| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Technical Analysis (TA)

ptholden

- 09 Jul 2007 23:14

- 09 Jul 2007 23:14

I often find all manner of reference to Technical Analysis whilst reading threads, questioning certain elements, asking for advice on indicators and also requesting advice on a stock and whether it's a good time to buy, sell, hold or remain indifferent. I am the first to admit that my own TA is still in its infancy, but I do spend time on expanding my knowledge (hopefully in the right direction!).

Rather than having to ask a TA question on a particular thread, perhaps this thread could be used as a forum for TA queries and become a knowledge base. Just a thought, if there is little or no interest, the thread will sink without trace and that will be the end of that. I will personally add a few snippets to help those with less knowledge (if that's possible) to keep things rolling. There is a danger that the thread will receive countless requests for opinions on a variety of stocks and there is only so much I can do alone, therefore I would more than welcome input from other posters, no matter how rudimentary they believe their own knowledge to be, hopefully some real experts will take the time to contribute.

Rather than having to ask a TA question on a particular thread, perhaps this thread could be used as a forum for TA queries and become a knowledge base. Just a thought, if there is little or no interest, the thread will sink without trace and that will be the end of that. I will personally add a few snippets to help those with less knowledge (if that's possible) to keep things rolling. There is a danger that the thread will receive countless requests for opinions on a variety of stocks and there is only so much I can do alone, therefore I would more than welcome input from other posters, no matter how rudimentary they believe their own knowledge to be, hopefully some real experts will take the time to contribute.

ptholden

- 24 Jul 2007 13:25

- 170 of 504

- 24 Jul 2007 13:25

- 170 of 504

maggie, 14 days is about the limit of my patience and by no means a definite close date. I find the hardest skill with TA is the time frame element. Taking CSR for example I expected it to break out to the upside within a week or two and then it goes and does it within two days. It's really dependant on the trend, obviously some are steeper than others and will hit targets quicker than those in shallower trends. The main thing is to identify the trend, entry and exit points. I think all three are equally important. Don't initiate trades just because a support line or resistance line is hit, it may not hold, establish how valid these areas are and wait and see. A good example would be SCHE, I originally suggested a short from 560p, a possible trade supported by resistance, but rather than dive in at that level I realised that the up move still had some strength and waited. Having waited I suggested shorting from 580p over the weekend, a trade that so far has netted 25 pts, rather than firstly been in a loss and now a small profit. Also remember that a trendline that has acted as support on numerous occasions is a lot more valid than one that has provided support on only two or three. Using all the tools available should limit trades becoming investing, it won't work all the time, but good discipline with sensible stops will protect your pot. There is nothing to stop you moving your stops either when you are in profit if you want to keep the position open.

pth

pth

sned - 24 Jul 2007 15:09 - 171 of 504

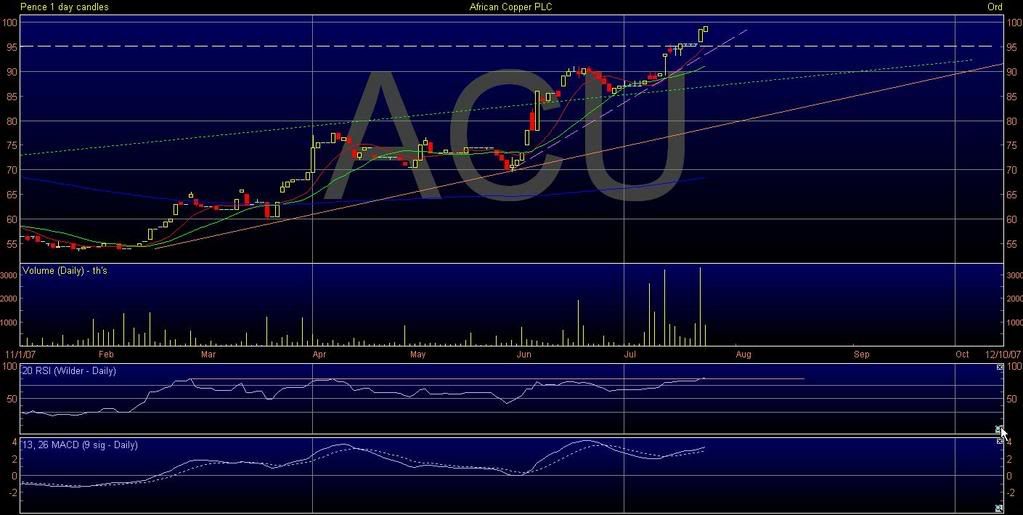

May I please ask for some opinions on this? I have seen a post on this but have not seen any analysis for it.

thanks Simon

sned - 24 Jul 2007 15:12 - 172 of 504

Sorry - the image is here - ACU - (used the wrong name extension)

(used the wrong name extension)

(used the wrong name extension)

