| Home | Log In | Register | Our Services | My Account | Contact | Help |

You are NOT currently logged in

Davai - 18 Apr 2012 11:13

Thread designed to record set-ups and targets on index and FX pairs.

'A market is only your enemy until you understand it, then it becomes your best friend.'

Any questions, please feel free to ask.

From time to time i may openly state an opinion regarding direction of a set-up and wish to add that in no way am i recommending a trade. I am sometimes only in trades for a matter of minutes and can't always update as to entry/exits taken.

As always, markets are dangerous places to be and must be respected as such. Always use stop losses and never over-leverage; 3% of your pot as a maximum per trade. As always, YOU are responsible for your own trades! Happy pip hunting!

Click HERE to visit me at FXtechnicals.net

Davai - 20 Apr 2012 14:48 - 29 of 423

Given up on the Euro some time ago. Not trending nicely at all and has an algo in play that gives me an entry right into a corrective move, so straight into a loss almost to stop out before turning. here is a perfect example of this, (despite it looking like a valid set-up, i can do without the stress!) The algo comes and goes, but it hasn't been flavour of the month for a while now;

Davai - 20 Apr 2012 14:49 - 30 of 423

Davai - 20 Apr 2012 21:34 - 31 of 423

Davai - 20 Apr 2012 21:45 - 32 of 423

Davai - 21 Apr 2012 13:20 - 33 of 423

Davai - 21 Apr 2012 13:22 - 34 of 423

Obviously complete contrast between the last two charts, so i need the market to show its hand. Will post an exact set-up as it happens. No trigger, no trade. Discipline and patience are equally as important as reading charts in a traders world.

Davai - 23 Apr 2012 10:21 - 35 of 423

Fridays action on the Dax (in particular) was puzzling if it was indeed to be as i had labeled it (a 'i'&'ii' leading to (sub)wave 'iii'), (bigger red circle);

Although powering up in the morning, there was simply no continuance. I was expecting something like i have shown, but instead we got the action within the blue circle, which was at least a red flag so to speak.

I closed the long and although i was tempted to re-enter as it drifted down in the evening, i thought it better to wait for more evidence.

Well, from the off this morning it looked like the alternative count was indeed the way forward, (this on the Dow, but they all make the main moves roughly in conjunction with one another);

Sure enough i got a short trigger on the FTSE at 08:01 and would consider we have quite a way to drop over the coming week. Perhaps a little too early to make that assumption, so the first requirement is a LL on the Dax (6529 req'd)

Although powering up in the morning, there was simply no continuance. I was expecting something like i have shown, but instead we got the action within the blue circle, which was at least a red flag so to speak.

I closed the long and although i was tempted to re-enter as it drifted down in the evening, i thought it better to wait for more evidence.

Well, from the off this morning it looked like the alternative count was indeed the way forward, (this on the Dow, but they all make the main moves roughly in conjunction with one another);

Sure enough i got a short trigger on the FTSE at 08:01 and would consider we have quite a way to drop over the coming week. Perhaps a little too early to make that assumption, so the first requirement is a LL on the Dax (6529 req'd)

