| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

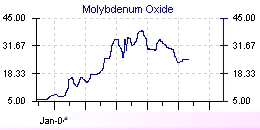

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 07 May 2006 08:57

- 122 of 213

- 07 May 2006 08:57

- 122 of 213

cynic

- 07 May 2006 09:31

- 123 of 213

- 07 May 2006 09:31

- 123 of 213

PapalPower

- 07 May 2006 10:29

- 124 of 213

- 07 May 2006 10:29

- 124 of 213

cynic

- 07 May 2006 11:54

- 125 of 213

- 07 May 2006 11:54

- 125 of 213

PapalPower

- 08 May 2006 12:35

- 126 of 213

- 08 May 2006 12:35

- 126 of 213

http://uk.biz.yahoo.com/03052006/214/eureka-dips-despite-meeting-targets.html

=============================================================

Eureka dips despite meeting targets

LONDON (ShareCast) - Eureka Mining (LSE: EKA.L - news) , focused on assets based in Kazakhstan and the surrounding regions of the former Soviet Advertisement Union, slipped back today despite meeting all its targets for 2005.

First concentrates at its Stepnogorsk plant in Kazakhstan produced during current commissioning, with Eureka's share of production in 2006 estimated at 600,000lbs of molybdenum.

Scoping studies on the Russian Miheevskoye deposit, the largest of the Chelyabinsk deposits, indicate a robust project, with first production expected in late 2008, it said.

Chairman Kevin Foo said, "I believe 2006 will be another exciting year. The Shorskoye molybdenum project should generate cash, although initially this will retire local bank project finance, following our decision to 'fast track' this project to take advantage of the high molybdenum prices."

"We also expect to complete the pre-feasibility study of the Chelyabinsk copper/gold project in Russia and to start work on the definitive feasibility study of this project which should be available in early 2007."

"We are developing our existing assets to provide cash and targeting further acquisitions in base metal and gold projects to participate actively in the current resources boom," he added.

Broker Ambrian said the re-calculation of the Miheevskoye resource to JORC measured and indicated resource categories is one of the key objectives for 2006.

The scoping study envisages processing 20m tonnes per annum of ore for 100,000 tonnes of copper in concentrate.

At a capital cost of $342m, the company's consultants estimate a project NPV (10%) of $257m at $1/lb copper and $400/oz gold.

"With an expected flow of news during the year, we re-iterate our previous target valuation of 175p/share," it said.

PapalPower

- 09 May 2006 15:17

- 127 of 213

- 09 May 2006 15:17

- 127 of 213

PapalPower

- 10 May 2006 08:05

- 128 of 213

- 10 May 2006 08:05

- 128 of 213

PapalPower

- 12 May 2006 04:33

- 129 of 213

- 12 May 2006 04:33

- 129 of 213

http://www.investorschronicle.co.uk/content/free/2006/News/news_20060512_4.html

Soaring copper prices set to boost base-metals market

Metals consultancy Bloomsbury Minerals Economics has taken a contrarian view on the copper market, with real upside implications for base-metals stocks. The red metal continues to confound expectations, with the three-month future on the London Metals Exchange up 80 per cent this year, and just breaching a fresh record at 8,000 a tonne. But the consensus view, according to the much-respected International Copper Study Group (ICSG), is that the market will move into surplus in the second half of 2006, with a subsequent cooling of prices. This view has been echoed in the media recently, with widespread stories in national newspapers about a speculator-blown bubble distorting the underlying fundamentals of the market.

However, while Bloomsbury says that it has a broadly similar demand growth estimate to that assumed by the ICSG, it believes that the latter has underestimated the baseline consumption for last year on which this growth will build. And the resulting divergence in calculations is such that Bloomsbury does not see a surplus emerging until the middle of next year. Until then, there will be ongoing deficits, resulting in further price spikes, although in absolute terms neither may match current levels. The difference is important because much of the analyst community pays attention to the ICSG, and will have formed their outlook accordingly. If Bloomsbury is right, though, the wild ride on copper isn't drawing to a close any time soon.

PapalPower

- 12 May 2006 17:24

- 130 of 213

- 12 May 2006 17:24

- 130 of 213

PapalPower

- 15 May 2006 10:16

- 131 of 213

- 15 May 2006 10:16

- 131 of 213

" These Results are expected to enhance the resource size, with an

update planned for June 2006.

Since the original resource estimate and mining study was completed, Eureka has

conducted a major drilling programme with the objective of upgrading the Russian

category resource to JORC compliant Measured and Indicated Mineral Resources.

