| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Traders Thread - Thursday 10th October (TRAD)

Greystone

- 10 Oct 2013 05:51

- 2 of 19

- 10 Oct 2013 05:51

- 2 of 19

Good morning traders!

In the US last night, the Dow rose 26 points to 14,803, the Nasdaq fell 17 points to

3,678 and the S&P500 was flat at 1,656.

In Asia today, the Nikkei was recently up 110 points at 14,148 and the Hang Seng off

189 points at 22,844.

WTI crude oil traded at $101.61 a barrel and Brent crude at $109.06.

Gold settled at $1,307 an ounce.

Good hunting!

G.

In the US last night, the Dow rose 26 points to 14,803, the Nasdaq fell 17 points to

3,678 and the S&P500 was flat at 1,656.

In Asia today, the Nikkei was recently up 110 points at 14,148 and the Hang Seng off

189 points at 22,844.

WTI crude oil traded at $101.61 a barrel and Brent crude at $109.06.

Gold settled at $1,307 an ounce.

Good hunting!

G.

skinny

- 10 Oct 2013 06:14

- 3 of 19

- 10 Oct 2013 06:14

- 3 of 19

skinny

- 10 Oct 2013 07:02

- 4 of 19

- 10 Oct 2013 07:02

- 4 of 19

European Factors to Watch-Signs of progress in U.S. standoff to help shares

Thu Oct 10, 2013 6:34am BST

LONDON, Oct 10 (Reuters) - European shares were expected to snap a three-day

losing streak and bounce back from one-month lows on Thursday, on signs of some

progress to end the U.S. fiscal stalemate and avoid a possible debt default next

week.

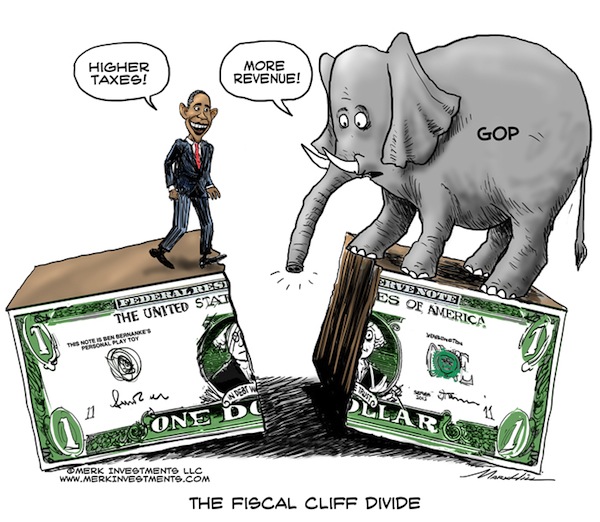

U.S. Republicans were considering a short-term hike in the government's

borrowing authority to buy time for talks on broader policy measures, a

Republican leadership aide said on Wednesday. President Barack Obama has said he

would accept a short-term ceiling increase as long as no strings were attached.

Financial spreadbetters predicted a higher open for the European market,

mirroring gains on Wall Street and in Japan. Britain's FTSE 100 was seen

opening 10 to 16 points, or as much as 0.3 percent higher, Germany's DAX

to gain 33 to 41 points, or as much as 0.5 percent, and France's CAC 40

to rise 20 to 25 points, or as much as 0.6 percent.

U.S. shares rose 0.1 to 0.5 percent on Wednesday. The

pan-European FTSEurofirst 300 index ended 0.5 percent lower on

Wednesday after hitting a one-month low. Japan's Nikkei average was up

0.9 percent on Thursday.

Thu Oct 10, 2013 6:34am BST

LONDON, Oct 10 (Reuters) - European shares were expected to snap a three-day

losing streak and bounce back from one-month lows on Thursday, on signs of some

progress to end the U.S. fiscal stalemate and avoid a possible debt default next

week.

U.S. Republicans were considering a short-term hike in the government's

borrowing authority to buy time for talks on broader policy measures, a

Republican leadership aide said on Wednesday. President Barack Obama has said he

would accept a short-term ceiling increase as long as no strings were attached.

Financial spreadbetters predicted a higher open for the European market,

mirroring gains on Wall Street and in Japan. Britain's FTSE 100 was seen

opening 10 to 16 points, or as much as 0.3 percent higher, Germany's DAX

to gain 33 to 41 points, or as much as 0.5 percent, and France's CAC 40

to rise 20 to 25 points, or as much as 0.6 percent.

U.S. shares rose 0.1 to 0.5 percent on Wednesday. The

pan-European FTSEurofirst 300 index ended 0.5 percent lower on

Wednesday after hitting a one-month low. Japan's Nikkei average was up

0.9 percent on Thursday.

skinny

- 10 Oct 2013 07:10

- 5 of 19

- 10 Oct 2013 07:10

- 5 of 19

UK Stocks-Factors to watch on Thursday, Oct. 10

LONDON | Thu Oct 10, 2013 6:55am BST

Oct 10 (Reuters) - Britain's FTSE 100 index is seen opening up 10 points on Thursday, according to financial bookmakers. For more on the factors affecting European stocks, please click on

* The blue-chip FTSE 100 index closed down by 0.4 percent, or 27.92 points, to 6,337.91 points, to mark its lowest closing level since ending at 6,229.87 points on July 3.

