| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Bullshare

- 29 May 2015 13:29

- 29 May 2015 13:29

Access to Level 2 information gives investors a deeper view of market mechanics but requires a sophisticated investor to really get the most from it as Shares Magazines’ Seán Flynn discovers.

As truisms go, ‘knowledge is power’ would probably take some beating but in the context of market information, the phrase still resonates. If you want essential data to help you become a better trader, ‘Level 2’ is the service that will give you that power.

Many investors will have heard of Level 2 but most do not know what it means. Read on and you’ll understand why it can give you the edge when trading the markets.

For most retail investors, basic metrics like bid price, offer price, bid/offer spread, percentage share price change on the day, trading high and low and total volume will suffice for their needs. Most investors/traders who get financial data from newspapers, magazines or websites receive what is characterised as Level 1 information which consists simply of each company’s share price depicted as mid/bid/offer only.

This information is of utility to those who are simply looking to compare today’s price and movement against yesterday’s closing price, but it does not show you the market makers’ pricing or the size and quantity of orders waiting to be filled in the market place. It is this additional information that potentially gives the active investor the edge.

Level 1 is satisfactory for people who only want to know the price of stock to buy or sell. It is also adequate for basic charting. Level 2 is a format which refers to the full depth of information available in the markets including market makers’ quotes, the quantity of stock they are quoting and the size quantity of buy/sell limit orders waiting to be filled in the market.

Level 2 is split into three stock categories: SEAQ (Stock Exchange Automated Quotations System), the blue chip SETS (Stock Exchange Electronic Trading Service) and SETSqx.

Expert opinion

From a trader’s point of view at least, trading without Level 2 is like driving blindfolded, or at least that’s the considered opinion of Dominic Connolly author of The UK Trader’s Bible.

When viewing a Level 2 screen for the first time, it would be clear from the level of information being provided that it is aimed at investors with a certain level of sophistication. Yet there are some who would argue that the profile of Level 2 is moving more towards retail investors who are not just short-term traders.

Ian Patrick Lauder, a capital markets business development manager with the London Stock Exchange (LSE), argues that Level 2 access provides investors and traders with a richer, more in-depth picture of how prices are formed in a given security. While this is undoubtedly useful to frequent and day traders, he maintains that even retail investors who don’t trade with such frequency will find that the granular detail on price formation offered by Level 2 access can only enhance their understanding of how the security in question is being traded and how price access is being determined.

While the current profile of a typical L2 subscriber is currently more likely to be that of a day trader or a frequent trader – who would by Lauder’s reckoning – be making an average of 40-50 trades a month, the increasing tendency of private investors towards more sophisticated strategies supports the view that subscriptions to Level 2 access will increase over time.

Luke Dods, a sales trader at Saxo Capital Markets, reckons that Level 2 would be appropriate for anyone that is taking their investments and execution seriously. ‘Level 2 is very valuable for any investor that would like to see beyond your standard bid/offer price. It allows the investor to trade with a peace of mind, as they can see if their order size is appropriate for the current price.

‘A client trading a Level 1 price will only see what volume is valid at the bid/offer price. Level 2 will allow the investor to see the volume at the bid/offers that are pending in the market,’ Dods explains.

‘A frequent occurrence in the market is when an investor executes a “market” order when only seeing the Level 1 price. This often leads to multiple fills and can often move the market and receive a price purchased a lot higher (receiving a worse price than intended). Level 2 helps avoid that situation because you will be able to see what volume is behind the market and at what prices,’ he adds.

How it works

A Level 2 window on your computer screen is divided into two sections – the bid and the offer side. The bid or buy side – located on the left – show the total number of shares that buyers wish to purchase at the corresponding price.

Arranged in descending order, the bid side displays the highest bids on the top with the lower bids following below. The offer or sell side is located on the right and displays the total number of shares that sellers wish to offload at corresponding prices. The sell side is arranged in ascending order with the lowest sells at the top and the higher prices below.

How a Level 2 screen appears will have a lot to do with which one of the LSE’s three main platforms the highlighted stock is traded.

The bigger companies including the FTSE 100 blue chips are traded electronically on the SETS order book. Smaller companies still trade on a quote-driven platform supported by market makers. This system is known as SEAQ (Stock Exchange Automated Quotation).

Many mid-cap stocks trade on a hybrid system known as SETSqx which is basically a SETS order-book driven system supported by firm quotes from market makers, running in parallel with a SEAQ-like off-order-book system. This hybrid system of automated order-book and market maker quotes is intended to provide extra liquidity.

Trading the blue chips

SETS (stock exchange electronic trading system) is the electronic order-driven system for trading the UK blue chip stocks including FTSE 100 and FTSE Eurotop 300 stocks.

The SETS order book matches buy and sell orders on a price/time priority. On SEAQ all buys and sells go through a market maker which acts as an intermediary. The basis of SETS is that it directly matches willing buyers and sellers, creating efficiency in the markets by doing away with the intermediary of the market maker. This efficiency is true while the SETS system is populated by the most liquid and heavily-traded stocks, but if matched bargains operated on less liquid stocks, waiting for a buyer to match with a seller could take hours, days or weeks.