(used the wrong name extension)

cynic

- 24 Jul 2007 15:29

- 173 of 504

- 24 Jul 2007 15:29

- 173 of 504

PT ..... SOLA may now be worth a revisit, though my view is that it will now head south, perhaps down to +/-460.

do you also have the gubbins for Cable? ...... that may be of interest to some ...... for myself have just shorted at 20636, just shy of the real target of 20700, but close enough i figured

do you also have the gubbins for Cable? ...... that may be of interest to some ...... for myself have just shorted at 20636, just shy of the real target of 20700, but close enough i figured

ptholden

- 24 Jul 2007 15:37

- 174 of 504

- 24 Jul 2007 15:37

- 174 of 504

Richard, I'll post a Cable chart later, but it's a whole new ball game :S

ptholden

- 24 Jul 2007 15:38

- 175 of 504

- 24 Jul 2007 15:38

- 175 of 504

sned, I'll have a look later and post summat, nice uptrend this year though :)

cynic

- 24 Jul 2007 16:16

- 176 of 504

- 24 Jul 2007 16:16

- 176 of 504

Greyhound reckons support at 20530, but if 20700 broken then anywhere, though he is betting on 21000

ptholden

- 24 Jul 2007 16:22

- 177 of 504

- 24 Jul 2007 16:22

- 177 of 504

All coming together nicely today:

DOO on the slide

SCHE reached the initial target of 545p (hit 542p), the revised target of 535p perhaps in sight.

CSR staying in its 'box'

TAN managed to get through 200p and passed my short entry of 207p (hit 211p) and now falling off, will it go as far as my target of 175p though?

Tate & Lyle showing weakness as expected

COH continues to ease off

Suggested shorting of ACM last night would now be in profit, although only slighlty thus far.

One theme throughout - all shorts!

pth

DOO on the slide

SCHE reached the initial target of 545p (hit 542p), the revised target of 535p perhaps in sight.

CSR staying in its 'box'

TAN managed to get through 200p and passed my short entry of 207p (hit 211p) and now falling off, will it go as far as my target of 175p though?

Tate & Lyle showing weakness as expected

COH continues to ease off

Suggested shorting of ACM last night would now be in profit, although only slighlty thus far.

One theme throughout - all shorts!

pth

ptholden

- 24 Jul 2007 16:25

- 178 of 504

- 24 Jul 2007 16:25

- 178 of 504

Forgot about my long - WNG - not unaffected by today's tribulations, but hanging in there.

Greyhound - 24 Jul 2007 16:30 - 179 of 504

Thought I'd better join in if we're talking cable/fx, only as it's my full time job. I see big support at 2.0530 and remain bullish above. Not withstanding we're at multi year highs corporates still failing (as usual) to cover and believe we're in a new phase now and see us 2.10/2.1050. Not specifically sterling strength but dollar weakness and getting sold across AUD/NZD/JPY... good luck!

cynic

- 24 Jul 2007 16:47

- 180 of 504

- 24 Jul 2007 16:47

- 180 of 504

hope you ain't going to piss on my party Mr G! ...... in the money at the moment, but that can change very quickly ...... your "big support" at 20530 well noted and may top slice at that level, just to cover my arse (from your attentions!)

Greyhound - 24 Jul 2007 16:52 - 181 of 504

Not a great deal of UK/US data out this week. Nationwide house prices on 26th to keep an eye on. US confidence tonight. Just be wary and as long as you don't leave it open then you're fine. Gut feeling tells me sell the dollar...and keep selling it. EUR/JPY already being talked of at 170. Might not be a quiet summer.

cynic

- 24 Jul 2007 16:56

- 182 of 504

- 24 Jul 2007 16:56

- 182 of 504

thanks for the advice ..... except when travelling, i monitor throughout the day and have learnt the hard way to cut losses

ptholden

- 24 Jul 2007 19:41

- 183 of 504

- 24 Jul 2007 19:41

- 183 of 504

ACU for Mr Sned :)

A few lines to look at here. The green dotted trendline goes back to Dec 2006, since then it has acted as both support and resistance in equal measure and hence its inclusion, it may well act as support again during any pullback. The brownish trendline has been overtaken by a steeper rise (purple dashed line) and if (when?) this steeper trend fails, again this may provide support. The horizontal white dashed line is the previous all time high.

So where does ACU go from here? Obviously the SP has 'broken' out, but the indicators don't seem to offer much room for further rises as the moment. The RSI usually retreats from this level, but that doesn't mean there will be a sell off. Personally I think there will be a consolidation of sorts and an easing of the SP, would keep an eye on 90p as a level which broken may cause concern.

Bit woolly I know, hope it helps.

pth

![<a href=]()

A few lines to look at here. The green dotted trendline goes back to Dec 2006, since then it has acted as both support and resistance in equal measure and hence its inclusion, it may well act as support again during any pullback. The brownish trendline has been overtaken by a steeper rise (purple dashed line) and if (when?) this steeper trend fails, again this may provide support. The horizontal white dashed line is the previous all time high.

