| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

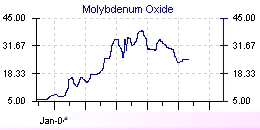

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 02 Sep 2006 08:27

- 185 of 213

- 02 Sep 2006 08:27

- 185 of 213

EKA is one of my picks for September, hoping for that 200p bid :)

Entries at the link below (click on Entry Form on the page)

http://www.stockchallenge.co.uk/sc/index.htm

PapalPower

- 03 Sep 2006 11:24

- 186 of 213

- 03 Sep 2006 11:24

- 186 of 213

1/ Previous director buys :

Top Director Buys

Eureka Mining (EKA)

Director name: Mr David Bartley

Amount purchased: 123,840 @ 127.00p

Value: 157,277

Eureka Mining (EKA)

Director name: Mr Malcolm James

Amount purchased: 61,000 @ 122.00p

Value: 74,420

Eureka Mining (EKA)

Director name: Mr Malcolm James

Amount purchased: 47,000 @ 127.00p

Value: 59,690

2/ Last placing was at 125p

The management want a return for themselves, and also for those institutions, in order to build the relationship for the future.

Therefore, for me, over 200p does, as I keep saying, seem very very likely IMO :)

DYOR !!

PapalPower

- 04 Sep 2006 14:29

- 187 of 213

- 04 Sep 2006 14:29

- 187 of 213

PapalPower

- 05 Sep 2006 11:13

- 188 of 213

- 05 Sep 2006 11:13

- 188 of 213

Will watch for a T sell later in the day, or late reported in the coming days.

PapalPower

- 08 Sep 2006 02:01

- 189 of 213

- 08 Sep 2006 02:01

- 189 of 213

If we get firm new of it being Russian, I might revise my price target up from 200+p to being 250p to 300p+ range :)

Quote - "It would seem likely that any bidder would be Russian. The Russian have really turned it up a gear over the last 2 years to build a group of heavy hitting resource companies. This would be an easy take out option to pick up some interesting projects, get into bed with KazAtomProm and probably most interesting, pick up an AIM listing to tap capital markets."

PapalPower

- 08 Sep 2006 12:41

- 190 of 213

- 08 Sep 2006 12:41

- 190 of 213

silvermede

- 12 Sep 2006 08:55

- 191 of 213

- 12 Sep 2006 08:55

- 191 of 213

silvermede

- 12 Sep 2006 09:52

- 192 of 213

- 12 Sep 2006 09:52

- 192 of 213

With Kevin FOO having a foot in both camps, does this indicate a common sense move or is it a SH*T or Bust move & grasping at straws?

silvermede

- 13 Sep 2006 09:30

- 193 of 213

- 13 Sep 2006 09:30

- 193 of 213

PapalPower

- 13 Sep 2006 10:53

- 194 of 213

- 13 Sep 2006 10:53

- 194 of 213

I am still holding, not selling, and think the PI selling yesterday was overdone. The wording of the RNS was in compliance of the takeover rules, so they had to say what they said.

I would hope now for an all paper deal from CER, maybe 120p a share equivalent, like 1 CER share for every 2 EKA or something like that.

Mind you, it could also go the wrong way, but I think its simply come down to delays on Moly shipments have left them exposed for interims, so time for CER to make their play.

Fingers crossed and wait for further news end of this week and next.

silvermede

- 13 Sep 2006 11:09

- 195 of 213

- 13 Sep 2006 11:09

- 195 of 213

PapalPower

- 14 Sep 2006 10:51

- 196 of 213

- 14 Sep 2006 10:51

- 196 of 213

14 September 2006

Eureka Mining Plc

14 September 2006

USD1.25m from First Molybdenum Sales, Kazakhstan

Highlights:

First revenues of USD 1.25m received by the JV and further revenue

anticipated

Molybdenum prices remaining high at $25/$27/Ib

Mining rates at Shorskoye 40,000 BCM per month, tonnage rates through the

processing facility doubled from 700t/d at commissioning to 1,400t/d at

present.

Eureka Mining Plc ('Eureka') (Tic: EKA) announces that our joint venture company

has signed contracts for the sale of molybdenum concentrate and has received its

first cash payment of USD 1.25 million. This revenue will be used to cover

operating costs and repay local bank debt.

Commenting today, Jonathan Scott-Barrett, CEO of Eureka said, 'This is an

important milestone for Molyken and Eureka, with first revenue of USD 1.25

million from concentrate sales received by the joint venture. Today Eureka

realises its key objective of having a revenue producing mining asset within its

portfolio. With a very strong joint venture partnership and established

production we are well placed to immediately take advantage of high molybdenum

prices and we shall look to pursue expansion of throughput at Shorskoye. '

For further information:

Jonathan Scott-Barrett Kevin Foo

Chief Executive Officer Chairman

Eureka Mining Plc Eureka Mining Plc

Tel: +44 (0)20 7921 8810 Tel: +44 (0)20 7921 8810

Laurence Read/Ed Portman

Conduit PR

Tel: +44 (0)20 7429 6605 / +44 (0)20 7429 6607

silvermede

- 14 Sep 2006 10:52

- 197 of 213

- 14 Sep 2006 10:52

- 197 of 213

How does that compare with their Operating costs??

PapalPower

- 14 Sep 2006 11:39

- 198 of 213

- 14 Sep 2006 11:39

- 198 of 213

Really good news though is it not :)

silvermede

- 14 Sep 2006 11:44

- 199 of 213

- 14 Sep 2006 11:44

- 199 of 213

PapalPower

- 14 Sep 2006 13:23

- 200 of 213

- 14 Sep 2006 13:23

- 200 of 213

I am still hoping for all paper and 120p+.........so fingers crossed we can :)

PapalPower

- 14 Sep 2006 14:37

- 201 of 213

- 14 Sep 2006 14:37

- 201 of 213

I would guess they know whats going on ??? perhaps........

http://www.advfn.com/p.php?pid=nmona&article=16836515

Thats a positive sign :)

PapalPower

- 14 Sep 2006 14:43

- 202 of 213

- 14 Sep 2006 14:43

- 202 of 213

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

PapalPower

- 15 Sep 2006 01:33

- 203 of 213

- 15 Sep 2006 01:33

- 203 of 213

Its a funny old world this one of mining corporate finance and sometimes compliance makes a mockery of common sense. On 31 August AIM listed Eureka Mining, which was a base metal spin-off from Celtic Resources at the beginning of 2004, announced that it had entered talks with an undisclosed party, but said there was no guarantee that a deal would materialise. That is one good way to get shares on the move and old Minews surmised that the most likely bidder must be Celtic Resources as it still has a holding of 18 per cent in Eureka and is stuffed with cash after being paid US$80 million for a diminished stake in the Nezhdaninskoye gold mine in Siberia. .. more ..

http://www.minesite.com/storyFull5.php?storySeq=3794

Lostandfound - 15 Sep 2006 12:03 - 204 of 213

I'm confused on this one. One minute they are short of funds and about to cease trading, or be bought out by some unknown group, the next they get $1.5m from sales - which they must have had some knowledge about.

Any idea what their cash burn rate is? Am I alone in thinking this odd?