| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Traders Thread - Tuesday 8th October (TRAD)

Greystone

- 08 Oct 2013 05:52

- 2 of 12

- 08 Oct 2013 05:52

- 2 of 12

Good morning traders!

In the US last night, the Dow fell 137 points to 14,936, the Nasdaq shed 38 points at

3,770 and the S&P500 lost 15 points at 1,676.

In Asia today, the Nikkei was recently up 10 points at 13,863 and the Hang Seng

ahead 223 points at 23,197.

WTI crude oil traded at $103.03 a barrel and Brent crude at $109.68.

Gold settled at $1,324 an ounce.

Good hunting!

G.

In the US last night, the Dow fell 137 points to 14,936, the Nasdaq shed 38 points at

3,770 and the S&P500 lost 15 points at 1,676.

In Asia today, the Nikkei was recently up 10 points at 13,863 and the Hang Seng

ahead 223 points at 23,197.

WTI crude oil traded at $103.03 a barrel and Brent crude at $109.68.

Gold settled at $1,324 an ounce.

Good hunting!

G.

skinny

- 08 Oct 2013 06:00

- 3 of 12

- 08 Oct 2013 06:00

- 3 of 12

skinny

- 08 Oct 2013 06:34

- 4 of 12

- 08 Oct 2013 06:34

- 4 of 12

The beginning of the future?

Nuclear fusion milestone passed at US lab

"The BBC understands that during an experiment in late September, the amount of energy released through the fusion reaction exceeded the amount of energy being absorbed by the fuel - the first time this had been achieved at any fusion facility in the world."

Nuclear fusion milestone passed at US lab

"The BBC understands that during an experiment in late September, the amount of energy released through the fusion reaction exceeded the amount of energy being absorbed by the fuel - the first time this had been achieved at any fusion facility in the world."

skinny

- 08 Oct 2013 06:58

- 5 of 12

- 08 Oct 2013 06:58

- 5 of 12

European Factors to Watch-Shares set to extend losses

Tue Oct 8, 2013 6:32am BST

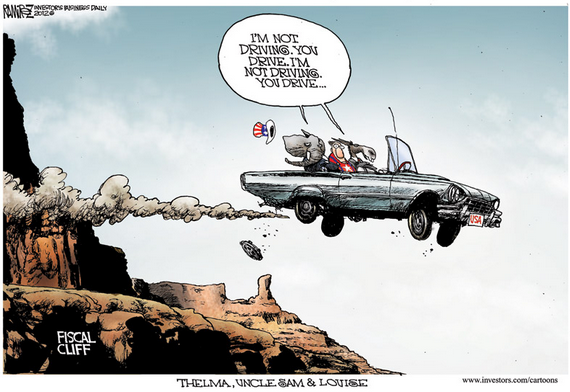

PARIS, Oct 8 (Reuters) - European stocks are seen falling on Tuesday, losing

ground for the fourth time in five sessions as investors continued to move to

the sidelines, rattled by the lack of significant progress in resolving the U.S.

budget standoff.

Financial spread betters expect Britain's FTSE 100 to open 11 to 24

points lower, or down 0.4 percent, Germany's DAX to open 20 to 27

points lower, or down 0.3 percent, and France's CAC 40 to open 17 to 20

points lower, or down 0.5 percent.

As the U.S. government shutdown entered a second week, investors worry that

Republicans and Democrats won't reach an agreement on the budget as well as on

the debt ceiling ahead of the Oct. 17 deadline, which could result in a U.S.

debt default.

"With such huge uncertainties in the market at the moment, no one has the

confidence or nerve to place any sizable positions," Capital Spreads trader

Jonathan Sudaria said in a note.

"The bulls are cautious of a prolonged stalemate and the bears are fearful

of any surprise deal being done so the only trading of note is by those taking

profits after the September run up."

Tue Oct 8, 2013 6:32am BST

PARIS, Oct 8 (Reuters) - European stocks are seen falling on Tuesday, losing

ground for the fourth time in five sessions as investors continued to move to

the sidelines, rattled by the lack of significant progress in resolving the U.S.

budget standoff.

Financial spread betters expect Britain's FTSE 100 to open 11 to 24

points lower, or down 0.4 percent, Germany's DAX to open 20 to 27

points lower, or down 0.3 percent, and France's CAC 40 to open 17 to 20

points lower, or down 0.5 percent.

As the U.S. government shutdown entered a second week, investors worry that

Republicans and Democrats won't reach an agreement on the budget as well as on

the debt ceiling ahead of the Oct. 17 deadline, which could result in a U.S.

debt default.

"With such huge uncertainties in the market at the moment, no one has the

confidence or nerve to place any sizable positions," Capital Spreads trader

Jonathan Sudaria said in a note.

"The bulls are cautious of a prolonged stalemate and the bears are fearful

of any surprise deal being done so the only trading of note is by those taking

profits after the September run up."

skinny

- 08 Oct 2013 07:22

- 6 of 12

- 08 Oct 2013 07:22

- 6 of 12

Nikkei snaps 4-day losing streak; U.S. worries still a drag

Tue Oct 8, 2013 7:12am BST

TOKYO, Oct 8 (Reuters) - Japan's Nikkei stock average

notched its first rise in five sessions on Tuesday, tracking

gains in other Asian markets, but a lack of progress in ending

the U.S. government shutdown and the debt-ceiling standoff kept

investors on edge.

The benchmark Nikkei closed up 0.3 percent at

13,894.61, rebounding from a five-week low of 13,748.94 hit

earlier in the session.

The broader Topix added 0.2 percent to 1,150.13 in

relatively thin trade, with 2.64 billion shares changing hands.

Tue Oct 8, 2013 7:12am BST

TOKYO, Oct 8 (Reuters) - Japan's Nikkei stock average

notched its first rise in five sessions on Tuesday, tracking

gains in other Asian markets, but a lack of progress in ending

the U.S. government shutdown and the debt-ceiling standoff kept

investors on edge.

The benchmark Nikkei closed up 0.3 percent at

13,894.61, rebounding from a five-week low of 13,748.94 hit

earlier in the session.

The broader Topix added 0.2 percent to 1,150.13 in

relatively thin trade, with 2.64 billion shares changing hands.

skinny

- 08 Oct 2013 08:21

- 7 of 12

- 08 Oct 2013 08:21

- 7 of 12

CHF CPI m/m 0.3% 0.2% -0.1%

CHF Retail Sales y/y 2.4% 1.7% 0.6%

CHF Retail Sales y/y 2.4% 1.7% 0.6%

Greystone

- 08 Oct 2013 08:57

- 8 of 12

- 08 Oct 2013 08:57

- 8 of 12

skinny

- 08 Oct 2013 11:00

- 9 of 12

- 08 Oct 2013 11:00

- 9 of 12

German Factory Orders m/m -0.3% 1.2% -2.7%

Greystone

- 08 Oct 2013 12:32

- 10 of 12

- 08 Oct 2013 12:32

- 10 of 12

Greystone

- 08 Oct 2013 14:54

- 11 of 12

- 08 Oct 2013 14:54

- 11 of 12

Ex-dividends to knock 3.72 points off the FTSE100 tomorrow

Greystone

- 08 Oct 2013 17:05

- 12 of 12

- 08 Oct 2013 17:05

- 12 of 12

- Page:

- 1