Because of the efficiency of the SETS system, stocks traded tend to have narrow spreads so the cost of entry and exit from a position is much smaller. As an ordinary ‘punter’ should you wish to buy or sell a SETS stock, your broker will invariably still trade through a market maker, who will not display separate prices but simply use the SETS Level 2 screen to indicate where the market lies.

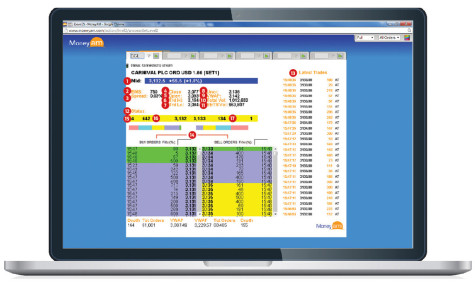

An example of SETS

(Click on image to enlarge)

Cruise operator Carnival (CCL) topped the risers on the FTSE 100 on 15 May, rising 1.8% to £31.33. When Carnival reported its first quarter results on 2 April the £6.6 billion cap swung to a net profit of $49 million in the quarter ended 28 February from a loss of $20 million a year earlier, helped by a 38% drop in the price of fuel. Yields – a closely-watched measure of passenger spending and ticket sales – rose by 2%.

1. Mid price (3132.5) is the simple average price between bid and offer i.e. £31.32 and £31.33. The mid price has risen 55p since it closed the previous trading day which is a 1.8% increase.

2. This is the minimum number of shares that a market maker must make a firm price in. (On SETS stocks, market makers are not visible but will quote the yellow strip price).

3. The percentage shown is the difference between the bid and ask price. The lower the spread, the better. Active traders who buy and sell stock during the day will soon lose money if they trade in stocks with wide spreads.

4. The stock’s mid price at the close on the previous trading day.

5. The stock’s mid price opened this morning.

6. The highest price traded so far today.

7. The lowest price traded so far today.

8. The uncrossing price of the last auction (the mean price at which the bids and offers can be matched) is then taken as the closing price for the stock.

9. Volume Weighed Average Price: This is a running mean average benchmark used by institutions. Calculated by adding up the pence traded for every transaction (price times shares traded) and then divided by the total shares traded for the day. The theory is that if you buy at a price lower than the VWAP it is a good trade. An example would be of a stock that had only traded twice in a day, say 10,000 shares at 200p and 10,000 at 215p, the VWAP would be 207.5p.

10. This is the accumulated total of all trades that have occurred so far that day.

11. This is the volume of trades executed through the electronic SETS system. The other shares have been traded via a market maker.

12. This refers to the current position in this stock, at the moment it is saying the market for this stock is open and is trading continuously.

13. The details of the last 20+ trades that have occurred today, showing time of trade, price of trade, quantity traded and trade code: AT = SETS electronic matched bargain; O = no conditions attached via a market maker; L =Late declared trade.

14. There are a considerable number of order types in the markets but for the purposes of explaining SETS we will focus on the two main types.

Market Orders: This is an order to buy or sell a stock at the current market price – immediately. Unless you specify otherwise, your broker will enter your order as a market order. The advantage of a market order is you are almost always guaranteed your order will be executed (as long as there are willing buyers and sellers). In the case of a market order your broker will simply deal through a market maker or deal through the SETS system with the top quotes on either the buy or

sell side.

Limit Orders: To avoid buying stock at a price higher or selling a stock lower than you want, you need to place a limit order rather than a market order. A limit order is an order to buy or sell a security at a specific price. When you place a market order, you cannot control the price at which your order will be filled. The basis behind the SETS buy and sell quotes is that they are all limit orders placed in the system by individuals, companies or institutions.

15. The total number of limit orders on the buy side, at the best price of £31.32 in this case is 4. On the sell side at the price of £31.33 the depth is just 1.

16. On the left hand (buy) side of the touch price strip, the volume limit orders at the current best price of £31.32p now showing is 642. On the sell side there are 134 shares waiting to be sold at the best price of £31.33.

17. In this case £31.32p on the buy side which is the highest price someone is prepared to pay. On the sell side this is £31.33 which is the lowest price someone is prepared to sell at.

Granting access

Level 2 SEAQ provides real-time access to the quotations of individual market makers registered in every London Stock Exchange SEAQ stock as well as the offering or bidding sizes that they will trade up to. This level of access gives the name of the market makers looking to trade the stock, and allows traders to see which ones are showing the most interest in a stock and identify the patterns for each one.

Market makers provide continuous bid and offer prices for each of the stocks they have on their ‘books’. There can be as few as one or as many as 20 (or more) for a particular stock depending on the average daily volume; the more actively traded a stock is, the more attractive it is for them to deal in. They must maintain this continuous two-sided quote (bid and offer) at normal market size or greater at all times. This ensures that there is a buyer for the sell order and a seller for the buy order at any time.

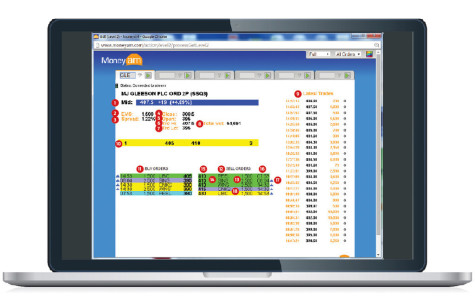

An example of SEAQ

(Click on image to enlarge)

Midlands-focused housebuilder MJ Gleeson (GLE) advanced 3.4% to 401.5p on the back of a 15 May trading update that underlying profit for the year could exceed expectations. In its Gleeson Homes business, the group is forecasting 730 completions in the year to end-June, which represents growth of 30% on the prior year. Davy Research reckons ‘the statement adds to the weight of evidence that points to ongoing positive trading conditions in the UK housing market.’

