| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 23 Jul 2006 11:11

- 156 of 213

- 23 Jul 2006 11:11

- 156 of 213

unionhall - 23 Jul'06 - 09:42 - 816

Shouldn't have any problem negotiating sales contracts....

From Gold World Friday, July 21...

A Hungry China Set to Gobble More Moly

By Steve Christ

BALTIMORE, MD -- China is still hungry. Go figure. After all, this is the same nation that continues to build the city equivalent of a Philadelphia...every single month!

It seems like no matter how much the world markets put on its plate, it is never enough. This fact is never more apparent than in the steel market where the dragon seems to be completely unquenchable.

Recently released Chinese GDP figures only underscore this fact.

On Tuesday the National Bureau of Statistics released a figure that even took some China watchers by surprise. Amazingly, China's second quarter growth had surged at the fastest rate of any quarter in a decade despite official efforts to slow the pace of growth by curbing investment.

On an annualized basis, this equated to a stunning annualized growth rate of 11.3%.

Naturally, this type of growth requires enormous amounts of commodities. And none of these is more important than steel.

Simply put, China needs steel in the same way that its babies need rice. Without it they would simply wither away. I know this because I recently talked to my publisher Brian Hicks, whose wife is Chinese.

He said his 3-year old daughter can eat 3-times the amount of rice than he can.

And to feed Chinese economy it takes lots and lots of steel. All types of steel that you can imagine. Its massive trade surplus couldn't be built or maintained without it. Without steel China would wither.

Because of this it is no secret that China has entered into tens of billions of dollars worth of iron ore contracts to maintain their mills.

This is where Molybdenum comes in. In fact "moly" and steel are joined at the hip.

This is because without Moly the production of certain grades of steel becomes impossible. Used as an alloy in the steel making process it lends both strength and corrosion resistance to the finished product. As such over 2/3 of all moly is used in the production of these steel alloys.

Needless to say these are important qualities. In fact, these types of steel are crucial to water distribution systems, chemical processing systems, automotive parts, construction equipment, gas and oil pipelines and off shore rigs.

In fact without these moly-laden steels offshore drilling would be exceedingly difficult. Not only is high molybdenum steel used as a hardener in drill stems, but an incredible 27% of all off shore rigs are built with stainless steel containing moly.

And in today's world one thing is for sure- we can't get enough of these rigs.

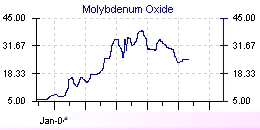

These and other factors have combined to propel moly to new heights. The chart below illustrates this fact as moly prices have soared beginning in Sept 02. Since then, moly increased an incredible 800% in late 05 and has since pulled back to a $26.25/lb for an overall gain of over 500%.

These price levels naturally are the result of supply and demand imbalance in the market.

These imbalances will certain continue well into the future as China continues to gobble up more and more moly.

In fact, recently released figures have projected that China's domestic consumption of molybdenum is set to increase 20% this year as strong demand from steel plants is continuing amid tight domestic moly supplies.

These tight supplies have been further deepened by increased stainless steel production in Japan. Japanese stainless production is up 7.75% year over year. As a result, Japan imported 214mt of roasted molybdenum concentrates and ores from China in May 2006, an increase of 29% year over year.

This is creating tighter and tighter markets. And tight market mean one thing-big profits.

PapalPower

- 25 Jul 2006 10:31

- 157 of 213

- 25 Jul 2006 10:31

- 157 of 213

News is due in the coming weeks of license granted for Moly exports, and then the firsts sales and shipping contracts for the Molybdenum already produced and being produced.

PapalPower

- 26 Jul 2006 10:07

- 158 of 213

- 26 Jul 2006 10:07

- 158 of 213

http://www.investegate.co.uk/article.aspx?id=200607260958567423G

PapalPower

- 27 Jul 2006 08:30

- 159 of 213

- 27 Jul 2006 08:30

- 159 of 213

Broker target price was 175p.......lets hope that gets upgraded too soon.

