| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

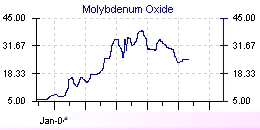

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 25 Apr 2006 11:18

- 100 of 213

- 25 Apr 2006 11:18

- 100 of 213

PapalPower

- 26 Apr 2006 01:31

- 101 of 213

- 26 Apr 2006 01:31

- 101 of 213

unionhall - 25 Apr'06 - 16:49 - 396 of 399

By Nick Trevethan

LONDON (Reuters) - Copper extended its record-breaking rally on Tuesday, supported by threats to supply and strong demand, and the trend may extend into the long term, analysts said.

"I think we are still in the early stages of the bull trend in copper. We have years of strong prices ahead of us," Barclays Capital analyst Ingrid Sternby said.

"In this uncharted territory, I would look for round numbers. With inventories where they are, prices can spiral higher very quickly. The fundamentals are very compelling."

Three-month copper futures on the London Metal Exchange (LME) hit a record $7,045 a tonne on Tuesday, climbing more than three percent from Monday.

Stocks of the key industrial metal in LME-bonded warehouses were 117,450 tonnes on Tuesday, equivalent to about 2-1/2 days of global consumption. Inventories have fallen from almost 1 million tonnes in April 2002.

"Copper is going to continue up. Supporting that is the latest Ifo business survey and comments from Caterpillar who see many years of strong growth ahead," Sternby said.

Germany's Ifo April business sentiment index unexpectedly rose to a fresh 15-year high of 105.9 from 105.4 in March.

Caterpillar Inc.'s chief financial officer said on Monday he believed the machinery maker had several more years of strong growth ahead.

"This cycle has legs," he said. "We don't think people understand how strong things are...Virtually everywhere on the planet, things look good."

DEMAND STRONG

Net imports of the copper by China, which consumes a fifth of the world's production, rose to 39,760 tonnes in March from a net 32,825 tonnes in February despite increased exports attributed to the State Reserve Bureau.

As a result copper prices would remain high.

The Chilean Copper Commission on Monday raised its forecast for the average 2006 copper price to a range of $2.60-$2.64/lb from its previous forecast of $1.72-$1.76/lb.

Sentiment was also supported by industrial unrest in Mexico, Chile and Canada.

"Copper will continue to go higher. We could see $200-300 on the downside, but the trend is up and I can't see where any real weakness will come from," an LME trader said

PapalPower

- 26 Apr 2006 08:10

- 102 of 213

- 26 Apr 2006 08:10

- 102 of 213

By Jack Lifton

25 Apr 2006 at 05:08 PM EDT

.................................Molybdenum

Since I last wrote about molybdenum there has been some significant movement in the American domestic market to re-open past producers and to develop new mines, because the global market is in a basic undersupply condition.

I said in my earlier article that considering all of the factors involved, the price of molybdenum would not go higher and would probably drop, as additional concentrates get refined in reopened capacity in the near term. I did not take into account the substantial increase in the demand for oil, Chinese resource shortages and the real possibility of U.S. dollar devaluation.

Phelps Dodge [NYSE:PD] has taken these factors into account and has just (April 6, 2006) announced the reopening of the old Climax Molybdenum Mine in the Leadville, Colorado, area. This is a dramatic vote by Phelps Dodge in the future value of molybdenum, because Colorado is one of the three most difficult places in the world to get an environmental permit to remove anything from the ground or process it above ground.

Phelps Dodge has committed up to $250 million to bring the Climax mine back into production beginning in late 2009 or early 2010. The mine when back to full operation is projected to produce 30 million pounds of Mo per year at an estimated cost of $4.00 (2006 U.S. dollars per pound). PD estimates that the value of this output will be, in constant 2006 dollars, $750 million per year. They are clearly putting their money where their mouths are.

The gold price rush now occurring is another factor increasing the supply of molybdenum in the U.S. Past producing gold mines are being brought into operation, as fast as environmental permitting will allow throughout the U.S. west.

