| Home | Log In | Register | Our Services | My Account | Contact | Help |

Eureka Mining, the prospects are good. (EKA)

PapalPower

- 05 Feb 2006 04:44

- 05 Feb 2006 04:44

Main Web Site : http://www.eurekamining.co.uk

EKA is now a Molybdenum producer in Kazahkstan, and is in the process of bringing the Chelyabinsk Copper/Gold project into production in 2008.

Latest Presentation June 2006 : Presentation Link (10MB PPT file)

Research Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

26th Jan 2006 Press Commentary : Press Link

About Eureka Mining

Key contact : Mr Kevin Foo Non-Exec Chairman

E-Mail : kevin.foo@eurekamining.co.uk

Eureka Mining Plc is a UK based mining exploration and project development company, focusing on projects in the Former Soviet Union. It is the Companys view that Kazakhstan and other central Asian FSU countries represent an area of significant opportunity. This belief is supported by the quality of the portfolio of assets which Eureka has acquired including;

the Shorskoye molybdenum deposit;

the acquisition of the Chelyabinsk Copper Project; and

the advanced exploration projects of Kentau, Mykubinsk and Central Kazakhstan projects. The Mykubinsk and Central Kazakhstan polymetallic project has assets situated in northern Kazakhstan and the Kentau exploration project has identified several gold and base metal deposits.

Shorskoye Molybdenum Project:

50/50 JV with KazAtomProm, largest Kazakhstan State Mining Company

Production projected for 1st Qtr 2006

Project Finance in place

Chelyabinsk Copper Project

Production planned for 2008

Very large resource base with with 3.57Mt Cu / 4.2Moz Au

First western group into Russian Copper Heartland and consequential opportunities in base metals

Kazakhstan Exploration Projects

At the Dostyk Copper-Gold Projects in Central Kazakhstan, we have reviewed all historical data and identified at least six drill targets, with particular focus on base metal projects. During 2004, we drilled five projects and completed significant field activity on two projects, including the high priority targets Berezky Central, Maiozek, Akkuduk (porphyry style), Ushtagan (epithermal gold), Maikain, Baygustam and Burovoy (VMS). We intend to focus on the most promising of these deposits in 2005/2006.

The Kentau Project in southern Kazakhstan has undergone an extensive data review, with a comprehensive Geographic Information Systems database being created. This has enabled us to plan a focused exploration programme on previously identified targets. Drilling is expected to commence in May 2005 at two of the best targets, using a large Reverse Circulation (RC) rig.

We entered into an option agreement to acquire the Nova Dnieprovka (Nova) Gold Mine in northern Kazakhstan. However, after a thorough assessment and reinterpretation of the project, including the completion of a drilling programme, we decided not to exercise the option and purchase agreement over the Nova project.

Our exploration and assessment teams are continuously reviewing potential projects for Eureka across the FSU and only the very best are selected for further work.

__________________________________________________________________

Some figures to think about (thanks to unionhall)

Current Market cap (@ 1.37) - 36m

Chelyabinsk NPV 508m (@ $1.60 copper and $550 Gold)

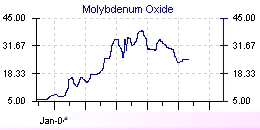

Shorskoye - 10m profit p/a @ $20 Moly

Major shareholders

Latest major holder figures are, from 26.6 million shares in issue :

Celtic Resources hold 15.02%

RAB Capital hold 6.19%

Kevin Foo holds 3.43% (Director)

David Bartley holds 3.02% (Director)

Malcom James holds 1.070% (Director)

Andrzej Sliwa holds 0.76% (Director)

JSB holds 0.177% (Director)

Latest News / Links / Research Reports

Reserach Report : http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

25th April 2006 Moly Update :

http://www.resourceinvestor.com/pebble.asp?relid=19141

2006 Moly Report : http://www.golden-phoenix.com/documents/TheEconomicsofMolybdenum.pdf

____________________________________________________________________

The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project.