These results will form the basis of an updated resource estimate scheduled to

be issued in June, followed by pre-feasibility study results scheduled for early

July. It is anticipated that this will provide a bankable resource statement for

the Definitive Feasibility Study, due in early 2007.

Jonathan Scott-Barrett, CEO of Eureka Mining said, 'We have completed a

comprehensive drilling campaign of more than 23,000m to confirm assays, geology

and resources potential and so far the results have exceeded our expectations.

We have a substantial Copper Porphyry Deposit on our hands and we are looking

forward to the next phase of development at Miheevskoye and increasing our

understanding and size of the deposit.'"

PapalPower

- 21 May 2006 12:41

- 132 of 213

- 21 May 2006 12:41

- 132 of 213

PapalPower

- 23 May 2006 15:40

- 133 of 213

- 23 May 2006 15:40

- 133 of 213

The Economics of Molybdenum

Pub Time: 2006/03

Abstract

This report provides up-to-date market analysis of resources, production, consumption, end-use market trends, international trade and prices.

This report offers in-depth, independent analysis of the current and future supply, demand from end-use markets, and the implications these developments are likely to have on prices in the future, including:

Continued strong growth in Chinese demand for molybdenum is expected as stainless steel production capacity is scheduled to double by the end of 2006.

There may be a decline in Chinese supplies to the West (maybe to zero) as Chinese demand increases and its production either plateaus or even declines because of restructuring of the domestic mining industry.

Molybdenum production in the USA, Chile and Peru was able to increase rapidly in 2004 and 2005, mainly by employing unused capacity to meet increased demand. This is unlikely to continue, and new projects may take some time to come into production.

There could be a period in 2006/07 of very tight supply, if demand continues to rise....

Highly corrosion resistant molybdenum-bearing stainless steel appears to be gaining ground on other types of stainless steel. Consequently, growth rates for molybdenum demand could be higher than those for stainless steel market as a whole.

Although the price of molybdenum eased slightly through late 2005 and early 2006, it could be expected to rise again through 2006."

PapalPower

- 28 May 2006 02:13

- 134 of 213

- 28 May 2006 02:13

- 134 of 213

Molybdenum Oxide

57%min FOB China

25.3-26.3 USD/lb Mo

PapalPower

- 08 Jun 2006 17:05

- 135 of 213

- 08 Jun 2006 17:05

- 135 of 213

Anyway, looks like UBS are turning back to bullish on mining, well at least on copper, from digitallook.com

Broker tips: Antofagasta, C&W, Yell, British Energy, Cadbury

Chilean copper miner Antofagasta has been upped to buy from neutral at UBS as part of a wider note on the mining sector.

The Swiss broker noted that the miner has fallen some 23% in the last three weeks, as it raised commodity price forecasts and EPS estimates. UBS added that the likelihood of further M&A action has increased.

Credit Suisse applauded Cable & Wireless managements new business plan as it upgraded th e shares to outperform from neutral.

The telecoms firm argued that the companys UK operations remain key to its valuation, adding that the balance of risk is on the upside. Credit Suisse upped its price target to 116p from 100p.

Directories group Yell Group offers a better discount to concerns over regulatory and acquisition issues, said SG Securities, following its recent weakness.

cynic

- 08 Jun 2006 17:12

- 136 of 213

- 08 Jun 2006 17:12

- 136 of 213

I have been calling copper over-valued for a few weeks, though I did not have the courage of my convictions ...... You will very strong nerves and deep pockets to start buying mining issues for the time-being

PapalPower

- 15 Jun 2006 09:41

- 137 of 213

- 15 Jun 2006 09:41

- 137 of 213

PapalPower

- 16 Jun 2006 08:19

- 138 of 213

- 16 Jun 2006 08:19

- 138 of 213

PapalPower

- 16 Jun 2006 16:50

- 139 of 213

- 16 Jun 2006 16:50

- 139 of 213

I said at those lovely 80p prices that some buys there would pay back very well, and now is just the start, hold on and watch what unfolds with Chelyabinsk :)

We are a producer now on Eureka, with Moly production at very nice prices as well :)

PapalPower

- 19 Jun 2006 04:47

- 140 of 213

- 19 Jun 2006 04:47

- 140 of 213

We are still waiting for the updates on drilling at Chelyabinsk.........resource upgrade etc...

PapalPower

- 20 Jun 2006 18:38

- 141 of 213

- 20 Jun 2006 18:38

- 141 of 213

Good read on the link below :

19 June 2006 Eureka Mining project to double Chelyabinsk gold output

http://metalsplace.com/metalsnews/?a=5644