Many of them produced molybdenum as a by-product that was ignored when, as recently as six years ago it was worth only $3.50 per pound. Last June, 2005, molybdenum touched $50 per pound; it has since settled at about half of that, but I think that we will not see any further decreases as long as the economies of Asia and India are growing.

Note also that Phelps Dodge has historically been a receptive toll producer for other companies, so some other gold miners with molybdenum by-products will not have to construct their own smelters. This will make permitting much easier for them.

Conclusion

Finally, since major mining companies today use juniors as their prospecting arms, keep your eyes open for reports of tungsten, molybdenum, vanadium and chromium, along with gold and platinum group metals reported and hyped by the juniors.

And if you must follow a trend let it be the trend to invest in natural resources outside of the United States other than gold and platinum. Maybe, just maybe, commodity and minor metals will be the new global currency.

PapalPower

- 26 Apr 2006 10:39

- 103 of 213

- 26 Apr 2006 10:39

- 103 of 213

Therefore, with added potential for mid May IC coverage, then June pre BFS news, plus June IC update, then December final BFS complete for Chelyabinsk, you see a lovely stream of events coming this year !! :)

PapalPower

- 26 Apr 2006 11:08

- 104 of 213

- 26 Apr 2006 11:08

- 104 of 213

PapalPower

- 26 Apr 2006 15:18

- 105 of 213

- 26 Apr 2006 15:18

- 105 of 213

PapalPower

- 27 Apr 2006 08:13

- 106 of 213

- 27 Apr 2006 08:13

- 106 of 213

PapalPower

- 27 Apr 2006 09:06

- 107 of 213

- 27 Apr 2006 09:06

- 107 of 213

PapalPower

- 28 Apr 2006 00:55

- 108 of 213

- 28 Apr 2006 00:55

- 108 of 213

PapalPower

- 01 May 2006 05:15

- 109 of 213

- 01 May 2006 05:15

- 109 of 213

Tuesday 2 May

UK RESULTS: : (final) Epic Reconstruction, Eureka Mining; (interim) Aberdeen Asset Management, CSR, Formation

Wednesday 3 May

UK RESULTS: (F) Babcock International, Matalan; (I) easyJet, Tomkins, BG Group, British Sky Broadcasting, British American Tobacco, Numis, Surfcontrol

Thursday 4 May

UK RESULTS: (F) Blacks Leisure, iTrain; (I) Imperial Chemical Industries, Lonmin, Royal Dutch Shell, Sanderson

Friday 5 May

UK RESULTS: (F) Body Shop International, NWD

PapalPower

- 02 May 2006 04:01

- 110 of 213

- 02 May 2006 04:01

- 110 of 213

Moly production on line, and Chelyabinsk 100% owned, where does that put us with the target prices...

http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

PapalPower

- 02 May 2006 11:44

- 111 of 213

- 02 May 2006 11:44

- 111 of 213

350K X trade today, looks like its time for VDM to wake up ahead of the summer start of mining :) Maybe................

PapalPower

- 02 May 2006 15:42

- 112 of 213

- 02 May 2006 15:42

- 112 of 213

Early start to the day then ;)

PapalPower

- 03 May 2006 01:30

- 113 of 213

- 03 May 2006 01:30

- 113 of 213

PapalPower

- 03 May 2006 07:07

- 114 of 213

- 03 May 2006 07:07

- 114 of 213

Good news, we are producing Moly concentrates now :)

3 May 2006 Eureka Mining Plc

Preliminary results

Financial Highlights

Net assets of approximately US$46 million

Successful 9 million placing with institutional investors of 7.2 million

shares issued at 125p per share in September 2005.

Appointment of Barclays Capital in July 2005 to act as financial advisors

to assist with the Chelyabinsk Copper Project.