(*Note : Molybdenum does not trade on the London Metals Exchange or any other publicly traded commodity exchange. Its price is determined solely by supply/demand in the marketplace and supply contracts. In a report dated Oct. 28, 2005, RBC Capital Markets forecast that 2006 and 2007 molybdenum prices would be approximately US$25/lb and US$15/lb, respectively [source: RBC Capital Markets, Global Base Metal Equity and Commodity Report Card, company reports].*)

How will the Moly be processed ? Eureka pulled off a deal with KazAtProm.Eureka has 15-year access to state-owned KazAtomProm's processing facilities, which will allow the company to start producing molybdenum concentrate in February.The processing plant also handles other minerals.The proximity of the plant to the Chinese border, allows for quick, cheap and simple transport links to a major demand area for Moly

Implementation and schedule of Moly production

Utilising the Stepnogorsk processing facility allows Eureka to develop the Shorskoye asset and take advantage of the buoyant molybdenum market, commencing mining in Q3 05 and saleable concentrate by Q1 06. The key project milestones are:

August 2005 - award contracts

August 2005 - first blast and ore to crusher

September 2005 - first ore to Stepnogorsk

October 2005 - first equipment to Stepnogorsk

February 2006 - concentrator commissioning (Stepnogorsk)

February 2006 - Chelyabinsk 100% purchased by Eureka

May 2006 - first production from Stepnogorsk (Skorshoye)

____________________________________________________________________

Molybdenum Information Links

http://www.freemarketnews.com/Analysis/60/3742/2006-02-10.asp?wid=60&nid=3742

http://www.gold-eagle.com/editorials_05/reser092205.html

http://321energy.com/editorials/fross/fross120605.html

http://www.cozine.com/archive/cc2005/01370511.html

At 25$ / lb Moly prices : (Shorskoye Project)

2006 Moly production = 600,000 lbs = 14.7 million dollars sales price

2007 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2008 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2009 Moly production = 1,200,000 lbs = 29.4 million dollars sales price

2010 etc etc etc

___________________________________________________________

Recent Director Buying :

Kevin Foo BUY 5,000 on 21 June 2006 @ 81p

Kevin Foo BUY 18,000 on 21 June 2006 @ 90.3p

Kevin Foo BUY 9,000 on 22 June 2006 @ 92pb>

PapalPower

- 10 Mar 2006 10:00

- 31 of 213

- 10 Mar 2006 10:00

- 31 of 213

The Fox Davies report puts the value at this stage at over 300p with a long term price target of over 500p when Chelyabinsk is on line from 2008, therefore we should be looking for a price of well over 200p once Moly production is on line and news comes from the pre BFS :

http://www.fox-davies.com/FDC_Eureka_Report_220605.pdf

Base Case: Around 330380p/share: this assumes US$1.10/lb copper long-term, US$20/lb molybdenum in 2006, and a discount rate of 20%.

Upper Case: Around 550p/share: this uses the Base Case metal prices, but uses a lower discount rate of 15%. The market will apply this lower rate over time, as management demonstrates success at Shorskoye and Chelyabinsk

PapalPower

- 10 Mar 2006 10:00

- 32 of 213

- 10 Mar 2006 10:00

- 32 of 213

There has been some nervousness over mining stocks on uncertainty over metal pricing negotiations and some oversupply. Copper prices fell back over the past few days to a low of around $4750/t although there are signs of recovery. 2006 commodity prices overall are set to be pretty buoyant against historical levels but not as high as in 2005, an exceptionally strong year. None of this, though, changes our fairly bullish long term view on commodities overall - there will inevitably be short term relaxation of sector performance and accompanying investor nervousness but, in our view, the long term path is up.

PapalPower

- 10 Mar 2006 11:34

- 33 of 213

- 10 Mar 2006 11:34

- 33 of 213

PapalPower

- 11 Mar 2006 02:22

- 34 of 213

- 11 Mar 2006 02:22

- 34 of 213

Presently its 2.21$ per pound as per below :

"DJ Comex Copper Review: Reverses From Lows To End Higher 10th March

NEW YORK (Dow Jones)--Comex copper overcame a lower open and pressure

throughout the session to settled higher on Friday at the New York Mercantile

Exchange.

The most-active May contract settled 1.45 cents higher at $2.2100 per pound.

During the session the contract dipped to a $2.1550 low but buying interest

moved in to take it higher by the close.

Analysts at Barclays Capital in London said current trading conditions remain

highly nervous, creating large price volatility, with market participants

particularly uncertain over the effects of a rising interest-rate environment

across major economies.

"While higher borrowing costs might limit fund involvement, we think the

recent negative reaction in the base metal markets is exaggerated, based on the

outlook for supply and demand fundamentals," said Barclays.

Bill O'Neill, a managing partner at LOGIC Advisors, said copper has been

easing along with other metals, but he added that strong U.S. economic data on

Friday was helpful for copper.

The U.S. data, which also took the dollar higher, included a rise in nonfarm

payrolls by 243,000 after rising by a revised 170,000 in January and 145,000 in

December. The unemployment rate rose slightly to 4.8% last month from 4.7% in

January. The jobs figure rose above market expectations of 212,000 but

economists had been looking for a steady 4.7% unemployment reading.

