| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Traders Thread - Monday 6th March (TRAD)

Greystone

- 05 Mar 2006 12:31

- 2 of 15

- 05 Mar 2006 12:31

- 2 of 15

Greystone

- 05 Mar 2006 12:31

- 3 of 15

- 05 Mar 2006 12:31

- 3 of 15

Greystone

- 05 Mar 2006 12:31

- 4 of 15

- 05 Mar 2006 12:31

- 4 of 15

Greystone

- 05 Mar 2006 12:32

- 5 of 15

- 05 Mar 2006 12:32

- 5 of 15

| A Brief Look At The Week Ahead | |

| Investors will be looking to the Bank of England for some clarity on monetary policy this week. Few think the repo rate will change from its current 4.5% at the Bank's rate-setting meeting on Thursday. HSBC rounds off the bank reporting season with Mondays full-year's numbers. Market consensus is for around 9% pre-tax profit growth to $20.6bn. With its announcement coming at the end of a generally strong set of results, the banker has a hard act to follow. Investors nominate two key areas of particular interest: the growth of impaired loans in its UK and US personal lending business; and any signs of sustainable growth in the revamped corporate, investment banking and markets division. This week's round of results from the building sector is unlikely to be impressive. Redrow is forecast to produce a fall in interim profit to around 55m on Tuesday. Margins are likely to be under pressure due to a decline in average unit prices and the rising cost of land. Carillion's full-year results announcement on Wednesday will likely be overshadowed by an update on the Mowlem purchase. As one analyst says: "While the valuation is pretty compelling, we want to know about the integration and what drove the deal." Analysts are forecasting a full-year pre-tax profit of 57m. The losing bidder for Mowlem, Balfour Beatty, is likely to post FY pre-tax profit of around 135m the same day. Analysts are keen to hear a commentary on Mansell, the social housing division, and an update on the burgeoning market for public-private partnerships, where Balfour Beatty has a strong presence. However, margins remain under pressure. Insurer Royal & SunAlliance publishes full-year results on Thursday. Analysts are predicting an operating pre-tax profit of 660m, against 258m last year. However, while the percentage change is large, much of the increase comes from management action taken in the past two years to make cost savings and pull out of the US. Other companies of interest taking the stage this week include Inchcape on Monday; Aegis and Provalis on Tuesday; ITV and Axis-Shield on Wednesday; Cobham and National Express on Thursday and Greggs on Friday. Another busy week with the building sector under particular scrutiny. It is blowing a hurricane where I am and I know it is not too hot where you are. Let's hope that is not an ill portent for the week ahead. Good hunting! Greystone (Greystone is Alan English, City Editor at MoneyAM.) | |

Greystone

- 06 Mar 2006 06:45

- 7 of 15

- 06 Mar 2006 06:45

- 7 of 15

Good morning traders!

In Asia today, the Nikkei closed up 237.82 points at 15,901.16, while the Hang Seng hit the midpoint up 10.79 points at 15,812.79.

New York's main oil contract, light sweet crude for delivery in April, was down 41 cents at $63.26 from its close of $63.67 in the US Friday.

Happy Monday!

G.

In Asia today, the Nikkei closed up 237.82 points at 15,901.16, while the Hang Seng hit the midpoint up 10.79 points at 15,812.79.

New York's main oil contract, light sweet crude for delivery in April, was down 41 cents at $63.26 from its close of $63.67 in the US Friday.

Happy Monday!

G.

Mega Bucks

- 06 Mar 2006 07:12

- 8 of 15

- 06 Mar 2006 07:12

- 8 of 15

a very good morning to you all !!!!

Master RSI

- 06 Mar 2006 08:29

- 9 of 15

- 06 Mar 2006 08:29

- 9 of 15

This is my selection for the "UPS" this week ZRL

;MA(20);MA(200);AreaBB(26,2);ZIGLABEL(6)&Layout=2Line;Default;Price;HisDate&XCycle=&XFormat=)

| Share | Volume | Chart | News | Various |

| ZRL price 14.25p | Heavy volume every day last week with about 4 times the usual | Broke the downtrend last week as it went 4 month side ways from 10.25 to 12.25p an uptrend on its way now | Last week announced High Grade Uranium 6.4% mineral find at Oryx prospect from initial sample. Uranium is highly price at the moment as stockpiles are decreasing, demand from China has help uranium to record prices recently but it could well double or triple in the next few years if demand for nuclear power is strong in the future as analyst are predicting | Has 10 projects ( gold and copper ) within Zambia the Chumbwe gold project is the most advanced now drilling development in 07 and production in 08. Has a 49% stake on ZNI worth 2.1M, cash of 4.5M and only a market cap of 13.6M |

Stan

- 06 Mar 2006 11:34

- 10 of 15

- 06 Mar 2006 11:34

- 10 of 15

Morning All,

A number of chunky Ex. Divis this week I see.