LONDON | Thu Oct 10, 2013 6:55am BST

Oct 10 (Reuters) - Britain's FTSE 100 index is seen opening up 10 points on Thursday, according to financial bookmakers. For more on the factors affecting European stocks, please click on

* The blue-chip FTSE 100 index closed down by 0.4 percent, or 27.92 points, to 6,337.91 points, to mark its lowest closing level since ending at 6,229.87 points on July 3.

skinny

- 10 Oct 2013 07:33

- 6 of 19

- 10 Oct 2013 07:33

- 6 of 19

Nikkei hits 1-week high on hopes for progress in Washington

Thu Oct 10, 2013 7:17am BST

TOKYO, Oct 10 (Reuters) - Japan's Nikkei share average

gained 1.1 percent and hit a one-week high on Thursday, buoyed

by hopes that U.S. politicians will resolve the fiscal standoff

soon, lifting such exporters as Toyota Motor Corp and

Honda Motor Co.

The Nikkei closed up at 14,194.71 after touching

14,200.31, its highest since Oct. 3.

The Topix gained 1 percent to 1,177.95.

Thu Oct 10, 2013 7:17am BST

TOKYO, Oct 10 (Reuters) - Japan's Nikkei share average

gained 1.1 percent and hit a one-week high on Thursday, buoyed

by hopes that U.S. politicians will resolve the fiscal standoff

soon, lifting such exporters as Toyota Motor Corp and

Honda Motor Co.

The Nikkei closed up at 14,194.71 after touching

14,200.31, its highest since Oct. 3.

The Topix gained 1 percent to 1,177.95.

skinny

- 10 Oct 2013 07:45

- 7 of 19

- 10 Oct 2013 07:45

- 7 of 19

French Industrial Production m/m 0.2% 0.7% -0.6%

Greystone

- 10 Oct 2013 08:47

- 8 of 19

- 10 Oct 2013 08:47

- 8 of 19

skinny

- 10 Oct 2013 09:00

- 9 of 19

- 10 Oct 2013 09:00

- 9 of 19

Italian Industrial Production m/m -0.3% 0.6% -1.1%

skinny

- 10 Oct 2013 12:03

- 10 of 19

- 10 Oct 2013 12:03

- 10 of 19

GBP Asset Purchase Facility 375B 375B 375B

GBP Official Bank Rate 0.50% 0.50% 0.50%

GBP Official Bank Rate 0.50% 0.50% 0.50%

Greystone

- 10 Oct 2013 12:22

- 11 of 19

- 10 Oct 2013 12:22

- 11 of 19

skinny

- 10 Oct 2013 13:32

- 12 of 19

- 10 Oct 2013 13:32

- 12 of 19

CAD NHPI m/m 0.1% 0.3% 0.2%

USD Unemployment Claims 374K 307K 308K

USD Unemployment Claims 374K 307K 308K

ExecLine

- 10 Oct 2013 15:02

- 13 of 19

- 10 Oct 2013 15:02

- 13 of 19

Here's how the shut down will be sorted:

Senior House Republican sources have been telling CNN since earlier this week the idea of raising the debt ceiling for four to six weeks is the most viable way out of the stalemate.

A House Democratic lawmaker told CNN on Wednesday evening that President Barack Obama held a private White House meeting. In it, he said he would likely agree to a short term debt ceiling deal if that’s what Republicans would support in order to avoid default, the lawmaker

http://ktla.com/2013/10/09/house-gop-to-unveil-short-term-debt-ceiling-increase/#ixzz2hKMozKYY

Senior House Republican sources have been telling CNN since earlier this week the idea of raising the debt ceiling for four to six weeks is the most viable way out of the stalemate.

A House Democratic lawmaker told CNN on Wednesday evening that President Barack Obama held a private White House meeting. In it, he said he would likely agree to a short term debt ceiling deal if that’s what Republicans would support in order to avoid default, the lawmaker

http://ktla.com/2013/10/09/house-gop-to-unveil-short-term-debt-ceiling-increase/#ixzz2hKMozKYY

skinny

- 10 Oct 2013 15:06

- 14 of 19

- 10 Oct 2013 15:06

- 14 of 19

skinny

- 10 Oct 2013 16:50

- 15 of 19

- 10 Oct 2013 16:50

- 15 of 19

US Republicans in debt-ceiling offer

US Republicans have offered President Barack Obama a short-term debt limit increase to stave off default.

House Speaker John Boehner said they would do so in exchange for wider negotiations with the White House to end a government shutdown.

US Republicans have offered President Barack Obama a short-term debt limit increase to stave off default.

House Speaker John Boehner said they would do so in exchange for wider negotiations with the White House to end a government shutdown.

Greystone

- 10 Oct 2013 16:58

- 16 of 19

- 10 Oct 2013 16:58

- 16 of 19

skinny

- 10 Oct 2013 20:17

- 17 of 19

- 10 Oct 2013 20:17

- 17 of 19

Republicans offer plan to postpone U.S. default

WASHINGTON | Thu Oct 10, 2013 7:27pm BST

(Reuters) - Republicans in the House of Representatives offered a plan on Thursday that would postpone a possible U.S. default and urged President Barack Obama to negotiate an end to the 10-day government shutdown.

The move signalled a new willingness by Republicans to break a standoff of their own making that has thrown America's future creditworthiness into question.

WASHINGTON | Thu Oct 10, 2013 7:27pm BST

(Reuters) - Republicans in the House of Representatives offered a plan on Thursday that would postpone a possible U.S. default and urged President Barack Obama to negotiate an end to the 10-day government shutdown.

The move signalled a new willingness by Republicans to break a standoff of their own making that has thrown America's future creditworthiness into question.

skinny

- 10 Oct 2013 20:23

- 18 of 19

- 10 Oct 2013 20:23

- 18 of 19

Stan

- 10 Oct 2013 20:32

- 19 of 19

- 10 Oct 2013 20:32

- 19 of 19

No shares?.. You called.

- Page:

- 1