Settlements (ranges include overnight and day sessions):

March(HGH06) $2.2170; up 1.25c; Range $2.1660-$2.2220

May (HGK06) $2.2100; up 1.45c; Range $2.1550-$2.2130 "

PapalPower

- 11 Mar 2006 16:51

- 35 of 213

- 11 Mar 2006 16:51

- 35 of 213

US$24.50/lb

(Metal Bulletin,

U.S. molybdenum oxide,

Feb. 28, 2006)

Another link to get up to date Moly prices on :

http://www.bluepearl.ca/s/Home.asp

PapalPower

- 11 Mar 2006 17:05

- 36 of 213

- 11 Mar 2006 17:05

- 36 of 213

http://tinyurl.com/hhvrc

"In other news, South Korea plans to begin stockpiling strategic reserves of industrial metals needed for making electronic goods, according to an official at a state-run resources agency, cited in a Reuters report.

"If the metal imports from the countries are suspended because of war or natural disaster, this would badly hit South Korea's IT industry," an official at the Korea Resources Corporation was cited as saying.

Seoul will reportedly start from 2007 to stock pile 14 types of minor metals including indium, ferro-molybdenum, cobalt, manganese, antimony, ferro-titanium and ferro-tungsten. "

PapalPower

- 13 Mar 2006 06:46

- 37 of 213

- 13 Mar 2006 06:46

- 37 of 213

It might also point to them getting ready for war before the end of this decade, as a final solution to the problems with North Korea.....that is not such a nice thought.

PapalPower

- 13 Mar 2006 09:22

- 38 of 213

- 13 Mar 2006 09:22

- 38 of 213

tallsiii

- 13 Mar 2006 13:24

- 39 of 213

- 13 Mar 2006 13:24

- 39 of 213

PapalPower

- 13 Mar 2006 13:43

- 40 of 213

- 13 Mar 2006 13:43

- 40 of 213

Roughly 4 to 5 weeks from April Moly production on line.

Then from that 4 to 6 weeks for pre BFS complete.

The from there 5 to 6 months for the very big one, BFS complete.

With BFS done this should be over 300p I think, so lets start the ball rolling slowely and build up first with Moly production on line, then some more before pre-BFS and then more for the final BFS done :)

PapalPower

- 14 Mar 2006 00:57

- 41 of 213

- 14 Mar 2006 00:57

- 41 of 213

PapalPower

- 14 Mar 2006 11:22

- 42 of 213

- 14 Mar 2006 11:22

- 42 of 213

A colleague of mine has been in contact with Jonathan Scott-Barrett yesterday at EKA, and the timescales of the recent RNS still hold, these being Moly production on line and producing in April, then pre-BFS complete in May and final BFS complete in December.

Excellent news :) no concerns or worries and all proceeding well.

silvermede

- 14 Mar 2006 12:59

- 43 of 213

- 14 Mar 2006 12:59

- 43 of 213

Just to let you know that your posts are read and appreciated, these do look good long term roll on 300p :)

PapalPower

- 14 Mar 2006 13:54

- 44 of 213

- 14 Mar 2006 13:54

- 44 of 213

Things do look good, should be over 300p by year end on a complete and done BFS in December.

PapalPower

- 15 Mar 2006 14:01

- 45 of 213

- 15 Mar 2006 14:01

- 45 of 213

PapalPower

- 16 Mar 2006 01:19

- 46 of 213

- 16 Mar 2006 01:19

- 46 of 213

"The Company has used an average molybdenum price of US$19/lb throughout the first year and US$12/lb thereafter to calculate cash flows arising from the project."

unionhall - 15 Mar'06 - 20:52 - 105 of 105

Chilean copper producer Antofagasta PLC said Tuesday it expected molybdenum prices to average about $23/lb in 2006 due to current tight supplies and the unlikelihood of significant supply increases. However, prices are expected to be lower than the Platts 2005 average moly oxide price of about $32/lb as the second-half of 2006 might see some slowing.

PapalPower

- 17 Mar 2006 14:31

- 47 of 213

- 17 Mar 2006 14:31

- 47 of 213

PapalPower

- 17 Mar 2006 16:26

- 48 of 213

- 17 Mar 2006 16:26

- 48 of 213

Looks good for next week.

PapalPower

- 19 Mar 2006 04:27

- 49 of 213

- 19 Mar 2006 04:27

- 49 of 213

dale4j - 19 Mar 2006 05:31 - 50 of 213

Why do you think these dipped to below 100p around Christmas time? Steady climb since then.