Davai - 23 Apr 2012 12:48 - 36 of 423

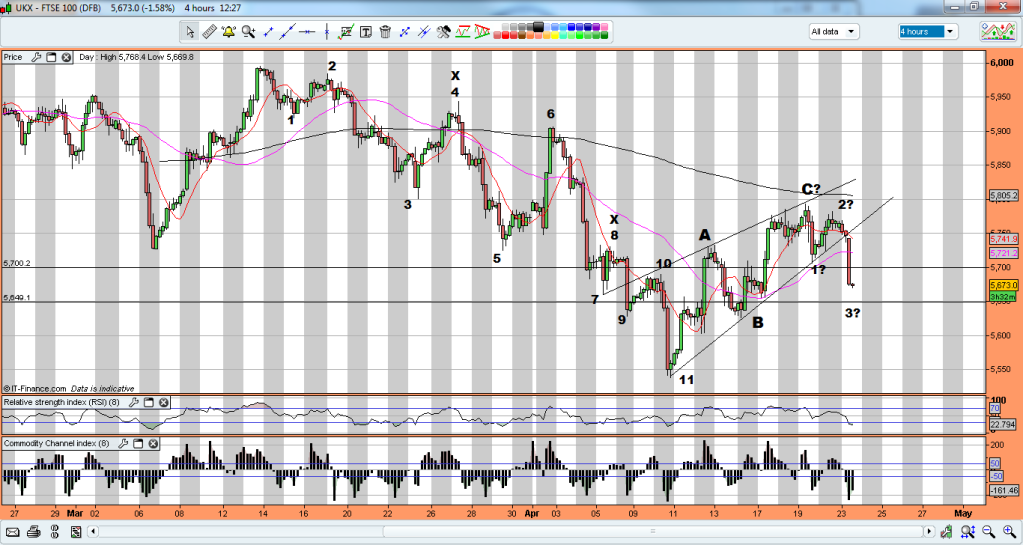

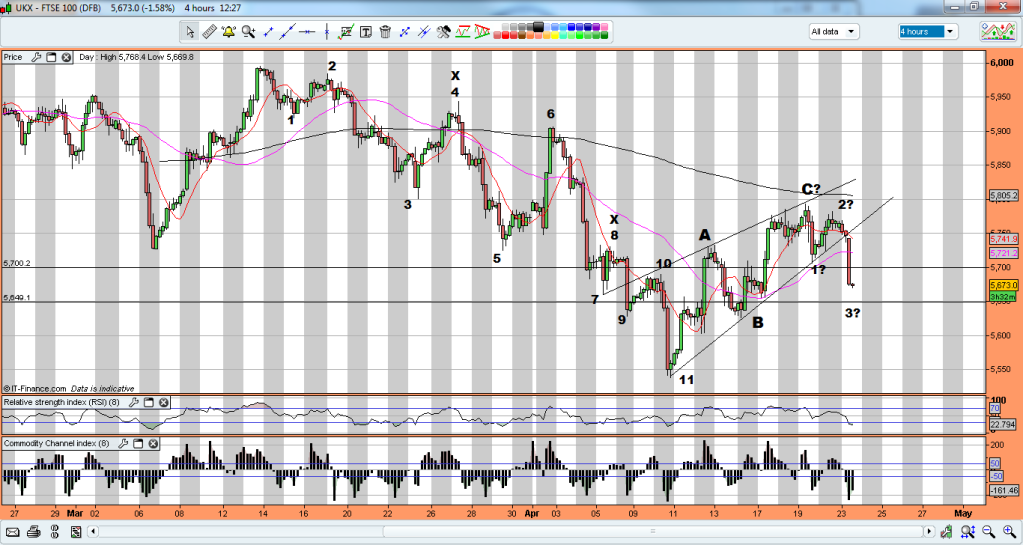

Updated FTSE probability;

The only thing i don't like is that, again, its not very easy to make an obvious 5wave counter with 'A' and subsequent abc 3wave for 'B', (should be a 5-3-5). Certainly tricky right now and thus it best to keep taking small profits as and when the market gives the next clue. Trying to second guess the longer move right now, is simply not possible, with far too many connotations.

The only thing i don't like is that, again, its not very easy to make an obvious 5wave counter with 'A' and subsequent abc 3wave for 'B', (should be a 5-3-5). Certainly tricky right now and thus it best to keep taking small profits as and when the market gives the next clue. Trying to second guess the longer move right now, is simply not possible, with far too many connotations.

Davai - 23 Apr 2012 13:08 - 37 of 423

Davai - 23 Apr 2012 16:15 - 38 of 423

Davai - 23 Apr 2012 18:16 - 39 of 423

Ok, so using this as a diary to log my thought process. I have a system that works perfectly during trends, being able to dictate a TP (target price) with a very high success rate and thus, have never bothered trading the corrective moves as the chop makes it somewhat unreliable, however, i have deemed it necessary to continue to trade such times as they can indeed last for months. This has seen me have to concentrate more on studying Elliott Wave. It is obvious that you can't try to predict too far ahead during complex correctives, due to the endless connotations available to the market, however, it is very useful indeed to have a plan beforehand and then to reduce the timescales and look for shorter term set-ups. Here's a chart of the £/Yen that i have labelled... My thoughts with regard to the recent gain is that it is still corrective and we will see lower to come after completing a 'B' wave, however, i'm struggling to label last weeks rise as a full 5 waves. I thought the pullback today might be a 'iv', however it just doesn't fit and rather think this is as per the chart. Lets see how it plays out and at least i can compare afterwards to see where i went wrong...

(or curse that i never traded it, if it plays out correctly!)

(or curse that i never traded it, if it plays out correctly!)

Davai - 24 Apr 2012 10:29 - 40 of 423

Davai - 24 Apr 2012 12:34 - 41 of 423

Going back to my chart of the £/Yen in post 39;

To zoom in now on my 'suspected' 3 legged (abc) 'B'wave (of the 5-3-5), in particular what i expect to be the 'c', we can label it in 5;

Not so sure about allowing my subwaves 'i'&'iv' to overlap, but its not important. the interesting thing i have noticed on many occasion is that the subwave 'iv' of 3, is very often a smaller version of the pattern to expect in the 4th, (as shown in the red circles), in this case a flat abc correction...