So where does ACU go from here? Obviously the SP has 'broken' out, but the indicators don't seem to offer much room for further rises as the moment. The RSI usually retreats from this level, but that doesn't mean there will be a sell off. Personally I think there will be a consolidation of sorts and an easing of the SP, would keep an eye on 90p as a level which broken may cause concern.

Bit woolly I know, hope it helps.

pth

ptholden

- 24 Jul 2007 21:07

- 184 of 504

- 24 Jul 2007 21:07

- 184 of 504

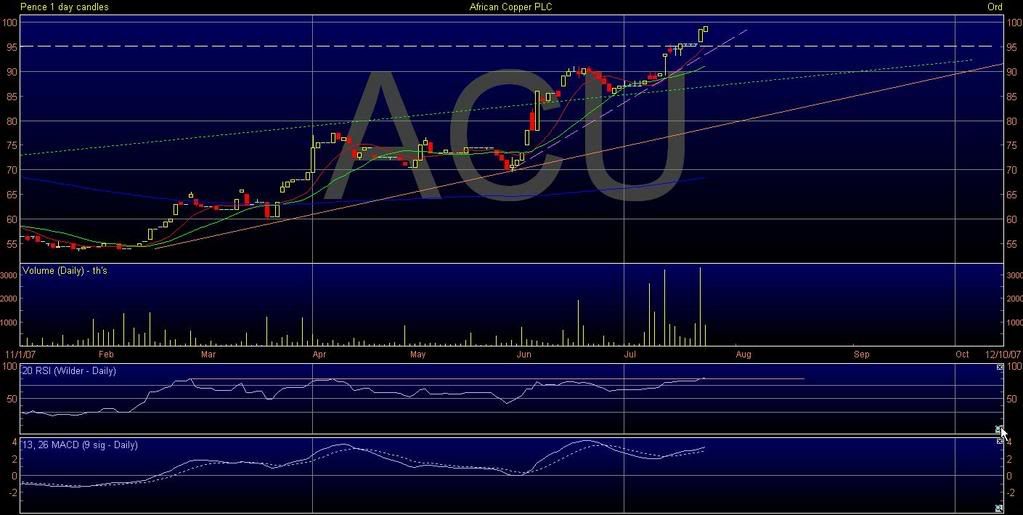

Acambis:

The reason I posted this yesterday as a possible short is self explanatory. ACU has been in a steady decline for an awful long time. Everything seems to point to further weakness and the SP is currently quite close to the top of this channel. Bit of a slow mover though. The company claim that everything is going to be ok with a pipeline of positive news expected so I would exercise some caution with a stop just above the channel.

pth

![<a href=]()

The reason I posted this yesterday as a possible short is self explanatory. ACU has been in a steady decline for an awful long time. Everything seems to point to further weakness and the SP is currently quite close to the top of this channel. Bit of a slow mover though. The company claim that everything is going to be ok with a pipeline of positive news expected so I would exercise some caution with a stop just above the channel.

pth

maggiebt4

- 24 Jul 2007 21:15

- 185 of 504

- 24 Jul 2007 21:15

- 185 of 504

Thanks again PTH I can see what you mean by waiting to establish the trend. So another question, (you did say I could ask!!!!) Regards SCHE I can see your support at 535 suppose it bounces off that, would you be looking for it to breach the 545 mark before going long, I do think this is going to to up again. Alternatively if it breaches 535 would I be correct in saying next support is 500?

EMG is still creeping up I think it willl test the high again, fingers crossed.

EMG is still creeping up I think it willl test the high again, fingers crossed.

cynic

- 24 Jul 2007 21:19

- 186 of 504

- 24 Jul 2007 21:19

- 186 of 504

be prepared for a very bloody opening tomorrow morning ....... am so thankful i took slabs of profit over the last couple of weeks and shall probably now just ride out the storm ...... SOLA could easily tumble very sharply and having just looked at the charts, DOO could also fall heavily, but there will still be the odd stock that bucks the trend for special reasons - e.g. t/o approach

maggiebt4

- 24 Jul 2007 21:19

- 187 of 504

- 24 Jul 2007 21:19

- 187 of 504

Forget that question PTH have just read the SCHE thread and have got my answers at least I got the 500 right :)

ptholden

- 24 Jul 2007 21:35

- 188 of 504

- 24 Jul 2007 21:35

- 188 of 504

maggie, you answered the second part of your question yourself, as to the first. I wouldn't necessarily go long just because the SP climbed back through a previous support line. It is important not to use any one indicator in isolation, use evrything at your disposal to maximise the success of a trade. Since I have started this thread I have continually assessed the overall state of the market, well at least my take on it. Not much point in going long on anything if we're in a major bear market (not saying we are, but.............) keep these things in mind.

pth

pth

maggiebt4

- 24 Jul 2007 22:24

- 189 of 504

- 24 Jul 2007 22:24

- 189 of 504

Thanks Think I'll follow Cynic's lead and ride out the storm. Hope it's a short one.