As the Company is still in the exploration and development phase, 2005 had

an operating loss of US$2.7 million of which US$1.6 million was exchange

losses

Kazakhstan

50/50 Joint Venture signed with the Kazakhstan State uranium company,

KazAtomProm. KazAtomProm has contributed existing processing plant capacity

and infrastructure, substantially reducing capital costs and enabling fast

track development of project.

Mining at Shorskoye has commenced, with the average grade for the first

three years expected to be 0.2% molybdenum; equivalent to 2-3% copper at

current prices.

First concentrates at Stepnogorsk plant produced during current

commissioning, with Eureka's share of production in 2006 estimated at

600,000lbs of molybdenum.

Russia

In January 2005, we announced the 51% acquisition of the Urals based Chelyabinsk Copper/Gold project in Southern Russia. All the conditions to acquire the remaining 49% were substantially met prior to year end, and the acquisition has now been completed.

Scoping studies on the larger Miheevskoye deposit carried out by St. Barbara

Consultancy Services indicate a robust project, with the following highlights:

NPV(10%) of US$257m and IRR of 23.6% @ US$1.00/lb copper and $400/oz gold.

Mine cash operating cost of US$0.39c/lb copper before credits.

Capital cost estimated at US$342m for 26 Mt per annum concentrator.

High grade starter pit of 45 Mt of ore, with greater than 0.7% copper

equivalent which can be mined in the initial years based on a copper price

of US$0.90c/lb and a gold price of US$425/oz.

Mining strip ratio low at 0.35:1 waste: ore.

Metallurgical test work positive, concentrate grades of 24-25% copper and

9g/t gold.

First production anticipated in late 2008.

The Company would also like to thank David Bartley for all his work at Eureka

and we wish him a speedy recovery. Jonathan Scott-Barrett, who took over as CEO earlier this year, is now building on David's work and actively developing the Company's assets.

Accompanying this highlights page, please find the Chairman's statement, Chief

Executive Officer's report and financial results as extracted from the Company's annual report and accounts, which will be distributed to shareholders on 12 May and available shortly thereafter on our website.

PapalPower

- 03 May 2006 07:09

- 115 of 213

- 03 May 2006 07:09

- 115 of 213

Eureka has set the key operational targets outlined for 2006. We are working

hard on these tasks and look forward to keeping our shareholders informed of our

progress towards these objectives.

Operational targets for 2006:

Full production of the molybdenum concentrate by the plant at Stepnogorsk,

which takes Eureka from exploration into revenue generation.

Complete the Definitive Feasibility Study at Chelyabinsk by Q1 2007 and

then, working with our financial partners, raise the project finance to

enable production to commence in late 2008

Continue exploration in Russia and the FSU to identify new mining

opportunities.

Raise additional funds as appropriate.

In summary, I feel that Eureka Mining is poised to become a profitable

molybdenum producer, is actively developing the large Miheevskoye copper/gold

deposit and is ready to take advantage of the buoyant metal prices we are

enjoying by further acquisitions. Moreover, our field of expertise, the FSU, is

the most exciting of all new regions in mining developments, because of the vast potential and the undeveloped riches that are present. We are relishing the challenge and are determined for success.

Jonathan Scott-Barrett

Chief Executive Officer

PapalPower

- 03 May 2006 07:57

- 116 of 213

- 03 May 2006 07:57

- 116 of 213

The EKA price is very cheap in my opinion for a Moly producer now !! :)

PapalPower

- 03 May 2006 14:57

- 117 of 213

- 03 May 2006 14:57

- 117 of 213

Edited Press Release

Eureka Mining said Wednesday it has made "outstanding progress" on its key objectives since its flotation.

The group said: "Our special expertise is operating in the former Soviet Union, or FSU, and with the abundant resources base in this huge area and with metal markets enjoying buoyant times, we feel we are in the right place, at the right time, with the right team."

The group said its objectives met included developing a mining company focused on assets based in Kazakhstan and the surrounding regions of the FSU, acquiring additional assets which represent realistic commercial ventures for Eureka and allocating resources to achieve maximum value for the company.