PapalPower

- 27 Jul 2006 10:05

- 160 of 213

- 27 Jul 2006 10:05

- 160 of 213

Never mind, its all over now, and with the pre FS done, and Moly news imminent, its still below the 90p price paid by a director 4 weeks ago.... bargain I think :)

PapalPower

- 28 Jul 2006 01:33

- 161 of 213

- 28 Jul 2006 01:33

- 161 of 213

.......In a note on the mining sector, UBS upped its commodity price forecasts for copper, nickel, iron ore platinum and molybdenum by an average of 7% in 2006 and 19% in 2007 following revisions to its supply-demand balances. However, UBS lowered its alumina price forecast by 6% and its aluminium forecast by 20%. The broker raised sector earnings forecast by 4% in 2006 and 11% in 2007. The Swiss broker's top picks were Xstrata and Lonmin , but it has "buy" ratings on all the major UK mining groups. Shares in Xstrata added 107p to 2,141p and Lonmin stock added 89p to 2,865p........

PapalPower

- 28 Jul 2006 08:32

- 162 of 213

- 28 Jul 2006 08:32

- 162 of 213

PapalPower

- 28 Jul 2006 14:01

- 163 of 213

- 28 Jul 2006 14:01

- 163 of 213

No delayed trades so a T at the end of the day perhaps ?

PapalPower

- 29 Jul 2006 01:21

- 164 of 213

- 29 Jul 2006 01:21

- 164 of 213

http://www.stockinterview.com/molybdenum-energy.html

PapalPower

- 12 Aug 2006 16:44

- 165 of 213

- 12 Aug 2006 16:44

- 165 of 213

azalea - 9 Aug'06 - 14:33 - 953 of 966

konil

Following the issues we raised in our posts regarding production, licences and orders, I emailed EKA and have today received the following reply.

We have produced over 200 tons of molybdenum concentrate during the commissioning and "optimized running" phase of the plant. The production licence should be granted in the next week or so.

We have buyers for the concentrate, so once we get the necessary permits we shall sell all our production.

Jonathan Scott-Barrett

CEO

Eureka Mining Plc

By my reading that is explictly good news and very reassuring.

PapalPower

- 17 Aug 2006 06:17

- 166 of 213

- 17 Aug 2006 06:17

- 166 of 213

http://www.resourceinvestor.com/pebble.asp?relid=22727

PapalPower

- 29 Aug 2006 13:04

- 167 of 213

- 29 Aug 2006 13:04

- 167 of 213

http://www.proactiveinvestors.co.uk/articles/article.asp?EKA

PapalPower

- 30 Aug 2006 01:09

- 168 of 213

- 30 Aug 2006 01:09

- 168 of 213

If the above 20$ trend continues, and short term a spike back up above 30$ happens, it certainly will be boosting the revenues for Eureka.

PapalPower

- 30 Aug 2006 08:55

- 169 of 213

- 30 Aug 2006 08:55

- 169 of 213

Now, it looks like its cleared the overhang, and perhaps we can start now moving back on up.

PapalPower

- 30 Aug 2006 12:17

- 170 of 213

- 30 Aug 2006 12:17

- 170 of 213

PapalPower

- 30 Aug 2006 13:27

- 171 of 213

- 30 Aug 2006 13:27

- 171 of 213

News is overdue, so there could well be good reason behind the rise :) DYOR !

PapalPower

- 30 Aug 2006 14:14

- 172 of 213

- 30 Aug 2006 14:14

- 172 of 213

No sellers around, thats whats good to see.

PapalPower

- 30 Aug 2006 14:30

- 173 of 213

- 30 Aug 2006 14:30

- 173 of 213

g64946 - 30 Aug 2006 20:25 - 174 of 213

PapalPower

- 31 Aug 2006 00:26

- 175 of 213

- 31 Aug 2006 00:26

- 175 of 213

Present Ambrian valuation (prior to Moly shipping news) was around 180p per share fair value, which should now increase should Moly shipping be happening.

I would not think an inside job, as Foo would not have purchased shares in June and supported the SP.

With Moly shipment happening, the valuation should be well over 200p I think.

I was in on Neutec Pharma (NTP) recently, which was 500p SP and then the final bid for that was over 1000p, a solid doubling between market SP and take out price. This one has better potential to rise more than that IMO. I am still in on OSH which has doubled already from the takeover interest being announced, and should, we hope, have tripled by take out price.

Get ready for some action in the days and weeks ahead :)