| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 23 May 2006 15:40

- 133 of 213

- 23 May 2006 15:40

- 133 of 213

The Economics of Molybdenum

Pub Time: 2006/03

Abstract

This report provides up-to-date market analysis of resources, production, consumption, end-use market trends, international trade and prices.

This report offers in-depth, independent analysis of the current and future supply, demand from end-use markets, and the implications these developments are likely to have on prices in the future, including:

Continued strong growth in Chinese demand for molybdenum is expected as stainless steel production capacity is scheduled to double by the end of 2006.

There may be a decline in Chinese supplies to the West (maybe to zero) as Chinese demand increases and its production either plateaus or even declines because of restructuring of the domestic mining industry.

Molybdenum production in the USA, Chile and Peru was able to increase rapidly in 2004 and 2005, mainly by employing unused capacity to meet increased demand. This is unlikely to continue, and new projects may take some time to come into production.

There could be a period in 2006/07 of very tight supply, if demand continues to rise....

Highly corrosion resistant molybdenum-bearing stainless steel appears to be gaining ground on other types of stainless steel. Consequently, growth rates for molybdenum demand could be higher than those for stainless steel market as a whole.

Although the price of molybdenum eased slightly through late 2005 and early 2006, it could be expected to rise again through 2006."

PapalPower

- 28 May 2006 02:13

- 134 of 213

- 28 May 2006 02:13

- 134 of 213

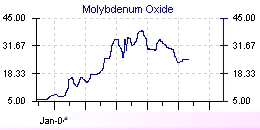

Molybdenum Oxide

57%min FOB China

25.3-26.3 USD/lb Mo

PapalPower

- 08 Jun 2006 17:05

- 135 of 213

- 08 Jun 2006 17:05

- 135 of 213

Anyway, looks like UBS are turning back to bullish on mining, well at least on copper, from digitallook.com

Broker tips: Antofagasta, C&W, Yell, British Energy, Cadbury

Chilean copper miner Antofagasta has been upped to buy from neutral at UBS as part of a wider note on the mining sector.

The Swiss broker noted that the miner has fallen some 23% in the last three weeks, as it raised commodity price forecasts and EPS estimates. UBS added that the likelihood of further M&A action has increased.

Credit Suisse applauded Cable & Wireless managements new business plan as it upgraded th e shares to outperform from neutral.

The telecoms firm argued that the companys UK operations remain key to its valuation, adding that the balance of risk is on the upside. Credit Suisse upped its price target to 116p from 100p.

Directories group Yell Group offers a better discount to concerns over regulatory and acquisition issues, said SG Securities, following its recent weakness.

cynic

- 08 Jun 2006 17:12

- 136 of 213

- 08 Jun 2006 17:12

- 136 of 213

I have been calling copper over-valued for a few weeks, though I did not have the courage of my convictions ...... You will very strong nerves and deep pockets to start buying mining issues for the time-being

PapalPower

- 15 Jun 2006 09:41

- 137 of 213

- 15 Jun 2006 09:41

- 137 of 213

PapalPower

- 16 Jun 2006 08:19

- 138 of 213

- 16 Jun 2006 08:19

- 138 of 213

PapalPower

- 16 Jun 2006 16:50

- 139 of 213

- 16 Jun 2006 16:50

- 139 of 213

I said at those lovely 80p prices that some buys there would pay back very well, and now is just the start, hold on and watch what unfolds with Chelyabinsk :)

We are a producer now on Eureka, with Moly production at very nice prices as well :)

PapalPower

- 19 Jun 2006 04:47

- 140 of 213

- 19 Jun 2006 04:47

- 140 of 213

We are still waiting for the updates on drilling at Chelyabinsk.........resource upgrade etc...

PapalPower

- 20 Jun 2006 18:38

- 141 of 213

- 20 Jun 2006 18:38

- 141 of 213

Good read on the link below :

19 June 2006 Eureka Mining project to double Chelyabinsk gold output

http://metalsplace.com/metalsnews/?a=5644

tallsiii

- 26 Jun 2006 12:24

- 142 of 213

- 26 Jun 2006 12:24

- 142 of 213

The closer we get to 2008 and production, the more valuable the resource becomes.

PapalPower

- 26 Jun 2006 14:26

- 143 of 213

- 26 Jun 2006 14:26

- 143 of 213

cynic

- 26 Jun 2006 14:37

- 144 of 213

- 26 Jun 2006 14:37

- 144 of 213

PapalPower

- 26 Jun 2006 15:31

- 145 of 213

- 26 Jun 2006 15:31

- 145 of 213

In 2008 comes the additional copper/gold from Chelyabinsk in Russia, but as of now EKA is a producer of Moly with shipping of the first consignment due July :)

I think you have not researched EKA fully :)

cynic

- 26 Jun 2006 15:35

- 146 of 213

- 26 Jun 2006 15:35

- 146 of 213

tallsiii

- 26 Jun 2006 19:01

- 147 of 213

- 26 Jun 2006 19:01

- 147 of 213

PapalPower

- 27 Jun 2006 02:30

- 148 of 213

- 27 Jun 2006 02:30

- 148 of 213

PapalPower

- 27 Jun 2006 12:23

- 149 of 213

- 27 Jun 2006 12:23

- 149 of 213

RNS Number:2257F

Eureka Mining PLC

27 June 2006

Eureka Mining Plc

Directors' dealings and significant shareholding

Eureka Mining Plc ("Eureka") was informed on 23 June 2006 that Kevin Foo, a

director of Eureka, had purchased ordinary shares of 1 penny each ("Shares") in

the share capital of Eureka in the market as follows:

Kevin Foo

5,000 on 21 June 2006 at 81p

18,000 on 21 June 2006 90.3p

9,000 on 22 June 2006 92p

At the date of this announcement Kevin Foo is beneficially interested in 911,192 Shares (3.43 per cent. of the currently issued Shares).

www.eurekamining.co.uk

PapalPower

- 29 Jun 2006 01:26

- 150 of 213

- 29 Jun 2006 01:26

- 150 of 213

Cannot see any news in the next few weeks, as Director purchases have happened, but late summer we are overdue news on the Chelyabinsk drill results and possible resource upgrade. However if they are presently negotiating something on Chelyabinsk they may withhold the drill results until such time as a potential agreement is made.

PapalPower

- 29 Jun 2006 11:59

- 151 of 213

- 29 Jun 2006 11:59

- 151 of 213

I think people can see why Kevin Foo purchased EKA and not VOG now ;)