Anyone having a go?

A number of chunky Ex. Divis this week I see.

Anyone having a go?

Greystone

- 06 Mar 2006 12:50

- 11 of 15

- 06 Mar 2006 12:50

- 11 of 15

Master RSI

- 06 Mar 2006 13:58

- 12 of 15

- 06 Mar 2006 13:58

- 12 of 15

Keep an Eye (Added by Master RSI on Mon 06 Mar 10:41 am)

LTR - Mid 5.875p

Reason Large volume today with share price up and later news of change of adviser. Something is cooking over here.

Last week announced final results of at Filipina Grande -copper and gold and Chile's Iron Oxide Copper Gold

LTR - Mid 5.875p

Reason Large volume today with share price up and later news of change of adviser. Something is cooking over here.

Last week announced final results of at Filipina Grande -copper and gold and Chile's Iron Oxide Copper Gold

Master RSI

- 06 Mar 2006 14:07

- 13 of 15

- 06 Mar 2006 14:07

- 13 of 15

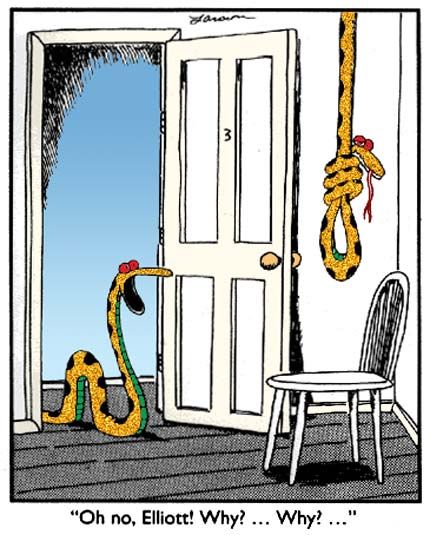

LUNCH TIME FUN

JOWELL'S affairs

Hang by media or really by her stupidity ?

Too many crooks on the NEW Labour (Money is their problem)-

- Mr Mandelson, Mr Blunket, Mrs Jowell ...

" Too many cooks spoilt the broth "

JOWELL'S affairs

Hang by media or really by her stupidity ?

Too many crooks on the NEW Labour (Money is their problem)-

- Mr Mandelson, Mr Blunket, Mrs Jowell ...

" Too many cooks spoilt the broth "

Greystone

- 06 Mar 2006 17:05

- 14 of 15

- 06 Mar 2006 17:05

- 14 of 15

Master RSI

- 06 Mar 2006 17:30

- 15 of 15

- 06 Mar 2006 17:30

- 15 of 15

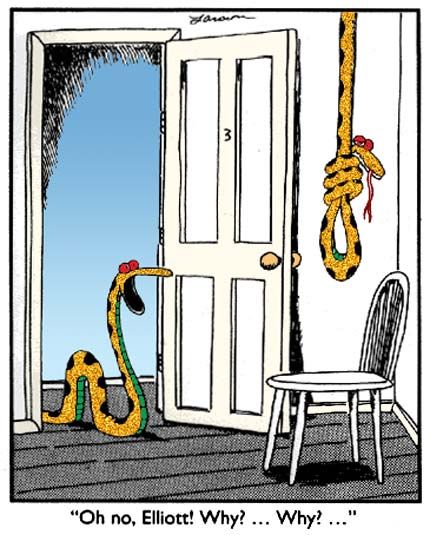

JOKE OF THE DAY

Yum

Two robins were sitting in a tree.

"I'm really hungry," said the first one.

"Me, too," said the second. "Let's fly down and find some lunch."

They flew down to the ground and found a nice plot

of newly plowed ground that was just full of worms.

They ate and ate and ate until they could eat no more.

"I'm so full I don't think I can fly back up into the tree,"

said the first one. "Me neither.

Let's just lie back here and bask in the warm sun,"

said the second. "OK," said the first.

No sooner than they had fallen asleep,

when a big fat tom cat snuck up and gobbled them up.

As the cat sat washing his face after his meal,

he thought, "I just love baskin' robins."

Yum

Two robins were sitting in a tree.

"I'm really hungry," said the first one.

"Me, too," said the second. "Let's fly down and find some lunch."

They flew down to the ground and found a nice plot

of newly plowed ground that was just full of worms.

They ate and ate and ate until they could eat no more.

"I'm so full I don't think I can fly back up into the tree,"

said the first one. "Me neither.

Let's just lie back here and bask in the warm sun,"

said the second. "OK," said the first.

No sooner than they had fallen asleep,

when a big fat tom cat snuck up and gobbled them up.

As the cat sat washing his face after his meal,

he thought, "I just love baskin' robins."

- Page:

- 1