1. This is the simple average price between bid and offer; similar to SETS screen.

2. Like the SETS screen, this is the minimum number of shares that a market maker must make a firm price in. Investors can buy or sell fewer than this number, in which case they will definitely deal at the price quoted. Anyone wishing to deal in more than the EMS (Exchange Market Size) may have to accept less than the market price if they are selling, and pay more than the market price if they are buyer.

3. The percentage shown is the difference between the bid and ask price.

4. The stock’s mid price at the close on the previous trading day.

5. This stock’s mid price.

6. The highest price traded so far today.

7. The lowest price traded so far today.

8. This is the accumulated total of all the shares traded in the stock so far that day.

9. These are the details of the last 20+ trades that have occurred today, showing time of trade, price of trade, quantity traded and trade code: O =normal trade with no conditions attached; L =Late declared trade.

10. This displays the best buy and sell order prices quoted by the market makers. The single figures on either end of the yellow strip indicate how many market makers are making that best price.

11. The price at which each market maker is prepared to buy the stock.

12. The price at which each market maker is prepared to sell.

13. This is the price currently quoted by each individual market maker. Although the display might say a certain price behind the scenes there are systems in place to negotiate a better price both manually (over the phone) or automatically (price improver schemes – RSP gateways).

14. This is a short-form code for each market maker. LIBC: Liberum, SING: N+1Singer, PEEL: Peel Hunt, WINS: Winterfloods.

15. The size that each market maker is prepared to deal in at the prices quoted. Notice that in most cases they are prepared to deal at the prices quoted at 100,000 shares rather than the normal market size (NMS) of 50,000. Although each market maker is quoting their own price, the LSE rules state that all market makers are duty bound to deal at the yellow strip prices at NMS (in this case 50,000 shares) even though they are not the market maker with the best quote.

16. The last time each individual market maker changed their price in either an upward or downward direction.

17. This is the direction the market makers last moved their price.

18. Provides a graphical indication of the depth of the market and bands the prices market makers are offering.

An example of SETSqx

(Click on image to enlarge)

SETSqx is a hybrid of both the SETS and SEAQ system. It was introduced in 2003 to try and improve the liquidity of the FTSE 250 stocks which previously were dealt on the SEAQ market. In essence the system works as for SETS but the market makers themselves are visible in the screen.

The screen shot gives an example of a SETSqx system on Level 2 featuring international windows and doors specialist Tyman (TYMN). The small cap posted its AGM trading statement on 15 May and said trading in the first four months of 2015 had been in line with the board’s expectations but also noted that this period typically sees lower seasonal levels of activity in the group’s principal Northern Hemisphere end-markets.

Big bang to Level 2

Since the 1986 Big Bang, which was characterised by the deregulation of the LSE, there was no longer a need for separate market making and broker firms. Many banks now have both in-house market makers and sales traders or brokers.

While market makers no longer officially exist in SETS stocks, most banks will be happy to make a two-way risk price in the most liquid blue-chip stocks and the spreads available on these securities will be much narrower than those available on smaller caps as a consequence of their traded with increased liquidity and lower volatility.

Pre-1997, the market was based around a screen-based quote-driven structure of competing market makers quoting risk prices to brokers acting on behalf of clients. A broker would contact a market maker for a two-way price in the stock and seek their client the best price by getting the lowest buying (offer) price and the highest price to sell (bid) and the remnants of this system stay with us but only for the small cap companies quoted on the LSE’s SEAQ platform. Market makers earned their profit from the spread (difference between buying selling price) with the broker earning client commission.

The rise of execution-only internet brokers from the 1990s onwards lead to a proliferation of retail service providers (RSP). This electronic network connecting brokers and market-makers facilitates the execution of smaller retail orders in both SEAQ and SETS stocks and greatly simplifying the process by dispensing with the need for phone calls.

When using execution-only brokers, a request for a quote to buy or sell shares leads to the broker’s RSP network automatically polling the market makers and they will reflect the best bid and offer available at that time. Normally, the client will than have 15-20 seconds to accept the quoted price. Typically there will be a small improvement on the prevailing market touch price.

The utility of Level 2 information is readily apparent in that it allows the investor to see the full order book on a given security with the yellow strip providing the collated headline data from all the orders listed below which give a clear picture of the market depth in that security. It can provide a multi-layered insight into a stock’s price action. It can tell you what type of traders are buying or selling a stock, where the stock is likely to head in the near term, and more besides.

Direct Market Access

Retail investors, for the most part, use execution-only retail service providers but through brokers, direct market access can also be employed. DMA allows investors to take greater control of their trades by using a broker to place orders directly on the central market along with all the other market participants.

Since the rise of fully electronic trading in the 1990s, a new type of market developed – the order-driven market. Under this system, the exchange has an electronic order book to which participants submit the price they want to pay and the amount they are prepared to buy and sell. Those orders remain on the book until they are accepted or cancelled.