To zoom in now on my 'suspected' 3 legged (abc) 'B'wave (of the 5-3-5), in particular what i expect to be the 'c', we can label it in 5;

Not so sure about allowing my subwaves 'i'&'iv' to overlap, but its not important. the interesting thing i have noticed on many occasion is that the subwave 'iv' of 3, is very often a smaller version of the pattern to expect in the 4th, (as shown in the red circles), in this case a flat abc correction...

Davai - 24 Apr 2012 22:26 - 42 of 423

With ref to above, slightly confusing, but i think it can be labelled differently, but with the same HH outcome (as was the case). Knackered right now, so will do it in the morning.

Davai - 25 Apr 2012 10:07 - 43 of 423

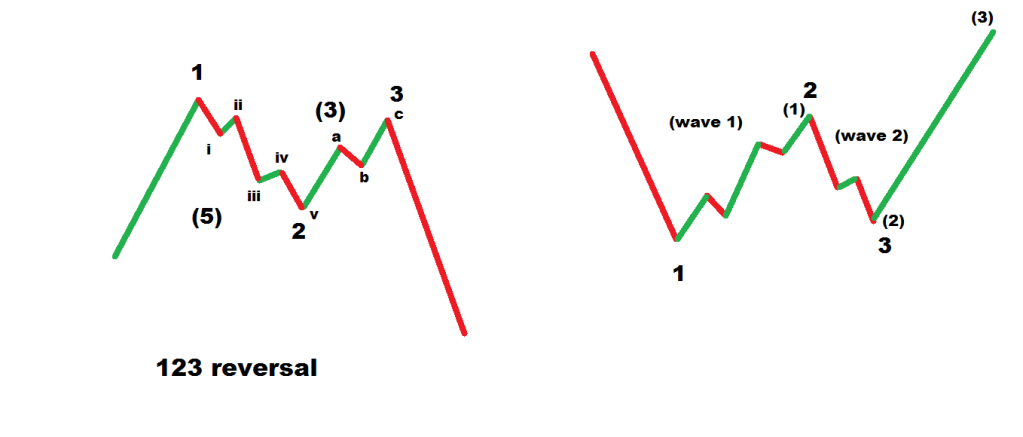

Ok, so without trying to label every last minuette subwave, this is how it looks. It's obvious to me that extended 5th waves occur frequently during corrective cycles, so point learnt. I have shown this in the following chart. I was right to expect a HH as per post 41, but didn't realise we were printing a larger (and somewhat out of proportion, it has to be said) 4th, (red circle)... Whilst looking for an end to the 5th, i look out for what is essentially a 123 reversal. As explained before, it is basically waves 1&2 of the next move, (blue circle)... the 123 is numbered 5,1&2 in that order, within the blue circle. Entry is upon break of point 2 and stop a pip above point 3... I went short earlier @ 13,120 using this popular reversal pattern, the poor GDP data sped things up a tad!

Davai - 25 Apr 2012 10:22 - 44 of 423

Davai - 25 Apr 2012 14:47 - 45 of 423

Update to trade and i think the markets done me a beauty. Originally banked a whack from the sharp drop this morning, but a bit of ill-discipline later and i find myself shorting free-style within what i presumed was a 4th wave, feeling safe in the knowledge a 5th wave and LL (lower low) was to come. Except, it took me far too long to accept or realise that the move wasn't flat enough. Pullback of '2' was quite sharp as per last chart, so '4' should be flat. Looking at the following chart, we have what i believe was a short 4th, (now shown as 'iv') with the 5th ('v') ending exactly to the tenth of a pip level with '3' ('iii'). This means back in 3 waves corrective for an ABC to form a much larger 1&2... I decided to close out giving back a large chunk of what i had gained earlier!... follow me so far?!

The chart;

I could have raised my stops, but would rather let it play out and look for more confirmation instead. I'm watching two fib retracement levels (orange and red) for a bounce, (the orange 61.8% being favourable as it should be a resistance turned support level). We then go back to looking for another 123 reversal pattern to form subwaves 1&2 of the 3rd. If correct a much larger drop should ensue. lets see...

The chart;

I could have raised my stops, but would rather let it play out and look for more confirmation instead. I'm watching two fib retracement levels (orange and red) for a bounce, (the orange 61.8% being favourable as it should be a resistance turned support level). We then go back to looking for another 123 reversal pattern to form subwaves 1&2 of the 3rd. If correct a much larger drop should ensue. lets see...