| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Traders Thread - Week commencing Monday 01st October 2018 (TRAD)

skinny

- 30 Sep 2018 10:20

- 30 Sep 2018 10:20

Forward Diary

Live Crude & Gold 15 minute & Daily Charts

Today's Economic timetable

Upcoming UK Ex-Dividend Dates

Reuters

Bloomberg Top Headlines

Marketwatch

The Wall Street Journal

The New York Times

Global Markets

Asian Markets News

South China Morning Post

Japan Times

Business Standard

China Daily

Moscow Times

Bitcoin/Pound Chart

Bitcoin/Pound ChartFTSE / DOW YTD

CC

- 02 Oct 2018 08:26

- 17 of 59

- 02 Oct 2018 08:26

- 17 of 59

Good morning.

Sitting here looking at LLOY in astonishment. I really never thought I'd see it starting with 57 ever again.

Sitting here looking at LLOY in astonishment. I really never thought I'd see it starting with 57 ever again.

CC

- 02 Oct 2018 08:28

- 18 of 59

- 02 Oct 2018 08:28

- 18 of 59

https://uk.reuters.com/article/uk-italy-budget-dimaio/italy-wont-change-2-4-percent-deficit-goal-despite-eu-pressure-di-maio-idUKKCN1MC0NY?il=0">

Italy not budging

Italy not budging

kimoldfield

- 02 Oct 2018 09:08

- 19 of 59

- 02 Oct 2018 09:08

- 19 of 59

Good morning!

CC

- 02 Oct 2018 13:27

- 20 of 59

- 02 Oct 2018 13:27

- 20 of 59

Today I am shredding contract notes from 2000-2002. The days when they got posted to you and trades cost between £12 and £20.

My portfolio had some pretty scary stuff in it then. Who remembers Tadpole Technology, Thus, GTL, Paladin Resources, Chorion?

I see I managed to make a considerable sum on Jarvis. Bust now of course. And what of Cenes, Reflec, Courts, Minmet and other crap I held at the time.

I had some decent stuff too, all of which I sold of course. I have a contract note here showing I sold 10,500 GFRD at 27.5p, having bought them at 20.4p. The long term chart shows a big gap up in 2009 so I assume that was a share split. Who knows. They are £10 now.

My portfolio had some pretty scary stuff in it then. Who remembers Tadpole Technology, Thus, GTL, Paladin Resources, Chorion?

I see I managed to make a considerable sum on Jarvis. Bust now of course. And what of Cenes, Reflec, Courts, Minmet and other crap I held at the time.

I had some decent stuff too, all of which I sold of course. I have a contract note here showing I sold 10,500 GFRD at 27.5p, having bought them at 20.4p. The long term chart shows a big gap up in 2009 so I assume that was a share split. Who knows. They are £10 now.

Fred1new

- 02 Oct 2018 13:55

- 21 of 59

- 02 Oct 2018 13:55

- 21 of 59

The majority who live learn as they travel.

Hopefully, not repeating to often their own mistake or those made by others.

Would you like to buy a few of my old contract notes?

Some going very cheap.

8-)

Hopefully, not repeating to often their own mistake or those made by others.

Would you like to buy a few of my old contract notes?

Some going very cheap.

8-)

kimoldfield

- 02 Oct 2018 15:01

- 22 of 59

- 02 Oct 2018 15:01

- 22 of 59

I lost a very modest sum on Thus/Cable & Wireless, can't say the same for some of my other disasters!😃

skinny

- 02 Oct 2018 15:18

- 23 of 59

- 02 Oct 2018 15:18

- 23 of 59

I made enough on Reflec to buy a car at the time.

From memory, I made money on Thus and Chorion and lost on Tadpole - I was holding Jarvis when they went under!

How about Infobank @£39 a share and Geo interactive Media from 22p to @£34 in less than a year and ARM and...............

From memory, I made money on Thus and Chorion and lost on Tadpole - I was holding Jarvis when they went under!

How about Infobank @£39 a share and Geo interactive Media from 22p to @£34 in less than a year and ARM and...............

CC

- 02 Oct 2018 16:49

- 24 of 59

- 02 Oct 2018 16:49

- 24 of 59

Despite some great gains I lost overall from the tech boom. I held on when stocks starting coming off and took too long to sell.

I'm generally not invested in stuff like TERN these days. The last foray I had into this area was Sphere Medical about 3 years ago, where I watched 90% of my investment disappear in 2 years.

Right now I've only got 3 stocks which I think may multi-bag and I have the conviction to hold. NMD which I bought at 115p and is now 485p and I think can multibag again from here. CTO which I'm sure you're all fed up with me posting about, where my average is around 66p and it's now only 81p, PCF where my average is 24p and it's now 38p.