A number of brokers offer direct access and they will vet clients before offering this service. One of the most important differences between trading with a retail service provider and using DMA is that with an RSP, a trader is given a price and they have 15 or 30 seconds to accept this price. In the case of trading via DMA, once an order goes into the system it becomes immediately executable. Direct market access may afford a trader a slightly better price than is available through a market maker and enable them to manage their orders slightly better.

Market experience

There are certainly advantages to DMA and these advantages are clearly leveraged by the use of Level 2 information but only experience and market education can let a trader recognise what is actually happening in the market.

Being able to recognise the existence of various strategies like Iceberg trades which, using an algorithm, buy or sell specific tranche sizes of an equity over the course of a day or a portion of a trading day, are often used by larger institutions and this can be identified using Level 2 information.

Some other strategies such as ‘spoofing’, ie. the placing of orders a little above market price and placing a smaller buy order a little below the market, are at the heart of the recent flash crash trader Navinder Singh Sarao’s arrest.

The day trader is fighting extradition to the US on 22 counts of fraud and commodity manipulation but there are some in the market who question the reasoning behind his arrest given that – on one interpretation – he is only technically guilty of outmanoeuvring the front-running algorithms used by the bigger institutions that in themselves could already be seen as gaming the market.

Dods at Saxo points out: ‘There has been a constant debate over algorithmic trading in the market place, but you need to accept that this is now a big part of the market, hence why I think anyone that wants to take their trading seriously should have access to as much information as possible. It is also worth noting that execution strategies such as ‘Icebergs’ and ‘VWAPs’ are not just available for the big banks and hedge funds; with Saxo every account whether big or small can execute using these strategies.’

Avoiding the race to bottom

Seeking to close the gap between retail and institutional trading capabilities is IG’s (IGG) stockbroking platform.

Retail service providers – traditional stockbroking platforms to you and I – have engaged in a race to the bottom to deliver trading costs as cheaply as possible, according to Gary Tibbs, IG’s share dealing director that means service and functionality has gone out of the window in a quest to deliver the cheapest product.

Cheapest is not always best, according to Yibbs – particularly if it means clients pay a low headline trading cost yet receive a worse price on the security they are buying or selling.

Retail investors have enough on their plate just deciding what stocks to invest in, without going into the complexities of ‘lit’ and ‘dark’ exchanges.

Yet IGreckons some investors are specialised enough to be interested and – whether or not investors understand the complexities – better pricing achieved via its smart-routing process can only be a good thing.

Not only is there an opportunity to get better spreads on IG’s platform through its link-up to a variety of venues, it is also able to offer some neat functionality other brokers can’t.

First, it offers an expanded range of transaction types not available from its rivals. A good example is a basic algorithmic trade which enables investors to place a buy order which pegs itself slightly above the best available order in the market. known as a ‘pegged-to-primary’ bid, it means investors should get a better deal than a simple order which takes the best offer price.

Importantly, while a pegged-to- primary ‘buy’ order can move up if the market moves, it’s unable to move down, so an investor can be left hanging if the market moves aggressively against the stock.

Second, it offers ‘direct market access’ (DMA) which, as covered elsewhere in the article, enables investors to see and place their order in the LSE order book.

Conversations with other market participants say this is not actually possible because the LSE only deals with market makers and these are the only entities with authority to place orders. even if IG’s traders are not directly entering trades into the order book, it’s a neat feature to have.

Third, as well as gaining a direct view of the LSE order book, IG’s platform through its level 2 Dealer option can aggregate pricing across other venues including dark pools to provide the best available deal on a security. We’ve not seen anything like that offered by other retail stockbrokers.

‘Previously, multilateral trading facilities’ lit and dark liquidity was only available to large institutional investors,’ says Tibbs. ‘We enable all contracts-for-difference (CFD) traders and stockbroking clients to access these new venues through our direct market access trading solutions.’

There’s a catch

IG’s in-depth facilities come at a price and investors making small and infrequent trades do not benefit as much from tighter spreads as more active traders with much larger deal sizes.

UK transaction costs are between £6 and £12 on IG, while US and European fees are slightly more complicated, featuring a percentage of deal-size commission plus a foreign exchange translation.

Direct transaction costs and administration fees tend to form a higher proportion of expenses in a smaller portfolio. those with more assets who tend to trade frequently could well find IG’s service cheaper than rivals with lower headline costs.

Finally, IG recently rolled out international trading which includes the ability to trade stocks in the out-of-hours exchange in new York. listed companies in the US often report results after the close of trading, allowing investors in the overnight market to trade ahead of the official opening of the stock exchange the next morning.

Tibbs says IG’s service is differentiated because it offers direct ownership of the international securities traded rather than through American Depositary instruments, which tend to be the favoured option of most retail stockbrokers. All of these features enable IG to provide what is known as ‘best execution’ to its clients.

Regulator agenda

The topic is being pushed heavily by regulator the Financial conduct Authority (FCA) which says a number of brokers are using ‘carve outs’ to exempt themselves from actively seeking the best or most appropriate execution for clients.

Execution has become more complex since 2007 when the Markets in Financial instruments Directive (MiFiD) paved the way for more competition among trading venues. Since then, a number of alternative trading venues have sprung up to compete with the London Stock exchange, including ‘lit’ exchanges like BATS chi-X and ISDX, which was acquired by interdealer broker ICAP (ICAP) and ‘dark’ or off- exchange options.

