recent weakness in consumer spending is likely to prove "short-lived." Under the circumstances, he said, the Fed must raise its key federal-funds rate to a "more neutral setting" that neither stimulates nor curbs economic growth.

Greenspan: '01 Tax Cuts Were Necessary To Curb Recession

Federal Reserve Chairman Alan Greenspan on Wednesday defended the $1.3 trillion tax cuts that Congress enacted in 2001, saying the cuts helped stave off a deeper recession than the one the economy suffered that year.

But Greenspan told U.S. lawmakers that he is worried about the long-term outlook for the budget and urged Congress to adopt rules that would require spending increases to be offset by tax increases or tax cuts to be offset by spending cuts.

Treasurys Slide Continues With More Greenspan On The Way

With Federal Reserve Chairman Alan Greenspan's upbeat assessment of the U.S. economy still fresh in the minds of investors, Treasurys fell further in midmorning trade Wednesday, with shorter-dated maturities suffering the most.

Market participants are now listening to the Chairman's responses to questions from the House Financial Services Committee in the second leg of his semi-annual congressional testimony. Greenspan delivered an identical speech to the committee as the one given to the Senate Banking Committee on Tuesday.

(END) Dow Jones Newswires

July 21, 2004 11:04 ET (15:04 GMT)

The following is a special summary of U.S. Federal Reserve Chairman Alan Greenspan's testimony before the House Financial Services Committee. For full coverage of the events and a complete verbatim text of Greenspan's comments, please search the code G/FED.

Greenspan Reiterates Fed Sees Gradual Interest-Rate Rise

Federal Reserve Chairman Alan Greenspan said Wednesday the U.S. central bank aims to continue raising interest rates at a gradual clip over the next 18 months or so, but is ready to "respond promptly and flexibly" if inflation proves to be higher than policymakers now expect.

In the second round of his semi-annual testimony to Congress on monetary policy, Greenspan said the latest economic data show the U.S. economic recovery has become "broad-based" and "self-sustaining." He downplayed worries that the recovery is losing steam, saying the recent weakness in consumer spending is likely to prove "short-lived." Under the circumstances, he said, the Fed must raise its key federal-funds rate to a "more neutral setting" that neither stimulates nor curbs economic growth.

Greenspan: '01 Tax Cuts Were Necessary To Curb Recession

Federal Reserve Chairman Alan Greenspan on Wednesday defended the $1.3 trillion tax cuts that Congress enacted in 2001, saying the cuts helped stave off a deeper recession than the one the economy suffered that year.

But Greenspan told U.S. lawmakers that he is worried about the long-term outlook for the budget and urged Congress to adopt rules that would require spending increases to be offset by tax increases or tax cuts to be offset by spending cuts.

Treasurys Slide Continues With More Greenspan On The Way

With Federal Reserve Chairman Alan Greenspan's upbeat assessment of the U.S. economy still fresh in the minds of investors, Treasurys fell further in midmorning trade Wednesday, with shorter-dated maturities suffering the most.

Market participants are now listening to the Chairman's responses to questions from the House Financial Services Committee in the second leg of his semi-annual congressional testimony. Greenspan delivered an identical speech to the committee as the one given to the Senate Banking Committee on Tuesday.

(END) Dow Jones Newswires

July 21, 2004 11:04 ET (15:04 GMT)