I have a few others which I think may double but if that happens I'm pretty likely to sell unless a good reason comes along not to.

I'm generally not invested in stuff like TERN these days. The last foray I had into this area was Sphere Medical about 3 years ago, where I watched 90% of my investment disappear in 2 years.

Right now I've only got 3 stocks which I think may multi-bag and I have the conviction to hold. NMD which I bought at 115p and is now 485p and I think can multibag again from here. CTO which I'm sure you're all fed up with me posting about, where my average is around 66p and it's now only 81p, PCF where my average is 24p and it's now 38p.

I have a few others which I think may double but if that happens I'm pretty likely to sell unless a good reason comes along not to.

kimoldfield

- 03 Oct 2018 07:25

- 25 of 59

- 03 Oct 2018 07:25

- 25 of 59

Good morning!

CC

- 03 Oct 2018 07:58

- 26 of 59

- 03 Oct 2018 07:58

- 26 of 59

Morning all

Stan

- 03 Oct 2018 08:00

- 27 of 59

- 03 Oct 2018 08:00

- 27 of 59

Morning all.

skinny

- 03 Oct 2018 09:03

- 28 of 59

- 03 Oct 2018 09:03

- 28 of 59

skinny

- 03 Oct 2018 12:11

- 29 of 59

- 03 Oct 2018 12:11

- 29 of 59

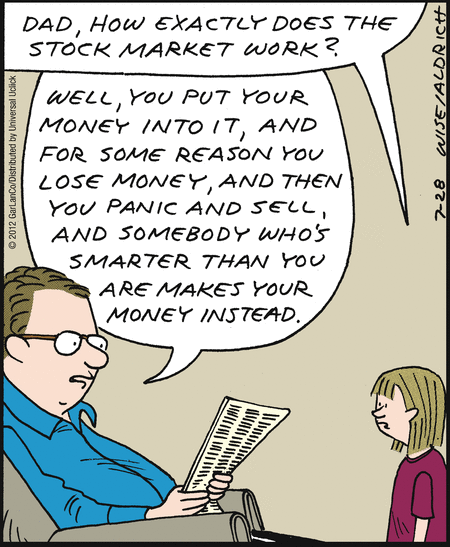

How it feels lately ....

skinny

- 03 Oct 2018 12:25

- 30 of 59

- 03 Oct 2018 12:25

- 30 of 59

CC

- 03 Oct 2018 13:14

- 31 of 59

- 03 Oct 2018 13:14

- 31 of 59

Post #29 covers me as well at the moment. Nearly every stock in my portfolio is struggling at the moment and last week was most unpleasant

If anyone missed the program last night on how RBS nearly broke Britain I'm sure it will be on iplayer. Well worth watching.

If anyone missed the program last night on how RBS nearly broke Britain I'm sure it will be on iplayer. Well worth watching.

Fred1new

- 03 Oct 2018 13:27

- 32 of 59

- 03 Oct 2018 13:27

- 32 of 59

3 out of 28 down.

The other 25up at the moment.

Not despairing yet.

Noticed that the end of the day B/S for Lloyds was heavy in Buys (if you can believe the figures.)

Date Buy Vol Sell Vol Total Vol

02/10/2018 113,880,689 66,899,766 180,780,455

01/10/2018 84,867,882 50,460,963 135,328,845

28/09/2018 87,724,025 147,426,476 235,150,501

27/09/2018 84,369,724 31,646,181 116,015,905

26/09/2018 73,973,551 79,802,121 153,775,672

The other 25up at the moment.

Not despairing yet.

Noticed that the end of the day B/S for Lloyds was heavy in Buys (if you can believe the figures.)

Date Buy Vol Sell Vol Total Vol

02/10/2018 113,880,689 66,899,766 180,780,455

01/10/2018 84,867,882 50,460,963 135,328,845

28/09/2018 87,724,025 147,426,476 235,150,501

27/09/2018 84,369,724 31,646,181 116,015,905

26/09/2018 73,973,551 79,802,121 153,775,672

kimoldfield

- 03 Oct 2018 13:38

- 33 of 59

- 03 Oct 2018 13:38

- 33 of 59

The RBS story was really good, showing how really bad Fred the Shred et al were!

CC

- 03 Oct 2018 14:20

- 34 of 59

- 03 Oct 2018 14:20

- 34 of 59

Quote of the program for Fred "It's not a scallop kitchen -it does other sea-food as well"

CC

- 03 Oct 2018 14:27

- 35 of 59

- 03 Oct 2018 14:27

- 35 of 59

It's looking very blue as well for me as well today Fred. My issue is LLOY still begins with 5 and a few days ago it began with a 6 so no matter how happy I may be today I'm going to require a few sustained blue days to get anywhere.