Competition in the market should mean lower transaction costs and better pricing. others argue that costs associated with hooking up to and searching multiple venues for pricing is expensive and damaging to liquidity in London’s Main Market.

A government report into the impact of MiFiD published last year indicates spreads narrowed after implementation, though the outcome was more mixed on liquidity, favouring large cap stocks over mid caps, for example.

All stockbrokers present a ‘best execution policy’, which will usually be attached to account opening documents and can also be found on their websites.

Try MoneyAM’s level 2 for FREE

Got to https://www.moneyam.com/promo/ and enter promo code L2trial

As truisms go, ‘knowledge is power’ would probably take some beating but in the context of market information, the phrase still resonates. If you want essential data to help you become a better trader, ‘Level 2’ is the service that will give you that power.

Many investors will have heard of Level 2 but most do not know what it means. Read on and you’ll understand why it can give you the edge when trading the markets.

For most retail investors, basic metrics like bid price, offer price, bid/offer spread, percentage share price change on the day, trading high and low and total volume will suffice for their needs. Most investors/traders who get financial data from newspapers, magazines or websites receive what is characterised as Level 1 information which consists simply of each company’s share price depicted as mid/bid/offer only.

This information is of utility to those who are simply looking to compare today’s price and movement against yesterday’s closing price, but it does not show you the market makers’ pricing or the size and quantity of orders waiting to be filled in the market place. It is this additional information that potentially gives the active investor the edge.

Level 1 is satisfactory for people who only want to know the price of stock to buy or sell. It is also adequate for basic charting. Level 2 is a format which refers to the full depth of information available in the markets including market makers’ quotes, the quantity of stock they are quoting and the size quantity of buy/sell limit orders waiting to be filled in the market.

Level 2 is split into three stock categories: SEAQ (Stock Exchange Automated Quotations System), the blue chip SETS (Stock Exchange Electronic Trading Service) and SETSqx.

Expert opinion

From a trader’s point of view at least, trading without Level 2 is like driving blindfolded, or at least that’s the considered opinion of Dominic Connolly author of The UK Trader’s Bible.

When viewing a Level 2 screen for the first time, it would be clear from the level of information being provided that it is aimed at investors with a certain level of sophistication. Yet there are some who would argue that the profile of Level 2 is moving more towards retail investors who are not just short-term traders.

Ian Patrick Lauder, a capital markets business development manager with the London Stock Exchange (LSE), argues that Level 2 access provides investors and traders with a richer, more in-depth picture of how prices are formed in a given security. While this is undoubtedly useful to frequent and day traders, he maintains that even retail investors who don’t trade with such frequency will find that the granular detail on price formation offered by Level 2 access can only enhance their understanding of how the security in question is being traded and how price access is being determined.

While the current profile of a typical L2 subscriber is currently more likely to be that of a day trader or a frequent trader – who would by Lauder’s reckoning – be making an average of 40-50 trades a month, the increasing tendency of private investors towards more sophisticated strategies supports the view that subscriptions to Level 2 access will increase over time.

Luke Dods, a sales trader at Saxo Capital Markets, reckons that Level 2 would be appropriate for anyone that is taking their investments and execution seriously. ‘Level 2 is very valuable for any investor that would like to see beyond your standard bid/offer price. It allows the investor to trade with a peace of mind, as they can see if their order size is appropriate for the current price.

‘A client trading a Level 1 price will only see what volume is valid at the bid/offer price. Level 2 will allow the investor to see the volume at the bid/offers that are pending in the market,’ Dods explains.

‘A frequent occurrence in the market is when an investor executes a “market” order when only seeing the Level 1 price. This often leads to multiple fills and can often move the market and receive a price purchased a lot higher (receiving a worse price than intended). Level 2 helps avoid that situation because you will be able to see what volume is behind the market and at what prices,’ he adds.

How it works

A Level 2 window on your computer screen is divided into two sections – the bid and the offer side. The bid or buy side – located on the left – show the total number of shares that buyers wish to purchase at the corresponding price.

Arranged in descending order, the bid side displays the highest bids on the top with the lower bids following below. The offer or sell side is located on the right and displays the total number of shares that sellers wish to offload at corresponding prices. The sell side is arranged in ascending order with the lowest sells at the top and the higher prices below.

How a Level 2 screen appears will have a lot to do with which one of the LSE’s three main platforms the highlighted stock is traded.

The bigger companies including the FTSE 100 blue chips are traded electronically on the SETS order book. Smaller companies still trade on a quote-driven platform supported by market makers. This system is known as SEAQ (Stock Exchange Automated Quotation).

Many mid-cap stocks trade on a hybrid system known as SETSqx which is basically a SETS order-book driven system supported by firm quotes from market makers, running in parallel with a SEAQ-like off-order-book system. This hybrid system of automated order-book and market maker quotes is intended to provide extra liquidity.

Trading the blue chips

SETS (stock exchange electronic trading system) is the electronic order-driven system for trading the UK blue chip stocks including FTSE 100 and FTSE Eurotop 300 stocks.

The SETS order book matches buy and sell orders on a price/time priority. On SEAQ all buys and sells go through a market maker which acts as an intermediary. The basis of SETS is that it directly matches willing buyers and sellers, creating efficiency in the markets by doing away with the intermediary of the market maker. This efficiency is true while the SETS system is populated by the most liquid and heavily-traded stocks, but if matched bargains operated on less liquid stocks, waiting for a buyer to match with a seller could take hours, days or weeks.