Eureka said it is poised to become a profitable molybdenum producer and is actively developing the large Miheevskoye copper/gold deposit. The company added it is ready to take advantage of the buoyant metal prices with further acquisitions.

The group said its 50/50 joint venture signed with the Kazakhstan State uranium company, KazAtomProm, has contributed existing processing plant capacity and infrastructure, substantially reducing capital costs and enabling fast track development of project.

The company said mining at Shorskoye has commenced, with the average grade for the first three years expected to be 0.2% molybdenum; equivalent to 2-3% copper at current prices.

Eureka said that first concentrates at Stepnogorsk plant produced during current commissioning, with the groups share of production in 2006 estimated at 600,000lbs of molybdenum. The company added that scoping studies on the larger Miheevskoye deposit carried out by St. Barbara Consultancy Services indicate a robust project, with first production anticipated in late 2008.

Eureka said that during 2005 it raised GBP9.0 million and expect to seek further funds this summer to continue its development and exploitation of the Chelyabinsk project.

Mining operations at the Shorskoye project are well underway to ensure adequate stockpiles are ready for processing, the company added.

Eureka said the Dostyk Copper/Gold project in central Kazakhstan is still being reviewed and the six best drill targets, focused mainly on base metal projects, have been identified. The results are being evaluated and decisions will be taken regarding further activities once the results are known.

At the Chelyabinsk Copper/Gold Projec, the company said Wardrop Engineers, an independent Canadian mining and engineering consultancy, is conducting a pre-feasibility study due for completion in the second quarter of 2006. Subject to satisfactory results of this study, the Company will proceed to a Definitive Feasibility Study which will be due in early 2007.

(END) Dow Jones Newswires

PapalPower

- 04 May 2006 06:35

- 118 of 213

- 04 May 2006 06:35

- 118 of 213

"COINCIDENCE'? Maybe. Only 24 hours after broker and investment bank Evolution revealed it has entered into exclusive talks with Dutch bank ING; to buy stockbroker Williams de Broe, its top small-cap sales team led by Jeremy Warner-Allen resigns to join Cenkos Securities, the specialist broking firm set up by Andy Stewart, the racehorse enthusiast who founded Collins Stewart."

PapalPower

- 05 May 2006 12:28

- 119 of 213

- 05 May 2006 12:28

- 119 of 213

05/05/2006 12:00:00

Copper pulls the other metals higher, there seems no stopping it at the moment

BaseMetals.com Report

Copper prices advanced further on Thursday as concerns rose about the fundamental situation copper is in, with more talk that the supply deficit may extend into 2007 or possibly even 2008 as strikes and production difficulties continue to ravish the market. In addition there seems to be a fairly broad based rise in nationalistic protests against the mining industry, which has affected copper, nickel, Indonesia, New Caledonia, Peru and is now a potential worrying in Bolivia. Which ever way you look at the market it seems that all the news is stacked up on the side of the bulls. Indeed it is difficult to see just what is capable of derailing this runaway train. Obviously it could be something as simple as funds deciding to take profits, but who knows when they will decide to do this?

The other metals started to follow copper higher yesterday, but initially they seemed to follow reluctantly, but as copper failed to retreat the buying in the other metals gained upward momentum with aluminium and zinc hitting fresh highs and nickel moving back towards the $20,000 level. Even lead is hammering on the top line of its sideways channel and may now have enough incentive to break higher.

This new found strength in the metals once again should act as a strong reminder that there is little point trying to pick the top of the market, but you should have your contingency plan ready and in place. At some stage before too long the acceleration is likely to grind to a sudden halt, stall and then collapse, but it could go higher still in the short term.

- ends -

For further information please contact:

William Adams

Metals analyst, BaseMetals.com

press@basemetals.com

http://www.basemetals.com

BaseMetals.com

12 Camomile Street

London EC3A 7PT

UK

T: +44 (0) 20 7929 6339

F: +44 (0) 20 7929 2369