Because of the efficiency of the SETS system, stocks traded tend to have narrow spreads so the cost of entry and exit from a position is much smaller. As an ordinary ‘punter’ should you wish to buy or sell a SETS stock, your broker will invariably still trade through a market maker, who will not display separate prices but simply use the SETS Level 2 screen to indicate where the market lies.

An example of SETS

(Click on image to enlarge)

Cruise operator Carnival (CCL) topped the risers on the FTSE 100 on 15 May, rising 1.8% to £31.33. When Carnival reported its first quarter results on 2 April the £6.6 billion cap swung to a net profit of $49 million in the quarter ended 28 February from a loss of $20 million a year earlier, helped by a 38% drop in the price of fuel. Yields – a closely-watched measure of passenger spending and ticket sales – rose by 2%.

1. Mid price (3132.5) is the simple average price between bid and offer i.e. £31.32 and £31.33. The mid price has risen 55p since it closed the previous trading day which is a 1.8% increase.

2. This is the minimum number of shares that a market maker must make a firm price in. (On SETS stocks, market makers are not visible but will quote the yellow strip price).

3. The percentage shown is the difference between the bid and ask price. The lower the spread, the better. Active traders who buy and sell stock during the day will soon lose money if they trade in stocks with wide spreads.

4. The stock’s mid price at the close on the previous trading day.

5. The stock’s mid price opened this morning.

6. The highest price traded so far today.

7. The lowest price traded so far today.

8. The uncrossing price of the last auction (the mean price at which the bids and offers can be matched) is then taken as the closing price for the stock.

9. Volume Weighed Average Price: This is a running mean average benchmark used by institutions. Calculated by adding up the pence traded for every transaction (price times shares traded) and then divided by the total shares traded for the day. The theory is that if you buy at a price lower than the VWAP it is a good trade. An example would be of a stock that had only traded twice in a day, say 10,000 shares at 200p and 10,000 at 215p, the VWAP would be 207.5p.

10. This is the accumulated total of all trades that have occurred so far that day.

11. This is the volume of trades executed through the electronic SETS system. The other shares have been traded via a market maker.

12. This refers to the current position in this stock, at the moment it is saying the market for this stock is open and is trading continuously.

13. The details of the last 20+ trades that have occurred today, showing time of trade, price of trade, quantity traded and trade code: AT = SETS electronic matched bargain; O = no conditions attached via a market maker; L =Late declared trade.

14. There are a considerable number of order types in the markets but for the purposes of explaining SETS we will focus on the two main types.

Market Orders: This is an order to buy or sell a stock at the current market price – immediately. Unless you specify otherwise, your broker will enter your order as a market order. The advantage of a market order is you are almost always guaranteed your order will be executed (as long as there are willing buyers and sellers). In the case of a market order your broker will simply deal through a market maker or deal through the SETS system with the top quotes on either the buy or

sell side.

Limit Orders: To avoid buying stock at a price higher or selling a stock lower than you want, you need to place a limit order rather than a market order. A limit order is an order to buy or sell a security at a specific price. When you place a market order, you cannot control the price at which your order will be filled. The basis behind the SETS buy and sell quotes is that they are all limit orders placed in the system by individuals, companies or institutions.

15. The total number of limit orders on the buy side, at the best price of £31.32 in this case is 4. On the sell side at the price of £31.33 the depth is just 1.

16. On the left hand (buy) side of the touch price strip, the volume limit orders at the current best price of £31.32p now showing is 642. On the sell side there are 134 shares waiting to be sold at the best price of £31.33.

17. In this case £31.32p on the buy side which is the highest price someone is prepared to pay. On the sell side this is £31.33 which is the lowest price someone is prepared to sell at.

Granting access

Level 2 SEAQ provides real-time access to the quotations of individual market makers registered in every London Stock Exchange SEAQ stock as well as the offering or bidding sizes that they will trade up to. This level of access gives the name of the market makers looking to trade the stock, and allows traders to see which ones are showing the most interest in a stock and identify the patterns for each one.

Market makers provide continuous bid and offer prices for each of the stocks they have on their ‘books’. There can be as few as one or as many as 20 (or more) for a particular stock depending on the average daily volume; the more actively traded a stock is, the more attractive it is for them to deal in. They must maintain this continuous two-sided quote (bid and offer) at normal market size or greater at all times. This ensures that there is a buyer for the sell order and a seller for the buy order at any time.

An example of SEAQ

(Click on image to enlarge)

Midlands-focused housebuilder MJ Gleeson (GLE) advanced 3.4% to 401.5p on the back of a 15 May trading update that underlying profit for the year could exceed expectations. In its Gleeson Homes business, the group is forecasting 730 completions in the year to end-June, which represents growth of 30% on the prior year. Davy Research reckons ‘the statement adds to the weight of evidence that points to ongoing positive trading conditions in the UK housing market.’

1. This is the simple average price between bid and offer; similar to SETS screen.

2. Like the SETS screen, this is the minimum number of shares that a market maker must make a firm price in. Investors can buy or sell fewer than this number, in which case they will definitely deal at the price quoted. Anyone wishing to deal in more than the EMS (Exchange Market Size) may have to accept less than the market price if they are selling, and pay more than the market price if they are buyer.

3. The percentage shown is the difference between the bid and ask price.

4. The stock’s mid price at the close on the previous trading day.

5. This stock’s mid price.

6. The highest price traded so far today.

7. The lowest price traded so far today.

8. This is the accumulated total of all the shares traded in the stock so far that day.

9. These are the details of the last 20+ trades that have occurred today, showing time of trade, price of trade, quantity traded and trade code: O =normal trade with no conditions attached; L =Late declared trade.

10. This displays the best buy and sell order prices quoted by the market makers. The single figures on either end of the yellow strip indicate how many market makers are making that best price.

11. The price at which each market maker is prepared to buy the stock.

12. The price at which each market maker is prepared to sell.

13. This is the price currently quoted by each individual market maker. Although the display might say a certain price behind the scenes there are systems in place to negotiate a better price both manually (over the phone) or automatically (price improver schemes – RSP gateways).

14. This is a short-form code for each market maker. LIBC: Liberum, SING: N+1Singer, PEEL: Peel Hunt, WINS: Winterfloods.

15. The size that each market maker is prepared to deal in at the prices quoted. Notice that in most cases they are prepared to deal at the prices quoted at 100,000 shares rather than the normal market size (NMS) of 50,000. Although each market maker is quoting their own price, the LSE rules state that all market makers are duty bound to deal at the yellow strip prices at NMS (in this case 50,000 shares) even though they are not the market maker with the best quote.

16. The last time each individual market maker changed their price in either an upward or downward direction.

17. This is the direction the market makers last moved their price.

18. Provides a graphical indication of the depth of the market and bands the prices market makers are offering.

An example of SETSqx

(Click on image to enlarge)

SETSqx is a hybrid of both the SETS and SEAQ system. It was introduced in 2003 to try and improve the liquidity of the FTSE 250 stocks which previously were dealt on the SEAQ market. In essence the system works as for SETS but the market makers themselves are visible in the screen.

The screen shot gives an example of a SETSqx system on Level 2 featuring international windows and doors specialist Tyman (TYMN). The small cap posted its AGM trading statement on 15 May and said trading in the first four months of 2015 had been in line with the board’s expectations but also noted that this period typically sees lower seasonal levels of activity in the group’s principal Northern Hemisphere end-markets.

Big bang to Level 2

Since the 1986 Big Bang, which was characterised by the deregulation of the LSE, there was no longer a need for separate market making and broker firms. Many banks now have both in-house market makers and sales traders or brokers.

While market makers no longer officially exist in SETS stocks, most banks will be happy to make a two-way risk price in the most liquid blue-chip stocks and the spreads available on these securities will be much narrower than those available on smaller caps as a consequence of their traded with increased liquidity and lower volatility.

Pre-1997, the market was based around a screen-based quote-driven structure of competing market makers quoting risk prices to brokers acting on behalf of clients. A broker would contact a market maker for a two-way price in the stock and seek their client the best price by getting the lowest buying (offer) price and the highest price to sell (bid) and the remnants of this system stay with us but only for the small cap companies quoted on the LSE’s SEAQ platform. Market makers earned their profit from the spread (difference between buying selling price) with the broker earning client commission.

The rise of execution-only internet brokers from the 1990s onwards lead to a proliferation of retail service providers (RSP). This electronic network connecting brokers and market-makers facilitates the execution of smaller retail orders in both SEAQ and SETS stocks and greatly simplifying the process by dispensing with the need for phone calls.

When using execution-only brokers, a request for a quote to buy or sell shares leads to the broker’s RSP network automatically polling the market makers and they will reflect the best bid and offer available at that time. Normally, the client will than have 15-20 seconds to accept the quoted price. Typically there will be a small improvement on the prevailing market touch price.

The utility of Level 2 information is readily apparent in that it allows the investor to see the full order book on a given security with the yellow strip providing the collated headline data from all the orders listed below which give a clear picture of the market depth in that security. It can provide a multi-layered insight into a stock’s price action. It can tell you what type of traders are buying or selling a stock, where the stock is likely to head in the near term, and more besides.

Direct Market Access

Retail investors, for the most part, use execution-only retail service providers but through brokers, direct market access can also be employed. DMA allows investors to take greater control of their trades by using a broker to place orders directly on the central market along with all the other market participants.

Since the rise of fully electronic trading in the 1990s, a new type of market developed – the order-driven market. Under this system, the exchange has an electronic order book to which participants submit the price they want to pay and the amount they are prepared to buy and sell. Those orders remain on the book until they are accepted or cancelled.

A number of brokers offer direct access and they will vet clients before offering this service. One of the most important differences between trading with a retail service provider and using DMA is that with an RSP, a trader is given a price and they have 15 or 30 seconds to accept this price. In the case of trading via DMA, once an order goes into the system it becomes immediately executable. Direct market access may afford a trader a slightly better price than is available through a market maker and enable them to manage their orders slightly better.

Market experience

There are certainly advantages to DMA and these advantages are clearly leveraged by the use of Level 2 information but only experience and market education can let a trader recognise what is actually happening in the market.

Being able to recognise the existence of various strategies like Iceberg trades which, using an algorithm, buy or sell specific tranche sizes of an equity over the course of a day or a portion of a trading day, are often used by larger institutions and this can be identified using Level 2 information.

Some other strategies such as ‘spoofing’, ie. the placing of orders a little above market price and placing a smaller buy order a little below the market, are at the heart of the recent flash crash trader Navinder Singh Sarao’s arrest.

The day trader is fighting extradition to the US on 22 counts of fraud and commodity manipulation but there are some in the market who question the reasoning behind his arrest given that – on one interpretation – he is only technically guilty of outmanoeuvring the front-running algorithms used by the bigger institutions that in themselves could already be seen as gaming the market.

Dods at Saxo points out: ‘There has been a constant debate over algorithmic trading in the market place, but you need to accept that this is now a big part of the market, hence why I think anyone that wants to take their trading seriously should have access to as much information as possible. It is also worth noting that execution strategies such as ‘Icebergs’ and ‘VWAPs’ are not just available for the big banks and hedge funds; with Saxo every account whether big or small can execute using these strategies.’

Avoiding the race to bottom

Seeking to close the gap between retail and institutional trading capabilities is IG’s (IGG) stockbroking platform.

Retail service providers – traditional stockbroking platforms to you and I – have engaged in a race to the bottom to deliver trading costs as cheaply as possible, according to Gary Tibbs, IG’s share dealing director that means service and functionality has gone out of the window in a quest to deliver the cheapest product.

Cheapest is not always best, according to Yibbs – particularly if it means clients pay a low headline trading cost yet receive a worse price on the security they are buying or selling.

Retail investors have enough on their plate just deciding what stocks to invest in, without going into the complexities of ‘lit’ and ‘dark’ exchanges.

Yet IGreckons some investors are specialised enough to be interested and – whether or not investors understand the complexities – better pricing achieved via its smart-routing process can only be a good thing.

Not only is there an opportunity to get better spreads on IG’s platform through its link-up to a variety of venues, it is also able to offer some neat functionality other brokers can’t.

First, it offers an expanded range of transaction types not available from its rivals. A good example is a basic algorithmic trade which enables investors to place a buy order which pegs itself slightly above the best available order in the market. known as a ‘pegged-to-primary’ bid, it means investors should get a better deal than a simple order which takes the best offer price.

Importantly, while a pegged-to- primary ‘buy’ order can move up if the market moves, it’s unable to move down, so an investor can be left hanging if the market moves aggressively against the stock.

Second, it offers ‘direct market access’ (DMA) which, as covered elsewhere in the article, enables investors to see and place their order in the LSE order book.

Conversations with other market participants say this is not actually possible because the LSE only deals with market makers and these are the only entities with authority to place orders. even if IG’s traders are not directly entering trades into the order book, it’s a neat feature to have.

Third, as well as gaining a direct view of the LSE order book, IG’s platform through its level 2 Dealer option can aggregate pricing across other venues including dark pools to provide the best available deal on a security. We’ve not seen anything like that offered by other retail stockbrokers.

‘Previously, multilateral trading facilities’ lit and dark liquidity was only available to large institutional investors,’ says Tibbs. ‘We enable all contracts-for-difference (CFD) traders and stockbroking clients to access these new venues through our direct market access trading solutions.’

There’s a catch

IG’s in-depth facilities come at a price and investors making small and infrequent trades do not benefit as much from tighter spreads as more active traders with much larger deal sizes.

UK transaction costs are between £6 and £12 on IG, while US and European fees are slightly more complicated, featuring a percentage of deal-size commission plus a foreign exchange translation.

Direct transaction costs and administration fees tend to form a higher proportion of expenses in a smaller portfolio. those with more assets who tend to trade frequently could well find IG’s service cheaper than rivals with lower headline costs.

Finally, IG recently rolled out international trading which includes the ability to trade stocks in the out-of-hours exchange in new York. listed companies in the US often report results after the close of trading, allowing investors in the overnight market to trade ahead of the official opening of the stock exchange the next morning.

Tibbs says IG’s service is differentiated because it offers direct ownership of the international securities traded rather than through American Depositary instruments, which tend to be the favoured option of most retail stockbrokers. All of these features enable IG to provide what is known as ‘best execution’ to its clients.

Regulator agenda

The topic is being pushed heavily by regulator the Financial conduct Authority (FCA) which says a number of brokers are using ‘carve outs’ to exempt themselves from actively seeking the best or most appropriate execution for clients.

Execution has become more complex since 2007 when the Markets in Financial instruments Directive (MiFiD) paved the way for more competition among trading venues. Since then, a number of alternative trading venues have sprung up to compete with the London Stock exchange, including ‘lit’ exchanges like BATS chi-X and ISDX, which was acquired by interdealer broker ICAP (ICAP) and ‘dark’ or off- exchange options.

Competition in the market should mean lower transaction costs and better pricing. others argue that costs associated with hooking up to and searching multiple venues for pricing is expensive and damaging to liquidity in London’s Main Market.

A government report into the impact of MiFiD published last year indicates spreads narrowed after implementation, though the outcome was more mixed on liquidity, favouring large cap stocks over mid caps, for example.

All stockbrokers present a ‘best execution policy’, which will usually be attached to account opening documents and can also be found on their websites.

Try MoneyAM’s level 2 for FREE

Got to https://www.moneyam.com/promo/ and enter promo code L2trial

- Page:

- 1